Steady progress on strategic priorities and financial targets

supports increase in dividend

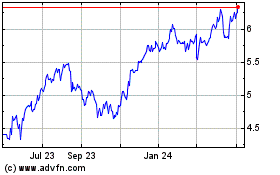

- Net result of EUR 849 million in the second quarter of 2021

reflects strong operating result and fair value gains on

investments from favorable market movements

- All segments contribute to the increase of the operating result

by 62% compared with the second quarter of 2020 to EUR 562 million,

driven by expense savings, increased fees due to higher equity

markets, and a normalization of claims experience in the United

States

- Cash Capital at Holding increases to EUR 1.4 billion, and

remains in the upper half of Aegon’s operating range. Capital

ratios of all three main units are above their respective operating

levels; Group Solvency II ratio increases by 14%-points to

208%

- In the US variable annuity business, Aegon launched a lump-sum

buy-out program and will be expanding its dynamic hedging program

to release capital and increase the predictability of capital

generation

- Interim dividend increases by EUR 0.02 to EUR 0.08 per common

share to reflect steady progress made on our strategic priorities

and financial targets

Statement of Lard Friese, CEO

“I am encouraged by the steady progress we have made on our

strategic and financial transformation in the second quarter of

2021. Economic recovery – aided by increased vaccination rates –

supported our results.

Increased fees due to favorable equity markets, the

normalization of claims experience in the United States, and

expense savings contributed to a 62% increase in our operating

result to EUR 562 million. We have made good progress on the

implementation of our expense savings program, resulting in a EUR

220 million reduction of annual addressable expenses through the

second quarter. This strengthens our confidence in our ability to

deliver on the targeted EUR 400 million expense saving by 2023.

By introducing innovative new products, expanding distribution,

and enhancing customer service we are driving growth in our

Strategic Asset category. We achieved double digit sales growth in

US Life, delivered another quarter of strong sales in US

Middle-Market Retirement Plans, and almost doubled the net deposits

in our UK Workplace business. We continued our strong growth

momentum in the Netherlands, with record-high levels of both

mortgages under administration, and assets under administration in

our new-style defined contribution pension business.

Aegon Asset Management also extended its growth track record of

positive third-party net deposits, as strong demand for our

solutions – both in our wholly-owned business and in our Chinese

joint venture – continues. In our ESG portfolio, Aegon Asset

Management and its partners have helped to fund investments in

affordable and workforce housing units in the United States to

better serve our local communities.

In July, we launched a program that offers certain variable

annuity customers a lump-sum payment in return for surrendering

their policies. The buyout program will reduce Transamerica’s

financial market exposure, with the remaining legacy variable

annuities portfolio to be dynamically hedged for equity and

interest rate risk. This creates value by releasing capital at

terms we believe are favorable compared to other alternatives, and

increases the predictability of the capital that the business

generates.

The progress we are making on our strategic priorities and

financial targets provides us with the confidence to accelerate the

increase in dividends, on our path to pay around 25 eurocents per

common share by 2023. Therefore, we are announcing today an

increase in our interim dividend by EUR 0.02 to EUR 0.08 per common

share. Furthermore, the strength of our balance sheet also allows

us to take another step towards achieving our deleveraging target

by announcing the redemption of USD 250 million perpetual capital

securities this year.

I would like to thank our 22,000 employees who, in the face of

an ongoing pandemic and change, followed through on our strategic

and operational plans in the second quarter.”

Strategic highlights

Aegon N.V.

unaudited

Strategic highlights - Focus. Execute.

Deliver.

Key performance indicators

2Q 2021

2Q 2020

%

1Q 2021

%

YTD 2021

YTD 2020

%

Addressable expenses *

2,813

3,061

(8)

2,855

(1)

n/a

n/a

Change compared to FY 2019

(245)

3

n.m.

(203)

(21)

n/a

n/a

Strategic Assets

Americas Individual Solutions - Life,

US

New business strain (USD million)

71

82

(13)

73

(3)

145

157

(8)

New life sales (USD million)

95

76

24

83

14

178

142

25

MCVNB (USD million) **

73

50

45

52

41

124

87

43

Americas Workplace Solutions -

Retirement Plans Middle-Market

Net deposits (USD million)

324

340

(5)

194

67

518

277

87

Written sales (USD million)

1,114

576

93

1,124

(1)

2,237

1,463

53

The Netherlands

Mortgage origination (EUR million)

2,897

3,044

(5)

3,031

(4)

5,928

5,584

6

Workplace Solutions net deposits (EUR

million)

198

165

20

173

15

371

317

17

Net growth Knab customers ('000s of

customers)

5.6

9.5

(41)

10.4

(46)

16.1

14.7

9

United Kingdom

Platform expenses / AuA

21 bps

26 bps

22 bps

21 bps

26 bps

Annualized revenues gained/(lost) on net

deposits (GBP million)

(1)

-

n.m.

(2)

35

(3)

(2)

(31)

Workplace net deposits (GBP million)

1,060

587

81

295

n.m.

1,355

997

36

Retail net deposits (GBP million)

(78)

(103)

24

(42)

(85)

(119)

(365)

67

Growth Markets (Spain & Portugal,

China, Brazil)

New life sales (EUR million)

53

42

26

65

(19)

117

112

5

MCVNB (Life) (EUR million)

17

16

6

32

(46)

49

42

15

New premium production (P&C and

A&H) (EUR million)

28

11

167

29

(1)

57

30

88

Asset Management - Global

Platforms

Operating margin (%)

13.6%

11.7%

16

12.8%

6

13.2%

10.2%

29

Net deposits (EUR million)

1,512

2,494

(39)

(3,572)

n.m.

(2,061)

5,797

n.m.

of which Third-party (EUR million)

2,100

(454)

n.m.

138

n.m.

2,239

(2,125)

n.m.

Annualized revenues gained/(lost) (EUR

million)

4

5

(26)

-

n.m.

3

5

(33)

Financial Assets

Americas - Variable Annuities

Capital generation (USD million)

302

840

(64)

79

n.m.

381

(809)

n.m.

Dynamic hedge effectiveness ratio (%)

***

99%

97%

(1)

99%

-

99%

96%

(1)

Americas - Long-Term Care

Capital generation (USD million)

138

4

n.m.

76

80

214

28

n.m.

Actual to expected claim ratio (%)

(IFRS)

52%

87%

(41)

43%

21

47%

86%

(45)

NPV of rate increases approved since

end-2020 (USD million)

176

n/a

112

176

n/a

The Netherlands - NL Life

Operating capital generation (EUR

million)

67

32

112

27

148

95

77

22

Remittances to Aegon NL (EUR million)

25

-

n.m.

25

116

50

121

(59)

Solvency II ratio (%)

172%

174%

(1)

149%

16

172%

174%

(1)

* Trailing four quarters in constant

currency, EUR million.

** MCVNB 1Q 2021 restated for methodology

change for Indexed universal life (IUL) pricing model.

*** Updated definition of hedge

effectiveness which now reflects the effectiveness per individual

hedged risks, instead of the total.

Aegon’s strategy

Aegon is taking significant steps to transform the company in

order to improve its performance and create value for its customers

and shareholders. To ensure delivery against these objectives, a

rigorous and granular operating plan has been developed across the

Group. Aegon focuses on three core markets (the United States, the

Netherlands, and the United Kingdom), three growth markets (Spain

& Portugal, China, and Brazil) and one global asset manager.

