0000846475

false

0000846475

2023-09-08

2023-09-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 8, 2023

Zynex, Inc.

(Exact Name of Registrant as Specified in

its Charter)

| Nevada |

001-38804 |

90-0275169 |

| |

|

|

(State or other jurisdiction

of incorporation) |

Commission File

Number |

(I.R.S. Employer Identification

number) |

9655 Maroon Circle, Englewood, CO 80112

(Address of principal

executive offices) (Zip Code)

Registrant's telephone number, including area code: (800) 495-6670

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Ticker symbol(s) |

Name of each exchange on which

registered |

| Common Stock, $0.001 par value per share |

ZYXI |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

ITEM 8.01 OTHER EVENTS

Repurchase Plan

On September 11, 2023,

Zynex, Inc. (the “Company”) announced that its Board of Directors authorized a 10b5-1 share repurchase plan for up to $10.0

million of the Company’s common stock (the “Repurchase Plan”).

Pursuant to the Repurchase

Plan, the Company may purchase from time-to-time outstanding shares of common stock in open market and negotiated purchases, effective

September 13, 2023, and continuing for a period of one year or until full use of the $10.0 million, whichever comes first. These repurchases

will be made in compliance with the SEC's Rule 10b-18 and Rule 10b-5 under the Securities Exchange Act of 1934, subject to market conditions,

available liquidity, cash flow, applicable legal requirements and other factors. The Repurchase Plan does not obligate the Company to

acquire any particular amount of common stock and the plan may be suspended or discontinued at any time. The Company expects to finance

the purchases with existing cash balances.

The full text of the

press release announcing the Repurchase Plan is furnished herewith as Exhibit 99.1.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

d) Exhibits.

The following exhibits are filed with this report.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| Dated: September 11, 2023 |

ZYNEX, INC. |

| |

|

| |

/s/ Dan Moorhead |

| |

Dan Moorhead |

| |

Chief Financial Officer |

Exhibit 99.1

Zynex Announces Share Repurchase Program

Englewood,

CO – September 11, 2023 – Zynex, Inc. (NASDAQ: ZYXI), an innovative medical technology company specializing

in the manufacture and sale of non-invasive medical devices for pain management, rehabilitation, and patient monitoring, today announced

that its board of directors approved a program to repurchase $10.0 million of the Company's common stock. The program will commence on

September 13, 2023, and is scheduled to terminate on September 12, 2024, or when the $10.0 million limit is reached.

“We are focused on continuing to deliver

strong returns for our shareholders, and continuing the repurchase program shows our confidence in the Company’s outlook and future

cash flow,” said Thomas Sandgaard, Founder and CEO of Zynex. "Our consistent operating performance allows us an opportunity

to invest in Zynex and return value to our shareholders simultaneously."

The Company may repurchase stock from time to

time in open market and negotiated transactions, effective immediately through the next twelve months. These transactions will be

made in compliance with the SEC's Rule 10b-18, subject to market conditions, available liquidity, cash flow, applicable legal requirements,

and other factors. The specific prices, numbers of shares, and timing of purchase transactions will be determined by the Company from

time to time in its sole discretion. This program does not obligate the Company to acquire any particular amount of common stock,

and the program may be suspended or discontinued at any time, including in the event the Company would be deemed to be acquiring its shares

under Rule 13e-3 of the Securities Exchange Act of 1934, as amended.

The Company expects to finance the purchases

with existing cash balances, which is not expected to have a material impact on capital levels.

Zynex, Inc. had approximately 41.7 million shares

issued and 35.1 million shares outstanding as of September 8, 2023.

About Zynex,

Inc.

Zynex, founded in 1996, develops, manufactures, markets, and sells medical devices used for pain management

and rehabilitation as well as non-invasive fluid, sepsis, and laser-based pulse oximetry monitoring systems for use in hospitals. For

additional information, please visit: www.zynex.com.

Safe Harbor Statement

This

release contains forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation

Reform Act of 1995.

Forward-looking statements

are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and

assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy

and other future conditions. Because forward-looking statements

relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and

many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the

forward-looking statements. Therefore, you should not rely on any of these forward looking statements. The

Company makes no express or implied representation or warranty as to the completeness of forward-looking statements or, in the case of

projections, as to their attainability or the accuracy and completeness of the assumptions from which they are derived. Factors that could

cause actual results to materially differ from forward-looking statements include, but are not limited to, the need to obtain CE marking

of new products, the acceptance of new products as well as existing products by doctors and hospitals, larger competitors with greater

financial resources, the need to keep pace with technological changes, our dependence on the reimbursement for our products from health

insurance companies, our dependence on third party manufacturers to produce our products on time and to our specifications, implementation

of our sales strategy including a strong direct sales force, the impact of COVID-19 on the global economy and other risks described in

our filings with the Securities and Exchange Commission including but not limited to, our Annual Report on Form 10-K for the year ended December

31, 2022 as well as our quarterly reports on Form 10-Q and current reports on Form 8-K.

Any forward-looking

statement made by us in this release is based only on information currently available to us and speaks only as of the date on which it

is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time

to time, whether as a result of new information, future developments or otherwise.

Investor Relations Contact:

Quinn Callanan, CFA or Brian Prenoveau, CFA

MZ Group – MZ North America

ZYXI@mzgroup.us

+949 694 9594

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

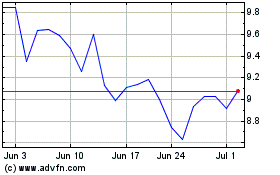

Zynex (NASDAQ:ZYXI)

Historical Stock Chart

From Apr 2024 to May 2024

Zynex (NASDAQ:ZYXI)

Historical Stock Chart

From May 2023 to May 2024