Vivos Therapeutics, Inc. (“Vivos” or the

“Company’’) (NASDAQ: VVOS), a leading medical device and technology

company specializing in the development and commercialization of

highly effective proprietary treatments for sleep related breathing

disorders (including all severities of obstructive sleep apnea (OSA

in adults)), today reported financial results and operating

highlights for the fourth quarter and full year ended December 31,

2023.

Fourth Quarter and Full Year 2023

Financial and Operating Summary

- Revenue was $3.2 million for the fourth quarter of 2023 and

$13.8 million for the full year ended December 31, 2023, compared

to $4.0 million and $16.0 million for the fourth quarter and full

year ended December 31, 2022, respectively, mainly due to lower

appliance revenue and Vivos Integrated Provider (VIP) enrollments,

offset by increased revenue from home sleep testing services and

seminars conducted at the Vivos Institute in Denver. Importantly,

Vivos believes that governmental investigations of unrelated third

parties with non-FDA approved products in the sleep apnea treatment

space adversely impacted new Vivos case starts and VIP enrollments

during 2023.

- Gross profit was $2.1 million for the fourth quarter of 2023

and $8.3 million for the full year ended December 31, 2023,

compared to $2.4 million and $10.0 million for the comparable

periods in 2022, respectively, attributable primarily to the

decrease in revenue;

- Gross margin was 64% and 60% for the fourth quarters of 2023

and 2022, respectively. For the full year ended December 31, 2023,

gross margin was 60%, compared 63% for the full year ended December

31, 2022;

- Operating expenses for the fourth quarter of 2023 decreased by

a significant amount ($2.2 million, or 26%) versus the fourth

quarter of 2022, reflecting Vivos’ previously announced

cost-cutting initiatives including personnel and related expenses.

For the full year ended December 31, 2023 operating expenses

decreased by $9.5 million or 27%, compared to the full year

2022;

- Vivos’ cost-cutting initiatives also led to significant

year-over-year reductions of net loss of $1.8 million, or a 30%

reduction, and $10.3 million, or a 43% reduction, for the fourth

quarter and full year ended December 31, 2023, respectively,

compared to the same periods in 2022. Vivos plans to utilize its

cost reductions to help achieve cash flow positive operations by

the end of 2024 should revenue increase as planned;

- Cash and cash equivalents were $1.6 million at December 31,

2023. Subsequent to year end, in February 2024, an outstanding

common stock purchase warrant held by an institutional investor to

purchase an aggregate of 980,393 shares of Vivos common stock was

exercised for gross proceeds of approximately $4.0 million;

- As of December 31, 2023, patients treated with Vivos’ patented

oral appliances totaled over 42,000 worldwide, compared to over

33,000 as of the end of 2022. Vivos has also trained more than

1,900 dentists in the use of The Vivos Method and Vivos’ related

value-added services, compared to over 1,700 as of the end of

2022;

- In October 2023, Vivos announced two key strategic agreements

with Ormco, a division of publicly-traded Envista Holdings

Corporation, and On Demand Orthodontist (ODO), offering Vivos’

national network of providers access to Spark™ Clear Aligners. The

agreements will expand Vivos’ current product line and are expected

to create near term additional revenue opportunities;

- Also in October, Vivos announced an exclusive distribution

agreement with NOUM DMCC (“Noum”), a Dubai-based company focused on

diagnostic testing and treatment product distribution for

healthcare providers and hospital networks treating obstructive

sleep apnea patients throughout the Middle East-North Africa (MENA)

region. Subject to regulatory approvals, Vivos could see revenue

from this collaboration in 2024;

- Later in October, Vivos announced that its flagship

daytime-nighttime appliance (DNA) will be tested in a clinical

trial at Stanford Medicine. The protocol has been finalized and

participant enrollment will begin in 2024. Study participants with

moderate to severe OSA will be randomly assigned to either

treatment with Vivos’ DNA appliance or CPAP (continuous positive

airway pressure) machine, the current industry standard for OSA

treatment. Sleep studies will be performed prior to and following a

course of treatment using in-lab polysomnography to assess changes

in the patients’ apnea-hypopnea index (AHI);

- On October 27, 2023, Vivos effected a 1-for-25 reverse stock

split of its issued and outstanding common stock. The reverse stock

split was approved at Vivos’ 2023 Annual Meeting of Stockholders on

September 22, 2023;

