UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities

Exchange Act of 1934

|

|

|

Filed by the Registrant

|

|

Filed by a Party other than the Registrant

|

|

Check the appropriate box:

|

|

Preliminary Proxy Statement

|

|

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

|

|

Definitive Proxy Statement

|

|

Definitive Additional Materials

|

|

Soliciting Material under §240.14a-12

|

VERTEX PHARMACEUTICALS INCORPORATED

(Name of Registrant as Specified In Its Charter)

|

Payment

of Filing Fee (Check the appropriate box):

|

|

No fee required.

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

|

|

|

|

(set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

Fee paid previously with preliminary materials.

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule

and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

Dear Shareholders:

Since 2012 we have executed on our strategy

of investing in scientific innovation to create transformative medicines for people with serious diseases - a strategy we believe

maximizes benefits for patients and generates long-term value for shareholders. By all measures, 2018 was an extraordinary year

for Vertex, as we accelerated our Phase 3 triple combination programs in cystic fibrosis, advanced and expanded our pipeline into

disease areas outside of CF and delivered exceptional performance for our shareholders. Over the longer term, the successful execution

of our strategy has caused Vertex to grow from a market capitalization of approximately $7 billion in early 2012 to over $45 billion

in early 2019.

In CF, we are on the brink of delivering a triple

combination regimen that will provide superior benefit to the vast majority of CF patients, bringing us closer to our goal of creating

highly effective treatments for all patients with CF. In 2018, we accelerated the clinical development of two triple combination

regimens -initiating Phase 3 development in early 2018 and obtaining positive Phase 3 clinical data from both of these programs

by early 2019. Based upon this data, we are on track to submit an NDA in the United States for a triple combination regimen in

the third quarter of 2019, followed soon thereafter by regulatory submissions in the European Union and other jurisdictions. We

believe that in 2020, just four years after the initial discovery of VX-445 and VX-659, we will begin delivering a triple combination

regimen to CF patients, including many who have been waiting years for the first treatment for the underlying cause of their disease

and others who are eligible for our current medicines but could benefit from improved treatment options.

Beyond CF, we expanded our pipeline by advancing

multiple programs into the clinic and obtaining important data from ongoing trials. In late 2018, we initiated a clinical trial

for our first drug candidate with the potential to treat alpha-1 antitrypsin deficiency, a genetic disorder that results in life-shortening

complications in the lung and liver. In pain, we have generated compelling Phase 2 data in three different pain types - acute pain,

musculoskeletal pain and neuropathic pain - with VX-150, a non-opioid drug candidate that inhibits NaV1.8. In collaboration with CRISPR

Therapeutics, we also initiated clinical trials to evaluate CTX001, a CRISPR/Cas9 gene editing therapy, as a potential treatment

for sickle cell disease and beta thalassemia. In addition to these drug candidates, we expect that we will advance additional compounds

into the clinic in 2019, including potential additional compounds targeting pain and alpha-1 antitrypsin deficiency and our first

compound targeting focal segmental glomerulosclerosis, a serious kidney disease. This rapid expansion of our pipeline is the result

of a research strategy that applies the lessons we learned in CF regarding the importance of: validated targets that address causal

human biology; predictive lab assays and clinical biomarkers that give us an early indication of clinical efficacy; rapid paths

to regulatory approval; and a focus on transformative medicines regardless of modality.

Our ability to bring our CF medicines to many

more patients resulted in $3.0 billion in total CF revenues in 2018, a 40% increase as compared to 2017, and we expect product

revenues to continue to increase in 2019 and beyond. Our revenue growth, together with disciplined operating expense management,

has created significant positive cash flows and expanding operating income, all while allowing us to continue investing in innovation

to generate additional transformational medicines.

While we are gratified that our accomplishments

have been reflected in our business performance, we are proudest of the way that our medicines are positively impacting the lives

of patients with CF. There is no more meaningful statement of the power of transformative medicines than their ability to change

the way patients think about themselves and their future.

Sincerely,

Jeffrey M. Leiden, M.D., Ph.D.

Chairman, Chief Executive Officer and President

|

Notice of Annual

Meeting of Shareholders

|

Wednesday,

June 5, 2019

9:30 a.m.

50 Northern Avenue

Boston, Massachusetts 02210

Dear Shareholders:

You are invited to attend Vertex Pharmaceuticals

Incorporated’s 2019 Annual Meeting of Shareholders. At the meeting, shareholders will vote:

|

|

|

to elect the six director nominees that are set forth in the attached proxy statement to one year terms expiring in 2020;

|

|

|

|

to approve an amendment and restatement of our 2013 Stock and Option Plan, that, among other things, increases the number

of shares authorized for issuance under this plan by 5.0 million shares;

|

|

|

|

to approve an amendment and restatement of our Employee Stock Purchase Plan that, among other things, increases the number

of shares authorized for issuance under this plan by 2.0 million shares;

|

|

|

|

to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for 2019;

|

|

|

|

to approve our named executive officers’ compensation in an advisory vote; and

|

|

|

|

on two proposals submitted by our shareholders, if properly presented at the meeting.

|

Shareholders also will transact any other business

that may properly come before the annual meeting or any adjournment or postponement of the annual meeting.

RECORD DATE:

You can vote if you were a shareholder of record

on April 10, 2019.

Your vote matters. Whether or not you plan

to attend the annual meeting, please ensure that your shares are represented by voting, signing, dating and returning your proxy

in the enclosed envelope, which requires no postage if mailed in the United States.

April 26, 2019

By Order of the Board of Directors

Sabrina Yohai

Secretary

|

|

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS.

This proxy statement and the enclosed proxy card are first being mailed or furnished to our shareholders on or about

April 29, 2019. This proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2018 are available

to holders of record of our common stock at www.envisionreports.com/vrtx and to beneficial holders of our common stock at

www.edocumentview.com/vrtx.

|

|

SUMMARY

By all measures, 2018 was an extraordinary year

for Vertex, as we continued to execute on our strategy of investing in scientific innovation to create transformative medicines

for people with serious diseases. In 2018, we obtained approval for and launched SYMDEKO/SYMKEVI, our third medicine for CF, and

accelerated the development of our triple combination regimens, which we believe will allow us to treat the vast majority of patients

with CF and will provide an improved treatment option for many patients currently taking our medicines. Outside of CF, we advanced

our Phase 2 clinical program in pain, initiated our first clinical trial of a potential medicine for alpha-1 anti-trypsin deficiency

and the first clinical trial for CTX001, which we are co-developing with CRISPR Therapeutics, as a potential treatment for beta

thalassemia and sickle cell disease. Our exceptional performance in 2018 included 40% growth in total product revenues and increasing

cash flows. As we enter 2019, we are on track to deliver more new transformative medicines for patients thereby increasing revenues,

expanding operating income and creating long-term shareholder value.

