false000150021700015002172024-02-062024-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 8-K

_________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

February 6, 2024

_________________________

American Assets Trust, Inc.

(Exact name of registrant as specified in its charter)

_________________________

| | | | | | | | |

| Maryland | 001-35030 | 27-3338708 |

(State or other jurisdiction

of incorporation) | (Commission

File No.) | (I.R.S. Employer

Identification No.) |

3420 Carmel Mountain Road, Suite 100

San Diego, California 92121

(Address of principal executive offices and Zip Code)

(858) 350-2600

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

_________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | |

| Name of Registrant | Title of each class | Trading Symbol | Name of each exchange on which registered |

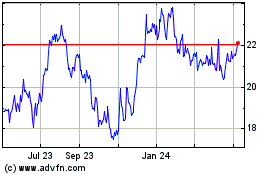

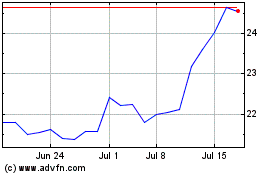

| American Assets Trust, Inc. | Common Stock, par value $0.01 per share | AAT | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 6, 2024, American Assets Trust, Inc. (the “Company”) issued a press release regarding its financial results for the quarter and fiscal year ending December 31, 2023. Also on February 6, 2024, the Company made available on the "Investors" page of its website at www.americanassetstrust.com certain supplemental information concerning the Company’s financial results and operations for the quarter and fiscal year ending December 31, 2023. Copies of the press release and supplemental information are attached hereto as Exhibits 99.1 and 99.2, respectively.

Exhibits 99.1 and 99.2, are being furnished pursuant to Item 2.02 and shall not be deemed “filed” for any purpose, including for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. Such information shall not be incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 7.01 Regulation FD Disclosure.

As discussed in Item 2.02 above, the Company issued a press release regarding its financial results for the quarter and fiscal year ending December 31, 2023 and made available on its website certain supplemental information relating thereto.

The information being furnished pursuant to Item 7.01 and shall not be deemed “filed” for any purpose, including for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section. Such information shall not be incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

The following exhibits are filed herewith:

| | | | | | | | |

Exhibit Number | | Exhibit Description |

| 99.1** | | |

| 99.2** | | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document). |

_____________________

** Furnished herewith

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | |

| American Assets Trust, Inc. |

| By: | /s/ Robert F. Barton |

| Robert F. Barton Executive Vice President, CFO |

| February 6, 2024 | | |

American Assets Trust, Inc. Reports Fourth Quarter and Year End 2023 Financial Results

Net income available to common stockholders of $10.5 million and $50.4 million for the three months and year ended December 31, 2023, respectively, or $0.17 and $0.84 per diluted share, respectively.

Funds from Operations ("FFO") per diluted share increased 2% and 3% year-over-year for the three months and year ended December 31, 2023, respectively, to $0.57 and $2.40 per diluted share, respectively.

Introducing 2024 annual guidance midpoint of $2.26 with a range of $2.19 to $2.33 of FFO per diluted share.

SAN DIEGO, California - 2/6/2024 - American Assets Trust, Inc. (NYSE: AAT) (the “company”) today reported financial results for its fourth quarter and year ended December 31, 2023.

Fourth Quarter Highlights

•Net income available to common stockholders of $10.5 million and $50.4 million for the three months and year ended December 31, 2023, respectively, or $0.17 and $0.84 per diluted share, respectively.

•FFO increased 2% and 3% year-over-year to $0.57 and $2.40 per diluted share for the three months and year ended December 31, 2023, respectively, compared to the same periods in 2022.

•Same-store cash Net Operating Income ("NOI") increased 2.6% and 4.5% year-over-year for the three months and year ended December 31, 2023, respectively, compared to the same periods in 2022.

•Introducing 2024 annual guidance midpoint of $2.26 with a range of $2.19 to $2.33 of FFO per diluted share.

•Leased approximately 23,000 comparable office square feet at an average straight-line basis and cash-basis contractual rent increase of 30% and 22%, respectively, during the fourth quarter.

•Leased approximately 108,000 comparable retail square feet at an average straight-line basis and cash-basis contractual rent increase of 13% and 7%, respectively, during the fourth quarter.

Financial Results

| | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited, amounts in thousands, except per share data) | Three Months Ended December 31 | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income attributable to American Assets Trust, Inc. stockholders | $ | 10,481 | | | $ | 9,629 | | | $ | 50,378 | | | $ | 43,506 | |

| Basic and diluted income attributable to common stockholders per share | $ | 0.17 | | | $ | 0.16 | | | $ | 0.84 | | | $ | 0.72 | |

| FFO attributable to common stock and common units | $ | 43,210 | | | $ | 42,334 | | | $ | 183,441 | | | $ | 178,574 | |

| FFO per diluted share and unit | $ | 0.57 | | | $ | 0.56 | | | $ | 2.40 | | | $ | 2.34 | |

Net income attributable to common stockholders increased $6.9 million for the year ended December 31, 2023 compared to the same period in 2022, primarily due to (i) a $6.3 million net settlement payment received on January 3, 2023 related to certain building systems at our Hassalo on Eighth property, (ii) a $4.7 million net increase in our office segment primarily due to higher annualized base rents at Torrey Reserve Campus, Solana Crossing and The Landmark at One Market, (iii) a $3.1 million net increase in our retail segment due to new tenant leases signed,

scheduled rent increases and tenants previously on alternate rent reverting back to basic monthly rent, and (iv) a $3.1 million net increase at Waikiki Beach Walk - Embassy Suites due to increased tourism into Hawaii. These increases were offset by higher net interest expense of approximately $6.5 million primarily due to the $225 million Amended and Restated Term Loan Agreement and higher general and administrative expenses of $3.8 million primarily due to an increase in employee-related costs and general legal expenses.

FFO increased $0.9 million for the three months ended December 31, 2023 compared to the same period in 2022, primarily due to an increase in our office segment due to higher annualized base rents and an increase at Waikiki Beach Walk - Embassy Suites due to increased tourism. These increases were offset by prior year accelerated revenue recognition of tenant improvement overages, as well as higher interest expense and general and administrative expenses as described above.

FFO is a non-GAAP supplemental earnings measure which the company considers meaningful in measuring its operating performance. A reconciliation of net income to FFO is attached to this press release.

Leasing

The portfolio leased status as of the end of the indicated quarter was as follows:

| | | | | | | | | | | |

| December 31, 2023 | September 30, 2023 | December 31, 2022 |

| Total Portfolio | | | |

| Office | 86.0% | 86.8% | 88.9% |

| Retail | 94.3% | 94.4% | 93.5% |

| Multifamily | 92.3% | 89.5% | 91.8% |

| Mixed-Use: | | | |

| Retail | 95.1% | 95.1% | 93.8% |

| Hotel | 85.2% | 85.3% | 76.9% |

| | | |

| Same-Store Portfolio | | |

Office (1) | 88.9% | 89.7% | 91.9% |

| Retail | 94.3% | 94.4% | 93.5% |

| Multifamily | 92.3% | 89.5% | 91.8% |

| Mixed-Use: | | | |

| Retail | 95.1% | 95.1% | 93.8% |

| Hotel | 85.2% | 85.3% | 76.9% |

(1) Same-store office leased percentages include Bel-Spring 520 which was acquired on March 8, 2022. Same-store office leased percentages exclude (i) One Beach Street due to significant redevelopment activity; (ii) the 710 building at Lloyd Portfolio which was placed into operations on November 1, 2022, approximately one year after completing renovations of the building and (iii) land held for development.

During the fourth quarter of 2023, the company signed 32 leases for approximately 147,200 square feet of office and retail space, as well as 505 multifamily apartment leases. Renewals accounted for 71% of the comparable office leases, 94% of the comparable retail leases, and 60% of the residential leases.

Office and Retail

On a comparable space basis (i.e. leases for which there was a former tenant) during the fourth quarter of 2023 and year ended December 31, 2023, our retail and office leasing spreads are shown below: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Number of Leases Signed | Comparable Leased Sq. Ft. | Average Cash Basis % Change Over Prior Rent | Average Cash Contractual Rent Per Sq. Ft. | Prior Average Cash Contractual Rent Per Sq. Ft. | Straight-Line Basis % Change Over Prior Rent |

| Office | Q4 2023 | 7 | 23,000 | | 22.4% | | $55.00 | $44.93 | | 30.1% | |

| FY 2023 | 34 | 261,000 | | 2.4% | | $69.92 | $68.31 | | 10.8% | |

| | | | | | | | | | | |

| Retail | Q4 2023 | 18 | 108,000 | | 6.8% | | $31.29 | $29.31 | | 12.8% | |

| FY 2023 | 75 | 368,000 | | 6.5% | | $34.36 | $32.08 | | 15.4% | |

Multifamily

The average monthly base rent per leased unit for our multifamily properties for the fourth quarter of 2023 was $2,654 compared to an average monthly base rent per leased unit of $2,516 for the fourth quarter of 2022, which is an increase of approximately 5.5%.