- In November 2023, Vivos amended its national distribution

agreement with Lincare, a leading supplier of in-home respiratory

therapy products and services for approximately 1.8 million

patients, giving Lincare a six-month exclusivity period to

distribute certain designated Vivos devices. The agreement follows

the successful conclusion of a distribution pilot with Lincare, and

marks an important milestone in Vivos’ strategy to engage with

leading durable medical equipment (DME) companies in the United

States; and

- Later in November, Vivos was granted 510(k) clearance from the

U.S. Food and Drug Administration (FDA) for treating severe OSA in

adults using the Vivos’ removable CARE (Complete Airway

Repositioning and/or Expansion) oral appliances. Vivos’ CARE

appliances include the flagship DNA oral appliance, the mRNA oral

appliance and the mmRNA oral appliance. This represents the first

time the FDA has ever granted an oral appliance a clearance to

treat moderate and severe OSA in adults, 18 years of age and older

along with positive airway pressure (PAP) and/or myofunctional

therapy, as needed.

Kirk Huntsman, Vivos’ Chairman and Chief

Executive Officer, stated, “In 2023, we took a number of steps to

expand our portfolio of proprietary products, open up new revenue

streams, lower our cost structure and strengthen our liquidity

position. We also worked tirelessly to expand our FDA approvals to

put ourselves in a better position for long-term revenue growth. We

have made substantial progress and are now starting to see the

benefits of our actions. In 2023, our operating expenses declined

by 27% annually. That is no small feat and it speaks to the

tremendous efforts of our entire team. Also, these are not one-time

cost reductions. Our results represent ongoing cost efficiencies we

have achieved throughout our entire organization. Based on our

progress to date and our revenue growth efforts for 2024, we

continue to anticipate becoming cash flow positive from operations

by the end of this year.”

“We also took actions to strengthen our capital

structure and improve our liquidity. Last year, we effected a

1-for-25 reverse stock split to come back into compliance with

Nasdaq’s minimum bid requirement. More recently, we completed a $4

million private placement in November and in February we completed

a warrant exercise transaction that generated about $4 million in

gross proceeds. While we expect to look to raise additional capital

in 2024, we believe these actions will go a long way toward

providing us with the necessary capital resources to enact our near

and longer-term growth plans.

“In addition, throughout 2023 we established a

number of key relationships to expand our product line and extend

our international presence into the Middle East/North Africa (MENA)

region. We have also begun to actively cultivate relationships and

collaborations with medical doctors to assist in treating their OSA

patients by local Vivos-trained dentists. We expect that over time,

these relationships will drive higher patient referrals and create

long-term revenue opportunities for us.

“Perhaps most important, in November, we

received FDA 510(k) clearance for our CARE oral medical devices to

treat severe OSA. Since then, we’ve received high levels of

inquiries related to our Vivos CARE products that treat OSA in

adults. As a result, signed VIP enrollment contracts in the fourth

quarter increased 38% sequentially. We are thrilled by this recent

business momentum and expect these higher inquiries and expanded

sales pipeline could create opportunities for revenue growth in

2024.

“As we move through the new year, macroeconomic

trends exiting 2023 and in early 2024 give us optimism that the

larger environment is improving. At the same time, we are seeing

increased interest from dentists and medical professionals related

to our growing portfolio of products, driven by our new FDA

clearance for severe OSA. The FDA clearance to treat severe OSA has

provided the credibility we have needed for medical doctors to

recommend Vivos oral medical devices to their patients. Given all

this, the key relationships we’ve established, our success in

managing costs and reducing our cash burn, our increased liquidity

and enhanced capital structure, we are extremely excited about our

prospects for this year. We believe we have all the necessary tools

in place to implement our growth plans, drive increased revenues

and achieve cash flow positive operations and profitability in the

foreseeable future, and we remain committed to doing so,” Mr.

Huntsman concluded.

Vivos encourages investors and other interested

parties to join its conference call today at 5:00 p.m. Eastern time

(details below), where management will discuss further details on

topics including: (i) Vivos’ expanded product line and revenue

potential, (ii) the potential significant impact of Vivos’ recent

strategic collaborations on Vivos’ near-term revenue growth, (iii)

an update on Vivos’ DME sales and marketing efforts; (iv)

additional programs for dentists to enroll with Vivos, and (v)

Vivos’ current cash position and actions taken to reduce

expenses.

In addition, further information on Vivos’

financial results is included on the attached condensed

consolidated balance sheets and statements of operations, and

additional explanations of Vivos’ financial performance are

provided in the Vivos’ Annual Report on Form 10-K for the twelve

months ended December 31, 2023, which will be filed with the

Securities and Exchange Commission (“SEC”). The full 10-K report

will be available on the SEC Filings section of the Investor

Relations section of Vivos’ website at

https://vivos.com/investor-relations.

