Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-252167

PROSPECTUS

SUPPLEMENT

(To

Prospectus dated January 22, 2021)

VERB

TECHNOLOGY COMPANY, INC.

Up

to $30,000,000 of Common Stock

Verb

Technology Company, Inc. has entered into an At-The-Market Issuance Sales Agreement (the “Sales Agreement”) with Truist Securities,

Inc. (the “Sales Agent”) relating to the offer and sale of up to $30,000,000 of our common stock, par value $0.0001 per share,

offered by this prospectus supplement and the accompanying prospectus.

Sales

of our common stock, if any, under this prospectus supplement and the accompanying prospectus may be made in transactions that are deemed

to be “at-the-market” offerings as defined in Rule 415(a)(4) under the Securities Act of 1933, as amended (the “Securities

Act”), including sales made directly on or through The Nasdaq Capital Market, the trading market for our common stock, or any other

trading market in the United States for our common stock, sales made to or through a market maker other than on an exchange, directly

to the Sales Agent as principal in negotiated transactions, or through a combination of any such methods of sale. The Sales Agent will

act as sales agent on a commercially reasonable efforts basis consistent with its normal trading and sales practices. There is no arrangement

for funds to be received in any escrow, trust or similar arrangement.

We

will pay the Sales Agent a commission of up to 3.0% of the gross sales price per share of common stock issued by us and sold through

the Sales Agent as our sales agent under the Sales Agreement. In connection with the sale of the common stock on our behalf, the Sales

Agent will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of the Sales Agent

will be deemed to be underwriting commissions or discounts.

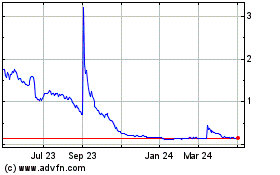

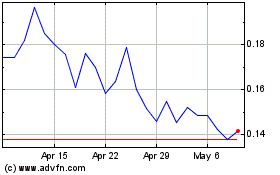

Our common stock is listed on The Nasdaq Capital

Market under the symbol “VERB.” On November 15, 2021, the last reported sale price of our common stock on The Nasdaq Capital

Market was $1.99 per share.

Investing in our common stock involves a high

degree of risk. Refer to the section entitled “Risk Factors” beginning on page S-5 of this prospectus for a discussion of information

that should be considered in connection with an investment in our common stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Sales Agent

Truist Securities

The

date of this prospectus supplement is November 16, 2021.

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

ABOUT

THIS PROSPECTUS

This

document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and also

adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference herein. The second

part, the accompanying prospectus, provides more general information. Generally, when we refer to this prospectus, we are referring to

both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement

and the information contained in the accompanying prospectus or any document incorporated by reference herein or therein filed prior

to the date of this prospectus supplement, you should rely on the information in this prospectus supplement; provided that if any statement

in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated

by reference in the accompanying prospectus—the statement in the document having the later date modifies or supersedes the earlier

statement.

The

representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated

by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating

risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such

representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and

covenants should not be relied on as accurately representing the current state of our affairs.

You

should rely only on the information contained in this prospectus supplement or the accompanying prospectus, or the information incorporated

by reference herein or therein. We have not authorized anyone to provide you with information that is different. The information contained

in this prospectus supplement or the accompanying prospectus, or incorporated by reference herein or therein, is accurate only as of

the respective dates thereof, regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or of

any sale of our shares. It is important that you read and consider all information contained in this prospectus supplement and

the accompanying prospectus, including the documents incorporated by reference herein and therein, in making your investment decision.

You should also read and consider the information in the documents to which we have referred you in the sections entitled “Where

You Can Find Additional Information” and “Incorporation of Certain Information by Reference” in this prospectus.

We

are offering shares of our common stock only in jurisdictions where offers are permitted. The distribution of this prospectus and the

offering of our shares in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession

of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our shares and the distribution

of this prospectus outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer to

sell, or a solicitation of an offer to buy, any shares offered by this prospectus by any person in any jurisdiction in which it is unlawful

for such person to make such an offer or solicitation.

Unless

otherwise mentioned, or unless the context requires otherwise, all references in this prospectus supplement to the “Company,”

“we,” “us,” “our” and “Verb” refer to Verb Technology Company, Inc., a Nevada corporation.

PROSPECTUS

SUMMARY

This

prospectus summary highlights selected information included elsewhere in this prospectus and does not contain all of the information

you should consider before buying shares of our common stock. You should read the entire prospectus carefully, including the section

entitled “Risk Factors” and the financial statements and related notes incorporated by reference in this prospectus,

before deciding to invest in our common stock. Some of the statements in this prospectus constitute forward-looking statements. For additional information, refer to the section entitled “Cautionary

Note Regarding Forward-Looking Statements.”

Our

Business

Overview

We

are a Software-as-a-Service (“SaaS”) applications platform developer. Our platform is comprised of a suite of

interactive video-based sales enablement business software products marketed on a subscription basis. Our applications, available in

both mobile and desktop versions, are offered as a fully integrated suite, as well as on a standalone basis, and include verbCRM,

our white-labelled Customer Relationship Management (“CRM”) application for large sales-based enterprises; verbTEAMS,

our CRM application for small-and medium-sized businesses and solopreneurs; verbLEARN, our Learning Management System application,

verbLIVE, our Live Stream eCommerce application, verbPULSE, our artificial intelligence notification application, and verbMAIL, our

interactive video sales communication tool integrated with Microsoft Outlook.

Our

Technology

Our

suite of applications can be distinguished from other sales enablement applications because our applications utilize our proprietary

interactive video technology as the primary means of communication between sales and marketing professionals and their customers and

prospects. Moreover, the proprietary data collection and analytics capabilities of our applications inform our users on their devices

in real time, when and for how long their prospects have watched a video, how many times such prospects watched it, and what they clicked

on, which allows our users to focus their time and efforts on ‘hot leads’ or interested prospects rather than on those that

have not seen such video or otherwise expressed interest in such content. Users can create their hot lead lists by using familiar, intuitive

‘swipe left/swipe right’ on-screen navigation. Our clients report that these capabilities provide for a much more efficient

and effective sales process, resulting in increased sales conversion rates. We developed the proprietary patent-pending interactive video

technology, as well as several other patent-issued and patent-pending technologies that serve as the unique foundation for all our platform

applications.

