Air Lease Corporation Announces Pricing of Public Offering of $1.2 Billion of Senior Unsecured Medium-Term Notes

June 18 2024 - 3:40AM

Business Wire

Air Lease Corporation (NYSE: AL) (the “Company”) announced the

pricing on June 17, 2024 of its public offering of $600.0 million

aggregate principal amount of 5.30% senior unsecured medium-term

notes due June 25, 2026 (the “2026 Notes”) and $600.0 million

aggregate principal amount of 5.20% senior unsecured medium-term

notes due July 15, 2031 (the “2031 Notes” and, together with the

2026 Notes, the “Notes”). The sale of the Notes is expected to

close on June 25, 2024, subject to satisfaction of customary

closing conditions.

The 2026 Notes will mature on June 25, 2026 and will bear

interest at a rate of 5.30% per annum, payable semi-annually in

arrears on June 25 and December 25 of each year, commencing on

December 25, 2024. The 2031 Notes will mature on July 15, 2031 and

will bear interest at a rate of 5.20% per annum, payable

semi-annually in arrears on January 15 and July 15 of each year,

commencing on January 15, 2025.

The Company intends to use the net proceeds of the offering for

general corporate purposes, which may include, among other things,

the purchase of commercial aircraft and the repayment of existing

indebtedness.

BMO Capital Markets Corp. (only with respect to the 2026 Notes),

BNP Paribas Securities Corp. (only with respect to the 2031 Notes),

BofA Securities, Inc., Fifth Third Securities, Inc. (only with

respect to the 2026 Notes), J.P. Morgan Securities LLC, KeyBanc

Capital Markets Inc. (only with respect to the 2031 Notes), TD

Securities (USA) LLC (only with respect to the 2031 Notes), Truist

Securities, Inc. (only with respect to the 2026 Notes) and U.S.

Bancorp Investments, Inc. (only with respect to the 2026 Notes) are

acting as joint book-running managers for the offering of the

Notes.

The Notes are being offered pursuant to the Company’s effective

shelf registration statement, previously filed with the Securities

and Exchange Commission (the “SEC”) on May 6, 2024. The offering of

the Notes is being made only by means of the prospectus supplement,

dated May 6, 2024, supplementing the base prospectus, dated May 6,

2024, as may be further supplemented by any free writing prospectus

and/or pricing supplements the Company may file with the SEC.

Before you invest, you should read the base prospectus, prospectus

supplement and any other documents the Company may file with the

SEC for more complete information about the Company and this

offering. You may obtain these documents for free by visiting EDGAR

on the SEC’s website at www.sec.gov. Alternatively, copies may be

obtained from: (i) BMO Capital Markets Corp. (only with respect to

the 2026 Notes) toll-free at (866) 864-7760, (ii) BNP Paribas

Securities Corp. (only with respect to the 2031 Notes) toll-free at

(800) 854-5674, (iii) BofA Securities, Inc. toll-free at

1-800-294-1322, (iv) Fifth Third Securities, Inc. (only with

respect to the 2026 Notes) at (866) 531-5353, (v) J.P. Morgan

Securities LLC collect at (212) 834-4533, (vi) KeyBanc Capital

Markets Inc. (only with respect to the 2031 Notes) at (866)

227-6479, (vii) TD Securities (USA) LLC (only with respect to the

2031 Notes) toll-free at (855) 495-9846, (viii) Truist Securities,

Inc. (only with respect to the 2026 Notes) at (404) 926-5625 or

(ix) U.S. Bancorp Investments, Inc. (only with respect to the 2026

Notes) at (877) 558-2607.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy the Notes, nor shall there be any

sale of the Notes in any state or other jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

jurisdiction.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements relating to the expected closing of the

offering and the intended use of proceeds. Such statements are

based on current expectations and projections about the Company’s

future results, prospects and opportunities and are not guarantees

of future performance. Such statements will not be updated unless

required by law. Actual results and performance may differ

materially from those expressed or forecasted in forward-looking

statements due to a number of factors, including but not limited

to, unexpected delays in the closing process for the Notes,

unanticipated cash needs, and those risks detailed in the Company’s

filings with the SEC, including the Company’s Annual Report on Form

10-K for the fiscal year ended December 31, 2023 and Quarterly

Report on Form 10-Q for the quarter ended March 31, 2024.

Source: Air Lease Corporation

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240618963016/en/

Investors: Jason Arnold Vice President, Investor Relations

Phone: +1 310.553.0555 Email: investors@airleasecorp.com

Media: Laura Woeste Senior Manager, Media & Investor Relations

Ashley Arnold Senior Manager, Media & Investor Relations Phone:

+1 310.553.0555 Email: press@airleasecorp.com

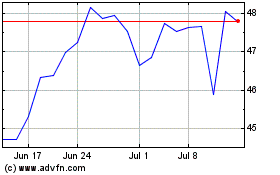

Air Lease (NYSE:AL)

Historical Stock Chart

From Oct 2024 to Nov 2024

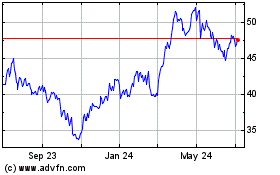

Air Lease (NYSE:AL)

Historical Stock Chart

From Nov 2023 to Nov 2024