00018287232023Q212/31FALSEhttp://fasb.org/us-gaap/2023#AccountingStandardsUpdate201613Memberhttp://fasb.org/us-gaap/2023#AccountingStandardsUpdate202108Member33.3333.3300018287232023-01-012023-06-300001828723us-gaap:CommonClassAMember2023-08-11xbrli:shares0001828723us-gaap:CommonClassBMember2023-08-1100018287232023-04-012023-06-30iso4217:USD00018287232022-04-012022-06-3000018287232022-01-012022-06-30iso4217:USDxbrli:shares00018287232023-06-3000018287232022-12-310001828723us-gaap:RelatedPartyMember2023-06-300001828723us-gaap:RelatedPartyMember2022-12-310001828723us-gaap:NonrelatedPartyMember2023-06-300001828723us-gaap:NonrelatedPartyMember2022-12-310001828723us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-06-300001828723us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310001828723us-gaap:CommonStockMember2022-03-310001828723us-gaap:AdditionalPaidInCapitalMember2022-03-310001828723us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001828723us-gaap:RetainedEarningsMember2022-03-310001828723us-gaap:ParentMember2022-03-310001828723us-gaap:NoncontrollingInterestMember2022-03-3100018287232022-03-310001828723us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001828723us-gaap:ParentMember2022-04-012022-06-300001828723us-gaap:NoncontrollingInterestMember2022-04-012022-06-300001828723us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-04-012022-06-300001828723us-gaap:CommonStockMemberamps:PublicAndPlacementWarrantsMember2022-04-012022-06-300001828723us-gaap:AdditionalPaidInCapitalMemberamps:PublicAndPlacementWarrantsMember2022-04-012022-06-300001828723amps:PublicAndPlacementWarrantsMemberus-gaap:ParentMember2022-04-012022-06-300001828723amps:PublicAndPlacementWarrantsMember2022-04-012022-06-300001828723us-gaap:RetainedEarningsMember2022-04-012022-06-300001828723us-gaap:CommonStockMember2022-06-300001828723us-gaap:AdditionalPaidInCapitalMember2022-06-300001828723us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001828723us-gaap:RetainedEarningsMember2022-06-300001828723us-gaap:ParentMember2022-06-300001828723us-gaap:NoncontrollingInterestMember2022-06-3000018287232022-06-300001828723us-gaap:CommonStockMember2023-03-310001828723us-gaap:AdditionalPaidInCapitalMember2023-03-310001828723us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001828723us-gaap:RetainedEarningsMember2023-03-310001828723us-gaap:ParentMember2023-03-310001828723us-gaap:NoncontrollingInterestMember2023-03-3100018287232023-03-310001828723us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001828723us-gaap:ParentMember2023-04-012023-06-300001828723us-gaap:NoncontrollingInterestMember2023-04-012023-06-300001828723us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001828723us-gaap:RetainedEarningsMember2023-04-012023-06-300001828723us-gaap:CommonStockMember2023-06-300001828723us-gaap:AdditionalPaidInCapitalMember2023-06-300001828723us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001828723us-gaap:RetainedEarningsMember2023-06-300001828723us-gaap:ParentMember2023-06-300001828723us-gaap:NoncontrollingInterestMember2023-06-300001828723us-gaap:CommonStockMember2021-12-310001828723us-gaap:AdditionalPaidInCapitalMember2021-12-310001828723us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001828723us-gaap:RetainedEarningsMember2021-12-310001828723us-gaap:ParentMember2021-12-310001828723us-gaap:NoncontrollingInterestMember2021-12-3100018287232021-12-310001828723us-gaap:AdditionalPaidInCapitalMember2022-01-012022-06-300001828723us-gaap:ParentMember2022-01-012022-06-300001828723us-gaap:NoncontrollingInterestMember2022-01-012022-06-300001828723us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-01-012022-06-300001828723us-gaap:CommonClassAMemberus-gaap:AdditionalPaidInCapitalMember2022-01-012022-06-300001828723us-gaap:CommonClassAMemberus-gaap:ParentMember2022-01-012022-06-300001828723us-gaap:CommonClassAMember2022-01-012022-06-300001828723us-gaap:CommonStockMemberamps:PublicAndPlacementWarrantsMember2022-01-012022-06-300001828723us-gaap:AdditionalPaidInCapitalMemberamps:PublicAndPlacementWarrantsMember2022-01-012022-06-300001828723amps:PublicAndPlacementWarrantsMemberus-gaap:ParentMember2022-01-012022-06-300001828723amps:PublicAndPlacementWarrantsMember2022-01-012022-06-300001828723us-gaap:RetainedEarningsMember2022-01-012022-06-300001828723us-gaap:CommonStockMember2022-12-310001828723us-gaap:AdditionalPaidInCapitalMember2022-12-310001828723us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001828723us-gaap:RetainedEarningsMember2022-12-310001828723us-gaap:ParentMember2022-12-310001828723us-gaap:NoncontrollingInterestMember2022-12-310001828723us-gaap:CommonStockMember2023-01-012023-06-300001828723us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001828723us-gaap:ParentMember2023-01-012023-06-300001828723us-gaap:NoncontrollingInterestMember2023-01-012023-06-300001828723us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-01-012023-06-300001828723us-gaap:CommonClassAMemberus-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001828723us-gaap:CommonClassAMemberus-gaap:ParentMember2023-01-012023-06-300001828723us-gaap:CommonClassAMember2023-01-012023-06-300001828723us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-06-300001828723us-gaap:RetainedEarningsMember2023-01-012023-06-300001828723srt:RestatementAdjustmentMember2022-12-310001828723srt:RestatementAdjustmentMember2022-01-012022-06-300001828723us-gaap:CommonClassBMember2023-06-300001828723us-gaap:AccountsReceivableMemberamps:CustomerOneMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-06-30xbrli:pure0001828723amps:CustomerOneMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2023-04-012023-06-300001828723amps:CustomerOneMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-06-300001828723us-gaap:AccountsReceivableMemberamps:CustomerOneMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001828723us-gaap:AccountingStandardsUpdate201613Member2023-01-012023-06-300001828723us-gaap:AccountingStandardsUpdate202108Member2023-01-012023-06-300001828723us-gaap:AccountingStandardsUpdate202108Member2023-01-010001828723amps:PowerPurchaseAgreementsMember2023-04-012023-06-300001828723amps:PowerPurchaseAgreementsMember2022-04-012022-06-300001828723amps:PowerPurchaseAgreementsMember2023-01-012023-06-300001828723amps:PowerPurchaseAgreementsMember2022-01-012022-06-300001828723amps:NetMeteringCreditAgreementsMember2023-04-012023-06-300001828723amps:NetMeteringCreditAgreementsMember2022-04-012022-06-300001828723amps:NetMeteringCreditAgreementsMember2023-01-012023-06-300001828723amps:NetMeteringCreditAgreementsMember2022-01-012022-06-300001828723amps:PowerSalesOnWholesaleMarketsMember2023-04-012023-06-300001828723amps:PowerSalesOnWholesaleMarketsMember2022-04-012022-06-300001828723amps:PowerSalesOnWholesaleMarketsMember2023-01-012023-06-300001828723amps:PowerSalesOnWholesaleMarketsMember2022-01-012022-06-300001828723amps:PowerSalesMember2023-04-012023-06-300001828723amps:PowerSalesMember2022-04-012022-06-300001828723amps:PowerSalesMember2023-01-012023-06-300001828723amps:PowerSalesMember2022-01-012022-06-300001828723amps:SolarRenewableEnergyCreditRevenueMember2023-04-012023-06-300001828723amps:SolarRenewableEnergyCreditRevenueMember2022-04-012022-06-300001828723amps:SolarRenewableEnergyCreditRevenueMember2023-01-012023-06-300001828723amps:SolarRenewableEnergyCreditRevenueMember2022-01-012022-06-300001828723amps:RentalIncomeMember2023-04-012023-06-300001828723amps:RentalIncomeMember2022-04-012022-06-300001828723amps:RentalIncomeMember2023-01-012023-06-300001828723amps:RentalIncomeMember2022-01-012022-06-300001828723amps:PerformanceBasedIncentivesMember2023-04-012023-06-300001828723amps:PerformanceBasedIncentivesMember2022-04-012022-06-300001828723amps:PerformanceBasedIncentivesMember2023-01-012023-06-300001828723amps:PerformanceBasedIncentivesMember2022-01-012022-06-300001828723amps:RevenueRecognizedOnContractLiabilitiesMember2023-04-012023-06-300001828723amps:RevenueRecognizedOnContractLiabilitiesMember2022-04-012022-06-300001828723amps:RevenueRecognizedOnContractLiabilitiesMember2023-01-012023-06-300001828723amps:RevenueRecognizedOnContractLiabilitiesMember2022-01-012022-06-300001828723amps:PowerPurchaseAgreementsMember2023-06-300001828723amps:PowerPurchaseAgreementsMember2022-12-310001828723amps:NetMeteringCreditAgreementsMember2023-06-300001828723amps:NetMeteringCreditAgreementsMember2022-12-310001828723amps:PowerSalesOnWholesaleMarketsMember2023-06-300001828723amps:PowerSalesOnWholesaleMarketsMember2022-12-310001828723amps:PowerSalesMember2023-06-300001828723amps:PowerSalesMember2022-12-310001828723amps:SolarRenewableEnergyCreditRevenueMember2023-06-300001828723amps:SolarRenewableEnergyCreditRevenueMember2022-12-310001828723amps:RentalIncomeMember2023-06-300001828723amps:RentalIncomeMember2022-12-310001828723amps:PerformanceBasedIncentivesMember2023-06-300001828723amps:PerformanceBasedIncentivesMember2022-12-310001828723amps:SolarRenewableEnergyCreditsMember2023-06-300001828723amps:SolarRenewableEnergyCreditsMember2022-12-310001828723amps:ZildjianSolarVLLCMember2023-01-012023-06-30amps:variableInterestEntity0001828723amps:ZildjianSolarVLLCMember2022-01-012022-12-310001828723amps:ZildjianSolarVLLCMemberamps:StellarMAAcquisitionMember2023-01-11utr:MW0001828723amps:StellarMAAcquisitionMember2023-01-112023-01-110001828723amps:StellarMAAcquisitionMember2023-01-110001828723amps:AcquisitionsOfVIEsMember2023-01-012023-06-300001828723amps:TrueGreenIIAcquisitionMember2023-06-300001828723amps:AssetAcquisitionsMember2023-06-300001828723amps:AssetAcquisitionsMember2023-01-012023-06-300001828723amps:AcquisitionsOfVIEsMember2023-06-300001828723amps:TrueGreenIIAcquisitionMember2023-02-15amps:operatingSolarEnergyFacility0001828723amps:TrueGreenIIAcquisitionMember2023-02-15amps:developmentSolarEnergyFacility0001828723amps:TrueGreenIIAcquisitionMember2023-02-152023-02-150001828723amps:TrueGreenIIAcquisitionMember2022-12-230001828723amps:TrueGreenIIAcquisitionMember2023-02-152023-06-300001828723amps:TrueGreenIIAcquisitionMemberamps:MeasurementPeriodAdjustmentsMember2023-02-152023-06-300001828723amps:TrueGreenIIAcquisitionMemberamps:MeasurementPeriodAdjustmentsMember2023-02-152023-02-150001828723amps:TrueGreenIIAcquisitionMemberamps:PreliminaryAllocationMember2023-02-150001828723amps:FinalAllocationMemberamps:TrueGreenIIAcquisitionMember2023-02-150001828723amps:TrueGreenIIAcquisitionMemberamps:PreliminaryAllocationMember2023-02-152023-02-150001828723amps:FinalAllocationMemberamps:TrueGreenIIAcquisitionMember2023-02-152023-02-150001828723amps:TrueGreenIIIAcquisitionMember2023-01-012023-06-300001828723amps:TrueGreenIIIAcquisitionMember2023-04-012023-06-300001828723amps:FavorableRateRevenueContractsMemberamps:PowerPurchaseAgreementsMemberamps:TrueGreenIIAcquisitionMember2023-02-152023-02-150001828723amps:FavorableRateRevenueContractsMemberamps:RenewableEnergyCreditsMemberamps:TrueGreenIIAcquisitionMember2023-02-152023-02-150001828723amps:UnfavorableRateRevenueContractsMemberamps:PowerPurchaseAgreementsMemberamps:TrueGreenIIAcquisitionMember2023-02-152023-02-150001828723amps:UnfavorableRateRevenueContractsMemberamps:RenewableEnergyCreditsMemberamps:TrueGreenIIAcquisitionMember2023-02-152023-02-150001828723amps:TrueGreenIIAcquisitionMember2023-04-012023-06-300001828723amps:TrueGreenIIAcquisitionMember2022-04-012022-06-300001828723amps:TrueGreenIIAcquisitionMember2023-01-012023-06-300001828723amps:TrueGreenIIAcquisitionMember2022-01-012022-06-300001828723amps:DESRIIIDESRIVOfAcquisitionMember2022-11-11amps:facility0001828723amps:PreliminaryAllocationMemberamps:DESRIIIDESRIVOfAcquisitionMember2022-11-112022-11-110001828723amps:DESRIIIDESRIVOfAcquisitionMember2022-11-110001828723amps:DESRIIIDESRIVOfAcquisitionMember2022-11-112022-11-110001828723amps:DESRIIIDESRIVOfAcquisitionMember2023-04-012023-06-300001828723amps:FavorableRateRevenueContractsMemberamps:PowerPurchaseAgreementsMemberamps:DESRIIIDESRIVOfAcquisitionMember2021-08-252021-08-250001828723amps:UnfavorableRateRevenueContractsMemberamps:PowerPurchaseAgreementsMemberamps:DESRIIIDESRIVOfAcquisitionMember2021-08-252021-08-250001828723amps:APAFTermLoanMember2023-06-300001828723amps:APAFTermLoanMember2022-12-310001828723amps:APAFIITermLoanMember2023-06-300001828723amps:APAFIITermLoanMember2022-12-310001828723amps:APAFIITermLoanMemberamps:SecuredOvernightFinancingRateMember2023-06-300001828723amps:APAFIIITermLoanMember2023-06-300001828723amps:APAFIIITermLoanMember2022-12-310001828723amps:APAGRevolverMember2023-06-300001828723amps:APAGRevolverMember2022-12-310001828723amps:SecuredOvernightFinancingRateMemberamps:APAGRevolverMember2023-06-300001828723amps:OtherTermLoansMember2023-06-300001828723amps:OtherTermLoansMember2022-12-310001828723amps:FinancingObligationsRecognizedInFailedSaleLeasebackTransactionsMember2023-06-300001828723amps:FinancingObligationsRecognizedInFailedSaleLeasebackTransactionsMember2022-12-310001828723amps:BlackstoneCreditFacilityMemberamps:APAFTermLoanMember2021-08-250001828723amps:BlackstoneCreditFacilityMemberamps:APAFTermLoanMember2021-08-252021-08-250001828723amps:APAFIITermLoanMemberamps:OtherTermLoansMember2022-12-230001828723amps:APAFIITermLoanMemberamps:SecuredOvernightFinancingRateMember2022-12-232022-12-230001828723amps:APAFIITermLoanMember2022-12-230001828723amps:APAFIIITermLoanMember2023-02-150001828723amps:APAFIIITermLoanMember2023-01-012023-06-300001828723amps:APAFIIITermLoanMember2023-06-150001828723amps:APAFIIITermLoanMember2023-06-152023-06-150001828723amps:APAGRevolverMember2022-12-192022-12-190001828723us-gaap:ConstructionLoansMemberamps:ConstructionToTermLoanFacilityMember2020-01-100001828723amps:ConstructionToTermLoanFacilityMember2023-01-012023-06-300001828723amps:ConstructionToTermLoanFacilityMember2023-06-152023-06-150001828723us-gaap:ConstructionLoansMemberamps:ConstructionToTermLoanFacilityMember2022-12-310001828723amps:TermLoanMemberamps:ConstructionToTermLoanFacilityMember2022-12-310001828723amps:ConstructionToTermLoanFacilityMember2022-12-310001828723amps:StellarNJ2AcquisitionMemberamps:ProjectLevelTermLoanMember2022-08-290001828723amps:ProjectLevelTermLoanMember2023-06-300001828723amps:ProjectLevelTermLoanMember2022-12-310001828723us-gaap:LetterOfCreditMemberamps:DeutscheBankMember2023-06-300001828723us-gaap:UnusedLinesOfCreditMemberamps:DeutscheBankMember2023-06-300001828723us-gaap:LetterOfCreditMemberamps:DeutscheBankMember2022-12-310001828723us-gaap:UnusedLinesOfCreditMemberamps:DeutscheBankMember2022-12-310001828723us-gaap:LetterOfCreditMemberamps:FifthThirdBankMember2023-06-300001828723us-gaap:UnusedLinesOfCreditMemberamps:FifthThirdBankMember2023-06-300001828723us-gaap:LetterOfCreditMemberamps:FifthThirdBankMember2022-12-310001828723us-gaap:UnusedLinesOfCreditMemberamps:FifthThirdBankMember2022-12-310001828723us-gaap:LetterOfCreditMemberamps:CITBankNAMember2023-06-300001828723us-gaap:UnusedLinesOfCreditMemberamps:CITBankNAMember2023-06-300001828723us-gaap:LetterOfCreditMemberamps:CITBankNAMember2022-12-310001828723us-gaap:UnusedLinesOfCreditMemberamps:CITBankNAMember2022-12-310001828723us-gaap:LetterOfCreditMemberamps:KeyBankAndTheHuntingtonBankMember2023-06-300001828723us-gaap:UnusedLinesOfCreditMemberamps:KeyBankAndTheHuntingtonBankMember2023-06-300001828723us-gaap:LetterOfCreditMemberamps:KeyBankAndTheHuntingtonBankMember2022-12-310001828723us-gaap:UnusedLinesOfCreditMemberamps:KeyBankAndTheHuntingtonBankMember2022-12-310001828723us-gaap:LetterOfCreditMemberamps:CitibankNAMember2023-06-300001828723us-gaap:UnusedLinesOfCreditMemberamps:CitibankNAMember2023-06-300001828723us-gaap:LetterOfCreditMemberamps:CitibankNAMember2022-12-310001828723us-gaap:UnusedLinesOfCreditMemberamps:CitibankNAMember2022-12-310001828723us-gaap:LetterOfCreditMember2023-06-300001828723us-gaap:UnusedLinesOfCreditMember2023-06-300001828723us-gaap:LetterOfCreditMember2022-12-310001828723us-gaap:UnusedLinesOfCreditMember2022-12-310001828723us-gaap:SuretyBondMember2023-06-300001828723us-gaap:SuretyBondMember2022-12-3100018287232022-01-012022-12-310001828723amps:StellarHIAcquisitionMember2023-06-300001828723us-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateSwapMember2023-06-300001828723us-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel2Member2023-06-300001828723us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateSwapMember2023-06-300001828723us-gaap:InterestRateSwapMember2023-06-300001828723amps:ForwardStartingInterestRateSwapMemberus-gaap:FairValueInputsLevel1Member2023-06-300001828