Our

Products

verbCRM

combines the capabilities of CRM lead-generation, content management, and in-video ecommerce capabilities in an intuitive, yet powerful

tool for both inexperienced as well as highly skilled sales professionals. verbCRM allows users to quickly and easily create, distribute,

and post videos to which they can add a choice of on-screen clickable icons which, when clicked, allow viewers to respond to the user’s

call-to-action in real-time, in the video, while the video is playing, without leaving or stopping the video. For example, our technology

allows a prospect or customer to click on a product they see featured in a video and impulse buy it, or to click on a calendar icon in

the video to make an appointment with a salesperson, among many other novel features and functionalities designed to eliminate or reduce

friction from the sales process for our users. The verbCRM app is designed to be easy to use and navigate and takes little time and

training for a user to begin using the app effectively. It usually takes less than four minutes for a novice user to create an interactive

video from our app. Users can add interactive icons to pre-existing videos, as well as to newly created videos shot with practically

any mobile device. verbCRM interactive videos can be distributed via email, text messaging, chat app, or posted to popular social media

directly and easily from our app. No software download is required to view Verb interactive videos on virtually any mobile or desktop

device, including smart TVs.

verbLEARN

is an interactive, video-based learning management system that incorporates all of the clickable in-video technology featured in

our verbCRM application and adapts them for use by educators for video-based education. verbLEARN is used by enterprises seeking to educate

a large sales team or a customer base about new products, or elicit feedback about existing products. It also incorporates Verb’s

proprietary data collection and analytics capabilities that inform users in real time when and for how long the viewers watched the video,

how many times they watched it, and what they clicked on, in addition to adding gamification features that enhance the learning aspects

of the application.

verbLIVE

builds on popular video-based platforms such as Facebook Live, Zoom, WebEx, and Go2Meeting, among others, by adding Verb’s

proprietary interactive in-video ecommerce capabilities – including an in-video Shopify shopping cart integrated for Shopify account

holders - to our own live stream video broadcasting application. verbLIVE is a next-generation live stream platform that allows hosts

to utilize a variety of novel sales-driving features, including placing interactive icons on-screen that appear on the screens of all

viewers, providing in-video click-to-purchase capabilities for products or services featured in the live video broadcast, in real-time,

driving friction-free selling. verbLIVE also provides the host with real-time viewer engagement data and interaction analytics. verbLIVE

is entirely browser-based, allowing it to function easily and effectively on all devices without requiring the host or the viewers to

download software, and is secured through end-to-end encryption.

verbPULSE is a business/augmented

intelligence notification-based sales enablement platform feature set that tracks users’ interactions with current and prospective

customers and then helps coach users by telling them what to do next in order to close the sale, virtually automating the selling process.

verbTEAMS

is our interactive, video-based CRM for small-and medium-sized businesses and solopreneurs. verbTEAMS also incorporates verbLIVE

as a bundled application. verbTEAMS features self-sign-up, self-onboarding, self-configuring, content management system capabilities,

user level administrative capabilities, and high-quality analytics capabilities in both mobile and desktop platforms that sync with one

another. It also has a built-in one-click sync capability with Salesforce.

We continue to invest in the future

of interactive livestreaming. Following are some of our recent initiatives:

MARKETPLACE is a centralized,

immersive and social online destination where shoppers will be able to explore shoppable livestream events hosted worldwide 24/7 across

numerous product and service categories. Through MARKETPLACE, which will incorporate our verbLIVE Attribution technology, shoppers will

be able to communicate with hosts and ask questions about products in real-time through an on-screen chat visible to all shoppers, and

invite friends and family to share in their shopping experience. Shoppers will be able to click on an unintrusive in-video overlay to

place items in an on-screen shopping cart for purchase without interrupting the video. Throughout the experience, the shopping cart follows

shoppers seamlessly from event to event, shoppable video to shoppable video, host to host, product to product. We believe the tools MARKETPLACE

will offer will make it an attractive platform for big box retail, boutiques, and celebrities, as well as for their customers and followers.

verbTV is an online destination

for shoppable entertainment where viewers will be able to click on-screen to purchase featured products and services in lieu of viewing

traditional advertisements. VerbTV will feature commercial-free television content, such as concerts, game shows, sports and e-sports,

sitcoms, podcasts, special events, news, live events, and other forms of video entertainment, all of which will be interactive and shoppable.

In addition to attracting viewers through our innovative approach to advertising, we believe the native ecommerce capabilities, real-time

monetization, data collection and analytical tools offered by the platform will attract producers, content creators, sponsors, and advertisers

alike.

Verb

Partnerships and Integrations

verbMAIL

for Microsoft Outlook is a product of our partnership with Microsoft and is available as an add-in to Microsoft Outlook for Outlook

and Office 365 subscribers. verbMAIL allows users to create interactive videos seamlessly within Outlook by clicking the verbMAIL icon

in the Outlook toolbar. The videos are automatically added to an email and can be sent easily through Outlook using the user’s

contacts they already have in Outlook. The application allows users to easily track viewer engagement and together with other features

represents an effective sales tool available for all Outlook users worldwide. Currently offered without charge, a subscription-based

paid version with a suite of enhanced features for sales and marketing professionals is slated for release later this year.

verbMAIL

for Google Gmail is currently under development. It will include a feature set substantially identical to verbMAIL for Outlook.

Salesforce Integration.

We have completed and deployed the integration of verbLIVE

into Salesforce and have launched a joint marketing campaign with Salesforce to introduce the verbLIVE plug-in functionality to current

Salesforce users. We have also developed a verbCRM sync application for Salesforce users that is currently being utilized by at least

one of our large enterprise clients and the verbLIVE plug-in is now being offered to all Salesforce users on a monthly subscription fee

basis while we work to build adoption rates.

Popular

Enterprise Back-Office System Integrations. We have integrated

verbCRM into systems offered by 17 of the most popular direct sales back-office system providers, such as Direct Scale, Exigo, By Design,

Thatcher, Multisoft, Xennsoft, and Party Plan. Direct sales back-office systems provide many of the support functions required for direct

sales operations, including payroll, customer genealogy management, statistics, rankings, and earnings, among other direct sales financial

tracking capabilities. The integration into these back-office providers, facilitated through our own API development, allows single sign-on

convenience for users, as well as enhanced data analytics and reporting capabilities for all users. Our experience confirms that

our integration into these back-end platforms accelerates the adoption of verbCRM by large direct sales enterprises that rely on these

systems and as such, we believe this represents a competitive advantage.

Non-Digital

Products and Services

Historically,

we provided certain non-digital services to some of our enterprise clients such as printing and fulfillment services. We designed and

printed welcome kits and starter kits for their marketing needs and provided fulfillment services, which consisted of managing the preparation,

handling and shipping of our client’s custom-branded merchandise they use for marketing purposes at conferences and other events.

We also managed the fulfillment of our clients’ product sample packs that verbCRM users order through the app for automated delivery

and tracking to their customers and prospects.

