UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) September 30, 2015

|

|

World Acceptance Corporation |

(Exact Name of Registrant as Specified in its Charter) |

|

| | | | |

South Carolina | | 0-19599 | | 57-0425114 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

|

|

108 Frederick Street Greenville, South Carolina 29607 |

(Address of Principal Executive Offices) (Zip Code) |

|

|

864-298-9800 |

(Registrant’s Telephone Number, Including Area Code) |

|

|

Not Applicable |

(Former name or address, if changed from last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

A. Alexander (Sandy) McLean III Retirement Effective September 30, 2015 and Entry Into Retirement Agreement.

Consistent with the CEO succession planning of the Company previously announced on June 2, 2015, World Acceptance Corporation (the “Company”) and the Company’s Chief Executive Officer A. Alexander (Sandy) McLean III entered into a retirement agreement dated September 30, 2015 (the “Retirement Agreement”) pursuant to which Mr. McLean has retired from his positions as Chief Executive Officer and as a director of the Company effective September 30, 2015. The Retirement Agreement (a) requires Mr. McLean to be available to consult with the Company as needed for a period of two (2) years after retirement and cooperate with the Company regarding any litigation, claim, or investigation affecting the Company for a period of six (6) years after the effective date of his retirement; (b) provides for a release by Mr. McLean of all claims against the Company arising through the date of the Retirement Agreement subject to certain exceptions including claims for indemnification from the Company arising from acts or omissions prior to his retirement; (c) requires Mr. McLean to continue to abide by the restrictive covenants set forth in his Employment Agreement with the Company dated April 1, 2007, including covenants against competition and soliciting the Company’s employees for a period for two (2) years after Mr. McLean’s retirement; and (d) requires Mr. McLean to refrain from disparaging the Company and to continue to protect the Company’s confidential information. In exchange for his promises in the Retirement Agreement, (i) the Company will pay Mr. McLean’s current salary through the retirement date and a prorated annual incentive award, (ii) Mr. McLean will be entitled to retain all vested stock options and restricted stock previously granted by the Company and currently unvested options for an additional 13,000 shares of the Company’s common stock and 21,000 Group B restricted shares will become vested, (iii) Mr. McLean will receive his vested benefits under the Company’s 401(k) plan and SERP, and (iv) title to Mr. McLean’s Company car will be transferred to him. Incentive compensation previously received by Mr. McLean remains subject to the Company’s present and future recoupment and claw-back policies. The foregoing summary, which does not purport to be a complete description of the Retirement Agreement, is qualified by reference to the terms of the agreement, which is filed as Exhibit 99.1 to this Current Report on Form 8-K.

Accession of Janet Lewis Matricciani to the Position of Chief Executive Officer.

Consistent with the CEO succession planning of the Company previously announced on June 2, 2015, the Company appointed Janet Lewis Matricciani as Chief Executive Officer of the Company, effective October 1, 2015. Effective October 1, 2015, Ms. Matricciani will no longer serve as Chief Operating Officer of the Company. Ms. Matricciani, age 47, has served as the Company’s Chief Operating Officer since January 2014 and has over 26 years of business experience, primarily in the financial services arena. Before joining the Company, she was the Chief Executive Officer of Antenna International, a leading creator of handheld audio, multimedia and virtual tours for museums, cultural and historic sites and tourist attractions, from 2010 through 2013. She also worked as Senior Vice President of Corporate Development for K12 Inc., a technology-based education company, from 2008 through 2010.

On October 1, 2015, the Compensation and Stock Option Committee of the Board approved the issuance of 15,000 shares of restricted stock to Ms. Matricciani. The restricted shares are service-based and will vest in full over the next three years, with one-third vesting on each anniversary of the grant date, regardless of the performance of the Company. The form of the Company’s Executive Restricted Stock Award Agreement is filed as Exhibit 99.2 to this Current Report on Form 8-K.

|

| |

Item 9.01. | Financial Statements and Exhibits. |

(d) | Exhibits

|

| |

Exhibit 99.1 | Retirement Agreement dated September 30, 2015, by and between the Company and A. Alexander McLean III. |

| |

Exhibit 99.2 | Form of Executive Restricted Stock Award Agreement. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

Date: October 1, 2015 | | |

| World Acceptance Corporation | |

| | | |

| By: | /s/ John L. Calmes Jr. | |

| | John L. Calmes Jr. | |

| | Vice President and Chief Financial Officer | |

EXHIBIT INDEX

|

| |

Exhibit Number | Exhibit |

99.1 | Retirement Agreement dated September 30, 2015, by and between the Company and A. Alexander McLean III. |

99.2 | Form of Executive Restricted Stock Award Agreement. |

WORLD ACCEPTANCE CORPORATION

RETIREMENT AGREEMENT

THIS RETIREMENT AGREEMENT (this “Agreement”) is made this 30th day of September , 2015 by and between World Acceptance Corporation and its subsidiaries, and affiliate companies (hereinafter collectively referred to as the “Company”), and A. Alexander (Sandy) McLean III (“Executive”).