723amps:ForwardStartingInterestRateSwapMemberus-gaap:FairValueInputsLevel2Member2023-06-300001828723amps:ForwardStartingInterestRateSwapMemberus-gaap:FairValueInputsLevel3Member2023-06-300001828723amps:ForwardStartingInterestRateSwapMember2023-06-300001828723us-gaap:FairValueInputsLevel1Member2023-06-300001828723us-gaap:FairValueInputsLevel2Member2023-06-300001828723us-gaap:FairValueInputsLevel3Member2023-06-300001828723amps:ContingentConsiderationLiabilityMemberus-gaap:FairValueInputsLevel1Member2023-06-300001828723amps:ContingentConsiderationLiabilityMemberus-gaap:FairValueInputsLevel2Member2023-06-300001828723amps:ContingentConsiderationLiabilityMemberus-gaap:FairValueInputsLevel3Member2023-06-300001828723amps:ContingentConsiderationLiabilityMember2023-06-300001828723us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001828723us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Member2022-12-310001828723us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Member2022-12-310001828723us-gaap:MoneyMarketFundsMember2022-12-310001828723us-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateSwapMember2022-12-310001828723us-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel2Member2022-12-310001828723us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateSwapMember2022-12-310001828723us-gaap:InterestRateSwapMember2022-12-310001828723us-gaap:FairValueInputsLevel1Member2022-12-310001828723us-gaap:FairValueInputsLevel2Member2022-12-310001828723us-gaap:FairValueInputsLevel3Member2022-12-310001828723amps:ContingentConsiderationLiabilityMemberus-gaap:FairValueInputsLevel1Member2022-12-310001828723amps:ContingentConsiderationLiabilityMemberus-gaap:FairValueInputsLevel2Member2022-12-310001828723amps:ContingentConsiderationLiabilityMemberus-gaap:FairValueInputsLevel3Member2022-12-310001828723amps:ContingentConsiderationLiabilityMember2022-12-310001828723us-gaap:InterestRateSwapMember2023-04-012023-06-300001828723us-gaap:InterestRateSwapMember2023-01-012023-06-300001828723amps:ForwardStartingInterestRateSwapMember2023-06-152023-06-150001828723amps:ForwardStartingInterestRateSwapMember2023-04-012023-06-300001828723amps:ForwardStartingInterestRateSwapMember2023-01-012023-06-300001828723amps:SolarAcquisitionMember2020-12-220001828723amps:SolarAcquisitionMember2020-12-222020-12-220001828723amps:SolarAcquisitionMember2023-06-300001828723amps:SolarAcquisitionMember2022-12-310001828723amps:SolarAcquisitionMemberamps:PowerRateMember2023-01-012023-06-300001828723amps:SolarAcquisitionMemberamps:PowerRateMember2023-04-012023-06-300001828723amps:SolarAcquisitionMemberamps:PowerRateMember2022-04-012022-06-300001828723amps:ProductionVolumeMemberamps:SolarAcquisitionMember2022-01-012022-06-300001828723amps:SolarAcquisitionMember2023-01-012023-06-300001828723amps:SolarAcquisitionMember2022-01-012022-06-3000018287232021-01-012021-12-310001828723us-gaap:CommonClassAMember2023-06-300001828723us-gaap:CommonClassAMember2022-12-310001828723us-gaap:CommonClassBMember2022-12-310001828723amps:ATMEquityProgramMember2023-04-062023-04-060001828723amps:ATMEquityProgramMember2023-01-012023-06-300001828723srt:MinimumMember2023-01-012023-06-300001828723srt:MaximumMember2023-01-012023-06-300001828723us-gaap:PerformanceGuaranteeMember2022-12-310001828723us-gaap:PerformanceGuaranteeMember2023-06-300001828723amps:APAFTermLoanAndAPAFIIITermLoanMemberus-gaap:RelatedPartyMember2023-04-012023-06-300001828723amps:APAFTermLoanAndAPAFIIITermLoanMemberus-gaap:RelatedPartyMember2022-04-012022-06-300001828723amps:APAFTermLoanAndAPAFIIITermLoanMemberus-gaap:RelatedPartyMember2023-01-012023-06-300001828723amps:APAFTermLoanAndAPAFIIITermLoanMemberus-gaap:RelatedPartyMember2022-01-012022-06-300001828723amps:APAFTermLoanAndAPAFIIITermLoanMemberus-gaap:RelatedPartyMember2023-06-300001828723amps:APAFTermLoanAndAPAFIIITermLoanMemberus-gaap:RelatedPartyMember2022-12-310001828723amps:CBREGroupIncMembersrt:MinimumMemberus-gaap:RelatedPartyMember2022-12-09iso4217:USDutr:MW0001828723amps:CBREGroupIncMembersrt:MaximumMemberus-gaap:RelatedPartyMember2022-12-090001828723amps:CBREGroupIncMemberamps:CommercialCollaborationAgreementMemberus-gaap:RelatedPartyMember2023-01-012023-06-300001828723amps:CBREGroupIncMemberamps:CommercialCollaborationAgreementMemberus-gaap:RelatedPartyMember2022-01-012022-12-310001828723amps:CBREGroupIncMemberamps:PurchaseAndSaleAgreementMemberus-gaap:RelatedPartyMember2023-04-012023-06-300001828723amps:CBREGroupIncMemberamps:PurchaseAndSaleAgreementMemberus-gaap:RelatedPartyMember2022-04-012022-06-300001828723amps:CBREGroupIncMemberus-gaap:RelatedPartyMemberamps:MasterServicesAgreementMember2023-01-012023-06-300001828723amps:CBREGroupIncMemberus-gaap:RelatedPartyMemberamps:MasterServicesAgreementMember2022-01-012022-06-300001828723amps:CBREGroupIncMemberus-gaap:RelatedPartyMemberamps:MasterServicesAgreementMember2023-06-300001828723amps:CBREGroupIncMemberus-gaap:RelatedPartyMemberamps:MasterServicesAgreementMember2022-12-310001828723us-gaap:RestrictedStockUnitsRSUMember2023-04-012023-06-300001828723us-gaap:RestrictedStockUnitsRSUMember2022-04-012022-06-300001828723us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-300001828723us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-06-300001828723us-gaap:RestrictedStockMember2023-04-012023-06-300001828723us-gaap:RestrictedStockMember2022-04-012022-06-300001828723us-gaap:RestrictedStockMember2023-01-012023-06-300001828723us-gaap:RestrictedStockMember2022-01-012022-06-300001828723us-gaap:CommonClassAMember2023-04-012023-06-300001828723us-gaap:CommonClassAMember2022-04-012022-06-300001828723us-gaap:RestrictedStockUnitsRSUMember2023-06-300001828723us-gaap:RestrictedStockUnitsRSUMember2022-12-310001828723us-gaap:RestrictedStockUnitsRSUMemberamps:HoldingsRestrictedUnitsPlanMember2023-06-300001828723us-gaap:RestrictedStockUnitsRSUMemberamps:HoldingsRestrictedUnitsPlanMember2022-12-310001828723amps:OmnibusIncentivePlanMemberamps:PerformanceBasedRestrictedStockUnitsRSUsMember2021-07-120001828723us-gaap:CommonClassAMemberamps:OmnibusIncentivePlanMember2021-07-120001828723amps:OmnibusIncentivePlanMember2021-07-120001828723amps:TimeBasedRestrictedStockUnitsRSUsMemberamps:OmnibusIncentivePlanMember2023-04-012023-06-300001828723amps:TimeBasedRestrictedStockUnitsRSUsMemberamps:OmnibusIncentivePlanMember2023-01-012023-06-300001828723amps:OmnibusIncentivePlanMemberamps:PerformanceBasedRestrictedStockUnitsRSUsMember2023-01-012023-06-300001828723amps:OmnibusIncentivePlanMemberamps:PerformanceBasedRestrictedStockUnitsRSUsMember2023-04-012023-06-300001828723us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMemberamps:OmnibusIncentivePlanMember2023-04-012023-06-300001828723us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMemberamps:OmnibusIncentivePlanMember2023-01-012023-06-300001828723us-gaap:RestrictedStockUnitsRSUMemberamps:OmnibusIncentivePlanMember2023-01-012023-06-30amps:installment0001828723us-gaap:RestrictedStockUnitsRSUMemberamps:OmnibusIncentivePlanMember2023-04-012023-06-300001828723us-gaap:CommonClassAMemberamps:OmnibusIncentivePlanMember2023-06-300001828723us-gaap:CommonClassAMemberamps:OmnibusIncentivePlanMember2022-12-310001828723amps:OmnibusIncentivePlanMember2023-06-300001828723us-gaap:RestrictedStockUnitsRSUMemberamps:OmnibusIncentivePlanMember2022-04-012022-06-300001828723us-gaap:RestrictedStockUnitsRSUMemberamps:OmnibusIncentivePlanMember2022-01-012022-06-300001828723us-gaap:CommonClassAMemberamps:EmployeeStockPurchasePlanMember2023-06-300001828723us-gaap:CommonClassAMemberamps:EmployeeStockPurchasePlanMember2022-12-310001828723amps:EmployeeStockPurchasePlanMember2023-06-300001828723us-gaap:CommonClassAMemberamps:EmployeeStockPurchasePlanMember2022-06-300001828723us-gaap:CommonClassAMemberamps:EmployeeStockPurchasePlanMember2022-01-012022-06-300001828723us-gaap:CommonClassAMemberamps:EmployeeStockPurchasePlanMember2023-01-012023-06-300001828723amps:TimeBasedRestrictedStockUnitsRSUsMemberamps:OmnibusIncentivePlanMember2021-07-122021-07-120001828723amps:OmnibusIncentivePlanMemberamps:PerformanceBasedRestrictedStockUnitsRSUsMember2021-07-122021-07-120001828723amps:APAFIIITermLoanMemberus-gaap:SubsequentEventMember2023-07-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2023

