0001636222FALSEAddisonTexas00016362222024-11-192024-11-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 19, 2024

WINGSTOP INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-37425 | 47-3494862 |

| (State or other jurisdiction of incorporation or organization) | Commission File Number | (IRS Employer Identification No.) |

| | |

| 15505 Wright Brothers Drive | | |

Addison, Texas | | 75001 |

| (Address of principal executive offices) | | (Zip Code) |

(972) 686-6500

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

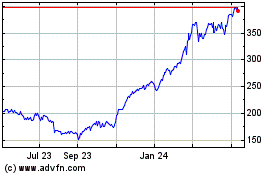

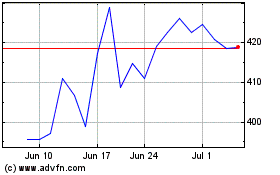

| Common Stock, par value $0.01 per share | WING | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 1.01. | Entry into a Material Definitive Agreement |

On November 19, 2024, Wingstop Inc. (the “Company”) and certain of its indirect wholly owned subsidiaries, Wingstop Restaurants, Inc., a Texas corporation (“Wingstop Restaurants”), Wingstop Funding LLC, a Delaware limited liability company (the “Issuer”), Wingstop Guarantor LLC, a Delaware limited liability company (“Wingstop Guarantor”), and Wingstop Franchising LLC, a Delaware limited liability company (“Wingstop Franchisor” and, together with the Company, Wingstop Restaurants, the Issuer and Wingstop Guarantor, the “Wingstop Parties”), entered into a Purchase Agreement, dated as of November 19, 2024 (the “Purchase Agreement”), with Morgan Stanley & Co. LLC and Barclays Capital Inc. (each, an “Initial Purchaser” and collectively, the “Initial Purchasers”), pursuant to which, among other things, the Issuer, a special purpose subsidiary of the Company, has agreed to issue and sell $500 million of its Series 2024-1 5.858% Fixed Rate Senior Secured Notes, Class A-2 (the “Notes”), in a privately placed securitization transaction under an amended and restated indenture to be executed by the Issuer.

Interest payments on the Notes are payable on a quarterly basis. The legal final maturity date of the Notes is in December of 2054, but, unless earlier prepaid to the extent permitted under the indenture that will govern the Notes, the anticipated repayment date of the Notes will be in December 2031. If the Issuer has not repaid or refinanced the Notes prior to the anticipated repayment date, additional interest will accrue on the Notes in an amount equal to the greater of (A) 5.00% per annum and (B) a per annum interest rate equal to the excess, if any, by which the sum of the following exceeds the original interest rate of the Notes (i) the yield to maturity (adjusted to a quarterly bond-equivalent basis) on such anticipated repayment date of the United States Treasury Security having a term closest to 10 years, plus (ii) 5.00%, plus (iii) 1.60%.

The Purchase Agreement includes customary representations, warranties and covenants by the Wingstop Parties. It also provides that the Wingstop Parties will jointly and severally indemnify the Initial Purchasers against certain liabilities, including liabilities under the Securities Act of 1933, as amended (the “Securities Act”). The closing of the sale of the Notes is expected to occur on Tuesday, December 3, 2024, subject to the satisfaction of various closing conditions specified in the Purchase Agreement.

The Initial Purchasers and their affiliates have, from time to time, performed and may in the future perform various advisory, structuring, investment banking, and commercial banking services for the Wingstop Parties for which they received or will receive customary fees and expenses.

The foregoing description of the Purchase Agreement does not purport to be complete and is subject to, and qualified in its entirety by, reference to the Purchase Agreement, a copy of which is attached hereto as Exhibit 10.1.

The Notes will not be registered under the Securities Act and may not be offered or sold in the United States absent such registration or an exemption from the registration requirements of the Securities Act. This report shall not constitute an offer to sell or a solicitation of an offer to buy any security and shall not constitute an offer, solicitation or sale of any securities in any jurisdiction where such an offering or sale would be unlawful. This report contains information about pending transactions, and there can be no assurance that these transactions will be completed.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits |

| | | | | |

| (d) | Exhibits |

| 10.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

| |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized. | | | | | | | | | | | | | | |

| | | | Wingstop Inc. |

| | | | |

| | | | |

| Date: | November 20, 2024 | | By: | /s/ Alex R. Kaleida |

| | | | Chief Financial Officer (Principal Financial and Accounting Officer) |

WINGSTOP FUNDING LLC

WINGSTOP GUARANTOR LLC

WINGSTOP FRANCHISING LLC

$500,000,000 SERIES 2024-1 5.858% FIXED RATE SENIOR SECURED NOTES, CLASS A-2

PURCHASE AGREEMENT

November 19, 2024

Morgan Stanley & CO. LLC,

1585 Broadway, 4th Floor

New York, New York 10036

as Initial Purchaser

Barclays Capital Inc.,

745 Seventh Avenue, 5th Floor

New York, New York 10019

as Initial Purchaser

Ladies and Gentlemen:

Wingstop Funding LLC, a Delaware limited liability company (the “Issuer”), proposes, upon the terms and conditions set forth in this agreement (as the same may be amended or otherwise modified from time to time in accordance with the terms hereof, this “Agreement”), to issue and sell to Morgan Stanley & Co. LLC and Barclays Capital Inc. (each, an “Initial Purchaser” and collectively, the “Initial Purchasers”), $500,000,000 aggregate principal amount of the Series 2024-1 5.858% Fixed Rate Senior Secured Notes, Class A-2 (the “Class A-2 Notes”). The Class A-2 Notes (i) will have terms and provisions that are summarized in the Pricing Disclosure Package (as defined below) and (ii) are to be issued pursuant to an amended and restated Base Indenture, dated as of March 9, 2022 (the “Series 2022-1 Closing Date”) (as amended by the First Supplement to the Second Amended and Restated Base Indenture, to be dated as of the Series 2024-1 Closing Date (the “First Supplement to Base Indenture”) and as the same may be further amended, amended and restated, supplemented or otherwise modified from time to time in accordance with the terms thereof, the “Base Indenture”) and a series supplement thereto (the “Series 2024-1 Supplement” and, together with the Base Indenture, the “Indenture”), each to be dated as of December 3, 2024 (the “Series 2024-1 Closing Date”) and entered into between the Issuer and Citibank, N.A., a national banking association, as the trustee (in such capacity, the “Trustee”) and the securities intermediary thereunder. The Issuer’s obligations under the Class A-2 Notes, including the due and punctual payment of interest on the Class A-2 Notes, will be jointly and severally irrevocably and unconditionally guaranteed (the “Guarantees”) by Wingstop Guarantor LLC, a Delaware limited liability company (“Funding Holdco”), and Wingstop Franchising LLC, a Delaware limited liability company (“Wingstop Franchisor” and, together with Funding Holdco, the “Guarantors”, and each a “Guarantor” and, together with the Issuer, the “Securitization Entities”), pursuant to an amended and restated Guarantee and Collateral Agreement, dated as of October 30, 2020 (as further amended, amended and restated, supplemented or otherwise modified from time to time in accordance with the terms thereof, the “Guarantee and Collateral Agreement”), as the same shall be reaffirmed pursuant to the Omnibus Amendment and Reaffirmation Agreement to be dated as of the Series 2024-1 Closing Date (the “Omnibus Amendment and Reaffirmation Agreement”), by and among the Wingstop Entities (as defined below) party thereto, the Initial Purchasers, the Trustee, the Back-Up Manager, and Midland Loan Services, a division of PNC Bank, National Association, as servicer (the “Servicer”) as Control Party. As

used herein, the term “Class A-2 Notes” shall include the Guarantees, unless the context otherwise requires. This Agreement is to confirm the agreement concerning the purchase of the Class A-2 Notes from the Issuer by the Initial Purchasers.