WHEREAS, Executive has communicated his intention to retire from the Company on September 30, 2015 (the “Retirement Date”);

WHEREAS, the Company has acknowledged and accepted Executive’s retirement and agreed to begin the transition of Executive’s role, vision, strategy, and leadership to others within the Company;

WHEREAS, Executive’s Employment Agreement dated April 1, 2007 (“Employment Agreement”) will remain in place, except as expressly modified herein, up to the Retirement Date;

WHEREAS, the Company wishes to receive transition and support services from Executive and a Release from Executive and to ensure the protection of the Company’s confidential information and legitimate competitive interests;

WHEREAS, in exchange for his promises and commitments made herein, the Company has agreed to provide Executive with certain benefits as set forth herein;

NOW, THEREFORE, in consideration of the foregoing, of the mutual promises contained herein and of other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby agree as follows:

1.Retirement and Resignation. Executive’s employment with the Company will end on the Retirement Date. To effect Executive’s retirement, Executive hereby resigns, as of the Retirement Date, as a director and from each and every office with the Company. Executive agrees to execute documents in a form satisfactory to the Company to effectuate any such resignations.

2.Duties through Retirement Date. Executive agrees to continue to faithfully perform his duties under the Employment Agreement until the Retirement Date. From the date hereof through the Retirement Date, Executive shall fully cooperate in the transition of his leadership, strategy, and vision to other executives, and commits to support such executives, subject to and as directed by the Board of Directors of the Company.

3.Cessation of Benefits. From and after the Retirement Date, Executive will not have the right to participate in or receive any benefit under any employee benefit plan of the Company, any fringe benefit plan of the Company, or any other plan, policy or arrangement of the Company providing benefits or perquisites to employees of the Company generally or individually. Provided, however, Executive will be entitled the rights: (i) to continued coverage under the Company’s health and dental benefit plans as provided by COBRA, as set forth in Section 9(i) hereof; (ii) to retain and be paid vested benefits under the terms of the Company’s tax-qualified pension plans; (iii) to Executive’s vested and accrued rights to receive benefits under the Company’s Supplemental Income Plans, including, as applicable, such original, amended and restated versions thereof (“SERP”); (iv) to submit claims pursuant to the terms of the Company’s welfare benefit plans for benefits arising out of events occurring prior to the Retirement Date; (iv) to exercise any conversion rights provided to Executive under the terms of the Company’s benefit plans; (v) to receive such other benefits and payments as expressly set forth or referred to in this Agreement; and (vi) to receive reimbursement from the Company of expenses Executive incurred prior to the Retirement Date, provided that such expenses are otherwise reimbursable under the terms of the Company’s policies.

4.Noncompetition Covenants. Executive reaffirms and agrees to be bound by the terms of Section X of the Employment Agreement, and agrees that compliance therewith will be a condition of his receiving benefits under this Agreement. Executive’s obligations in this regard include his agreement not to be employed by any party engaged in the same business as the Company, as well as his agreement not to solicit the Company’s employees for a period extending until two years after the Retirement Date.

5.Confidential Information. The Executive agrees to act as a fiduciary to the Company and to maintain the confidentiality of Confidential Information at all times during and after Executive’s employment with the Company and will not, at any time (i) use any Confidential Information for Executive’s own benefit or for the benefit of any other person, firm, or entity; (ii) reveal or disclose any Confidential Information to any person other than authorized representatives of the Company; or (iii) remove or aid in the removal from the Company’s premises, retain, transmit, download, or save any copy or copies of Confidential Information in either written, digital, electronic, voice, or other electronic media data form, except (A) in the performance of Executive’s authorized duties in the furtherance of the business of the Company or (B) with the prior written consent of an authorized officer of the Company. “Confidential Information” means any nonpublic information used in the Company’s business and from which the Company derives commercial value from not being generally known to the public or industry, including without limitation financial information (including budgets, forecasting, projections, costs, margins and pricing); employee information (including payroll and benefits information and personnel records); marketing plans, proposals and data; customer information; trade secrets; patents; copyrights and trademarks, computerized information or data (including programs, networks, databases, information technology architecture and infrastructure, hardware and software) (all or any portion of which, and the materials on which they are used, whether or not specifically labeled or identified as “confidential”).

6.Assistance and Cooperation. Executive agrees that from and after the Retirement Date for a period of two (2) years, he will be available to consult with Company as needed and will cooperate in the transition and in any other manner reasonably requested. In addition, for a period of six (6) years following the Retirement Date, Executive agrees to cooperate with and provide assistance to the Company and its legal counsel in connection with any claim, litigation (including arbitration or administrative hearings) or investigation affecting the Company, in which, in the reasonable judgment of the Company's counsel, Executive’s assistance or cooperation is needed. Executive shall, when requested by the Company, provide testimony, information, affidavits or other assistance as reasonably requested and shall travel at the Company's request in order to fulfill this obligation. Provided, however, that, in connection with such litigation or investigation, the Company shall reasonably accommodate Executive’s schedule, shall provide Executive with reasonable notice in advance of the times in which Employee’s cooperation or assistance is requested, and reimburse Executive for any travel expenses incurred with respect to such matters.

7.Nondisparagement. The Executive agrees that he will not make disparaging remarks to anyone about the Company or its practices, any management personnel or any other employee, that disrupts or impairs the Company’s normal, ongoing business operations, or that harms the Company’s reputation with its employees, customers, suppliers or the public. Likewise, the Company agrees that none of its officers or directors will make any disparaging remarks about Executive.

