FALSE000151428100015142812024-02-222024-02-220001514281us-gaap:CommonStockMember2024-02-222024-02-220001514281mitt:SeriesCumulativeReedmablePreferredStockMember2024-02-222024-02-220001514281mitt:SeriesBCumulativeReedmablePreferredStockMember2024-02-222024-02-220001514281mitt:SeriesCFixedToFloatingRateCumulativeRedeemablePreferredMember2024-02-222024-02-220001514281mitt:SeniorNotesDue2029Member2024-02-222024-02-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 22, 2024

AG Mortgage Investment Trust, Inc.

(Exact name of registrant as specified in its charter) | | | | | | | | |

| Maryland | 001-35151 | 27-5254382 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

245 Park Avenue, 26th floor

New York, New York 10167

(Address of principal executive offices)

Registrant's telephone number, including area code: (212) 692-2000

Not Applicable

(Former Name or Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c) |

| | | | | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class: | | Trading Symbols: | | Name of each exchange on which registered: |

| Common Stock, $0.01 par value per share | | MITT | | New York Stock Exchange | (NYSE) |

| 8.25% Series A Cumulative Redeemable Preferred Stock | | MITT PrA | | New York Stock Exchange | (NYSE) |

| 8.00% Series B Cumulative Redeemable Preferred Stock | | MITT PrB | | New York Stock Exchange | (NYSE) |

| 8.000% Series C Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock | | MITT PrC | | New York Stock Exchange | (NYSE) |

| 9.500% Senior Notes due 2029 | | MITN | | New York Stock Exchange | (NYSE) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 22, 2024, AG Mortgage Investment Trust, Inc. (the “Company”) issued a press release announcing its financial results for the full year and fiscal quarter ended December 31, 2023 (the “Release”).

Pursuant to the rules and regulations of the Securities and Exchange Commission, the Release is attached to this Report as Exhibit 99.1 and the information contained in the Release is incorporated into this Item 2.02 by this reference. The information contained in this Item 2.02, including Exhibit 99.1, is being “furnished” and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or into any filing or other document pursuant to the Exchange Act, except as otherwise expressly stated in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. | | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Date: February 22, 2024 | AG MORTGAGE INVESTMENT TRUST, INC. |

| | |

| By: | /s/ JENNY B. NESLIN |

| | Name: Jenny B. Neslin |

| | Title: General Counsel and Secretary |

Exhibit 99.1

AG Mortgage Investment Trust, Inc. Reports Full Year and Fourth Quarter 2023 Results

NEW YORK, NY, February 22, 2024 / Business Wire - AG Mortgage Investment Trust, Inc. ("MITT," "we," the "Company," or "our") (NYSE: MITT) today reported financial results for the full year and quarter ended December 31, 2023.

FULL YEAR AND FOURTH QUARTER 2023 FINANCIAL HIGHLIGHTS

Full Year 2023:

•$10.46 Book Value per share as of December 31, 2023 compared to $11.39 as of December 31, 2022(1)

•$10.20 Adjusted Book Value per share as of December 31, 2023 compared to $11.03 as of December 31, 2022(1)

◦Decrease of approximately (7.5)% from December 31, 2022

◦Annual Economic Return on Equity of (1.0)%(2)

•$1.68 and $0.39 of Net Income/(Loss) and Earnings Available for Distribution ("EAD") per diluted common share, respectively(3)

•$0.72 dividend per common share declared in 2023

Fourth Quarter 2023:

•Decrease in Adjusted Book Value per share of approximately (7.2)% from September 30, 2023

◦Quarterly Economic Return on Equity of (5.6)%(2)

•$1.35 and $0.17 of Net Income/(Loss) and EAD per diluted common share, respectively(3)

•$0.18 dividend per common share declared in Q4 2023

MANAGEMENT REMARKS

"The past year has been transformational for MITT. We completed an M&A transaction to increase our market capitalization by nearly 50% and consistently executed on our business strategy, repositioning a significant portion of equity into higher yielding securitized residential assets and de-risking our recourse leverage exposure,” said TJ Durkin, Chief Executive Officer and President. "Looking ahead, we are confident in our ability to build on this momentum, focused on driving earnings power and enhancing G&A efficiencies to make MITT a more scaled and profitable investment vehicle for our stockholders."

ACQUISITION OF WESTERN ASSET MORTGAGE CAPITAL CORPORATION

On December 6, 2023, the Company completed its acquisition of Western Asset Mortgage Capital Corporation ("WMC"), an externally managed mortgage REIT that focused on investing in, financing, and managing a portfolio of residential mortgage loans, real estate related securities, and commercial real estate loans. Pursuant to the terms of the related merger agreement, at the WMC acquisition closing, each outstanding share of WMC common stock was converted into the right to receive (1) from MITT, 1.498 shares of MITT common stock and (2) from MITT's Manager, a cash amount of $0.92 per share. Cash was paid in lieu of fractional shares resulting from the acquisition. The following summarizes certain highlights of the WMC acquisition:

•Issued approximately 9.2 million shares of MITT common stock to former WMC common stockholders, increasing our market capitalization by approximately 46%

•Acquired $1.2 billion of assets consisting primarily of securitized residential mortgage loans, increasing our investment portfolio by approximately 25%

•Assumed $1.1 billion of liabilities inclusive of securitized debt, financing arrangements, and 6.75% Convertible Senior Notes due 2024 (the "Convertible Notes")

•Increased total equity by $81.4 million and recorded a bargain purchase gain of $30.2 million

•Manager contributed $5.7 million of cash consideration to WMC shareholders

•Manager agreed to waive $2.4 million of management fees beginning in the fourth quarter 2023

•Manager agreed to offset $1.3 million in future reimbursable expenses under the management agreement