On the Series 2024-1 Closing Date, (i) the Securitization Entities, Wingstop Restaurants, Inc., a Texas corporation, as manager (in such capacity, the “Manager”), the Trustee and the Servicer will enter an Omnibus Amendment to Management and Servicing Agreements (the “Omnibus Amendment”), which amends (x) the Amended and Restated Management Agreement, dated as of October 30, 2022 (as so amended, the “Management Agreement”) pursuant to which the Manager manages the assets and business of the Securitization Entities and (y) the Second Amended and Restated Servicing Agreement, dated as of March 9, 2022 (as so amended, the “Servicing Agreement”) pursuant to which the Servicer services and administers the Class A-2 Notes and the Collateral and (ii) the Securitization Entities, the Manager, FTI Consulting, Inc., a Maryland corporation, as back-up manager (the “Back-Up Manager”), and the Trustee will enter into a Third Amended and Restated Back-Up Management and Consulting Agreement (the “Back-Up Management Agreement”) pursuant to which the Back-Up Manager will continue to provide certain consulting and back-up management services to the Securitization Entities, the Servicer and the Trustee. For purposes of this Agreement (i) “Parent” shall mean Wingstop Inc., a Delaware corporation, that is the indirect owner of the Manager and the Securitization Entities, and (ii) “Wingstop Entities” shall mean, collectively, Parent, the Manager and the Securitization Entities. On or prior to the Series 2024-1 Closing Date, the Issuer and the Trustee will also enter into the first amendment to the Series 2022-1 Supplement (the “First Amendment to the Series 2022-1 Supplement”) for the purpose of amending certain provisions relating to the Series 2022-1 Class A-1 Notes.

For purposes of this Agreement, capitalized terms used but not defined herein shall have the meanings given to such terms or incorporated by reference in the “Certain Definitions” section of the Pricing Disclosure Package (as defined below).

1.Purchase and Resale of the Class A-2 Notes. The Class A-2 Notes will be offered and sold to the Initial Purchasers without registration under the United States Securities Act of 1933, as amended (the “Securities Act”), in reliance on an exemption pursuant to Section 4(a)(2) under the Securities Act. The Issuer, the Manager and the Guarantors have prepared (i) a preliminary offering memorandum, dated November 13, 2024 (the “Preliminary Offering Memorandum”), (ii) a pricing term sheet substantially in the form attached hereto as Schedule II (the “Pricing Term Sheet”) setting forth the terms of the Class A-2 Notes omitted from the Preliminary Offering Memorandum and certain other information, (iii) the final investor presentation, dated November 2024 and attached hereto as Exhibit I (the “Investor Presentation”), and (iv) a final offering memorandum, dated as of the date hereof (the “Offering Memorandum”), setting forth information regarding the Issuer, the Guarantors, the Manager, Parent, the Class A-2 Notes and the Guarantees. The Preliminary Offering Memorandum together with the Pricing Term Sheet, the Investor Presentation and the Supplementary Materials (as defined below), are collectively referred to as the “Pricing Disclosure Package”. The Issuer, the Manager and the Guarantors hereby confirm that they have authorized the use of the Pricing Disclosure Package, the Offering Memorandum and the Supplementary Materials in connection with the offering and resale of the Class A-2 Notes by the Initial Purchasers. “Applicable Time” means 1:47 p.m. (New York City time) on the date of this Agreement. Any reference to the Preliminary Offering Memorandum, Pricing Disclosure Package or the Offering Memorandum, as the case may be, as amended or supplemented, as of any specified date, shall be deemed to include any documents filed (not furnished, unless such furnished document is expressly incorporated by reference in the Preliminary Offering Memorandum, the Pricing Disclosure Package or the Offering Memorandum, as the case may be) with the United States Securities and Exchange Commission (the “Commission”) pursuant to Section 13(a), 13(c), 14 or 15(d) of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”) after the date of the Preliminary Offering Memorandum, Pricing Disclosure Package or the Offering Memorandum, as the case may be, and prior to such specified date, as well as any documents expressly incorporated by reference therein, including Parent’s most recent Annual Report on Form 10-K, dated February 21, 2024, and Quarterly Report on Form 10-Q, dated October 30, 2024. All documents filed under the Exchange

Act and so deemed to be incorporated by reference in the Preliminary Offering Memorandum, Pricing Disclosure Package or the Offering Memorandum, as the case may be, or any amendment or supplement thereto are hereinafter called the “Exchange Act Reports”.

Any reference to documents “included” in another document shall also be deemed to refer to any documents incorporated by reference therein, other than with respect to documents “included” or incorporated by reference into any Exchange Act Reports and unless the context otherwise dictates.

It is understood and acknowledged that upon original issuance thereof, and until such time as the same is no longer required under the applicable requirements of the Securities Act, the Class A-2 Notes (and all securities issued in exchange therefor or in substitution thereof) will bear the legends set forth in Section 4.4 of the Series 2024-1 Supplement.

You have advised the Issuer that the Initial Purchasers will offer and resell (the “Exempt Resales”) the Class A-2 Notes purchased by the Initial Purchasers hereunder on the terms set forth in each of the Pricing Disclosure Package and the Offering Memorandum, as amended or supplemented, solely (a) to any individual, corporation (including a business trust), partnership, limited liability partnership, limited liability company, joint venture, association, joint stock company, trust (including any beneficiary thereof), unincorporated association or government or any agency or political subdivision thereof (collectively, a “person”) whom it reasonably believes to be a “qualified institutional buyer” (“QIB”) within the meaning of Rule 144A under the Securities Act (“Rule 144A”) in transactions exempt from the registration requirements of the Securities Act, (b) outside of the United States to persons who are not “U.S. persons” as defined in Regulation S under the Securities Act (“Regulation S”) (such persons, “Non-U.S. Persons”) in offshore transactions in reliance on Regulation S or (c) to the Issuer or any affiliate of the Issuer, that, in the case of clauses (a) and (b), are not Competitors (as such term is defined in the Offering Memorandum). As used in the preceding sentence, the terms “offshore transaction” and “United States” have the meanings assigned to them in Regulation S. Those persons specified in clauses (a), (b) and (c) above are referred to herein as “Eligible Purchasers”.

2.Representations, Warranties and Agreements of the Issuer, the Guarantors, Parent, and the Manager. The Issuer, the Guarantors, Parent and the Manager jointly and severally, represent, warrant and agree, on and as of the date hereof and the Series 2024-1 Closing Date (except as otherwise specified herein), as follows:

(a)When the Class A-2 Notes and Guarantees are issued and delivered pursuant to this Agreement, such Class A-2 Notes and Guarantees will not be of the same class (within the meaning of Rule 144A) as securities of the Issuer or the Guarantors that are listed on a national securities exchange registered under Section 6 of the Exchange Act, or that are quoted in a United States automated inter-dealer quotation system.

(b)None of the Issuer, the Guarantors or the Manager is, and after giving effect to the offer and sale of the Class A-2 Notes and the application of the proceeds therefrom as described under “Use of Proceeds” in each of the Pricing Disclosure Package and the Offering Memorandum will be, an “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”) within the meaning of Section 3(a)(1) thereunder. In connection with the foregoing, the Issuer and the Guarantors are relying on an exclusion or exemption from the definition of “investment company” under Section 3(a)(1) of the Investment Company Act, although additional exemptions or exclusions may be available to the Issuer.

(c)The Issuer does not constitute a “covered fund” (a “Covered Fund”) for purposes of Section 619 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, otherwise known as the “Volcker Rule.”