In May 2020, we executed a contract with Range Printing (“Range”), a company in the business of providing enterprise

class printing, sample assembly, warehousing, packaging, shipping, and fulfillment services. Pursuant to the contract, through an automated

process we have established for this purpose, Range receives orders for samples and merchandise from us as and when we receive them from

our clients and users, and print, assemble, store, package and ship such samples and merchandise on our behalf. The Range contract provides

for a service fee arrangement based upon the specific services to be provided by Range that is designed to maintain our relationship

with our clients by continuing to service their non-digital needs, while eliminating the labor and overhead costs associated with the

provision of such services by us.

Our

Market

Our client base has historically

consisted primarily of multi-national direct sales enterprises to whom we provide white-labeled, client-branded versions of our products.

Our clients now include large enterprises in the life sciences sector, professional sports franchises, educational institutions, not-for-profits,

as well as clients in the entertainment industry, and the burgeoning CBD industry, among other business sectors. As of September 30, 2021,

we provide subscription-based application services to approximately 140 enterprise clients for use in over 139 countries, in over 48 languages,

which collectively account for a user base generated through more than 3.0 million downloads of our verbCRM application. Among the new

business sectors targeted for this year are medical equipment and pharmaceutical sales, armed services and government institutions, small

businesses and individual entrepreneurs.

Corporate

Information

We

are a Nevada corporation that was incorporated in February 2005. Our principal executive and administrative offices are located at 782

South Auto Mall Drive, American Fork, Utah 84003, and our telephone number is (855) 250-2300. Our website address is https://www.verb.tech/.

Information on or accessed through our website is not incorporated into this prospectus and is not a part of this prospectus.

The

Offering

|

Shares

offered by us

|

|

Shares

of our common stock having an aggregate offering price of up to $30,000,000.

|

|

|

|

|

|

Common

stock to be outstanding immediately after this offering

|

|

Up

to 15,075,376 shares, after giving effect to the sale of $30.0 million of shares of our common stock at an assumed price of $1.99

per share, which was the closing price of our common stock on The Nasdaq Capital Market on November 15, 2021. The maximum number

of shares that may be issued will vary depending on the price at which shares may be sold from time to time during this offering.(1)

|

|

|

|

|

|

The

Nasdaq Capital Market symbol

|

|

VERB

|

|

|

|

|

|

Use

of Proceeds

|

|

We

intend to use the net proceeds from this offering for working capital and other general corporate purposes. For additional information, refer to the section entitled “Use of Proceeds.”

|

|

|

|

|

|

Risk

Factors

|

|

Investing

in our common stock involves a high degree of risk. You should carefully consider the information set forth in the section entitled

“Risk Factors” beginning on page S-5 of this prospectus for a discussion of information that should be considered

in connection with an investment in our common stock.

|

|

(1)

|

The number of shares of common

stock that will be outstanding immediately after this offering is based on the 70,169,666 shares outstanding as of September 30,

2021, and excludes the following:

|

|

|

●

|

5,528,405

shares of common stock issuable upon the exercise of outstanding stock options as of September 30, 2021, with a weighted-average

exercise price of $1.70 per share;

|

|

|

|

|

|

|

●

|

2,109,999

shares of common stock issuable upon vesting of restricted stock unit awards as of September 30, 2021, with a weighted-average grant

date fair value of $1.41 per share;

|

|

|

|

|

|

|

●

|

5,673,601

shares of common stock reserved for future issuance under our 2019 Omnibus Incentive Plan (the “Incentive Plan”) as of

September 30, 2021;

|

|

|

|

|

|

|

●

|

11,008,302

shares of common stock issuable upon exercise of warrants to purchase common stock outstanding as of September 30, 2021, with a weighted-average

exercise price of $2.67 per share; and

|

|

|

|

|

|

|

●

|

any

additional shares of common stock we may issue from time to time after that date.

|

Unless

otherwise indicated, all information in this prospectus assumes no exercise of outstanding options and warrants.

RISK

FACTORS

An

investment in our common stock involves a high degree of risk. Before deciding whether to invest in our common stock, you should consider

carefully the risks described below, as well as the risk factors contained in our most recent Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q filed with the Securities and Exchange Commission (“SEC”), together with the other information contained in this

prospectus supplement, the accompanying prospectus, and the information and documents incorporated by reference herein and therein. If

any of these risks actually occurs, our business, financial condition, results of operations and liquidity could be materially adversely

impacted. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment.

Risks

Related to This Offering

Sales of our common stock in this offering,

or the perception that such sales may occur, could cause the market price of our common stock to fall.

We may issue and sell shares

of our common stock for aggregate gross proceeds of up to $30.0 million from time to time in connection with this offering. The issuance

and sale from time to time of these new shares of common stock, or our ability to issue these new shares of common stock in this offering,

could have the effect of depressing the market price of our common stock.

You will suffer immediate and substantial dilution

in the net tangible book value per share of the common stock that you purchase in this offering.

The shares sold in this offering,

if any, will be sold from time to time at various prices; however, the assumed offering price of our common stock is substantially higher

than the net tangible book value per share of our common stock. Therefore, if you purchase shares of common stock in this offering, you

will pay a price per share of common stock that substantially exceeds our net tangible book value per share after giving effect to this

offering. Assuming that an aggregate of 15,075,376 shares of our common stock are sold at a price of $1.99 per share of common stock,

which is the last reported sale price of our common stock on The Nasdaq Capital Market (“Nasdaq”) on November 15, 2021,

for aggregate gross proceeds of $30.0 million, and after deducting commissions and estimated offering expenses payable by us, new investors

in this offering will experience immediate dilution of $1.76 per share, representing the difference between the assumed offering price

of the common stock and our as adjusted net tangible book value per share as of September 30, 2021 after giving effect to this offering.

For a more detailed illustration of the dilution you would incur if you purchase common stock in this offering, refer to the section entitled

“Dilution.”

If

you purchase shares of common stock in this offering, you may also experience future dilution as a result of future equity offerings.

We

may be required to raise additional capital in the future to fund the growth and operation of our business. To raise additional capital,

we may offer additional shares of our common stock, or other securities convertible into, or exercisable or exchangeable for, shares

of our common stock, at prices that may be lower than the assumed offering price of our common stock in this offering. In addition,

investors purchasing our securities in the future could have rights superior to those of our existing stockholders. Furthermore, if any

of our outstanding options or warrants are exercised at prices below the assumed offering price, or if we grant additional options

or other awards under our equity incentive plans, or if we issue additional warrants, you may experience further dilution of your investment.

We

have no intention of declaring dividends in the foreseeable future.

The

decision to pay cash dividends on our common stock rests with our board of directors and will depend on a number of factors, including

our earnings, cash balance, capital requirements and financial condition. We do not anticipate declaring any dividends in the foreseeable

future, as we intend to use any excess cash for the development, operation and expansion of our business. Investors in our common stock should not expect to receive dividend income on their investment, and investors will be dependent

on the appreciation of our common stock, if any, to earn a return on their investment.