Aegon’s businesses within its core markets have been separated into

Financial Assets and Strategic Assets. The aim is to release

capital from Financial Assets and from businesses outside its core

and growth markets, and re-allocate capital to growth opportunities

in Strategic Assets, growth markets and Asset Management.

Throughout this transformation, the company aims to maintain a

solid capital position in the business units and at the Holding.

Through proactive risk management actions, Aegon is improving its

risk profile and reducing the volatility of its capital ratios.

Operational improvement plan

Aegon has an ambitious plan comprised of more than 1,100

detailed initiatives designed to improve the operating performance

of its business by reducing costs, expanding margins and growing

profitably. A total of 528 initiatives have been executed between

the launch of the operational improvement plan and the end of the

second quarter 2021, of which 421 are related to expense

savings.

Aegon is implementing an expense savings program aimed at

reducing addressable expenses by EUR 400 million in 2023 compared

with the base year 2019. Aegon has delivered on its ambition to

achieve half of its expense reduction target by the end of 2021. In

the trailing four quarters, Aegon has reduced addressable expenses

by EUR 245 million compared with the base year 2019. Of this

expense reduction, EUR 220 million was driven by expense savings

initiatives. The remaining reduction in annual addressable expenses

reflects expense benefits related to reduced activity in a COVID-19

environment net of expenses made for growth initiatives, which are

aimed at improving customer service, enhancing user experience and

developing new products. These growth initiatives contributed EUR

26 million to the operating result in the second quarter of 2021.

The company will continue to execute the expense and growth

initiatives at pace.

Strategic Assets

Strategic Assets are businesses with a greater potential for an

attractive return on capital, and where Aegon is well positioned

for growth. In these businesses, Aegon will invest in profitable

growth by expanding its customer base and increasing its

margins.

Americas

In the US Individual Solutions business, Transamerica’s aim is

to achieve a top-5 position in Term Life, Whole Life Final Expense,

and Indexed Universal Life through profitable sales growth. New

life sales in the second quarter of 2021 amounted to USD 95

million, which represents an increase of 24% compared with the same

period last year. This was mainly driven by an increase in new

sales of Indexed Universal Life. Transamerica is benefiting from an

increase in licensed agents at World Financial Group (WFG) and a

higher market share in this distribution channel from the addition

of a funeral planning benefit to Indexed Universal Life products

for qualifying policyholders. Transamerica developed this new

benefit to provide grieving beneficiaries valuable resources to

help the insured person’s family plan end-of-life services.

Furthermore, Whole Life Final Expense sales increased following

enhancements made both to the product and the application process.

In the second quarter of 2021, the market consistent value of new

business for Life increased by 45% compared with the same period

last year to USD 73 million. This was largely driven by higher

sales, lower underwriting expenses, and a more favorable product

mix.

In the US Workplace Solutions business, Transamerica aims to

compete as a top-5 player in new sales in the Middle‑Market segment

of Retirement Plans. Momentum is building here with four

consecutive quarters of written sales of over USD 1 billion.

Written sales were supported by Pooled Plan Arrangement contract

wins. These multi-employer pension schemes are a strategic growth

driver. Net deposits for the Middle-Market were positive at USD 324

million.

The Netherlands

Aegon is the largest third-party mortgage originator in the

Netherlands, benefiting from its scale, high service levels to

intermediaries and customers, and diversified funding. In the

second quarter of 2021, the company originated EUR 2.9 billion of

residential mortgages – of which two thirds were fee-based

mortgages originated for third-party investors – and mortgages

under administration reached a record EUR 58 billion. Aegon expects

mortgage origination volumes to decrease in the second half of

2021, as spreads on mortgages have come down year-to-date.

Net deposits for the Workplace Solutions defined contribution

products (PPI) in the Netherlands increased by 20% compared with

the second quarter of 2020 to EUR 198 million. PPI assets under

management surpassed the EUR 5 billion mark for the first time,

underscoring Aegon’s leading position in this market.

Aegon is further developing its online bank Knab into a digital

gateway for individual retirement solutions. In the second quarter

of 2021, the online bank grew its customer base by over 5,000. To

accelerate its strategy, Aegon has stopped offering savings

products to customers of its original savings bank. These customers

are being encouraged to either convert their accounts to Knab

accounts or transfer their funds to another bank. Knab customers

receive access to products, services and features that provide

insight into daily banking matters and to products that help them

accumulate wealth.

United Kingdom

Aegon’s assets under administration in the United Kingdom

reached GBP 200 billion for the first time, as it continues to

increase scale in the UK pension and savings market. The growth in

assets reflects strong markets, and benefits from a number of

ongoing investments in the business. Aegon’s platform business in

the United Kingdom – excluding the low-margin Institutional

business – doubled its net deposits compared with the same quarter

last year to GBP 1.0 billion, driven by the Workplace segment. This

reflects Aegon’s ability to serve the needs of both middle-market

employers and large corporates. This quarter’s net deposits in the

United Kingdom included a significant Master Trust contract win,

which underscores that Aegon is well positioned in this

fast-growing market of multi-employer pension schemes. Aegon

continues to invest in the overall Workplace proposition to give

the business a distinctive position in the key area of member

engagement. An example thereof is the acquisition of Pension Geeks,

an award-winning business that specializes in connecting people

with their finances through innovative engagement techniques,

communication and events. This acquisition is expected to further

improve the customer experience, make communications more

personalized, and drive growth.

By profitably growing its platform business, and by reducing

expenses, Aegon UK aims to mitigate the impact from the gradual

run-off of its traditional product portfolio. The traditional

product portfolio is the main driver behind annualized revenue lost

on net deposits for the second quarter. Expense initiatives, as

well as the favorable impact from market movements on assets have

contributed to an improvement in efficiency, with platform expenses

as a percentage of assets under administration decreasing by 5

basis points compared with the second quarter of last year to 21

basis points.

Financial Assets

Financial Assets are blocks of business which have closed for

new sales, and which are capital intensive with relatively low

returns on capital employed. Aegon has established dedicated teams

to manage these businesses, who are responsible for maximizing

their value through disciplined risk management and capital

management actions. To achieve this, Aegon is initially focusing on

unilateral and bilateral actions before any third-party solutions

would be taken into consideration. Unilateral actions are those

that can be executed fully under Aegon’s control, while bilateral

actions require the interaction and consideration of other

stakeholders.

Americas

An example of such a bilateral action, is the lump-sum buy-out

program that Transamerica launched in July 2021 for policyholders

of Variable Annuities with guaranteed minimum income benefit (GMIB)

riders, whose financial objectives may have changed since the

issuance of their policies. Under the program, policyholders are

being offered a lump-sum payment – exceeding the account value – in

return for surrendering their Variable Annuity policy with GMIB

riders, subject to certain conditions. The program will reduce

hedge costs for the remaining Variable Annuities portfolio going

forward and will reduce Transamerica’s economic exposure at a price

that is more favorable than the price that Aegon believes would be

possible to achieve in a transaction with a third party.