8.Release. The Executive agrees to and does release and forever discharge the Company, any related or successor corporation or other entity (including but not limited to any parent, subsidiary and/or affiliate), their benefit plans and programs, and all of their past and present officers, directors, employees, administrators and trustees (collectively the “Parties Released by this Agreement”), from any and all losses, expenses, liabilities, claims, rights, contracts, agreements and entitlements of every kind and description (collectively referred to as “Claims”), whether known or unknown, that Executive has now or may later claim to have had against any of the Parties Released by this Agreement arising out of anything that has occurred up through the date that Executive signs this Agreement, including, without limitation, any Claims arising out of Executive’s employment or service with the Company. This release includes, but is not limited to, any Claims for additional compensation, benefits, bonuses, severance, incentive pay or awards, back pay, reinstatement, personal injuries, breach of contract (express or implied), claims for compensation or benefits under the Employment Agreement, breach of any covenant of good faith and fair dealing (express or implied), or for recovery of any losses or other damages to Executive or Executive’s property based on any alleged violation of Title VII of the Civil Rights Act of 1964, 42 U.S.C. § 2000e et seq. (prohibiting discrimination on account of race, sex, color, national origin or religion); the Age Discrimination in Employment Act of 1967, 29 U.S.C. § 621 et seq. (prohibiting discrimination on account of age); the Americans With Disabilities Act of 1990, 42 U.S.C. § 12101 et seq. (prohibiting discrimination on account of disabilities); the Employee Retirement Income Security Act of 1974, 29 U.S.C. § 1001 et seq.; or any other federal, state or local statutory or common law. The Executive further agrees that this release may be pleaded as a complete bar to any action or suit before any court or tribunal.

For the purpose of implementing a full and complete release and discharge of the Parties Released by this Agreement, Executive expressly acknowledges that this Agreement is intended to include in its effect, without limitation, all Claims which Executive does not know or suspect to exist in Executive’s favor at the time Executive signs this Agreement, and that this Agreement contemplates the extinguishment of any such Claim or Claims. For clarification and notwithstanding anything herein to the contrary, this Agreement shall not be deemed to release or discharge any claims (i) for amounts or benefits due to Executive or Executive’s heirs pursuant to or preserved by this Agreement, including without limitation any payments or benefits due to Executive hereunder and any and all rights Executive has against the Company and/or its insurers relating to indemnification for acts undertaken by Executive prior to the date hereof; (ii) that arise out of events that occur after the execution of this Agreement; or (iii) that may not be released by law.

Neither the provisions in this Section 8, nor elsewhere in this Agreement prevents Executive from submitting a petition or charge with any state or government agency or from cooperating with any federal or state governmental inquiry or investigation, including without limitation the Equal Employment Opportunity Commission (EEOC), Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), the Consumer Financial Protection Bureau (CFPB) or any other self-regulatory organization or any governmental entity. Provided, however, Executive acknowledges that the benefits Executive is receiving pursuant to this Agreement are intended to provide the full and only compensation to Executive for any and all claims, damages or other demands that Executive might have or make against the Company or any of the Parties Released by this Agreement, and Executive agrees forever to waive any right to monetary recovery from the Company or its affiliates in the event any administrative agency or other public or governmental authority, individual or group of individuals pursues any claim on Executive’s behalf, and Executive agrees that he will not request or accept anything of value from the Company or its affiliates not provided for in this Agreement as compensation or damages related to his employment or service with the Company.

9.Compensation and Benefits. In exchange for Executive’s promises and execution of those promises set forth in this Agreement, as well as the release set forth above, the Company agrees to pay or provide to Executive the following:

(a)Until the Retirement Date, Executive shall receive his current base salary and shall continue to participate in the Company’s employee benefit plans in which he currently participates.

(b)Pursuant to the Company’s Executive Incentive Plan, and in full satisfaction of any amounts owed in connection therewith, Executive shall be eligible to receive an annual incentive award that will be prorated based on Executive’s service through the Retirement Date (i.e., 6/12 months). The payment of this pro-rated annual incentive will be made as soon as practicable following the certification of the Company’s performance by the Compensation and Stock Option Committee (the "Compensation Committee"), but not later than June 15, 2016.

(c)Executive shall be entitled to retain all stock options and restricted shares that have vested as of the date of this Agreement. All such options may be exercised according to the terms of the award agreements.

(d)All stock options and restricted stock issued to Executive that are not vested as of the date of this Agreement will be forfeited pursuant to the terms of the applicable award agreements, except that (i) the 13,000 WRLD stock options scheduled to vest on December 7, 2015 shall vest on the Retirement Date, and shall be exercisable by Executive at any time prior to the option expiration date, as a retiree who has attained at least 10 years of service with the Company and (ii) 21,000 of Executive’s Group B restricted shares, which represent twenty-five percent (25%) of the grant of such shares to Executive, shall vest on the Retirement Date. Executive agrees to hold any equity referred to in this Section 9(d) for the duration of his noncompetition and consulting obligations set forth in Sections 4 and 6 hereof.

(e)Executive shall be entitled to receive his vested and accrued benefits under the Company’s pension and welfare benefit plans, including without limitation the Company’s 401(k) plan and the SERP.

(f)Executive shall be entitled to exercise any conversion rights provided under and pursuant to the terms of the Company’s employee benefits plans.

(g)Executive shall be entitled to receive reimbursement for any expenses incurred prior to the Retirement Date, in accord with the Company’s policies with respect to the same.

(h)The Company will assign title to Executive's company car to Executive free and clear of all liens, deliverable on the Retirement Date;

(i)Executive’s retirement from the Company is a “qualifying event” under the Consolidated Omnibus Budget Reconciliation Act (“COBRA”). Executive will be provided an opportunity to continue health and dental coverage through the Company’s benefit plans after his retirement, as required by and pursuant to the terms of COBRA. Executive will receive a separate notice of his COBRA rights in order to allow him the chance to decide whether to elect (and pay for) COBRA continuation coverage. The Company agrees to pay Executive the sum of $18,000 in lieu of Company-funded COBRA coverage. This amount will be paid to Executive on the first regular payroll date following the Company’s receipt of his COBRA election.