•The WMC acquisition is expected to result in significant annual expense savings of $5 million to $7 million and to be accretive to earnings in 2024

•As a result of the acquisition, two WMC independent directors joined the MITT Board, creating 75% independence on MITT's Board of Directors

INVESTMENT, FINANCING, AND CAPITAL MARKETS HIGHLIGHTS

•$5.9 billion Investment Portfolio as of December 31, 2023(4)

◦Purchased $1.2 billion of Non-Agency and Agency-Eligible Loans during 2023, $281.8 million of which were purchased in the fourth quarter 2023

◦Loans with a fair value of $74.2 million committed to be purchased from Arc Home(5) as of December 31, 2023

•$5.6 billion of financing as of December 31, 2023(4)

◦$4.8 billion of non-recourse financing and $0.8 billion of recourse financing

◦Executed three rated securitizations of $1.0 billion of unpaid principal balance during 2023 converting recourse financing with mark-to-market margin calls to non-recourse financing without mark-to-market margin calls

◦In January 2024, executed a rated Agency-Eligible securitization of $377.5 million of unpaid principal balance, converting recourse financing with mark-to-market margin calls to non-recourse financing without mark-to-market margin calls

◦In January 2024, completed the issuance and sale of $34.5 million aggregate principal amount of 9.500% Senior Unsecured Notes due 2029, generating $32.8 million in net proceeds to the Company

◦In January 2024, repurchased $7.1 million of aggregate principal amount of outstanding Convertible Notes, which were assumed by a subsidiary of the Company, and guaranteed by the Company, in the WMC acquisition

•10.5x GAAP Leverage Ratio and 1.5x Economic Leverage Ratio as of December 31, 2023

•0.9% Net Interest Margin(6)

•$112.3 million of total liquidity as of December 31, 2023

◦Consisted of $111.5 million of cash and cash equivalents and $0.8 million of unencumbered Agency RMBS

•Accretive repurchase of 1.1 million shares of common stock for $6.4 million during 2023, representing a weighted average cost of $5.72 per share

◦$16.5 million of capacity remaining under our existing repurchase programs as of the date of this release

OUR MANAGER AND TPG ANGELO GORDON

On November 1, 2023, TPG Inc. ("TPG") completed the previously announced acquisition of Angelo Gordon (the "TPG Transaction"), pursuant to which Angelo Gordon, including our Manager, became indirect subsidiaries of TPG. Pursuant to the management agreement with the Manager, the closing of the TPG Transaction resulted in an assignment of the management agreement. Our independent directors unanimously consented to such assignment on July 31, 2023 in advance of the TPG Transaction closing. There were no changes to the management agreement in connection with the TPG Transaction and the assignment of the management agreement became effective upon the closing of the TPG Transaction.

INVESTMENT PORTFOLIO

The following summarizes the Company’s investment portfolio as of December 31, 2023(4) ($ in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fair Value | | Yield(7) | | Financing | | Cost of Funds(a), (8) | | Equity |

Residential Investments(b) | | $5,788.4 | | 5.8% | | $5,390.6 | | 5.1% | | $397.8 |

| Agency RMBS | | 15.7 | | 10.2% | | 12.6 | | 6.2% | | 3.1 |

| Legacy WMC Commercial and Other Investments | | 123.8 | | 15.2% | | 79.6 | | 7.8% | | 44.2 |

| Total Investment Portfolio | | $5,927.9 | | 6.1% | | $5,482.8 | | 5.1% | | $445.1 |

| Cash and Cash Equivalents | | 111.5 | | 5.3% | | — | | | | 111.5 |

Interest Rate Swaps(c) | | 12.2 | | 1.7% | | — | | | | 12.2 |

Arc Home(5) | | 33.6 | | | | — | | | | 33.6 |

| Convertible senior unsecured notes | | — | | | | 85.3 | | 8.4% | | (85.3) |

| Non-interest earning assets, net | | 11.3 | | | | — | | | | 11.3 |

| Total | | $6,096.5 | | | | $5,568.1 | | | | $528.4 |

| | | | | | | | | | |

| Total Investment Portfolio | | $5,927.9 | | 6.1% | | $5,482.8 | | 5.1% | | $445.1 |

Less: Investments in Debt and Equity of Affiliates(b) | | 22.9 | | 31.4% | | 3.6 | | 8.0% | | 19.3 |

| Total | | $5,905.0 | | 5.9% | | $5,479.2 | | 5.1% | | $425.8 |

(a) Total Cost of Funds shown includes the cost or benefit from our interest rate hedges. Total Cost of Funds as of December 31, 2023 excluding the cost or benefit of our interest rate hedges would be 5.3%.

(b) As of December 31, 2023, includes fair value of $22.9 million of Residential Investments that are included in the “Investments in debt and equity of affiliates” line item on our consolidated balance sheet. These Residential Investments include $15.3 million of Non-QM Securities and $7.6 million of Re/Non-Performing Securities.

(c) Fair value on interest rate swaps represents the sum of the net fair value of interest rate swaps and the margin posted on interest rate swaps as of December 31, 2023. Yield on interest rate swaps represents the net receive/(pay) rate as of December 31, 2023. The impact of the net interest component of interest rate swaps on cost of funds is included within the respective investment portfolio asset line items.