Aegon expects to expand the dynamic hedging program, covering

the equity and interest rate risks of its US Variable Annuities

block with guaranteed minimum withdrawal benefits (GMWB), to the

entire Variable Annuities portfolio once the take-up rate of the

lump-sum buy-out program becomes more clear. This expanded hedging

program will include policies with guaranteed minimum death benefit

riders (GMDB) and the remaining policies with GMIB riders, as of

the start of the fourth quarter of 2021. This builds on the

effective dynamic hedging program of the GMWB portfolio where the

hedge effectiveness for the targeted risks was consistently above

95% over the last six quarters. Dynamic hedging stabilizes cash

flows on an economic basis and reduces sensitivities to equity and

interest rate risks. The operational preparations for the expansion

of the dynamic hedge program were completed in the second quarter

of 2021, and the existing macro hedges will be adjusted during the

third quarter to smoothen the transition to dynamic hedging.

The combination of extending the dynamic hedge to the full

portfolio of Variable Annuities together with the execution of the

lump-sum buy-out program is expected to have up to 5%-points

negative impact on the RBC ratio based on current market

conditions. Dynamic hedging decreases available capital as a result

of reflecting the hedge costs in the calculation of the reserves,

which is largely offset by lower required capital as a result of

holding higher reserves. On an ongoing basis, the expansion of the

dynamic hedging program is expected to reduce operating capital

generation by around USD 50 million per year. At the same time,

Transamerica’s reduced exposure to equity and interest rate risks

leads to more predictable capital generation over the lifetime of

the variable annuity business, and increases the certainty of

remittances. Expanding the Variable Annuity dynamic hedging program

and executing the lump-sum buy-out program is expected to result in

a USD 0.5 to 0.7 billion pre-tax, one-time loss to be reported in

Other charges in the third quarter of 2021. This is mostly driven

by a non-cash write-off of deferred acquisition costs.

After the full implementation of both programs in the second

half of 2021, Aegon will consider further unilateral and bilateral

actions to maximize the value of the variable annuity business.

Aegon will also allocate internal resources to investigate its

options regarding potential third‑party solutions. Aegon will

update the market on its progress in the first half of 2022.

The primary management action regarding Transamerica’s Long-Term

Care block is a multi-year rate increase program that has a value

of USD 300 million. In the second quarter of 2021, the company

obtained regulatory approvals for additional rate increases worth

USD 64 million, bringing the value of approvals achieved

year-to-date to USD 176 million. Furthermore, claims experience

developed favorably for the Long-Term Care business with an

actual-to-expected ratio of 52% for the second quarter of 2021 as a

result of elevated claims terminations due to the impact of the

COVID-19 pandemic, and a one-time reserve release. Adjusted for

this reserve release, the actual-to-expected claims ratio amounted

to 81%.

The Netherlands

The dedicated team responsible for the Dutch Life business is

actively managing risks and the capital position to enhance the

consistency of remittances to the Group. The main legal entity of

the Dutch Life business – Aegon Levensverzekering N.V. –

implemented a quarterly remittance policy in the fourth quarter of

2020, and again remitted EUR 25 million in the second quarter of

2021. Its Solvency II ratio increased from 149% to 172% during the

second quarter of 2021, which is above the operating level of 150%.

The increase includes benefits from management actions, model

updates and favorable market movements.

Growth Markets and Asset Management

In its growth markets – Brazil, Spain & Portugal and China –

Aegon will continue to invest in profitable growth.

To align the organization to its strategy, Aegon’s Brazilian

joint venture Mongeral Aegon Group (MAG) will become part of Aegon

International, and will be reported as part of this segment from

2022 onwards. As a result, Aegon International will include all

three growth markets. This will sharpen the focus on growth, and

offer the necessary support to these important markets.

The market consistent value of new business (MCVNB) from life

products in Aegon’s growth markets increased by 6% to EUR 17

million, mainly driven by higher new life sales in Brazil and Spain

& Portugal. New premium production for property & casualty

and accident & health insurance increased by 167% compared with

the second quarter of 2020 to EUR 28 million as a result of new

products launched in Spain & Portugal. Sales through Aegon’s

bancassurance partners are benefitting from the redesign of the

digital sales channels to accelerate the digital transformation in

insurance distribution. The redesign includes easier customer

access to these sales channels by upgrading websites, enhanced data

analytics to better understand customer behavior and needs, and the

introduction of monthly online sales campaigns. These actions

supported a doubling of sales through the digital channels to over

15% of total production in June.

Aegon Asset Management aims to significantly increase the

operating margin of its Global Platforms by improving efficiency

and driving growth. Third-party net deposits on the Global

Platforms were EUR 2.1 billion in the second quarter of 2021,

driven by significant net deposits in various investment strategies

on the Fixed Income platform. This builds on Aegon’s track record

of positive third-party net deposits. Annualized revenues gained

for the Global Platforms amounted to EUR 4 million for the quarter

and reflect strong net deposits. The operating margin of the Global

Platforms increased by 2 percentage points compared with the second

quarter of 2020 to 13.6% as a result of higher revenues from net

deposits, favorable market movements and origination fees in

Aegon’s Real Assets business associated with responsible investment

mandates in Workforce housing and Affordable housing. Aegon Asset

Management is transitioning to a global operating platform to

improve efficiency and customer experience. This will also

significantly reduce technical complexity by bringing several

different solutions to a single enterprise solution. As an

important first step in this process, all front office and risk

teams now have access to a shared risk management module Aladdin

provided by BlackRock.

Smaller, niche or sub-scale businesses

In small markets or markets where Aegon has sub-scale or niche

positions, capital will be managed tightly with a bias to exit.

Aegon has taken the decision to combine its programs for

purchasing corporate insurance – such as management liability risks

– and centralize all retained risks into one existing US-based

carrier to achieve cost and capital efficiencies. As part of this

process, Aegon will wind down its Irish corporate insurance entity.

Over time, this is expected to result in a release of EUR 40

million of capital invested in this entity.

On April 27, 2021, Transamerica closed the sale of its portfolio

of fintech and insurtech companies to a fund managed and advised by

Swiss-based private equity firm Montana Capital Partners. The

transaction had a positive impact of EUR 40 million on Cash Capital

at the Holding in the second quarter of 2021.

Strengthening the balance sheet

Aegon aims to continue strengthening its balance sheet, and is

taking proactive management actions to improve its risk profile and

reduce the volatility of its capital ratios.

At the Capital Markets Day on December 10, 2020, Aegon announced

its plans to reduce its economic interest rate exposure in the

United States by one third to one half in order to reduce its

dependency on financial markets and improve its risk profile. At

the end of the second quarter of 2021, Aegon had already executed

over two thirds of this plan through management actions, primarily

by lengthening the duration of its asset portfolio and extending

its forward starting swap program.

Today, Aegon announced that it is exercising its right to redeem

the USD 250 million floating rate perpetual capital securities with

a minimum coupon of 4% issued in 2005. The redemption is in line

with Aegon’s target to reduce leverage. The redemption of these

grandfathered Tier 1 securities will be effective September 15,

2021, when the principal amount will be repaid together with any

accrued and unpaid interest. After the redemption, Aegon will have

reduced its gross financial leverage by approximately EUR 700

million since the third quarter of 2020 to EUR 5.9 billion. Aegon

targets to reduce its gross financial leverage to between EUR 5.0

to 5.5 billion by 2023.

