TEKLA LIFE SCIENCES INVESTORS

Schedule of Investments

June 30, 2023 (Unaudited)

| Convertible Preferreds (Restricted) (a)(b) - 7.4% | |

Shares | | |

Value | |

| Biotechnology – 4.4% | |

| | | |

| | |

| Arbor Biotechnologies, Series B, 8.00% | |

| 38,624 | | |

$ | 640,000 | |

| Arkuda Therapeutics, Inc. Series A, 6.00% | |

| 1,008,829 | | |

| 1,783,811 | |

| Arkuda Therapeutics, Inc. Series B, 6.00% | |

| 447,566 | | |

| 791,386 | |

| Flamingo Therapeutics, Inc. Series A3 (c) | |

| 107,120 | | |

| 714,194 | |

| Hotspot Therapeutics, Inc. Series B, 6.00% | |

| 1,291,668 | | |

| 4,186,167 | |

| Hotspot Therapeutics, Inc. Series C, 6.00% | |

| 284,119 | | |

| 920,801 | |

| ImmuneID, Inc. Series A, 8.00% | |

| 480,000 | | |

| 309,024 | |

| Invetx, Inc. Series A, 8.00% | |

| 3,229,167 | | |

| 2,163,865 | |

| Invetx, Inc. Series B, 8.00% | |

| 1,387,853 | | |

| 930,000 | |

| Parthenon Therapeutics, Inc. Series A | |

| 832,650 | | |

| 1,599,995 | |

| Priothera Ltd. Series A, 6.00% (c) | |

| 152,534 | | |

| 1,664,452 | |

| Quell Therapeutics, Series B (c) | |

| 731,121 | | |

| 1,520,001 | |

| ReCode Therapeutics, Series B, 5.00% | |

| 138,630 | | |

| 1,279,998 | |

| | |

| | | |

| 18,503,694 | |

| Health Care Equipment & Supplies – 0.3% | |

| | | |

| | |

| IO Light Holdings, Inc. Series A2 | |

| 421,634 | | |

| 1,200,814 | |

| | |

| | | |

| | |

| Pharmaceuticals – 2.7% | |

| | | |

| | |

| Amolyt Pharma SAS Series C (c) | |

| 480,841 | | |

| 1,122,845 | |

| Aristea Therapeutics, Inc. Series B, 8.00% | |

| 290,187 | | |

| 1,600,004 | |

| Biotheryx, Inc. Series E, 8.00% | |

| 609,524 | | |

| 1,600,000 | |

| Curasen Therapeutics, Inc. Series A | |

| 7,801,332 | | |

| 3,740,739 | |

| Endeavor Biomedicines, Inc. Series B, 8.00% | |

| 296,855 | | |

| 1,399,998 | |

| HiberCell, Inc. Series B | |

| 1,305,163 | | |

| 1,599,999 | |

| | |

| | | |

| 11,063,585 | |

| Total Convertible Preferreds (Cost $33,917,539) | |

| | | |

| 30,768,093 | |

| Common Stocks - 83.5% | |

Shares | | |

Value | |

| Biotechnology – 67.3% | |

| | | |

| | |

| 89bio, Inc. (b) | |

| 105,898 | | |

| 2,006,767 | |

| Adicet Bio, Inc. (b) | |

| 40,329 | | |

| 97,999 | |

| Affimed N.V. (b)(c) | |

| 208,624 | | |

| 124,799 | |

| Akero Therapeutics, Inc. (b) | |

| 21,447 | | |

| 1,001,360 | |

| Alkermes plc (b) | |

| 135,706 | | |

| 4,247,598 | |

| Alnylam Pharmaceuticals, Inc. (b) | |

| 50,776 | | |

| 9,644,393 | |

| Altimmune, Inc. (b) | |

| 75,000 | | |

| 264,750 | |

| ALX Oncology Holdings, Inc. (b) | |

| 66,211 | | |

| 497,245 | |

| Amgen, Inc. | |

| 125,819 | | |

| 27,934,334 | |

| Apellis Pharmaceuticals, Inc. (b) | |

| 52,609 | | |

| 4,792,680 | |

| ARCA biopharma, Inc. (b) | |

| 32,461 | | |

| 65,896 | |

| Arcus Biosciences, Inc. (b) | |

| 32,839 | | |

| 666,960 | |

| Arcutis Biotherapeutics, Inc. (b)(d) | |

| 62,005 | | |

| 590,908 | |

| Ardelyx, Inc. (b) | |

| 257,406 | | |

| 872,606 | |

| argenx SE ADR (b) | |

| 17,273 | | |

| 6,731,806 | |

| Ascendis Pharma A/S ADR (b) | |

| 45,830 | | |

| 4,090,328 | |

| Beam Therapeutics, Inc. (b) | |

| 15,817 | | |

| 505,037 | |

The accompanying

notes are an integral part of this Schedule of Investments.