Future

sales of our common stock in the public market could cause our stock price to fall.

Sales

of a substantial number of shares of our common stock in the public market, or the perception that these sales might occur, could depress

the market price of our common stock and could impair our ability to raise capital through the sale of additional equity securities.

As of September 30, 2021, we had 70,169,666 shares of common stock outstanding, all of which shares were, and continue to be,

eligible for sale in the public market, subject in some cases to compliance with the requirements of Rule 144, including the volume limitations

and manner of sale requirements. In addition, all of the shares offered under this prospectus will be freely tradable upon issuance without

restriction.

The common stock offered hereby will be

sold in “at-the-market” offerings, and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares

in this offering at different times will likely pay different prices, and so may experience different outcomes in their investment results.

We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold, and there is no minimum or

maximum sales price. Investors may experience a decline in the value of their shares as a result of share sales made at prices lower

than the prices they paid.

The actual number of shares we will issue under the Sales Agreement,

at any one time or in total, is uncertain.

Subject to certain limitations

in the Sales Agreement and compliance with applicable law, we have the discretion to deliver a sales notice to the Sales Agent at any

time throughout the term of the Sales Agreement. The number of shares that are sold by the Sales Agent after we deliver a sales notice

will fluctuate based on the market price of the common stock during the sales period and limits we set with the Sales Agent. Because

the price per share of each share sold will fluctuate based on the market price of our common stock during the sales period, it is not

possible at this stage to predict the number of shares, if any, that will ultimately be issued.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the

accompanying prospectus, and the documents incorporated by reference herein and therein, contain “forward-looking statements”

within the meaning of the federal securities laws, which statements are subject to considerable risks and uncertainties. These forward-looking

statements are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995.

All statements included or incorporated by reference in this prospectus, other than statements of historical fact, are forward-looking

statements. You can identify forward-looking statements by the use of words such as “anticipate,” “believe,” “continue”

“could,” “expect,” “intend,” “may,” “will,” or the negative of such terms,

or other comparable terminology. Forward-looking statements also include the assumptions underlying or relating to such statements. In

particular, forward-looking statements included or incorporated by reference in this prospectus relate to, among other things, our future

or assumed financial condition, results of operations, liquidity, business forecasts and plans, strategic plans and objectives, financing

plans, customers, products and competitive environment. We caution you that the foregoing list may not include all of the forward-looking

statements made in this prospectus.

Our

forward-looking statements are based on our management’s current assumptions and expectations about future events and trends, which

affect or may affect our business, strategy, operations or financial performance. Although we believe that these forward-looking statements

are based upon reasonable assumptions, they are subject to numerous known and unknown risks and uncertainties and are made in light of

information currently available to us. Our actual financial condition and results could differ materially from those anticipated in these

forward-looking statements as a result of various factors, including those set forth in the section entitled “Risk Factors”

beginning on page S-5 of this prospectus, as well as the risk factors contained in our most recent Annual Report on Form 10-K, Quarterly

Reports on Form 10-Q and the other reports we file with the SEC. You should read this prospectus with the understanding that our actual

future results may be materially different from and worse than what we expect.

Moreover,

we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management

to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any

factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Forward-looking

statements speak only as of the date they were made, and, except to the extent required by law or Nasdaq Listing Rules, we undertake

no obligation to update or review any forward-looking statement because of new information, future events or other

factors.

We

qualify all of our forward-looking statements by these cautionary statements.

USE

OF PROCEEDS

We may issue and sell shares

of our common stock having aggregate gross proceeds of up to $30.0 million from time to time. Because

there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions

paid to the Sales Agent and proceeds to us, if any, are not determinable at this time. We estimate that the net proceeds from the sale

of the shares of common stock that we are offering may be up to approximately $29.3 million, after deducting commissions payable to the

Sales Agent and estimated offering expenses payable by us.

We

intend to use the net proceeds of this offering for working capital and other general corporate purposes. We have not yet determined

the amount of net proceeds to be used specifically for any particular purposes or the timing of these expenditures. Accordingly, our

management will have significant discretion and flexibility in applying the net proceeds from the sale of these securities, and investors

will be relying on our judgment regarding the application of the net proceeds from this offering.

Pending

our use of the net proceeds from this offering, we intend to maintain the net proceeds as cash deposits or cash management instruments,

such as U.S. government securities or money market mutual funds.

DIVIDEND

POLICY

We

have never paid cash dividends on our common stock and do not anticipate declaring any dividends in the foreseeable future. We intend

to use any excess cash for the development, operation and expansion of our business. The decision to pay cash dividends on our common

stock rests with our board of directors and will depend on a number of factors, including our earnings, cash balance, capital requirements

and financial condition. Investors in our common stock should not expect to receive dividend income on

their investment, and investors will be dependent on the appreciation of our common stock, if any, to earn a return on their investment.

DILUTION

If

you purchase shares of common stock in this offering, you will

experience dilution to the extent of the difference between the public offering price per share in this offering and our

as adjusted net tangible book value per share after this offering.

Our net tangible book

value as of September 30, 2021 was approximately $(9.7) million or $(0.14) per share of common stock. Net tangible book value per

share is determined by dividing the net of total tangible assets less total liabilities, by the aggregate number of shares of common stock

outstanding as of September 30, 2021.

After giving effect

to the sale of our common stock in the aggregate amount of $30.0 million at the assumed offering price of $1.99 per share of common

stock, the last reported sale price of our common stock on November 15, 2021, and after deducting commissions and estimated offering

expenses payable by us, our as adjusted net tangible book value as of September 30, 2021 would have been approximately $19.6 million,

or $0.23 per share of common stock. This represents an immediate increase in net tangible book value of $0.37 per share to our existing

stockholders and immediate dilution of $1.76 per share to new investors in this offering.

The following table illustrates

this dilution on a per share basis. The as adjusted information is illustrative only and will adjust based on the actual public offering

price, the actual number of shares sold and other terms of the offering determined at the time shares of our common stock are sold pursuant

to this prospectus supplement. The as adjusted information assumes that all of our common stock in the aggregate amount of $30.0 million

is sold at the assumed public offering price of $1.99 per share. The shares sold in this offering, if any, will be sold from time to time

at various prices.

