Viridian Therapeutics, Inc.DE false 0001590750 --12-15 0001590750 2023-12-15 2023-12-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 15, 2023

VIRIDIAN THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-36483 |

|

47-1187261 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 221 Crescent Street, Suite 401 Waltham, MA |

|

02453 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (617) 272-4600

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

|

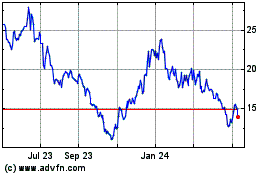

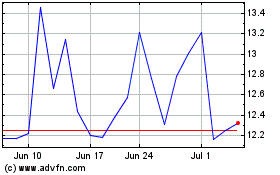

VRDN |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.03 |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

Effective December 15, 2023, the board of directors (the “Board”) of Viridian Therapeutics, Inc. (the “Company”) adopted the Fourth Amended and Restated Bylaws of the Company (the “Bylaws”). The Bylaws have been amended to designate the federal district courts of the United States as the sole and exclusive forum for any complaint asserting a cause of action arising under the Securities Act of 1933, as amended (the “Securities Act”).

The foregoing summary of the changes effected by the Bylaws does not purport to be complete and is qualified in its entirety by reference to the complete text of the Bylaws, which are attached hereto as Exhibit 3.1 and are incorporated herein by reference.

| Item 7.01 |

Regulation FD Disclosure. |

On December 18, 2023, the Company issued a press release announcing positive clinical data in its healthy volunteer study and the selection of VRDN-003 as a potential best-in-class subcutaneous (“SC”) anti insulin-like growth factor-1 receptor (“IGF-1R”) program with extended half-life for pivotal development in thyroid eye disease (“TED”). The Company will host a conference call and webcast today, Monday, December 18, 2023 at 8:00 a.m., Eastern Time, to discuss the data results and other updates.

A copy of the press release and the data presentation that will be referenced during the conference call are furnished as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K and are incorporated by reference herein. The exhibits furnished under Item 7.01 of this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act, regardless of any general incorporation language in such filing.

On December 18, 2023, the Company announced the selection of VRDN-003 as its lead SC program for TED based on positive data from a Phase 1 clinical study in healthy volunteers. The data showed that VRDN-003 has an extended half-life of 40-50 days, about 4-5 times longer than VRDN-001 and based upon comparisons of publicly disclosed data, significantly longer than other first generation anti IGF-1R antibodies. VRDN-003 was well tolerated and exhibited sustained pharmacodynamics supporting its development as a potential best-in-class, more convenient, less frequent, low-volume, self-administered, subcutaneous IGF-1R therapy for patients with TED.

VRDN-003 Results

VRDN-003 is a monoclonal antibody that acts as a full antagonist of IGF-1R, a clinically and commercially validated target for TED. VRDN-003 utilizes the same binding domain as VRDN-001 and is engineered with three amino acid changes to the Fc region designed to extend the half-life of the parent antibody, and therefore potentially enabling less frequent and more convenient dosing. VRDN-003 is designed to maintain the clinical response of VRDN-001 IV while significantly increasing patient convenience.

| |

• |

|

Study Design: VRDN-003 was dosed in four single dose cohorts of healthy volunteers at a concentration of 150 mg/ml receiving 5 mg/kg IV (n=4), 300 mg SC (n=6), 15 mg/kg IV (n=4) and 600 mg SC (n=6). A fifth cohort of two doses of VRDN-003 (n=4) is ongoing. |

| |

• |

|

Extended Half Life: VRDN-003 pharmacokinetics data showed an extended half-life of 40-50 days, which is a 4-to-5-fold increase over the half-life of VRDN-001 (which showed a half-life of 10-12 days). |

| |

• |

|

Prolonged Pharmacodynamics (“PD”): Following a single subcutaneous dose of VRDN-003, IGF-1 serum levels increased approximately 4-fold at peak. This was consistent with the increases in IGF-1 levels that have been shown in the clinic following a single dose of VRDN-001 SC and IV. IGF-1 is a PD biomarker for IGF-1R target engagement. IGF-1R inhibition by an anti-IGF-1R antibody demonstrated an increase in serum levels of its natural ligand IGF-1. |

| |

• |

|

Well Tolerated: VRDN-003 was well tolerated in all subjects with no serious adverse events. All treatment-related, treatment-emergent adverse events were grade 1 (mild). In the reported dataset, no antidrug antibodies (“ADAs”) were detected. |

| |

• |

|

Dosing Flexibility for Pivotal Development: VRDN-003 modeling demonstrates dosing flexibility for the program’s anticipated global pivotal development. |

| |

• |

|

Q8W (dosing once every 8 weeks): Modeled dose schedule is predicted to achieve Cmin and Cavg exposure achieved with 3 mg/kg VRDN-001 IV. |

| |

• |

|

Q4W (dosing once every 4 weeks): Modeled dose schedule is predicted to achieve Cmin exposures seen for 10 mg/kg VRDN-001 IV and exceed the Cavg exposure seen for 3 mg/kg by a factor of 2. |

| |

• |

|

Q2W (dosing once every 2 weeks): Modeled dose schedule is predicted to exceed Cmin exposures seen for 20 mg/kg VRDN-001 IV and the Cavg exposures seen for 10 mg/kg VRDN-001 IV. |

Based on the data reported, VRDN-003 has been selected as the Company’s go-forward candidate for subcutaneous development. The Company expects to initiate the VRDN-003 pivotal program in mid-2024, pending alignment with regulatory authorities. Based on these positive results and the expected development timeline for VRDN-003, both VRDN-001 SC and VRDN-002 SC development have been deprioritized.

VRDN-001 SC and VRDN-002 Results

VRDN-001 SC is a subcutaneous formulation of the same antibody being evaluated as an IV product candidate in the company’s ongoing Phase 3 THRIVE and THRIVE-2 clinical trials. The Phase 1 healthy volunteer study included a cohort of the SC formulation of VRDN-001 at a concentration of 150 mg/ml dosed in two single dose cohorts of healthy volunteers either receiving 3.5 mg/kg IV (n= 8) or 300mg SC (n=8). SC data showed an expected half-life of 10-12 days. Q1W dosing of VRDN-001 SC was modeled to achieve or exceed exposures shown for 10 mg/kg VRDN-001 IV and would be expected to achieve comparable clinical response to VRDN-001 10 mg/kg IV. VRDN-001 SC also showed an increase in IGF-1 levels similar to VRDN-001 IV and VRDN-003 SC. VRDN-001 SC was well tolerated in all subjects with no serious adverse events. All treatment-related, treatment-emergent adverse events were grade 1 (mild) and grade 2 (moderate).

VRDN-002 is a different and novel monoclonal antibody targeting IGF-1R as compared to VRDN-001 or VRDN-003. Similar to VRDN-003, VRDN-002 was engineered to have an extended half-life to allow for less frequent dosing. VRDN-002 SC was dosed at a concentration of 150 mg/ml in two single dose cohorts of healthy volunteers, either receiving 3.5mg/kg IV (n=8) or 300mg SC (n=8). Healthy volunteer data for VRDN-002 showed an extended half-life of 43 days as previously disclosed. VRDN-002 also showed a prolonged pharmacodynamic effect and increased IGF-1 levels, but the magnitude of increase was not as great as with VRDN-003 or VRDN-001. VRDN-002 was well tolerated in all subjects with no serious adverse events. All treatment-related, treatment-emergent adverse events were grade 1 (mild). No ADAs were detected.