| | |

SHARES | | |

VALUE | |

| Biotechnology – continued | |

| | | |

| | |

| BeiGene Ltd. ADR (b) | |

| 16,838 | | |

$ | 3,002,215 | |

| Bellicum Pharmaceuticals, Inc. (b) | |

| 6,000 | | |

| 2,220 | |

| Bicycle Therapeutics plc ADR (b) | |

| 44,338 | | |

| 1,131,506 | |

| BioCryst Pharmaceuticals, Inc. (b) | |

| 202,491 | | |

| 1,425,537 | |

| Biogen, Inc. (b) | |

| 66,498 | | |

| 18,941,955 | |

| BioMarin Pharmaceutical, Inc. (b) | |

| 73,705 | | |

| 6,388,749 | |

| BioNTech SE ADR | |

| 37,462 | | |

| 4,043,274 | |

| Black Diamond Therapeutics, Inc. (b)(d) | |

| 41,586 | | |

| 210,009 | |

| Bridgebio Pharma, Inc. (b) | |

| 26,580 | | |

| 457,176 | |

| Caribou Biosciences, Inc. (b) | |

| 181,487 | | |

| 771,320 | |

| Cerevel Therapeutics Holdings, Inc. (b) | |

| 74,161 | | |

| 2,357,578 | |

| Chinook Therapeutics, Inc. (b) | |

| 59,063 | | |

| 2,269,200 | |

| Corbus Pharmaceuticals Holdings, Inc. (b) | |

| 5,143 | | |

| 40,321 | |

| Crinetics Pharmaceuticals, Inc. (b) | |

| 78,529 | | |

| 1,415,093 | |

| CRISPR Therapeutics AG (b)(c) | |

| 22,571 | | |

| 1,267,136 | |

| Cytokinetics, Inc. (b) | |

| 86,944 | | |

| 2,836,113 | |

| Denali Therapeutics, Inc. (b) | |

| 110,331 | | |

| 3,255,868 | |

| Exelixis, Inc. (b) | |

| 192,199 | | |

| 3,672,923 | |

| Fusion Pharmaceuticals, Inc. (b)(c) | |

| 6,511 | | |

| 30,471 | |

| Fusion Pharmaceuticals, Inc. (Restricted) (a)(b)(c) | |

| 3,256 | | |

| 13,714 | |

| G1 Therapeutics, Inc. (b) | |

| 223,377 | | |

| 556,209 | |

| Galera Therapeutics, Inc. (b) | |

| 125,773 | | |

| 392,412 | |

| Gilead Sciences, Inc. | |

| 441,671 | | |

| 34,039,584 | |

| Harpoon Therapeutics, Inc. (b) | |

| 259,910 | | |

| 184,536 | |

| HilleVax, Inc. (b) | |

| 27,000 | | |

| 464,130 | |

| I-Mab ADR (b) | |

| 26,109 | | |

| 78,066 | |

| Immunovant, Inc. (b) | |

| 150,400 | | |

| 2,853,088 | |

| Intellia Therapeutics, Inc. (b) | |

| 50,605 | | |

| 2,063,672 | |

| Intercept Pharmaceuticals, Inc. (b) | |

| 18,630 | | |

| 206,048 | |

| Ionis Pharmaceuticals, Inc. (b) | |

| 31,341 | | |

| 1,285,921 | |

| iTeos Therapeutics, Inc. (b) | |

| 45,735 | | |

| 605,531 | |

| Karuna Therapeutics, Inc. (b) | |

| 19,434 | | |

| 4,214,263 | |

| Madrigal Pharmaceuticals, Inc. (b) | |

| 12,110 | | |

| 2,797,410 | |

| Mereo Biopharma Group plc ADR (b)(c) | |

| 487,283 | | |

| 643,214 | |

| Moderna, Inc. (b) | |

| 107,787 | | |

| 13,096,120 | |

| Natera, Inc. (b) | |

| 24,636 | | |

| 1,198,788 | |

| Neurocrine Biosciences, Inc. (b) | |

| 38,692 | | |

| 3,648,656 | |

| NexGel, Inc. (b) | |

| 1,273 | | |

| 3,195 | |

| Nkarta, Inc. (b) | |

| 28,988 | | |

| 63,484 | |

| Novavax, Inc. (b)(d) | |

| 26,612 | | |

| 197,727 | |

| Praxis Precision Medicines, Inc. (b) | |

| 23,594 | | |

| 27,133 | |

| Precision BioSciences, Inc. (b) | |

| 69,727 | | |

| 36,676 | |

| Pyxis Oncology, Inc. (b)(d) | |

| 226,657 | | |

| 580,242 | |

| Rallybio Corp. (b) | |

| 377,375 | | |

| 2,135,943 | |

| Regeneron Pharmaceuticals, Inc. (b) | |

| 44,256 | | |

| 31,799,706 | |

| Repare Therapeutics, Inc. (b)(c) | |

| 29,150 | | |

| 308,407 | |

| Sarepta Therapeutics, Inc. (b) | |

| 58,187 | | |

| 6,663,575 | |

| Scholar Rock Holding Corp. (b) | |

| 40,716 | | |

| 306,999 | |

The accompanying

notes are an integral part of this Schedule of Investments.