|

|

|

|

|

|

|

Amount

|

|

|

Assumed

offering price per share

|

|

|

|

|

|

$

|

1.99

|

|

|

Net

tangible book value per share at September 30, 2021

|

|

$

|

(0.14

|

)

|

|

|

|

|

|

Increase

in net tangible book value per share to the existing stockholders attributable to this offering

|

|

$

|

0.37

|

|

|

|

|

|

|

As

adjusted net tangible book value per share attributable to this offering

|

|

|

|

|

|

$

|

0.23

|

|

|

Dilution

per share to new investors in this offering

|

|

|

|

|

|

$

|

1.76

|

|

The

number of shares of common stock that will be outstanding immediately after this offering is based on the 70,169,666 shares outstanding

as of September 30, 2021, and excludes the following:

|

|

●

|

5,528,405

shares of common stock issuable upon the exercise of outstanding

stock options as of September 30, 2021, with a weighted-average exercise price of $1.70 per share;

|

|

|

|

|

|

|

●

|

2,109,999

shares of common stock issuable upon vesting of restricted stock unit awards as of September 30, 2021, with a weighted-average

grant date fair value of $1.41 per share;

|

|

|

|

|

|

|

●

|

5,673,601

shares of common stock reserved for future issuance under the Incentive Plan as of September 30, 2021;

|

|

|

|

|

|

|

●

|

11,008,302

shares of common stock issuable upon exercise of warrants to purchase

common stock outstanding as of September 30, 2021, with a weighted-average exercise price of $2.67 per share; and

|

|

|

|

|

|

|

●

|

any additional shares of common stock we may issue from time to time after

that date.

|

PLAN

OF DISTRIBUTION

We

have entered into an At-The-Market Issuance Sales Agreement with Truist Securities, Inc., as Sales Agent, under which we may issue and

sell over a period of time, and from time to time, shares of our common stock having an aggregate offering price of up to $30.0 million

through the Sales Agent acting as sales agent or directly to the Sales Agent acting as principal. This prospectus supplement relates

to our ability to issue and sell over a period of time, and from time to time, shares of our common stock to or through the Sales Agent

pursuant to the Sales Agreement. Sales of the shares to which this prospectus supplement and the accompanying prospectus relate, if any,

may be made in transactions that are deemed to be “at-the-market” offerings as defined in Rule 415 under the Securities Act,

including sales made directly on or through Nasdaq, the trading market for our common stock, or any other trading market in the Unites

States for our common stock, sales made to or through a market maker other than on an exchange, directly to the Sales Agent as principal

in negotiated transactions, or through a combination of any such methods of sale. To the extent required by Regulation M, the Sales Agent

acting as our sales agent will not engage in any transactions that stabilize our common stock while the offering is ongoing under this

prospectus supplement.

Upon

written instructions from us, the Sales Agent will offer the shares of our common stock, subject to the terms and conditions of the Sales

Agreement, on a daily basis or as otherwise agreed upon by us and the Sales Agent. We will designate the maximum amount of shares of

our common stock to be sold through the Sales Agent on a daily basis or otherwise determine such maximum amount together with the Sales

Agent, subject to certain limitations set forth by the SEC. Subject to the terms and conditions of the Sales Agreement, the Sales Agent

will use commercially reasonable efforts to sell on our behalf all of the shares of our common stock so designated or determined. We

may instruct the Sales Agent not to sell shares of our common stock if the sales cannot be effected at or above the price designated

by us in any such instruction. The Sales Agent may also sell our common stock in negotiated transactions with our prior approval. We

or the Sales Agent may suspend the offering of shares of our common stock being made under the Sales Agreement upon proper notice to

the other party.

For

its services as sales agent in connection with the sale of shares of our common stock that may be offered hereby, we will pay the Sales

Agent an aggregate fee of up to 3.0% of the gross sales price per share for any shares sold through it acting as our sales agent. The

remaining sales proceeds, after deducting any expenses payable by us and any transaction fees imposed by any governmental, regulatory

or self-regulatory organization in connection with the sales, will equal our net proceeds for the sale of such shares. We have agreed

to reimburse the Sales Agent for certain of its expenses in an amount not to exceed $50,000, and, thereafter, reasonable fees

and expenses of the Sales Agent’s incurred in conjunction of performing legal services related to the Sales Agreement for the Company.

The

Sales Agent will provide written confirmation to us no later than the opening of the trading day immediately following the day in which

shares of common stock are sold by it on our behalf under the Sales Agreement. Each confirmation will include the number of shares sold

on that day, the compensation payable by us to the Sales Agent and the proceeds to us net of such compensation.

Settlement

for sales of our common stock will occur, unless the parties agree otherwise, on the second business day following the date on which

any sales were made in return for payment of the proceeds to us net of compensation paid by us to the Sales Agent. There is no arrangement

for funds to be received in an escrow, trust or similar arrangement.

Unless

otherwise required, we will report at least quarterly the number of shares of common stock sold through the Sales Agent under the Sales

Agreement, the net proceeds to us and the compensation paid by us to the Sales Agent in connection with the sales of common stock.

In

connection with the sale of common stock on our behalf, the Sales Agent will be deemed to be an “underwriter” within the

meaning of the Securities Act, and the compensation paid to it will be deemed to be underwriting commissions or discounts. We have agreed,

under the Sales Agreement, to provide indemnification and contribution to the Sales Agent against certain civil liabilities, including

liabilities under the Securities Act.

In

the ordinary course of its business, the Sales Agent and/or its affiliates may perform investment banking, broker-dealer, financial advisory

or other services for us for which it may receive separate fees.

We

estimate that the total expenses from this offering payable by us, excluding compensation payable to the Sales Agent under the Sales

Agreement, will be approximately $75,000.

The

offering of common stock pursuant to the Sales Agreement will terminate upon the earlier of (1) the sale of shares of our common stock

with an aggregate offering price of $30.0 million subject to the Sales Agreement and (2) the termination

of the Sales Agreement, pursuant to its terms, by either the Sales Agent or us.

The Company and the Sales Agent may

in the future agree to add one or more additional sales agents to the offering, in which case the Company will file a further prospectus

supplement providing the name of such additional sales agents and any other required information.

LEGAL

MATTERS

The

validity of the shares of common stock offered under this prospectus will be passed upon by Stradling Yocca Carlson & Rauth, P.C.,

Newport Beach, California. Certain legal matters relating to this offering will be passed upon for the Sales Agent by Goodwin Procter

LLP, New York, New York.

EXPERTS

The

financial statements of Verb Technology Company, Inc. as of and for the years ended December 31, 2020 and 2019 appearing in Verb Technology

Company, Inc.’s Annual Report on Form 10-K have been audited by Weinberg & Company, P.A., an independent registered public

accounting firm, as stated in their report thereon, included therein, and are incorporated by reference in reliance upon such report

and upon the authority of such firm as experts in accounting and auditing.

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

We

have filed with the SEC a registration statement on Form S-3 under the Securities Act, and the rules and regulations promulgated thereunder,

with respect to the shares of common stock offered under this prospectus. This prospectus, which constitutes a part of the registration

statement, does not contain all of the information contained in the registration statement and the exhibits and schedules thereto. Certain

contracts and other documents described in this prospectus, and the documents incorporated by reference herein, are filed as exhibits

to the registration statement, and you may review the full text of these contracts and documents by referring to these exhibits. For

further information with respect to us and the shares of common stock offered under this prospectus, reference is made to the registration

statement and its exhibits and schedules.