FINANCING PROFILE

The following summarizes the Company’s financing as of December 31, 2023(4) ($ in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Securitized Debt | | Residential Bond Financing(a) | | Residential Loan Financing | | Agency Financing | | Legacy WMC Commercial Financing(b) | | Unsecured Notes(c) | | Total |

| Amount | | $4,711.6 | | $401.0 | | $278.0 | | $12.6 | | $79.6 | | $85.3 | | $5,568.1 |

Cost of Funds(8),(d) | | 4.9% | | 6.1% | | 6.1% | | 6.2% | | 7.8% | | 8.4% | | 5.1% |

| Advance Rate | | 88% | | 54% | | 88% | | 84% | | 68% | | N/A | | N/A |

Available Borrowing Capacity(e) | | N/A | | N/A | | $1,775.0 | | N/A | | N/A | | N/A | | $1,775.0 |

| Recourse/Non-Recourse | | Non-Recourse | | Recourse/Non-Recourse | | Recourse | | Recourse | | Recourse | | Recourse | | Recourse/Non-Recourse |

| | | | | | | | | | | | | | |

| Financing Amount | | $4,711.6 | | $401.0 | | $278.0 | | $12.6 | | $79.6 | | $85.3 | | $5,568.1 |

| Less: Financing in Investments in Debt and Equity of Affiliates | | — | | 3.6 | | — | | — | | — | | — | | 3.6 |

| Financing: GAAP Basis | | $4,711.6 | | $397.4 | | $278.0 | | $12.6 | | $79.6 | | $85.3 | | $5,564.5 |

(a) Includes financing on the retained tranches from securitizations issued by the Company and consolidated in the “Securitized residential mortgage loans, at fair value” line item on the Company’s consolidated balance sheets. Additionally, includes financing on Non-Agency RMBS included in the “Real estate securities, at fair value” and “Investments in debt and equity of affiliates” line items on the Company’s consolidated balance sheets.

(b) Includes financing on Commercial loans and CMBS included in the "Commercial loans, at fair value" and “Real estate securities, at fair value” line items, respectively, on the Company’s consolidated balance sheets.

(c) Includes Convertible Notes assumed by MITT's subsidiary in the WMC acquisition as of December 31, 2023.

(d) Total Cost of Funds shown includes the cost or benefit from the Company's interest rate hedges. Cost of Funds as of December 31, 2023 excluding the cost or benefit of our interest rate hedges would be 5.3%.

(e) The borrowing capacity under our residential mortgage loan warehouse financing arrangements is uncommitted by the lenders.

In January 2024, the Company issued $34.5 million aggregate principal amount of 9.500% Senior Notes due 2029 and used a portion of the proceeds to repurchase $7.1 million of aggregate principal amount of the Convertible Notes.

ARC HOME UPDATE(5)

•Arc Home continues to focus on Non-Agency Loan originations:

◦Arc Home originated $420.8 million and $1.6 billion of residential mortgage loans during Q4 2023 and the full year 2023, respectively

◦MITT purchased loans with an unpaid principal balance of $232.3 million and $675.0 million during Q4 2023 and the full year 2023, respectively, from Arc Home

◦As of December 31, 2023, MITT had a commitment to purchase loans with an unpaid principle balance of $72.7 million from Arc Home

•Cash of $13.4 million as of December 31, 2023, along with Arc Home's $85.0 million MSR portfolio that is largely unlevered, provides Arc Home with a strong financial position to manage the current dynamics in the mortgage origination market

•Arc Home generated an after-tax net loss of $(4.3) million in the fourth quarter 2023 primarily resulting from declines in origination volumes coupled with mark to market losses in the fair value of Arc Home's mortgage servicing right portfolio

◦MITT's portion of the after-tax net loss was $(1.9) million, prior to removing any gains on loans acquired by MITT from Arc Home which approximated $0.3 million during the fourth quarter of 2023(a)

•As of December 31, 2023, the fair value of MITT’s investment in Arc Home was calculated using a valuation multiple of 0.89x book value

(a) MITT eliminates any gains or losses on loans acquired by MITT from Arc Home from the "Equity in earnings/(loss) from affiliates" line item and decreases or increases the cost basis of the underlying loans accordingly resulting in unrealized gains or losses, which are recorded in the "Net unrealized gains/(losses)" line item on the Company's consolidated income statement.

BOOK VALUE ROLL-FORWARD

The below table provides a summary of our fourth quarter and full year 2023 activity impacting book value as well as a reconciliation to adjusted book value ($ in thousands, except per share data).

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended December 31, 2023 | | Year Ended December 31, 2023 |

| | Amount | | Per Diluted Share(3) | | Amount | | Per Diluted Share(3) |

Beginning Book Value(1) | | $ | 229,950 | | | $ | 11.37 | | | $ | 242,328 | | | $ | 11.39 | |

| Common dividend | | (4,103) | | | (0.18) | | | (15,063) | | | (0.72) | |

Equity from WMC acquisition(a) | | 81,353 | | | (0.76) | | | 81,353 | | | (0.75) | |

| Issuance/(repurchase) of common stock | | 119 | | | — | | | (5,972) | | | 0.29 | |

| Earnings available for distribution | | 3,948 | | | 0.17 | | | 8,274 | | | 0.39 | |

| Net realized and unrealized gain/(loss) included within equity in earnings/(loss) from affiliates | | (2,228) | | | (0.09) | | | (938) | | | (0.04) | |

| Net realized gain/(loss) | | (1,474) | | | (0.06) | | | 7,697 | | | 0.36 | |

| Net unrealized gain/(loss) | | 1,707 | | | 0.07 | | | 1,450 | | | 0.07 | |

| | | | | | | | |

| Transaction related expenses and deal related performance fees | | (1,376) | | | (0.06) | | | (11,233) | | | (0.53) | |

12/31/23 Book Value(1) | | $ | 307,896 | | | $ | 10.46 | | | $ | 307,896 | | | $ | 10.46 | |

| Change in Book Value | | 77,946 | | | (0.91) | | | 65,568 | | | (0.93) | |

| | | | | | | | |

12/31/23 Book Value(1) | | $ | 307,896 | | | $ | 10.46 | | | $ | 307,896 | | | $ | 10.46 | |

| Net proceeds less liquidation preference of preferred stock | | (7,519) | | | (0.26) | | | (7,519) | | | (0.26) | |