Same-Store Cash Net Operating Income

For the three months and year ended December 31, 2023, same-store cash NOI increased 2.6% and 4.5%, respectively, compared to the three months and year ended December 31, 2022. The same-store cash NOI by segment was as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended (1) | | | | | Year Ended (2) | | | |

| December 31, | | | | | December 31, | | | |

| 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Cash Basis: | | | | | | | | | | | | | |

| Office | $ | 35,540 | | | $ | 34,316 | | | 3.6 | | % | | $ | 138,405 | | | $ | 133,490 | | | 3.7 | | % |

| Retail | 18,255 | | | 18,480 | | | (1.2) | | | | 72,657 | | | 69,491 | | | 4.6 | | |

| Multifamily | 8,543 | | | 8,271 | | | 3.3 | | | | 33,994 | | | 32,224 | | | 5.5 | | |

| Mixed-Use | 5,285 | | | 4,869 | | | 8.5 | | | | 23,458 | | | 21,734 | | | 7.9 | | |

| Same-store Cash NOI | $ | 67,623 | | | $ | 65,936 | | | 2.6 | | % | | $ | 268,514 | | | $ | 256,939 | | | 4.5 | | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

(1) Same-store portfolio includes Bel-Spring 520 which was acquired on March 8, 2022. Same-store portfolio excludes (i) One Beach Street due to significant redevelopment activity; (ii) the 710 building at Lloyd Portfolio which was placed into operations on November 1, 2022, approximately one year after completing renovations of the building and (iii) land held for development.

(2) Same-store portfolio excludes (i) One Beach Street, due to significant redevelopment activity; (ii) Bel-Spring 520 which was acquired on March 8, 2022; (iii) the 710 building at Lloyd Portfolio which was placed into operations on November 1, 2022, approximately one year after completing renovations of the building and (iv) land held for development.

Same-store cash NOI is a non-GAAP supplemental earnings measure which the company considers meaningful in measuring its operating performance. A reconciliation of same-store cash NOI to net income is attached to this press release.

Balance Sheet and Liquidity

At December 31, 2023, the company had gross real estate assets of $3.7 billion and liquidity of $482.9 million, comprised of cash and cash equivalents of $82.9 million and $400.0 million of availability on its line of credit. At December 31, 2023, the company had only 1 out of 31 assets encumbered by a mortgage.

Dividends

The company declared dividends on its shares of common stock of $0.33 per share for the fourth quarter of 2023. The dividends were paid on December 21, 2023.

In addition, the company has declared a dividend on its common stock of $0.335 per share for the first quarter of 2024. The dividend will be paid in cash on March 21, 2024 to stockholders of record on March 7, 2024.

Guidance

The company is introducing 2024 guidance for full year 2024 FFO per diluted share of $2.19 to 2.33 per share, with a midpoint of $2.26.

Management will discuss the company's guidance in more detail during tomorrow's earnings call. Except as discussed during the call, the company's guidance excludes any impact from future acquisitions, dispositions, equity issuances or repurchases, debt financing or repayments. The foregoing estimates are forward-looking and reflect management's view of current and future market conditions, including certain assumptions with respect to leasing activity, rental rates, occupancy levels, interest rates, credit spreads and the amount and timing of acquisition and development activities. The company's actual results may differ materially from these estimates.

Conference Call

The company will hold a conference call to discuss the results for the three months ended and year ended December 31, 2023 on Wednesday, February 7, 2024 at 8:00 a.m. Pacific Time (“PT”). To participate in the event by telephone, please dial 1-833-630-1956 and ask to join the American Assets Trust, Inc. conference call. A live on-demand audio webcast of the conference call will be available on the company's website at www.americanassetstrust.com. A replay of the call will also be available on the company's website.

Supplemental Information

Supplemental financial information regarding the company's three months and year ended December 31, 2023 results may be found on the "Financial Reporting" tab of the “Investors” page of the company's website at www.americanassetstrust.com. This supplemental information provides additional detail on items such as property occupancy, financial performance by property and debt maturity schedules.

Financial Information

American Assets Trust, Inc.

Consolidated Balance Sheets

(In Thousands, Except Share Data) | | | | | | | | | | | | | | | | | |

| December 31, 2023 | | December 31, 2022 |

| | | | |

| Assets | (unaudited) | | |

| Real estate, at cost | | | | | |

| Operating real estate | $ | 3,502,251 | | | $ | 3,468,537 | |

| Construction in progress | | 239,030 | | | | 202,385 | |

| Held for development | | 487 | | | | 547 | |

| | 3,741,768 | | | | 3,671,469 | |

| Accumulated depreciation | | (1,036,453) | | | | (936,913) | |

| Real estate, net | | 2,705,315 | | | | 2,734,556 | |

| Cash and cash equivalents | | 82,888 | | | | 49,571 | |

| | | | | |

| Accounts receivable, net | | 7,624 | | | | 7,848 | |

| Deferred rent receivables, net | | 89,210 | | | | 87,192 | |

| Other assets, net | | 99,644 | | | | 108,714 | |

| | | | | |

| Total assets | $ | 2,984,681 | | | $ | 2,987,881 | |

| Liabilities and equity | | | | | |

| Liabilities: | | | | | |

| Secured notes payable, net | $ | 74,669 | | | $ | 74,578 | |

| Unsecured notes payable, net | | 1,614,958 | | | | 1,539,453 | |

| Unsecured line of credit, net | | — | | | | 34,057 | |

| Accounts payable and accrued expenses | | 61,312 | | | | 65,992 | |

| Security deposits payable | | 8,880 | | | | 8,699 | |

| Other liabilities and deferred credits, net | | 71,187 | | | | 79,577 | |

| | | | | |

| Total liabilities | | 1,831,006 | | | | 1,802,356 | |

| Commitments and contingencies | | | | | |

| Equity: | | | | | |

| American Assets Trust, Inc. stockholders' equity | | | | | |

| Common stock, $0.01 par value, 490,000,000 shares authorized, 60,895,786 and 60,718,653 shares issued and outstanding at December 31, 2023 and December 31, 2022, respectively | | 609 | | | | 607 | |

| Additional paid-in capital | | 1,469,206 | | | | 1,461,201 | |

| Accumulated dividends in excess of net income | | (280,239) | | | | (251,167) | |

| Accumulated other comprehensive income | | 8,282 | | | | 10,624 | |

| Total American Assets Trust, Inc. stockholders' equity | | 1,197,858 | | | | 1,221,265 | |

| Noncontrolling interests | | (44,183) | | | | (35,740) | |

| Total equity | | 1,153,675 | | | | 1,185,525 | |

| Total liabilities and equity | $ | 2,984,681 | | | $ | 2,987,881 | |

American Assets Trust, Inc.

Unaudited Consolidated Statements of Operations

(In Thousands, Except Shares and Per Share Data) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue: | | | | | | | |

| Rental income | $ | 107,268 | | | $ | 101,037 | | | $ | 419,373 | | | $ | 402,507 | |

| Other property income | 5,223 | | | 4,963 | | | 21,791 | | | 20,141 | |

| Total revenue | 112,491 | | | 106,000 | | | 441,164 | | | 422,648 | |

| Expenses: | | | | | | | |

| Rental expenses | 32,673 | | | 29,209 | | | 118,801 | | | 107,645 | |

| Real estate taxes | 11,039 | | | 10,595 | | | 45,156 | | | 44,788 | |

| General and administrative | 9,472 | | | 9,013 | | | 35,960 | | | 32,143 | |

| Depreciation and amortization | 29,908 | | | 30,110 | | | 119,500 | | | 123,338 | |

| Total operating expenses | 83,092 | | | 78,927 | | | 319,417 | | | 307,914 | |

| Operating income | 29,399 | | | 27,073 | | | 121,747 | | | 114,734 | |

| Interest expense, net | (16,284) | | | (14,565) | | | (64,706) | | | (58,232) | |

| | | | | | | |

| | | | | | | |

| Other income (expense), net | 377 | | | (102) | | | 7,649 | | | (625) | |

| Net income | 13,492 | | | 12,406 | | | 64,690 | | | 55,877 | |

| Net income attributable to restricted shares | (193) | | | (184) | | | (761) | | | (648) | |

Net income attributable to unitholders in the Operating Partnership | (2,818) | | | (2,593) | | | (13,551) | | | (11,723) | |