Financial highlights

Financial overview

unaudited

EUR millions

Notes

2Q 2021

2Q 2020

%

1Q 2021

%

YTD 2021

YTD 2020

%

Americas

282

133

112

163

73

445

262

70

The Netherlands

185

166

11

184

-

370

321

15

United Kingdom

44

37

19

39

12

84

81

3

International

34

33

1

28

20

62

82

(25)

Asset Management

71

33

115

75

(5)

146

71

106

Holding and other activities

(54)

(56)

4

(59)

8

(112)

(112)

(1)

Operating result

1

562

347

62

431

30

993

705

41

Fair value items

468

(698)

n.m.

3

n.m.

471

679

(31)

Realized gains / (losses) on

investments

162

1

n.m.

31

n.m.

193

16

n.m.

Net impairments

15

(135)

n.m.

16

(6)

31

(194)

n.m.

Non-operating items

644

(832)

n.m.

50

n.m.

694

501

39

Other income / (charges)

(153)

(909)

83

1

n.m.

(152)

(1,071)

86

Result before tax

1,053

(1,394)

n.m.

482

117

1,536

135

n.m.

Income tax

(205)

326

n.m.

(96)

(114)

(301)

68

n.m.

Net result

849

(1,068)

n.m.

386

118

1,235

202

n.m.

Net result attributable to:

Owners of Aegon N.V.

842

(1,069)

n.m.

383

118

1,226

202

n.m.

Non-controlling interests

6

1

n.m.

3

103

9

1

n.m.

Operating result after tax

454

284

60

357

27

812

594

37

Return on equity

4

10.4%

6.1%

71

8.8%

19

9.7%

6.6%

46

Operating expenses

961

994

(3)

954

1

1,916

1,985

(3)

of which addressable expenses

8

706

782

(10)

691

2

1,398

1,571

(15)

Americas

7,930

10,082

(21)

11,013

(28)

18,943

22,485

(16)

The Netherlands

5,131

3,852

33

4,488

14

9,619

7,580

27

United Kingdom

5,207

4,301

21

4,061

28

9,268

7,295

27

International

4

76

(95)

11

(65)

15

163

(91)

Asset Management (Third-party and

Strategic Partnerships only)

36,931

32,337

5

39,778

(15)

76,709

65,043

13

Total gross deposits

9

55,204

50,649

3

59,351

(12)

114,554

102,566

9

Americas

(3,626)

(756)

n.m.

(3,609)

-

(7,234)

(2,270)

n.m.

The Netherlands

241

572

(58)

204

18

445

691

(36)

United Kingdom

1,783

2,271

(21)

686

160

2,469

2,054

20

International

(2)

44

n.m.

6

n.m.

4

82

(95)

Asset Management (Third-party and

Strategic Partnerships only)

2,915

(218)

n.m.

3,119

(7)

6,034

395

n.m.

Total net deposits / (outflows)

9

1,311

1,912

(31)

407

n.m.

1,718

952

80

Americas

114

97

18

98

17

212

185

15

The Netherlands

16

21

(24)

21

(24)

37

47

(22)

United Kingdom

7

7

7

8

(9)

15

19

(20)

International

35

50

(31)

54

(36)

89

131

(32)

New life sales (recurring plus 1/10

single)

2,9

172

175

(2)

181

(5)

353

383

(8)

New premium production accident &

health insurance

29

47

(37)

55

(47)

84

121

(30)

New premium production property &

casualty insurance

26

23

16

25

4

52

59

(12)

Market consistent value of new

business

124

8

n.m.

153

(19)

276

107

n.m.

Note: For 2020 a reclass has been made

between operating and non-operating results for the US and TLB

related to US macro hedges, periodic intangibles unlocking and run

off businesses.

Aegon N.V.

unaudited

Leverage

2Q

2Q

1Q

2021

2020

2021

Gross financial leverage (EUR

millions)

6,070

6,611

6,080

Gross financial leverage ratio (%)

25.8%

28.4%

26.7%

Aegon N.V.

unaudited

Cash Capital at Holding

2Q

2Q

1Q

EUR millions

2021

2020

2021

Beginning of period

1,191

1,379

1,149

Americas

176

407

17

The Netherlands

25

-

25

United Kingdom

-

-

49

International

34

4

24

Asset Management

40

-

-

Holding and other activities

-

25

-

Gross remittances

275

436

115

Funding and operating expenses

(100)

(107)

(41)

Free cash flow

175

330

75

Divestitures

40

-

21

Capital injections

(17)

(5)

(50)

Capital flows from / (to) shareholders

-

-

-

Net change in gross financial leverage

-

-

-

Other

(4)

2

(4)

End of period

1,386

1,706

1,191

Aegon N.V.

unaudited

Capital ratios

2Q

2Q

1Q

EUR millions

Notes

2021

2020

2021

US RBC ratio

444%

407%

428%

NL Life Solvency II ratio

172%

174%

149%

Scottish Equitable plc (UK) Solvency II

ratio

163%

145%

158%

Eligible Own Funds

19,436

17,463

18,810

Consolidated Group SCR

9,353

8,933

9,676

Aegon N.V. Solvency II ratio

10,11

208%

195%

194%

Eligible Own Funds to meet MCR

8,509

7,239

7,869

Minimum Capital Requirement (MCR)

2,286

2,262

2,274

Aegon N.V. MCR ratio

372%

320%

346%

Aegon N.V.

Capital generation

unaudited

Q2

Q2

Q1

EUR millions

2021

2020

%

2021

%

Earnings on in-force*

362

77

n.m.

218

66

Release of required

175

294

(40)

239

(27)

New business strain

(161)

(217)

(26)

(234)

(31)

Operating capital generation*

376

155

143

223

69

One-time items*

606

507

20

107

n.m.

Market impacts

488

(1,911)

(126)

(358)

n.m.

Capital generation*

1,470

(1,249)

n.m.

(28)

n.m.

* Capital generation (earnings on in-force, operating capital

generation and one-time items) for 2020 has been restated to

smoothen the impact of UFR and Holding funding costs.

Aegon N.V.

Operating capital generation per

segment

unaudited

Q2

Q2

Q1

EUR millions

2021

2020

%

2021

%

Americas

225

55

n.m.

115

95

The Netherlands*

89

43

106

37

139

United Kingdom

57

30

92

44

29

International

39

62

(38)

42

(8)

Asset Management

25

38

(33)

49

(49)

Holding and other activities*

(59)

(73)

(19)

(66)

(10)

Operating capital generation*

376

155

143

223

69

* Capital generation (earnings on in-force, operating capital

generation and one-time items) for 2020 has been restated to

smoothen the impact of UFR and Holding funding costs.

Operating result

Aegon’s operating result increased by 62% compared with the

second quarter of 2020 to EUR 562 million with higher earnings

across all segments. This was mainly driven by better claims

experience in the Americas, expense savings, and increased fees due

to higher equity markets. This more than offset the

reclassification of the result of Central & Eastern Europe from

operating result to Other income following the announced divestment

of the business. Adjusted for this reclassification and on a

constant currency basis, Aegon’s operating result increased by 74%

compared with the second quarter of 2020.

The operating result from the Americas more than doubled

compared with the second quarter of 2020 to EUR 282 million, driven

by better claims experience related to the COVID-19 pandemic.