Financial Performance

Our CF medicines, KALYDECO, ORKAMBI and SYMDEKO/SYMKEVI,

are transforming the lives of eligible patients around the globe and driving our financial performance.

|

Our CF net product revenues increased to $3.04 billion in 2018, up 40% as compared

to 2017

|

|

We exceeded our initial CF net product revenue guidance in 2018 by $313 million ($3.04 billion

as compared to the mid-point of our initial guidance of $2.73 billion)

|

|

Our GAAP net income increased to $2.1 billion in 2018 from GAAP net income of $263 million

in 2017

|

|

Our non-GAAP net income increased to $1.1 billion in 2018, up $564 million, or 114%,

from 2017, driven by our increased net product revenues (a reconciliation of non-GAAP net income is provided in Appendix C)

|

|

We increased our net cash position by approximately $1.1 billion in 2018, to approximately

$3.2 billion

|

|

In 2019, we expect to further increase CF product revenues by approximately 15% and to continue

generating substantial cash flows

|

|

Beyond 2019, our CF net product revenues and operating income are positioned for substantial

further growth if we are successful in obtaining approval for a triple combination regimen

|

VERTEX PHARMACEUTICALS

INCORPORATED

-

2019 Proxy Statement

5

CF

Pipeline

Advances in our pipeline and our strategic execution

have moved us closer to our goal of delivering highly effective treatments to all patients with CF. In January 2012, KALYDECO was

first approved to treat approximately 1,000 patients with the G551D mutation in the United States. Since then, we have followed

a focused strategy of developing new medicines for CF: expanding the number of patients eligible for our medicines and seeking

improved treatment options for all patients. We believe our triple combination regimens will provide the first treatment for the

underlying cause of CF for patients with the F508del mutation and a mutation that results in minimal function in the defective

CFTR protein (referred to as F508del/Min patients) as well as an improved treatment option (greater efficacy) for the vast majority

of CF patients currently using our medicines.

CF Medicines

Since the beginning of 2018, we have:

|

Obtained approval for SYMDEKO/SYMKEVI (tezacaftor in combination with ivacaftor) in the United States

in early 2018 and in the European Union in late 2018

|

|

Successfully launched SYMDEKO in the United States

|

|

Obtained regulatory approvals and advanced clinical trials designed to provide younger children access to our CF medicines

|

|

Entered into innovative long-term access agreements in ex-U.S markets, including Australia, Denmark, Israel, Luxembourg

and Sweden

|

Triple Combinations

Regimens

Since the beginning of 2018, we have:

|

Accelerated our Phase 3 development program for triple combination regimens

|

|

Announced positive data from two Phase 3 clinical trials evaluating the triple combination of VX-659, tezacaftor and ivacaftor

in F508del/Min patients and F508del homozygous patients 12 years of age or older

|

|

Announced positive data from two Phase 3 clinical trials evaluating the triple combination of VX-445, tezacaftor and ivacaftor

in F508del/Min patients and F508del homozygous patients 12 years of age or older

|

|

Positioned ourselves to submit for one triple combination regimen — an NDA in the United States in the third quarter of

2019 and an MAA in the European Union in the fourth quarter of 2019

|

|

Initiated a Phase 1 clinical trial to evaluate VX-121, an additional next-generation CFTR corrector

|

VERTEX PHARMACEUTICALS

INCORPORATED

-

2019 Proxy Statement

6

Non-CF

Pipeline

Over the last decade, we have demonstrated an

ability to serially discover and develop multiple transformative medicines for serious diseases. In 2018, we and our collaborators

continued our serial innovation, advancing promising non-CF programs for important diseases. Specifically, since the beginning

of 2018, we have:

|

Initiated a Phase 1 clinical trial for a novel drug candidate for alpha-1 antitrypsin deficiency

|

|

Initiated Phase 1/2 clinical trials of CTX001, an investigational gene-editing treatment that we are evaluating as a potential

treatment for beta-thalassemia and sickle cell disease

|

|

Obtained clinical proof-of-concept from Phase 2 clinical trials evaluating VX-150, a selective non-opioid NaV1.8 inhibitor,

as a potential treatment for pain

|

|

Advanced our research program for focal segmental glomerulosclerosis into late-stage preclinical development

|

|

Janssen Pharmaceuticals, our collaborator, is conducting Phase 3 development of pimodivir as a potential treatment for

influenza

|

|

|

|

|

|

* We are co-developing CTX001 with CRISPR Therapeutics

|

|

** We have outlicensed pimodivir to Janssen Pharmaceuticals and M6620 to Merck KGaA

|

Increased

Shareholder Value

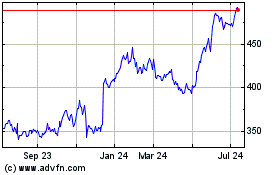

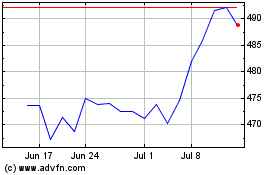

Driven by our exceptional performance and our

pipeline success, our stock price increased by 11% from $149.86 per share to $165.71 per share in 2018. In 2018, our total shareholder

return was positive 10.6% as compared to negative total shareholder returns for the Nasdaq Biotechnology Index, or NBI, and the

S&P 500 index.

VERTEX PHARMACEUTICALS

INCORPORATED

-

2019 Proxy Statement

7

Although we were pleased with our performance

in 2018, biotechnology companies are best measured over the long term and in comparison with their peers, as opposed to in one-year

increments and in isolation. The following chart shows our total shareholder return during the 1-year, 3-year and 5-year periods

ending December 31, 2018 compared to the NBI and the following members of our peer group: Alexion, Regeneron, BioMarin, Gilead,

Celgene and Biogen. These peers are the companies we consider most similar to our company based on their business models (see pages

51 and 52).

2018

Compensation Decisions and Pay-for Performance

In 2018, we received support from 96% of our

shareholders on our say-on-pay proposal. We believe this support is consistent with our shareholders’ understanding of our

business model and the long-term value we are creating. In 2018, our board of directors and management development and compensation

committee, or MDCC, reviewed our compensation programs and made the following key decisions:

|

We maintained the same compensation program design that we implemented in 2016, which closely ties

pay with performance and has contributed to our short- and long-term successes

|

|

The company’s exceptional performance in 2018 resulted in a leading rating (a company rating of 148.5 out of a potential

150) for 2018 and annual cash bonuses near the high end of the range for 2018, commensurate with the performance described

above

|

|

Our CEO’s salary has been unchanged at $1.3 million since 2014 and is aligned with the median CEO base salary of

our peer companies. We increased the base salaries of certain of our other named executive officers by approximately 7% based

on a comparative analysis with our peer group

|

|

We increased our target equity grants by $1.0 million for our CEO and $500,000 for our executive vice presidents based

on a market analysis of our peer group

|

|

We continued our utilization of a mix of equity that consists of performance stock units that vest solely upon achievement

of rigorous performance goals, stock options that only have value if our stock price appreciates and time-vesting restricted

stock units that reward stock price appreciation but also serve as a long-term retention tool

|

Corporate

Social Responsibility

Vertex has grown into a leading global biotechnology

company that serially innovates to bring transformative medicines to people with serious diseases around the world. As we’ve

grown, so too has our commitment to corporate social responsibility. As a reflection of that commitment, Barron’s included Vertex

on Barron’s 100 Most Sustainable Companies list.

|

Community.

In 2018, Vertex and its employees supported more than 1,100 nonprofit organizations

in 13 countries through Vertex Volunteers and The Vertex Foundation’s Matching Gift Program. The Vertex Foundation,

a long-term source of charitable giving that was established in 2017, seeks to improve the lives of people with serious diseases

and in its communities through education, innovation, and health. These efforts are part of our 10-year, $500 million

corporate giving commitment.

|

|

Workplace.