OR

| | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-04321

ALTUS POWER, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | | 85-3448396 | |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) | |

| |

2200 Atlantic Street, Sixth Floor | | | |

Stamford, | CT | | 06902 | |

(Address of Principal Executive Offices) | (Zip Code) | |

(203)-698-0090

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

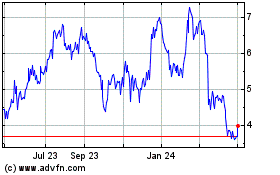

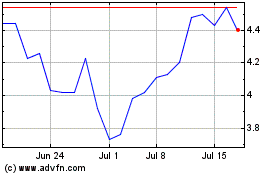

| Class A common stock, par value $0.0001 per share | AMPS | New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of August 11, 2023, there were 158,989,953 shares of Class A common stock outstanding and 1,006,250 shares of Class B common stock outstanding.

Table of Contents

Part I. Financial Statements

Item 1. Financial Statements

Altus Power, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

(In thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Operating revenues, net | $ | 46,513 | | | $ | 24,762 | | | $ | 75,891 | | | $ | 43,961 | |

| Operating expenses | | | | | | | |

| Cost of operations (exclusive of depreciation and amortization shown separately below) | 7,581 | | | 4,290 | | | 13,557 | | | 8,354 | |

| General and administrative | 8,291 | | | 6,558 | | | 15,653 | | | 12,942 | |

| Depreciation, amortization and accretion expense | 12,959 | | | 6,863 | | | 24,335 | | | 13,685 | |

| Acquisition and entity formation costs | 1,369 | | | 52 | | | 2,860 | | | 346 | |

| Loss (gain) on fair value remeasurement of contingent consideration | 50 | | | (1,140) | | | 100 | | | (971) | |

| Stock-based compensation | 4,256 | | | 2,657 | | | 7,128 | | | 3,962 | |

| Total operating expenses | $ | 34,506 | | | $ | 19,280 | | | $ | 63,633 | | | $ | 38,318 | |

| Operating income | 12,007 | | | 5,482 | | | 12,258 | | | 5,643 | |

| Other (income) expense | | | | | | | |

| Change in fair value of redeemable warrant liability | — | | | (4,659) | | | — | | | (23,117) | |

| Change in fair value of Alignment Shares liability | (2,805) | | | (16,705) | | | (19,823) | | | (63,051) | |

| Other expense (income), net | 1,789 | | | (608) | | | 1,879 | | | (593) | |

| Interest expense, net | 8,524 | | | 5,173 | | | 20,970 | | | 10,111 | |

| Total other expense (income) | $ | 7,508 | | | $ | (16,799) | | | $ | 3,026 | | | $ | (76,650) | |

| Income before income tax expense | $ | 4,499 | | | $ | 22,281 | | | $ | 9,232 | | | $ | 82,293 | |

| Income tax expense | (1,129) | | | (707) | | | (2,017) | | | (584) | |

| Net income | $ | 3,370 | | | $ | 21,574 | | | $ | 7,215 | | | $ | 81,709 | |

| Net loss attributable to noncontrolling interests and redeemable noncontrolling interests | (3,455) | | | (2,541) | | | (5,227) | | | (2,825) | |

| Net income attributable to Altus Power, Inc. | $ | 6,825 | | | $ | 24,115 | | | $ | 12,442 | | | $ | 84,534 | |

| Net income per share attributable to common stockholders | | | | | | | |

| Basic | $ | 0.04 | | | $ | 0.16 | | | $ | 0.08 | | | $ | 0.55 | |

| Diluted | $ | 0.04 | | | $ | 0.16 | | | $ | 0.08 | | | $ | 0.55 | |

| Weighted average shares used to compute net income per share attributable to common stockholders | | | | | | | |

| Basic | 158,719,684 | | | 153,310,068 | | | 158,670,950 | | | 152,988,078 | |

| Diluted | 158,978,275 | | | 153,954,843 | | | 160,747,045 | | | 153,771,992 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Altus Power, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(unaudited)

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net income | $ | 3,370 | | | $ | 21,574 | | | $ | 7,215 | | | $ | 81,709 | |

| Other comprehensive income | | | | | | | |

| Foreign currency translation adjustment | — | | | — | | | 9 | | | — | |

| Unrealized gain on a cash flow hedge, net of tax | 3,770 | | | — | | | 2,999 | | | — | |

| Other comprehensive income, net of tax | $ | 3,770 | | | $ | — | | | $ | 3,008 | | | $ | — | |

| Total comprehensive income | $ | 7,140 | | | $ | 21,574 | | | $ | 10,223 | | | $ | 81,709 | |

| Comprehensive loss attributable to the noncontrolling and redeemable noncontrolling interests | (3,455) | | | (2,541) | | | (5,227) | | | (2,825) | |

| Comprehensive income attributable to Altus Power, Inc. | $ | 10,595 | | | $ | 24,115 | | | $ | 15,450 | | | $ | 84,534 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Altus Power, Inc.

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

(In thousands, except share and per share data)

| | | | | | | | | | | |

| | As of June 30, 2023 | | As of December 31, 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 69,114 | | | $ | 193,016 | |

| Current portion of restricted cash | 3,700 | | | 2,404 | |

| Accounts receivable, net | 27,041 | | | 13,443 | |

| Other current assets | 6,451 | | | 6,206 | |

| Total current assets | 106,306 | | | 215,069 | |

| Restricted cash, noncurrent portion | 11,321 | | | 3,978 | |

| Property, plant and equipment, net | 1,405,497 | | | 1,005,147 | |

| Intangible assets, net | 47,429 | | | 47,627 | |

| Operating lease asset | 151,653 | | | 94,463 | |

| Derivative assets | 5,134 | | | 3,953 | |

| Other assets | 8,047 | | | 6,651 | |

| Total assets | $ | 1,735,387 | | | $ | 1,376,888 | |

| Liabilities, redeemable noncontrolling interests, and stockholders' equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 5,664 | | | $ | 2,740 | |

| Construction payable | 14,972 | | | 9,038 | |

| Interest payable | 7,473 | | | 4,436 | |

| Purchase price payable, current | 22,400 | | | 12,077 | |

| Due to related parties | 153 | | | 112 | |

| Current portion of long-term debt, net | 32,071 | | | 29,959 | |

| Operating lease liability, current | 3,568 | | | 3,339 | |

| Contract liability, current | 3,807 | | | 2,590 | |

| Other current liabilities | 7,322 | | | 3,937 | |

| Total current liabilities | 97,430 | | | 68,228 | |

| Alignment Shares liability | 46,311 | | | 66,145 | |

| Long-term debt, net of unamortized debt issuance costs and current portion | 878,465 | | | 634,603 | |

| Intangible liabilities, net | 14,631 | | | 12,411 | |

| Purchase price payable, noncurrent | — | | | 6,940 | |

| Asset retirement obligations | 13,931 | | | 9,575 | |

| Operating lease liability, noncurrent | 157,876 | | | 94,819 | |

| Contract liability, noncurrent | 6,518 | | | 5,397 | |

| Deferred tax liabilities, net | 13,581 | | | 11,011 | |

| Other long-term liabilities | 3,526 | | | 4,700 | |

| Total liabilities | $ | 1,232,269 | | | $ | 913,829 | |

| Commitments and contingent liabilities (Note 11) | | | |

| Redeemable noncontrolling interests | 20,667 | | | 18,133 | |

| Stockholders' equity | | | |

Common stock $0.0001 par value; 988,591,250 shares authorized as of June 30, 2023, and December 31, 2022; 158,989,953 and 158,904,401 shares issued and outstanding as of June 30, 2023, and December 31, 2022 | 16 | | | 16 | |

| Additional paid-in capital | 478,458 | | | 470,004 | |

| Accumulated deficit | (33,477) | | | (45,919) | |

| Accumulated other comprehensive income | 3,008 | | | — | |

| Total stockholders' equity | $ | 448,005 | | | $ | 424,101 | |

| Noncontrolling interests | 34,446 | | | 20,825 | |

| Total equity | $ | 482,451 | | | $ | 444,926 | |

| Total liabilities, redeemable noncontrolling interests, and stockholders' equity | $ | 1,735,387 | | | $ | 1,376,888 | |