(j)The Company will provide Executive on the Retirement Date the Company-owned MacBook and cell phone Executive is currently assigned. Consistent with his obligations pursuant to Sections 5 and 13 hereof, Executive agrees to cooperate in the removal of Company data and information from such devices.

10.Exclusive Payment. The benefits to be provided to Executive under the terms of this Agreement, as set forth in Section 9 above, shall be made in lieu and in replacement of any other program, plan, policy, agreement or arrangement of the Company, including without limitation any provision of any severance, change-of-control or other plan or program, including without limitation any and all rights to receive any payments or benefits under or pursuant to the terms of the Employment Agreement.

11.Withholding. All payments required to be made by the Company to Executive under this Agreement shall be subject to the withholding of such amounts for taxes and other payroll deductions as the Company may reasonably determine it should withhold pursuant to any applicable law or regulation.

12.Indemnification. The Company shall continue to indemnify Executive and provide advancement of expenses pursuant to the terms and conditions set forth in the Company’s articles of incorporation and bylaws with respect to any acts or omissions prior to the Retirement Date, and nothing herein shall affect Executive’s rights as an insured under the terms of the Company’s liability policies for such acts or omissions. In addition, the Company shall not take any action, without the consent of Executive or as required by law, to eliminate, amend or reduce such rights of indemnification and advancement afforded to Executive as of the effective date of this Agreement.

13.Return of Property. Executive agrees that he will not retain, and will promptly return to the Company following the Retirement Date, any and all Company property in his possession or subject to his control, including but not limited to, keys, credit and identification cards, Company-provided equipment, computers or any other items provided to Executive by the Company for Executive’s use, together with all written or recorded materials, documents, computer discs, plans, records, or other papers or electronic information related to the Company’s business affairs, except such property that Executive is expressly entitled to retain as set forth herein. Executive represents that he has not and will not copy, download, store or retain software, documents or other materials or files originating with or belonging to the Company, and that he has not retained copies of any Company property or materials, including on any computer tape, diskette, disc, flash drive or any form of storage media, whether portable or installed.

14.Parachute Payment. Notwithstanding any provision of this Agreement to the contrary, in the event that any amount or benefit to be paid or provided to Executive under this Agreement or otherwise constitutes a “parachute payment” within the meaning of Section 280G of the Code, and but for this provision, would be subject to the excise tax imposed by Section 4999 of the Code, then the totality of those amounts shall be either: (a) delivered in full, or (b) delivered as to such lesser extent which would result in no portion of such payments and benefits being subject to excise tax under Section 4999 of the Code, whichever of the foregoing amounts, taking into account the applicable federal, state and local income and employment taxes and the excise tax imposed by Section 4999 of the Code (and any equivalent state or local excise taxes), results in the receipt by Executive on an after-tax basis, of the greatest amount of such payments and benefits, notwithstanding that all or some portion of such amount may be taxable under Section 4999 of the Code. Any reduction of any amount required by this provision shall be made in accordance with Section 409A of the Code and shall occur in the following order: (1) reduction of cash payments to Executive under this Agreement or otherwise; (2) reduction of other benefits paid or provided to Executive; and (3) reduction of vesting acceleration of equity awards under this Agreement or otherwise. If two or more equity awards are granted on the same date, each award will be reduced on a pro rata basis (dollar-for-dollar).

15.Claw-back. Executive expressly acknowledges and agrees that any and all incentive-based compensation, as well as the equivalent cash value thereof with respect to any and all such incentive-based awards that have become vested, exercised, free of restriction or otherwise released to and/or monetized by or for the benefit of the Participant or any transferee or assignee thereof under or pursuant to the Company’s incentive or stock option plans, including such incentive-based awards and amounts set forth in Section 9 hereof (collectively, “Incentive-Based Compensation”), are and will be fully subject to the terms of any policy regarding repayment, recoupment or claw-back of compensation now or hereafter adopted by the Company in response to the requirements of the Dodd-Frank Wall Street Reform and Consumer Protection Act, rulemaking of the Securities and Exchange Commission or otherwise. Executive acknowledges and agrees that any such policy will apply to any and all Incentive-Based Compensation in accordance with its terms, whether retroactively or prospectively, and agrees to cooperate fully with the Company to facilitate the recovery of any Incentive-Based Compensation that the Committee determines in its sole discretion is reasonably required to be recovered pursuant to the terms of such policy.

16.Notices. For purposes of this Agreement, notices and all other communications provided for in this Agreement shall be in writing and shall be deemed to have been duly given (a) on the date of delivery, if delivered by hand, (b) on the date of transmission, if delivered by confirmed facsimile or electronic mail, (c) on the first business day following the date of deposit, if delivered by guaranteed overnight delivery service, or (d) on the fourth business day following the date delivered or mailed by United States registered or certified mail, return receipt requested, postage prepaid, addressed as follows:

If to Executive: At the last address on the records of the Company.

If to the Company: At the Company’s principal executive offices, Attention General Counsel.

17.Severability. If any provision of this Agreement (or any subpart thereof) is unenforceable or is held to be unenforceable, the Parties agree that such provision shall be fully severable, and this Agreement and its terms shall be construed and enforced as if such unenforceable provision had never been a part of this Agreement. Under such circumstances, the remaining provisions of the Agreement shall remain in full force and effect, and a court construing the unenforceable provision shall add to this Agreement and make a part of it, in lieu of the unenforceable provision, a provision as similar in terms and effect to such unenforceable provision as may be enforceable.