Conference Call

To access Vivos’ investor conference call,

please dial (888) 886-7786, or for international callers, (416)

764-8658. A replay will be available shortly after the call and can

be accessed by dialing (844) 512-2921, or for international

callers, (412) 317-6671. The passcode for the live call and the

replay is 27185528. The replay will be available until April 11,

2024.

A live webcast of the conference call can be

accessed on Vivos’ website at https://vivos.com/investor-relations.

An online archive of the webcast will be available on the Company’s

website for 30 days following the call.

About Vivos Therapeutics,

Inc.

Vivos Therapeutics, Inc. (NASDAQ: VVOS) is a

medical technology company focused on developing and

commercializing innovative diagnostic and treatment methods for

patients suffering from breathing and sleep issues arising from

certain dentofacial abnormalities such as obstructive sleep apnea

(OSA) and snoring in adults. The Vivos Method represents the first

clinically effective nonsurgical, noninvasive, nonpharmaceutical

and cost-effective solution for treating mild to severe OSA. It has

proven effective in over 42,000 patients treated worldwide by more

than 1,900 trained dentists.

The Vivos Method includes treatment regimens

that employ the proprietary CARE appliance therapy and other

modalities that alter the size, shape and position of the soft

tissues that comprise a patient’s upper airway and/or palate. The

Vivos Method opens airway space and may significantly reduce

symptoms and conditions associated with mild-to-severe OSA, such as

lowering Apnea Hypopnea Index scores. Vivos also markets and

distributes SleepImage diagnostic technology under its VivoScore

program for home sleep testing in adults and children. The Vivos

Integrated Practice (VIP) program offers dentists training and

other value-added services in connection with using The Vivos

Method.

For more information, visit

www.vivos.com.

Cautionary Note Regarding

Forward-Looking Statements

This press release, the conference call referred

to herein, and statements of the Company’s management made in

connection therewith contain “forward-looking statements” (as

defined in Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended)

concerning future events. Words such as “may”, “should”, “expects”,

“projects,” “intends”, “plans”, “believes”, “anticipates”, “hopes”,

“estimates”, “goal” and variations of such words and similar

expressions are intended to identify forward-looking statements.

These statements involve significant known and unknown risks and

are based upon several assumptions and estimates, which are

inherently subject to significant uncertainties and contingencies,

many of which are beyond Vivos’ control. Actual results (including,

without limitation, the results of the Company’s sales and

marketing initiatives and results of operations) may differ

materially and adversely from those expressed or implied by such

forward-looking statements. Factors that could cause actual results

to differ materially include, but are not limited to: (i) the risk

that Vivos may be unable to implement revenue, sales, marketing,

collaboration and other strategies that increase revenues, (ii) the

risk that some patients may not achieve the desired results from

using Vivos’ products, (iii) risks associated with regulatory

scrutiny of and adverse publicity in the sleep apnea treatment

sector; (iv) the risk that Vivos may be unable to secure additional

financing on reasonable terms when needed, if at all, or maintain

its Nasdaq listing and (v) other risk factors described in Vivos’

filings with the SEC. Vivos’ filings can be obtained free of charge

on the SEC’s website at www.sec.gov. Except to the extent required

by law, Vivos expressly disclaims any obligations or undertaking to

release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in Vivos’

expectations with respect thereto or any change in events,

conditions, or circumstances on which any statement is based.

Vivos Investor Relations and Media

Contact:Julie GannonInvestor Relations

Officer720-442-8113jgannon@vivoslife.com

-Tables Follow-

VIVOS THERAPEUTICS

INC.Unaudited Condensed Consolidated Balance

SheetsDecember 31, 2023 and

2022(In Thousands, Except Per Share

Amounts)