Our commitment to diversity and inclusion on our board and in our workforce is ingrained in our culture.

Five of our ten directors are diverse on a gender and/or ethnic basis. 51% of our global workforce and 38% of our leadership

are women. We have been recognized for these efforts, ranking fifth among 1,000 companies in Forbes’ 2019 Best Employers

for Diversity list.

|

|

Environment.

We are committed to sustainability, with strong local efforts reducing our environmental impact. Vertex’s

facilities in Boston and San Diego are LEED Gold certified, and we are on track to reduce emissions by 35% by 2020 at our

Boston site (over a 2015 baseline). We are building on these efforts and working to establish long-term environmental targets.

|

VERTEX PHARMACEUTICALS

INCORPORATED

-

2019 Proxy Statement

8

Corporate Governance

We are committed to maintaining strong corporate

governance practices that promote the long-term interests of our shareholders and strengthen board and management accountability.

VERTEX PHARMACEUTICALS

INCORPORATED

-

2019 Proxy Statement

9

|

Voting

Matters

|

|

|

|

|

|

|

|

Item

1:

|

|

FOR

|

|

Election of Directors for One Year Term Expiring in 2020

|

|

all Nominees

|

|

|

|

|

|

Item

2:

|

|

FOR

|

|

Approval of Amendment and Restatement of 2013 Stock and Option Plan

|

|

|

|

|

|

|

|

Item

3:

|

|

FOR

|

|

Approval of Amendment to Employee Stock Purchase Plan

|

|

|

|

|

|

|

|

Item

4:

|

|

FOR

|

|

Ratify Selection of Independent Auditor for 2019

|

|

|

|

|

|

|

|

Item

5:

|

|

FOR

|

|

Approve, on an Advisory Basis, Our Named Executive Officer Compensation

|

|

|

|

|

|

|

|

Item

6:

|

|

AGAINST

|

|

Shareholder Proposal Regarding Report Relating to Drug Pricing and Executive Compensation

|

|

|

|

|

|

|

|

Item

7:

|

|

AGAINST

|

|

Shareholder Proposal Regarding Lobbying Report

|

|

|

VERTEX PHARMACEUTICALS

INCORPORATED

-

2019 Proxy Statement

10

Table of Contents

VERTEX

PHARMACEUTICALS INCORPORATED

-

2019 Proxy Statement

11

PROXY STATEMENT

This proxy statement, with the enclosed proxy

card, is being furnished to shareholders of Vertex Pharmaceuticals Incorporated in connection with the solicitation by our board

of directors of proxies to be voted at our 2019 annual meeting of shareholders and at any postponements or adjournments thereof.

The annual meeting will be held on Wednesday, June 5, 2019, at 9:30 a.m. at our headquarters, which are located at 50 Northern

Avenue, Boston, Massachusetts.

This proxy statement and the enclosed proxy

card are first being mailed or otherwise furnished to our shareholders on or about April 29, 2019. Our 2018 Annual Report on Form

10-K and other materials regarding our company are being mailed to the shareholders with this proxy statement, but are not part

of this proxy statement.

VERTEX

PHARMACEUTICALS INCORPORATED

-

2019 Proxy Statement

12

|

Item 1

|

Election of Directors

|

Our board of directors has

nominated Sangeeta Bhatia, Lloyd Carney, Terrence Kearney, Yuchun Lee, Jeffrey Leiden, and Bruce Sachs for election at our 2019

annual meeting of shareholders to hold office until our 2020 annual meeting of shareholders.

Our board of directors is our company’s

ultimate decision-making body, except with respect to those matters reserved to the shareholders. Our board selects our senior

management team, which in turn is responsible for the day-to-day operations of our company. Our board acts as an advisor and counselor

to senior management and oversees its performance.

In 2017, we amended our charter and

by-laws to phase out our staggered board. Six members of our board of directors will be up for election at our 2019 annual

meeting of shareholders and all of our board members will be up for election at our 2020 annual meeting of shareholders.

Sangeeta Bhatia, Lloyd Carney, Terrence Kearney, Yuchun Lee, Jeffrey Leiden, and Bruce Sachs have been nominated by our board

for election at the 2019 annual meeting of shareholders for one-year terms that will expire at the 2020 annual meeting of

shareholders. Elaine Ullian, a current director, is not standing for re-election at the 2019 annual meeting of shareholders.

Each of the nominees has agreed to be named in this proxy statement and to serve if elected. We believe that all of the

nominees will be able and willing to serve if elected. However, if any nominee should become unable or unwilling to serve for

any reason, proxies may be voted for another person nominated as a substitute by our board, or our board may reduce the

number of directors.

Board Structure and Composition

The corporate governance and nominating committee

of our board of directors is responsible for recommending the composition and structure of our board and for developing criteria

for board membership. This committee regularly reviews director competencies, qualities and experiences, with the goal of ensuring

that our board is comprised of a team of directors who function collegially and effectively and who are able to apply their experience

toward meaningful contributions to general corporate strategy and oversight of corporate performance, risk management, organizational

development and succession planning.

Our by-laws provide that the size of our

board may range between three and eleven members. We currently have ten members on our board and expect to have nine members of

our board following the 2019 annual meeting of shareholders. Our corporate governance and nominating committee may seek additional

director candidates who meet the criteria below in order to complement the qualifications and experience of our existing board

members. Our corporate governance and nominating committee may engage a search firm to recommend candidates who satisfy the criteria.

Director

Criteria, Qualifications and Experience; Diversity

The corporate governance and

nominating committee seeks to recommend for nomination directors of stature who have a substantive knowledge of our business

and industry or who can bring to the board specific and valuable strategic or management capabilities acquired in other

industries. The committee expects each of our directors to have proven leadership, sound judgment, integrity and a commitment

to the success of our company. It also seeks personal qualities that foster a respectful environment in which our directors

listen to one another and hold engaged and constructive discussions. These goals for our board composition presuppose a

diverse range of viewpoints, experiences and specific expertise. The corporate governance and nominating committee considers

a nominee’s personal characteristics and business experience relative to those of our existing board members, including

the type of prior management experience, levels of expertise relevant to our business and its growth stage, prior board

service, reputation in the business community, personal characteristics such as gender and race, and other factors that the

committee believes to be important. When considering whether or not to re-nominate a director for board service, the

corporate governance and nominating committee also considers whether the potential nominee has served as a member of the

board for more than 20 years and whether the potential nominee is over 72 years of age. Our commitment to diversity is

demonstrated by the composition of our board, which includes three women and three ethnically diverse individuals.

VERTEX

PHARMACEUTICALS INCORPORATED

-

2019 Proxy Statement

13

The follow table and charts provide information

regarding our director nominees, each of whom is a continuing director, and Elaine Ullian, who is not seeking reelection at our

2019 annual meeting of shareholders.

|

|

Bhatia

|

Carney

|

Garber

|

Kearney

|

Lee

|

Leiden

|

McGlynn

|

Sachs

|

Ullian

|

Young

|

|

Leadership Experience.

We

believe that directors who have held significant leadership positions over extended periods of time provide our company with

special insights.

|

|

|

|

|

|

|

|

|

|

|

|

Industry Knowledge.

We seek

directors with substantive knowledge of the healthcare and biotechnology industries to successfully advise and oversee the

strategic development and direction of our company.

|

|

|

|

|

|

|

|

|

|

|

|

Financial Expertise.