Next Steps for the Development of VRDN-003 in TED

Based on the results reported, the company expects to initiate global pivotal clinical trials of VRDN-003 in mid-2024 with planned trials in both active and chronic TED patients pending alignment with regulatory authorities.

Forward-Looking Statements

This Current Report on Form 8-K and the press release contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements may be identified by the use of words such as, but not limited to, “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” or other similar terms or expressions that concern the Company’s expectations, plans and intentions. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on the Company’s current beliefs, expectations, and assumptions. Forward-looking statements include, without limitation, statements regarding: the therapeutic potential and utility, efficacy and clinical benefits of VRDN-003 for TED; the expected exposure levels of VRDN-003; the safety profile of VRDN-003; the potential dosing frequency for VRDN-003; trial designs, clinical development plans and timing for VRDN-003, including the global pivotal clinical trials of VRDN-003 in active and chronic TED patients; the expected attractiveness of VRDN-003 and convenience for patients; and anticipated work

with regulatory authorities. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. No representations or warranties (expressed or implied) are made about the accuracy of any such forward-looking statements. Such forward-looking statements are subject to a number of material risks and uncertainties including but not limited to: the potential efficacy and safety of VRDN-001, VRDN-002, and VRDN-003 for the treatment of TED; the potential for VRDN-006 and VRDN-008; the relationship between the results from the positive data from completed or ongoing clinical trials and the results of ongoing or future clinical trials; the timing, progress and plans for the Company’s ongoing or future research, pre-clinical and clinical development programs; trial protocols for ongoing clinical trials; expectations regarding the timing for IND filings; expectations regarding the timing for enrollment and data; uncertainty and potential delays related to clinical drug development; the duration and impact of regulatory delays in the Company’s clinical programs; the timing of and the Company’s ability to obtain and maintain regulatory approvals for its therapeutic candidates; manufacturing risks; competition from other therapies or products; estimates of market size; other matters that could affect the sufficiency of existing cash, cash equivalents and short-term investments to fund operations; the Company’s financial position and its projected cash runway; the Company’s future operating results and financial performance; the clinical utility of the Company’s therapeutic candidates and its intellectual property position; the timing of pre-clinical and clinical trial activities and reporting results from same, including those risks set forth under the caption “Risk Factors” in the Company’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (“SEC”) on November 13, 2023 and other subsequent disclosure documents filed with the SEC. Any forward-looking statement speaks only as of the date on which it was made. Neither the Company, nor its affiliates, advisors, or representatives, undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date hereof.

The following risk factor is provided to supplement the Company’s risk factor disclosure contained in the Company’s prior public filings, including those discussed under the heading “Item 1A. Risk Factors” in the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2023.

Preliminary data from our clinical trials that we announce or publish are subject to audit and verification procedures that could result in material changes in the final data.

From time to time, we publish preliminary data from our clinical trials. On December 18, 2023, we reported clinical data from our Phase 1 clinical study in healthy volunteers and announced the selection of VRDN-003 as our lead subcutaneous program for TED. This data set includes preliminary data which was not subject to the standard quality control measures typically associated with final clinical trial results. Based on the comparable pharmacology of VRDN-003 and VRDN-001, we believe VRDN-003 can maintain the clinical response of VRDN-001 IV while significantly increasing patient convenience. However, the data from our Phase 2 trials for VRDN-001 may also not be fully reflective of topline results for our Phase 3 THRIVE and THRIVE -2 trials which are expected in 2024. Topline or preliminary data from our clinical trials that we announce or publish from time to time, including the data from our Phase 1 study in healthy volunteers and the data for VRDN-001 from our ongoing trials, may change as more patient data become available, and we become subject to audit and verification procedures that could result in material changes in the final data. This creates a risk that the final results could be materially different from the preliminary results reported to date. Significant adverse differences between preliminary data and final data could materially harm our reputation and business prospects.

| Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Viridian Therapeutics, Inc. |

|

|

|

|

| Date: December 18, 2023 |

|

|

|

By: |

|

/s/ Stephen Mahoney |

|

|

|

|

|

|

Stephen Mahoney |

|

|

|

|

|

|

President, Chief Executive Officer, and Director |

Exhibit 3.1

FOURTH AMENDED AND RESTATED BYLAWS

OF

VIRIDIAN

THERAPEUTICS, INC.

ARTICLE 1

OFFICES

Section 1.01.

Registered Office. The registered office of Viridian Therapeutics, Inc. (hereinafter, the “Corporation”) shall be in the City of Wilmington, County of New Castle, State of Delaware 19810.

Section 1.02. Other Offices. The Corporation may also have offices at such other places both within and without the State of

Delaware as the board of directors of the Corporation (the “Board of Directors”) may from time to time determine or the business of the Corporation may require.

Section 1.03. Books. The books of the Corporation may be kept within or without the State of Delaware as the Board of Directors

may from time to time determine or the business of the Corporation may require.

ARTICLE 2

MEETINGS OF STOCKHOLDERS

Section 2.01. Time and Place of Meetings. All meetings of the stockholders shall be held at such place, if any, either within or

without the State of Delaware, on such date and at such time as may be determined from time to time by the Board of Directors (or the Chairman in the absence of a designation by the Board of Directors).

Section 2.02. Annual Meetings. An annual meeting of the stockholders, commencing with the year 2015, shall be held for the

election of directors and to transact such other business as may properly be brought before the meeting. Any other proper business may be transacted at the annual meeting. The Board of Directors may postpone, reschedule or cancel any annual meeting

of stockholders previously scheduled by the Board of Directors.

Section 2.03. Special Meetings. Special meetings of the

stockholders for any purpose or purposes may be called by the Board of Directors, the Chairman of the Board of Directors or the President of the Corporation, and may not be called by any other person. Business transacted at any special meeting of

the stockholders shall be limited to the purposes stated in the notice. The Board of Directors may postpone, reschedule or cancel any special meeting of stockholders previously scheduled by the Board of Directors. Notwithstanding the foregoing,

whenever holders of one or more classes or series of Preferred Stock shall have the right, voting separately as a class or series, to elect directors, such holders may call, pursuant to the terms of the resolution or resolutions adopted by the Board

of Directors pursuant to Article 4 hereto, special meetings of holders of such Preferred Stock.

Section 2.04. Notice of Meetings

and Adjourned Meetings; Waivers of Notice.

(a) Whenever stockholders are required or permitted to take any action at a meeting, a

written notice of the meeting shall be given which shall state the place, if any, date and hour of the meeting, the means of remote communications, if any, by which stockholders and proxy holders may be deemed to be present in person and vote at

such meeting, the record date for determining the stockholders entitled to vote at the meeting (if such date is different from the record date for stockholders entitled to notice of the meeting) and, in the case of a special meeting, the purpose or

purposes for which the meeting is called. Unless otherwise provided by the General Corporation Law of the State of Delaware as the same exists or may hereafter be amended (“Delaware Law”), the Certificate of Incorporation or these Bylaws,

such notice of any meeting shall be given not less than ten (10) nor more than sixty (60) days before the date of the meeting to each stockholder of record entitled to vote at such meeting. Except as otherwise provided herein or permitted

by applicable law, notice of stockholders shall be in writing and delivered personally or mailed to the stockholders at their address appearing on the books of the Corporation. Without limiting the manner by which notice otherwise may be given

effectively to stockholders, notice of meetings may be given to stockholders by means of electronic transmission in accordance with applicable law.