12/31/23 Adjusted Book Value(1) | | $ | 300,377 | | | $ | 10.20 | | | $ | 300,377 | | | $ | 10.20 | |

| | | | | | | | |

Beginning Book Value(1) | | $ | 229,950 | | | $ | 11.37 | | | $ | 242,328 | | | $ | 11.39 | |

| Net proceeds less liquidation preference of preferred stock | | (7,519) | | | (0.37) | | | (7,519) | | | (0.36) | |

Beginning Adjusted Book Value(1) | | $ | 222,431 | | | $ | 11.00 | | | $ | 234,809 | | | $ | 11.03 | |

(a) Equity from WMC acquisition includes the issuance of MITT common stock to WMC shareholders as well as the bargain purchase gain.

DIVIDENDS

The Company announced that on February 16, 2024 its Board of Directors (the "Board") declared first quarter 2024 preferred stock dividends as follows:

In accordance with the terms of its 8.25% Series A Cumulative Redeemable Preferred Stock (the "Series A Preferred Stock"), the Board declared a quarterly cash dividend of $0.51563 per share on its Series A Preferred Stock;

In accordance with the terms of its 8.00% Series B Cumulative Redeemable Preferred Stock (the "Series B Preferred Stock"), the Board declared a quarterly cash dividend of $0.50 per share on its Series B Preferred Stock; and

In accordance with the terms of its 8.000% Series C Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock (the "Series C Preferred Stock"), the Board declared a quarterly cash dividend of $0.50 per share on its Series C Preferred Stock.

The above dividends for the Series A Preferred Stock, the Series B Preferred Stock, and the Series C Preferred Stock are payable on March 18, 2024 to preferred shareholders of record on February 29, 2024.

In accordance with the terms of the merger agreement for the WMC acquisition, the Board declared the following interim common stock dividends:

•On November 20, 2023, the Board declared a second interim fourth quarter dividend of $0.05 per share of common stock that was paid on January 2, 2024 to common stockholders of record as of November 30, 2023.

•On October 24, 2023, the Board declared an interim fourth quarter dividend of $0.08 per share of common stock that was paid on November 8, 2023 to common stockholders of record as of November 3, 2023.

In addition, on December 15, 2023, the Board declared the remaining fourth quarter dividend of $0.05 per share of common stock that was paid on January 31, 2024 to common stockholders of record as of December 29, 2023.

On November 3, 2023, the Board declared a quarterly dividend of $0.51563 per share on the Series A Preferred Stock, $0.50 per share on the Series B Preferred Stock, and $0.50 per share on the Series C Preferred Stock. The dividends were paid on December 18, 2023 to preferred stockholders of record as of November 30, 2023.

STOCKHOLDER CALL

The Company invites stockholders, prospective stockholders, and analysts to participate in MITT’s fourth quarter earnings conference call on Thursday, February 22, 2024 at 8:30 a.m. Eastern Time.

To participate in the call by telephone, please dial (800) 445-7795 at least five minutes prior to the start time. International callers should dial (785) 424-1699. The Conference ID is MITTQ423. To listen to the live webcast of the conference call, please go to https://event.on24.com/wcc/r/4503620/58E78A554509AAFDAA8097512BFD7B3D and register using the same Conference ID.

A presentation will accompany the conference call and will be available prior to the call on the Company’s website, www.agmit.com, under "Presentations" in the "News & Presentations" section.

For those unable to listen to the live call, an audio replay will be available on February 22, 2024 through 9:00 a.m. Eastern Time on March 22, 2024. To access the replay, please go to the Company’s website at www.agmit.com.

ABOUT AG MORTGAGE INVESTMENT TRUST, INC.

AG Mortgage Investment Trust, Inc. is a residential mortgage REIT with a focus on investing in a diversified risk-adjusted portfolio of residential mortgage-related assets in the U.S. mortgage market. AG Mortgage Investment Trust, Inc. is externally managed and advised by AG REIT Management, LLC, a subsidiary of Angelo, Gordon & Co., L.P., a diversified credit and real estate investing platform within TPG.

Additional information can be found on the Company’s website at www.agmit.com.

ABOUT TPG ANGELO GORDON

Founded in 1988, Angelo, Gordon & Co., L.P. ("TPG Angelo Gordon") is a diversified credit and real estate investing platform within TPG. The platform currently manages approximately $78 billion* across a broad range of credit and real estate strategies. For more information, visit www.angelogordon.com.

*TPG Angelo Gordon’s currently stated assets under management (“AUM”) of approximately $78 billion as of December 31, 2023 reflects fund-level asset-related leverage. Prior to May 15, 2023, TPG Angelo Gordon calculated its AUM as net assets under management excluding leverage, which resulted in TPG Angelo Gordon AUM of approximately $53 billion as of December 31, 2022. The difference reflects a change in TPG Angelo Gordon’s AUM calculation methodology and not any material change to TPG Angelo Gordon’s investment advisory business. For a description of the factors TPG Angelo Gordon considers when calculating AUM, please see the disclosure at www.angelogordon.com/disclaimers/.