We believe

that an understanding of finance is important for members of our board, and our budgeting processes and financial and strategic

transactions require our directors to be financially knowledgeable.

|

|

|

|

|

|

|

|

|

|

|

|

International Perspective.

We have significant operations outside the United States and value directors with experience in the operation of complex multinational

organizations.

|

|

|

|

|

|

|

|

|

|

|

|

Public Policy and Regulation.

We operate in a highly-regulated industry and seek directors who have experience in public policy and the regulation

of medicines.

|

|

|

|

|

|

|

|

|

|

|

|

Academic Experience or Technological

Background.

As a biotechnology company that seeks to develop transformative medicines for patients with serious diseases,

we look for directors with backgrounds in academia, science and technology and, in particular, the research and development

of pharmaceutical products.

|

|

|

|

|

|

|

|

|

|

|

|

Commitment to Company Values

and Goals.

We seek directors who are committed to our company and its values and goals and who value the contributions

that can be provided by individuals who believe in our company and its prospects for success.

|

|

|

|

|

|

|

|

|

|

|

|

Independence

|

Y

|

Y

|

Y

|

Y

|

Y

|

N

|

Y

|

Y

|

Y

|

Y

|

|

Age

|

50

|

57

|

63

|

64

|

53

|

63

|

59

|

59

|

71

|

74

|

|

Tenure on Board

|

3

|

0

|

1

|

7

|

6

|

9

|

7

|

20

|

21

|

4

|

|

Gender

|

F

|

M

|

M

|

M

|

M

|

M

|

F

|

M

|

F

|

M

|

|

Ethnic Diversity

|

|

|

|

|

|

|

|

|

|

|

VERTEX

PHARMACEUTICALS INCORPORATED

-

2019 Proxy Statement

14

Shareholder-Recommended Director Candidates

The corporate governance and

nominating committee will consider director candidates recommended by shareholders using the same criteria for director

selection described above under

Director Criteria, Qualifications and Experience; Diversity.

Shareholders recommending

candidates for consideration should submit any pertinent information regarding the candidate, including biographical

information and a statement by the proposed candidate that he or she is willing to serve if nominated and elected, by mail to

our corporate secretary at our offices at 50 Northern Avenue, Boston, Massachusetts 02210. If a shareholder wishes to

nominate a candidate to be considered for election as a director at the 2020 annual meeting of shareholders using the

procedures set forth in our by-laws, the shareholder must follow the procedures described in

Other

Information—Shareholder Proposals for the 2020 Annual Meeting and Nominations for Director

on page 80 of this proxy

statement.

Our by-laws provide for proxy access, a process

that allows qualifying shareholders to nominate a director candidate for consideration at an annual meeting of shareholders and

have such candidate be included in our proxy materials for the applicable shareholder meeting. The key elements of our proxy

access by-law are as follows:

|

Provision

|

|

Requirement

|

|

Ownership Threshold and Holding Period

|

|

Available to shareholders owning 3% or more of our shares continuously

for at least 3 years.

|

|

Number of Board Seats

|

|

Total number of proxy access nominees is capped at 20% of the existing

board seats (or the closest whole number below 20%), with a minimum of two.

|

|

Aggregation Limits

|

|

20-shareholder limit on the number of shareholders who can aggregate

their shares to satisfy the 3% ownership requirement.

|

|

Proxy Fights

|

|

Proxy access nominees will not be included in the proxy materials if

we receive notice that a shareholder intends to nominate a candidate who is not to be included in our proxy

materials.

|

|

Future Ineligibility

|

|

Proxy access nominees who fail

to receive at least 10% of the votes cast “for” such nominee may not be re-nominated as a proxy access nominee

for the next two annual meetings.

|

The above table is only a summary of

our proxy access by-law and is qualified in its entirety by our by-laws, which are set forth in Exhibit 3.1 of a Quarterly

Report on Form 10-Q that we filed with the SEC on July 28, 2017. A shareholder who wishes to nominate a proxy access nominee

to be considered for election as a director at the 2020 annual meeting of shareholders must follow the procedures set forth

in our by-laws as well as those described in

Other Information—Shareholder Proposals for the 2020 Annual Meeting and

Nominations for Director

on page 80 of this proxy statement.

Majority Vote Standard

Our by-laws provide for a majority

vote standard for uncontested elections of our directors. Under our by-laws, director nominees in an uncontested election who

receive more votes cast “for” such director nominee than “against” such director nominee are elected.

Our board’s policy is that any nominee for director in an uncontested election who receives a greater number of votes

“against” than votes “for” the nominee’s election shall promptly tender his or her resignation

to the chair of our board following certification of the shareholder vote. Our corporate governance and nominating committee

will promptly consider the tendered resignation. Based on all factors it deems in its discretion to be relevant, the

committee will recommend that our board either accept or reject the resignation and may recommend that the board adopt

measures designed to address any issues perceived to underlie the election results. Our board will then act on the corporate

governance and nominating committee’s recommendation. We will promptly disclose our board’s decision, including,

if applicable, the reasons for rejecting the tendered resignation. Any director whose resignation is being

considered under this policy will not participate in the corporate governance and nominating committee or board

considerations, recommendations or actions with respect to the tendered resignation.

VERTEX

PHARMACEUTICALS INCORPORATED

-

2019 Proxy Statement

15

Director Nominees

Present Terms Expiring

in 2019 and Proposed Terms to Expire in 2020

Sangeeta Bhatia, M.D., Ph.D.

|

Age: 50

|

Committee Assignments:

|

|

Director Since: 2015

|

|

Chair – Science and Technology Committee

|

|

|

|

Member – Corporate Governance and Nominating Committee

|

Dr. Bhatia is a professor at the Massachusetts Institute of Technology,

or MIT, where she currently serves as the John J. and Dorothy Wilson Professor of Health Sciences & Technology/Electrical

Engineering & Computer Science. For the 2018 year, Dr. Bhatia was on sabbatical from MIT while she served as a co-founder

of Glympse Bio, a private company focused on developing in vivo sensing technology dedicated to disease monitoring. Prior to joining

MIT in 2005, Dr. Bhatia was a professor of bioengineering and medicine at the University of California at San Diego from 1998 through

2005. Dr. Bhatia also is an investigator for the Howard Hughes Medical Institute, a member of the Department of Medicine at Brigham

and Women’s Hospital, a member of the Broad Institute and a member of the Koch Institute for Integrative Cancer Research.

Dr. Bhatia holds a Sc.B. in biomedical engineering from Brown University, an S.M. and Ph.D. in Mechanical Engineering from MIT

and an M.D. from Harvard Medical School.

Skills and Qualifications

:

Dr. Bhatia is a leading

academic scientist and medical researcher. Her extensive experience in the field of biomedical engineering and in-depth understanding

on the use of advanced technologies in medical research provides valuable insights to our board of directors, including with respect

to our key research and development initiatives.