1

(b) Any meeting of the stockholders, annual or special, may be adjourned from time to time

to reconvene at the same or some other place, if any. Unless these Bylaws otherwise require, when a meeting is adjourned to another time or place (whether or not a quorum is present), notice need not be given of the adjourned meeting if the time,

place, if any, thereof and the means of remote communications, if any, by which stockholders and proxy holders may be deemed to be present in person and vote at such meeting, are announced at the meeting at which the adjournment is taken. At the

adjourned meeting, the Corporation may transact any business which might have been transacted at the original meeting. If the adjournment is for more than thirty (30) days, or after the adjournment a new record date is fixed for the adjourned

meeting, a notice of the adjourned meeting shall be given to each stockholder of record entitled to vote at the meeting as of the record date for determining the stockholders entitled to notice of the meeting. If mailed, such notice shall be deemed

to be given when deposited in the United States mail, postage prepaid, directed to the stockholder at such stockholder’s address as it appears on the records of the Corporation.

(c) A written waiver of any such notice signed by the person entitled thereto, or a waiver by electronic transmission by the person entitled

to notice, whether before or after the time stated therein, shall be deemed equivalent to notice. Attendance of a person at a meeting shall constitute a waiver of notice of such meeting, except when the person attends the meeting for the express

purpose of objecting, at the beginning of the meeting, to the transaction of any business because the meeting is not lawfully called or convened. Any stockholder so waiving notice of the meeting shall be bound by the proceedings of the meeting in

all respects as if due notice thereof had been given. Business transacted at any special meeting of stockholders shall be limited to the purposes stated in the notice.

Section 2.05. Quorum. Unless otherwise provided in the Certificate of Incorporation or these Bylaws, and subject to Delaware Law,

the presence, in person or by proxy, of the holders of a majority of the outstanding capital stock of the Corporation entitled to vote at a meeting of stockholders shall constitute a quorum for the transaction of business. If, however, such quorum

shall not be present or represented at any meeting of the stockholders, then the chairman of the meeting, or a majority of the voting power entitled to vote thereat, present in person or represented by proxy, shall have the power to adjourn the

meeting in the manner provided in Section 2.04, without notice other than announcement at the meeting, until a quorum shall be present or represented. A quorum once established, shall not be broken by the subsequent withdrawal of enough votes

to leave less than a quorum. At such adjourned meeting at which a quorum shall be present or represented, any business may be transacted which might have been transacted at the meeting as originally notified. Shares of stock of the Corporation

belonging to the Corporation or to another corporation, if a majority of the shares entitled to vote in the election of directors of such other corporation is held, directly or indirectly, by the Corporation, shall neither be entitled to vote nor be

counted for quorum purposes; provided, however, that the foregoing shall not limit the right of the Corporation, or any subsidiary of the Corporation, to vote stock, including but not limited to its own stock, held by it in a fiduciary capacity.

Section 2.06. Voting; Proxies.

(a) Unless otherwise provided in the Certificate of Incorporation and subject to Delaware Law, each stockholder shall be entitled to one vote

for each outstanding share of capital stock of the Corporation held by such stockholder. Any share of capital stock of the Corporation held by the Corporation shall have no voting rights. Except as otherwise provided by law, the Certificate of

Incorporation or these Bylaws, in all matters other than the election of directors, the affirmative vote of the majority of the votes cast at a meeting of the stockholders by the holders of stock entitled to vote on such matter shall be the act of

the stockholders. Subject to the rights of the holders of any series of preferred stock to elect additional directors under specific circumstances, directors shall be elected by a plurality of the votes cast at a meeting of the stockholders by the

holders of stock entitled to vote on the election of directors.

(b) Each stockholder entitled to vote at a meeting of stockholders, or to

express consent or dissent to a corporate action in writing without a meeting, may authorize another person or persons to act for such stockholder by proxy, appointed by an instrument in writing, subscribed by such stockholder or by his attorney

thereunto authorized, or by proxy sent by cable, telegram or by any means of electronic communication permitted by law, which results in a writing from such stockholder or by his attorney, and delivered to the secretary of the meeting. No proxy

shall be voted or acted upon after three (3) years from its date, unless said proxy provides for a

2

longer period. A proxy shall be irrevocable if it states that it is irrevocable and if, and only as long as, it is coupled with an interest sufficient in law to support an irrevocable power. A

stockholder may revoke any proxy which is not irrevocable by attending the meeting and voting in person or by delivering to the Secretary of the Corporation a revocation of the proxy or a new proxy bearing a later date.

(c) Voting at meetings of stockholders need not be by written ballot. Votes may be cast by any stockholder entitled to vote in person or by

his proxy. In determining the number of votes cast for or against a proposal or nominee, shares abstaining from voting on a matter (or votes withheld in the case of director elections) will not be treated as votes cast, but will be counted for

purposes of determining a quorum. A non-vote by a broker will be counted for purposes of determining a quorum but not for purposes of determining the number of votes cast.

Section 2.07. Inspector of Elections; Opening and Closing the Polls. The Board of Directors by resolution shall appoint one or

more inspectors, which inspector or inspectors may include individuals who serve the Corporation in other capacities, including, without limitation, as officers, employees, agents or representatives, to act at the meetings of stockholders and make a

written report thereof. One or more persons may be designated as alternate inspectors to replace any inspector who fails to act. If no inspector or alternate has been appointed to act or is able to act at a meeting of stockholders, the presiding

officer of the meeting shall appoint one or more inspectors to act at the meeting. Each inspector, before discharging his or her duties, shall take and sign an oath faithfully to execute the duties of inspector with strict impartiality and according

to the best of his or her ability. The inspectors shall have the duties prescribed by law. The presiding officer of the meeting shall fix and announce at the meeting the date and time of the opening and the closing of the polls for each matter upon

which the stockholders will vote at a meeting.

Section 2.08.[Reserved].

Section 2.09. Organization. At each meeting of stockholders, the Chairman of the Board, if one shall have been elected, or in the

Chairman’s absence or if one shall not have been elected, the director designated by the vote of the majority of the directors, shall act as chairman of, and preside at, the meeting. The Secretary, or in the Secretary’s absence or

inability to act, the person whom the chairman of the meeting shall appoint secretary of the meeting, shall act as secretary of the meeting and keep the minutes thereof.

Section 2.10. Order of Business. The order of business at all meetings of stockholders shall be as determined by the chairman of

the meeting.