The following table presents the assets and liabilities of the consolidated variable interest entities (Refer to Note 4).

| | | | | | | | | | | |

| (In thousands) | As of June 30, 2023 | | As of December 31, 2022 |

| Assets of consolidated VIEs, included in total assets above: | | | |

| Cash | $ | 12,842 | | | $ | 11,652 | |

| Current portion of restricted cash | 2,377 | | | 1,152 | |

| Accounts receivable, net | 9,941 | | | 2,952 | |

| Other current assets | 587 | | | 678 | |

| Restricted cash, noncurrent portion | 2,800 | | | 1,762 | |

| Property, plant and equipment, net | 689,897 | | | 401,711 | |

| Intangible assets, net | 5,861 | | | 5,308 | |

| Operating lease asset | 59,016 | | | 36,211 | |

| Other assets | 2,039 | | | 591 | |

| Total assets of consolidated VIEs | $ | 785,360 | | | $ | 462,017 | |

| Liabilities of consolidated VIEs, included in total liabilities above: | | | |

| Accounts payable | $ | 669 | | | $ | 454 | |

| Construction payable | 2,053 | | | — | |

| Purchase price payable, current | 219 | | | — | |

| Operating lease liability, current | 1,264 | | | 2,742 | |

| Current portion of long-term debt, net | 3,025 | | | 2,336 | |

| Contract liability | 484 | | | — | |

| Other current liabilities | 186 | | | 199 | |

| Long-term debt, net of unamortized debt issuance costs and current portion | 39,791 | | | 33,332 | |

| Intangible liabilities, net | 2,130 | | | 1,899 | |

| Asset retirement obligations | 7,595 | | | 4,438 | |

| Operating lease liability, noncurrent | 62,455 | | | 33,204 | |

| Contract liability | 3,950 | | | — | |

| Other long-term liabilities | 1,890 | | | 565 | |

| Total liabilities of consolidated VIEs | $ | 125,711 | | | $ | 79,169 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Altus Power, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

(unaudited)

(In thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional

Paid-in Capital | | Accumulated Other Comprehensive Income | | Accumulated Deficit | | Total

Stockholders'

Equity | | Non

Controlling

Interests | | Total Equity |

| | Shares | | Amount | | | | | | |

| As of March 31, 2022 | 153,648,830 | | | $ | 15 | | | $ | 406,867 | | | $ | — | | | $ | (40,937) | | | $ | 365,945 | | | $ | 20,361 | | | $ | 386,306 | |

| Stock-based compensation | — | | | — | | | 2,657 | | | — | | | — | | | 2,657 | | | — | | | 2,657 | |

| Cash distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | (336) | | | (336) | |

| Cash contributions from noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | 1,064 | | | 1,064 | |

| Conversion of alignment shares to Class A Common Stock and exercised warrants | 2,021 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Exchange of warrants into common stock | 1,067,417 | | | — | | | 7,308 | | | — | | | — | | | 7,308 | | | — | | | 7,308 | |

| Net income (loss) | — | | | — | | | — | | | — | | | 24,115 | | | 24,115 | | | (2,394) | | | 21,721 | |

As of June 30, 2022 | 154,718,268 | | | 15 | | | 416,832 | | | — | | | (16,822) | | | 400,025 | | | 18,695 | | | 418,720 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional

Paid-in Capital | | Accumulated Other Comprehensive (Loss) Income | | Accumulated

Deficit | | Total

Stockholders'

Equity | | Non

Controlling

Interests | | Total Equity |

| | Shares | | Amount | | | | | | |

| As of March 31, 2023 | 158,989,953 | | | $ | 16 | | | $ | 474,202 | | | $ | (762) | | | $ | (40,302) | | | $ | 433,154 | | | $ | 32,699 | | | $ | 465,853 | |

| Stock-based compensation | — | | | — | | | 4,256 | | | — | | | — | | | 4,256 | | | — | | | 4,256 | |

| Cash distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | (489) | | | (489) | |

| Cash contributions from noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | 4,537 | | | 4,537 | |

| Noncontrolling interests assumed through acquisitions | — | | | — | | | — | | | — | | | — | | | — | | | 204 | | | 204 | |

| Other comprehensive income | — | | | — | | | — | | | 3,770 | | | — | | | 3,770 | | | — | | | 3,770 | |

| Net income (loss) | — | | | — | | | — | | | — | | | 6,825 | | | 6,825 | | | (2,505) | | | 4,320 | |

As of June 30, 2023 | 158,989,953 | | | $ | 16 | | | $ | 478,458 | | | $ | 3,008 | | | $ | (33,477) | | | $ | 448,005 | | | $ | 34,446 | | | $ | 482,451 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Altus Power, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

(unaudited)

(In thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional

Paid-in Capital | | Accumulated Other Comprehensive Income | | Accumulated Deficit | | Total

Stockholders'

Equity | | Non

Controlling

Interests | | Total Equity |

| | Shares | | Amount | | | | | | |

As of December 31, 2021 | 153,648,830 | | | $ | 15 | | | $ | 406,259 | | | $ | — | | | $ | (101,356) | | | $ | 304,918 | | | $ | 21,093 | | | $ | 326,011 | |

| Stock-based compensation | — | | | — | | | 3,962 | | | — | | | — | | | 3,962 | | | — | | | 3,962 | |

| Cash distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | (666) | | | (666) | |

| Cash contributions from noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | 1,064 | | | 1,064 | |

| Equity issuance costs | — | | | — | | | (712) | | | — | | | — | | | (712) | | | — | | | (712) | |

| Conversion of Alignment Shares to Class A Common Stock and exercised warrants | 2,021 | | | — | | | 15 | | | — | | | — | | | 15 | | | — | | | 15 | |

| Exchange of warrants into common stock | 1,067,417 | | | — | | | 7,308 | | | — | | | — | | | 7,308 | | | — | | | 7,308 | |

| Net income (loss) | — | | | — | | | — | | | — | | | 84,534 | | | 84,534 | | | (2,796) | | | 81,738 | |

As of June 30, 2022 | 154,718,268 | | | 15 | | | 416,832 | | | — | | | (16,822) | | | 400,025 | | | 18,695 | | | 418,720 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional

Paid-in Capital | | Accumulated Other Comprehensive Income | | Accumulated

Deficit | | Total

Stockholders'

Equity | | Non

Controlling

Interests | | Total Equity |

| | Shares | | Amount | | | | | | |

As of December 31, 2022 | 158,904,401 | | | $ | 16 | | | $ | 470,004 | | | $ | — | | | $ | (45,919) | | | $ | 424,101 | | | $ | 20,825 | | | $ | 444,926 | |

| Stock-based compensation | 83,541 | | | — | | | 7,069 | | | — | | | — | | | 7,069 | | | — | | | 7,069 | |

| Cash distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | (1,015) | | | (1,015) | |

| Cash contributions from noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | 6,274 | | | 6,274 | |

| Conversion of Alignment Shares to Class A Common Stock and exercised warrants | 2,011 | | | — | | | 11 | | | — | | | — | | | 11 | | | — | | | 11 | |

| Noncontrolling interests assumed through acquisitions | — | | | — | | | — | | | — | | | — | | | — | | | 13,500 | | | 13,500 | |

| Redemption of redeemable non-controlling interests | — | | | — | | | 1,374 | | | — | | | — | | | 1,374 | | | — | | | 1,374 | |

| Other comprehensive income | — | | | — | | | — | | | 3,008 | | | — | | | 3,008 | | | — | | | 3,008 | |

| Net income (loss) | — | | | — | | | — | | | — | | | 12,442 | | | 12,442 | | | (5,138) | | | 7,304 | |

As of June 30, 2023 | 158,989,953 | | | $ | 16 | | | $ | 478,458 | | | $ | 3,008 | | | $ | (33,477) | | | $ | 448,005 | | | $ | 34,446 | | | $ | 482,451 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Altus Power, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