Net income attributable to American Assets Trust, Inc. stockholders | $ | 10,481 | | | $ | 9,629 | | | $ | 50,378 | | | $ | 43,506 | |

| | | | | | | |

| Net income per share | | | | | | | |

Basic income attributable to common stockholders per share | $ | 0.17 | | | $ | 0.16 | | | $ | 0.84 | | | $ | 0.72 | |

Weighted average shares of common stock outstanding - basic | 60,193,953 | | | 60,072,517 | | | 60,158,976 | | | 60,048,970 | |

| | | | | | | |

Diluted income attributable to common stockholders per share | $ | 0.17 | | | $ | 0.16 | | | $ | 0.84 | | | $ | 0.72 | |

Weighted average shares of common stock outstanding - diluted | 76,375,490 | | | 76,254,054 | | | 76,340,513 | | | 76,230,507 | |

| | | | | | | |

| Dividends declared per common share | $ | 0.33 | | | $ | 0.32 | | | $ | 1.32 | | | $ | 1.28 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Reconciliation of Net Income to Funds From Operations

The company's FFO attributable to common stockholders and operating partnership unitholders and reconciliation to net income is as follows (in thousands except shares and per share data, unaudited): | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, 2023 | | December 31, 2023 |

| Funds From Operations (FFO) | | | | | |

| Net income | $ | 13,492 | | | $ | 64,690 | |

| Depreciation and amortization of real estate assets | | 29,908 | | | | 119,500 | |

| | | | | |

| FFO, as defined by NAREIT | $ | 43,400 | | | $ | 184,190 | |

| Less: Nonforfeitable dividends on restricted stock awards | | (190) | | | | (749) | |

| FFO attributable to common stock and units | $ | 43,210 | | | $ | 183,441 | |

| FFO per diluted share/unit | $ | 0.57 | | | $ | 2.40 | |

| Weighted average number of common shares and units, diluted | | 76,381,507 | | | | 76,346,772 | |

Reconciliation of Same-Store Cash NOI to Net Income

The company's reconciliation of Same-Store Cash NOI to Net Income is as follows (in thousands, unaudited): | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended (1) | | Year Ended (2) |

| December 31, | | December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Same-store cash NOI | 67,623 | | | $ | 65,936 | | | $ | 268,514 | | | $ | 256,939 | |

| Non-same-store cash NOI | (432) | | | (271) | | | 566 | | | 558 | |

Tenant improvement reimbursements (3) | 505 | | | 134 | | | 1,104 | | | 3,604 | |

| Cash NOI | $ | 67,696 | | | $ | 65,799 | | | $ | 270,184 | | | $ | 261,101 | |

Non-cash revenue and other operating expenses (4) | 1,083 | | | 397 | | | 7,023 | | | 9,114 | |

| General and administrative | (9,472) | | | (9,013) | | | (35,960) | | | (32,143) | |

| Depreciation and amortization | (29,908) | | | (30,110) | | | (119,500) | | | (123,338) | |

| Interest expense, net | (16,284) | | | (14,565) | | | (64,706) | | | (58,232) | |

| | | | | | | |

| | | | | | | |

| Other income (expense), net | 377 | | | (102) | | | 7,649 | | | (625) | |

| Net income | $ | 13,492 | | | $ | 12,406 | | | $ | 64,690 | | | $ | 55,877 | |

| | | | | | | |

| Number of properties included in same-store analysis | 30 | | 29 | | 29 | | 27 |

(1) Same-store portfolio includes Bel-Spring 520 which was acquired on March 8, 2022. Same-store portfolio excludes (i) One Beach Street due to significant redevelopment activity; (ii) the 710 building at Lloyd Portfolio which was placed into operations on November 1, 2022, approximately one year after completing renovations of the building and (iii) land held for development.

(2) Same-store portfolio excludes (i) One Beach Street, due to significant redevelopment activity; (ii) Bel-Spring 520 which was acquired on March 8, 2022; (iii) the 710 building at Lloyd Portfolio which was placed into operations on November 1, 2022, approximately one year after completing renovations of the building and (iv) land held for development.

(3) Tenant improvement reimbursements are excluded from same-store cash NOI to provide a more accurate measure of operating performance.

(4) Represents adjustments related to the straight-line rent income recognized during the period offset by cash received during the period and the provision for bad debts recorded for deferred rent receivable balances, the amortization of above (below) market rents, the amortization of lease incentives paid to tenants, the amortization of other lease intangibles, and straight-line rent expense for our lease of the Annex at The Landmark at One Market.

Reported results are preliminary and not final until the filing of the company's Form 10-K with the Securities and Exchange Commission and, therefore, remain subject to adjustment.

Use of Non-GAAP Information

Funds from Operations

The company calculates FFO in accordance with the standards established by the National Association of Real Estate Investment Trusts ("NAREIT"). FFO represents net income (computed in accordance with GAAP), excluding gains (or losses) from sales of depreciable operating property, impairment losses, real estate related depreciation and amortization (excluding amortization of deferred financing costs) and after adjustments for unconsolidated partnerships and joint ventures.

FFO is a supplemental non-GAAP financial measure. Management uses FFO as a supplemental performance measure because it believes that FFO is beneficial to investors as a starting point in measuring the company's operational performance. Specifically, in excluding real estate related depreciation and amortization and gains and losses from property dispositions, which do not relate to or are not indicative of operating performance, FFO provides a performance measure that, when compared year-over-year, captures trends in occupancy rates, rental rates and operating costs. The company also believes that, as a widely recognized measure of the performance of REITs, FFO will be used by investors as a basis to compare the company's operating performance with that of other REITs. However, because FFO excludes depreciation and amortization and captures neither the changes in the value of the company's properties that result from use or market conditions nor the level of capital expenditures and leasing commissions necessary to maintain the operating performance of the company's properties, all of which have real economic effects and could materially impact the company's results from operations, the utility of FFO as a measure of the company's performance is limited. In addition, other equity REITs may not calculate FFO in accordance with the NAREIT definition as the company does, and, accordingly, the company's FFO may not be comparable to such other REITs' FFO. Accordingly, FFO should be considered only as a supplement to net income as a measure of the company's performance. FFO should not be used as a measure of the company's liquidity, nor is it indicative of funds available to fund the company's cash needs, including the company's ability to pay dividends or service indebtedness. FFO also should not be used as a supplement to or substitute for cash flow from operating activities computed in accordance with GAAP.

Cash Net Operating Income

The company uses NOI internally to evaluate and compare the operating performance of the company's properties. The company believes cash NOI provides useful information to investors regarding the company's financial condition and results of operations because it reflects only those income and expense items that are incurred at the property level, and when compared across periods, can be used to determine trends in earnings of the company's properties as this measure is not affected by (1) the non-cash revenue and expense recognition items, (2) the cost of funds of the property owner, (3) the impact of depreciation and amortization expenses as well as gains or losses from the sale of operating real estate assets that are included in net income computed in accordance with GAAP or (4) general and administrative expenses and other gains and losses that are specific to the property owner. The company believes the exclusion of these items from net income is useful because the resulting measure captures the actual revenue generated and actual expenses incurred in operating the company's properties as well as trends in occupancy rates, rental rates and operating costs. Cash NOI is a measure of the operating performance of the company's properties but does not measure the company's performance as a whole. Cash NOI is therefore not a substitute for net income as computed in accordance with GAAP.

Cash NOI is a non-GAAP financial measure of performance. The company defines cash NOI as operating revenues (rental income, tenant reimbursements, lease termination fees, ground lease rental income and other property income) less property and related expenses (property expenses, ground lease expense, property marketing costs, real estate taxes and insurance), adjusted for non-cash revenue and operating expense items such as straight-line rent, amortization of lease intangibles, amortization of lease incentives and other adjustments. Cash NOI also excludes general and administrative expenses, depreciation and amortization, interest expense, other nonproperty income and losses, acquisition-related expense, gains and losses from property dispositions, extraordinary items, tenant improvements, and leasing commissions. Other REITs may use different methodologies for calculating cash NOI, and accordingly, the company's cash NOI may not be comparable to the cash NOIs of other REITs.

About American Assets Trust, Inc.

American Assets Trust, Inc. is a full service, vertically integrated and self-administered real estate investment trust ("REIT"), headquartered in San Diego, California. The company has over 55 years of experience in acquiring, improving, developing and managing premier office, retail, and residential properties throughout the United States in some of the nation’s most dynamic, high-barrier-to-entry markets primarily in Southern California, Northern California, Washington, Oregon, Texas and Hawaii. The company's office portfolio comprises approximately 4.1 million rentable square feet, and its retail portfolio comprises approximately 3.1 million rentable square feet. In addition, the company owns one mixed-use property (including approximately 94,000 rentable square feet of retail space and a 369-room all-suite hotel) and 2,110 multifamily units. In 2011, the company was formed to succeed to the real estate business of American Assets, Inc., a privately held corporation founded in 1967 and, as such, has significant experience, long-standing relationships and extensive knowledge of its core markets, submarkets and asset classes. For additional information, please visit www.americanassetstrust.com.