(d)Assuming that the representations and warranties of the Initial Purchasers in Section 3 hereof are true, the purchase and resale of the Class A-2 Notes pursuant hereto (including pursuant to the Exempt Resales) is exempt from the registration requirements of the Securities Act. No form of general solicitation or general advertising within the meaning of Regulation D under the Securities Act (including, but not limited to, advertisements, articles, notices or other communications published in any newspaper, magazine or similar medium or broadcast over television or radio, or any seminar or meeting whose attendees have been invited by any general solicitation or general advertising) (a “General Solicitation”) was used by the Issuer, the Guarantors, the Manager, any of their respective affiliates or any of their respective representatives (other than the Initial Purchasers and their respective affiliates and their respective representatives, as to whom the Issuer, the Guarantors and the Manager make no representation) in connection with the offer and sale of the Class A-2 Notes.

(e)No directed selling efforts within the meaning of Rule 902 under the Securities Act were used by the Issuer, the Guarantors, the Manager, any of their respective affiliates or any of their respective representatives (other than the Initial Purchasers and their respective affiliates and their respective representatives, as to whom the Issuer, the Guarantors and the Manager make no representation) with respect to Class A-2 Notes sold outside the United States to persons who are Non-U.S. Persons, and each of the Issuer, the Guarantors, the Manager, any of their respective affiliates and any person acting on its or their behalf (other than the Initial Purchasers and their respective affiliates and their respective representatives, as to whom the Issuer, the Guarantors, the Parent and the Manager make no representation) has complied with the “offering restrictions” required by Rule 902 under the Securities Act.

(f)Each of the Preliminary Offering Memorandum, the Pricing Disclosure Package and the Offering Memorandum, each as of its respective date, contains or incorporates by reference all the information specified in, and meeting the requirements of, Rule 144A(d)(4) under the Securities Act.

(g)The Preliminary Offering Memorandum, the Pricing Disclosure Package and the Offering Memorandum have been prepared by the Issuer, the Guarantors and the Manager for use by the Initial Purchasers in connection with the Exempt Resales. No order or decree preventing the use of the Preliminary Offering Memorandum, the Pricing Disclosure Package or the Offering Memorandum, or any order asserting that the transactions contemplated by this Agreement are subject to the registration requirements of the Securities Act has been issued, and no proceeding for that purpose has commenced or is pending or, to the knowledge of the Issuer, the Guarantors or the Manager, has been overtly threatened.

(h)The Preliminary Offering Memorandum did not, as of its date, and the Pricing Disclosure Package did not, as of the Applicable Time, and will not, as of the Series 2024-1 Closing Date (or, in the case of financial information with respect to historical periods included in the Pricing Disclosure Package, did not, as of such dates), contain an untrue statement of a material fact or omit to state a material fact necessary in order to make the statements made therein, in the light of the circumstances under which they were made, not misleading; provided that no representation or warranty is made as to information contained or incorporated in or omitted from the Preliminary Offering Memorandum or the Pricing Disclosure Package in reliance upon and in conformity with the Initial Purchasers Information (as defined in Section 8(e) below).

(i)The Offering Memorandum will not, as of its date and as of the Series 2024-1 Closing Date (or, in the case of financial information with respect to historical periods included in the Offering Memorandum, did not, as of such date), contain an untrue statement of a material fact or omit to state a material fact necessary in order to make the statements made therein, in the light of the circumstances under which they were made, not misleading; provided that no representation or warranty is made as to information contained or incorporated in or omitted from the Offering Memorandum in reliance upon and in conformity with the Initial Purchasers Information.

(j)None of the Issuer, the Guarantors or the Manager has made any offer to sell or solicitation of an offer to buy the Class A-2 Notes that would constitute a “free writing prospectus” (if the offering of the Class A-2 Notes was made pursuant to a registered offering under the Securities Act), as defined in Rule 405 under the Securities Act (a “Free Writing Offering Document”) without the prior consent of the Initial Purchasers. Any Free Writing Offering Documents, together with any additional information and materials distributed to one or more potential Noteholders by the Issuer, any Guarantor or the Manager, or by the Initial Purchasers in connection with the offering and sale of the Class A-2 Notes, in each case, listed on Schedule III hereto, are collectively referred to herein as “Supplementary Materials”; provided, that no Free Writing Offering Document or any such other additional information or materials will constitute Supplementary Materials unless (i) distributed by the Issuer, any Guarantor or the Manager or (ii) unless the distribution thereof has been expressly consented to by the Initial Purchasers and the Issuer and/or the Manager in writing (including via email to the applicable parties).

(k)The statistical and market-related data included in the Pricing Disclosure Package and the Offering Memorandum and the consolidated financial statements of (i) Parent and its Subsidiaries and (ii) the Securitization Entities, in each case, included or incorporated by reference in the Pricing Disclosure Package and the Offering Memorandum are based on or derived from sources that the Issuer, the Guarantors, Parent and the Manager believe to be reliable in all material respects.

(l)The Exchange Act Reports, when they were or are filed with the Commission, conformed or will conform in all material respects to the applicable requirements of the Exchange Act and the applicable rules and regulations of the Commission thereunder. The Exchange Act Reports did not and will not, when filed with the Commission, contain an untrue statement of a material fact or omit to state a material fact necessary to make the statements therein, in the light of the circumstances under which they were made, not misleading.

(m)Each of the Issuer, Parent, the Manager and the Guarantors has been duly organized, is validly existing and in good standing as a limited liability company or corporation, as applicable, under the laws of its jurisdiction of organization and is duly qualified to do business and in good standing as a limited liability company or corporation, as applicable, in each jurisdiction in which its ownership or lease of property or the conduct of its businesses requires such qualification, except where the failure to be so qualified or in good standing would not, in the aggregate, reasonably be expected to have a material adverse effect on (i) the financial condition, results of operations, stockholders’ or members’ equity (as applicable), properties, business or prospects of the Issuer, any Guarantor, Parent, the Manager and their respective subsidiaries, taken as a whole, or (ii) the ability of the Issuer, any Guarantor, Parent or the Manager to close the transactions contemplated by this Agreement on or prior to the Series 2024-1 Closing Date or to perform its obligations under this Agreement or any of the other Transaction Documents (as defined in the Offering Memorandum) (a “Material Adverse Effect”). Each of the Issuer, the Guarantors, Parent and the Manager has all power and authority necessary to own or hold its properties and to conduct the businesses in which it is now engaged.

(n)Parent and its Subsidiaries have the consolidated indebtedness and cash capitalization as set forth in each of the Pricing Disclosure Package and the Offering Memorandum as of the date specified in each such document (it being understood that such capitalization information is preliminary and not audited or reviewed, as described in such section), and all of the issued shares of capital stock of Parent have been duly authorized and validly issued and are fully paid and non-assessable. All of the outstanding shares of capital stock, membership interests, limited liability company interests or other equity interests of each of the Securitization Entities are and will be as of the Series 2024-1 Closing Date, owned, directly or indirectly, by Parent, free and clear of any lien, charge, encumbrance or other interest which secures payment or performance of any obligation in any real or personal property, asset or other right held, owned or being purchased or acquired (collectively, “Liens”), except for Liens created by the Base Indenture or the other Transaction Documents or which constitute Permitted Liens (as such terms are defined in the Offering Memorandum).

(o)The Issuer has all requisite limited liability company power and authority to execute, deliver and perform its obligations under the Indenture. The Indenture has been duly and validly authorized by the Issuer and upon its execution and delivery and, assuming due authorization, execution and delivery by the Trustee, will constitute the valid and binding agreement of the Issuer, enforceable against it in accordance with its terms, except that the enforceability of the Indenture may be subject to bankruptcy, insolvency, reorganization, fraudulent conveyance or transfer, moratorium and similar laws affecting creditors’ rights generally and subject to general principles of equity (regardless of whether enforceability is considered in a proceeding in equity or at law) and, except as rights to indemnification and contribution under the Indenture may be limited under applicable law. Assuming the accuracy of the representations and warranties of the Initial Purchasers contained in Section 3 hereof, no qualification of the Indenture under the Trust Indenture Act of 1939 (the “Trust Indenture Act”) is required in connection with the offer and sale of the Class A-2 Notes in the manner contemplated hereby or in connection with the Exempt Resales. On the Series 2024-1 Closing Date, the Indenture will conform in all material respects to the description thereof in each of the Pricing Disclosure Package and the Offering Memorandum.