(In thousands)

| | | | | | | | | | | |

| | Six Months Ended June 30, |

| | 2023 | | 2022 |

| Cash flows from operating activities | | | |

| Net income | $ | 7,215 | | | $ | 81,709 | |

| Adjustments to reconcile net income to net cash from operating activities: | | | |

| Depreciation, amortization and accretion | 24,335 | | | 13,685 | |

| Non-cash lease expense | 499 | | | — | |

| Deferred tax expense | 2,011 | | | 550 | |

| Amortization of debt discount and financing costs | 1,683 | | | 1,428 | |

| Change in fair value of redeemable warrant liability | — | | | (23,117) | |

| Change in fair value of Alignment Shares liability | (19,823) | | | (63,051) | |

| Remeasurement of contingent consideration | 100 | | | (971) | |

| Stock-based compensation | 7,069 | | | 3,962 | |

| Other | 1,350 | | | (189) | |

| Changes in assets and liabilities, excluding the effect of acquisitions | | | |

| Accounts receivable | (9,597) | | | (3,940) | |

| Due to related parties | 41 | | | — | |

| Derivative assets | 2,676 | | | (1,777) | |

| Other assets | 1,607 | | | 2,712 | |

| Accounts payable | 2,924 | | | (722) | |

| Interest payable | 3,037 | | | (78) | |

| Contract liability | 243 | | | — | |

| Other liabilities | 121 | | | 1,668 | |

| Net cash provided by operating activities | 25,491 | | | 11,869 | |

| Cash flows used for investing activities | | | |

| Capital expenditures | (61,982) | | | (23,338) | |

| Payments to acquire businesses, net of cash and restricted cash acquired | (288,903) | | | — | |

| Payments to acquire renewable energy facilities from third parties, net of cash and restricted cash acquired | (22,433) | | | (11,572) | |

| Net cash used for investing activities | (373,318) | | | (34,910) | |

| Cash flows used for financing activities | | | |

| Proceeds from issuance of long-term debt | 269,850 | | | — | |

| Repayment of long-term debt | (31,068) | | | (8,120) | |

| Payment of debt issuance costs | (2,548) | | | (42) | |

| Payment of deferred purchase price payable | (4,531) | | | — | |

| Payment of equity issuance costs | — | | | (744) | |

| Payment of contingent consideration | — | | | (45) | |

| Contributions from noncontrolling interests | 6,274 | | | 2,151 | |

| Redemption of redeemable noncontrolling interests | (3,224) | | | — | |

| Distributions to noncontrolling interests | (2,189) | | | (1,148) | |

| Net cash provided by (used for) financing activities | 232,564 | | | (7,948) | |

| Net decrease in cash, cash equivalents, and restricted cash | (115,263) | | | (30,989) | |

| Cash, cash equivalents, and restricted cash, beginning of period | 199,398 | | | 330,321 | |

| Cash, cash equivalents, and restricted cash, end of period | $ | 84,135 | | | $ | 299,332 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2023 | | 2022 |

| Supplemental cash flow disclosure | | | |

| Cash paid for interest | $ | 15,299 | | | $ | 9,804 | |

| Cash paid for taxes | — | | | 39 | |

| Non-cash investing and financing activities | | | |

| Asset retirement obligations | $ | 3,943 | | | $ | 96 | |

| Debt assumed through acquisitions | 7,883 | | | — | |

| Noncontrolling interest assumed through acquisitions | 13,500 | | | — | |

| Redeemable noncontrolling interest assumed through acquisitions | 8,100 | | | — | |

| Acquisitions of property and equipment included in construction payable | 6,125 | | | — | |

| Acquisitions of property, plant and equipment included in other current liabilities | — | | | 1,334 | |

| Conversion of Alignment Shares into common stock | 11 | | | 15 | |

| Deferred purchase price payable | 7,606 | | | — | |

| Construction loan conversion | — | | | (4,186) | |

| Term loan conversion | — | | | 4,186 | |

| Exchange of warrants into common stock | — | | | 7,303 | |

Table of Contents

Altus Power, Inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

(Dollar amounts in thousands, except per share data, unless otherwise noted)

1.General

Company Overview

Altus Power, Inc., a Delaware corporation (the “Company” or "Altus Power"), headquartered in Stamford, Connecticut, develops, owns, constructs and operates large-scale roof, ground and carport-based photovoltaic solar energy generation and storage systems, for the purpose of producing and selling electricity to credit worthy counterparties, including commercial and industrial, public sector and community solar customers, under long-term contracts. The Solar energy facilities are owned by the Company in project specific limited liability companies (the “Solar Facility Subsidiaries”).

On December 9, 2021 (the "Closing Date"), CBRE Acquisition Holdings, Inc. ("CBAH"), a special purpose acquisition company, consummated the business combination pursuant to the terms of the business combination agreement entered into on July 12, 2021 (the "Business Combination Agreement"), whereby, among other things, CBAH Merger Sub I, Inc. ("First Merger Sub") merged with and into Altus Power, Inc. (f/k/a Altus Power America, Inc.) ("Legacy Altus") with Legacy Altus continuing as the surviving corporation, and immediately thereafter Legacy Altus merged with and into CBAH Merger Sub II, Inc. ("Second Merger Sub") with Second Merger Sub continuing as the surviving entity and as a wholly owned subsidiary of CBAH (together with the merger with the First Merger Sub, the “Merger”). In connection with the closing of the Merger, CBAH changed its name to "Altus Power, Inc." and CBAH Merger Sub II (after merger with Legacy Altus) changed its name to "Altus Power, LLC."

2.Significant Accounting Policies

Basis of Presentation and Principles of Consolidation

The Company prepares its unaudited condensed consolidated financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and regulations of the U.S. Securities and Exchange Commission ("SEC") for interim financial reporting. The Company’s condensed consolidated financial statements include the results of wholly-owned and partially-owned subsidiaries in which the Company has a controlling interest. All intercompany balances and transactions have been eliminated in consolidation.

Certain information and footnote disclosures normally included in consolidated financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to such rules and regulations. Accordingly, these unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements for the year ended December 31, 2022, filed with the Company’s 2022 annual report on Form 10-K on March 30, 2023, and the related notes which provide a more complete discussion of the Company’s accounting policies and certain other information. The information as of December 31, 2022, included in the condensed consolidated balance sheets was derived from the Company’s audited consolidated financial statements. The condensed consolidated financial statements were prepared on the same basis as the audited consolidated financial statements and reflect all adjustments, including normal recurring adjustments, which are, in the opinion of management, necessary for a fair statement of the Company’s financial position as of June 30, 2023, and the results of operations and cash flows for the three and six months ended June 30, 2023, and 2022. The results of operations for the three and six months ended June 30, 2023, are not necessarily indicative of the results that may be expected for the full year or any other future interim or annual period.

Reclassifications

Certain prior year amounts have been reclassified for consistency with the current year financial statement presentation. Such reclassifications have no impact on previously reported net income, stockholders' equity, or cash flows. For the year ended December 31, 2022, $2.6 million was reclassified from other current liabilities to contract liability, current on the condensed consolidated balance sheet. This change had no impact on total current liabilities reported in the consolidated balance sheet. Further, for the six months ended June 30, 2022, $1.8 million was reclassified from unrealized gain on interest rate swaps in the adjustments to reconcile net income to net cash from operating activities section of the condensed consolidated statements of cash flows to derivative assets in the changes in assets, and liabilities, excluding the effect of acquisitions section of the condensed consolidated cash flows. This change had no impact on cash provided by operating activities in the consolidated statement of cash flows.

Table of Contents

Altus Power, Inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

(Dollar amounts in thousands, except per share data, unless otherwise noted)

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the condensed consolidated financial statements and accompanying notes. Actual results could differ materially from those estimates.

In recording transactions and balances resulting from business operations, the Company uses estimates based on the best information available. Estimates are used for such items as the fair value of net assets acquired in connection with accounting for business combinations, the useful lives of the solar energy facilities, and inputs and assumptions used in the valuation of asset retirement obligations (“AROs”), contingent consideration, derivative instruments, and Class B common stock, par value $0.0001 per share ("Alignment Shares").

Segment Information

Operating segments are defined as components of a company about which separate financial information is available that is evaluated regularly by the chief operating decision maker, or decision-making group, in deciding how to allocate resources and in assessing performance. The Company’s chief operating decision makers are the co-chief executive officers. Based on the financial information presented to and reviewed by the chief operating decision makers in deciding how to allocate the resources and in assessing the performance of the Company, the Company has determined it operates as a single operating segment and has one reportable segment, which includes revenue under power purchase agreements, revenue from net metering credit agreements, solar renewable energy credit revenue, rental income, performance based incentives and other revenue. The Company’s principal operations, revenue and decision-making functions are located in the United States.

Cash, Cash Equivalents, and Restricted Cash

Cash and cash equivalents includes all cash balances on deposit with financial institutions and readily marketable securities with original maturity dates of three months or less at the time of acquisition and are denominated in U.S. dollars. Pursuant to the budgeting process, the Company maintains certain cash and cash equivalents on hand for possible equipment replacement related costs.

The Company records cash that is restricted as to withdrawal or use under the terms of certain contractual agreements as restricted cash. Restricted cash is included in current portion of restricted cash and restricted cash, noncurrent portion on the condensed consolidated balance sheets and includes cash held with financial institutions for cash collateralized letters of credit pursuant to various financing and construction agreements.

The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported within the condensed consolidated balance sheets. Cash, cash equivalents, and restricted cash consist of the following:

| | | | | | | | | | | |

| | As of June 30, 2023 | | As of December 31, 2022 |

| Cash and cash equivalents | $ | 69,114 | | | $ | 193,016 | |

| Current portion of restricted cash | 3,700 | | | 2,404 | |

| Restricted cash, noncurrent portion | 11,321 | | | 3,978 | |

| Total | $ | 84,135 | | | $ | 199,398 | |

Concentration of Credit Risk

The Company maintains its cash in bank deposit accounts which, at times, may exceed Federal Deposit Insurance Corporation insurance limits. The Company has not experienced any losses in such accounts and believes it is not exposed to any significant credit risk on cash balances.