Forward Looking Statements

This press release may contain forward-looking statements within the meaning of the federal securities laws, which are based on current expectations, forecasts and assumptions that involve risks and uncertainties that could cause actual outcomes and results to differ materially. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: adverse economic or real estate developments in our markets; defaults on, early terminations of or non-renewal of leases by tenants, including significant tenants; decreased rental rates or increased vacancy rates; our failure to generate sufficient cash flows to service our outstanding indebtedness; fluctuations in interest rates and increased operating costs; our failure to obtain necessary outside financing; our inability to develop or redevelop our properties due to market conditions; general economic conditions; financial market fluctuations; risks that affect the general office, retail, multifamily and mixed-use environment; the competitive environment in which we operate; system failures or security incidents through cyber attacks; the impact of epidemics, pandemics, or other outbreaks of illness, disease or virus (such as the outbreak of COVID-19 and its variants) and the actions taken by government authorities and others related thereto, including the ability of our company, our properties and our tenants to operate; difficulties in identifying properties to acquire and completing acquisitions; our failure to successfully operate acquired properties and operations; risks related to joint venture arrangements; on-going and/or potential litigation; difficulties in completing dispositions; conflicts of interests with our officers or directors; lack or insufficient amounts of insurance; environmental uncertainties and risks related to adverse weather conditions and natural disasters; other factors affecting the real estate industry generally; limitations imposed on our business and our ability to satisfy complex rules in order for American Assets Trust, Inc. to continue to qualify as a REIT, for U.S. federal income tax purposes; and changes in governmental regulations or interpretations thereof, such as real estate and zoning laws and increases in real property tax rates and taxation of REITs. While forward-looking statements reflect the company's good faith beliefs, assumptions and expectations, they are not guarantees of future performance. For a further discussion of these and other factors that could cause the company's future results to differ materially from any forward-looking statements, see the section entitled “Risk Factors” in the company's most recent annual report on Form 10-K, and other risks described in documents subsequently filed by the company from time to time with the Securities and Exchange Commission. The company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes.

Source: American Assets Trust, Inc.

Investor and Media Contact:

American Assets Trust

Robert F. Barton

Executive Vice President and Chief Financial Officer

858-350-2607

| | | | | |

| |

| FOURTH QUARTER 2023 |

| Supplemental Information |

| |

| | | | | |

| |

|

|

| Investor and Media Contact |

| American Assets Trust, Inc. |

| Robert F. Barton |

| Executive Vice President and Chief Financial Officer |

| 858-350-2607 |

American Assets Trust, Inc.'s Portfolio is concentrated in high-barrier-to-entry markets

with favorable supply/demand characteristics | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | Office | | Retail | | Multifamily | Mixed-Use |

| Market | | Square Feet | | Square Feet | | Units | Square Feet | | Suites |

| San Diego | | 1,590,552 | | | 1,322,200 | | | 1,453 | | (1) | — | | | — | |

| | | | | | | | | | |

| Bellevue | | 1,032,683 | | | — | | | — | | | — | | | — | |

| | | | | | | | | | |

| Portland | | 912,592 | | | 44,236 | | | 657 | | | — | | | — | |

| | | | | | | | | | |

| Monterey | | — | | | 673,155 | | | — | | | — | | | — | |

| | | | | | | | | | |

| San Antonio | | — | | | 588,148 | | | — | | | — | | | — | |

| | | | | | | | | | |

| San Francisco | | 522,696 | | | 35,159 | | | — | | | — | | | — | |

| | | | | | | | | | |

| Oahu | | — | | | 429,718 | | | — | | | 93,925 | | | 369 | |

| | | | | | | | | | |

| Total | | 4,058,523 | | | 3,092,616 | | | 2,110 | | | 93,925 | | | 369 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Square Feet | | % | | NOI % (2) |

| Note: Circled areas represent all markets in which American Assets Trust, Inc. currently owns and operates its real estate properties. Net rentable square footage may be adjusted from the prior periods to reflect re-measurement of leased space at the properties. | | Office | | 4.1 | | million | | 57% | | 53% |

| Retail | | 3.1 | | million | | 43% | | 27% |

| Data is as of December 31, 2023. | | Totals | | 7.2 | | million | | | | |

| (1) Includes 120 RV spaces. | | | | | | | | | |

| (2) Percentage of Net Operating Income (NOI) calculated for the three months ended December 31, 2023. Reconciliation of NOI to net income is included in the Glossary of Terms. | | | | | | | | | |

| | | | | |

| Fourth Quarter 2023 Supplemental Information | Page |

2

| | | | | | | | |

| FOURTH QUARTER 2023 SUPPLEMENTAL INFORMATION | |

| 1. | FINANCIAL HIGHLIGHTS | |

| Consolidated Balance Sheets | |

| Consolidated Statements of Operations | |

| Funds From Operations (FFO), FFO As Adjusted & Funds Available for Distribution | |

| Corporate Guidance | |

| Same-Store Net Operating Income (NOI) | |

| Same-Store Cash NOI Comparison excluding Redevelopment | |

| Same-Store Cash NOI Comparison with Redevelopment | |

| Cash NOI By Region | |

| Cash NOI Breakdown | |

| Property Revenue and Operating Expenses | |

| Segment Capital Expenditures | |

| Summary of Outstanding Debt | |

| Market Capitalization | |

| Summary of Development Opportunities | |

| 2. | PORTFOLIO DATA | |

| Property Report | |

| Office Leasing Summary | |

| Retail Leasing Summary | |

| Multifamily Leasing Summary | |

| Mixed-Use Leasing Summary | |

| Lease Expirations | |

| Portfolio Leased Statistics | |

| Top Tenants - Office | |

| Top Tenants - Retail | |

| 3. | APPENDIX | |

| Glossary of Terms | |

This Supplemental Information contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act). Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods which may be incorrect or imprecise and we may not be able to realize them. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: adverse economic or real estate developments in our markets; defaults on, early terminations of or non-renewal of leases by tenants, including significant tenants; decreased rental rates or increased vacancy rates; our failure to generate sufficient cash flows to service our outstanding indebtedness; fluctuations in interest rates and increased operating costs; our failure to obtain necessary outside financing; our inability to develop or redevelop our properties due to market conditions; general economic conditions; financial market fluctuations; risks that affect the general office, retail, multifamily and mixed-use environment; the competitive environment in which we operate; system failures or security incidents through cyber attacks; the impact of epidemics, pandemics, or other outbreaks of illness, disease or virus (such as the outbreak of COVID-19 and its variants) and the actions taken by government authorities and others related thereto, including the ability of our company, our properties and our tenants to operate; difficulties in identifying properties to acquire and completing acquisitions; our failure to successfully operate acquired properties and operations; risks related to joint venture arrangements; on-going and/or potential litigation; difficulties in completing dispositions; conflicts of interests with our officers or directors; lack or insufficient amounts of insurance; environmental uncertainties and risks related to adverse weather conditions and natural disasters; other factors affecting the real estate industry generally; limitations imposed on our business and our ability to satisfy complex rules in order for American Assets Trust, Inc. to continue to qualify as a REIT, for U.S. federal income tax purposes; and changes in governmental regulations or interpretations thereof, such as real estate and zoning laws and increases in real property tax rates and taxation of REITs.