18.Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed to be an original, but all of which together shall constitute one and the same instrument.

19.Code Section 409A Compliance. The Parties intend that any amounts or benefits payable or provided under this Agreement comply with the provisions of Section 409A of the Internal Revenue Code (“Code Section 409A”) and the Treasury Regulations relating thereto so as not to subject Executive to the payment of the tax, interest and any tax penalty which may be imposed under Code Section 409A. The provisions of this Agreement shall be interpreted in a manner consistent with such intent. A termination of employment of Executive shall not be deemed to have occurred for purposes of any provision of this Agreement providing for the payment of any amounts or benefits upon or following a termination of employment unless such termination is also a “separation of service” within the meaning of Code Section 409A. If an amount is to be paid under this Agreement in two or more installments, each installment shall be treated as a separate payment for purposes of Code Section 409A. If Executive is considered to be a “specified employee” (as defined in Code Section 409A and related Treasury Regulations) at the Retirement Date, a portion of the amount payable to Executive under Section 9 hereof shall be delayed for six (6) months following Executive’s separation of service if and to the extent necessary to comply with the requirements of Section 409A. Any amounts payable to Executive during such six (6) month-period that are delayed due to the limitation in the preceding sentence shall be paid to Executive in a lump sum on or after the first day of the seventh (7th) month following Executive’s separation from service. Executive acknowledges and agree that he has been advised by the Company to consult with tax counsel of his own choosing regarding the tax consequences to him of the performance of the terms and provisions of this Agreement.

20.Entire Agreement. This Agreement constitutes the entire Agreement by the Company and Executive with respect to the subject matter hereof, and supersedes any and all prior agreements or understandings between Executive and the Company, including the Employment Agreement with respect to the subject matter hereof, whether written or oral. This Agreement may be amended or modified only by a written instrument executed by Executive and the Company.

21.Governing Law. This Agreement shall be construed in accordance with the substantive laws of the State of South Carolina without regard to conflict of laws principles.

22.Acknowledgements. By signing this Agreement, Executive acknowledges that:

(a)He has carefully read and fully understand the Agreement;

(b)He is signing the Agreement voluntarily;

(c)The Company has encouraged and advised Executive to consult with an attorney prior to executing the Agreement and that Executive has had the opportunity to obtain all advice and information you deem necessary about matters related to this Agreement;

(d)Executive has been given a period of at least twenty-one (21) days after receiving this Agreement to consider its terms before signing it;

(e)Executive has seven (7) days after signing this Agreement and release to revoke his acceptance by delivering a signed notice of revocation to the Company, and that upon delivery of a timely notice of revocation, this Agreement will be null and void and neither the Company nor Executive will have any rights or obligations under it. Accordingly, this Agreement and release shall not become effective or enforceable until the seven-day revocation period has expired. If Executive’s signature is not revoked by Executive during the seven-day period, it shall be deemed accepted and this Agreement will take effect on the eighth (8th) day.

SIGNATURE PAGE TO RETIREMENT AGREEMENT

IN WITNESS WHEREOF, the parties hereto have executed this Agreement on the date first written above.

A. Alexander (Sandy) McLean, III – Executive

WORLD ACCEPTANCE CORPORATION

By:

Name:

Title:

World Acceptance Corporation - Retirement Agreement Page 1 of 1

A. Alexander (Sandy) McLean, III

WORLD ACCEPTANCE CORPORATION

EXECUTIVE RESTRICTED STOCK AWARD AGREEMENT

World Acceptance Corporation, a South Carolina corporation (the "Company"), pursuant to its [2011][2008] Stock Option Plan, as amended from time to time (the "Plan"), hereby grants to the holder listed below ("Participant"), the number of shares of Restricted Stock (the "Award" or "Target Award") set forth below. The terms and conditions of the Award are set forth below.

|

| |

PARTICIPANT: | [ ] |

GRANT DATE: | [ ] |

TOTAL NUMBER OF SHARES OF RESTRICTED STOCK: | [ ] |

VESTING SCHEDULE: | [ ] |

THIS AGREEMENT, effective as of the Grant Date above, represents the grant of Restricted Stock by the Company to the Participant named above, pursuant to the provisions of the Plan and this Agreement. All capitalized terms shall have the meanings ascribed to them in the Plan, unless specifically set forth otherwise herein. The parties hereto agree as follows:

| |

1. | Grant of Award. The Company hereby grants to the Participant an award of [ ] shares of the Company’s Stock subject to the restrictions placed thereon pursuant to the terms of this Agreement ("Restricted Shares"), subject to the terms and conditions set forth herein and in the Plan. |

| |

a. | Escrow of Shares. A certificate representing the Restricted Shares shall be issued in the name of the Participant and shall be escrowed with the Human Resources Department or Chief Financial Officer of the Company (the "Escrow Agent") subject to removal of the restrictions placed thereon or forfeiture pursuant to the terms of this Agreement. |

| |

a. | Vesting. Except as provided in Section 2(c) below, the Participant shall vest with respect to one third of the Restricted Shares on each of the first three anniversaries of the Grant Date provided that the Participant is employed by the Company through each such anniversary (each a "Vesting Date"). Notwithstanding the foregoing, if the Participant’s employment is terminated by reason of the Participant’s death, then the Participant’s beneficiary (or if no beneficiary was designated or if no designated beneficiary survives the Participant, then the Participant's estate) shall vest with respect to any and all of the Restricted Shares that have not previously vested. Once vested pursuant to the terms of this Agreement, the Restricted Shares shall be deemed "Vested Shares." |