Unfavorable mortality claims experience improved from EUR 88

million in the second quarter of last year to EUR 27 million in

this quarter. Favorable morbidity claims experience – including a

one-time reserve release – contributed EUR 55 million in this

quarter compared with EUR 48 million in the second quarter of 2020.

The operating result also benefited from increased fees due to

favorable equity market performance – especially in Variable

Annuities, Retirement Plans, and Mutual Funds – as well as a higher

investment margin in Life, and lower addressable expenses.

Aegon’s operating result in the Netherlands increased by 11%

compared with the second quarter of 2020 to EUR 185 million. This

was mainly driven by a higher investment margin in the Life

business, growth in Mortgages, and the benefit of expense savings

initiatives.

The operating result from the United Kingdom increased by 19%

compared with the second quarter of 2020, or 15% on a constant

currency basis to EUR 44 million. Higher fee revenues from the

growth of the platform business and favorable equity markets, along

with lower expenses, more than offset the impacts from the loss of

earnings due to the sale of Stonebridge and the gradual run-off of

the traditional product portfolio. Lower expenses were in part

driven by expense savings initiatives, as well as favorable timing

with respect to incurring costs.

The operating result from International increased by EUR 1

million to EUR 34 million in the second quarter of 2021, as better

results at TLB and in Spain & Portugal were only partly offset

by the reclassification of the result of Central & Eastern

Europe from operating result to Other income following the

announced divestment of the business. Adjusting for this impact and

on a constant currency basis, the operating result increased by 60%

driven by improved claims experience, as well as business growth in

Spain & Portugal.

The operating result from Aegon Asset Management more than

doubled compared with the second quarter of 2020 to EUR 71 million.

The increase was mostly driven by higher management fees and

performance fees in Aegon's Chinese asset management joint venture,

Aegon Industrial Fund Management Company (AIFMC). The operating

result from Global Platforms also increased, mainly because of

higher revenues resulting from net deposits and favorable market

movements.

The operating result from the Holding improved by EUR 2 million

to a loss of EUR 54 million, mainly driven by funding expenses.

Non-operating items

The result from non-operating items amounted to EUR 644 million

in the second quarter of 2021, mainly resulting from fair value

items and realized gains on investments.

Fair value items

The gains from fair value items amounted to EUR 468 million in

the second quarter of 2021. A positive result on fair value

investments was largely driven by private equity and real estate

revaluations in the Americas and the Netherlands. In addition, the

macro hedge programs in the Americas delivered a gain because of

the interest rate hedge paying off as interest rates declined.

Realized gains on investments

Realized gains on investments amounted to EUR 162 million,

mainly due to gains on debt securities which were sold to fund

investments in long-duration assets as part of the interest rate

risk management plan.

Net recoveries

Net recoveries amounted to EUR 15 million, as recoveries on

investments – including the unsecured loan portfolio in the

Netherlands, and corporate credits and mortgage-backed securities

in the Americas – more than offset gross impairments.

Other charges

Other charges amounted to EUR 153 million and were mainly the

result of assumption updates for Variable Annuities surrender rates

to reflect portfolio and industry experience. One-time investments

related to the operational improvement plan, along with charges

related to settlements of litigation in the Americas, were almost

fully offset by the release of a technical provision in the

Netherlands following a settlement related to a co‑insurance

contract.

Net result

The income tax expense amounted to EUR 205 million, while the

profit before tax was EUR 1,053 million, resulting in a net result

of EUR 849 million. The effective tax rate of 19% is below the

nominal tax rate, which is mainly due to tax-exempt income and tax

credits in the Americas. Moreover, there was a one-time tax benefit

in the United Kingdom due to an increase in the corporate income

tax rate from 19% to 25%, effective from April 2023, that was

enacted in May 2021. This led to an increase in the value of

deferred tax assets.

Expenses

Addressable expenses decreased by 10% compared with the second

quarter of 2020, or 6% on a constant currency basis, to EUR 706

million. This was mainly driven by expense savings initiatives as

part of the operational improvement plan. Furthermore, expenses

benefited from lower travel, marketing, and sales activities due to

the impact of the COVID-19 pandemic. Addressable expenses in both

the second quarter of 2020 and 2021 exclude expenses related to

Central & Eastern Europe following the announced divestment of

the business.

Operating expenses decreased by 3% compared with the second

quarter of 2020 to EUR 961 million. The decline in addressable

expenses, lower IFRS 9 / 17 project costs, and favorable currency

movements were partly offset by higher one-time investments, which

included EUR 94 million related to the operational improvement plan

in the second quarter of 2021.

Sales

Net deposits for the Group amounted to EUR 1.3 billion in the

second quarter of 2021. This was mainly the result of EUR 2.9

billion third-party net deposits in Asset Management, from both the

Global Platforms and AIFMC. Furthermore, the United Kingdom

contributed EUR 1.8 billion net deposits driven by the platform

business, and the Netherlands contributed EUR 0.2 billion as a

result of continued demand for defined contribution products (PPI).

These were partly offset by EUR 3.6 billion net outflows in the

Americas, which were mainly attributable to outflows in the large

market segment of Retirement Plans and Variable Annuities. The

latter reflects Aegon’s decision to stop the sale of Variable

Annuities with significant interest rate sensitive living benefit

riders and increased surrenders in part of the book.

New life sales declined by 2% compared with the second quarter

of 2020 to EUR 172 million. This was mainly driven by exclusion of

new life sales from Central & Eastern Europe following the

announced divestment of the business. Adjusting for this impact and

on a constant currency basis, new life sales were up 16% compared

with the second quarter of 2020. This was mostly driven by higher

sales in the Americas, where Indexed Universal Life sales benefited

from a 13% increase in licensed agents at World Financial Group,

and a higher market share in this distribution channel. This was

partly offset by lower sales in the Netherlands following the

decision to classify the Dutch Life business as a Financial Asset

and, over time close most products for new sales. In International,

higher sales in Spain & Portugal from initiatives to grow the

bancassurance channel more than offset lower sales in China.

New premium production for accident & health insurance

decreased by 37% compared with the second quarter of 2020 to EUR 29

million due to lower sales in the Americas. This was mainly due to

last year’s decision to exit the individual Medicare supplement

segment, and the fact that last year’s second quarter included

sales of three, larger contracts in Workplace Solutions that did

not repeat this year.

New premium production for property & casualty increased by

16% compared with the second quarter of 2020 to EUR 26 million, as

a result of higher sales in Spain & Portugal. This was

partially offset by the exclusion of sales from Central &

Eastern Europe following the announced divestment of the business.

Adjusting for this impact, property & casualty sales almost

tripled.

Market consistent value of new business

Market consistent value of new business (MCVNB) increased from

EUR 8 million in the second quarter of 2020 to EUR 124 million in

the second quarter of 2021. This was mainly driven by an increase

in MCVNB in the Americas resulting from higher volumes and margins

in Indexed Universal Life, and a lower production of Variable

Annuities following the decision to stop selling Variable Annuities

with significant interest rate sensitive riders. In addition, MCVNB

in the United Kingdom benefited from higher premium increments by

existing customers, which led to higher volumes and margins.

Shareholders’ equity

Shareholders’ equity excluding revaluation reserves increased by

EUR 0.8 billion during the second quarter of 2021, to EUR 17.5

billion – or EUR 8.38 per common share – on June 30, 2021, driven

by retained earnings.