(p)The Issuer has all requisite limited liability company power and authority to execute, issue, sell and perform its obligations under the Class A-2 Notes. The Class A-2 Notes have been duly authorized by the Issuer and, when duly executed by the Issuer in accordance with the terms of the Indenture, assuming due authentication of the Class A-2 Notes by the Trustee, upon delivery to the Initial Purchasers against payment therefor in accordance with the terms hereof, will be validly issued and delivered and will constitute valid and binding obligations of the Issuer entitled to the benefits of the Indenture, enforceable against the Issuer in accordance with their terms, except that the enforceability of the Class A-2 Notes may be subject to bankruptcy, insolvency, reorganization, fraudulent conveyance or transfer, moratorium and similar laws affecting creditors’ rights generally and subject to general principles of equity (regardless of whether enforceability is considered in a proceeding in equity or at law). On the Series 2024-1 Closing Date, the Class A-2 Notes will conform in all material respects to the description thereof in each of the Pricing Disclosure Package and the Offering Memorandum.

(q)Each of the Guarantors has all requisite limited liability company power and authority to perform its obligations under the Guarantee and Collateral Agreement. The Guarantee and Collateral Agreement has been duly and validly authorized, executed and delivered by each Guarantor, and constitutes the valid and binding agreement of each Guarantor, enforceable against each Guarantor in accordance with its terms, except that the enforceability of the Guarantee and Collateral Agreement may be subject to bankruptcy, insolvency, reorganization, fraudulent conveyance or transfer, moratorium and similar laws affecting creditors’ rights generally and subject to general principles of equity (regardless of whether enforceability is considered in a proceeding in equity or at law) and, except as rights to indemnification and contribution under the Guarantee and Collateral Agreement may be limited under applicable law. On the Series 2024-1 Closing Date, the Guarantee and Collateral Agreement will conform in all material respects to the description thereof in each of the Pricing Disclosure Package and the Offering Memorandum.

(r)Each of Parent, the Issuer, the Guarantors and the Manager, as applicable, has all requisite limited liability company or corporate power and authority, as applicable, to perform its obligations under each Transaction Document (as such term is defined in the Offering Memorandum) to which it is a party and each of the Issuer, the Guarantors and the Manager has all requisite limited liability company or corporate power and authority, as applicable, to executed and deliver the Back-Up Management Agreement, the Omnibus Amendment, the First Supplement to Base Indenture and the First Amendment to the Series 2022-1 Supplement. Each Transaction Document has been duly and validly authorized by Parent, the Issuer, the Guarantors and the Manager (in each case, to the extent a party thereto), and constitutes (and, the Back-Up Management Agreement, Omnibus Amendment, the First Supplement to Base Indenture and the First Amendment to the Series 2022-1 Supplement, when executed and delivered by the Issuer, the Guarantors and the Manager, as applicable, in accordance with the terms thereof, will constitute) the valid and binding obligation of Parent, the Issuer, the Guarantors and the

Manager (in each case, to the extent a party thereto), in accordance with the terms thereof, enforceable against it in accordance with its terms, (i) except that the enforceability of the Transaction Documents may be subject to bankruptcy, insolvency, reorganization, fraudulent conveyance or transfer, moratorium and similar laws affecting creditors’ rights generally and subject to general principles of equity (regardless of whether enforceability is considered in a proceeding in equity or at law), (ii) except as rights to indemnification and contribution under the Transaction Documents may be limited under applicable law, and (iii) except as to covenants not to institute bankruptcy or similar proceedings may be limited under applicable law. On the Series 2024-1 Closing Date, each such Transaction Document will conform in all material respects to the description thereof (if any) in each of the Pricing Disclosure Package and the Offering Memorandum.

(s)Each of the Issuer, the Guarantors, Parent and the Manager has all requisite limited liability company or corporate power and authority, as applicable, to execute, deliver and perform its obligations under this Agreement. This Agreement has been duly and validly authorized, executed and delivered by each of the Issuer, the Guarantors, Parent and the Manager.

(t)The issue and sale of the Class A-2 Notes and the Guarantees, the execution, delivery and performance by the Issuer, the Guarantors, Parent and the Manager (as applicable) of the Class A-2 Notes, the Guarantees, the Indenture, this Agreement and the other Transaction Documents, to the extent a party thereto, the granting of liens as required by the Indenture and pursuant to the Guarantee and Collateral Agreement by such parties thereto, the application of the proceeds from the sale of the Class A-2 Notes as described under “Use of Proceeds” in each of the Pricing Disclosure Package and the Offering Memorandum and the consummation of the transactions contemplated hereby and by any of the foregoing will not (i) (A) result in the imposition of any Liens upon any property or assets of the Issuer, the Guarantors, Parent, the Manager or any of their respective subsidiaries, or (B) conflict with or result in a breach or violation of any of the terms or provisions of, or constitute a default under, any indenture, mortgage, deed of trust, loan agreement, credit agreement, security agreement, license, lease or other agreement or instrument (giving effect to any amendments or terminations thereof as contemplated by the Pricing Disclosure Package and the Offering Memorandum) to which the Issuer, the Guarantors, Parent, the Manager or any of their respective subsidiaries is a party or by which the Issuer, the Guarantors, Parent, the Manager or any of their respective subsidiaries is bound or to which any of the property or assets of the Issuer, the Guarantors, Parent, the Manager or any of their respective subsidiaries is subject, except in the case of subclause (A) above for Liens created by the Base Indenture, the Guarantee and Collateral Agreement or the other Transaction Documents or Permitted Liens (as defined in the Offering Memorandum), (ii) result in any violation of the provisions of the certificate of formation, limited liability company agreement, charter or by-laws (or similar organizational documents) of any of the Issuer, the Guarantors, Parent, the Manager or any of their respective subsidiaries or (iii) to the Manager’s, Parent’s, each Guarantor’s and the Issuer’s knowledge, result in any violation of any statute or any judgment, order, decree, rule or regulation of any court or governmental agency or body having jurisdiction over any of the Issuer, the Guarantors, Parent, the Manager or any of their respective subsidiaries or any of their respective properties or assets, except, with respect to clauses (i) and (iii) above, where any such matters would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

(u)No consent, approval, authorization or order of, or filing, registration or qualification with any court or governmental agency or body having jurisdiction over any of the Issuer, the Guarantors, Parent, the Manager or any of their respective properties or any of their respective assets is required for the issue and sale of the Class A-2 Notes and the Guarantees, the execution, delivery and performance by the Issuer, the Guarantors, Parent and the Manager, to the extent a party thereto, of the Class A-2 Notes, the Guarantees, the Indenture, this Agreement and the other Transaction Documents (to the extent they are parties thereto), the application of the proceeds from the sale of the Class A-2 Notes as described under “Use of Proceeds” in each of the Pricing Disclosure Package and the Offering Memorandum and the consummation of the transactions contemplated hereby and by any of the foregoing, except for (i) such consents, approvals, authorizations, orders, filings, registrations or qualifications as shall have been obtained or made prior to the Series 2024-1 Closing Date or are

permitted to be obtained or made subsequent to the Series 2024-1 Closing Date pursuant to the Indenture, (ii) such consents, approvals, authorizations, orders, filings, registrations or qualifications as may be required under state securities or Blue Sky laws in connection with the purchase and distribution and resale (including pursuant to the Exempt Resales) of the Class A-2 Notes by the Initial Purchasers, and (iii) any consent, approval, authorization, order, filing, registration or qualification with any court or governmental agency to whose jurisdiction none of the Issuer, the Guarantors, Parent, the Manager or any subsidiary of the foregoing that is a party to the Transaction Documents is subject, in each case with respect to clauses (i) through (iii) above, if the failure to obtain such consent, approval, authorization, order, filing, registration or qualification would not reasonably be expected to have a Material Adverse Effect.