While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, or new information, data or methods, future events or other changes. For a further discussion of these and other factors that could impact our future results, refer to our most recent Annual Report on Form 10-K and other risks described in documents subsequently filed by us from time to time with the Securities and Exchange Commission.

| | | | | |

| Fourth Quarter 2023 Supplemental Information | Page |

3

FINANCIAL HIGHLIGHTS

| | | | | |

| Fourth Quarter 2023 Supplemental Information | Page |

4

| | | | | |

| |

| CONSOLIDATED BALANCE SHEETS | |

| |

| | | | | | | | | | | |

| (Amounts in thousands, except shares and per share data) | December 31, 2023 | | December 31, 2022 |

| | | |

| ASSETS | (unaudited) | | |

| Real estate, at cost | | | |

| Operating real estate | $ | 3,502,251 | | | $ | 3,468,537 | |

| Construction in progress | 239,030 | | | 202,385 | |

| Held for development | 487 | | | 547 | |

| 3,741,768 | | | 3,671,469 | |

| Accumulated depreciation | (1,036,453) | | | (936,913) | |

| Net real estate | 2,705,315 | | | 2,734,556 | |

| Cash and cash equivalents | 82,888 | | | 49,571 | |

| | | |

| | | |

| Accounts receivable, net | 7,624 | | | 7,848 | |

| Deferred rent receivable, net | 89,210 | | | 87,192 | |

| Other assets, net | 99,644 | | | 108,714 | |

| | | |

| TOTAL ASSETS | $ | 2,984,681 | | | $ | 2,987,881 | |

| LIABILITIES AND EQUITY | | | |

| LIABILITIES: | | | |

| Secured notes payable, net | $ | 74,669 | | | $ | 74,578 | |

| Unsecured notes payable, net | 1,614,958 | | | 1,539,453 | |

| Unsecured line of credit, net | — | | | 34,057 | |

| Accounts payable and accrued expenses | 61,312 | | | 65,992 | |

| Security deposits payable | 8,880 | | | 8,699 | |

| Other liabilities and deferred credits, net | 71,187 | | | 79,577 | |

| | | |

| Total liabilities | 1,831,006 | | | 1,802,356 | |

| Commitments and contingencies | | | |

| EQUITY: | | | |

| American Assets Trust, Inc. stockholders' equity | | | |

| Common stock, $0.01 par value, 490,000,000 shares authorized, 60,895,786 and 60,718,653 shares issued and outstanding at December 31, 2023 and December 31, 2022, respectively | 609 | | | 607 | |

| Additional paid in capital | 1,469,206 | | | 1,461,201 | |

| Accumulated dividends in excess of net income | (280,239) | | | (251,167) | |

| Accumulated other comprehensive income | 8,282 | | | 10,624 | |

| Total American Assets Trust, Inc. stockholders' equity | 1,197,858 | | | 1,221,265 | |

| Noncontrolling interests | (44,183) | | | (35,740) | |

| Total equity | 1,153,675 | | | 1,185,525 | |

| TOTAL LIABILITIES AND EQUITY | $ | 2,984,681 | | | $ | 2,987,881 | |

| | | | | |

| Fourth Quarter 2023 Supplemental Information | Page |

5

| | | | | |

| |

| CONSOLIDATED STATEMENTS OF OPERATIONS | |

| |

| | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited, amounts in thousands, except shares and per share data) | Three Months Ended | | Year Ended |

| December 31, | | December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| REVENUE: | | | | | | | |

| Rental income | $ | 107,268 | | | $ | 101,037 | | | $ | 419,373 | | | $ | 402,507 | |

| Other property income | 5,223 | | | 4,963 | | | 21,791 | | | 20,141 | |

| Total revenue | 112,491 | | | 106,000 | | | 441,164 | | | 422,648 | |

| EXPENSES: | | | | | | | |

| Rental expenses | 32,673 | | | 29,209 | | | 118,801 | | | 107,645 | |

| Real estate taxes | 11,039 | | | 10,595 | | | 45,156 | | | 44,788 | |

| General and administrative | 9,472 | | | 9,013 | | | 35,960 | | | 32,143 | |

| Depreciation and amortization | 29,908 | | | 30,110 | | | 119,500 | | | 123,338 | |

| Total operating expenses | 83,092 | | | 78,927 | | | 319,417 | | | 307,914 | |

| OPERATING INCOME | 29,399 | | | 27,073 | | | 121,747 | | | 114,734 | |

| Interest expense, net | (16,284) | | | (14,565) | | | (64,706) | | | (58,232) | |

| | | | | | | |

| | | | | | | |

| Other income (expense), net | 377 | | | (102) | | | 7,649 | | | (625) | |

| NET INCOME | 13,492 | | | 12,406 | | | 64,690 | | | 55,877 | |

| Net income attributable to restricted shares | (193) | | | (184) | | | (761) | | | (648) | |

| Net income attributable to unitholders in the Operating Partnership | (2,818) | | | (2,593) | | | (13,551) | | | (11,723) | |

| NET INCOME ATTRIBUTABLE TO AMERICAN ASSETS TRUST, INC. STOCKHOLDERS | $ | 10,481 | | | $ | 9,629 | | | $ | 50,378 | | | $ | 43,506 | |

| | | | | | | |

| EARNINGS PER COMMON SHARE | | | | | | | |

| Basic income from operations attributable to common stockholders per share | $ | 0.17 | | | $ | 0.16 | | | $ | 0.84 | | | $ | 0.72 | |

| Weighted average shares of common stock outstanding - basic | 60,193,953 | | | 60,072,517 | | | 60,158,976 | | | 60,048,970 | |

| Diluted income from continuing operations attributable to common stockholders per share | $ | 0.17 | | | $ | 0.16 | | | $ | 0.84 | | | $ | 0.72 | |

| Weighted average shares of common stock outstanding - diluted | 76,375,490 | | | 76,254,054 | | | 76,340,513 | | | 76,230,507 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | |

| Fourth Quarter 2023 Supplemental Information | Page |

6

| | | | | |

| |

| FUNDS FROM OPERATIONS, FFO AS ADJUSTED & FUNDS AVAILABLE FOR DISTRIBUTION | |

| |

| | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited, amounts in thousands, except shares and per share data) | Three Months Ended | | Year Ended |

| December 31, | | December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

Funds from Operations (FFO) (1) | | | | | | | |

| Net income | $ | 13,492 | | | $ | 12,406 | | | $ | 64,690 | | | $ | 55,877 | |

| Depreciation and amortization of real estate assets | 29,908 | | | 30,110 | | | 119,500 | | | 123,338 | |

| | | | | | | |

| FFO, as defined by NAREIT | 43,400 | | | 42,516 | | | 184,190 | | | 179,215 | |

| | | | | | | |

| Less: Nonforfeitable dividends on restricted stock awards | (190) | | | (182) | | | (749) | | | (641) | |

| FFO attributable to common stock and common units | $ | 43,210 | | | $ | 42,334 | | | $ | 183,441 | | | $ | 178,574 | |

| | | | | | | |

| FFO per diluted share/unit | $ | 0.57 | | | $ | 0.56 | | | $ | 2.40 | | | $ | 2.34 | |

| | | | | | | |

Weighted average number of common shares and common units, diluted (2) | 76,381,507 | | | 76,256,916 | | | 76,346,772 | | | 76,233,814 | |

| | | | | | | |

Funds Available for Distribution (FAD) (1) | $ | 33,081 | | | $ | 31,775 | | | $ | 133,420 | | | $ | 132,852 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Dividends | | | | | | | |

| Dividends declared and paid | $ | 25,436 | | | $ | 24,609 | | | $ | 101,571 | | | $ | 98,248 | |

| Dividends declared and paid per share/unit | $ | 0.33 | | | $ | 0.32 | | | $ | 1.32 | | | $ | 1.28 | |

FFO is a non-GAAP supplemental earnings measure which we consider meaningful in measuring our operating performance.

| | | | | |

| Fourth Quarter 2023 Supplemental Information | Page |

7

| | | | | |

| |

| FUNDS FROM OPERATIONS, FFO AS ADJUSTED & FUNDS AVAILABLE FOR DISTRIBUTION (CONTINUED) | |

| |

| | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited, amounts in thousands, except shares and per share data) | Three Months Ended | | Year Ended |

| December 31, | | December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

Funds Available for Distribution (FAD) (1) | | | | | | | |

| FFO | $ | 43,400 | | | $ | 42,516 | | | $ | 184,190 | | | $ | 179,215 | |

| Adjustments: | | | | | | | |

| Tenant improvements, leasing commissions and maintenance capital expenditures | (12,465) | | | (14,013) | | | (55,226) | | | (47,880) | |

Net effect of straight-line rents (3) | (361) | | | 370 | | | (4,135) | | | (5,996) | |

Amortization of net above (below) market rents (4) | (748) | | | (810) | | | (3,085) | | | (3,307) | |

Net effect of other lease assets (5) | 26 | | | 45 | | | 199 | | | 191 | |

| Amortization of debt issuance costs and debt fair value adjustment | 835 | | | 651 | | | 3,388 | | | 2,581 | |

| Non-cash compensation expense | 2,584 | | | 3,198 | | | 8,838 | | | 8,689 | |

| | | | | | | |

| | | | | | | |

| Nonforfeitable dividends on restricted stock awards | (190) | | | (182) | | | (749) | | | (641) | |

| | | | | | | |

| FAD | $ | 33,081 | | | $ | 31,775 | | | $ | 133,420 | | | $ | 132,852 | |

| | | | | | | |

| Summary of Capital Expenditures | | | | | | | |

| Tenant improvements and leasing commissions | $ | 3,306 | | | $ | 7,032 | | | $ | 21,190 | | | $ | 27,698 | |

| Maintenance capital expenditures | 9,159 | | | 6,981 | | | 34,036 | | | 20,182 | |

| $ | 12,465 | | | $ | 14,013 | | | $ | 55,226 | | | $ | 47,880 | |

Notes:

(1) See Glossary of Terms.

