Usio, Inc: (Nasdaq: USIO), a FinTech and integrated electronic

payment solutions provider, today announced financial results for

the fourth quarter and year 2020, which ended December 31, 2020.

Louis Hoch, President and Chief Executive Officer of Usio, said,

“Fourth quarter results once again illustrated the strength of our

multi-channel distribution strategy and the momentum it is

creating. Revenue growth in the quarter accelerated to 27.4%,

driven primarily by strong growth in our prepaid business, an

increase in card revenues and a one-month contribution from Output

Solutions, which was acquired late in the quarter. This strong

growth also demonstrated the leverage in our model, as gross

profits were up 62.7%, we generated an $800,000 improvement at the

operating income (loss) compared to the same quarter a year ago and

we achieved adjusted EBITDA positive cash flow in Q4. We ended the

year in a strong financial position, which will enable us to

continue to invest in our technology, sales and marketing

initiatives to further capitalize on growth opportunities and drive

shareholder value."

“We are extremely excited by the prospect for even faster growth

in calendar year 2021. Looking across the enterprise, our

PayFac business has inflected with PayFac's single largest

customer/client now rapidly boarding and improved conversion rates

throughout our growing portfolio of ISV relationships. Our Prepaid

business has established a new, higher level of performance, and we

are preparing for the next leg up. Our new line of business, Usio

Output Solutions should significantly add to this year’s

performance, with the opportunity to generate even better

performance through the dynamic cross-selling opportunities it

creates as a complement to our other businesses. And, most

importantly, in our ACH business, our relationships with leading

organizations in fast-growing industries like cryptocurrency should

drive strong growth in our most profitable segment and is back on

track for year-over-year growth in the first quarter of 2021. As a

result, revenues should be up significantly and we should

achieve positive cash flow this year. In each of our segments, our

success stems from our winning formula of innovative technology and

unparalleled service, which continues to provide a differentiated,

competitive advantage across the electronic payments

landscape.”

Fourth Quarter 2020 Financial Summary

Revenues were $9.4 million for the fourth quarter, up

27% compared to $7.4 million in the same period last

year.

| |

|

Three Months Ended December 31, |

|

| |

|

(in millions, except percentages) |

|

| |

|

2020 |

|

2019 |

|

$ Change |

|

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ACH and complementary service

revenue |

|

$ |

2.4 |

|

$ |

2.3 |

|

$ |

0.1 |

|

|

3.3 |

% |

| Credit card revenue |

|

|

4.8 |

|

|

4.5 |

|

|

0.3 |

|

|

6.0 |

% |

| Prepaid card services

revenue |

|

|

1.0 |

|

|

0.5 |

|

|

0.5 |

|

|

97.5 |

% |

| Output solutions revenue |

|

|

1.2 |

|

|

— |

|

|

1.2 |

|

|

100.0 |

% |

|

Total Revenue |

|

$ |

9.4 |

|

$ |

7.4 |

|

$ |

2.0 |

|

|

27.4 |

% |

Revenue growth was primarily attributable to a

97.5% increase in prepaid revenues, the recognition of

approximately one month of revenues from the Output Solutions

acquisition and continued growth in our card business with PayFac

revenues up 22% from the same period last year.

Gross profits were $2.4 million, up

62.7% from $1.5 million from the same period last

year. Gross margins were 26.0% compared to 20.3% in the

same period last year. Gross margins in the quarter primarily

reflect a shift to a higher proportion of revenues from our more

profitable business lines including strong gross profit performance

from Usio Output Solutions.

The operating loss for the quarter was $0.7 million

compared to an operating loss of approximately $1.5 million in

the same period last year. The improvement in operating performance

primarily reflects the significant increase in gross profits,

slightly offset by an increase in other selling, general and

administrative expenses.

Adjusted EBITDA was a positive $ 0.3 million in the

quarter, an improvement of nearly $900,000 compared to adjusted

EBITDA loss of $0.6 million in the same period a year

ago.

During the quarter, the Company recognized $813,500 of other

income associated with the forgiveness of its PPP loan.