FORWARD LOOKING STATEMENTS

This press release includes "forward-looking statements" within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995 related to dividends, book value, adjusted book value, our investments, our business and investment strategy, investment returns, return on equity, liquidity, financing, taxes, our assets, our interest rate sensitivity, and our views on certain macroeconomic trends and conditions, among others. Forward-looking statements are based on estimates, projections, beliefs and assumptions of management of our company at the time of such statements and are not guarantees of future performance. Forward-looking statements involve risks and uncertainties in predicting future results and conditions. Actual results could differ materially from those projected in these forward-looking statements due to a variety of factors, including, without limitation, our ability to drive earnings power and enhance G&A efficiencies to make MITT a more scaled and profitable investment vehicle for our stockholders; failure to realize the anticipated benefits and synergies of the WMC acquisition, including whether we will achieve the savings and accretion expected within the anticipated timeframe or at all; whether market conditions will improve in the timeline anticipated or at all; our ability to continue to grow our residential investment portfolio; our acquisition pipeline; our ability to invest in higher yielding assets through Arc Home, other origination partners or otherwise; our levels of liquidity, including whether our liquidity will sufficiently enable us to continue to deploy capital within the residential whole loan space as anticipated or at all; the impact of market, regulatory and structural changes on the market opportunities we expect to have, and whether we will be able to capitalize on such opportunities in the manner we anticipate; the impact of market volatility on our business and ability to execute our strategy; our trading volume and liquidity; our portfolio mix, including levels of Non-Agency and Agency mortgage loans; our ability to manage warehouse exposure as anticipated or at all; our levels of leverage, including our levels of recourse and non-recourse financing; our ability to repay or refinance corporate leverage; our ability to execute securitizations, including at the pace anticipated or at all; our ability to achieve our forecasted returns on equity on warehoused assets and post-securitization, including whether such returns will support earnings growth; changes in our business and investment strategy; our ability to grow our adjusted book value; our ability to predict and control costs; changes in inflation, interest rates and the fair value of our assets, including negative changes resulting in margin calls relating to the financing of our assets; the impact of credit spread movements on our business; the impact of interest rate changes on our asset yields and net interest margin; changes in the yield curve; the timing and amount of stock issuances pursuant to our ATM program or otherwise; the timing and amount of stock repurchases, if any; our capitalization, including the timing and amount of preferred stock repurchases or exchanges, if any; expense levels, including levels of management fees; changes in prepayment rates on the loans we own or that underlie our investment securities; our distribution policy; Arc Home’s performance, including its liquidity position and ability to manage current dynamics of the mortgage origination market; Arc Home’s origination volumes; the composition of Arc Home’s portfolio, including levels of MSR exposure; levels of leverage on Arc Home’s MSR portfolio; our percentage allocation of loans originated by Arc Home; increased rates of default or delinquencies and/or decreased recovery rates on our assets; the availability of and competition for our target investments; our ability to obtain and maintain financing arrangements on terms favorable to us or at all; changes in general economic or market conditions in our industry and in the finance and real estate markets, including the impact on the value of our assets; conditions in the market for Residential Investments and Agency RMBS; our levels of EAD; market conditions impacting commercial real estate; legislative and regulatory actions by the U.S. Department of the Treasury, the Federal Reserve and other agencies and instrumentalities; regional bank failures; our ability to make distributions to our stockholders in the future; our ability to maintain our qualification as a REIT for federal tax purposes; and our ability to qualify for an exemption from registration under the Investment Company Act of 1940, as amended. Additional information concerning these and other risk factors are contained in our filings with the Securities and Exchange Commission ("SEC"), including those described in Part I – Item 1A. "Risk Factors" of our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and in Part II - Item 1A "Risk Factors" of our Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, as such factors may be updated from time to time in our filings with the SEC. Copies are available free of charge on the SEC's website, http://www.sec.gov/. All forward looking statements in this press release speak only as of the date of this press release. We undertake no duty to update any forward-looking statements to reflect any change in our expectations or any change in events, conditions or circumstances on which any such statement is based. All financial information in this press release is as of December 31, 2023, unless otherwise indicated.

NON-GAAP FINANCIAL INFORMATION

In addition to the results presented in accordance with GAAP, this press release includes certain non-GAAP financial results and financial metrics derived therefrom, including Earnings Available for Distribution, investment portfolio, financing arrangements, and Economic Leverage Ratio, which are calculated by including or excluding unconsolidated investments in affiliates as described in the footnotes to this press release. Our management team believes that this non-GAAP financial information, when considered with our GAAP financial statements, provides supplemental information useful for investors to help evaluate our financial performance. However, our management team also believes that our definition of EAD has important limitations as it does not include certain earnings or losses our management team considers in evaluating our financial performance. Our presentation of non-GAAP financial information may not be comparable to similarly-titled

measures of other companies, who may use different calculations. This non-GAAP financial information should not be considered a substitute for, or superior to, the financial measures calculated in accordance with GAAP. Our GAAP financial results and the reconciliations of the non-GAAP financial measures included in this press release to the most directly comparable financial measures prepared in accordance with GAAP should be carefully evaluated.

AG Mortgage Investment Trust, Inc. and Subsidiaries

Consolidated Balance Sheets (Unaudited)

(in thousands, except per share data)

| | | | | | | | | | | |

| | December 31, 2023 | | December 31, 2022 |

| Assets | | | |

Securitized residential mortgage loans, at fair value - $645,876 and $423,967 pledged as collateral, respectively | $ | 5,358,281 | | | $ | 3,707,146 | |

Residential mortgage loans, at fair value - $315,225 and $353,039 pledged as collateral, respectively | 317,631 | | | 356,467 | |

Residential mortgage loans held for sale, at fair value - $0 and $64,984 pledged as collateral, respectively | — | | | 64,984 | |

Commercial loans, at fair value - $66,303 and $0 pledged as collateral, respectively | 66,303 | | | — | |