|

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,643 |

|

|

$ |

3,519 |

|

|

Accounts receivable, net of allowance of $250 and $712,

respectively |

|

|

202 |

|

|

|

457 |

|

|

Prepaid expenses and other current assets |

|

|

616 |

|

|

|

1,448 |

|

| |

|

|

|

|

|

|

|

|

|

Total current assets |

|

|

2,461 |

|

|

|

5,424 |

|

| |

|

|

|

|

|

|

|

|

| Long-term

assets |

|

|

|

|

|

|

|

|

|

Goodwill |

|

|

2,843 |

|

|

|

2,843 |

|

|

Property and equipment, net |

|

|

3,314 |

|

|

|

3,082 |

|

|

Operating lease right-of-use asset |

|

|

1,385 |

|

|

|

1,695 |

|

|

Intangible assets, net |

|

|

420 |

|

|

|

302 |

|

|

Deposits and other |

|

|

307 |

|

|

|

374 |

|

| |

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

10,730 |

|

|

$ |

13,720 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

2,145 |

|

|

$ |

1,411 |

|

|

Accrued expenses |

|

|

2,334 |

|

|

|

1,912 |

|

|

Current portion of contract liabilities |

|

|

2,138 |

|

|

|

2,926 |

|

|

Current portion of operating lease liability |

|

|

474 |

|

|

|

419 |

|

|

Other current liabilities |

|

|

198 |

|

|

|

145 |

|

| |

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

|

7,289 |

|

|

|

6,813 |

|

| |

|

|

|

|

|

|

|

|

| Long-term

liabilities |

|

|

|

|

|

|

|

|

|

Contract liabilities, net of current portion |

|

|

289 |

|

|

|

112 |

|

|

Employee retention credit liability |

|

|

1,220 |

|

|

|

- |

|

|

Operating lease liability, net of current portion |

|

|

1,521 |

|

|

|

1,994 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities |

|

|

10,319 |

|

|

|

8,919 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Stockholders’

equity |

|

|

|

|

|

|

|

|

|

Preferred Stock, $0.0001 par value per share. Authorized 50,000,000

shares; no shares issued and outstanding |

|

|

- |

|

|

|

- |

|

|

Common Stock, $0.0001 par value per share. Authorized 200,000,000

shares; issued and outstanding 1,833,877 shares as of December 31,

2023 and 920,592 shares as December 31, 2022 |

|

|

- |

|

|

|

- |

|

|

Additional paid-in capital |

|

|

93,462 |

|

|

|

84,269 |

|

|

Accumulated deficit |

|

|

(93,051 |

) |

|

|

(79,468 |

) |

|

Total stockholders’ equity |

|

|

411 |

|

|

|

4,801 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

10,730 |

|

|

$ |

13,720 |

|

|

|

|

|

|

|

|

|

|

|

VIVOS THERAPEUTICS

INC.Unaudited Condensed Consolidated Statements of

OperationsYears Ended December 31, 2023 and

2022(In Thousands, Except Per Share

Amounts)

|

|

|

2023 |

|

|

2022 |

|

|

Revenue |

|

|

|

|

|

|

|

|

|

Product revenue |

|

$ |

6,270 |

|

|

$ |

8,381 |

|

|

Service revenue |

|

|

7,531 |

|

|

|

7,643 |

|

|

Total revenue |

|

|

13,801 |

|

|

|

16,024 |

|

| |

|

|

|

|

|

|

|

|

|

Cost of sales (exclusive of depreciation and amortization shown

separately below) |

|

|

5,530 |

|

|

|

6,005 |

|

| |

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

8,271 |

|

|

|

10,019 |

|

| |

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

General and administrative |

|

|

22,479 |

|

|

|

29,041 |

|

|

Sales and marketing |

|

|

2,467 |

|

|

|

5,340 |

|

|

Depreciation and amortization |

|

|

621 |

|

|

|

669 |

|

| |

|

|

|

|

|

|

|

|

|

Total operating expenses |

|

|

25,567 |

|

|

|

35,050 |

|

| |

|

|

|

|

|

|

|

|

|

Operating loss |

|

|

(17,296 |

) |

|

|

(25,031 |

) |

| |

|

|

|

|

|

|

|

|

| Non-operating income

(expense) |

|

|

|

|

|

|

|

|

|

Other expense |

|

|

(212 |

) |

|

|

(190 |

) |

|

PPP loan forgiveness |

|

|

- |

|

|

|

1,287 |

|

|

Excess warrant fair value |

|

|

(6,453 |

) |

|

|

- |

|

|

Change in fair value of warrant liability, net of issuance costs of

$645 |

|

|

10,231 |

|

|

|

- |

|

|

Other income |

|

|

147 |

|

|

|

89 |

|

|

Loss before income taxes |

|

|

(13,583 |

) |

|

|

(23,845 |

) |

| |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(13,583 |

) |

|

$ |

(23,845 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss per share (basic and

diluted) |

|

$ |

(11.14 |

) |

|

$ |

(25.90 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted average number of

shares of Common Stock outstanding (basic and diluted) |

|

|

1,219,381 |

|

|

|

920,592 |

|

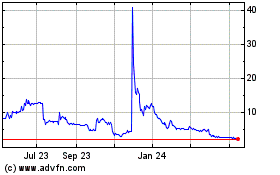

Vivos Therapeutics (NASDAQ:VVOS)

Historical Stock Chart

From Dec 2024 to Jan 2025

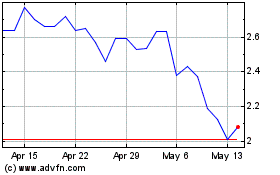

Vivos Therapeutics (NASDAQ:VVOS)

Historical Stock Chart

From Jan 2024 to Jan 2025