| | |

SHARES | | |

VALUE | |

| Biotechnology – continued | |

| | | |

| | |

| Seagen, Inc. (b) | |

| 39,220 | | |

$ | 7,548,281 | |

| Sutro Biopharma, Inc. (b) | |

| 28,965 | | |

| 134,687 | |

| TScan Therapeutics, Inc. (b) | |

| 61,943 | | |

| 154,858 | |

| uniQure N.V. (b)(c) | |

| 112,194 | | |

| 1,285,743 | |

| United Therapeutics Corp. (b) | |

| 14,745 | | |

| 3,254,959 | |

| Vaxcyte, Inc. (b)(c) | |

| 61,919 | | |

| 3,092,235 | |

| Vertex Pharmaceuticals, Inc. (b) | |

| 95,726 | | |

| 33,686,937 | |

| Xencor, Inc. (b) | |

| 16,800 | | |

| 419,496 | |

| Xenon Pharmaceuticals, Inc. (b)(c) | |

| 67,506 | | |

| 2,598,981 | |

| Zentalis Pharmaceuticals, Inc. (b) | |

| 40,156 | | |

| 1,132,801 | |

| | |

| | | |

| 281,427,557 | |

| Health Care Equipment & Supplies – 1.1%(b) | |

| | | |

| | |

| Cercacor Laboratories, Inc. (Restricted) (a) | |

| 130,000 | | |

| 186,947 | |

| Guardant Health, Inc. | |

| 44,542 | | |

| 1,594,604 | |

| IDEXX Laboratories, Inc. | |

| 2,989 | | |

| 1,501,165 | |

| Tactile Systems Technology, Inc. | |

| 58,472 | | |

| 1,457,707 | |

| | |

| | | |

| 4,740,423 | |

| Health Care Providers & Services – 1.2% | |

| | | |

| | |

| Charles River Laboratories International, Inc. (b) | |

| 14,134 | | |

| 2,971,674 | |

| InnovaCare, Inc. Escrow Shares (Restricted) (a) | |

| 148,148 | | |

| 18,711 | |

| Medpace Holdings, Inc. (b) | |

| 8,195 | | |

| 1,968,193 | |

| | |

| | | |

| 4,958,578 | |

| Life Sciences Tools & Services – 4.4% (b) | |

| | | |

| | |

| Adaptive Biotechnologies Corp. | |

| 206,072 | | |

| 1,382,743 | |

| Codexis, Inc. | |

| 69,125 | | |

| 193,550 | |

| Illumina, Inc. | |

| 88,297 | | |

| 16,554,805 | |

| | |

| | | |

| 18,131,098 | |

| Pharmaceuticals – 9.5% | |

| | | |

| | |

| Amylyx Pharmaceuticals, Inc. (b) | |

| 31,467 | | |

| 678,743 | |

| AstraZeneca plc ADR (c) | |

| 238,720 | | |

| 17,085,190 | |

| Edgewise Therapeutics, Inc. (b) | |

| 150,418 | | |

| 1,165,740 | |

| Eli Lilly & Co. | |

| 9,361 | | |

| 4,390,122 | |

| Endo International plc (b) | |

| 29,100 | | |

| 509 | |

| Fulcrum Therapeutics, Inc. (b) | |

| 256,888 | | |

| 847,730 | |

| Horizon Therapeutics plc (b) | |

| 21,912 | | |

| 2,253,649 | |

| Intra-Cellular Therapies, Inc. (b) | |

| 52,352 | | |

| 3,314,929 | |

| IQVIA Holdings, Inc. (b) | |

| 1,647 | | |

| 370,196 | |

| Jazz Pharmaceuticals plc (b) | |

| 27,751 | | |

| 3,440,291 | |

| Marinus Pharmaceuticals, Inc. (b) | |

| 125,041 | | |

| 1,357,945 | |

| Mirati Therapeutics, Inc. (b) | |

| 22,852 | | |

| 825,643 | |

| Oculis Holding AG (Restricted) (a)(c) | |

| 236,704 | | |

| 2,635,226 | |

| Reata Pharmaceuticals, Inc. Class A (b) | |

| 11,300 | | |

| 1,152,148 | |

| Spectrum Pharmaceuticals, Inc. (b) | |

| 34,880 | | |

| 33,485 | |

| Tetraphase Pharmaceuticals, Inc. CVR (a)(b) | |

| 14,218 | | |

| 853 | |

| Theseus Pharmaceuticals, Inc. (b)(d) | |

| 23,250 | | |

| 216,923 | |

The accompanying