The Company generated positive net income. Net income for

the fourth quarter of 2020 was $0.2 million, or

$0.01 per share and compared to a net loss of

$1.5 million or $0.12 per share for the same period last

year.

Usio continues to be in solid financial condition with $5.0

million in cash and cash equivalents and no significant debt at

December 31, 2020.

Financial Results for Full Year 2020

Revenues for 2020 were $32.3 million, up

14% from $28.2 million for the same period last

year.

| |

|

Year Ended December 31, |

|

| |

|

(in millions, except percentages) |

|

| |

|

2020 |

|

2019 |

|

$ Change |

|

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ACH and complementary service

revenue |

|

$ |

8.5 |

|

$ |

9.3 |

|

$ |

(0.9 |

) |

|

(9.3 |

)% |

| Credit card revenue |

|

19.5 |

|

|

17.3 |

|

|

2.1 |

|

|

12.3 |

% |

| Prepaid card services

revenue |

|

|

3.2 |

|

|

1.5 |

|

|

1.6 |

|

|

107.3 |

% |

| Output solutions revenue |

|

|

1.2 |

|

|

— |

|

|

1.2 |

|

|

100.0 |

% |

|

Total Revenue |

|

$ |

32.3 |

|

$ |

28.2 |

|

$ |

4.1 |

|

|

14.4 |

% |

Revenue growth was primarily attributable to a 107% increase in

prepaid revenues, incremental revenues from our Output Solutions

acquisition and 12% growth in our card business. ACH and

complimentary service revenues were down due to COVID-19 impacts to

our non-bank consumer lending merchants offset by gains in our

PINLess debit product.

Gross profit for the year ended December 31, 2020 was

$7.4 million, up 24.0% from $5.9 million for the

same period last year. Gross margins were 22.9% for the year

ended December 31, 2020 compared to 21.1% in the same period

last year reflecting an increase in the proportion of revenues

generated from our higher margin operations plus the one-month

impact of the Usio Output Solutions acquisition.

The Company recognized a significant improvement in most of its

profitability metrics. The operating loss for the year ended

December 31, 2020 decreased to $3.8 million compared

to a loss of $5.1 million for the same period of 2019 due to

the increase in gross profits. Adjusted EBITDA for the year ended

December 31, 2020 was a loss of $0.8 million compared to a

loss of $1.7 for the same period in the prior year. Net loss

for the year ended December 31, 2020 was $2.9 million or

$0.19 per share compared to a net loss of $5.1 million or

$0.39 per share in the same period last year.

Conference Call and Webcast

Usio, Inc.'s management will host a conference call with a live

webcast Tuesday March 30, 2021 at 11:00 am Eastern time to

provide a business update. To listen to the conference call,

interested parties within the U.S. should call

+1-844-883-3890. International callers should

call +1-412-317-9246. All callers should ask for the Usio

conference call. The conference call will also be available through

a live webcast, which can be accessed via the company’s website

at www.usio.com/invest.

A replay of the call will be available approximately one hour

after the end of the call through April 13, 2021. The replay

can be accessed via the Company’s website or by

dialing +1-877-344-7529 (U.S.) or

+1-412-317-0088 (international). The replay conference

playback code is 10153201.

About Usio, Inc.

Usio, Inc. (Nasdaq: USIO), a leading FinTech integrated payment

solutions provider, offers a wide range of payment solutions to

merchants, billers, banks, service bureaus, crypto exchanges and

card issuers. The Company operates credit, debit/prepaid, and ACH

payment processing platforms to deliver convenient, world-class

payment solutions and services to their clients. The strength of

the Company lies in its ability to provide tailored solutions for

card issuance, payment acceptance, and bill payments as well as its

unique technology in the prepaid sector. Usio is headquartered in

San Antonio, Texas, and has offices in Austin, Texas and Franklin,

Tennessee, just outside of Nashville.

Websites: www.usio.com, www.singularpayments.com, www.payfacinabox.com, www.akimbocard.com and www.usiooutput.com.