| |

b. | Change in Control. Notwithstanding any provision to the contrary in this Agreement, a Participant shall become fully and immediately vested in the Award in the event of the occurrence of a Change in Control, provided that the Participant remains in the continuous employ of the Company or any Subsidiary until the date of the consummation of such Change in Control. In the event of the occurrence of a Change in Control, the Vested Shares will be released within a reasonable time thereafter. For purposes of this Agreement "Change in Control" shall mean the occurrence of any of the following events: |

| |

i. | The consummation of (1) a merger, consolidation, statutory share exchange or similar form of transactions involving the (x) Company or (y) any Subsidiary, but in the case of this clause (y) only if Company Voting Securities (as defined below) are issued or issuable or, or (2) the sale or other disposition of all or substantially all of the assets of the Company (each of the foregoing events in clauses (1) and (2) being hereinafter referred to as a "Reorganization"), in each case, unless immediately following such Reorganization: |

| |

a) | all or substantially all of the individuals and entities who were the Beneficial Owners (as defined below) of the securities eligible to vote for the election of the Board (such securities, the "Company Voting Securities") outstanding immediately prior to the consummation of such Reorganization continue to Beneficially Own more than seventy percent (70%) of the combined voting power of the then outstanding voting securities of the corporation or other entity resulting from such Reorganization (including a corporation or entity that, as a result of such transaction, owns the Company or all or substantially all of the Company’s assets either directly or through one or more subsidiaries) (the "Continuing Entity") in substantially the same proportions as their ownership, immediately prior to the consummation of the Reorganization, of the outstanding Company Voting Securities (excluding, for purposes of determining such proportions, any outstanding voting securities of the Continuing Entity that such Beneficial Owners hold immediately following the consummation of the Reorganization as a result of their ownership prior to such consummation of voting securities of any corporation or entity involved in or forming part of such Reorganization other than the Company), |

| |

b) | no Person (excluding any employee benefit plan (or related trust) sponsored or maintained by the Continuing Entity or any corporation or entity controlled by the Continuing Entity) Beneficially Owns thirty-five percent (35%) or more of the combined voting power of the then outstanding voting securities of the Continuing Entity, and |

| |

c) | at least a majority of the members of the board of directors of the Continuing Entity were Incumbent Directors (as defined below) at the time of execution of the definitive agreement providing for such Reorganization or, in the absence of such an agreement, at the time at which approval of the Board was obtained for such Reorganization; |

| |

ii. | The shareholders of the Company approve a plan of complete liquidation or dissolution of the Company, unless such liquidation or dissolution is part of a transaction or series of transactions described in paragraph (i) above that does not otherwise constitute a Change in Control; |

iii.

| |

a) | any Person acquires Beneficial Ownership of, or acquires voting control over, twenty percent (20%) or more of either the outstanding Stock or the combined voting power of the then outstanding Company Voting Securities, either in a single transaction or in a series of transactions occurring within the twelve-month period ending on the date of the most recent acquisition (such Person, an “Acquiring Person”); provided, however, that for purposes of this paragraph (iii), no Person may become an Acquiring Person on account of any of the following acquisitions of Stock or Company Voting Securities: (1) any acquisition by the Company or any Subsidiary; (2) any acquisition by an underwriter temporarily holding such securities pursuant to an offering of such securities; (3) any acquisition by any employee benefit plan (or related trust) sponsored by or maintained by the Company or any Subsidiary; and (4) any acquisition upon consummation of a transaction described in paragraph (i) above that does not otherwise constitute a Change in Control under the terms of such paragraph (i), and |

| |

b) | a majority of the members of the Board are or become individuals who are (1) the Acquiring Person; (2) if the Acquiring Person is a group, members of such group; (3) Affiliates of the Acquiring Person; (4) if the Acquiring Person is a group, Affiliates of members of such group; and/or (5) individuals whose initial assumption of office as a member of the Board occurs as a result of (A) an actual or threatened election contest or actual or threatened solicitation of proxies or consents by or on behalf of the Acquiring Person or, if the Acquiring Person is a Group, any member(s) of such group or (B) the recommendation or request of the Acquiring Person or any member of the Board who is an Affiliate of the Acquiring Person or, if the Acquiring Person is a group, any member of such group (each such Board member, an “Acquiring Person Director”); or |

| |

iv. | During any period of twenty-four (24) consecutive months, individuals who were members of the Board at the beginning of such period (the "Incumbent Directors") cease at any time during such period for any reason to constitute at least a majority of the Board; provided, however, that any individual becoming a director subsequent to the beginning of such period whose appointment or election, or nomination for election by the Company’s shareholders, was approved by a vote of at least a majority of the directors then comprising the Incumbent Directors shall be considered as though such individual were an Incumbent Director, but excluding, for this purpose, any such individual whose initial assumption of office occurs as a result of either an actual or threatened election contest or actual or threatened solicitation of proxies or consents by or on behalf of an entity or Person other than the Board. |

For purposes of this definition, the term "Person" shall mean any individual, corporation, partnership, group, association or other person, as such term is defined in Section 13(d)(3) or Section 14(d)(2) of the Exchange Act, and the terms "Beneficial Owner," "Beneficially Own" and similar variations of such terms shall have the meaning given in Rule 13d-3 under the Exchange Act.