notes are an integral part of this Schedule of Investments.

| | |

Shares | | |

Value | |

| Pharmaceuticals – continued | |

| | | |

| | |

| VYNE Therapeutics, Inc. (b)(d) | |

| 2,255 | | |

$ | 9,155 | |

| | |

| | | |

| 39,778,477 | |

| Total Common Stocks (Cost $313,540,382) | |

| | | |

| 349,036,133 | |

| Exchange Traded Fund(b)(d) -

1.8% | |

| | | |

| | |

| SPDR S&P Biotech ETF | |

| 90,677 | | |

| 7,544,326 | |

| Total Exchange Traded Fund (Cost $6,888,393) | |

| | | |

| 7,544,326 | |

| Short-Term Investments – 6.5% | |

PRINCIPAL

AMOUNT | | |

| |

| MUFG Bank Ltd. Commercial Paper, 5.00%, due 07/06/23 | |

$ | 8,000,000 | | |

| 7,994,445 | |

| Repurchase Agreement, Fixed Income Clearing Corp., repurchase value $10,461,325, 1.52%, dated 06/30/23, due 07/03/23 (collateralized by U.S. Treasury Note 1.500%, due 01/31/27, market value $10,669,262) | |

| 10,460,000 | | |

| 10,460,000 | |

| | |

SHARES | | |

| |

| State Street Institutional U.S. Government Money Market Fund, Institutional Class, 5.03% (e) | |

| 8,965,139 | | |

| 8,965,139 | |

| TOTAL SHORT-TERM

INVESTMENTS (Cost $27,419,584) | |

| | | |

| 27,419,584 | |

| TOTAL INVESTMENTS BEFORE MILESTONE INTERESTS - 99.2% (Cost $381,765,898) | |

| | | |

| 414,768,136 | |

| MILESTONE INTERESTS (Restricted)(a)(b) - 2.4% | |

| | |

| |

| | |

INTERESTS | | |

| |

| Biotechnology – 0.0% | |

| | | |

| | |

| Amphivena Milestone Interest | |

| 1 | | |

| 0 | |

| Rainier Therapeutics Milestone Interest | |

| 1 | | |

| 0 | |

| Therachon Milestone Interest | |

| 1 | | |

| 0 | |

| | |

| | | |

| | |

| Pharmaceuticals – 2.4% | |

| | | |

| | |

| Afferent Milestone Interest | |

| 1 | | |

| 113,219 | |

| Ethismos Research Milestone Interest | |

| 1 | | |

| 0 | |

| Impact Biomedicines Milestone Interest | |

| 1 | | |

| 1,209,320 | |

| Neurovance Milestone Interest | |

| 1 | | |

| 8,629,194 | |

| | |

| | | |

| 9,951,733 | |

| Total Milestone

Interests (Cost $4,723,320) | |

| | | |

| 9,951,733 | |

| Total Investments -

101.6% (Cost $386,489,218) | |

| | | |

| 424,719,869 | |

| Other Liabilities In Excess Of Assets - (1.6)% | |

| | | |

| (6,743,945 | ) |

| Net Assets - 100% | |

| | | |

$ | 417,975,924 | |

The percentage shown for each investment category in the Schedule of Investments is based on net assets.

| (a) |

Security fair valued using significant unobservable inputs. See Investment Valuation and Fair Value Measurements. |

| (b) |

Non-income producing security. |

| (c) |

Foreign security. |

| (d) |

All or a portion of this security is on loan as of June 30, 2023. |

| (e) |

This security represents the investment of cash collateral received for securities lending and is a registered investment company advised by State Street Global Advisors. The rate shown is the annualized seven-day yield as of June 30, 2023. |

| ADR |

American Depository Receipt |

| CVR |

Contingent Value Right |

The accompanying

notes are an integral part of this Schedule of Investments.