Real estate securities, at fair value - $155,115 and $41,653 pledged as collateral, respectively | 162,821 | | | 43,719 | |

| Investments in debt and equity of affiliates | 55,103 | | | 71,064 | |

| Cash and cash equivalents | 111,534 | | | 84,621 | |

| Restricted cash | 14,039 | | | 14,182 | |

| Other assets | 40,716 | | | 27,595 | |

| Total Assets | $ | 6,126,428 | | | $ | 4,369,778 | |

| | | |

| Liabilities | | | |

| Securitized debt, at fair value | $ | 4,711,623 | | | $ | 3,262,352 | |

| Financing arrangements | 767,592 | | | 621,187 | |

| Convertible senior unsecured notes | 85,266 | | | — | |

| | | |

| Dividend payable | 1,472 | | | 3,846 | |

| Due to affiliates | 3,252 | | | 3,652 | |

| Other liabilities | 28,855 | | | 15,941 | |

| Total Liabilities | 5,598,060 | | | 3,906,978 | |

| Commitments and Contingencies | | | |

| Stockholders' Equity | | | |

Preferred stock - $227,991 aggregate liquidation preference | 220,472 | | | 220,472 | |

Common stock, par value $0.01 per share; 450,000 shares of common stock authorized and 29,437 and 21,284 shares issued and outstanding at December 31, 2023 and December 31, 2022, respectively | 294 | | | 212 | |

| Additional paid-in capital | 823,715 | | | 778,606 | |

| Retained earnings/(deficit) | (516,113) | | | (536,490) | |

| Total Stockholders' Equity | 528,368 | | | 462,800 | |

| | | |

| Total Liabilities & Stockholders' Equity | $ | 6,126,428 | | | $ | 4,369,778 | |

AG Mortgage Investment Trust, Inc. and Subsidiaries

Consolidated Statements of Operations (Unaudited)

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, 2023 | | Three Months Ended

December 31, 2022 | | Year Ended

December 31, 2023 | | |

| Net Interest Income | | | | | | | | |

| Interest income | | $ | 77,527 | | | $ | 57,286 | | | $ | 260,329 | | | |

| Interest expense | | 64,191 | | | 44,924 | | | 212,500 | | | |

| Total Net Interest Income | | 13,336 | | | 12,362 | | | 47,829 | | | |

| | | | | | | | |

| Other Income/(Loss) | | | | | | | | |

| Net interest component of interest rate swaps | | 1,655 | | | 927 | | | 6,680 | | | |

| Net realized gain/(loss) | | (1,474) | | | 21,317 | | | 7,697 | | | |

| Net unrealized gain/(loss) | | 1,707 | | | (14,602) | | | 1,450 | | | |

| Bargain purchase gain | | 30,190 | | | — | | | 30,190 | | | |

| Total Other Income/(Loss) | | 32,078 | | | 7,642 | | | 46,017 | | | |

| | | | | | | | |

| Expenses | | | | | | | | |

| Management fee to affiliate | | 1,521 | | | 2,112 | | | 7,711 | | | |

| Non-investment related expenses | | 2,229 | | | 1,582 | | | 10,077 | | | |

| Investment related expenses | | 2,903 | | 2,309 | | 9,808 | | |

| Transaction related expenses | | 1,376 | | | 1,535 | | | 11,076 | | | |

| Total Expenses | | 8,029 | | | 7,538 | | | 38,672 | | | |

| | | | | | | | |

| Income/(loss) before equity in earnings/(loss) from affiliates | | 37,385 | | | 12,466 | | | 55,174 | | | |

| | | | | | | | |

| Equity in earnings/(loss) from affiliates | | (2,032) | | | (772) | | | (1,390) | | | |

| Net Income/(Loss) | | 35,353 | | | 11,694 | | | 53,784 | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Dividends on preferred stock | | (4,586) | | | (4,586) | | | (18,344) | | | |

| | | | | | | | |

| Net Income/(Loss) Available to Common Stockholders | | $ | 30,767 | | | $ | 7,108 | | | $ | 35,440 | | | |

| | | | | | | | |

| Earnings/(Loss) Per Share of Common Stock | | | | | | | | |

| Basic | | $ | 1.35 | | | $ | 0.33 | | | $ | 1.68 | | | |

| Diluted | | $ | 1.35 | | | $ | 0.33 | | | $ | 1.68 | | | |

| | | | | | | | |

| Weighted Average Number of Shares of Common Stock Outstanding | | | | | | | | |

| Basic | | 22,836 | | | 21,824 | | | 21,095 | | | |

| Diluted | | 22,843 | | | 21,824 | | | 21,097 | | | |

NON-GAAP FINANCIAL MEASURES

Earnings Available for Distribution

This press release contains Earnings Available for Distribution ("EAD"), a non-GAAP financial measure. Our presentation of EAD may not be comparable to similarly-titled measures of other companies, who may use different calculations. This non-GAAP measure should not be considered a substitute for, or superior to, the financial measures calculated in accordance with GAAP. Our GAAP financial results and the reconciliations from these results should be carefully evaluated.

We define EAD, a non-GAAP financial measure, as Net Income/(loss) available to common stockholders excluding (i) (a) unrealized gains/(losses) on loans, real estate securities, derivatives and other investments, inclusive of our investment in AG Arc, and (b) net realized gains/(losses) on the sale or termination of such instruments, (ii) any transaction related expenses incurred in connection with the acquisition, disposition, or securitization of our investments as well as transaction related expenses incurred in connection with the WMC acquisition, (iii) accrued deal-related performance fees payable to third party operators to the extent the primary component of the accrual relates to items that are excluded from EAD, such as unrealized and realized gains/(losses), (iv) realized and unrealized changes in the fair value of Arc Home's net mortgage servicing rights and the derivatives intended to offset changes in the fair value of those net mortgage servicing rights, (v) deferred taxes recognized at our taxable REIT subsidiaries, if any, (vi) any gains/(losses) associated with exchange transactions on our common and preferred stock, and (vii) any bargain purchase gains recognized. Items (i) through (vii) above include any amount related to those items held in affiliated entities. Management considers the transaction related expenses referenced in (ii) above to be similar to realized losses incurred at the acquisition, disposition, or securitization of an asset and does not view them as being part of its core operations. Management views the exclusion described in (iv) above to be consistent with how it calculates EAD on the remainder of its portfolio. Management excludes all deferred taxes because it believes deferred taxes are not representative of current operations. EAD includes the net interest income and other income earned on our investments on a yield adjusted basis, including TBA dollar roll income/(loss) or any other investment activity that may earn or pay net interest or its economic equivalent.