For purposes of this definition, “Affiliate” means (a) any Person directly or indirectly controlling, controlled by or under common control with the Acquiring Person (or any of its members, if the Acquiring Person is a group); (b) any director, officer, member, manager, partner, five percent (5%) owner, attorney, financial or accounting adviser or other agent of the Acquiring Person (or any of its members, if the Acquiring Person is a group) or of any Person described in clause (a); or (c) any director, officer, member, manager, partner, five percent (5%) owner, attorney, financial or accounting adviser or other agent of any Person described in clause (b). For the purposes of this definition, “control,” when used with respect to any Person, means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such Person, whether through the ownership of voting securities, by contract or otherwise, and the terms “controlling” and “controlled” have meanings correlative to the foregoing.

The Board shall have full and final authority, in its discretion, to determine whether a Change in Control has occurred, the date of the occurrence of such Change in Control and any incidental matters relating thereto, provided that the determination as to whether one or more Board members are Acquiring Person Directors shall be made by a majority of members of the Board other than members who are Acquiring Person Directors or whose status as an Acquiring Person Director is in question.

| |

c. | Termination of Employment. Notwithstanding the terms of any other written agreement between the Company or any of its Subsidiaries and the Participant, in the event of a termination of the Participant’s employment with the Company or any of its Subsidiaries for any reason other than the Participant’s death, all unvested Restricted Shares will be immediately forfeited. |

| |

d. | Rights as Shareholder. The Participant shall have all the rights of a shareholder with respect to the Restricted Shares, subject to the restrictions herein, including the right to vote the Restricted Shares and to receive all dividends or other distributions paid or made with respect to the Restricted Shares. Any dividends declared and paid by the Company with respect to the Restricted Shares prior to the date that they become vested (the "Accrued Dividends") shall be paid to the Participant only to the extent that the Restricted Shares become Vested Shares. Any Accrued Dividends with respect to the Restricted Shares shall be forfeited to the extent that the Restricted Shares are forfeited. Accrued Dividends with respect to the Vested Shares shall be paid to the Participant within a reasonable time after the date that they become vested, without interest thereon, and any subsequent dividends or other distributions (in cash or other property, but excluding extraordinary dividends) that are declared and/or paid with respect to the Vested Shares shall be paid to the Participant on a current basis. |

| |

e. | Transferability. None of the Restricted Shares or any rights or interests therein may be sold, transferred, pledged, assigned or otherwise alienated or hypothecated in any manner whatsoever, other than by will or by the laws of descent and distribution, until they have vested. The terms of the Plan and this Agreement are binding upon the executors, administrators, heirs, successors and assigns of the Participant. |

| |

f. | Legends. Until they become vested, the Restricted Shares shall be subject to the following legend: |

"THE SHARES OF STOCK EVIDENCED BY THIS CERTIFICATE ARE SUBJECT TO AND ARE TRANSFERABLE ONLY IN ACCORDANCE WITH THAT CERTAIN AWARD AGREEMENT DATED [ ], 20__ FOR THE WORLD ACCEPTANCE CORPORATION [2011][2008] STOCK OPTION PLAN. ANY ATTEMPTED TRANSFER OF THE SHARES OF STOCK EVIDENCED BY THIS CERTIFICATE IN VIOLATION OF SUCH AWARD AGREEMENT SHALL BE NULL AND VOID AND WITHOUT EFFECT. A COPY OF THE AWARD AGREEMENT MAY BE OBTAINED FROM THE HUMAN RESOURCES DEPARTMENT OR CHIEF FINANCIAL OFFICER OF WORLD ACCEPTANCE CORPORATION."

| |

g. | Removal of Legend. After Restricted Shares become vested, and upon Participant’s request, the Participant shall be entitled to receive a certificate for such Vested Shares with the legend referred to in Section 2(g) removed and the Human Resources Department or Chief Financial Officer of the Company shall deliver to the Participant such certificate representing such Vested Shares, free and clear of all restrictions, except for any applicable securities laws restrictions. |

| |

h. | Delivery of Forfeited Shares. The Participant authorizes the Human Resources Department or Chief Financial Officer to deliver to the Company any and all Restricted Shares that are forfeited under the provisions of this Agreement. The Participant further authorizes the Company to hold as a general obligation of the Company any Accrued Dividends and to pay the Accrued Dividends to the Participant within a reasonable time after the underlying Restricted Shares become Vested Shares. |

| |

3. | Tax Withholding. The Company shall have the power and the right to deduct or withhold, or require the Participant or beneficiary to remit to the Company, the employer’s minimum statutory withholding based upon applicable statutory withholding rates for federal, state, and local taxes, domestic or foreign, including payroll taxes, that are applicable with respect to any taxable event arising as a result of this Agreement. The amount of any such withholding shall be determined by the Company. The Participant may satisfy any such tax withholding obligation by any or a combination of the following means: (i) cash payment; (ii) authorizing the Company to withhold from the Vested Shares otherwise issuable to the Participant the number of Shares having a Fair Market Value less than or equal to the amount of the withholding tax obligation; or (iii) delivering to the Company unencumbered shares of Stock owned by the Participant having a Fair Market Value less than or equal to the amount of the withholding tax obligation; provided, however, that with respect to clauses (ii) and (iii) above, the Committee in its sole discretion may disapprove such payment and require that such taxes be paid in cash. |