The Company had one customer that individually accounted for over 10% (i.e., 22.6%) of total accounts receivable as of June 30, 2023, one customer that individually accounted over 10% (i.e. 14.4%,) of total revenue for the three months ended June 30, 2023, and one customer that individually accounted for over 10% (i.e., 14.7%) of total revenue six months ended June 30, 2023.

Table of Contents

Altus Power, Inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

(Dollar amounts in thousands, except per share data, unless otherwise noted)

The Company had one customer that individually accounted for over 10% (i.e., 28.0%) of total accounts receivable as of December 31, 2022, and no customers that individually accounted for 10% of total revenue for the three and six months ended June 30, 2022.

Accounting Pronouncements

As a public company, the Company is provided the option to adopt new or revised accounting guidance as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) either (1) within the same periods as those otherwise applicable to public business entities, or (2) within the same time periods as non-public business entities, including early adoption when permissible. The Company expects to elect to adopt new or revised accounting guidance within the same time period as non-public business entities, as indicated below.

Recent Accounting Pronouncements Adopted

In June 2016, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments and has since released various amendments including ASU No. 2019-04. The new standard generally applies to financial assets and requires those assets to be reported at the amount expected to be realized. The ASU is effective for fiscal years beginning after December 15, 2022, and interim periods within those fiscal years. The Company has adopted this standard as of January 1, 2023 and the adoption did not have a material impact on the condensed consolidated financial statements.

In October 2021, the FASB issued ASU 2021-08, Business Combinations (Topic 805): Accounting for Contract Assets and Contract Liabilities from Contracts with Customers, which requires entities to recognize and measure contract assets and liabilities acquired in a business combination in accordance with Accounting Standards Codification ("ASC") 2014-09, Revenue from Contracts with Customers (Topic 606). The update will generally result in an entity recognizing contract assets and liabilities at amounts consistent with those recorded by the acquiree immediately before the acquisition date rather than at fair value. The new standard is effective on a prospective basis for fiscal years beginning after December 15, 2022, and was adopted by the Company on January 1, 2023. The Company applied the provisions of ASU 2021-08 to account for the True Green II Acquisition (defined in Note 5, "Acquisitions"), and recognized $3.5 million of contract liability assumed through the business combination.

3.Revenue and Accounts Receivable

Disaggregation of Revenue

The following table presents the detail of revenues as recorded in the unaudited condensed consolidated statements of operations:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Power sales under PPAs | $ | 16,641 | | | $ | 6,730 | | | $ | 25,627 | | | $ | 10,912 | |

| Power sales under NMCAs | 13,297 | | | 7,822 | | | 20,133 | | | 11,722 | |

| Power sales on wholesale markets | 568 | | | 1,155 | | | 924 | | | 1,738 | |

| Total revenue from power sales | 30,506 | | | 15,707 | | | 46,684 | | | 24,372 | |

| Solar renewable energy credit revenue | 13,526 | | | 7,975 | | | 23,593 | | | 17,506 | |

| Rental income | 986 | | | 785 | | | 1,612 | | | 1,429 | |

| Performance based incentives | 464 | | | 295 | | | 2,562 | | | 654 | |

| Revenue recognized on contract liabilities | 1,031 | | | — | | | 1,440 | | | — | |

| Total | $ | 46,513 | | | $ | 24,762 | | | $ | 75,891 | | | $ | 43,961 | |

Table of Contents

Altus Power, Inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

(Dollar amounts in thousands, except per share data, unless otherwise noted)

Accounts receivable

The following table presents the detail of receivables as recorded in accounts receivable in the unaudited condensed consolidated balance sheets:

| | | | | | | | | | | |

| | As of June 30, 2023 | | As of December 31, 2022 |

| Power sales under PPAs | $ | 7,467 | | | $ | 4,092 | |

| Power sales under NMCAs | 9,371 | | | 3,183 | |

| Power sales on wholesale markets | 134 | | | 223 | |

| Total power sales | 16,972 | | | 7,498 | |

| Solar renewable energy credits | 8,980 | | | 5,387 | |

| Rental income | 750 | | | 429 | |

| Performance based incentives | 339 | | | 129 | |

| Total | $ | 27,041 | | | $ | 13,443 | |

Payment is typically received within 30 days for invoiced revenue as part of power purchase agreements (“PPAs”) and net metering credit agreements (“NMCAs”). Receipt of payment relative to invoice date varies by customer for renewable energy credits ("SRECs"). As of both June 30, 2023, and December 31, 2022, the Company determined that the allowance for uncollectible accounts is $0.4 million.

The Company recognizes contract liabilities related to long-term agreements to sell SRECs that are prepaid by customers before SRECs are delivered. The Company will recognize revenue associated with the contract liabilities as SRECs are delivered to customers through 2037. As of June 30, 2023, the Company had current and non-current contract liabilities of $3.8 million and $6.5 million, respectively. As of December 31, 2022, the Company had current and non-current contract liabilities of $2.6 million and $5.4 million, respectively. The Company does not have any other significant contract asset or liability balances related to revenues.

4.Variable Interest Entities

The Company consolidates all variable interest entities (“VIEs”) in which it holds a variable interest and is deemed to be the primary beneficiary of the variable interest entity. Generally, a VIE is an entity with at least one of the following conditions: (a) the total equity investment at risk is insufficient to allow the entity to finance its activities without additional subordinated financial support, or (b) the holders of the equity investment at risk, as a group, lack the characteristics of having a controlling financial interest. The primary beneficiary of a VIE is required to consolidate the VIE and to disclose certain information about its significant variable interests in the VIE. The primary beneficiary of a VIE is the entity that has both 1) the power to direct the activities that most significantly impact the entity’s economic performance and 2) the obligations to absorb losses or receive benefits that could potentially be significant to the VIE.

The Company participates in certain partnership arrangements that qualify as VIEs. Consolidated VIEs consist primarily of tax equity financing arrangements and partnerships in which an investor holds a noncontrolling interest and does not have substantive kick-out or participating rights. The Company, through its subsidiaries, is the primary beneficiary of such VIEs, because as the manager, it has the power to direct the day-to-day operating activities of the entity. In addition, the Company is exposed to economics that could potentially be significant to the entity given its ownership interest, therefore, has consolidated the VIEs as of June 30, 2023, and December 31, 2022. No VIEs were deconsolidated during the six months ended June 30, 2023 and 2022.

The obligations of the consolidated VIEs discussed in the following paragraphs are nonrecourse to the Company. In certain instances where the Company establishes a new tax equity structure, the Company is required to provide liquidity in accordance with the contractual agreements. The Company has no requirement to provide liquidity to purchase assets or guarantee performance of the VIEs unless further noted in the following paragraphs. The Company made certain contributions during the six months ended June 30, 2023 and 2022, as determined in the respective operating agreement.

Table of Contents

Altus Power, Inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

(Dollar amounts in thousands, except per share data, unless otherwise noted)

The carrying amounts and classification of the consolidated VIE assets and liabilities included in condensed consolidated balance sheets are as follows:

| | | | | | | | | | | |

| | As of June 30, 2023 | | As of December 31, 2022 |

| Current assets | $ | 25,748 | | | $ | 16,434 | |

| Non-current assets | 759,612 | | | 445,583 | |

| Total assets | $ | 785,360 | | | $ | 462,017 | |

| Current liabilities | $ | 7,900 | | | $ | 5,731 | |

| Non-current liabilities | 117,811 | | | 73,438 | |

| Total liabilities | $ | 125,711 | | | $ | 79,169 | |

The amounts shown in the table above exclude intercompany balances which are eliminated upon consolidation. All of the assets in the table above are restricted for settlement of the VIE obligations, and all of the liabilities in the table above can only be settled using VIE resources.

The Company has not identified any VIEs during the six months ended June 30, 2023 and 2022, for which the Company determined that it is not the primary beneficiary and thus did not consolidate.

The Company considered qualitative and quantitative factors in determining which VIEs are deemed significant. During each of the six months ended June 30, 2023 and the year ended December 31, 2022, the Company consolidated thirty-three and twenty-six VIEs, respectively. No VIEs were deemed significant as of June 30, 2023 and December 31, 2022.

On January 11, 2023, the Company completed an acquisition through obtaining a controlling financial interest in a VIE which owns and operates a single 2.7 MW solar generating facility. The Company acquired a controlling financial interest by entering into an asset management agreement which provides the Company with the power to direct the operating activities of the VIE and the obligation to absorb losses or receive benefits that could potentially be significant to the VIE. Concurrent with the asset management agreement, the Company entered into a Membership Interest Purchase Agreement ("MIPA") to acquire all of the outstanding equity interests in the VIE on May 30, 2023 (the "Closing Date"). The entire purchase price of $3.8 million was paid on January 11, 2023. As a result of this acquisition, the Company recognized property, plant and equipment of $3.9 million, $0.7 million of operating lease asset, $0.7 million of operating lease liability, and asset retirement obligations of $0.1 million in the unaudited condensed consolidated balance sheet. Pursuant to the MIPA, the Company acquired all of the outstanding equity interests in the entity on May 30, 2023.