Investment Valuation

Shares of publicly

traded companies listed on national securities exchanges or trading in the over-the-counter market are typically valued at the last sale

price, as of the close of trading, generally 4 p.m., Eastern Time. The Board of Trustees of the Fund (the Trustees) has established and

approved fair valuation policies and procedures with respect to securities for which quoted prices may not be available or which do not

reflect fair value. Convertible, corporate and government bonds are valued using a third-party pricing service. Convertible bonds are

valued using this pricing service only on days when there is no sale reported. Restricted securities of companies that are publicly traded

are typically valued based on the closing market quote on the valuation date adjusted for the impact of the restriction as determined

in good faith by Tekla Capital Management LLC (the Adviser) also using fair valuation policies and procedures approved by the Trustees

described below. Non-exchange traded warrants of publicly traded companies are generally valued using the Black-Scholes model, which incorporates

both observable and unobservable inputs. Short-term investments with a maturity of 60 days or less are generally valued at amortized cost,

which approximates fair value.

Convertible preferred

shares, warrants or convertible note interests in private companies, milestone interests, and other restricted securities, as well as

shares of publicly traded companies for which market quotations are not readily available, such as stocks for which trading has been halted

or for which there are no current day sales, or which do not reflect fair value, are typically valued in good faith, based upon the recommendations

made by the Adviser pursuant to fair valuation policies and procedures approved by the Trustees.

The Adviser has a Valuation

Sub-Committee comprised of senior management which reports to the Valuation Committee of the Board at least quarterly. Each fair value

determination is based on a consideration of relevant factors, including both observable and unobservable inputs. Observable and unobservable

inputs may include (i) the existence of any contractual restrictions on the disposition of securities; (ii) information obtained

from the company, which may include an analysis of the company’s financial statements, products, intended markets or technologies;

(iii) the price of the same or similar security negotiated at arm’s length in an issuer’s completed subsequent round

of financing; (iv) the price and extent of public trading in similar securities of the issuer or of comparable companies; or (v) a

probability and time value adjusted analysis of contractual terms. Where available and appropriate, multiple valuation methodologies are

applied to confirm fair value. Significant unobservable inputs identified by the Adviser are often used in the fair value determination.

A significant change in any of these inputs may result in a significant change in the fair value measurement. Due to the uncertainty inherent

in the valuation process, such estimates of fair value may differ significantly from the values that would have been used had a ready

market for the investments existed, and differences could be material. Additionally, changes in the market environment and other events

that may occur over the life of the investments may cause the gains or losses ultimately realized on these investments to be different

from the valuations used at the date of this schedule of investments.

Federal Income Tax Cost

At

June 30, 2023, the cost of securities for Federal income tax purposes was $386,489,218. The net unrealized gain on securities

held by the Fund was $38,230,651, including gross unrealized gain of $117,726,507 and gross unrealized loss of $79,495,856.

Securities Lending

The Fund may lend its securities to

approved borrowers to earn additional income. The Fund receives cash collateral from the borrower and the initial collateral received

by the Fund is required to have a value of at least 102% of the current value of the loaned securities traded on U.S. exchanges, and a

value of at least 105% for all other securities. The Fund will invest its cash collateral in State Street Institutional U.S. Government

Money Market Fund (SAHXX), which is registered with the Securities and Exchange Commission (SEC) as an investment company. SAHXX invests

substantially all of its assets in the State Street U.S. Government Money Market Portfolio. The Fund will receive the benefit of any gains

and bear any losses generated by SAHXX with respect to the cash collateral.

The Fund has the right to recall loaned

securities on demand. If a borrower fails to return loaned securities when due, then the lending agent is responsible and indemnifies

the Fund for the lent securities. The lending agent uses the collateral received from the borrower to purchase replacement securities

of the same issue, type, class and series of the loaned securities. If the value of the collateral is less than the purchase cost of replacement

securities, the lending agent is responsible for satisfying the shortfall but only to the extent that the shortfall is not due to any

decrease in the value of SAHXX.

Although

the risk of loss on securities lent is mitigated by receiving collateral from the borrower and through lending agent indemnification,

the Fund could experience a delay in recovering securities or could experience a lower than expected return if the borrower fails to return

the securities on a timely basis. The Fund receives compensation for lending its securities by retaining a portion of the return on the

investment of the collateral and compensation from fees earned from borrowers of the securities. Securities lending income received by

the Fund is net of fees retained by the securities lending agent. Net income received from SAHXX is a component of securities lending

income as recorded by the Fund.