(2) For the three months and year ended December 31, 2023 and 2022, the weighted average common shares and common units used to compute FFO per diluted share/unit include operating partnership common units and unvested restricted stock awards that are subject to time vesting. The shares/units used to compute FFO per diluted share/unit include additional shares/units which were excluded from the computation of diluted EPS, as they were anti-dilutive for the periods presented.

(3) Represents the straight-line rent income recognized during the period offset by cash received during the period and the provision for bad debts recorded for deferred rent receivable balances.

(4) Represents the adjustment related to the acquisition of buildings with above (below) market rents.

(5) Represents adjustments related to amortization of lease incentives paid to tenants, amortization of lease intangibles, and straight-line rent expense for our leases at the Annex at The Landmark at One Market.

FFO is a non-GAAP supplemental earnings measure which we consider meaningful in measuring our operating performance.

| | | | | |

| Fourth Quarter 2023 Supplemental Information | Page |

8

| | | | | | | | | | | | | | | |

| (Amounts in thousands, except share and per share data) | | | | | | | |

| | | | | | | |

| 2024 Guidance Range (1) | | |

| Funds from Operations (FFO): | | | | | | | |

| Net income | $ | 54,633 | | | $ | 65,330 | | | | | |

| Depreciation and amortization of real estate assets | 113,470 | | | 113,470 | | | | | |

| FFO, as defined by NAREIT | 168,103 | | | 178,800 | | | | | |

| Less: Nonforfeitable dividends on restricted stock awards | (772) | | | (772) | | | | | |

| FFO attributable to common stock and units | $ | 167,331 | | | $ | 178,028 | | | | | |

| Weighted average number of common shares and units, diluted | 76,406,801 | | | 76,406,801 | | | | | |

| FFO per diluted share, updated | $ | 2.19 | | | $ | 2.33 | | | | | |

| | | | | | | |

| | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Notes:

(1) Management will discuss the company's guidance in more detail during tomorrow's earnings call. Except as discussed during the call, the company's guidance excludes any impact from future acquisitions, dispositions, equity issuances or repurchases, debt financing or repayments.

FFO is a non-GAAP supplemental earnings measure which we consider meaningful in measuring our operating performance.

These estimates are forward-looking and reflect management's view of current and future market conditions, including certain assumptions with respect to leasing activity, rental rates, occupancy levels, interest rates and the amount and timing of acquisition and development activities. Our actual results may differ materially from these estimates.

| | | | | |

| Fourth Quarter 2023 Supplemental Information | Page |

9

| | | | | |

| |

| SAME-STORE NET OPERATING INCOME (NOI) | |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited, amounts in thousands) | Three Months Ended December 31, 2023 (1) |

| Office | | Retail | | Multifamily | | Mixed-Use | | Total |

| Real estate rental revenue | | | | | | | | | |

| Same-store | $ | 52,711 | | | $ | 27,096 | | | $ | 15,922 | | | $ | 16,754 | | | $ | 112,483 | |

| Non-same store | 8 | | | — | | | — | | | — | | | 8 | |

| Total | 52,719 | | | 27,096 | | | 15,922 | | | 16,754 | | | 112,491 | |

| Real estate expenses | | | | | | | | | |

| Same-store | 15,822 | | | 8,677 | | | 7,446 | | | 11,325 | | | 43,270 | |

| Non-same store | 442 | | | — | | | — | | | — | | | 442 | |

| Total | 16,264 | | | 8,677 | | | 7,446 | | | 11,325 | | | 43,712 | |

| Net Operating Income (NOI) | | | | | | | | | |

| Same-store | 36,889 | | | 18,419 | | | 8,476 | | | 5,429 | | | 69,213 | |

| Non-same store | (434) | | | — | | | — | | | — | | | (434) | |

| Total | $ | 36,455 | | | $ | 18,419 | | | $ | 8,476 | | | $ | 5,429 | | | $ | 68,779 | |

| Same-store NOI | $ | 36,889 | | | $ | 18,419 | | | $ | 8,476 | | | $ | 5,429 | | | $ | 69,213 | |

Net effect of straight-line rents (2) | (368) | | | 83 | | | 67 | | | (144) | | | (362) | |

Amortization of net above (below) market rents (3) | (489) | | | (259) | | | — | | | — | | | (748) | |

Net effect of other lease assets (4) | 12 | | | 13 | | | — | | | — | | | 25 | |

Tenant improvement reimbursements (5) | (504) | | | (1) | | | — | | | — | | | (505) | |

Same-store cash NOI (5) | $ | 35,540 | | | $ | 18,255 | | | $ | 8,543 | | | $ | 5,285 | | | $ | 67,623 | |

Notes:

(1) Same-store and non-same store classifications are determined based on properties held on December 31, 2023 and 2022. See Glossary of Terms.

(2) Represents the straight-line rent income recognized during the period offset by cash received during the period and the provision for bad debts recorded for deferred rent receivable balances.

(3) Represents the adjustment related to the acquisition of buildings with above (below) market rents.

(4) Represents adjustments related to amortization of lease incentives paid to tenants, amortization of lease intangibles and straight-line rent expense for our leases at the Annex at The Landmark at One Market.

(5) Tenant improvement reimbursements are excluded from same-store cash NOI to provide a more accurate measure of operating performance.

NOI and same-store cash NOI are non-GAAP supplemental earnings measures which we consider meaningful in measuring our operating performance. Reconciliations of NOI and same-store cash NOI to net income are included in the Glossary of Terms.

| | | | | |

| Fourth Quarter 2023 Supplemental Information | Page |

10

| | | | | |

| |

| SAME-STORE NET OPERATING INCOME (NOI) (CONTINUED) | |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited, amounts in thousands) | Year Ended December 31, 2023 (1) |

| Office | | Retail | | Multifamily | | Mixed-Use | | Total |

| Real estate rental revenue | | | | | | | | | |

| Same-store | $ | 204,497 | | | $ | 104,767 | | | $ | 61,830 | | | $ | 66,711 | | | $ | 437,805 | |

| Non-same store | 3,359 | | | — | | | — | | | — | | | 3,359 | |

| Total | 207,856 | | | 104,767 | | | 61,830 | | | 66,711 | | | 441,164 | |

| Real estate expenses | | | | | | | | | |

| Same-store | 58,858 | | | 31,440 | | | 28,025 | | | 43,153 | | | 161,476 | |

| Non-same store | 2,481 | | | — | | | — | | | — | | | 2,481 | |

| Total | 61,339 | | | 31,440 | | | 28,025 | | | 43,153 | | | 163,957 | |

| Net Operating Income (NOI) | | | | | | | | | |

| Same-store | 145,639 | | | 73,327 | | | 33,805 | | | 23,558 | | | 276,329 | |

| Non-same store | 878 | | | — | | | — | | | — | | | 878 | |

| Total | $ | 146,517 | | | $ | 73,327 | | | $ | 33,805 | | | $ | 23,558 | | | $ | 277,207 | |

| Same-store NOI | $ | 145,639 | | | $ | 73,327 | | | $ | 33,805 | | | $ | 23,558 | | | $ | 276,329 | |

Net effect of straight-line rents (2) | (4,449) | | | 324 | | | 189 | | | (100) | | | (4,036) | |

Amortization of net above (below) market rents (3) | (1,834) | | | (1,039) | | | — | | | — | | | (2,873) | |

Net effect of other lease assets (4) | 148 | | | 50 | | | — | | | — | | | 198 | |

Tenant improvement reimbursements (5) | (1,099) | | | (5) | | | — | | | — | | | (1,104) | |

Same-store cash NOI (5) | $ | 138,405 | | | $ | 72,657 | | | $ | 33,994 | | | $ | 23,458 | | | $ | 268,514 | |

Notes:

(1) Same-store and non-same store classifications are determined based on properties held on December 31, 2023 and 2022. See Glossary of Terms.

(2) Represents the straight-line rent income recognized during the period offset by cash received during the period and the provision for bad debts recorded for deferred rent receivable balances.

(3) Represents the adjustment related to the acquisition of buildings with above (below) market rents.

(4) Represents adjustments related to amortization of lease incentives paid to tenants, amortization of lease intangibles, and straight-line rent expense for our leases at the Annex at The Landmark at One Market.