(v)There are no contracts, agreements or understandings between any of the Issuer, the Manager, Parent and the Guarantors and any person, granting such person the right to require the Issuer, Parent, the Manager or the Guarantors to file a registration statement under the Securities Act with respect to any securities of the Issuer, Parent, the Manager or the Guarantors owned or to be owned by such person.

(w)None of the Issuer, the Guarantors, Parent, the Manager nor any other person acting on behalf of the Issuer, the Guarantors, Parent or the Manager has sold or issued any securities that would be integrated with the offering of the Class A-2 Notes contemplated by this Agreement pursuant to the Securities Act, the rules and regulations thereunder or the interpretations thereof by the Commission.

(x)Since the date of the latest audited or reviewed financial statements of Parent included or incorporated by reference in the Pricing Disclosure Package and the Offering Memorandum, except as described in or contemplated by the Pricing Disclosure Package and the Offering Memorandum, none of the Issuer, the Guarantors, Parent, the Manager or any of their respective subsidiaries (i) has sustained any loss or interference with its business from fire, explosion, flood or other calamity, whether or not covered by insurance, or from any labor disturbance or dispute or court or governmental action, order or decree, (ii) has, other than with respect to Parent, issued or granted any securities, (iii) has incurred any material liability or obligation, direct or contingent, other than liabilities and obligations that were incurred in the ordinary course of business, (iv) has entered into any material transaction not in the ordinary course of business, (v) has other than with respect to Parent, declared or paid any dividend on its (A) corporate stock or shares (for any corporation), (B) shares, interests, participations, rights or other equivalents (however designated) of corporate stock (for any association or business entity), (C) partnership or membership interests (whether general or limited) (for any partnership or limited liability company) and (D) other interests or participations that confer on a person the right to receive a share of the profits and losses of, or distributions of assets of, the issuing person (collectively, “Capital Stock”), and (vi) other than with respect to Parent, has changed the Capital Stock or limited liability company interests, as applicable, or long-term debt of any of the Issuer, the Guarantors, the Manager or any of their respective subsidiaries nor has any adverse change, or any development involving a prospective adverse change, in or affecting the condition (financial or otherwise), results of operations, stockholders’ equity or limited liability company interests, as applicable, properties, management, business or prospects of any of the Issuer, the Guarantors, Parent, the Manager or their respective subsidiaries occurred, in each case with respect to clauses (i) through (vi) above, except as would not, in the aggregate, reasonably be expected to have a Material Adverse Effect.

(y)The historical consolidated financial statements of (i) Parent and its Subsidiaries and (ii) the Securitization Entities (in each case, including the related notes and supporting schedules), in each case, included or incorporated by reference in the Pricing Disclosure Package and the Offering Memorandum present fairly in all material respects the financial condition, results of operations and cash flows of the entities purported to be shown thereby, at the dates and for the periods indicated, and have been prepared in conformity with accounting principles generally accepted in the United States applied on a consistent basis throughout the periods involved. The “Transaction-Adjusted” financial information

included in the Pricing Disclosure Package and the Offering Memorandum has been derived from the books and records of Parent and its Subsidiaries in the manner described under and subject to the qualifications and limitations set forth under “Transaction-Adjusted Securitized Net Cash Flow of the Securitization Entities” and “Non-GAAP Financial Measures”. The financial measures that are presented in the Pricing Disclosure Package and the Offering Memorandum that have not been calculated in accordance with generally accepted accounting principles in the United States (“GAAP”) are based on amounts derived from the financial statements and books and records of Parent and its Subsidiaries, and the Securitization Entities, respectively, and the Issuer, Parent, the Manager and the Guarantors believe that any adjustments to such non-GAAP financial measures have a reasonable basis and have been made in good faith.

(z)KPMG LLP which has delivered the initial letter referred to in Section 7(o) hereof, (x) are independent certified public accountants with respect to Parent and its Subsidiaries within the meaning of the 1933 Act and the applicable rules and regulations adopted by the Commission and the Public Company Accounting Oversight Board (“PCAOB”) and (y) is an independent public accounting firm with respect to the Issuer as of the date hereof.

(aa)Deloitte & Touche LLP, who has delivered the Initial AUP Letter referred to in Section 7(p) hereof, was, as of the date of such report, and is, as of the date hereof, an independent evaluation consultant with respect to the Manager, the Issuer and the Guarantors.

(bb)On the Series 2024-1 Closing Date, each of the Issuer, the Guarantors and the Manager has good and marketable title to all property owned by them, in each case free and clear of all liens, encumbrances and defects, except (i) such as are described in the Pricing Disclosure Package and the Offering Memorandum, (ii) Permitted Liens, and (iii) such liens, encumbrances and defects that would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. All assets (if any) held under lease by the Issuer and the Guarantors are held by the relevant entity under valid, subsisting and enforceable leases, with such exceptions that would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

(cc)The Issuer and the Guarantors collectively own and have good title to any property subject to any Transaction Document that grants a Lien to secure any obligations under the Indenture or the Guarantee and Collateral Agreement (“Collateral”), free and clear of all Liens other than Permitted Liens. As of the Series 2024-1 Closing Date, the Base Indenture and the Guarantee and Collateral Agreement will be effective to create a valid and continuing Lien on the Collateral in favor of the Trustee on behalf of and for the benefit of the Secured Parties as required thereunder, which Lien on the Collateral will have been perfected to the extent recognized by applicable law (as described in, and subject to any exceptions to be set forth in, the Base Indenture or the Guarantee and Collateral Agreement) and will be prior to all other Liens (other than Permitted Liens), and will be enforceable as such as against creditors of and purchasers from the Issuer and each Guarantor in accordance with their terms, except as such enforceability may be limited by bankruptcy, insolvency, fraudulent conveyance or transfer, reorganization, moratorium and other similar laws affecting creditors’ rights generally or by general equitable principles (regardless of whether enforceability is considered in a proceeding in equity or at law), whether considered in a proceeding at law or in equity, and by an implied covenant of good faith and fair dealing. Except as described in the Offering Memorandum, each of the Issuer and the Guarantors will have received all consents and approvals required by the terms of the Collateral to the pledge of the Collateral to the Trustee under the Indenture and under the Guarantee and Collateral Agreement.

(dd)Other than the security interests granted to the Trustee under the Base Indenture, pursuant to the Guarantee and Collateral Agreement and the other Transaction Documents or any other Permitted Lien (including, for the avoidance of doubt, precautionary Liens granted in connection with the Contribution Agreements (together with any precautionary UCC-1 financing statement filings or

precautionary notice filings with the USPTO or the USCO)), none of the Issuer, the Guarantors, Parent, the Manager or any of their respective subsidiaries shall have pledged, assigned, sold or granted as of the Series 2024-1 Closing Date a security interest in the Collateral. As of the Series 2024-1 Closing Date, all action necessary (including the filing of UCC-1 financing statements and notice filings with the USPTO) to protect and evidence the Trustee’s security interest in the Collateral in the United States will have been duly and effectively taken (as described in, and subject to any exceptions to be set forth in, the Base Indenture or the Guarantee and Collateral Agreement). As of the Series 2024-1 Closing Date, no security agreement, financing statement, equivalent security or lien instrument or continuation statement authorized by the Issuer, any Guarantor, Parent, the Manager or any of their respective subsidiaries and listing such person as debtor covering all or any part of the Collateral shall be on file or of record in any jurisdiction except (i) in respect of Permitted Liens (including, for the avoidance of doubt, any other precautionary Liens granted in connection with the Contribution Agreements (together with any precautionary UCC-1 financing statement filings or precautionary notice filings with the USPTO or the USCO)) or (ii) such as may have been filed, recorded or made by such person in favor of the Trustee on behalf of the Secured Parties in connection with the Base Indenture and the Guarantee and Collateral Agreement, and no such person has authorized any such filing.