Section 2.11. Nomination of Directors. Only persons who are nominated in accordance with the procedures set

forth in these Bylaws shall be eligible to serve as directors. Nominations of persons for election to the Board of Directors of the Corporation may be made at a meeting of stockholders (a) by or at the direction of the Board of Directors or

(b) by any stockholder of the Corporation who is a stockholder of record at the time of giving of notice provided for in this Section 2.11, who shall be entitled to vote for the election of directors at the meeting and who complies with

the notice procedures set forth in this Section 2.11. Such nominations, other than those made by or at the direction of the Board of Directors, shall be made pursuant to timely notice in writing to the secretary of the Corporation. To be

timely, a stockholder’s notice shall be delivered to or mailed and received at the principal executive offices of the Corporation not later than the close of business on the sixtieth (60th) day, nor earlier than the close of business on the

ninetieth (90th) day in advance of the first anniversary of the preceding year’s annual meeting of stockholders; provided, however, that in the event that the date of the annual meeting is advanced more than thirty (30) days prior to such

anniversary date or delayed more than sixty (60) days after such anniversary date then to be timely such notice must be received by the Corporation no later than the later of the close of business on the seventieth (70th) day prior to the date

of the meeting or the close of business on the tenth (10th) day following the day on which public announcement of the date of the meeting was made. In no event shall the public announcement of the new meeting date commence a new notice time period

(or extend any notice time period). Such stockholder’s notice shall set forth (a) as to each person whom the stockholder proposes to nominate for election or reelection as a director, all information relating to such person that is

required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934 (including such person’s written consent to being named

in the proxy statement as a nominee and to serving as a director if elected); and (b) as to the stockholder giving the notice (i) the name and address, as they appear on the Corporation’s books, of such stockholder, and of the

beneficial owner, if any, on

3

whose behalf the nomination is being made, (ii) the class and number of shares of the Corporation which are owned (beneficially and of record) by such stockholder and owned by the beneficial

owner, if any, on whose behalf the nomination is being made, as of the date of the stockholder’s notice, and a representation that the stockholder will notify the Corporation in writing of the class and number of such shares owned of record and

beneficially as of the record date for the meeting promptly following the later of the record date or the date notice of the record date is first publicly disclosed, (iii) a description of any agreement, arrangement or understanding with

respect to such nomination between or among the stockholder and any of its affiliates or associates, and any others (including their names) acting in concert with any of the foregoing, and a representation that the stockholder will notify the

Corporation in writing of any such agreement, arrangement or understanding in effect as of the record date for the meeting promptly following the later of the record date or the date notice of the record date is first publicly disclosed, (iv) a

description of any agreement, arrangement or understanding (including, regardless of the form of settlement, any derivative, long or short positions, profit interests, forwards, futures, swaps, options, warrants, convertible securities, stock

appreciation or similar rights, hedging transactions and borrowed or loaned shares) that has been entered into as of the date of the proposing stockholder’s notice, by or on behalf of such stockholder with respect to the Corporation’s

securities, or any other agreement, arrangement or understanding that has been made, the effect or intent of which is to create or mitigate loss to, manage risk or benefit of share price changes for, or increase or decrease the voting power of, such

stockholder with respect to the Corporation’s securities, and a representation that the stockholder will notify the Corporation in writing of any such agreement, arrangement or understanding in effect as of the record date for the meeting

promptly following the later of the record date or the date notice of the record date is first publicly disclosed, (v) a representation that the proposing stockholder is a holder of record of the shares of the Corporation entitled to vote at

the meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice, and (vi) a representation whether the proposing stockholder intends to deliver a proxy statement and/or form of

proxy to holders of at least the percentage of the Corporation’s outstanding capital stock required to approve the nomination and/or otherwise to solicit proxies from the stockholders in support of the nomination. The Corporation may require

any proposed nominee to furnish such other information as it may reasonably require to determine the eligibility of such proposed nominee to serve as an independent director of the Corporation or that could be material to a reasonable

stockholder’s understanding of the independence, or lack thereof, of such nominee. At the request of the Board of Directors, any person nominated by the Board of Directors for election as a director shall furnish to the secretary of the

Corporation that information required to be set forth in a stockholder’s notice of nomination that pertains to the nominee. No person shall be eligible to serve as a director of the Corporation unless nominated in accordance with the procedures

set forth in this bylaw. The chairman of the meeting shall, if the facts warrant, determine and declare to the meeting that a nomination was not made in accordance with the procedures prescribed by the Bylaws, and if he should so determine, he shall

so declare to the meeting and the defective nomination shall be disregarded. Notwithstanding the foregoing provisions of this Section 2.11, a stockholder shall also comply with all applicable requirements of the Securities Exchange Act of 1934,

and the rules and regulations thereunder with respect to the matters set forth in this Section 2.11.

Section 2.12. Notice of

Business. At any meeting of the stockholders, only such business shall be conducted as shall have been brought before the meeting (a) by or at the direction of the Board of Directors or (b) by any stockholder of the Corporation who is

a stockholder of record at the time of giving of the notice provided for in this Section 2.12, who shall be entitled to vote at such meeting and who complies with the notice procedures set forth in this Section 2.12. In addition, any

proposal of business must be a proper matter for stockholder action. For business to be properly brought before a stockholder meeting by a stockholder, the stockholder must have given timely notice thereof in writing to the secretary of the

Corporation. To be timely, a stockholder’s notice shall be delivered to or mailed and received at the principal executive offices of the Corporation not later than the close of business on the sixtieth (60th) day, nor earlier than the close of

business on the ninetieth (90th) day in advance of the first anniversary of the preceding year’s annual meeting of stockholders; provided, however, that in the event that the date of the annual meeting is advanced more than thirty

(30) days prior to such anniversary date or delayed more than sixty (60) days after such anniversary date then to be timely such notice must be received by the Corporation no later than the later of the close of business on the seventieth

(70th) day prior to the date of the meeting or the close of business on the tenth (10th) day following the day on which public announcement of the date of the meeting was made. In no event shall the public announcement of the new meeting date

commence a new notice time period (or extend any notice time period). A stockholder’s notice to the secretary shall set forth as to each matter the stockholder proposes to bring before the meeting (a) a brief description of the business

desired to be brought before the meeting and the reasons for conducting such business at the meeting, (b) the name and address, as they appear

4

on the Corporation’s books, of the stockholder proposing such business and of the beneficial owner, if any, on whose behalf the proposal is being made, (c) the class and number of

shares of the Corporation which are owned (beneficially and of record) by such stockholder and owned by the beneficial owner, if any, on whose behalf the proposal is being made, as of the date of the stockholder’s notice, and a representation

that the stockholder will notify the Corporation in writing of the class and number of such shares owned of record and beneficially as of the record date for the meeting promptly following the later of the record date or the date notice of the

record date is first publicly disclosed, (d) a description of any agreement, arrangement or understanding with respect to such nomination between or among the stockholder and any of its affiliates or associates, and any others (including their

names) acting in concert with any of the foregoing, and a representation that the stockholder will notify the Corporation in writing of any such agreement, arrangement or understanding in effect as of the record date for the meeting promptly

following the later of the record date or the date notice of the record date is first publicly disclosed, (e) a description of any agreement, arrangement or understanding (including, regardless of the form of settlement, any derivative, long or

short positions, profit interests, forwards, futures, swaps, options, warrants, convertible securities, stock appreciation or similar rights, hedging transactions and borrowed or loaned shares) that has been entered into as of the date of the

proposing stockholder’s notice, by or on behalf of such stockholder with respect to the Corporation’s securities, or any other agreement, arrangement or understanding that has been made, the effect or intent of which is to create or

mitigate loss to, manage risk or benefit of share price changes for, or increase or decrease the voting power of, such stockholder with respect to the Corporation’s securities, and a representation that the stockholder will notify the

Corporation in writing of any such agreement, arrangement or understanding in effect as of the record date for the meeting promptly following the later of the record date or the date notice of the record date is first publicly disclosed, (f) a

representation that the proposing stockholder is a holder of record of the shares of the Corporation entitled to vote at the meeting and intends to appear in person or by proxy at the meeting to propose the business specified in the notice,

(g) a representation whether the proposing stockholder intends to deliver a proxy statement and/or form of proxy to holders of at least the percentage of the Corporation’s outstanding capital stock required to approve the proposal and/or

otherwise to solicit proxies from the stockholders in support of the proposal, (h) any material interest of the stockholder in such business, and (i) any other information relating to such stockholder and beneficial owner, if any, on whose

behalf the proposal is being made, required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for the proposal and pursuant to and in accordance with Regulation 14A under the

Securities Exchange Act of 1934. Notwithstanding anything in the Bylaws to the contrary, no business shall be conducted at a stockholder meeting except in accordance with the procedures set forth in this Section 2.12. The chairman of the

meeting shall, if the facts warrant, determine and declare to the meeting that business was not properly brought before the meeting and in accordance with the provisions of the Bylaws, and if he should so determine, he shall so declare to the

meeting and any such business not properly brought before the meeting shall not be transacted. Notwithstanding the foregoing, provisions of this Section 2.12, a stockholder shall also comply with all applicable requirements of the Securities

Exchange Act of 1934, and the rules and regulations thereunder with respect to the matters set forth in this Section 2.12.