Lloyd Carney

|

Age: 57

|

Committee Assignments:

|

|

Director Since: 2019

|

|

Expected to Join – Audit and Finance Committee

|

Mr. Carney is the Chairman and Chief Executive

Officer of ChaSerg Technology Acquisition Corp., a technology acquisition company. He was the Chief Executive Officer of Brocade

Communications Systems Inc., or Brocade, a global supplier of networking hardware and software, from January 2013 until 2017, when

it was acquired by Broadcom. Prior to Brocade, he served as Chief Executive Officer of Xsigo Systems, a cloud-based infrastructure

solutions provider, until its acquisition by Oracle. He has also served as the Chief Executive Officer and Chairman of Micromuse

Inc., a software solutions provider for business and service assurance, until its acquisition by IBM. Earlier in his career he

had held senior leadership roles at Juniper Networks, Inc., Nortel Networks Inc., and Bay Networks, Inc. He currently sits on the

board of directors at Visa Inc. and Nuance Communications, Inc. He holds a Bachelor of Science degree in Electrical Engineering

Technology from Wentworth Institute, a Master of Science degree in Applied Business Management from Lesley College, and an Honorary

Doctorate degree in Engineering from Wentworth Institute.

Skills and Qualifications:

Mr. Carney brings strong business judgment, honed through his time as a senior executive and board member of multiple global

technology companies, to our board of directors. Mr. Carney has extensive corporate leadership experience, including service as

the CEO of several technology companies, as well as financial expertise.

VERTEX

PHARMACEUTICALS INCORPORATED

-

2019 Proxy Statement

16

Terrence Kearney

|

Age:

64

|

Committee Assignments:

|

|

Director Since:

2011

|

|

Chair – Audit and Finance Committee

|

|

|

|

Member – Management Development and Compensation Committee

|

Mr. Kearney served as the Chief Operating

Officer of Hospira, Inc., a specialty pharmaceutical and medication delivery company, from April 2006 to January 2011. From April

2004 to April 2006, he served as Hospira’s Senior Vice President, Finance, and Chief Financial Officer, and he served as

Acting Chief Financial Officer through August 2006. Mr. Kearney served as Vice President and Treasurer of Abbott Laboratories from

2001 to April 2004. From 1996 to 2001, Mr. Kearney was Divisional Vice President and Controller for Abbott’s International

Division. Mr. Kearney serves as a member of the Board of Directors at Acceleron Pharma Inc., a biopharmaceutical company. He served

as a member of the Board of Directors of Innovia (formerly known as Theravance, Inc.), a royalty management company, from October

2014 through April 2016, and as member of the Board of Directors of AveXis, Inc., a gene therapy company, from January 2016 until

its acquisition in May 2018. Mr. Kearney has been a member of the Board of Directors of Levo Therapeutics, Inc., a biotechnology

company focused on developing treatments for Prader-Willi Syndrome, since 2018. He received his B.S. in biology from the University

of Illinois and his M.B.A. from the University of Denver.

Skills and Qualifications:

Mr. Kearney’s corporate leadership experience, industry knowledge and financial expertise make him a valuable contributor

to our board of directors. He has a practical perspective on the management of global pharmaceutical operations, including commercial,

manufacturing and research and development activities, and financial management strategies. He is an “audit committee financial

expert” with particular experience in matters faced by the audit committee of a company with pharmaceutical product revenues

and related expenses.

Yuchun Lee

|

Age:

53

|

Committee Assignments:

|

|

Director Since:

2012

|

|

Member – Audit and Finance Committee

|

|

|

|

Member – Science and Technology Committee

|

Mr. Lee serves as an Executive in Residence

and Partner of General Catalyst Partners, a venture capital firm, positions he has held since April of 2013. Mr. Lee also

serves as the Chief Executive Officer of Allego, Inc. and is Executive Chairman of Clarabridge, Inc. Mr. Lee was the Vice President

of IBM’s Enterprise Marketing Management Group from November 2010 through January 2013. Mr. Lee co-founded Unica Corporation,

a provider of software and services used to automate marketing processes, in 1992, and was Unica’s President and/or Chief

Executive Officer from 1992 through November 2010, when Unica was acquired by IBM. From 1989 to 1992, Mr. Lee was a senior consultant

at Digital Equipment Corporation, a supplier of general computing technology and consulting services. Mr. Lee holds a B.S. and

an M.S. in electrical engineering and computer science from the Massachusetts Institute of Technology and an M.B.A. from Babson

College.

Skills and Qualifications:

Mr. Lee’s expertise in marketing processes and customer engagement and business and financial experience make him a

valuable contributor to our board of directors. Mr. Lee is an innovator who founded and managed the growth of a successful technology

company and gained further leadership experience while serving as an executive at IBM. Mr. Lee’s experiences outside of

the biopharmaceutical sector provide the board with an important perspective on the issues facing the company.

Jeffrey Leiden, M.D.,

Ph.D.

|

Age: 63

|

Committee

Assignments:

|

|

Director

Since: 2009

|

|

Chairman, Chief Executive Officer and President

|

Dr. Leiden is our Chairman, Chief Executive

Officer and President. He has held the positions of Chief Executive Officer and President since February 2012 after joining us

as CEO Designee in December 2011. He has been a member of our Board of Directors since July 2009, the Chairman of our Board of

Directors since May 2012, and served as our lead independent director from October 2010 through December 2011. Dr. Leiden was a

Managing Director at Clarus Ventures, a life sciences venture capital firm, from 2006 through January 2012. Dr. Leiden was President

and Chief Operating Officer of Abbott Laboratories, Pharmaceuticals Products Group, and a member of the Board of Directors of Abbott

Laboratories from 2001 to 2006. From 1987 to 2000, Dr. Leiden held several academic appointments, including the Rawson Professor

of Medicine and Pathology and Chief of Cardiology and Director of the Cardiovascular Research Institute at the University of Chicago,

the Elkan R. Blout Professor of Biological Sciences at the Harvard School of Public Health, and Professor of Medicine

at Harvard Medical School. He is an elected member of both the American Academy of Arts and Sciences and the Institute of

Medicine of the National Academy of Sciences. Dr. Leiden serves as a director of Quest Diagnostics Inc., a medical diagnostics

company, and Massachusetts Mutual Life Insurance Company, an insurance company. Dr. Leiden was a director and the non-executive

Vice Chairman of the board of Shire plc, a specialty biopharmaceutical company, from 2006 to January 2012. Dr. Leiden received

his M.D., Ph.D. and B.A. degrees from the University of Chicago.

Skills and Qualifications:

Dr. Leiden possesses strong leadership qualities, demonstrated through his service as a senior executive in the pharmaceutical

industry and as a life sciences venture capitalist, and has extensive knowledge of the science underlying drug discovery and development

through his experiences as a distinguished physician, scientist and teacher. As our CEO and as a former senior executive at Abbott

Laboratories he brings a global perspective to our business and public policy issues facing our company. He also provides our

board of directors with in-depth knowledge of our company through the day-to-day leadership of our executives.

VERTEX

PHARMACEUTICALS INCORPORATED

-

2019 Proxy Statement

17

Bruce Sachs

|

Age: 59

|

Committee

Assignments:

|

|

Director

Since: 1998

|

|

Chair – Management Development and Compensation Committee

|

|

Co-lead

Independent Director

|

|

Member – Audit and Finance Committee

|

Mr. Sachs is a General Partner at Charles

River Ventures, a venture capital firm he joined in 1999. From 1998 to 1999, he served as Executive Vice President and General

Manager of Ascend Communications, Inc. From 1997 until 1998, Mr. Sachs served as President and Chief Executive Officer of Stratus

Computer, Inc. From 1995 to 1997, he served as Executive Vice President and General Manager of the Internet Telecom Business Group

at Bay Networks, Inc. From 1993 to 1995, he served as President and Chief Executive Officer of Xylogics, Inc. Mr. Sachs holds

a B.S.E.E. in electrical engineering from Bucknell University, an M.E.E. in electrical engineering from Cornell University, and

an M.B.A. from Northeastern University.