We

file annual, quarterly and current reports, proxy statements, and other information with the SEC. The SEC maintains a website that contains

these reports, proxy and information statements, and other information we file electronically with the SEC. Our filings are available

free of charge at the SEC’s website at www.sec.gov.

Our

website address is https://www.verb.tech/. We maintain a section on our website, https://www.verb.tech/investor-relations/sec-filings,

through which you can obtain copies of the reports, proxy and information statements, and other information we file electronically with

the SEC. We use our website as a channel of distribution for material company information. Important information, including financial

information, analyst presentations, financial news releases, and other material information about us is routinely posted on and accessible

on our website. The information set forth on, or accessible from, our website is not part of this prospectus.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” into this prospectus much of the information we file with the SEC, which means

that we can disclose important information to you by referring you to those publicly available documents. The information that we incorporate

by reference in this prospectus is considered to be part of this prospectus. These documents may include Annual Reports on Form

10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as proxy and information statements. You should read the

information incorporated by reference because it is an important part of this prospectus.

This

prospectus incorporates by reference the documents listed below, other than those documents or the portions of those documents deemed

to be furnished and not filed in accordance with SEC rules:

|

|

●

|

our Annual Report on Form 10-K for the fiscal year ended December 31, 2020,

filed with the SEC on March 31, 2021;

|

|

|

|

|

|

|

●

|

our Quarterly Report on Form 10-Q for the quarter ended March 31, 2021,

filed with the SEC on May 13, 2021;

|

|

|

|

|

|

|

●

|

our

Quarterly Report on Form 10-Q for the quarter ended June 30, 2021, filed with the SEC on August 16, 2021;

|

|

|

|

|

|

|

●

|

our Quarterly Report on Form 10-Q for the quarter ended September 30, 2021, filed with the SEC on November 15, 2021;

|

|

|

|

|

|

|

●

|

our Definitive Proxy Statement on Schedule 14A, filed with the SEC on September 3, 2021;

|

|

|

|

|

|

|

●

|

our

Current Reports on Form 8-K filed with the SEC on January 6, 2021, March 15, 2021, March

16, 2021, April 30, 2021, June 4, 2021, August 12, 2021, August 20, 2021, October 4, 2021, and October 22,

2021; and

|

|

|

|

|

|

|

●

|

the

description of our securities contained in Exhibit 4.17 of our Annual Report on Form 10-K for the fiscal year ended December 31,

2019, filed with the SEC on May 14, 2020, including any amendment or report filed for the purpose of updating such description.

|

We

also incorporate by reference any future filings (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K, and

exhibits filed on such form that are related to such items, unless such Form 8-K expressly provides to the contrary) made with the SEC

pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus supplement but prior to the termination

of the offering, and such future filings will become a part of this prospectus from the respective dates that such documents are filed

with the SEC. Any statement contained herein, or in a document incorporated by reference herein, shall be deemed to be modified or superseded

for purposes hereof or of the related prospectus supplement to the extent that a statement contained herein or in any other subsequently

filed document which is also incorporated herein modifies or supersedes such statement. Any such statement so modified or superseded

shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

You

may obtain copies of the documents incorporated by reference in this prospectus free of charge by requesting them in writing or by telephone

at the following address:

Verb

Technology Company, Inc.

782 South Auto Mall Drive

American Fork, Utah 84003

Attn: Investor Relations

Telephone: (855) 250-2300

$75,000,000

Common

Stock

Preferred

Stock

Debt

Securities

Warrants

Subscription

Rights

Units

We

may offer and sell up to $75,000,000 in the aggregate of the securities identified above from time to time in one or more offerings.

This prospectus provides you with a general description of the securities.

Each

time we offer and sell securities, we will provide a supplement to this prospectus that contains specific information about the offering

and the amounts, prices and terms of the securities. The supplement may also add, update or change information contained in this prospectus

with respect to that offering. You should carefully read this prospectus and the applicable prospectus supplement before you invest in

any of our securities.

We

may offer and sell the securities described in this prospectus and any prospectus supplement to or through one or more underwriters,

dealers and agents, or directly to purchasers, or through a combination of these methods. If any underwriters, dealers or agents are

involved in the sale of any of the securities, their names and any applicable purchase price, fee, commission or discount arrangement

between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement.

See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information.

No securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms

of the offering of such securities.

INVESTING

IN OUR SECURITIES INVOLVES RISKS. SEE THE “RISK FACTORS” ON PAGE 1 OF THIS PROSPECTUS AND ANY SIMILAR SECTION CONTAINED IN

THE APPLICABLE PROSPECTUS SUPPLEMENT CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES.

Our

common stock is listed on The Nasdaq Capital Market under the symbol “VERB.” On January 14, 2021 the last reported sale price

of our common stock on The Nasdaq Capital Market was $1.88 per share.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is January 22, 2021.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission, or the SEC, using a “shelf”

registration process. By using a shelf registration statement, we may sell securities from time to time and in one or more offerings

up to a total dollar amount of $75,000,000 as described in this prospectus.

This

prospectus provides you only with a general description of the securities that we may offer. Each time that we offer and sell securities,

we will provide a prospectus supplement to this prospectus that contains specific information about the securities being offered and

sold and the specific terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that

may contain material information relating to these offerings. The prospectus supplement or free writing prospectus may also add, update

or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information

in this prospectus and the applicable prospectus supplement or free writing prospectus, you should rely on the prospectus supplement

or free writing prospectus, as applicable. Before purchasing any securities, you should carefully read both this prospectus and the applicable

prospectus supplement (and any applicable free writing prospectuses), together with the additional information described under the heading

“Where You Can Find More Information.”

We

have not authorized anyone to provide you with any information or to make any representations other than those contained in, or incorporated

by reference in, this prospectus, any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us

or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information

that others may give you. We will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

You should assume that the information appearing in this prospectus and the applicable prospectus supplement to this prospectus is accurate

only as of the date on its respective cover, that the information appearing in any applicable free writing prospectus is accurate only

as of the date of that free writing prospectus, and that any information incorporated by reference is accurate only as of the date of

the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects

may have changed since those dates.

When

we refer to “Verb,” “we,” “our,” “us” and the “Company” in this prospectus,

we mean Verb Technology Company, Inc., and its consolidated subsidiaries unless otherwise specified. When we refer to “you,”

we mean the potential holders of the applicable series of securities.

ABOUT

VERB TECHNOLOGY COMPANY, INC.