Section 2.13. Proxy Rules. The foregoing notice requirements of Section 2.12 shall be deemed satisfied by a stockholder with

respect to business other than a nomination if the stockholder has notified the Corporation of his, her or its intention to present a proposal at an annual meeting in compliance with the applicable rules and regulations promulgated under Regulation

14A under the Securities Exchange Act of 1934 and such stockholder’s proposal has been included in a proxy statement that has been prepared by the Corporation to solicit proxies for such annual meeting.

Section 2.14. Effect of Noncompliance. Notwithstanding anything in these Bylaws to the contrary: (i) no nominations shall be

made or business shall be conducted at any annual meeting except in accordance with the procedures set forth in this Article 2, and (ii) unless otherwise required by law, if a stockholder intending to propose business or make nominations at an

annual meeting pursuant to this Article 2 does not provide the information required under this Article 2 to the Corporation promptly following the later of the record date or the date notice of the record date is first publicly disclosed, or the

proposing stockholder (or a qualified representative of the proposing stockholder) does not appear at the meeting to present the proposed business or nominations, such business or nominations shall not be considered, notwithstanding that proxies in

respect of such business or nominations may have been received by the Corporation. The requirements of this Article 2 shall apply to any business or nominations to be brought before an annual meeting by a stockholder whether such business or

nomination are to be included in the Corporation’s proxy statement pursuant to Rule 14a-8 of the Exchange Act or presented to stockholders by

5

means of an independently financed proxy solicitation. The requirements of this Article 2 are included to provide the Corporation notice of a stockholder’s intention to bring business or

nominations before an annual meeting and shall in no event be construed as imposing upon any stockholder the requirement to seek approval from the Corporation as a condition precedent to bringing any such business or making such nominations before

an annual meeting.

ARTICLE 3

DIRECTORS

Section 3.01.

General Powers. Except as otherwise provided by Delaware Law or the Certificate of Incorporation, the business and affairs of the Corporation shall be managed by or under the direction of the Board of Directors. The Board of Directors may

adopt such rules and procedures, not inconsistent with the Certificate of Incorporation, these Bylaws, Delaware Law or other applicable law as it may deem proper for the conduct of its meetings and the management of the Corporation

Section 3.02. Number, Election and Term of office. The Board of Directors shall consist of not less than three (3) nor more

than eleven (11) directors, with the exact number of directors to be determined from time to time solely by resolution adopted by the affirmative vote of a majority of the entire Board of Directors. Except as otherwise provided in the

Certificate of Incorporation, each director shall serve for a term ending on the date of the annual meeting of stockholders next following the annual meeting at which such director was elected. Notwithstanding the foregoing, each director shall hold

office until such director’s successor shall have been duly elected and qualified or until such director’s earlier death, resignation or removal. Directors need not be stockholders.

Section 3.03. Quorum and Manner of Acting. Unless the Certificate of Incorporation or these Bylaws require a greater number, the

presence of a majority of the total number of directors shall constitute a quorum for the transaction of business, and the affirmative vote of a majority of the directors present at a meeting at which a quorum is present shall be the act of the

Board of Directors. When a meeting is adjourned to another time or place (whether or not a quorum is present), notice need not be given of the adjourned meeting if the time and place thereof are announced at the meeting at which the adjournment is

taken. At the adjourned meeting, the Board of Directors may transact any business which might have been transacted at the original meeting. If a quorum shall not be present at any meeting of the Board of Directors the directors present thereat shall

adjourn the meeting, from time to time, without notice other than announcement at the meeting, until a quorum shall be present.

Section 3.04. Time and Place of Meetings. The Board of Directors shall hold its meetings at such place, either within or without

the State of Delaware, and at such time as may be determined from time to time by the Board of Directors (or the Chairman in the absence of a determination by the Board of Directors).

Section 3.05. Annual Meeting. The Board of Directors shall meet for the purpose of organization, the election of officers and the

transaction of other business, as soon as practicable after each annual meeting of stockholders, on the same day and at the same place where such annual meeting shall be held. Notice of such meeting need not be given. In the event such annual

meeting is not so held, the annual meeting of the Board of Directors may be held at such place either within or without the State of Delaware, on such date and at such time as shall be specified in a notice thereof given as hereinafter provided in

Section 3.07 herein or in a waiver of notice thereof signed by any director who chooses to waive the requirement of notice.

Section 3.06. Regular Meetings. After the place and time of regular meetings of the Board of Directors shall have been determined

and notice thereof shall have been once given to each member of the Board of Directors, regular meetings may be held without further notice being given.

Section 3.07. Special Meetings. Special meetings of the Board of Directors may be called by the Chairman of the Board or the

President and shall be called by the Chairman of the Board, President or Secretary on the written request of three or more directors. Notice of special meetings of the Board of Directors shall be given to each director at least 24 hours before the

date of the meeting via email, in writing or in such other manner as is determined by the Board of Directors.

6

Section 3.08. Committees. The Board of Directors may designate one or more

committees, each committee to consist of one or more of the directors of the Corporation. The Board may designate one or more directors as alternate members of any committee, who may replace any absent or disqualified member at any meeting of the

committee. In the absence or disqualification of a member of a committee, the member or members present at any meeting and not disqualified from voting, whether or not such member or members constitute a quorum, may unanimously appoint another

member of the Board of Directors to act at the meeting in the place of any such absent or disqualified member. Any such committee, to the extent provided in the resolution of the Board of Directors or by applicable law, shall have and may exercise

all the powers and authority of the Board of Directors in the management of the business and affairs of the Corporation, and may authorize the seal of the Corporation to be affixed to all papers which may require it; but no such committee shall have

the power or authority in reference to the following matter: (a) approving or adopting, or recommending to the stockholders, any action or matter expressly required by Delaware Law to be submitted to the stockholders for approval or

(b) adopting, amending or repealing any bylaw of the Corporation. Unless the Board of Directors provides otherwise, at all meetings of such committee, a majority of the then authorized members of the committee shall constitute a quorum for the

transaction of business, and the vote of a majority of the members of the committee present at the meeting at which there is a quorum shall be the act of the Committee. Each committee shall keep regular minutes of its meetings and report the same to

the Board of Directors when required. Except as otherwise provided in the Certificate of Incorporation, these Bylaws, or the resolution of the Board of Directors designating the committee, a committee may create one or more subcommittees, each

subcommittee to consist of one or more members of the committee, and delegate to a subcommittee any or all of the powers and authority of the committee.