A reconciliation of GAAP Net Income/(loss) available to common stockholders to EAD for the three months ended December 31, 2023, the three months ended December 31, 2022, and the year ended December 31, 2023 is set forth below (in thousands, except per share data):

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2023 | | Three Months Ended December 31, 2022 | | Year Ended December 31, 2023 |

| Net Income/(loss) available to common stockholders | | $ | 30,767 | | | $ | 7,108 | | | $ | 35,440 | |

| Add (Deduct): | | | | | | |

| Net realized (gain)/loss | | 1,474 | | | (21,317) | | | (7,697) | |

| Net unrealized (gain)/loss | | (1,707) | | | 14,602 | | | (1,450) | |

| Transaction related expenses and deal related performance fees | | 1,376 | | | 1,587 | | | 11,233 | |

| Equity in (earnings)/loss from affiliates | | 2,032 | | | 772 | | | 1,390 | |

EAD from equity method investments(a)(b) | | 196 | | | (1,565) | | | (452) | |

| | | | | | |

| | | | | | |

| | | | | | |

| Bargain purchase gain | | (30,190) | | | — | | | (30,190) | |

| Earnings available for distribution | | $ | 3,948 | | | $ | 1,187 | | | $ | 8,274 | |

| | | | | | |

| Earnings available for distribution, per diluted share | | $ | 0.17 | | | $ | 0.05 | | | $ | 0.39 | |

(a) For the three months ended December 31, 2023, the three months ended December 31, 2022, and the year ended December 31, 2023, $(0.3) million or $(0.01) per share, $43.0 thousand or $0.00 per share, and $(1.5) million or $(0.07) per share, respectively, of realized and unrealized changes in the fair value of Arc Home's net mortgage servicing rights, changes in the fair value of corresponding derivatives, and other asset impairments were excluded from EAD, net of deferred tax benefit or expense. Additionally, for the three months ended December 31, 2023, the three months ended December 31, 2022, and the year ended December 31, 2023, $0.3 million or $0.01 per share, $0.8 million or $0.04 per share, and $(1.5) million or $(0.07) per share, respectively, of unrealized changes in the fair value of our investment in Arc Home were excluded from EAD.

(b) EAD recognized by AG Arc does not include our portion of gains recorded by Arc Home in connection with the sale of residential mortgage loans to us. For the three months ended December 31, 2023, the three months ended December 31, 2022, and the year ended December 31, 2023, $0.3 million or $0.01 per share, $0.2 million or $0.01 per share, and $1.4 million or $0.07 per share of intra-entity profits recognized by Arc Home, respectively, and also decreased the cost basis of the underlying loans we purchased by the same amount.

The components of EAD for the three months ended December 31, 2023, the three months ended December 31, 2022, and the year ended December 31, 2023 is set forth below (in thousands, except per share data):

| | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 | | Three Months Ended December 31, 2022 | | Year Ended December 31, 2023 |

| Net Interest Income | $ | 14,360 | | | $ | 13,875 | | | $ | 53,215 | |

| | | | | |

| Net interest component of interest rate swaps | 1,655 | | | 927 | | | 6,680 | |

| | | | | |

| | | | | |

| | | | | |

| Arc Home EAD | (413) | | | (2,767) | | | (3,750) | |

Less: Elimination of gains on loans sold to MITT(a) | (301) | | | (163) | | | (1,442) | |

| | | | | |

| Arc Home EAD to MITT | (714) | | | (2,930) | | | (5,192) | |

| | | | | |

| Management fee to affiliate | (1,521) | | | (2,112) | | | (7,711) | |

| Non-investment related expenses | (2,229) | | | (1,582) | | | (10,077) | |

| Investment related expenses | (3,017) | | | (2,405) | | | (10,297) | |

| Dividends on preferred stock | (4,586) | | | (4,586) | | | (18,344) | |

| Operating Expense | (11,353) | | | (10,685) | | | (46,429) | |

| | | | | |

| Earnings available for distribution | $ | 3,948 | | | $ | 1,187 | | | $ | 8,274 | |

| | | | | |

| Earnings available for distribution, per diluted share | $ | 0.17 | | | $ | 0.05 | | | $ | 0.39 | |

(a) EAD excludes our portion of gains recorded by Arc Home in connection with the sale of residential mortgage loans to us. We eliminated such gains recognized by Arc Home and also decreased the cost basis of the underlying loans we purchased by the same amount. Upon reducing our cost basis, unrealized gains are recorded within net income based on the fair value of the underlying loans at quarter end.

Economic Leverage Ratio

This press release contains Economic Leverage Ratio, a non-GAAP financial measure. Our presentation of Economic Leverage Ratio may not be comparable to similarly-titled measures of other companies, who may use different calculations. This non-GAAP measure should not be considered a substitute for, or superior to, the financial measures calculated in accordance with GAAP. Our GAAP financial results and the reconciliations from these results should be carefully evaluated.