Overview

We

are a Software-as-a-Service applications platform developer. Our platform is comprised of a suite of interactive video-based sales enablement

business software products marketed on a subscription basis. Our applications, available in both mobile and desktop versions, are offered

as a fully integrated suite, as well as on a standalone basis, and include verbCRM, our white-labelled Customer Relationship Management

(“CRM”) application for large sales-based enterprises; verbTEAMS, our CRM application for small and medium sized businesses

and solopreneurs; verbLEARN, our Learning Management System application, and verbLIVE, our Live Stream eCommerce application.

Our

suite of applications can be distinguished from other sales enablement applications because our applications utilize our proprietary

interactive video technology as the primary means of communication between sales and marketing professionals and their customers and

prospects. Moreover, the proprietary data collection and analytics capabilities of our applications inform our users in real time, on

their devices, when and for how long their prospects have watched a video, how many times such prospects watched it, and what they clicked-on,

which allows our users to focus their time and efforts on ‘hot leads’ or interested prospects rather than on those that have

not seen such video or otherwise expressed interest in such content. Users can create their hot lead lists by using familiar, intuitive

‘swipe left/swipe right’ on-screen navigation. Our clients report that these capabilities provide for a much more efficient

and effective sales process, resulting in increased sales conversion rates. We developed the proprietary patent-pending interactive video

technology, as well as several other patent-issued and patent-pending technologies that serve as the unique foundation for all of our

platform applications

Corporate

Information

We

are a Nevada corporation. Our principal executive/administrative offices are located at 782 South Auto Mall Drive, American Fork, Utah

84003, and our telephone number is (855) 250-2300. Our website address is https://www.verb.tech/. Information on or accessed through

our website is not incorporated into this prospectus and is not a part of this prospectus.

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before making an investment decision or acquiring any offered securities pursuant to

this prospectus, you should carefully consider the specific factors discussed under the heading “Risk Factors” in the applicable

prospectus supplement, together with all of the other information contained or incorporated by reference in the prospectus supplement

or appearing or incorporated by reference in this prospectus, in light of your particular investment objectives and financial circumstances.

You should also consider the risks, uncertainties, and assumptions discussed under the heading “Risk Factors” included in

our most recent Annual Report on Form 10-K, as revised or supplemented by our subsequent Quarterly Reports on Form 10-Q, or our Current

Reports on Form 8-K that we have filed with the SEC, all of which are incorporated herein by reference, and which may be amended, supplemented,

or superseded from time to time by other reports we file with the SEC in the future. Moreover, the risks so described are not the only

risks we face. Additional risks not presently known to us or that we currently perceive as immaterial may ultimately prove more significant

than expected and impair our business operations. Any of these risks could adversely affect our business, financial condition, results

of operations, and prospects. The trading price of our securities could decline due to any of these risks and you may lose all or part

of your investment. This prospectus and the incorporated documents also contain forward-looking statements that involve risks and uncertainties.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, any prospectus supplement, and the documents incorporated by reference into this prospectus contain certain “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E

of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the Private Securities Litigation Reform Act of 1995 with

respect to our business, financial condition, liquidity, and results of operations. These forward-looking statements are not historical

facts but rather are plans and predictions based on current expectations, estimates, and projections about our industry, our beliefs,

and assumptions. We use words such as “may,” “will,” “could,” “should,” “anticipate,”

“expect,” “intend,” “project,” “plan,” “believe,” “seek,” “estimate,”

“assume,” and variations of these words and similar expressions to identify forward-looking statements. Statements in this

prospectus and the other documents incorporated by reference that are not historical facts are hereby identified as “forward-looking

statements” for the purpose of the safe harbor provided by Section 21E of the Exchange Act and Section 27A of the Securities Act.

These statements are not guarantees of future performance and are subject to certain risks, uncertainties, and other factors, some of

which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted

in the forward-looking statements. These risks and uncertainties include those described in the section above entitled “Risk Factors,”

in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, our subsequent Quarterly Reports on Form 10-Q for the

quarterly periods ended March 31, 2020, June 30, 2020, and September 30, 2020, and the risks detailed from time to time on our future

reports filed with the SEC.

You

should not place undue reliance on these forward-looking statements because the matters they describe are subject to certain risks, uncertainties,

and assumptions that are difficult to predict. The forward-looking statements contained in this prospectus or any prospectus supplement

are made as of the date of this prospectus or, in the case of any accompanying prospectus supplement or documents incorporated by reference,

the date of any such document. Over time, our actual results, performance, or achievements may differ from those expressed or implied

by our forward-looking statements, and such difference might be significant and materially adverse to our security holders. Except as

required by law, we undertake no obligation to update publicly any forward-looking statements, whether as a result of new information,

future events, or otherwise. We have identified some of the important factors that could cause future events to differ from our current

expectations and they are described in this prospectus under the captions “Risk Factors,” and as well as in our most recent

Annual Report on Form 10-K and any subsequently filed Quarterly Reports on Form 10-Q, and in other documents that we may file with the

SEC, all of which you should review carefully. Please consider our forward-looking statements in light of those risks as you read this

prospectus and any prospectus supplement.

USE

OF PROCEEDS

Except

as set forth in any accompanying prospectus supplement, we intend to use the net proceeds from the sale of any securities offered under

this prospectus for general corporate purposes unless the applicable prospectus supplement provides otherwise. General corporate purposes

may include, and are not limited to, research and development costs, the acquisition or licensing of other businesses, products or product

candidates, working capital and capital expenditures.

We

may temporarily invest the net proceeds in a variety of capital preservation instruments, including investment grade instruments, certificates

of deposit or direct or guaranteed obligations of the U.S. government, or may hold such proceeds as cash, until they are used for their

stated purpose. We have not determined the amount of net proceeds to be used specifically for such purposes. As a result, management

will retain broad discretion over the allocation of net proceeds.

DESCRIPTION

OF CAPITAL STOCK

The

following is a summary of all material characteristics of our capital stock as set forth in our Articles of Incorporation, as amended,

or Articles of Incorporation, and our Amended and Restated Bylaws, or Bylaws. The summary does not purport to be complete and is qualified

in its entirety by reference to our Articles of Incorporation and our Bylaws, and to the provisions of the Nevada Revised Statutes, or

the NRS. We encourage you to review complete copies of our Articles of Incorporation and our Bylaws. You can obtain copies of these documents

by following the directions outlined in “Where You Can Find More Information” and “Incorporation of Certain Information

by Reference” elsewhere in this prospectus.

Authorized

Capital Stock

Our

authorized capital stock consists of 200,000,000 shares of common stock, $0.0001 par value per share, and 15,000,000 shares of preferred

stock, $0.0001 par value per share, of which 6,000 shares have been designated Series A Preferred Stock. As of January 14, 2021, we had

48,392,483 shares of common stock outstanding and 1,856 shares of Series A Preferred Stock outstanding.