Section 3.09. Action by Consent. Unless otherwise restricted by the Certificate of Incorporation or these Bylaws, any action

required or permitted to be taken at any meeting of the Board of Directors or of any committee thereof may be taken without a meeting, if all members of the Board or such committee, as the case may be, consent thereto in writing or by electronic

transmission, and the writing or writings or electronic transmission or transmissions, are filed with the minutes of proceedings of the Board of Directors or such committee. Such filing shall be in paper form if the minutes are maintained in paper

form and shall be in electronic form if the minutes are maintained in electronic form.

Section 3.10. Telephonic Meetings.

Unless otherwise restricted by the Certificate of Incorporation or these Bylaws, members of the Board of Directors, or any committee designated by the Board of Directors, may participate in a meeting of the Board of Directors, or such committee,

as the case may be, by means of conference telephone or other communications equipment by means of which all persons participating in the meeting can hear each other, and such participation in a meeting shall constitute presence in person at the

meeting.

Section 3.11. Resignation. Any director may resign at any time by giving notice in writing or by electronic

transmission to the Board of Directors or to the Secretary of the Corporation. The resignation of any director shall take effect upon receipt of notice thereof or at such later time as shall be specified in such notice; and unless otherwise

specified therein, the acceptance of such resignation shall not be necessary to make it effective.

Section 3.12. Vacancies.

Unless otherwise provided in the Certificate of Incorporation, vacancies on the Board of Directors resulting from death, resignation, removal or otherwise and newly created directorships resulting from any increase in the number of directors may

be filled solely by the affirmative vote of a majority of the remaining directors then in office (although less than a quorum) or by the sole remaining director. Each director so elected shall hold office until the earlier of the expiration of the

term of office of the director whom he or she has replaced, a successor is duly elected and qualified or the earlier of such director’s death, resignation or removal. If there are no directors in office, then an election of directors may be

held in accordance with Delaware Law. Unless otherwise provided in the Certificate of Incorporation, when one or more directors shall resign from the Board, effective at a future date, a majority of the directors then in office, including those who

have so resigned, shall have the power to fill such future vacancy or vacancies, the vote thereon to take effect when such resignation or resignations shall become effective, and each director so chosen shall hold office as provided in the filling

of the other vacancies.

Section 3.13. Removal. No director may be removed from office by the stockholders except for cause

with the affirmative vote of the holders of not less than a majority of the total voting power of all outstanding securities of the Corporation then entitled to vote generally in the election of directors, voting together as a single class.

7

Section 3.14. Compensation. Unless otherwise restricted by the Certificate of

Incorporation or these Bylaws, the Board of Directors shall have authority to fix the compensation of directors, including fees and reimbursement of expenses.

Section 3.15. Preferred Stock Directors. Notwithstanding anything else contained herein, whenever the holders of one or more

classes or series of Preferred Stock shall have the right, voting separately as a class or series, to elect directors, the election, term of office, filing of vacancies, removal and other features of such directorships shall be governed by the terms

of the resolutions applicable thereto adopted by the Board of Directors pursuant to the Certificate of Incorporation, and such directors so elected shall not be subject to the provisions of Sections 3.02, 3.12 and 3.13 of this Article 3 unless

otherwise provided therein.

ARTICLE 4

OFFICERS

Section 4.01.

Principal Officers. The officers of the Corporation shall be elected by the Board of Directors and shall include a president, a treasurer and a secretary. The Board of Directors, in its discretion, may also elect a chairman (who must be a

director), one or more vice chairmen (who must be directors) and one or more vice presidents, assistant treasurers, assistant secretaries and other officers. Any two or more offices may be held by the same person.

(a) President. The President shall have general responsibility for the management and control of the operations of the corporation. The

President shall have the power to affix the signature of the Corporation to all contracts that have been authorized by the Board of Directors. The President shall, when requested, counsel with and advise the other officers of the Corporation and

shall perform such other duties as such officer may agree to or as the Board of Directors may from time to time determine.

(b)

Treasurer. The Treasurer shall supervise and be responsible for all the funds and securities of the Corporation, the deposit of all moneys and other valuables to the credit of the Corporation in depositories of the Corporation, borrowings and

compliance with the provisions of all indentures, agreements and instruments governing such borrowings to which the Corporation is a party, the disbursement of funds of the Corporation and the investment of its funds, and in general shall perform

all of the duties incident to the office of the Treasurer. The Treasurer shall, when requested, counsel with and advise the other officers of the Corporation and shall perform such other duties as such officer may agree with the President or as the

Board of Directors may from time to time determine.

(c) Secretary. The powers and duties of the Secretary are: (i) to act as

Secretary at all meetings of the Board of Directors, of the committees of the Board of Directors and of the stockholders and to record the proceedings of such meetings in a book or books to be kept for that purpose; (ii) to see that all notices

required to be given by the Corporation are duly given and served; (iii) to act as custodian of the seal of the Corporation and affix the seal or cause it to be affixed to all certificates of stock of the Corporation and to all documents, the

execution of which on behalf of the Corporation under its seal is duly authorized in accordance with the provisions of these Bylaws; (iv) to have charge of the books, records and papers of the Corporation and see that the reports, statements

and other documents required by law to be kept and filed are properly kept and filed; and (AT) to perform all of the duties incident to the office of Secretary. The Secretary shall, when requested, counsel with and advise the other officers of the

Corporation and shall perform such other duties as such officer may agree with the President or as the Board of Directors may from time to time determine.

Section 4.02. Term of Office; Vacancy; and Remuneration. Each officer shall hold office until his or her successor is elected and

qualified, or until his or her earlier death, resignation or removal. Any vacancy in any office shall be filled in such manner as the Board of Directors shall determine. The remuneration of all officers of the Corporation shall be fixed by the Board

of Directors.

8

Section 4.03. Subordinate Officers. The Board of Directors may delegate to any

principal officer the power to appoint and to remove any such subordinate officers, agents or employees.

Section 4.04. Removal.

Except as otherwise permitted with respect to subordinate officers, any officer may be removed, with or without cause, at any time, by the majority vote of the members of the Board of Directors then in office.

Section 4.05. Resignations. Any officer may resign at any time by giving written notice to the Board of Directors (or to a

principal officer if the Board of Directors has delegated to such principal officer the power to appoint and to remove such officer) of such person’s resignation. The resignation of any officer shall take effect upon receipt of notice thereof

or at such later time as shall be specified in such notice; and unless otherwise specified therein, the acceptance of such resignation shall not be necessary to make it effective.

Section 4.06. Powers and Duties. The officers of the Corporation shall have such powers and perform such duties incident to each

of their respective offices and such other duties as may from time to time be conferred upon or assigned to them by the Board of Directors.

ARTICLE 5

CAPITAL STOCK

Section 5.01. Certificates for Stock; Uncertificated Shares. The shares of the Corporation shall be represented by certificates,

provided that the Board of Directors of the Corporation may provide by resolution or resolutions that some or all of any or all classes or series of its stock shall be uncertificated shares that may be evidenced by a book entry system maintained by

the registrar of such stock. Any such resolution shall not apply to shares represented by a certificate until such certificate is surrendered to the Corporation. Except as otherwise provided by law, the rights and obligations of the holders of

uncertificated shares and the rights and obligations of the holders of shares represented by certificates of the same class and series shall be identical. Every holder of stock represented by certificates shall be entitled to have a certificate

signed by, or in the name of the Corporation by the Chairman or Vice Chairman of the Board of Directors, or the President or Vice President, and by the Treasurer or an Assistant Treasurer or the Secretary or an assistant Secretary of such

Corporation representing the number of shares registered in certificate form. Any or all of the signatures on the certificate may be a facsimile. In case any officer, transfer agent or registrar who has signed or whose facsimile signature has been

placed upon a certificate shall have ceased to be such officer, transfer agent or registrar before such certificate is issued, it may be issued by the Corporation with the same effect as if such person were such officer, transfer agent or registrar

at the date of issue. A Corporation shall not have power to issue a certificate in bearer form.