Gross financial leverage

Gross financial leverage remained stable at EUR 6.1 billion in

the second quarter of 2021. The gross financial leverage ratio

improved from 26.7% on March 31, 2021, to 25.8% on June 30, 2021,

as a result of the increase in shareholders’ equity excluding

revaluation reserves.

Today, Aegon announced that it is exercising its right to redeem

the USD 250 million floating rate perpetual capital securities with

a minimum coupon of 4% issued in 2005. The redemption is in line

with Aegon’s target to reduce leverage. The redemption of these

grandfathered Tier 1 securities will be effective September 15,

2021, when the principal amount will be repaid together with any

accrued and unpaid interest. After the redemption, Aegon will have

reduced its gross financial leverage by approximately EUR 700

million since the third quarter of 2020 to EUR 5.9 billion. Aegon

targets to reduce its gross financial leverage to between EUR 5.0

to 5.5 billion by 2023.

Cash Capital at Holding and free cash flow

Aegon’s Cash Capital at the Holding increased from EUR 1,191

million to EUR 1,386 million during the second quarter of 2021,

which is in the upper half of the operating range of EUR 0.5

billion to EUR 1.5 billion. Free cash flow to the Holding of EUR

175 million resulted from EUR 275 million gross remittances from

the units and EUR 100 million holding funding and operating

expenses. In addition, EUR 40 million proceeds were received by the

Holding in the second quarter from the divestment of Transamerica’s

portfolio of fintech and insurtech companies. These cash inflows

were partly offset by EUR 17 million capital injections, mainly due

to adverse claims experience in India, and EUR 4 million of other

items.

In the third quarter of 2021, Aegon expects to inject

approximately EUR 40 million in its joint venture in Brazil in

light of adverse mortality experience attributable to COVID-19, and

to strengthen the balance sheet to support its growth.

Capital ratios

Aegon’s Group Solvency II ratio increased from 194% to 208%

during the second quarter of 2021, with the capital ratios of its

three main units above their respective operating levels at the end

of the quarter. Capital generation after holding expenses amounted

to EUR 1,470 million for the second quarter of 2021. The benefit

from market movements totaled EUR 488 million and was mainly driven

by favorable equity market movements in the United States, and

private equity and real estate revaluations in the United States

and the Netherlands. One-time items amounted to EUR 606 million,

mainly from management actions and model changes in the

Netherlands, and a forthcoming increase in the corporate income tax

rate in the United Kingdom, which led to a reduction in required

capital. Operating capital generation amounted to EUR 376 million,

and reflects net favorable claims experience from morbidity and

mortality in the United States, and strong new business margins in

the United Kingdom.

The estimated RBC ratio in the United States increased from 428%

on March 31, 2021, to 444% on June 30, 2021, and remained above the

operating level of 400%. The RBC ratio was positively impacted by

higher equity markets, and by private equity and real estate

revaluations. Furthermore, management actions had a favorable

impact, and included the sale of an alternative asset portfolio.

This more than offset settlements of litigation related to monthly

deduction rate adjustments on certain universal life policies.

Assumption updates contributed positively, mostly because of an

expense assumption update to reflect expected benefits from expense

savings initiatives. This more than offset the impact from changing

the surrender assumptions to reflect portfolio and industry

experience. Strong operating capital generation, reflecting

favorable experience from morbidity and expenses, contributed

favorably and broadly offset dividend payments to the intermediate

holding company.

The estimated Solvency II ratio of NL Life increased from 149%

on March 31, 2021, to 172% on June 30, 2021, which is above the

operating level of 150%. The increase includes benefits from

management actions, model updates and favorable market movements.

The main management action was a settlement related to a

co-insurance contract. Model updates relate to refinements and were

mostly driven by more granular asset and expense modeling.

Furthermore, market movements had a favorable impact, mainly driven

by positive real estate revaluations following a strong Dutch

housing market and flattening of the interest rate curve at the

longer end. The latter impact reflects the fact that Aegon hedges

on an economic basis. Operating capital generation had a positive

impact, which more than offset the EUR 25 million dividend payment

to Group in the second quarter.

The estimated Solvency II ratio for Scottish Equitable Plc

increased from 158% on March 31, 2021 to 163% on June 30, 2021, and

remained above the operating level of 150%. The increase was

primarily driven by a forthcoming increase in the corporate income

tax rate, which led to a reduction in required capital. In

addition, operating capital generation had a positive impact.

2021 interim dividend

Aegon aims to pay out a sustainable dividend to allow equity

investors to participate in the company’s performance, which can

grow over time if Aegon’s performance so allows. Aegon targets a

dividend per common share of around EUR 0.25 over 2023. At its

Capital Markets Day, Aegon guided for muted near-term dividend

growth. Since then, Aegon has made steady progress on its strategic

priorities and financial targets. As a result, Aegon announces

today an interim dividend for 2021 of EUR 0.08 per common share,

which represents an increase of EUR 0.02 compared with the interim

dividend for 2020.

The interim dividend will be paid in cash or in stock at the

election of the shareholder. The value of the dividend to be paid

in shares will be approximately equal to the dividend to be paid in

cash. Aegon intends to neutralize the dilutive effect of the 2021

interim dividend to be paid in shares in the fourth quarter of this

year.

Aegon’s shares will be quoted ex-dividend on August 20, 2021.

The record date is August 23, 2021. The election

period for shareholders will run from August 25 up to and

including September 10, 2021. The stock fraction will be

based on the average share price on Euronext Amsterdam, using

the high and low of each of the five trading days

from September 6 through September 10, 2021. The stock dividend

ratio will be announced on Aegon’s website on September 10, 2021

after business hours. The dividend will be payable as of September

17, 2021.

Full version press release

Use this link for the full version of the press release

Additional information

Presentation

The conference call presentation is available on aegon.com as of

7.30 a.m. CET.

Supplements

Aegon’s 2Q 2021 Financial Supplement and other supplementary

documents are available on aegon.com.

Conference call including Q&A

The conference call starts at 9:00 a.m. CET, with an audio

webcast on aegon.com. Two hours after the conference call, a replay

will be available on aegon.com.

Click to join conference call

With ‘click to join’, there is no need to dial-in for the

conference call. Simply click the link below, enter your

information and you will be called back to directly join the

conference. The link becomes active 15 minutes prior to the

scheduled start time. Click here to connect. Should you wish not to

use the ‘click to join’ function, dial-in numbers are also

available.

Dial-in numbers for conference call United States: +1 720 543

0206 United Kingdom: +44 (0)330 336 9125 The Netherlands: +31 (0)

20 703 8211 Passcode: 7326631

Financial calendar 2021

Ex-dividend date interim dividend 2021 – August 20 Publication

stock fraction interim dividend 2021 – September 10 Payment date

interim dividend 2021 – September 17 Third quarter 2021 results –

November 11

All references to the payment of (interim) dividends are subject

to any relevant board or shareholders’ resolution to distribute

such (interim) dividend and barring unforeseen circumstances.

About Aegon

Aegon’s roots go back more than 175 years – to the first half of

the nineteenth century. Since then, Aegon has grown into an

international company, with businesses in the Americas, Europe and

Asia. Today, Aegon is one of the world’s leading financial services

organizations, providing life insurance, pensions and asset

management. Aegon’s purpose is to help people achieve a lifetime of

financial security. More information on aegon.com.