| |

4. | Adjustments. In the event of a change in capitalization described in Section 5.2(e) of the Plan, other than a dividend or other distribution described in Section 2(e) above, then unless such event or change results in the termination of all the Restricted Shares granted under this Agreement, the Committee shall adjust, in an equitable manner and as provided in the Plan, the number and class of shares underlying the Restricted Shares, the maximum number of shares for which the Award may vest, and the class of Stock as appropriate, to reflect the effect of such event or change in the Company’s capital structure in such a way as to preserve the value of the Award. |

| |

5. | Employment. Nothing in the Plan or in this Agreement shall confer upon the Participant any right to continue in the employ of the Company or any of its Subsidiaries or affiliated entities, or interfere in any way with the right to terminate the Participant’s employment at any time. |

| |

6. | Company Policies. The Participant agrees that the Award will be subject to any applicable clawback or recoupment policies, share trading policies and other policies that may be implemented by the Company’s Board or a duly authorized committee thereof, from time to time. |

| |

7. | Notices. Any written notice required or permitted under this Agreement shall be deemed given when delivered personally or electronically, as appropriate either to the Participant or to the Human Resources Department or Chief Financial Officer of the Company, or when deposited in a United States Post Office as registered mail, postage prepaid, addressed as appropriate either to the Participant at the then current address as maintained by the Company or such other address as the Participant may advise the Company in writing, or to the Attention: Human Resources Department or Chief Financial Officer, World Acceptance Corporation, at its headquarters office or such other address as the Company may designate in writing to the Participant. |

| |

8. | Failure to Enforce Not a Waiver. The failure of the Company to enforce at any time any provision of this Agreement shall in no way be construed to be a waiver of such provision or of any other provision hereof. Notwithstanding the foregoing, the Committee shall not waive any conditions, goals and restrictions on Restricted Shares intended to qualify as performance-based compensation within the meaning of Code Section 162(m) unless doing so would not cause such award to fail to qualify as performance-based compensation under Code Section 162(m). |

| |

9. | Plan Provisions. This Agreement and the rights of the Participant hereunder are subject to all the terms and conditions of the Plan, as the same may be amended from time to time, as well as to such rules and regulations as the Committee may adopt for administration of the Plan. Any inconsistency between the Agreement and the Plan shall be resolved in favor of the Plan. |

| |

10. | Acknowledgement of Authority. As a condition of receiving this Award, the Participant agrees that the Committee, and to the extent authority is afforded to the Board, the Board, shall have full and final authority to construe and interpret the Plan and this Agreement, and to make all other decisions and determinations as may be required under the terms of the Plan or this Agreement as they may deem necessary or advisable for the administration of the Plan or this Agreement, and that all such interpretations, decisions and determinations shall be final and binding on the Participant, the Company and all other interested persons. |

| |

11. | Section 16 Compliance. Notwithstanding any other provision of the Plan or this Agreement, if Participant is subject to Section 16 of the Securities Exchange Act of 1934 (the "Exchange Act"), the Plan, the Restricted Shares, and this Agreement shall be subject to any additional limitations set forth in any applicable exemptive rule under Section 16 of the Exchange Act (including any amendment to Rule 16b-3 of the Exchange Act) that are requirements for the application of such exemptive rule. To the extent permitted by applicable law, this Agreement shall be deemed amended to the extent necessary to conform to such applicable exemptive rule. |

| |

12. | Governing Law. All questions concerning the construction, validity and interpretation of this Agreement shall be governed by and construed according to the laws of the State of South Carolina without regard to conflict of law principles. |

| |

13. | Entire Agreement. The Plan and this Agreement (including any exhibit or schedule hereto) constitute the entire agreement of the parties and supersede in their entirety all prior undertakings and agreements of the Company and Participant with respect to the subject matter hereof. |

| |

14. | Counterparts. This Agreement may be executed in one or more counterparts, each of which will be deemed to be an original, but all of which together constitute one and the same instrument. |

| |

15. | Severability. In the event one or more of the provisions of this Agreement should, for any reason, be held to be invalid, illegal or unenforceable in any respect, such invalidity, illegality or unenforceability will not affect any other provisions of this Agreement, and this Agreement will be construed as if such invalid, illegal or unenforceable provision had never been contained herein. |

IN WITNESS WHEREOF, World Acceptance Corporation has executed this Agreement in duplicate on the _____ day of _______________, 20__.

WORLD ACCEPTANCE CORPORATION

|

| |

BY: | _____________________________________________ |

PRINT NAME: | _____________________________________________ |

Its: | _____________________________________________ |

I acknowledge receipt of a copy of the Plan (either as an attachment hereto or that has been previously received by me) and that I have carefully read this Award Agreement and the Plan. I agree to be bound by all of the provisions set forth in this Award Agreement and the Plan.

|

| |

BY: | _____________________________________________ |

PRINT NAME: | _____________________________________________ |

World Acceptance Corporation Page 1 of 8

Executive Restricted Stock Award Agreement

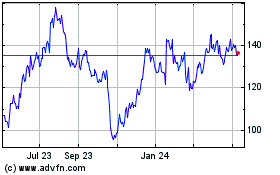

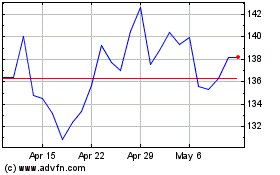

World Acceptance (NASDAQ:WRLD)

Historical Stock Chart

From Jun 2024 to Jul 2024

World Acceptance (NASDAQ:WRLD)

Historical Stock Chart

From Jul 2023 to Jul 2024