(ee)The Issuer, Parent, the Manager, the Guarantors and each of their respective subsidiaries carry, or are covered by, insurance from insurers of recognized financial responsibility (or self-insurance) in such amounts and covering such risks as is adequate for the conduct of their respective businesses and the value of their respective properties and as is customary for companies engaged in similar businesses in similar industries. All such policies of insurance of the Issuer, the Guarantors, Parent, the Manager and each of their respective subsidiaries are in full force and effect; the Issuer, the Guarantors, Parent, the Manager and each of their respective subsidiaries are in compliance with the terms of such policies in all material respects; and none of the Issuer, the Guarantors, Parent, the Manager and each of their respective subsidiaries has received notice from any insurer or agent of such insurer that capital improvements or other expenditures are required or necessary to be made in order to continue such insurance. There are no claims by the Issuer, the Guarantors, Parent, the Manager or each of their respective subsidiaries under any such policy or instrument as to which any insurance company is denying liability or defending under a reservation of rights clause, except as would not, in the aggregate, reasonably be expected to have a Material Adverse Effect; and none of the Issuer, the Guarantors, Parent, the Manager or any such subsidiaries has any reason to believe that it will not be able to renew its existing insurance coverage, in all material respects, as and when such coverage expires or to obtain similar coverage, in all material respects, from similar insurers as may be necessary to continue its business at a cost that would not, in the aggregate, reasonably be expected to have a Material Adverse Effect.

(ff)The Issuer, Parent, the Manager, the Guarantors and each of their respective subsidiaries have such permits, licenses, franchises, certificates of need and other approvals or authorizations of governmental or regulatory authorities (“Permits”) as are necessary under applicable law to own their properties and conduct their businesses in the manner described in the Pricing Disclosure Package and the Offering Memorandum, except for any of the foregoing that would not, in the aggregate, reasonably be expected to have a Material Adverse Effect. The Issuer, Parent, the Manager, the Guarantors and their respective subsidiaries have fulfilled and performed all of their obligations with respect to the Permits, and no event has occurred that allows, or after notice or lapse of time would allow, revocation or termination thereof or results in any other impairment of the rights of the holder of any such Permits, except for any of the foregoing that would not, in the aggregate, reasonably be expected to have a Material Adverse Effect. None of the Issuer, the Guarantors, Parent and the Manager has received notice of any revocation or modification of any such Permits or has any reason to believe that any such Permits will not be renewed in the ordinary course with only such exceptions as would not, in the aggregate, reasonably be expected to have a Material Adverse Effect.

(gg)(i) The Issuer, Parent, the Manager, the Guarantors and each of their respective subsidiaries own or possess adequate rights to use all material patents, patent applications, trademarks, service marks, trade names, trademark registrations, service mark registrations, copyrights, licenses,

know-how, software, systems and technology (including trade secrets and other unpatented and/or unpatentable proprietary or confidential information, systems or procedures) necessary for the conduct of each of their respective businesses and have no reason to believe that the conduct of each of their respective businesses will conflict with any such rights of others, and (ii) none of the Issuer, the Guarantors, Parent, the Manager or each of their respective subsidiaries has received any notice of any claim of conflict with any such rights of others, in each case with respect to clauses (i) and (ii) above except as would not, in the aggregate, reasonably be expected to have a Material Adverse Effect.

(hh)There are no legal or governmental proceedings pending to which the Issuer, the Guarantors, Parent, the Manager or any of their respective subsidiaries is a party or of which any property or assets of the Issuer, the Guarantors, Parent, the Manager or any of their respective subsidiaries is the subject that would, in the aggregate, reasonably be expected to have a Material Adverse Effect. To the Manager’s, Parent’s, each Guarantor’s and the Issuer’s knowledge, no such proceedings are threatened or contemplated by governmental authorities or others.

(ii)Reserved.

(jj)No labor disturbance by or dispute with the employees of the Issuer, the Guarantors, Parent, the Manager or any of their respective subsidiaries exists or, to the knowledge of the Issuer, the Guarantors, Parent, the Manager or any of their respective subsidiaries, is imminent that would, in the aggregate, reasonably be expected to have a Material Adverse Effect.

(kk)(i) Each “employee benefit plan” (within the meaning of Section 3(3) of the Employee Retirement Security Act of 1974, as amended (“ERISA”)) described in the Pricing Disclosure Package for which any of the Issuer, the Guarantors, Parent, the Manager or any member of any organization (each a “Controlled Group”) which is a member of a controlled group of corporations within the meaning of Section 414 of the Internal Revenue Code of 1986, as amended (the “Code”), with respect to such entity would have any liability (each a “Plan”) has been maintained in compliance in all material respects with its terms and with the requirements of all applicable statutes, rules and regulations including ERISA and the Code; (ii) no prohibited transaction, within the meaning of Section 406 of ERISA or Section 4975 of the Code, has occurred with respect to any Plan excluding transactions effected pursuant to a statutory or administrative exemption; (iii) except as disclosed in the Pricing Disclosure Package, with respect to each Plan subject to Title IV of ERISA (A) no “reportable event” (within the meaning of Section 4043(c) of ERISA) has occurred or is reasonably expected to occur, (B) no failure to satisfy the minimum funding standards of Section 302 of ERISA or Section 412 of the Code, whether or not waived, has occurred or is reasonably expected to occur and (C) none of the Issuer, the Guarantors, Parent, the Manager or any members of each respective Controlled Group has incurred, nor do any of the Issuer, the Guarantors, Parent, the Manager or members of each respective Controlled Group reasonably expect to incur, any liability under Title IV of ERISA (other than contributions to the Plan or premiums to the Pension Benefit Guaranty Corporation in the ordinary course and without default) in respect of a Plan (including a “multiemployer plan”, within the meaning of Section 4001(c)(3) of ERISA); and (iv) to the knowledge of the Issuer, the Guarantors, Parent and the Manager, each Plan that is intended to be qualified under Section 401(a) of the Code is so qualified and nothing has occurred, whether by action or by failure to act, which would cause the loss of such qualification, except, with respect to clauses (i) through (iv) above, to the extent any of the foregoing could not, in the aggregate, reasonably be expected to have a Material Adverse Effect.

(ll)The Issuer, the Guarantors, Parent and the Manager have filed all U.S. federal, state, local and foreign tax returns required to be filed through the date hereof, subject to permitted extensions, and have paid all taxes shown on such returns as required to be paid thereon (except for cases in which the failure to file or pay would not, in the aggregate, reasonably be expected to have a Material Adverse Effect, or except as is currently being contested in good faith and for which reserves have been established as required by GAAP), and no tax deficiency has been determined adversely to any of the Issuer, the Guarantors, Parent or the Manager, nor does any of the Issuer, the Guarantors, Parent or the

Manager have any knowledge of any tax deficiencies that have been, or could reasonably be expected to be, asserted against any of the Issuer, the Guarantors, Parent or the Manager, that could, in the aggregate, reasonably be expected to have a Material Adverse Effect.

(mm)There are no transfer taxes or other similar taxes, fees or charges under federal tax law or the laws of any state, or any political subdivision thereof, required to be paid in connection with the execution and delivery of this Agreement or the issuance by the Issuer or sale by the Issuer of the Class A-2 Notes.