Notes (1 of 2)

- For segment reporting purposes operating result, operating

result after tax, operating expenses, addressable expenses, income

tax (including joint ventures (jv's) and associated companies),

result before tax (including jv's and associated companies) and

market consistent value of new business are calculated by

consolidating on a proportionate basis the revenues and expenses of

Aegon’s joint ventures and Aegon’s associates. Aegon believes that

these non-IFRS measures provide meaningful information about the

underlying results of Aegon's business, including insight into the

financial measures that Aegon's senior management uses in managing

the business. Among other things, Aegon's senior management is

compensated based in part on Aegon's results against targets using

the non-IFRS measures presented here. While other insurers in

Aegon's peer group present substantially similar non-IFRS measures,

the non-IFRS measures presented in this document may nevertheless

differ from the non-IFRS measures presented by other insurers.

There is no standardized meaning to these measures under IFRS or

any other recognized set of accounting standards. Readers are

cautioned to consider carefully the different ways in which Aegon

and its peers present similar information before comparing them.

Aegon believes the non-IFRS measures shown herein, when read

together with Aegon's reported IFRS financial statements, provide

meaningful supplemental information for the investing public to

evaluate Aegon’s business after eliminating the impact of current

IFRS accounting policies for financial instruments and insurance

contracts, which embed a number of accounting policy alternatives

that companies may select in presenting their results (i.e.

companies can use different local GAAPs to measure the insurance

contract liability) and that can make the comparability from period

to period difficult. Aegon segment reporting is based on the

businesses as presented in internal reports that are regularly

reviewed by the Executive Board which is regarded as the chief

operating decision maker.

Segment information

unaudited

Second quarter 2021

Second quarter 2020

EUR millions

Segment total

Joint ventures and associates

eliminations

Consolidated

Segment total

Joint ventures and associates

eliminations

Consolidated

Operating result after tax

454

30

485

284

11

295

Tax on operating result

(108)

20

(88)

(62)

9

(53)

Operating result

562

10

572

347

2

348

Fair value items

468

(38)

430

(698)

(10)

(708)

Realized gains / (losses) on

investments

162

(2)

160

1

(1)

1

Net impairments

15

-

15

(135)

-

(135)

Non-operating items

644

(40)

605

(832)

(11)

(843)

Other income / (charges)

(153)

10

(143)

(909)

-

(909)

Result before tax

1,053

(20)

1,034

(1,394)

(9)

(1,403)

Income tax from certain proportionately

consolidated joint ventures and associates included in income

before tax

20

(20)

-

9

(9)

-

Income tax (expense) / benefit

(205)

20

(185)

326

9

335

Of which income tax from certain

proportionately consolidated joint ventures and associates included

in income before tax

(20)

20

-

(9)

9

-

Net result

849

-

849

(1,068)

-

(1,068)

Segment information

unaudited

First quarter 2021

EUR millions

Segment total

Joint ventures and associates

eliminations

Consolidated

Operating result after tax

357

(19)

338

Tax on operating result

(74)

24

(50)

Operating result

431

(43)

388

Fair value items

3

19

22

Realized gains / (losses) on

investments

31

(3)

28

Net impairments

16

-

16

Non-operating items

50

16

66

Other income / (charges)

1

3

4

Result before tax

482

(24)

458

Income tax from certain proportionately

consolidated joint ventures and associates included in income

before tax

24

(24)

-

Income tax (expense) / benefit

(96)

24

(72)

Of which income tax from certain

proportionately consolidated joint ventures and associates included

in income before tax

(24)

24

-

Net result

386

-

386

Segment information

unaudited

Second quarter 2021 YTD

Second quarter 2020 YTD

EUR millions

Segment total

Joint ventures and associates

eliminations

Consolidated

Segment total

Joint ventures and associates

eliminations

Consolidated

Operating result after tax

812

11

823

594

33

628

Tax on operating result

(182)

44

(138)

(110)

24

(87)

Operating result

993

(33)

960

705

10

714

Fair value items

471

(18)

452

679

(30)

649

Realized gains / (losses) on

investments

193

(5)

188

16

(5)

11

Net impairments

31

-

31

(193)

-

(193)

Non-operating items

694

(23)

671

501

(35)

467

Other income / (charges)

(152)

12

(140)

(1,071)

1

(1,070)

Result before tax

1,536

(44)

1,492

135

(24)

111

Income tax from certain proportionately

consolidated joint ventures and associates included in income

before tax

44

(44)

-

24

(24)

-

Income tax (expense) / benefit

(301)

44

(257)

68

24

92

Of which income tax from certain

proportionately consolidated joint ventures and associates included

in income before tax

(44)

44

-

(24)

24

-

Net result

1,235

-

1,235

202

-

202

Notes (2 of 2)

2)

New life sales is defined as new recurring

premiums plus 1/10 of single premiums.

3)

The present value, at point of sale, of

all cashflows for new business written during the reporting period,

calculated using approximate point of sale economics assumptions.

Market consistent value of new business is calculated using a risk

neutral approach, ignoring the investment returns expected to be

earned in the future in excess of risk-free rates (swap curves),

with the exception of an allowance for liquidity premium. The Swap

curve is extrapolated beyond the last liquid point to an ultimate

forward rate. The market consistent value of new business is

calculated on a post-tax basis, after allowing for the time value

financial options and guarantees, a market value margin for

non-hedgeable non-financial risks and the costs of non-hedgeable

stranded capital.

4)

Return on equity is a ratio calculated by

dividing the operating result after cost of leverage by the average

shareholders' equity excluding the revaluation reserve.

5)

Included in Other income/(charges) are

income/(charges) made to policyholders with respect to income tax

in the United Kingdom.

6)

Includes production on investment

contracts without a discretionary participation feature of which

the proceeds are not recognized as revenues but are directly added

to Aegon's investment contract liabilities for UK.

7)

APE = recurring premium + 1/10 single

premium.

8)

Reconciliation of operating expenses, used

for segment reporting, to Aegon's IFRS based operating

expenses.

unaudited

Q2

Q2

YTD Q2

YTD Q2

2021

2020

2021

2020

Employee expenses

477

517

967

1,038

Administrative expenses

411

418

786

822

Operating expenses for IFRS

reporting

887

935

1,753

1,860

Operating expenses related to jv's and

associates

74

60

162

126

Operating expenses in earnings

release

961

994

1,916

1,985

9)

New life sales, gross deposits and net

deposits data include results from Aegon’s joint ventures and

Aegon’s associates consolidated on a

proportionate basis.

10)

The calculation of the Solvency II capital

surplus and ratio are based on Solvency II requirements. For

insurance entities in Solvency II equivalent regimes (United

States, Bermuda and Brazil) local regulatory solvency measurements

are used. Specifically, required capital for the regulated entities

in the US is calculated as one and a half times (150%) the upper

end of the Company Action Level range (200% of Authorized Control

Level) as applied by the National Association of Insurance

Commissioners in the US, while the own funds is calculated by

applying a haircut to available capital under the local regulatory

solvency measurement of one time (100%) the upper end of the

Company Action Level range. For entities in financial sectors other

than the insurance sector, the solvency requirements of the

appropriate regulatory framework are taken into account in the

group ratio. The group ratio does include Aegon Bank N.V. As the UK

With-Profit funds is ring fenced, no surplus is taken into account

regarding the UK With-Profit funds for Aegon UK and Group

numbers.