As of June 30, 2023, the Fund loaned securities valued

at $8,872,702 and received $8,965,139 of cash collateral.

Fair Value Measurements

The Fund uses a three-tier hierarchy

to prioritize the assumptions, referred to as inputs, used in valuation techniques to measure fair value. The three-tier hierarchy of

inputs is summarized in the three broad levels. Level 1 includes quoted prices in active markets for identical investments. Level 2 includes

prices determined using other significant observable inputs (including quoted prices for similar investments, interest rates, credit risk, etc.).

The independent pricing vendor may value bank loans and debt securities at an evaluated bid price by employing methodologies that utilize

actual market transactions, broker-supplied valuations, and/or other methodologies designed to identify the market value for such securities

and such securities are considered Level 2 in the fair value hierarchy. Level 3 includes prices determined using significant unobservable

inputs (including the Fund’s own assumptions in determining the fair value of investments). These inputs or methodology used for

valuing securities are not necessarily an indication of the risk associated with investing in those securities.

For the period ended June 30, 2023, there were no transfers

between levels.

The following is a summary of the levels used as of June 30,

2023 to value the Fund's investments.

| Assets at Value | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Convertible Preferreds | |

| | | |

| | | |

| | | |

| | |

| Biotechnology | |

$ | - | | |

$ | - | | |

$ | 18,503,694 | | |

$ | 18,503,694 | |

| Health Care Equipment & Supplies | |

| - | | |

| - | | |

| 1,200,814 | | |

| 1,200,814 | |

| Pharmaceuticals | |

| - | | |

| - | | |

| 11,063,585 | | |

| 11,063,585 | |

| Common Stocks | |

| | | |

| | | |

| | | |

| | |

| Biotechnology | |

| 281,413,843 | | |

| 13,714 | | |

| - | | |

| 281,427,557 | |

| Health Care Equipment & Supplies | |

| 4,553,476 | | |

| - | | |

| 186,947 | | |

| 4,740,423 | |

| Health Care Providers & Services | |

| 4,939,867 | | |

| - | | |

| 18,711 | | |

| 4,958,578 | |

| Life Sciences Tools & Services | |

| 18,131,098 | | |

| - | | |

| - | | |

| 18,131,098 | |

| Pharmaceuticals | |

| 37,142,398 | | |

| 2,636,079 | | |

| - | | |

| 39,778,477 | |

| Exchange Traded Fund | |

| 7,544,326 | | |

| - | | |

| - | | |

| 7,544,326 | |

| Short-term Investments | |

| |

8,965,139 | | |

| 18,454,445 | | |

| - | | |

| 27,419,584 | |

| Milestone Interests | |

| | | |

| | | |

| | | |

| | |

| Biotechnology | |

| - | | |

| - | | |

| 0 | * | |

| 0 | * |

| Pharmaceuticals | |

| - | | |

| - | | |

| 9,951,733 | | |

| 9,951,733 | |

| Other Assets | |

| - | | |

| - | | |

| 189 | | |

| 189 | |

| Total | |

| 362,690,147 | | |

| 21,104,238 | | |

| 40,925,673 | | |

| 424,720,058 | |

* Represents security valued at zero.

The

following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value.

| Investment in securities | |

Balance as of

September

30, 2022 | | |

Net realized

gain (loss) and

change in

unrealized

appreciation

(depreciation) | | |

Cost of

purchases

and

conversions | | |

Proceeds

from

sales and

conversions | | |

Net

transfers

into

(out of)

Level 3 | | |

Balance as

of June 30,

2023 | |

| Convertible Preferred | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Biotechnology | |

$ | 19,442,876 | | |

$ | (649,173 | ) | |

$ | 1,041,096 | | |

$ | (1,331,105 | ) | |

$ | - | | |

$ | 18,503,694 | |

| Health Care Equipment & Supplies | |

| 1,423,015 | | |

| (222,954 | ) | |

| 753 | | |

| - | | |

| - | | |

| 1,200,814 | |

| Pharmaceuticals | |

| 11,406,061 | | |

| (1,604,872 | ) | |

| 1,262,396 | | |

| - | | |

| - | | |

| 11,063,585 | |

| Convertible Notes | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Biotechnology | |

| 0 | * | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Common Stocks | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Health Care Equipment & Supplies | |

| 502,845 | | |

| (315,898 | ) | |

| - | | |

| - | | |

| - | | |

| 186,947 | |

| Health Care Providers & Services | |

| 37,689 | | |

| 13,485 | | |

| - | | |

| (32,463 | ) | |

| - | | |

| 18,711 | |

| Milestone Interests | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Biotechnology | |