We define GAAP leverage as the sum of (1) Securitized debt, at fair value, (2) our GAAP Financing arrangements, net of any restricted cash posted on such financing arrangements, (3) Convertible senior unsecured notes, and (4) the amount payable on purchases that have not yet settled less the financing remaining on sales that have not yet settled. We define Economic Leverage, a non-GAAP metric, as the sum of: (i) our GAAP leverage, exclusive of any fully non-recourse financing arrangements, (ii) financing arrangements held through affiliated entities, net of any restricted cash posted on such financing arrangements, exclusive of any financing utilized through AG Arc, any adjustment related to unsettled trades as described in (4) in the previous sentence, and any non-recourse financing arrangements and (iii) our net TBA position (at cost), if any.

The calculation in the table below divides GAAP leverage and Economic Leverage by our GAAP stockholders’ equity to derive our leverage ratios. The following table presents a reconciliation of our Economic Leverage ratio to GAAP Leverage ($ in thousands).

| | | | | | | | | | | | | | | | | | | | |

| December 31, 2023 | | Leverage | | Stockholders' Equity | | Leverage Ratio |

| Securitized debt, at fair value | | $ | 4,711,623 | | | | | |

| GAAP Financing arrangements | | 767,592 | | | | | |

| Convertible senior unsecured notes | | 85,266 | | | | | |

| Restricted cash posted on Financing arrangements | | (1,696) | | | | | |

| | | | | | |

| GAAP Leverage | | $ | 5,562,785 | | | $ | 528,368 | | | 10.5x |

| Financing arrangements through affiliated entities | | 3,605 | | | | | |

Non-recourse financing arrangements(a) | | (4,774,595) | | | | | |

| Net TBA receivable/(payable) adjustment | | (9,163) | | | | | |

| Economic Leverage | | $ | 782,632 | | | $ | 528,368 | | | 1.5x |

(a) Non-recourse financing arrangements include securitized debt and other non-recourse financing arrangements.

Footnotes

(1) Book value is calculated using stockholders’ equity less net proceeds of our cumulative redeemable preferred stock ($220.5 million) as the numerator. Adjusted book value is calculated using stockholders’ equity less the liquidation preference of our cumulative redeemable preferred stock ($228.0 million) as the numerator.

(2) The economic return on equity represents the change in adjusted book value per share during the period, plus the common dividends per share declared over the period, divided by adjusted book value per share from the prior period.

(3) Diluted per share figures are calculated using diluted weighted average outstanding shares in accordance with GAAP.

(4) Our Investment Portfolio consists of Residential Investments, Agency RMBS, and WMC Legacy Commercial Investments, all of which are held at fair value. Our financing is inclusive of Securitized Debt, which is held at fair value, Financing Arrangements and Convertible Senior Unsecured Notes. Throughout this press release where we disclose our Investment Portfolio and the related financing, we have presented this information inclusive of (i) securities owned through investments in affiliates that are accounted for under GAAP using the equity method and, where applicable, (ii) long positions in TBAs, which are accounted for as derivatives under GAAP, but exclusive of our Convertible Senior Unsecured Notes. This presentation excludes investments through AG Arc LLC unless otherwise noted.

(5) We invest in Arc Home LLC, a licensed mortgage originator, through AG Arc LLC, one of our equity method investees. Our investment in AG Arc LLC is $33.6 million as of December 31, 2023, representing a 44.6% ownership interest.

(6) Net interest margin is calculated by subtracting the weighted average cost of funds from the weighted average yield for our Investment Portfolio, which excludes cash held.

(7) The yield on our debt investments represents an effective interest rate, which utilizes all estimates of future cash flows and adjusts for actual prepayment and cash flow activity as of quarter end. Our calculation excludes cash held by the Company and excludes any net TBA position. The calculation of weighted average yield is weighted based on fair value.

(8) The cost of funds at quarter end is calculated as the sum of (i) the weighted average funding costs on recourse financing arrangements outstanding at quarter end, (ii) the weighted average funding costs on non-recourse financing arrangements outstanding at quarter end, and (iii) the weighted average of the net pay or receive rate on our interest rate swaps outstanding at quarter end. The cost of funds at quarter end are weighted by the outstanding financing arrangements at quarter end, including any non-recourse financing arrangements.

v3.24.0.1

Cover

|

Feb. 22, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 22, 2024

|

| Entity Registrant Name |

AG Mortgage Investment Trust, Inc.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-35151

|

| Entity Tax Identification Number |

27-5254382

|

| Entity Address, Address Line One |

245 Park Avenue

|

| Entity Address, Address Line Two |

26th floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10167

|

| City Area Code |

212

|

| Local Phone Number |

692-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001514281

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

MITT

|

| Security Exchange Name |

NYSE

|

| Series Cumulative Reedmable Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

8.25% Series A Cumulative Redeemable Preferred Stock

|

| Trading Symbol |

MITT PrA

|

| Security Exchange Name |

NYSE

|

| Series B Cumulative Reedmable Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

8.00% Series B Cumulative Redeemable Preferred Stock

|

| Trading Symbol |

MITT PrB

|

| Security Exchange Name |

NYSE

|

| Series C Fixed to Floating Rate Cumulative Redeemable Preferred |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

8.000% Series C Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock

|

| Trading Symbol |

MITT PrC

|

| Security Exchange Name |

NYSE

|

| Senior Notes Due 2029 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

9.500% Senior Notes due 2029

|

| Trading Symbol |

MITN

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mitt_SeriesCumulativeReedmablePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mitt_SeriesBCumulativeReedmablePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mitt_SeriesCFixedToFloatingRateCumulativeRedeemablePreferredMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mitt_SeniorNotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

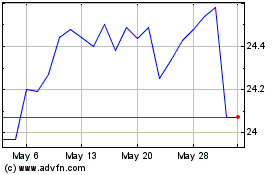

AG Mortgage Investment (NYSE:MITT-C)

Historical Stock Chart

From Nov 2024 to Dec 2024

AG Mortgage Investment (NYSE:MITT-C)

Historical Stock Chart

From Dec 2023 to Dec 2024