Common

Stock

All

outstanding shares of our common stock are fully paid and nonassessable. The following summarizes the rights of holders of our common

stock:

|

|

●

|

a

holder of common stock is entitled to one vote per share on all matters to be voted upon generally by the stockholders and are not

entitled to cumulative voting for the election of directors;

|

|

|

●

|

subject

to preferences that may apply to shares of preferred stock outstanding, the holders of common stock are entitled to receive lawful

dividends as may be declared by our board of directors;

|

|

|

●

|

upon

our liquidation, dissolution or winding up, the holders of shares of common stock are entitled to receive a pro rata portion of all

our assets remaining for distribution after satisfaction of all our liabilities and the payment of any liquidation preference of

any outstanding preferred stock;

|

|

|

●

|

there

are no redemption or sinking fund provisions applicable to our common stock; and

|

|

|

●

|

there

are no preemptive, subscription or conversion rights applicable to our common stock.

|

Preferred

Stock

All

of the preferred stock authorized in our articles of incorporation is undesignated. Our board of directors is authorized, without further

approval from our stockholders, to create one or more series of preferred stock, and to designate the rights, privileges, preferences,

restrictions, and limitations of any given series of preferred stock. Accordingly, our board of directors may, without stockholder approval,

issue shares of preferred stock with dividend, liquidation, conversion, voting, or other rights that could adversely affect the voting

power or other rights of the holders of our common stock. The issuance of preferred stock could have the effect of restricting dividends

payable to holders of our common stock, diluting the voting power of our common stock, impairing the liquidation rights of our common

stock, or delaying or preventing a change in control of us, all without further action by our stockholders. The following is a summary

of the terms and conditions of the Series A Preferred Stock.

Series

A Preferred Stock

The

rights and preferences of the Series A Preferred Stock are outlined below.

Rank

and Liquidation Preference

Shares

of Series A Preferred Stock rank prior to our common stock as to distribution of assets upon liquidation events, which include a liquidation,

dissolution or winding up of our company, whether voluntary or involuntary. The liquidation preference of each share of Series A Preferred

Stock is equal to $1,000.00, or the Stated Value, plus any accrued but unpaid dividends on the Series A Preferred Stock and any other

fees or liquidated damages then due and owing under the Certificate of Designation of Rights, Preferences, and Restrictions of Series

A Convertible Preferred Stock, or the Certificate of Designations. If the assets are insufficient to pay in full such amounts, then the

entire assets to be distributed to the holders of our Series A Preferred Stock shall be distributed pro rata among the holders of our

Series A Preferred Stock in accordance with the respective amounts that would be payable on such shares if all amounts payable thereon

were paid in full.

Dividend

Rights

The

holders of Series A Preferred Stock are entitled to receive lawful dividends as may be declared by our board of directors.

Optional

Conversion Rights

Each

share of Series A Preferred Stock is convertible at the option of the holder into shares of our common stock at any time. Each share

of Series A Preferred Stock is convertible into the number of shares of common stock as calculated by dividing the Stated Value of such

share of Series A Preferred Stock by the conversion price. The conversion price was initially $1.55 per share of Series A Preferred Stock,

which conversion price was subsequently adjusted to $1.10 per share and is subject to further adjustment; therefore, each share of Series

A Preferred Stock was initially convertible into approximately 645 shares of common stock and after adjustment of the conversion price

to $1.10 per share, each share of Series A convertible stock is now convertible into approximately 909 shares of common stock, which

number is equal to the quotient of the Stated Value of the Series A Preferred Stock of $1,000.00 divided by the conversion price of $1.10

per share of Series A Preferred Stock. No fractional shares or scrip representing fractional shares are to be issued upon conversion

of the Series A Preferred Stock. As to any fraction of share that the holder of Series A Preferred Stock would otherwise be entitled

to purchase upon conversion, we shall, at our election, either pay a cash adjustment in respect of such final fraction in an amount equal

to such fraction multiplied by the conversion price, or round up to the next whole share.

The

holders of Series A Preferred Stock cannot convert the Series A Preferred Stock if, after giving effect to the conversion, the number

of shares of our common stock beneficially held by the holder (together with such holder’s affiliates) would be in excess of 4.99%

(or, upon election by a holder prior to the issuance of any shares, 9.99% of the number of shares of our common stock issued and outstanding

immediately after giving effect to the issuance of any shares of common stock issuance upon conversion of the Series A Preferred Stock

held by the holder).

We

are also prevented from issuing shares of our common stock upon conversion of the Series A Preferred Stock or exercise of the August

Warrants (as defined below), which, when aggregated with any shares of our common stock issued on or after the issuance date and prior

to such conversion date or exercise date, as applicable (i) in connection with any conversion of the Series A Preferred Stock issued

pursuant to that certain securities purchase agreement entered into on August 14, 2019 by and among us and the investors thereto, or

SPA, (ii) in connection with the exercise of any August Warrants issued pursuant to the SPA, and (iii) in connection with the exercise

of any warrants issued to any registered broker-dealer as a fee in connection with the issuance of the securities pursuant to the SPA,

would exceed 4,459,725 shares of common stock, or 19.99% Cap. This prohibition will terminate upon the approval by our stockholders of

a release from such 19.99% Cap.

Mandatory

Conversion Rights

In

the event the closing price on The Nasdaq Capital Market is 100% greater than the then-base conversion price on each trading day for

any twenty trading days during a consecutive thirty trading day period, we may, within one trading day after the later of stockholder

approval to issue a number of shares of common stock in excess of the 19.99% Cap and the date that the conversion shares registration

statement filed by us with the SEC declared effective, notify each holder of Series A Preferred Stock that all or part of such holder’s

Series A Preferred Stock, plus all liquidated damages and other amounts due, were converted into shares of common stock. Any mandatory

conversion will be made into the number of shares of common stock determined on the same basis as the optional conversion rights above.

Conversion

Price Adjustments

The

conversion price of the Series A Preferred Stock is subject to certain customary adjustments, including upon certain subsequent equity

sales and rights offerings. The conversion price is also subject to downward adjustments if we issue shares of our common stock or securities

convertible into or exercisable for shares of common stock, other than specified excluded securities, at per share prices less than the

then-base conversion price. In this event, the conversion price shall be reduced to then-base conversion price.

The

conversion price is also subject to adjustment if we issue rights, options, or warrants to holders of common stock entitling them to

subscribe for or purchase shares of common stock at a price per share that is lower than the volume weighted average price on the date

for determination of stockholders entitled to receive such rights, option, or warrants. In this event, the conversion price shall be

multiplied by a fraction of which the denominator is the number of shares of common stock outstanding on the date of issuance of such

rights, options, or warrants plus the number of additional shares of common stock offered for subscription or purchase, and the numerator

shall be the number of shares of common stock outstanding on the date of issuance of such rights, options, or warrants plus the number