| 657,235 | | |

| (657,235 | ) | |

| - | | |

| - | | |

| - | | |

| 0 | * |

| Health Care Equipment & Supplies | |

| 727 | | |

| (641 | ) | |

| - | | |

| (86 | ) | |

| - | | |

| - | |

| Pharmaceuticals | |

| 5,028,292 | | |

| 4,923,441 | | |

| - | | |

| - | | |

| - | | |

| 9,951,733 | |

| Other Assets | |

| 189 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 189 | |

| Total | |

$ | 38,498,929 | | |

$ | 1,486,153 | | |

$ | 2,304,245 | | |

$ | (1,363,654 | ) | |

$ | - | | |

$ | 40,925,673 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

change in unrealized appreciation (depreciation) from investments still held as of June 30, 2023 | | | |

$ | 1,748,298 | |

* Represents security valued at zero.

The

following is a quantitative disclosure about significant unobservable inputs used in the determination of the fair value of Level

3 assets.

| |

|

Fair

Value at

June 30, 2023 |

|

Valuation

Technique |

|

Unobservable

Input |

|

Range

(Weighted Average) |

| Common Stocks |

|

$ |

186,947 |

|

Market approach |

|

Discount for lack of marketability

Revenue allocation |

|

50.00% (50.00%) |

| |

|

18,711 |

|

Probability adjusted

value |

|

Probability of events

Timing of events |

|

50.00%-100.00% (50.00%)

0.75-2.50 (0.75) years |

| Convertible Preferreds |

|

30,768,093 |

|

Transaction Price |

|

(a) |

|

N/A |

| Milestone Interests |

|

9,951,733 |

|

Probability adjusted

value |

|

Probability of events

Timing of events |

|

0.00%-100.00% (43.90%)

0.00-14.75 (1.98) years |

| Other Assets |

|

189 |

|

Probability adjusted

value |

|

Probability of events

Timing of events |

|

95.00%(95.00%)

5.5 (5.5) years |

| |

|

$ |

40,925,673 |

|

|

|

|

|

|

| (a) | The valuation technique used as a basis to approximate fair value of these investments is based transaction

price or subsequent financing rounds. |

Private Companies and Other Restricted

Securities

The Fund may invest in private companies

and other restricted securities if these securities would currently comprise 40% or less of net assets. The value of these securities

represented 10% of the Fund’s net assets at June 30, 2023.

At June 30, 2023, the Fund had

a commitment of $954,696 relating to additional investments in three private companies.

The following table details the acquisition

date, cost, carrying value per unit, and value of the Fund’s private companies and other restricted securities at June 30,