Skills and Qualifications:

Mr. Sachs brings strong business judgment, honed through his experience developing business strategy as a senior executive

and in venture capital, to our board of directors. Mr. Sachs has a deep understanding of our business and the global business

environment along with expertise in the technology that supports our infrastructure and operations. In addition, Mr. Sachs has

extensive business leadership experience, including service as a CEO at a technology company, as well as financial expertise.

Board Recommendation

In each of the director nominee and continuing

director biographies, we highlight the specific experience, qualifications, attributes, and skills that led the board of directors

to conclude that the director nominee or continuing director should serve on our board at this time.

Our board of directors recommends

that shareholders vote

FOR

each of the nominees.

Continuing Directors

— Terms to Expire in 2020

Alan Garber, M.D., Ph.D.

|

Age:

63

|

Committee Assignments:

|

|

Director Since:

2017

|

|

Member – Science and Technology Committee

|

Dr. Garber is Provost of Harvard University

and the Mallinckrodt Professor of Health Care Policy at Harvard Medical School, a Professor of Economics in the Faculty of Arts

and Sciences, Professor of Public Policy in the Harvard Kennedy School of Government, and Professor in the Department of Health

Policy and Management in the Harvard T.H. Chan School of Public Health. From 1998 until he joined Harvard in 2011, he was the Henry

J. Kaiser Jr. Professor, a Professor of Medicine, and a Professor (by courtesy) of Economics, Health Research and Policy, and of

Economics in the Graduate School of Business at Stanford University. Dr. Garber is a member of the National Academy of Medicine,

the American Society of Clinical Investigation, the Association of American Physicians, and the American Academy for Arts and Sciences.

He is a Fellow of the American Association for the Advancement of Science, the American College of Physicians, and the Royal College

of Physicians. Dr. Garber is also a Research Associate with the National Bureau of Economic Research and served as founding Director

of its Health Care Program for nineteen years. He also has served as a member of the National Advisory Council on Aging at the

National Institutes of Health, as a member of the Board of Health Advisers of the Congressional Budget Office and as Chair of the

Medicare Evidence Development and Coverage Advisory Committee at the Centers for Medicare and Medicaid Services. Dr. Garber has

been a member of the Board of Directors of Exelixis, Inc., a biopharmaceutical company, since 2005. Dr. Garber holds an A.B. summa

cum laude, an A.M. and a Ph.D., all in Economics, from Harvard University, and an M.D. with research honors from Stanford University.

Skills and Qualifications:

Dr. Garber brings extensive leadership experience and knowledge regarding science, medicine and the healthcare industry and

in particular healthcare economics to our board of directors. The insights he has developed as an expert in health care policy

and as an advisor to government agencies provides our board important perspectives on the issues facing our company.

VERTEX

PHARMACEUTICALS INCORPORATED

-

2019 Proxy Statement

18

Margaret McGlynn

|

Age:

59

|

Committee Assignments:

|

|

Director Since:

2011

|

|

Member – Science and Technology Committee

|

|

|

|

Member – Corporate Governance and Nominating Committee

|

Ms. McGlynn retired from Merck &

Co. in 2009, where she served as President, Vaccines and Infectious Diseases and as President, Hospital and Specialty Products.

During her 26 year career at Merck, she also held various leadership roles in the U.S. and globally in marketing, sales, managed

care and business development. Following her retirement, Ms. McGlynn served as the President and Chief Executive Officer of

the International AIDS Vaccine Initiative, a global not-for-profit organization whose mission is to ensure the development of safe,

effective and accessible HIV vaccines for use throughout the world, from 2011 until 2015. Ms. McGlynn serves as a member of the

Board of Directors for Air Products and Chemicals, Inc., a company specializing in gases and chemicals for industrial uses, and

Amicus Therapeutics, Inc., a biopharmaceutical company. She is also a member of the National Industrial Advisory Committee at the

University at Buffalo School of Pharmacy and Pharmaceutical Sciences. Ms. McGlynn holds a B.S. in Pharmacy and an M.B.A. in Marketing

from the State University of New York at Buffalo.

Skills and Qualifications:

Ms. McGlynn’s leadership experience and industry knowledge make her a valuable contributor to our board of directors.

Her service as an executive at Merck and her service on the board of Amicus Therapeutics and the board and audit committee of

Air Products and Chemicals, Inc. give her a practical understanding of organizational practices valuable to a company at our stage

of growth. Her experience in the development and commercialization of products across several therapeutic areas, and in her board

roles and advocacy in rare diseases, provides her with a valuable understanding of the scientific, public policy, regulatory and

marketplace issues we face in the drug development and commercialization process.

William Young

|

Age:

74

|

Committee Assignments:

|

|

Director Since:

2014

|

|

Member – Corporate Governance and Nominating Committee

|

|

|

|

Member – Management Development and Compensation Committee

|

Mr. Young is a Senior Advisor with Blackstone

Life Sciences (which acquired Clarus Ventures in 2018). Mr. Young joined Clarus Ventures, a life sciences venture capital firm,

in 2010. Prior to Clarus Ventures, Mr. Young served from 1999 until June 2009 as the Chairman and Chief Executive Officer

of Monogram Biosciences, Inc., a biotechnology company acquired by Laboratory Corporation of America in June 2009. From 1980

to 1999, Mr. Young was employed at Genentech, Inc. in positions of increasing responsibility, including as Chief Operating

Officer from 1997 to 1999, where he was responsible for all product development, manufacturing and commercial functions. Prior

to joining Genentech, Mr. Young was with Eli Lilly & Co. for 14 years. Mr. Young currently serves as the Chairman of the

Board of Directors of NanoString Technologies, Inc., and as a member of the Board of Directors of Theravance BioPharma Inc. Mr.

Young retired from BioMarin Pharmaceutical Inc.’s Board of Directors in November 2015 and as Biogen’s Chairman of the

Board in June 2014. Mr. Young holds a B.S. in Chemical Engineering from Purdue University, an M.B.A. from Indiana University and

an Honorary Doctorate in Engineering from Purdue University. Mr. Young was elected to the National Academy of Engineering in 1993

for his contributions to biotechnology.

Skills and Qualifications:

Mr. Young is a valuable contributor to our board of directors due to the in-depth knowledge of the biotechnology industry

that he acquired through his extensive experience as both a CEO and board member at numerous pharmaceutical and biotechnology

organizations and as a venture capitalist focused on the life sciences industry. Mr. Young’s strong leadership qualities,

global industry knowledge and financial expertise provide him with the background to work collaboratively with both management

and fellow board members in order to address issues facing our company.

VERTEX

PHARMACEUTICALS INCORPORATED

-

2019 Proxy Statement

19

CORPORATE GOVERNANCE AND RISK MANAGEMENT

We are committed to good corporate

governance and integrity in our business dealings. Our governance practices are documented in our Statement of Corporate Governance

Principles, which addresses the role and composition of our board of directors and the functioning of the board and its committees.

