VEON CEO letter to 2023 Noteholders

January 16 2023 - 1:30AM

Amsterdam, 16 January 2023 –

VEON Ltd. (NASDAQ: VEON, Euronext Amsterdam: VEON), a global

digital operator that provides converged connectivity and online

services, has today contacted holders (the “2023 Noteholders”) of

interests in the 5.95% notes due February 2023 and the 7.25% notes

due April 2023 (together, the “2023 Notes”) issued by VEON Holdings

BV (“VEON Holdings”) in relation to the English Scheme of

Arrangement (the “Scheme”) that aims to extend the maturities of

the 2023 Notes by eight months from their respective maturity

dates.

In the letter, VEON’s Chief Executive Officer

Kaan Terzioğlu requested the assistance and cooperation of 2023

Noteholders in connection with the Scheme, and specifically

requested them to vote in favour of the Scheme at the forthcoming

scheme meeting taking place on 24 January 2023. The deadline by

which 2023 Noteholders must submit their Voting and Proxy Forms

(or, if the 2023 Noteholder holds their 2023 Notes through DTC,

procure that their DTC participant submits on their behalf) is 5.00

p.m. (London time) on 20 January 2023. The letter further

explained:

“We understand the significance of what we are

asking and take our obligations to our stakeholders, including the

repayment of our debts in full and on time, very seriously.

However, despite strong operational results and

a strong balance sheet, given the current circumstances, we must

consider the repayment of the 2023 Notes within the context of our

future debt obligations beyond 2023 and the difficulties VEON

currently faces in raising debt or equity on the international

capital markets on commercially acceptable terms. It is this which

has led us to take the decision to launch the Scheme, as we believe

it would provide the best route to us repaying you in advance of

VEON Holdings’ other future debt obligations.

Your support and the resultant implementation of

the proposal set out in the Scheme will enable us to avoid the

near-term inefficient use of cash that would result from a

significant portion of the principal repayment (relating to 2023

Notes held via the Russian National Settlement Depository (“NSD”))

being trapped in international clearing systems (with no clear

prospect of such monies being returned to VEON). VEON and its legal

advisors have spent significant time and efforts exploring

potential options to avoid having cash trapped in the international

clearing systems, but at present there does not appear to be a

clearly viable path to avoid this unattractive outcome. At a time

that, due to Russian Decree 430, the Group potentially can no

longer rely on payments to the international clearing systems

effectively being recognised by its Russian noteholders as a full

discharge of the underlying liability, the proposed maturity

extension will provide additional time for the impact of Decree 430

on VimpelCom and the Group (as set out in the Scheme documentation)

to become clearer and for the Group to mitigate, where possible,

the associated risk of double payments. The Scheme proposal would

also provide time to progress our asset monetization strategy

anchored by the sale of our Russian business (the “VimpelCom

Disposal”), as announced on 24 November 2022. We believe that the

VimpelCom Disposal represents the single-most material deleveraging

action available to VEON Holdings and increases the prospects of

VEON regaining access to the international capital markets, and

thereby refinancing its indebtedness, on commercially acceptable

terms.

As set out more fully in the Scheme documents,

in return for granting us with a modest extension, we have sought

to compensate the 2023 Noteholders with the benefit of an amendment

fee and a put right. As announced on 11 January 2023, the Company

has further amended the terms of the proposal set out in the Scheme

and entered into undertakings to vote in favour of the Scheme with

certain 2023 Noteholders holding approximately 10.4% of the

principal amount of the 2023 Notes. Each of these amendments

improves the terms of the proposal for the benefit of the 2023

Noteholders.

If the Scheme fails, the directors of VEON

Holdings will need to continue to assess the Company’s solvency and

liquidity position up to the original maturity date of the February

2023 Notes. Whilst VEON Holdings will have sufficient cash to pay

the 2023 Notes on their original maturity dates, we cannot exclude

the possibility that the directors may determine that the best

action for VEON Holdings to take is not to pay on maturity while

the double-payment risk continues. We consider that, by providing

further runway to allow the sale of VimpelCom to complete, the

Scheme will greatly reduce the risks of non-payment and impact on

our stakeholders.

We are pleased that good progress has already

been made in respect of the implementation of the Scheme (and

strive to continue this progress). In particular, on 26

December, we announced that VEON Holdings was granted an OFAC

License (if you would like to see a copy of the OFAC License, you

can request a copy by email to bonds@veon.com). Following receipt

of this license, VEON Holdings believes that no further licenses

are required in order to permit eligible noteholders to vote on the

Scheme. In addition, we are in active dialogue with the Netherlands

Ministry of Finance and the UK Office of Financial Sanctions

Implementation in respect of the licenses we have sought from those

regulators, which will be required to implement the amendments

contemplated by the Scheme.

Therefore in consideration of the steps taken

above, we request your support and encourage you to vote in favour

of the Scheme at the forthcoming scheme meeting. By doing so,

you will provide us with crucial time to mitigate the risks of

trapped cash and potential double-payment and to undertake the

VimpelCom Disposal and our wider asset monetization programme, thus

allowing VEON to deleverage and provide the best-available route

for the repayment of your notes.For all relevant information in

relation to the Scheme please visit https://is.kroll.com/veon, and

any further questions on the voting process can be addressed to

Kroll Issuer Services Limited (as the Company’s information agent)

by email to veon@is.kroll.com or by telephone on + 44 20 7704

0880.

Finally, we acknowledge the questions which have

been raised by several of you to us and to our advisors and hope

that we have been able to address them. However should you have any

questions on the Scheme, other topics covered in this letter, or

other matters related to VEON Group, please contact

bonds@veon.com.

Thank you for your continued trust in and

support of our company.”

DisclaimerThis press release

contains “forward-looking statements”, as the phrase is defined in

Section 27A of the U.S. Securities Act of 1933, as amended, and

Section 21E of the U.S. Securities Exchange Act of 1934, as

amended. Forward-looking statements are not historical facts, and

include statements relating to, among other things, the Scheme,

expectations regarding management plans and the ability to

successfully execute operating model, governance, strategic and

development plans. Forward-looking statements are inherently

subject to risks and uncertainties, many of which VEON cannot

predict with accuracy and some of which VEON might not even

anticipate. The forward-looking statements contained in this

release speak only as of the date of this release. VEON does not

undertake to publicly update, except as required by U.S. federal

securities laws, any forward-looking statement to reflect events or

circumstances after such date or to reflect the occurrence of

unanticipated events.

About VEONVEON is a global

digital operator that currently provides converged connectivity and

online services to over 200 million customers in seven high-growth

markets. We are transforming people’s lives, empowering

individuals, creating opportunities for greater digital inclusion

and driving economic growth across countries that are home to more

than 8% of the world’s population. Headquartered in

Amsterdam, VEON is listed on NASDAQ and Euronext.

For more information visit:

https://www.veon.com.

Contact InformationVEONInvestor

RelationsNik Kershawbonds@veon.com

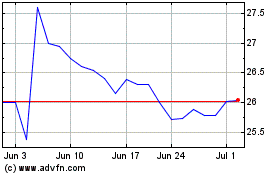

VEON (NASDAQ:VEON)

Historical Stock Chart

From Mar 2024 to Apr 2024

VEON (NASDAQ:VEON)

Historical Stock Chart

From Apr 2023 to Apr 2024