11)

The Solvency II capital ratio reflects

Aegon’s interpretation of Solvency II requirements and are not

final until filed with the regulators. The Solvency II capital

calculation is subject to supervisory review on an ongoing

basis.

12)

The numbers in this release are

unaudited.

Cautionary note regarding non-IFRS-EU measures

This document includes the following non-IFRS-EU financial

measures: operating result, income tax, result before tax, market

consistent value of new business, return on equity and addressable

expenses. These non-IFRS-EU measures, except for addressable

expenses, are calculated by consolidating on a proportionate basis

Aegon’s joint ventures and associated companies. The reconciliation

of these measures, except for market consistent value of new

business and return on equity, to the most comparable IFRS-EU

measure is provided in the notes to this press release. Market

consistent value of new business is not based on IFRS-EU, which are

used to report Aegon’s primary financial statements and should not

be viewed as a substitute for IFRS-EU financial measures. Aegon may

define and calculate market consistent value of new business

differently than other companies. Return on equity is a ratio using

a non-IFRS-EU measure and is calculated by dividing the operating

result after tax less cost of leverage by the average shareholders’

equity excluding the revaluation reserve. Operating expenses are

all expenses associated with selling and administrative activities

(excluding commissions) after reallocation of claim handling

expenses to benefits paid. This includes certain expenses recorded

in Other charges, including restructuring charges. Addressable

expenses are expenses reflected in the operating result, excluding

deferrable acquisition expenses, expenses in joint ventures and

associates and expenses related to operations in CEE countries.

Aegon believes that these non-IFRS-EU measures, together with the

IFRS-EU information, provide meaningful supplemental information

about the operating results of Aegon’s business including insight

into the financial measures that senior management uses in managing

the business.

Local currencies and constant currency exchange rates

This document contains certain information about Aegon’s

results, financial condition and revenue generating investments

presented in USD for the Americas and in GBP for the United

Kingdom, because those businesses operate and are managed primarily

in those currencies. Certain comparative information presented on a

constant currency basis eliminates the effects of changes in

currency exchange rates. None of this information is a substitute

for or superior to financial information about Aegon presented in

EUR, which is the currency of Aegon’s primary financial

statements.

Forward-looking statements

The statements contained in this document that are not

historical facts are forward-looking statements as defined in the

US Private Securities Litigation Reform Act of 1995. The following

are words that identify such forward-looking statements: aim,

believe, estimate, target, intend, may, expect, anticipate,

predict, project, counting on, plan, continue, want, forecast,

goal, should, would, could, is confident, will, and similar

expressions as they relate to Aegon. These statements are not

guarantees of future performance and involve risks, uncertainties

and assumptions that are difficult to predict. Aegon undertakes no

obligation to publicly update or revise any forward-looking

statements. Readers are cautioned not to place undue reliance on

these forward-looking statements, which merely reflect company

expectations at the time of writing. Actual results may differ

materially from expectations conveyed in forward-looking statements

due to changes caused by various risks and uncertainties. Such

risks and uncertainties include but are not limited to the

following:

- Changes in general economic and/or governmental conditions,

particularly in the United States, the Netherlands and the United

Kingdom;

- Changes in the performance of financial markets, including

emerging markets, such as with regard to:

- The frequency and severity of defaults by issuers in Aegon’s

fixed income investment portfolios;

- The effects of corporate bankruptcies and/or accounting

restatements on the financial markets and the resulting decline in

the value of equity and debt securities Aegon holds; and

- The effects of declining creditworthiness of certain public

sector securities and the resulting decline in the value of

government exposure that Aegon holds;

- Changes in the performance of Aegon’s investment portfolio and

decline in ratings of Aegon’s counterparties;

- Lowering of one or more of Aegon’s debt ratings issued by

recognized rating organizations and the adverse impact such action

may have on Aegon’s ability to raise capital and on its liquidity

and financial condition;

- Lowering of one or more of insurer financial strength ratings

of Aegon’s insurance subsidiaries and the adverse impact such

action may have on the written premium, policy retention,

profitability and liquidity of its insurance subsidiaries;

- The effect of the European Union’s Solvency II requirements and

other regulations in other jurisdictions affecting the capital

Aegon is required to maintain;

- Changes affecting interest rate levels and continuing low or

rapidly changing interest rate levels;

- Changes affecting currency exchange rates, in particular the

EUR/USD and EUR/GBP exchange rates;

- Changes in the availability of, and costs associated with,

liquidity sources such as bank and capital markets funding, as well

as conditions in the credit markets in general such as changes in

borrower and counterparty creditworthiness;

- Increasing levels of competition in the United States, the

Netherlands, the United Kingdom and emerging markets;

- Catastrophic events, either manmade or by nature, including by

way of example acts of God, acts of terrorism, acts of war and

pandemics, could result in material losses and significantly

interrupt Aegon’s business;

- The frequency and severity of insured loss events;

- Changes affecting longevity, mortality, morbidity, persistence

and other factors that may impact the profitability of Aegon’s

insurance products;

- Aegon’s projected results are highly sensitive to complex

mathematical models of financial markets, mortality, longevity, and

other dynamic systems subject to shocks and unpredictable

volatility. Should assumptions to these models later prove

incorrect, or should errors in those models escape the controls in

place to detect them, future performance will vary from projected

results;

- Reinsurers to whom Aegon has ceded significant underwriting

risks may fail to meet their obligations;

- Changes in customer behavior and public opinion in general

related to, among other things, the type of products Aegon sells,

including legal, regulatory or commercial necessity to meet

changing customer expectations;

- Customer responsiveness to both new products and distribution

channels;

- As Aegon’s operations support complex transactions and are

highly dependent on the proper functioning of information

technology, operational risks such as system disruptions or

failures, security or data privacy breaches, cyberattacks, human

error, failure to safeguard personally identifiable information,

changes in operational practices or inadequate controls including

with respect to third parties with which we do business may disrupt

Aegon’s business, damage its reputation and adversely affect its

results of operations, financial condition and cash flows;

- The impact of acquisitions and divestitures, restructurings,

product withdrawals and other unusual items, including Aegon’s

ability to integrate acquisitions and to obtain the anticipated

results and synergies from acquisitions;

- Aegon’s failure to achieve anticipated levels of earnings or

operational efficiencies, as well as other management initiatives

related to cost savings, cash capital at Holding, gross financial

leverage and free cash flow;

- Changes in the policies of central banks and/or

governments;

- Litigation or regulatory action that could require Aegon to pay

significant damages or change the way Aegon does business;

- Competitive, legal, regulatory, or tax changes that affect

profitability, the distribution cost of or demand for Aegon’s

products;

- Consequences of an actual or potential break-up of the European

monetary union in whole or in part, or the exit of the United

Kingdom from the European Union and potential consequences if other

European Union countries leave the European Union;

- Changes in laws and regulations, particularly those affecting

Aegon’s operations’ ability to hire and retain key personnel,

taxation of Aegon companies, the products Aegon sells, and the

attractiveness of certain products to its consumers;

- Regulatory changes relating to the pensions, investment, and

insurance industries in the jurisdictions in which Aegon

operates;

- Standard setting initiatives of supranational standard setting