2023. The Fund on its own does not have the right to demand that such securities be registered.

| Security (#) | |

Acquisition

Date | |

Cost | | |

Carrying Value

per Unit | | |

Value | |

| Afferent Milestone Interest | |

07/27/16 | |

$ | 161,871 | | |

$ | 113,219.00 | | |

$ | 113,219 | |

| Amolyt Pharma SAS Series C Cvt. Pfd | |

01/25/23 | |

| 1,125,854 | | |

| 2.34 | | |

| 1,122,845 | |

| Amphivena Milestone Interest | |

10/18/22 | |

| 0 | | |

| 0.00 | | |

| 0 | |

| Arbor Biotechnologies, Series B Cvt. Pfd | |

10/29/21 | |

| 643,318 | | |

| 16.57 | | |

| 640,000 | |

| Aristea Therapeutics, Inc. Series B Cvt. Pfd | |

07/27/21 | |

| 1,600,004 | | |

| 5.51 | | |

| 1,600,004 | |

| Arkuda Therapeutics, Inc. | |

| |

| | | |

| | | |

| | |

| Series A Cvt. Pfd | |

05/16/19, 04/02/20, 07/15/21 | |

| 2,403,867 | | |

| 1.77 | | |

| 1,783,811 | |

| Series B Cvt. Pfd | |

01/24/22, 01/23/23 | |

| 792,030 | | |

| 1.77 | | |

| 791,386 | |

| Biotheryx, Inc. Series E Cvt. Pfd | |

05/19/21 | |

| 3,206,621 | | |

| 2.62 | | |

| 1,600,000 | |

| Cercacor Laboratories, Inc. Common | |

03/31/98 | † |

| 0 | | |

| 1.44 | | |

| 186,947 | |

| Curasen Therapeutics, Inc. Series A Cvt. Pfd | |

09/18/18, 01/07/20, 10/21/21, 11/01/22 | |

| 3,742,602 | | |

| 0.48 | | |

| 3,740,739 | |

| Endeavor Biomedicines, Inc. Series B Cvt. Pfd | |

01/21/22 | |

| 1,401,736 | | |

| 4.72 | | |

| 1,399,998 | |

| Ethismos Research Milestone Interest | |

10/31/17 | |

| 0 | | |

| 0.00 | | |

| 0 | |

| Flamingo Therapeutics, Inc. Series A3 Cvt. Pfd | |

04/21/20,10/28/20 | † |

| 2,469,343 | | |

| 6.67 | | |

| 714,194 | |

| Fusion Pharmaceuticals, Inc. Common | |

09/20/22 | |

| 0 | | |

| 4.21 | | |

| 13,714 | |

| HiberCell, Inc. Series B Cvt. Pfd | |

05/05/21 | |

| 1,603,268 | | |

| 1.23 | | |

| 1,599,999 | |

| Hotspot Therapeutics, Inc. | |

| |

| | | |

| | | |

| | |

| Series B Cvt. Pfd | |

04/22/20, 06/17/21 | |

| 3,107,213 | | |

| 3.24 | | |

| 4,186,167 | |

| Series C Cvt. Pfd | |

11/15/21 | |

| 922,387 | | |

| 3.24 | | |

| 920,801 | |

| ImmuneID, Inc. Series A Cvt. Pfd | |

04/28/21 | |

| 962,127 | | |

| 0.64 | | |

| 309,024 | |

| Impact Biomedicines Milestone Interest | |

7/20/10 | |

| 0 | | |

| 1,209,320.00 | | |

| 1,209,320 | |

| InnovaCare, Inc. Escrow Shares Common | |

12/21/12 | † |

| 16,696 | | |

| 0.13 | | |

| 18,711 | |

| Invetx, Inc. | |

| |

| | | |

| | | |

| | |

| Series A Cvt. Pfd | |

08/06/20 | |

| 1,551,319 | | |

| 0.67 | | |

| 2,163,865 | |

| Series B Cvt. Pfd | |

03/28/22 | |

| 930,567 | | |

| 0.67 | | |

| 930,000 | |

| IO Light Holdings, Inc. Series A2 Cvt. Pfd | |

04/30/20, 05/17/21, 09/15/21 | † |

| 1,395,511 | | |

| 2.85 | | |

| 1,200,814 | |

| Neurovance Milestone Interest | |

03/20/17 | |

| 3,417,500 | | |

| 8,629,194.00 | | |

| 8,629,194 | |

| Oculis Holding AG Common | |

03/06/23 | |

| 1,990,345 | | |

| 11.13 | | |

| 2,635,226 | |

| Parthenon Therapeutics, Inc. Series A Cvt. Pfd | |

08/12/21, 05/24/23 | |

| 1,603,295 | | |

| 1.92 | | |

| 1,599,995 | |

| Priothera Ltd. Series A Cvt. Pfd | |

10/07/20, 10/19/21 | |

| 1,779,800 | | |

| 10.91 | | |

| 1,664,452 | |

| Quell Therapeutics, Series B Cvt. Pfd | |

11/29/21, 03/23/22 | |

| 1,391,039 | | |

| 2.08 | | |

| 1,520,001 | |

| Rainier Therapeutics Milestone Interest | |

09/28/21 | |

| 126,278 | | |

| 0.00 | | |

| 0 | |

| ReCode Therapeutics, Series B Cvt. Pfd | |

10/12/21, 02/16/22 | |

| 1,285,639 | | |

| 9.23 | | |

| 1,279,998 | |

| Therachon Milestone Interest | |

07/01/19 | |

| 1,017,671 | | |

| 0.00 | | |

| 0 | |

| | |

| |

$ | 40,647,901 | | |

| | | |

$ | 43,574,424 | |

| (#) |

See Schedule of Investments and corresponding footnotes for more information on each issuer. |

| † |

Interest received as part of a corporate action for a previously owned security. |

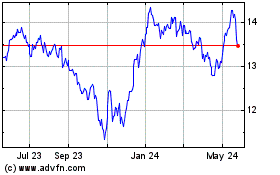

abrdn Life Sciences Inve... (NYSE:HQL)

Historical Stock Chart

From Apr 2024 to May 2024

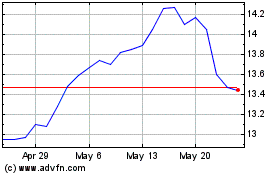

abrdn Life Sciences Inve... (NYSE:HQL)

Historical Stock Chart

From May 2023 to May 2024