As discussed in Note 5, on February 15, 2023 the Company completed the True Green II Acquisition through its purchase of all outstanding membership interests in APAF III Operating, LLC from True Green Capital Fund III, L.P. Through the True Green II Acquisition, the Company acquired eleven VIEs that consist primarily of tax equity financing arrangements and partnerships in which an investor holds a noncontrolling interest and does not have substantive kick-out or participating rights. The Company, through its subsidiaries, is the primary beneficiary of these VIEs because as the manager, it has the power to direct the day-to-day operating activities of the entity, and is exposed to economics that could potentially be significant to the entities through its ownership interests. As of June 30, 2023 the VIEs acquired through the True Green II Acquisition comprised of $9.4 million of current assets, $328.8 million of non-current assets, $4.0 million of current liabilities, and $45.3 million of non-current liabilities.

5.Acquisitions

2023 Acquisitions

Asset Acquisitions

During 2023, the Company acquired solar energy facilities located in Rhode Island and California with a total nameplate capacity of 8.5 MW from third parties for a total purchase price of $11.4 million. As of June 30, 2023, $0.3 million of total consideration remained payable to sellers and was included as purchase price payable on the condensed consolidated balance sheet. The acquisitions were accounted for as acquisitions of assets, whereby the Company acquired $12.2 million of property,

Table of Contents

Altus Power, Inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

(Dollar amounts in thousands, except per share data, unless otherwise noted)

plant and equipment and $1.4 million of operating lease assets, and assumed $1.4 million of operating lease liabilities, $0.4 million of intangible liabilities, and $0.2 million of asset retirement obligations.

Acquisitions of VIEs

During 2023, the Company acquired solar energy facilities located in Massachusetts and Maine with a total nameplate capacity of 4.1 MW from third parties for a total purchase price of $8.7 million. As of June 30, 2023, $0.2 million of total consideration remained payable to sellers and was included as purchase price payable on the condensed consolidated balance sheet. The acquisitions were accounted for as acquisitions of variable interest entities that do not constitute a business (refer to Note 4, "Variable Interest Entities"). The Company acquired $8.8 million of property, plant and equipment and $1.0 million of operating lease assets, and assumed $1.0 million of operating lease liabilities and $0.1 million of asset retirement obligations.

True Green II Acquisition

On February 15, 2023, APA Finance III, LLC ("APAF III"), a wholly-owned subsidiary of the Company, acquired a 220 MW portfolio of 55 operating and 3 in development solar energy facilities located across eight US states (the “True Green II Acquisition”). The portfolio was acquired from True Green Capital Fund III, L.P. (“True Green”) for total consideration of approximately $299.9 million. The purchase price and associated transaction costs were funded by the proceeds from the APAF III Term Loan (as defined in Note 6, "Debt") and cash on hand. The True Green II Acquisition was made pursuant to the purchase and sale agreement (the "PSA") dated December 23, 2022, and entered into by the Company to grow its portfolio of solar energy facilities. Pursuant to the PSA, the Company acquired 100% ownership interest in APAF III Operating, LLC, a holding entity that owns the acquired solar energy facilities.

The Company accounted for the True Green II Acquisition under the acquisition method of accounting for business combinations. Under the acquisition method, the purchase price was allocated to the assets acquired and liabilities assumed on February 15, 2023, based on their estimated fair value. All fair value measurements of assets acquired and liabilities assumed, including the noncontrolling interests, were based on significant estimates and assumptions, including Level 3 (unobservable) inputs, which require judgment. Estimates and assumptions include the estimates of future power generation, commodity prices, operating costs, and appropriate discount rates.

The assets acquired and liabilities assumed are recognized provisionally on the condensed consolidated balance sheet at their estimated fair values as of the acquisition date. The initial accounting for the business combination is not complete as the Company is in the process of obtaining additional information for the valuation of acquired tangible and intangible assets. The provisional amounts are subject to change to the extent that additional information is obtained about the facts and circumstances that existed as of the acquisition date. Under U.S. GAAP, the measurement period shall not exceed one year from the acquisition date and the Company will finalize these amounts no later than February 15, 2024.

Subsequent to the acquisition date, the Company made certain measurement period adjustments to provisional accounting recognized. These adjustments consist of an increase in Property, plant, and equipment of $0.8 million, a decrease in Operating lease asset of $0.7 million, an increase in Other assets of $0.8 million, a decrease in Long-term debt of $0.2 million, a decrease in Operating lease liability of $1.9 million, an increase in Other liabilities of $1.9 million, and an increase in Non-controlling interests of $0.2 million due to the clarification of information utilized to determine fair value during the measurement period. Additionally, the Company recorded a measurement period adjustment of $0.7 million to increase the fair value of consideration transferred, $0.4 million to decrease Accounts receivable, and $0.1 million to increase Property, plant, and equipment as a result of reconciling working capital adjustments with the seller. The following table presents the updated preliminary allocation of the purchase price to the assets acquired and liabilities assumed, based on their estimated fair values on February 15, 2023 and inclusive of the measurement period adjustments discussed above:

| | | | | | | | | | | | | | | | | |

| Provisional accounting as of February 15, 2023 | | Measurement period adjustments | | Adjusted provisional accounting as of February 15, 2023 |

| Assets | | | | | |

| Accounts receivable | $ | 4,358 | | | $ | (357) | | | $ | 4,001 | |

| Property, plant and equipment | 334,958 | | | 914 | | | 335,872 | |

| Intangible assets | 850 | | | — | | | 850 | |

Table of Contents

Altus Power, Inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

(Dollar amounts in thousands, except per share data, unless otherwise noted)

| | | | | | | | | | | | | | | | | |

| Operating lease asset | 32,053 | | | (742) | | | 31,311 | |

| Other assets | 1,739 | | | 835 | | | 2,574 | |

| Total assets acquired | 373,958 | | | 650 | | | 374,608 | |

| | | | | |

| Liabilities | | | | | |

Long-term debt(1) | 8,100 | | | (217) | | | 7,883 | |

| Intangible liabilities | 4,100 | | | — | | | 4,100 | |

| Asset retirement obligation | 3,795 | | | — | | | 3,795 | |

| Operating lease liability | 37,723 | | | (1,932) | | | 35,791 | |

Contract liability(2) | 3,534 | | | — | | | 3,534 | |

| Other liabilities | — | | | 1,932 | | | 1,932 | |

| Total liabilities assumed | 57,252 | | | (217) | | | 57,035 | |

| Redeemable non-controlling interests | 8,100 | | | — | | | 8,100 | |

| Non-controlling interests | 13,296 | | | 204 | | | 13,500 | |

| Total fair value of consideration transferred, net of cash acquired | $ | 295,310 | | | $ | 663 | | | $ | 295,973 | |

The fair value of consideration transferred, net of cash acquired, as of February 15, 2023, is determined as follows:

| | | | | | | | | | | | | | | | | |

| Provisional accounting as of February 15, 2023 | | Measurement period adjustments | | Adjusted provisional accounting as of February 15, 2023 |

| Cash consideration paid to True Green on closing | $ | 212,850 | | | $ | — | | | $ | 212,850 | |

| Cash consideration paid to settle debt and interest rate swaps on behalf of True Green | 76,046 | | | — | | | 76,046 | |

Cash consideration in escrow accounts(3) | 3,898 | | | — | | | 3,898 | |

Purchase price payable(4) | 7,069 | | | 663 | | | 7,732 | |

| Total fair value of consideration transferred | 299,863 | | | 663 | | | 300,526 | |

| Restricted cash acquired | 4,553 | | | — | | | 4,553 | |

| Total fair value of consideration transferred, net of cash acquired | $ | 295,310 | | | $ | 663 | | | 295,973 | |

(1) Acquired long-term debt relates to financing obligations recognized in failed sale leaseback transactions. Refer to Note 6, "Debt" for further information.

(2) Acquired contract liabilities relate to long-term agreements to sell renewable energy credits that were fully prepaid by the customer prior to the acquisition date. The Company will recognize revenue associated with the contract liabilities as renewable energy credits are delivered to the customer through 2036.

(3) Represents the portion of the consideration transferred that is held in escrow accounts as security for general indemnification claims.

(4) Purchase price payable represents the portion of the total hold back amount that was earned by True Green as of February 15, 2023, based on the completion of construction milestones related to assets in development.

The Company incurred approximately $2.3 million of acquisition related costs related to the True Green III Acquisition, which are recorded as part of Acquisition and entity formation costs in the condensed consolidated statement of operations for the six months ended June 30, 2023. Acquisition related costs include legal, consulting, and other transaction-related costs, as well as

Table of Contents

Altus Power, Inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

(Dollar amounts in thousands, except per share data, unless otherwise noted)

$0.8 million of costs to acquire SRECs available for sale that were sold by the Company to its customers during the three months ended June 30, 2023, which was recorded in Other current assets in the preliminary purchase price allocation.

The impact of the True Green III Acquisition on the Company's revenue and net income in the condensed consolidated statement of operations was an increase of $13.8 million and $7.9 million, respectively, for the six months ended June 30, 2023.

Intangibles at Acquisition Date