(5) Tenant improvement reimbursements are excluded from Same-store Cash NOI to provide a more accurate measure of operating performance.

NOI and same-store cash NOI are non-GAAP supplemental earnings measures which we consider meaningful in measuring our operating performance. Reconciliations of NOI and same-store cash NOI to net income are included in the Glossary of Terms.

| | | | | |

| Fourth Quarter 2023 Supplemental Information | Page |

11

| | | | | |

| |

| SAME-STORE CASH NOI COMPARISON EXCLUDING REDEVELOPMENT | |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited, amounts in thousands) | Three Months Ended | | | | Year Ended | | |

| December 31, | | | | December 31, | | |

| 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Cash Basis: | | | | | | | | | | | |

| Office | $ | 35,540 | | | $ | 34,316 | | | 3.6 | % | | $ | 138,405 | | | $ | 133,490 | | | 3.7 | % |

| Retail | 18,255 | | | 18,480 | | | (1.2) | | | 72,657 | | | 69,491 | | | 4.6 | |

| Multifamily | 8,543 | | | 8,271 | | | 3.3 | | | 33,994 | | | 32,224 | | | 5.5 | |

| Mixed-Use | 5,285 | | | 4,869 | | | 8.5 | | | 23,458 | | | 21,734 | | | 7.9 | |

Same-store Cash NOI (2)(3) | $ | 67,623 | | | $ | 65,936 | | | 2.6 | % | | $ | 268,514 | | | $ | 256,939 | | | 4.5 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Notes:

(1) Excluding lease termination fees, for the three months and year ended December 31, 2023 and 2022, the change in same-store cash NOI would be 2.7% and 4.5% respectively .

(2) See Glossary of Terms.

Same-store cash NOI is a non-GAAP supplemental earnings measure which we consider meaningful in measuring our operating performance. A reconciliation of same-store cash NOI to net income is included in the Glossary of Terms.

| | | | | |

| Fourth Quarter 2023 Supplemental Information | Page |

12

| | | | | |

| |

| SAME-STORE CASH NOI COMPARISON WITH REDEVELOPMENT | |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited, amounts in thousands) | Three Months Ended | | | | Year Ended | | |

| December 31, | | | | December 31, | | |

| 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Cash Basis: | | | | | | | | | | | |

| Office | $ | 35,385 | | | $ | 34,147 | | | 3.6 | % | | $ | 137,747 | | | $ | 133,016 | | | 3.6 | % |

| Retail | 18,255 | | | 18,480 | | | (1.2) | | | 72,657 | | | 69,491 | | | 4.6 | |

| Multifamily | 8,543 | | | 8,271 | | | 3.3 | | | 33,994 | | | 32,224 | | | 5.5 | |

| Mixed-Use | 5,285 | | | 4,869 | | | 8.5 | | | 23,458 | | | 21,734 | | | 7.9 | |

Same-store Cash NOI with Redevelopment (1)(2) | $ | 67,468 | | | $ | 65,767 | | | 2.6 | % | | $ | 267,856 | | | $ | 256,465 | | | 4.4 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Notes:

(1) Excluding lease termination fees, for the three months and year ended December 31, 2023 and 2022, the change in same-store cash NOI with redevelopment would be 2.8% and 4.4% respectively.

(2) See Glossary of Terms.

Same-store cash NOI with redevelopment is a non-GAAP supplemental earnings measure which we consider meaningful in measuring our operating performance. A reconciliation of same-store cash NOI with redevelopment to net income is included in the Glossary of Terms.

| | | | | |

| Fourth Quarter 2023 Supplemental Information | Page |

13

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited, amounts in thousands) | Three Months Ended December 31, 2023 |

| Office | | Retail | | Multifamily | | Mixed-Use | | Total |

| Cash Basis: | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Southern California | $ | 14,811 | | | $ | 8,457 | | | $ | 7,372 | | | $ | — | | | $ | 30,640 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Northern California | 7,485 | | | 2,874 | | | — | | | — | | | 10,359 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Hawaii | — | | | 3,131 | | | — | | | 5,285 | | | 8,416 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Oregon | 5,228 | | | 187 | | | 1,171 | | | — | | | 6,586 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Texas | — | | | 3,607 | | | — | | | — | | | 3,607 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Washington | 8,088 | | | — | | | — | | | — | | | 8,088 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Total Cash NOI | $ | 35,612 | | | $ | 18,256 | | | $ | 8,543 | | | $ | 5,285 | | | $ | 67,696 | |

Cash NOI is a non-GAAP supplemental earnings measure which we consider meaningful in measuring our operating performance. A reconciliation of cash NOI to net income is included in the Glossary of Terms.

| | | | | |

| Fourth Quarter 2023 Supplemental Information | Page |

14

| | |

| Three Months Ended December 31, 2023 |

| | | | | | | | |

| Cash NOI Breakdown | | |

| | |

| Portfolio Diversification by Geographic Region | | Portfolio Diversification by Segment |

Cash NOI is a non-GAAP supplemental earnings measure which we consider meaningful in measuring our operating performance. A reconciliation of cash NOI to net income is included in the Glossary of Terms.

| | | | | |

| Fourth Quarter 2023 Supplemental Information | Page |

15

| | | | | |

| |

| PROPERTY REVENUE AND OPERATING EXPENSES | |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited, amounts in thousands) | | Three Months Ended December 31, 2023 |

| | | | Additional | | | | Property | | | | |

| | | | Property | | Billed Expense | | Operating | | Rental | | Cash |

| Property | | Base Rent (1) | | Income (2) | | Reimbursements (3) | | Expenses (4) | | Adjustments (5) | | NOI (6) |

| Office Portfolio | | | | | | | | | | | | |

| La Jolla Commons | | $ | 8,526 | | | $ | 181 | | | $ | 2,614 | | | $ | (3,292) | | | $ | — | | | $ | 8,029 | |

Torrey Reserve Campus (7) | | 6,571 | | | 78 | | | 502 | | | (1,951) | | | (579) | | | 4,621 | |

| Torrey Point | | 1,445 | | | 112 | | | (18) | | | (445) | | | (318) | | | 776 | |

| Solana Crossing | | 2,123 | | | 11 | | | 161 | | | (691) | | | (124) | | | 1,480 | |

| The Landmark at One Market | | 10,266 | | | 75 | | | 683 | | | (3,437) | | | — | | | 7,587 | |

| One Beach Street | | — | | | — | | | — | | | (102) | | | — | | | (102) | |

| First & Main | | 2,740 | | | 203 | | | 789 | | | (1,142) | | | 53 | | | 2,643 | |

Lloyd Portfolio (7) | | 3,660 | | | 401 | | | 325 | | | (1,493) | | | (126) | | | 2,767 | |

| City Center Bellevue | | 6,325 | | | 500 | | | 504 | | | (1,851) | | | 73 | | | 5,551 | |

| Eastgate Office Park | | 1,145 | | | 24 | | | 581 | | | (832) | | | (54) | | | 864 | |

| Corporate Campus East III | | 1,123 | | | 57 | | | 477 | | | (486) | | | (7) | | | 1,164 | |

| Bel-Spring 520 | | 535 | | | 12 | | | 239 | | | (271) | | | (6) | | | 509 | |

| Subtotal Office Portfolio | | $ | 44,459 | | | $ | 1,654 | | | $ | 6,857 | | | $ | (15,993) | | | $ | (1,088) | | | $ | 35,889 | |

| Retail Portfolio | | | | | | | | | | | | |

| Carmel Country Plaza | | $ | 972 | | | $ | 47 | | | $ | 255 | | | $ | (265) | | | $ | 2 | | | $ | 1,011 | |

| Carmel Mountain Plaza | | 3,467 | | | 45 | | | 811 | | | (876) | | | 85 | | | 3,532 | |

| South Bay Marketplace | | 613 | | | 166 | | | 232 | | | (241) | | | — | | | 770 | |

| Gateway Marketplace | | 653 | | | — | | | 229 | | | (273) | | | (12) | | | 597 | |

| Lomas Santa Fe Plaza | | 1,660 | | | 16 | | | 385 | | | (1,146) | | | 8 | | | 923 | |

| Solana Beach Towne Centre | | 1,668 | | | 20 | | | 586 | | | (649) | | | (1) | | | 1,624 | |

| Del Monte Center | | 2,436 | | | 666 | | | 1,085 | | | (1,584) | | | (20) | | | 2,583 | |

| Geary Marketplace | | 307 | | | — | | | 109 | | | (125) | | | — | | | 291 | |

| The Shops at Kalakaua | | 275 | | | 15 | | | 51 | | | (100) | | | — | | | 241 | |

| Waikele Center | | 3,225 | | | 425 | | | 994 | | | (1,759) | | | 5 | | | 2,890 | |