Section 5.02. Transfer of Shares.

Shares of the stock of the Corporation may be transferred on the record of stockholders of the Corporation by the holder thereof or by such holder’s duly authorized attorney upon surrender of a certificate therefor properly endorsed or upon

receipt of proper transfer instructions from the registered holder of uncertificated shares or by such holder’s duly authorized attorney and upon compliance with appropriate procedures for transferring shares in uncertificated form, unless

waived by the Corporation.

Section 5.03. Authority for Additional Rules Regarding Transfer. The Board of Directors shall have

the power and authority to make all such rules and regulations as they may deem expedient concerning the issue, transfer and registration of certificated or uncertificated shares of the stock of the Corporation, as well as for the issuance of new

certificates in lieu of those which may be lost or destroyed, and may require of any stockholder requesting replacement of lost or destroyed certificates, bond in such amount and in such form as they may deem expedient to indemnify the Corporation,

and/or the transfer agents, and/or the registrars of its stock against any claims arising in connection therewith.

Section 5.04.

Lost, Stolen or Destroyed Stock Certificates; Issuance of New Certificates. The Corporation may issue a new certificate of stock in the place of any certificate theretofore issued by it, alleged to have been lost, stolen or destroyed, and the

Corporation may require the owner of the lost, stolen or destroyed certificate, or such owner’s legal representative, to give the Corporation a bond sufficient to indemnify it against any claim that may be made against it on account of the

alleged loss, theft or destruction of any such certificate or the issuance of such new certificate.

9

ARTICLE 6

INDEMNIFICATION AND ADVANCEMENT OF EXPENSES

Section 6.01. Right to Indemnification. The Corporation shall indemnify and hold harmless, to the fullest extent permitted by

applicable law as it presently exists or may hereafter be amended, any person (a “Covered Person”) who was or is made or is threatened to be made a party or is otherwise involved in any action, suit or proceeding, whether civil, criminal,

administrative or investigative (a “proceeding”), by reason of the fact that he or she, or a person for whom he or she is the legal representative, is or was a director or officer of the Corporation or, while a director or officer of the

Corporation, is or was serving at the request of the Corporation as a director, officer, employee or agent of another Corporation or of a partnership, joint venture, trust, enterprise or nonprofit entity, including service with respect to employee

benefit plans, against all liability and loss suffered and expenses (including attorneys’ fees) reasonably incurred by such Covered Person. Notwithstanding the preceding sentence, except as otherwise provided in Section 6.3, the

Corporation shall be required to indemnify a Covered Person in connection with a proceeding (or part thereof) commenced by such Covered Person only if the commencement of such proceeding (or part thereof) by the Covered Person was authorized in the

specific case by the Board of Directors of the Corporation.

Section 6.02. Prepayment of Expenses. The Corporation shall to

the fullest extent not prohibited by applicable law pay the expenses (including attorneys’ fees) incurred by a Covered Person in defending any proceeding in advance of its final disposition, provided, however, that, to the extent required by

law, such payment of expenses in advance of the final disposition of the proceeding shall be made only upon receipt of an undertaking by the Covered Person to repay all amounts advanced if it should be ultimately determined that the Covered Person

is not entitled to be indemnified under this Article VI or otherwise.

Section 6.03. Nonexclusivity of Rights. The rights

conferred on any Covered Person by this Article VI shall not be exclusive of any other rights which such Covered Person may have or hereafter acquire under any statute, provision of the Certificate of Incorporation, these Bylaws, agreement, vote of

stockholders or disinterested directors or otherwise.

Section 6.04. Other Sources. The Corporation’s obligation, if any,

to indemnify or to advance expenses to any Covered Person who was or is serving at its request as a director, officer, employee or agent of another Corporation, partnership, joint venture, trust, enterprise or nonprofit entity shall be reduced by

any amount such Covered Person may collect as indemnification or advancement of expenses from such other Corporation, partnership, joint venture, trust, enterprise or non-profit enterprise.

Section 6.05. Amendment or Repeal. Any right to indemnification or to advancement of expenses of any Covered Person arising

hereunder shall not be eliminated or impaired by an amendment to or repeal of these Bylaws after the occurrence of the act or omission that is the subject of the civil, criminal, administrative or investigative action, suit or proceeding for which

indemnification or advancement of expenses is sought.

Section 6.06. Other Indemnification and Advancement of Expenses. This

Article VI shall not limit the right of the Corporation, to the extent and in the manner permitted by law, to indemnify and to advance expenses to persons other than Covered Persons when and as authorized by appropriate corporate action.

ARTICLE 7

GENERAL PROVISIONS

Section 7.01. Fixing the Record Date.

(a) In order that the Corporation may determine the stockholders entitled to notice of or to vote at any meeting of stockholders or any

adjournment thereof, the Board of Directors may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is adopted by the Board of Directors, and which record date shall not be more than sixty

(60) nor less than ten (10) days before the date of such meeting. If the Board of Directors so fixes a date, such date shall also be the record date for determining the stockholders entitled to vote at such meeting unless the Board of

Directors determines, at the time it fixes the record date, that a

10

later date on or before the date of the meeting shall be the date for making such determination. If no record date is fixed by the Board of Directors, the record date for determining stockholders

entitled to notice of or to vote at a meeting of stockholders shall be at the close of business on the day next preceding the day on which notice is given, or, if notice is waived, at the close of business on the day next preceding the day on which

the meeting is held. A determination of stockholders of record entitled to notice of or to vote at a meeting of stockholders shall apply to any adjournment of the meeting; provided that the Board of Directors may fix a new record date for the

determination of stockholders entitled to vote at the adjourned meeting and in such case shall also fix as the record date for stockholders entitled to notice of such adjourned meeting the same or an earlier date as that fixed for the determination

of stockholders entitled to vote therewith at the adjourned meeting.

(b) In order that the Corporation may determine the stockholders

entitled to receive payment of any dividend or other distribution or allotment of any rights or the stockholders entitled to exercise any rights in respect of any change, conversion or exchange of stock, or for the purpose of any other lawful

action, the Board of Directors may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is adopted, and which record date shall be not more than sixty (60) days prior to such action.

If no record date is fixed, the record date for determining stockholders for any such purpose shall be at the close of business on the day on which the Board of Directors adopts the resolution relating thereto.

Section 7.02. Dividends. Subject to limitations contained in Delaware Law and the Certificate of Incorporation, the Board of

Directors may declare and pay dividends upon the shares of capital stock of the Corporation, which dividends may be paid either in cash, in property or in shares of the capital stock of the Corporation.

Section 7.03. Year. The fiscal year of the Corporation shall commence on January 1 and end on December 31 of each year.

The fiscal year of the Corporation may be changed by the Board of Directors.

Section 7.04. Corporate Seal. The corporate seal

shall have inscribed thereon the name of the Corporation, the year of its organization and the words “Corporate Seal, Delaware”. The seal may be used by causing it or a facsimile thereof to be impressed, affixed or otherwise reproduced.