You can find our governance documents, including our Statement of Corporate Governance Principles, charters for each committee

of the board and our Code of Conduct, on our website www.vrtx.com under “Investors—Corporate Governance—Governance

Documents.”

Independence, Chair

and Co-lead Independent Directors

Our board of directors has determined that nine

of our ten directors qualify as “independent” under the definition of that term adopted by The Nasdaq Stock Market

LLC, or Nasdaq. Our independent directors are Dr. Bhatia, Mr. Carney, Dr. Garber, Mr. Kearney, Mr. Lee, Ms. McGlynn, Mr. Sachs

and Mr. Young and Ms. Ullian, who is not seeking re-election at our 2019 annual meeting of shareholders. Our independent directors

meet in executive session without management at each regularly scheduled board meeting.

Dr. Leiden, our president and chief executive

officer, serves as the chairman of our board. Our employment agreement with Dr. Leiden provides that he will serve as the chairman

of our board through March 31, 2020. In addition, we have two co-lead independent directors who are elected by the independent

directors. Each of the board committees is chaired by one of our independent directors.

Our board believes that strong, independent board

leadership is a critical aspect of effective corporate governance, and our corporate governance principles require that if the

chair is not an independent director, then the independent directors elect a lead independent director. Since December 2011, Mr.

Sachs and Ms. Ullian have served as our co-lead independent directors. We believe this structure provides our board independent

leadership, while providing the benefit of having our chief executive officer, the individual with primary responsibility for managing

our day-to-day operations, chair regular board meetings as we discuss key business and strategic issues. Combined with the co-lead

independent directors and experienced and independent committee chairs, this structure provides strong independent oversight of

management.

Our co-lead independent directors’ responsibilities include:

|

calling and leading regular and special meetings of the independent directors;

|

|

serving as a liaison between our executive officers and the independent directors;

|

|

reviewing the planned dates for regularly scheduled board meetings and the primary agenda

items for each meeting; and

|

|

reviewing with the chair of each board committee agenda items that fall within the scope of

the responsibilities of that committee.

|

Board Committees

Our board of directors has established

various committees, each of which has a written charter, to assist in discharging its duties: the audit and finance

committee, or audit committee, the corporate governance and nominating committee, or CGNC, the MDCC and the science and

technology committee, or S&T committee. Each member of the audit committee, CGNC and MDCC is an independent director

as that term is defined by the SEC and Nasdaq. The primary responsibilities of each of the committees are set forth below,

and the committee memberships are provided in the table appearing on page 21 of this proxy statement.

Each of the committees has the authority, as

its members deem appropriate, to engage legal counsel or other experts or consultants in order to assist the committee in carrying

out its responsibilities.

Risk Management

Our board of directors discharges its overall

responsibility to oversee risk management with a focus on our most significant risks. We face considerable risk related to the

commercialization of our approved products, including regulatory risk with respect to our promotional activities and competition

from approved drugs and investigational drug candidates that may have product profiles superior to our approved products. We continue

to invest significant resources in research programs and clinical development programs as part of our strategy to develop transformative

medicines for patients with serious diseases. With respect to each of our drug development and commercialization programs, we face

considerable risk that the program will not ultimately result in a commercially successful pharmaceutical product. Our board and

its committees monitor and manage the strategic, compliance and operational risks related to our medicines and our research and

development programs through regular board and committee discussions that include presentations to the board and its committees

by our executive officers as well as during in-depth short- and long-term strategic reviews held at least annually.

VERTEX PHARMACEUTICALS

INCORPORATED

- 2019 Proxy Statement

20

For certain specific risk types, our board has

delegated oversight responsibility to board committees as follows:

|

Our audit committee oversees our policies and programs related to our financial

and accounting systems, accounting policies and investment strategies, internal audit function and cybersecurity. The audit

and finance committee also is responsible for addressing risks arising from related party transactions.

|

|

Our MDCC oversees risks associated with our compensation policies, management resources and

structure, and management development and selection processes.

|

|

Our CGNC oversees risks related to the company’s governance structure.

|

|

Our S&T committee oversees risks related to our research and development investments.

|

|

Our MDCC and corporate governance and nominating committee work together to oversee CEO succession

planning.

|

Code of Conduct

We have adopted a Code of Conduct that applies to all of our directors

and employees, including our chief executive officer and chief financial and accounting officers. Our Code of Conduct is available

on our website www.vrtx.com under “Investors—Corporate Governance—Governance Documents.” Disclosure regarding

any amendments to, or waivers from, provisions of the Code of Conduct that apply to our directors or principal executive, financial

or accounting officers will be posted on our website or included in a Current Report on Form 8-K within four business days following

the date of the amendment or waiver.

Board Attendance,

Committee Meetings and Committee Membership

The following table sets information regarding

the members of our board of directors. We expect that in June 2019, (i) Lloyd Carney, who joined our board in February 2019, will

join the audit and finance committee, and (ii) we will make additional changes to our committee memberships resulting from Elaine

Ullian’s retirement from our board of directors.

|

Director

(1)

|

|

Independence

|

|

Board

|

|

Audit

Committee

|

|

CGNC

|

|

MDCC

|

|

S&T Committee

|

|

2018

Attendance at

Meetings

(2)

|

|

Sangeeta N. Bhatia

|

|

|

|

|

|

|

|

|

|

|

|

|

|

93%

|

|

Lloyd Carney

|

|

|

|

|

|

|

|

|

|

|

|

|

|

n/a

|

|

Alan Garber

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100%

|

|

Terrence C. Kearney

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100%

|

|

Yuchun Lee

|

|

|

|

|

|

|

|

|

|

|

|

|

|

95%

|

|

Jeffrey M. Leiden

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100%

|

|

Margaret G. McGlynn

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100%

|

|

Bruce I. Sachs

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100%

|

|

Elaine S. Ullian

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100%

|

|

William D. Young

|

|

|

|

|

|

|

|

|

|

|

|

|

|

89%

|

|

2018 Meetings

|

|

|

|

7

|

|

9

|

|

5

|

|

7

|

|

3

|

|

|

|

= Member

|

|

= Chair

|

|

= Co-lead

|

|

(1)

|

We invite each of our directors to attend shareholder

meetings, and our chairman and two co-lead independent directors attended our 2018 annual shareholders meeting.

|

|

(2)

|

Includes meetings of the board of directors and meetings

of each committee of the board while the director served on such committee. Mr. Carney joined our board in February 2019.

|

Audit and Finance Committee

The primary purposes of the audit committee are to:

|

appoint, oversee and, if necessary, replace, our independent

registered public accounting firm;

|

|

assist our board of directors in fulfilling its responsibility for oversight

of our accounting and financial reporting processes;

|

|

review and make recommendations to our board concerning our financial

structure and financing strategy;

|

|

oversee our policies and programs related to our financial and accounting

systems and cybersecurity programs; and

|

|

oversee our internal audit function.

|

VERTEX PHARMACEUTICALS

INCORPORATED

- 2019 Proxy Statement

21

Our independent registered public accounting

firm reports directly to, and is held accountable by, our audit committee in connection with the audit of our annual financial

statements and related services.

Mr. Kearney, the chair of our audit committee,

is our “audit committee financial expert” as that term is defined in applicable regulations of the SEC. In addition,

each of the other members of the audit committee is qualified to serve as an audit committee financial expert under the SEC’s

rules.