| Alamo Quarry Market | | 3,698 | | | 319 | | | 1,122 | | | (1,535) | | | 3 | | | 3,607 | |

| Hassalo on Eighth - Retail | | 248 | | | 22 | | | 41 | | | (124) | | | — | | | 187 | |

| Subtotal Retail Portfolio | | $ | 19,222 | | | $ | 1,741 | | | $ | 5,900 | | | $ | (8,677) | | | $ | 70 | | | $ | 18,256 | |

| | | | | |

| Fourth Quarter 2023 Supplemental Information | Page |

16

| | | | | |

| |

| PROPERTY REVENUE AND OPERATING EXPENSES (CONTINUED) | |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited, amounts in thousands) | | Three Months Ended December 31, 2023 |

| | | | Additional | | | | Property | | | | |

| | | | Property | | Billed Expense | | Operating | | Rental | | Cash |

| Property | | Base Rent (1) | | Income (2) | | Reimbursements (3) | | Expenses (4) | | Adjustments (5) | | NOI (6) |

| Multifamily Portfolio | | | | | | | | | | | | |

| Loma Palisades | | $ | 4,246 | | | $ | 297 | | | $ | — | | | $ | (1,804) | | | $ | (77) | | | $ | 2,662 | |

| Imperial Beach Gardens | | 1,160 | | | 81 | | | — | | | (513) | | | — | | | 728 | |

| Mariner's Point | | 564 | | | 33 | | | — | | | (246) | | | — | | | 351 | |

| Santa Fe Park RV Resort | | 416 | | | 37 | | | — | | | (276) | | | — | | | 177 | |

| Pacific Ridge Apartments | | 5,929 | | | 214 | | | — | | | (2,606) | | | (83) | | | 3,454 | |

| Hassalo on Eighth - Multifamily | | 2,876 | | | 385 | | | — | | | (2,002) | | | (88) | | | 1,171 | |

| Subtotal Multifamily Portfolio | | $ | 15,191 | | | $ | 1,047 | | | $ | — | | | $ | (7,447) | | | $ | (248) | | | $ | 8,543 | |

| Mixed-Use Portfolio | | | | | | | | | | | | |

| Waikiki Beach Walk - Retail | | $ | 2,235 | | | $ | 1,235 | | | $ | 907 | | | $ | (1,725) | | | $ | (13) | | | $ | 2,639 | |

| Waikiki Beach Walk - Embassy Suites™ | | 10,470 | | | 1,776 | | | — | | | (9,600) | | | — | | | 2,646 | |

| Subtotal Mixed-Use Portfolio | | $ | 12,705 | | | $ | 3,011 | | | $ | 907 | | | $ | (11,325) | | | $ | (13) | | | $ | 5,285 | |

| Subtotal Development Properties | | $ | — | | | $ | 5 | | | $ | — | | | $ | (282) | | | $ | — | | | $ | (277) | |

| Total | | $ | 91,577 | | | $ | 7,458 | | | $ | 13,664 | | | $ | (43,724) | | | $ | (1,279) | | | $ | 67,696 | |

Cash NOI is a non-GAAP supplemental earnings measure which the company considers meaningful in measuring its operating performance. A reconciliation of total cash NOI to net income is included in the Glossary of Terms.

Notes:

(1) Base rent for our office and retail portfolio and the retail portion of our mixed-use portfolio represents base rent for the three months ended December 31, 2023 (before deferrals, abatements, and tenant improvement reimbursements) and excludes the impact of straight-line rent and above (below) market rent adjustments. Total abatements for our office portfolio were approximately $1.5 million for the three months ended December 31, 2023. Total abatements for our retail portfolio and mixed-use portfolio were minimal for the three months ended December 31, 2023. In the case of triple net or modified gross leases, annualized base rent does not include tenant reimbursements for real estate taxes, insurance, common area or other operating expenses. Multifamily portfolio base rent represents base rent (including parking, before abatements) less vacancy allowance and employee rent credits and includes additional rents (additional rents include insufficient notice penalties, month-to-month charges and pet rent). There were $0.2 million of abatements for our multifamily portfolio for the three months ended December 31, 2023. For Waikiki Beach Walk - Embassy SuitesTM, base rent is equal to the actual room revenue for the three months ended December 31, 2023. Total tenant improvement reimbursements for our office portfolio, retail portfolio and the retail portion of our mixed-use portfolio were approximately $0.5 million in the aggregate for the three months ended December 31, 2023.

(2) Represents additional property-related income for the three months ended December 31, 2023, which includes: (i) percentage rent, (ii) other rent (such as storage rent, license fees and association fees) and (iii) other property income (such as late fees, default fees, lease termination fees, parking revenue, the reimbursement of general excise taxes, laundry income and food and beverage sales).

(3) Represents billed tenant expense reimbursements for the three months ended December 31, 2023.

(4) Represents property operating expenses for the three months ended December 31, 2023. Property operating expenses includes all rental expenses, except non cash rent expense.

(5) Represents various rental adjustments related to base rent (deferrals, abatements, and tenant improvement reimbursements).

(6) See Glossary of Terms.

(7) Base rent shown includes amounts related to American Assets Trust, L.P.'s corporate leases at Torrey Point and Lloyd Portfolio. This intercompany rent is eliminated in the consolidated statement of operations. The base rent and abatement were both $0.4 million for the three months ended December 31, 2023.

| | | | | |

| Fourth Quarter 2023 Supplemental Information | Page |

17

| | | | | |

| |

| SEGMENT CAPITAL EXPENDITURES | |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited, amounts in thousands) | | Three Months Ended December 31, 2023 |

| Segment | | Tenant Improvements and Leasing Commissions | | Maintenance Capital Expenditures | | Total Tenant Improvements, Leasing Commissions and Maintenance Capital Expenditures | | Redevelopment and Expansions | | New Development | | Total Capital Expenditures |

| Office Portfolio | | $ | 2,071 | | | $ | 5,429 | | | $ | 7,500 | | | $ | 968 | | | $ | 6,226 | | | $ | 14,694 | |

| Retail Portfolio | | 1,192 | | | 1,866 | | | 3,058 | | | — | | | — | | | 3,058 | |

| Multifamily Portfolio | | — | | | 1,396 | | | 1,396 | | | — | | | — | | | 1,396 | |

| Mixed-Use Portfolio | | 43 | | | 468 | | | 511 | | | — | | | — | | | 511 | |

| Total | | $ | 3,306 | | | $ | 9,159 | | | $ | 12,465 | | | $ | 968 | | | $ | 6,226 | | | $ | 19,659 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Year Ended December 31, 2023 |

| Segment | | Tenant Improvements and Leasing Commissions | | Maintenance Capital Expenditures | | Total Tenant Improvements, Leasing Commissions and Maintenance Capital Expenditures | | Redevelopment and Expansions | | New Development | | Total Capital Expenditures |

| Office Portfolio | | $ | 15,010 | | | $ | 21,665 | | | $ | 36,675 | | | $ | 7,251 | | | $ | 27,410 | | | $ | 71,336 | |

| Retail Portfolio | | 5,668 | | | 3,188 | | | 8,856 | | | — | | | | | 8,856 | |

| Multifamily Portfolio | | — | | | 5,902 | | | 5,902 | | | — | | | | | 5,902 | |

| Mixed-Use Portfolio | | 512 | | | 3,281 | | | 3,793 | | | — | | | | | 3,793 | |

| Total | | $ | 21,190 | | | $ | 34,036 | | | $ | 55,226 | | | $ | 7,251 | | | $ | 27,410 | | | $ | 89,887 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

|

|

| | | | | | | | | | | | |

| | | | | |

| Fourth Quarter 2023 Supplemental Information | Page |

18

| | | | | |

| |

| SUMMARY OF OUTSTANDING DEBT | |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited, amounts in thousands) | | Amount | | | | | | |

| | Outstanding at | | | | Annual Debt | | |

| Debt | | December 31, 2023 | | Interest Rate | | Service (1) | | Maturity Date |

| City Center Bellevue | | 75,000 | | | 5.08 | % | | 3,874 | | | October 1, 2027 |

Secured Notes Payable / Weighted Average (2) | | $ | 75,000 | | | 5.08 | % | | $ | 3,874 | | | |

| | | | | | | | |

Term Loan A (3) | | $ | 100,000 | | | 2.70 | % | | $ | 2,700 | | | January 5, 2027 |

Term Loan B (4) | | 150,000 | | | 5.47 | % | | 8,378 | | | January 5, 2025 |

Term Loan C (5) | | 75,000 | | | 5.47 | % | | 4,189 | | | January 5, 2025 |