Section 7.05. Voting of Stock Owned by the Corporation. The Board of Directors may authorize any person, on behalf of the

Corporation, to attend, vote at and grant proxies to be used at any meeting of stockholders of any Corporation (except this Corporation) in which the Corporation may hold stock.

Section 7.06. Form of Records. Any records maintained by the Corporation in the regular course of its business, including its

stock ledger, books of account, and minute books, may be kept on, or by means of, or be in the form of, any information storage device or method, provided that the records so kept can be converted into clearly legible paper form within a reasonable

time.

Section 7.07. Amendments. These Bylaws or any of them, may be altered, amended or repealed, or new Bylaws may be made,

by the stockholders entitled to vote thereon at any annual or special meeting thereof or by the Board of Directors. Unless a higher percentage is required by the Certificate of Incorporation as to any matter which is the subject of these Bylaws, all

such amendments must be approved by the affirmative vote of the holders of the majority of the total voting power of all outstanding securities of the Corporation then entitled to vote generally in the election of directors, voting together as a

single class or by a majority of the Board of Directors.

ARTICLE 8

FORUM FOR ADJUDICATION OF DISPUTES

Section 8.01. Forum for Adjudication of Disputes. Unless the Corporation consents in writing to the selection of an alternative

forum, (a) the Court of Chancery of the State of Delaware (or, if the Court of Chancery does not have, or declines to accept, jurisdiction, another state court or a federal court located within the State of Delaware) shall be the sole and

exclusive forum for (i) any derivative action or proceeding brought on behalf of the Corporation, (ii) any action asserting a claim of breach of a fiduciary duty owed by any director, officer or other employee of the Corporation to the

Corporation or the Corporation’s stockholders, (iii) any action asserting

11

a claim arising pursuant to any provision of Delaware Law, the certificate of incorporation or the bylaws of the Corporation, or (iv) any action asserting a claim governed by the internal

affairs doctrine, and (b) the federal district courts of the United States of America shall be the sole and exclusive forum for any complaint asserting a cause of action arising under the Securities Act of 1933, to the fullest extent permitted

by law. Any person or entity purchasing or otherwise acquiring any interest in shares of capital stock of the Corporation shall be deemed to have notice of and consented to the provisions of this Section 8.01.

12

Exhibit 99.1

Viridian Therapeutics Announces Positive Clinical Data in Healthy Volunteer Study and Selects VRDN-003 as Potential Best-in-Class Subcutaneous

anti-IGF-1R Program with Extended Half-Life for Pivotal Development in Thyroid Eye Disease

- VRDN-003 clinical data exceeded expectations with extended half-life of 40-50 days, 4-5x longer than VRDN-001, supporting a potential

best-in-class, low-volume, less frequent, self-administered subcutaneous therapy for thyroid eye disease (TED) -

- Data support VRDN-003 dosing as infrequently as once every eight weeks and is expected to reach

exposure levels associated with robust clinical response in earlier trials of VRDN-001 in TED patients -

- Pivotal clinical development of subcutaneous VRDN-003 in TED patients expected to initiate mid-2024 pending alignment with regulatory authorities -

- Viridian to host investor conference

call and webcast today at 8:00am ET—

WALTHAM, Mass., December 18, 2023 — Viridian Therapeutics, Inc. (NASDAQ: VRDN), a biotechnology

company focused on discovering and developing potential best-in-class medicines for serious and rare diseases, today announced the selection of VRDN-003 as its lead subcutaneous (SC) program for thyroid eye disease (TED) based on positive data from a Phase 1 clinical study in healthy volunteers. The data showed that

VRDN-003 has an extended half-life of 40-50 days, about 4-5 times longer than VRDN-001

and based upon comparisons of publicly disclosed data, significantly longer than other first generation anti insulin-like growth factor-1 receptor (IGF-1R) antibodies. VRDN-003 was well tolerated and exhibited sustained pharmacodynamics supporting its development as a potential best-in-class, more

convenient, less frequent, low-volume, self-administered, subcutaneous IGF-1R therapy for patients with TED.

“The VRDN-003 data exceeded our expectations as a potential best-in-class treatment option for patients affected by TED and support advancing dosing regimens as infrequently as once every eight weeks, which we believe could be transformative for TED patients who

currently only have access to intravenous (IV) IGF-1R therapy,” said Steve Mahoney, President and CEO of Viridian Therapeutics. “The data reinforce our confidence in VRDN-003’s rapid development as a low-volume, self-administered, subcutaneous product. Given VRDN-003’s comparable

pharmacology with VRDN-001, which has already generated compelling clinical data in TED patients, we are excited about the clinical potential of this program for patients and our ability to rapidly move toward pivotal development.”

1

VRDN-003 Results

VRDN-003 is a monoclonal antibody that acts as a full antagonist of IGF-1R, a

clinically and commercially validated target for TED. VRDN-003 utilizes the same binding domain as VRDN-001 and is engineered with three amino acid changes to the Fc

region designed to extend the half-life of the parent antibody, and therefore potentially enabling less frequent and more convenient dosing. VRDN-003 is designed to maintain the clinical response of VRDN-001 IV while significantly increasing patient convenience.

| |

• |

|

Study Design: VRDN-003 was dosed in four single dose cohorts of

healthy volunteers at a concentration of 150 mg/ml receiving 5 mg/kg IV (n=4), 300 mg SC (n=6), 15 mg/kg IV (n=4) and 600 mg SC (n=6). A fifth cohort of two doses of VRDN-003 (n=4) is ongoing.

|

| |

• |

|

Extended Half Life: VRDN-003 pharmacokinetics data showed an

extended half-life of 40-50 days, which is a 4-to-5-fold increase over the half-life of VRDN-001 (which showed a half-life of 10-12 days). |

| |

• |

|

Prolonged Pharmacodynamics (PD): Following a single subcutaneous dose of

VRDN-003, IGF-1 serum levels increased approximately 4-fold at peak. This was consistent with the increases in IGF-1 levels that have been shown in the clinic following a single dose of VRDN-001 SC and IV. IGF-1 is a PD biomarker for IGF-1R target engagement. IGF-1R inhibition by an anti-IGF-1R antibody demonstrated an increase

in serum levels of its natural ligand IGF-1. |

| |

• |

|

Well Tolerated: VRDN-003 was well tolerated in all subjects

with no serious adverse events. All treatment-related, treatment-emergent adverse events were grade 1 (mild). In the reported dataset, no antidrug antibodies (ADAs) were detected. |

| |

• |

|

Dosing Flexibility for Pivotal Development: VRDN-003 modeling

demonstrates dosing flexibility for the program’s anticipated global pivotal development. |

| |

• |

|

Q8W (dosing once every 8 weeks): Modeled dose schedule is predicted to achieve Cmin and Cavg exposure achieved with 3 mg/kg VRDN-001 IV. |

2

| |

• |

|

Q4W (dosing once every 4 weeks): Modeled dose schedule is predicted to achieve Cmin exposures seen for 10 mg/kg VRDN-001 IV and exceed the Cavg exposure seen for 3 mg/kg

by a factor of 2. |

| |

• |

|

Q2W (dosing once every 2 weeks): Modeled dose schedule is predicted to exceed Cmin exposures seen for 20 mg/kg VRDN-001 IV and the Cavg exposures seen for 10 mg/kg VRDN-001 IV. |