The report of the audit committee appears on

page 39 of this proxy statement.

Our audit committee reviews and, if appropriate,

recommends for approval or ratification by our board, all transactions with related persons that are required to be disclosed by

us pursuant to Item 404(a) of Regulation S-K promulgated by the SEC, except for transactions, if any, related to the employment

of executive officers, which would be recommended for approval by the MDCC. Our policies and procedures with respect to transactions

with related persons are governed by our written Related Party Transaction Policy. Pursuant to this policy, related party transactions

include transactions, arrangements or relationships in which our company is a participant, the amount involved exceeds $120,000,

and one of our executive officers, directors, director nominees or 5% shareholders or their immediate family members, whom we refer

to as related persons, has a direct or indirect material interest, except where disclosure of such transaction would not be required

pursuant to Item 404(a) of Regulation S-K. As appropriate for the circumstances, our audit committee will review and consider the

related person’s interest in the related party transaction and such other factors as it deems appropriate. In 2018, we had

one transaction disclosable pursuant to Item 404(a) of Regulation S-K, pursuant to which we obtained software services from Allego

Inc., where Yuchun Lee, a member of our board of directors, serves as CEO. The transaction involved no payments directly to Mr.

Lee and payments of approximately $123,000 to Allego, Inc. The audit committee approved the transaction as the transactions were

entered into at arm’s length and comparable to those that would be provided to other unrelated entities in the marketplace.

Corporate Governance

and Nominating Committee

The CGNC:

|

assists our board of directors in developing and implementing

our corporate governance principles;

|

|

recommends the size and composition of our board and its committees;

|

|

develops and recommends to our board an annual self-evaluation process

to assess the effectiveness of our board and oversees this process;

|

|

reviews and recommends, with the advice of the MDCC, non-employee director

compensation on an annual basis;

|

|

identifies qualified individuals to become members of our board;

|

|

recommends director nominations to the full board; and

|

|

assists the board in external recruiting and evaluating potential candidates

for the CEO position.

|

Management Development

and Compensation Committee

The primary purposes of the MDCC are to oversee the discharge of our

board of directors’ responsibilities relating to:

|

compensating and developing our executives

(and assisting the corporate governance and nominating committee with respect to director compensation);

|

|

recommending to our board (i) ratings for the company

performance against company goals for the prior year and (ii) goals and weighting of goals for the next year;

|

|

assisting the board in evaluating potential internal

candidates for the CEO position; and

|

|

reviewing and approving our benefit and equity compensation

plans.

|

The MDCC has the authority to delegate any of its responsibilities

to individual members to the extent deemed appropriate by the MDCC in its sole discretion, but subject always to the general oversight

of the board.

See

Compensation Discussion and Analysis—Detailed Discussion

below for a discussion of the MDCC’s role in overseeing executive compensation.

The report of the MDCC appears on page 64 of this proxy statement.

Science and Technology

Committee

Our S&T committee discharges our board of directors’ responsibilities

relating to the oversight of our investment in pharmaceutical research and development. In furtherance of that oversight function,

the S&T committee:

|

reviews and assesses our current and planned research and development programs and technology initiatives

from a scientific perspective;

|

|

assesses the capabilities of our key scientific personnel and the depth and breadth of our scientific resources; and

|

|

provides strategic advice to our board regarding emerging science and technology issues and trends.

|

VERTEX PHARMACEUTICALS

INCORPORATED

- 2019 Proxy Statement

22

Compensation Committee

Interlocks and Insider Participation

Mr. Kearney, Mr. Sachs, Ms. Ullian and Mr.

Young served on the MDCC during 2018. Each member of the MDCC was an independent director while serving on the MDCC. No

member of our board of directors who was a member of our MDCC at any time during 2018 has ever been one of our employees or

officers. No member of our board who was a member of our MDCC at any time during 2018 has ever been a party to a transaction

required to be disclosed pursuant to Item 404(a) of Regulation S-K prior to becoming a member of our MDCC. During 2018, none

of our executive officers served as a member of the board of directors or compensation committee of the board of directors,

or performed the equivalent functions, of any entity that has one or more executive officers serving as a member of our board

or the MDCC.

Public Policy and

Engagement

The biotechnology industry is a highly-regulated industry, and it

is important to our business, our patients and our shareholders that we engage compliantly on public policy issues. This includes

providing advocacy for healthcare innovation and patient access to care. We engage with various policy makers to help promote

an environment in which we can continue to innovate and develop transformative medicines for the benefit of patients with serious

diseases.

We meet all federal, state and local laws and reporting requirements

governing corporate political contributions. We file quarterly reports on our federal lobbying activity in compliance with the

Honest Leadership and Open Government Act of 2007. These reports are available to the public at

https://soprweb.senate.gov/index.cfm?event=selectfields

.

Vertex is a member of a number of industry and trade groups, including

the Biotechnology Industry Association. These organizations represent the biotechnology industry and/or businesses more broadly

in engaging with policy makers on issues that affect our business. Our governmental affairs executives evaluate our participation

in these organizations regularly to ensure that they are broadly aligned with our business objectives, but we do not always agree

with positions taken by these organizations and/or its members.

VERTEX PHARMACEUTICALS

INCORPORATED

- 2019 Proxy Statement

23

DIRECTOR COMPENSATION

Non-Employee Director

Compensation Program

We have designed and implemented our compensation

program for our non-employee directors to attract, motivate and retain individuals who are committed to our values and goals and

who have the expertise and experience that we need to achieve those goals.

The compensation program for our non-employee directors is:

|

Compensation Elements

|

|

|

|

|

|

|

Cash

|

|

|

|

|

|

|

|

Annual Cash Retainer

|

|

|

|

$

|

100,000

|

|

|

Annual Committee Chair Retainer

|

|

Audit and Finance Committee

|

|

$

|

30,000

|

|

|

|

|

Management Development and Compensation Committee

|

|

$

|

25,000

|

|

|

|

|

Corporate Governance and Nominating Committee

|

|

$

|

20,000

|

|

|

|

|

Science and Technology Committee

|

|

$

|

20,000

|

|

|

Committee Membership Retainer

|

|

|

|

|

|

|

|

|

|

Audit and Finance Committee

|

|

$

|

15,000

|

|

|

|

|

Management Development and Compensation Committee

|

|

$

|

12,500

|

|

|

|

|

Corporate Governance and Nominating Committee

|

|

$

|

10,000

|

|

|

|

|

Science and Technology Committee

|

|

$

|

10,000

|

|

|

Annual Co-Lead Independent Director Retainer

|

|

|

|

$

|

40,000

|

|

|

Equity

|

|

|

|

|

|

|

|

Initial Equity Grant

|

|

A $400,000 value-based award in restricted stock units vesting after 12 months

|

|

Annual Equity Retainer

|

|

On June 1 of each year, a $400,000 value-based award, which the directors can elect to receive in the form of:

|

|

|

|

options that are fully-vested upon grant;

options that are fully-vested upon grant;

|

|

|

|

restricted stock units that vests on the first anniversary of the date of grant; or

restricted stock units that vests on the first anniversary of the date of grant; or

|

|

|

|

a mix of options and restricted stock units

a mix of options and restricted stock units

|

Each of our non-employee directors is eligible