(nn)Parent and its subsidiaries maintain a system of internal control over financial reporting that has been designed by, or under the supervision of, as applicable, Parent’s principal executive and principal financial officers, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with GAAP. Parent and its subsidiaries maintain internal accounting controls sufficient to provide reasonable assurances regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with GAAP, including, but not limited to, internal accounting controls that (A) pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the relevant entity, (B) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with GAAP, and that receipts and expenditures of the relevant entity are being made only in accordance with authorizations of management and directors of the relevant entity, and (C) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the relevant entity’s assets that could have a material effect on the financial statements. Since the date of the last audited or reviewed financial statements of Parent and its Subsidiaries included or incorporated by reference in the Pricing Disclosure Package and the Offering Memorandum, (i) Parent has not been advised of or become aware of any fraud that involves management or other employees who have a significant role in the internal control over financial reporting of Parent and its Subsidiaries taken as a whole or that is otherwise material to Parent and its Subsidiaries taken as a whole; and (ii) there have been no significant changes in the internal control over financial reporting of Parent and its Subsidiaries that have materially affected or are reasonably likely to materially affect the internal control of Parent and its Subsidiaries taken as a whole over financial reporting.

(oo)None of the Issuer, the Guarantors, Parent or the Manager (i) is in violation of its certificate of formation, limited liability company agreement, charter or by-laws (or similar organizational documents), (ii) is in default, and no event has occurred that, with notice or lapse of time or both, would constitute such a default, in the due performance or observance of any term, covenant, condition or other obligation contained in any indenture, mortgage, deed of trust, loan agreement, license or other agreement or instrument to which it is a party or by which it is bound or to which any of its properties or assets is subject, or (iii) is in violation of any statute or any order, rule or regulation of any court or governmental agency or body having jurisdiction over it or its property or assets or has failed to obtain any license, permit, certificate, franchise or other governmental authorization or permit necessary to the ownership of its property or to the conduct of its business, except in each of clauses (ii) and (iii) above, to the extent any such violation, conflict, breach, violation, failure or default would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

(pp)None of the Issuer, the Guarantors, Parent or the Manager, nor to the knowledge of the Issuer, the Guarantors, Parent or the Manager, any of their respective directors, officers, managers, members, agents or employees, has during the last five (5) years: (i) used any corporate or company funds for any unlawful contribution, gift, entertainment or other unlawful expense relating to political activity; (ii) made any direct or indirect unlawful payment to any domestic government official or “foreign official” (as defined in the Foreign Corrupt Practices Act of 1977, as amended, and the rules and regulations thereunder (collectively, the “FCPA”)) or foreign government employee from corporate or company funds; (iii) violated or is in violation of any provision of any applicable law or regulation implementing the OECD Convention on Combating Bribery of Foreign Public Officials in International

Business Transactions or any applicable provision of the FCPA, the Bribery Act 2010 of the United Kingdom (the “UK”), or any other similar law or statute of any other jurisdiction in which it operates its business, including, in each case, the rules and regulations thereunder; or (iv) otherwise made any bribe, unlawful rebate, unlawful payoff, unlawful influence payment, unlawful kickback or other unlawful payment; and each of the Issuer, the Guarantors, Parent or the Manager have conducted their respective businesses in material compliance with the FCPA and have instituted and maintain (or a parent entity has instituted and maintains) policies and procedures reasonably designed to ensure, and which are reasonably expected to continue to ensure, compliance therewith.

(qq)Reserved.

(rr)None of the transactions contemplated by this Agreement (including, without limitation, the use of the proceeds from the sale of the Class A-2 Notes), will violate or result in a violation of Section 7 of the Exchange Act, or any regulation promulgated thereunder, including, without limitation, Regulations T, U and X of the Board of Governors of the Federal Reserve System.

(ss)The statements made in the Pricing Disclosure Package and the Offering Memorandum under the captions “Description of the Series 2024-1 Notes” and “Description of the Indenture and the Guarantee and Collateral Agreement”, insofar as they constitute a summary of the terms of the Class A-2 Notes, the Guarantees and the Indenture, and under the captions “Net Cash Flow of the Securitization Entities”, “Description of Wingstop’s Business”, “Certain Relationships and Related-Party Transactions”, “Description of the Securitization Entities”, “Characteristics of Certain Branded Restaurants”, “Description of the Franchise Arrangements”, “Description of the Manager and Management Agreement”, “Description of the Servicer and the Servicing Agreement” (other than the first seventeen paragraphs), “Description of the Back-Up Manager and the Back-Up Management Agreement”, “Description of the Contribution Agreements”, “Description of the Wingstop IP License Agreement”, “Certain Legal Aspects of the Franchise Arrangements”, “Certain U.S. Federal Income Tax Consequences”, “Certain ERISA and Related Considerations”, “Transfer Restrictions” and “EU/UK Risk Retention Letter”, insofar as they purport to constitute summaries of the terms of statutes, rules or regulations, legal or governmental proceedings or contracts and other documents, constitute accurate summaries of the terms of such statutes, rules and regulations, legal and governmental proceedings and contracts and other documents in all material respects.

(tt)The Issuer, Parent, the Manager, the Guarantors and their respective affiliates have not taken, directly or indirectly, any action designed to or that has constituted or that would reasonably be expected to cause or result in the stabilization or manipulation of the price of any security of the Issuer, the Guarantors, Parent and the Manager in connection with the offering of the Class A-2 Notes.

(uu)Since the date of the most recent balance sheet of Parent and its Subsidiaries audited by KPMG LLP included or incorporated by reference in the Pricing Disclosure Package, (i) Parent has not been advised of or become aware of (A) any significant deficiencies in the design or operation of internal control over financial reporting, that could adversely affect the ability of Parent or any of its subsidiaries to record, process, summarize and report financial data, or any material weaknesses in internal control over financial reporting, and (B) any fraud, whether or not material, that involves management or other employees who have a significant role in the internal control over financial reporting of any of Parent and each of its subsidiaries; and (ii) there have been no significant adverse changes in internal control over financial reporting or in other factors that could significantly affect internal control over financial reporting.

(vv)No subsidiary of the Issuer is currently prohibited, directly or indirectly, from paying any dividends to the Issuer or the Guarantors, from making any other distribution on such subsidiary’s Capital Stock, from repaying the Issuer or the Guarantors any loans or advances to such subsidiary from the Issuer or the Guarantors or from transferring any of such subsidiary’s property or

assets to the Issuer or the Guarantors or any other subsidiary of the Issuer or the Guarantors, except as described in the Pricing Disclosure Package and the Offering Memorandum.

(ww)The Issuer is not currently prohibited, directly or indirectly, from paying any dividends to its parent, from making any other distribution on its Capital Stock, from repaying to its parent or to the Guarantors any loans or advances from its parent or the Guarantors, or from transferring any of its property or assets to its parent, the Guarantors or any other subsidiary of the Guarantors, except as described in the Pricing Disclosure Package and the Offering Memorandum.

(xx)None of the Issuer, the Guarantors, Parent, the Manager or any of their respective subsidiaries is in violation of or has received notice of any violation with respect to any federal or state law relating to discrimination in the hiring, promotion or pay of employees, nor any applicable federal or state wage and hour laws, nor any state law precluding the denial of credit due to the neighborhood in which a property is situated, the violation of any of which could, in the aggregate, reasonably be expected to have a Material Adverse Effect.

(yy)The operations of Parent and its subsidiaries are and have been conducted at all times in compliance with applicable financial recordkeeping and reporting requirements of the Currency and Foreign Transactions Reporting Act of 1970, as amended, the money laundering statutes of all jurisdictions, the rules and regulations thereunder and any related or similar rules, regulations or guidelines, issued, administered or enforced by any governmental agency (collectively, the “Money Laundering Laws”) and no action, suit or proceeding by or before any court or governmental agency, authority or body or any arbitrator involving any of Parent or its subsidiaries with respect to the Money Laundering Laws is pending or, to the knowledge of Parent, threatened.

(zz)(A) None of the Issuer, the Guarantors, Parent, the Manager or any of their respective subsidiaries nor, to the knowledge of any of the Issuer, the Guarantors, Parent or the Manager, any director, officer, manager, member, employee, agent or affiliate of any of the Issuer, the Guarantors, Parent, the Manager or any of their respective subsidiaries is currently subject to any U.S. sanctions administered by the Office of Foreign Assets Control of the U.S. Treasury Department (“OFAC”); or sanctions administered by the U.S. Department of State, the United Nations Security Council, the European Union, any European Union member state, His Majesty’s Treasury, or other relevant sanctions authority (collectively, “Sanctions”), nor is such relevant individual or entity located, organized or resident in a country or territory that is the target of or subject to comprehensive U.S. sanctions administered by OFAC (as of the date hereof, Cuba, Iran, North Korea, Syria, the Crimea region of Ukraine, the so-called Donetsk People’s Republic, the so-called Luhansk People’s Republic, or any covered region of Ukraine identified pursuant to Executive Order 14065) (each a “Sanctioned Country”); (B) the Issuer, the Guarantors, Parent and the Manager will not directly or indirectly use the proceeds of the offering of the Class A-2 Notes, or lend, contribute or otherwise make available such proceeds to any subsidiary, joint venture partner or other person or entity, for the purpose of making payments or funding activity in violation of any the Sanctions; (C) the Issuer (or the Manager on its behalf), the Guarantors (or the Manager on their behalf), Parent and the Manager maintain policies and procedures reasonably designed to ensure, and which are reasonably expected to continue to ensure, compliance with Sanctions; and (D) the proceeds from the sale of the Class A-2 Notes to the Initial Purchasers on the Series 2024-1 Closing Date will not be used in relation to the assets or business of any of the Issuer, the Guarantors, Parent and the Manager or any of their respective subsidiaries in Russia or Belarus and will not be used by any of the Issuer, the Guarantors, Parent and the Manager or any of their respective subsidiaries for new business in Russia or Belarus for so long as the applicable Sanctions targeting Russian and/or Belarus are in effect.

(aaa)Immediately after the consummation of the transactions contemplated by this Agreement, each of the Issuer, the Guarantors, Parent and the Manager will be Solvent; provided that in the case of each Securitization Entity, the liabilities of the other Securitization Entities with respect to debts, liabilities and obligations for which such Securitization Entity is jointly and severally liable shall be taken into account. As used in this Agreement, the term “Solvent” means, with respect to a particular date, that on such date (i) the present fair market value (or present fair saleable value) of the assets of the relevant entity are not less than the total amount required to pay the probable liabilities of such entity on its total existing debts and liabilities (including contingent liabilities) as they become absolute and matured, (ii) the relevant entity is able to realize upon its assets and pay its debts and other liabilities, contingent obligations and commitments as they mature and become due in the normal course of business, (iii) assuming the completion of the transactions contemplated by the Transaction Documents, the relevant entity is not incurring debts or liabilities beyond its ability to pay as such debts and liabilities mature, (iv) the relevant entity is not engaged in any business or transaction, and is not about to engage in any business or transaction, for which its property would constitute unreasonably small capital after giving due consideration to the prevailing practice in the industry in which such entity is engaged, (v) the relevant entity is not a defendant in any civil action that would reasonably be likely to result in a judgment that such entity is or would become unable to satisfy and (vi) the relevant entity is not otherwise insolvent under the standards set forth under any U.S. federal law or under the laws of its state of formation. In computing the amount of such contingent liabilities at any time, it is intended that such liabilities will be computed at the amount that, in the light of all the facts and circumstances existing at such time, represents the amount that can reasonably be expected to become an actual or matured liability.

(bbb)None of the Issuer, the Guarantors, Parent the Manager or any of their respective subsidiaries have participated in a plan or scheme to evade the registration requirements of the Securities Act through the sale of the Class A-2 Notes or the Guarantees pursuant to Regulation S.

(ccc)The Issuer represents that, based on (i) disclosure under the sections entitled “Notice to Investors” and “Transfer Restrictions” in the Offering Memorandum, (ii) the inclusion in the Class A-2 Notes of the legend set forth in Section 4.4 of the Series 2024-1 Supplement and (iii) the representations, warranties and agreements of the Initial Purchasers contained herein, it has a reasonable belief that the sale of the Class A-2 Notes to the Initial Purchasers and subsequent transfers will be limited to Eligible Purchasers.

(ddd)None of the Issuer, the Guarantors, Parent or the Manager is a party to any contract, agreement or understanding with any person (other than this Agreement) that would give rise to a valid claim against any of them or the Initial Purchasers for a brokerage commission, finder’s fee or like payment in connection with the offering and sale of the Class A-2 Notes (other than this Agreement).

(eee)The Issuer, the Guarantors, Parent, the Manager and their respective affiliates have not taken any action or omitted to take any action which may result in the loss by the Initial Purchasers of the ability to rely on any stabilization safe harbor provided by Article 5 of Regulation (EU) No. 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (as amended, the “EUWA”) and as amended (the "UK MAR").

(fff)No forward-looking statement (within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act) contained in the Pricing Disclosure Package or the Offering Memorandum has been made without a reasonable basis or has been disclosed other than in good faith.

(ggg) (i) Parent has provided a Rule 17g-5 Representation (as defined below) to Kroll Bond Rating Agency, LLC (“KBRA” and the “Rating Agency”); (ii) an executed copy of the Rule 17g-5 Representation delivered to the Rating Agency has been delivered to the Initial Purchasers; and (iii) Parent, the Issuer, the Manager and each Guarantor has complied and will in the future comply in all material respects with each Rule 17g-5 Representation. For purposes of this Agreement, “Rule 17g-5

Representation” means a written representation relating to Rule 17g-5 under the Exchange Act provided to the Rating Agency, which is substantially in the form of the Rule 17g-5 representation in such organization’s engagement letter or otherwise satisfies the requirements of paragraph (a)(3)(iii) of Rule 17g-5 under the Exchange Act.

(hhh)Payments on the Class A-2 Notes will not depend primarily on cash flow from self-liquidating financial assets within the meaning of Section 3(a)(79) of the Exchange Act.

Any certificate signed by any officer of Parent or the Manager and delivered to the Initial Purchasers or counsel for the Initial Purchasers in connection with the offering of the Class A-2 Notes shall be deemed a representation and warranty by Parent or the Manager (as applicable) to the Initial Purchasers as to matters covered thereby, and not a representation or warranty by the individual officer.

Any certificate signed by any officer of the Issuer or any Guarantor and delivered to the Initial Purchasers or counsel for the Initial Purchasers in connection with the offering of the Class A-2 Notes shall be deemed a representation and warranty by the Issuer or such Guarantor, jointly and severally, as to matters covered thereby, to the Initial Purchasers, and not a representation or warranty by the individual officer.

3.Purchase of the Class A-2 Notes by the Initial Purchasers, Agreements to Sell, Purchase and Resell.

(a)The Issuer hereby agrees, on the basis of the representations, warranties, covenants and agreements of the Initial Purchasers contained herein and subject to all the terms and conditions set forth herein, to issue and sell to the Initial Purchasers and, upon the basis of the representations, warranties and agreements of each of the Issuer, the Guarantors, Parent and the Manager contained herein and subject to all the terms and conditions set forth herein, each of the Initial Purchaser, severally and not jointly, agrees to purchase from the Issuer the principal amount of Class A-2 Notes at the price and in the amounts set forth and corresponding to the Initial Purchaser’s name in Schedule I hereto. The Issuer and the Guarantors shall not be obligated to deliver any of the securities to be delivered hereunder except upon payment for all of the securities to be purchased as provided herein.