About Non-GAAP Financial Measures

This press release includes non-GAAP financial measures, EBITDA

and adjusted EBITDA, as defined in Regulation G of the Securities

and Exchange Act of 1934, as amended. The Company reports its

financial results in compliance with GAAP, but believes that also

discussing non-GAAP measures provides investors with financial

measures it uses in the management of its business. The Company

defines EBITDA as operating income (loss), before interest, taxes,

depreciation and amortization of intangibles. The Company defines

adjusted EBITDA as EBITDA, as defined above, plus non-cash stock

option costs and certain non-recurring items, such as acquisitions.

These measures may not be comparable to similarly titled measures

reported by other companies. Management uses EBITDA and adjusted

EBITDA as indicators of the Company's operating performance and

ability to fund acquisitions, capital expenditures and other

investments and, in the absence of refinancing options, to repay

debt obligations.

Management believes EBITDA and adjusted EBITDA are helpful to

investors in evaluating the Company's operating performance because

non-cash costs and other items that management believes are not

indicative of its results of operations are excluded. EBITDA and

adjusted EBITDA are supplemental non-GAAP measures, which have

limitations as an analytical tool. Non-GAAP financial measures

should not be considered as a substitute for, or superior to,

measures of financial performance prepared in accordance with GAAP.

Non-GAAP financial measures do not reflect a comprehensive system

of accounting, may differ from GAAP measures with the same names,

and may differ from non-GAAP financial measures with the same or

similar names that are used by other companies. For a description

of our use of EBITDA and adjusted EBITDA, and a reconciliation of

EBITDA and adjusted EBITDA to operating income (loss), see the

section of this press release titled "Non-GAAP Reconciliation."

FORWARD-LOOKING STATEMENTS DISCLAIMER

Except for the historical information contained herein, the

matters discussed in this release include forward-looking

statements which are covered by safe harbors. Those statements

include, but may not be limited to, all statements regarding

management's intent, belief and expectations, such as statements

concerning our future and our operating and growth strategy. These

forward-looking statements are identified by the use of words such

as "believe," "intend," "look forward," "anticipate," "schedule,”

and "expect" among others. Forward-looking statements in this press

release are subject to certain risks and uncertainties inherent in

the Company's business that could cause actual results to vary,

including such risks related to an economic downturn as a result of

the COVID-19 pandemic, the realization of opportunities from the

IMS acquisition, the management of the Company's growth, the loss

of key resellers, the relationships with the Automated

Clearinghouse network, bank sponsors, third-party card processing

providers and merchants, the security of our software, hardware and

information, the volatility of the stock price, the need to obtain

additional financing, risks associated with new tax legislation,

and compliance with complex federal, state and local laws and

regulations, and other risks detailed from time to time in the

Company's filings with the Securities and Exchange Commission

including its annual report on Form 10-K for the fiscal year ended

December 31, 2020. One or more of these factors have affected, and

in the future, could affect the Company’s businesses and financial

results in the future and could cause actual results to differ

materially from plans and projections. The Company believes that

the assumptions underlying the forward-looking statements included

in this release will prove to be accurate. In light of the

significant uncertainties inherent in the forward-looking

statements included herein, the inclusion of such information

should not be regarded as a representation by us or any other

person that the objectives and plans will be achieved. All

forward-looking statements made in this release are based on

information presently available to management. The Company assumes

no obligation to update any forward-looking statements, except as

required by law.

Contact:

Joe Hassett, Investor

Relationsjoeh@gregoryfca.com610-228-2110

USIO, INC.CONSOLIDATED

BALANCE SHEETS

| |

|

December 31,2020 |

|

December 31,2019 |

|

|

ASSETS |

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

5,011,132 |

|

$ |

2,137,580 |

|

| Accounts receivable, net |

|

|

2,863,638 |

|

|

1,274,001 |

|

| Settlement processing

assets |

|

|

43,558,442 |

|

|

38,906,780 |

|

| Prepaid card load assets |

|

|

7,610,242 |

|

|

528,434 |

|

| Customer deposits |

|

|

1,305,296 |

|

|

— |

|

| Inventory |

|

|

176,466 |

|

|

— |

|

| Prepaid expenses and

other |

|

|

301,755 |

|

|

183,575 |

|

|

Current assets before merchant reserves |

|

|

60,826,971 |

|

|

43,030,370 |

|

| Merchant reserves |

|

|

8,265,555 |

|

|

10,016,904 |

|

|

Total current assets |

|

|

69,092,526 |

|

|

53,047,274 |

|

| |

|

|

|

|

|

|

|

| Property and equipment,

net |

|

|

3,105,926 |

|

|

1,557,521 |

|

| |

|

|

|

|

|

|

|

| Other assets: |

|

|

|

|

|

|

|

|

Intangibles, net |

|

|

6,035,761 |

|

|

2,676,427 |

|

|

Deferred tax asset |

|

|

1,394,000 |

|

|

1,394,000 |

|

|

Operating lease right-of-use assets |

|

|

2,671,266 |

|

|

2,480,902 |

|

|

Other assets |

|

|

368,078 |

|

|

404,055 |

|

|

Total other assets |

|

|

10,469,105 |

|

|

6,955,384 |

|

| |

|

|

|

|

|

|

|

| Total

Assets |

|

$ |

82,667,557 |

|

$ |

61,560,179 |

|

| |

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

851,349 |

|

$ |

419,849 |

|

|

Accrued expenses |

|

|

1,463,944 |

|

|

1,360,551 |

|

|

Operating lease liabilities, current portion |

|

|

346,913 |

|

|

356,184 |

|

|

Settlement processing obligations |

|

|

43,558,442 |

|

|

38,906,780 |

|

|

Prepaid card load liabilities |

|

|

7,610,242 |

|

|

528,434 |

|

|

Customer deposits |

|

|

1,305,296 |

|

|

— |

|

|

Deferred revenues |

|

|

66,572 |

|

|

123,529 |

|

| Current liabilities before

merchant reserve obligations |

|

|

55,202,758 |

|

|

41,695,327 |

|

|

Merchant reserve obligations |

|

|

8,265,555 |

|

|

10,016,904 |

|

|

Total current liabilities |

|

|

63,468,313 |

|

|

51,712,231 |

|

| |

|

|

|

|

|

|

|

| Non-current liabilities: |

|

|

|

|

|

|

|

|

Operating lease liabilities, non-current portion |

|

|

2,495,883 |

|

|

2,279,613 |

|

|

Total liabilities |

|

|

65,964,196 |

|

|

53,991,844 |

|

| |

|

|

|

|

|

|

|

| Stockholders' Equity: |

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value, 10,000,000 shares authorized; -0-

shares issued and outstanding in 2020 and 2019 |

|

|

— |

|

|

— |

|

| |

|

|

|

|

|

|

|

|

Common stock, $0.001 par value, 200,000,000 shares authorized;

26,260,776 and 18,224,577 issued and 24,974,995 and 17,104,998

outstanding in 2020 and 2019 |

|

|

194,692 |

|

|

186,656 |

|

|

Additional paid-in capital |

|

|

89,659,433 |

|

|

77,055,273 |

|

|

Treasury stock, at cost; 1,285,781 and 1,119,579 shares in 2020 and

2019 |

|

|

(2,165,721 |

) |

|

(1,885,452 |

) |

|

Deferred compensation |

|

|

(5,926,872 |

) |

|

(5,636,154 |

) |

|

Accumulated deficit |

|

|

(65,058,171 |

) |

|

(62,151,988 |

) |

|

Total stockholders' equity |

|

|

16,703,361 |

|

|

7,568,335 |

|

| |

|

|

|

|

|

|

|

| Total Liabilities and

Stockholders' Equity |

|

$ |

82,667,557 |

|

$ |

61,560,179 |

|

USIO, INC.CONSOLIDATED

STATEMENTS OF OPERATIONS

| |

|

Three Months Ended (unaudited) |

|

Twelve Months Ended |

|

| |

|

December 31,2020 |

|

December 31,2019 |

|

December 31,2020 |

|

December 31,2019 |

|

|

Revenues |

|

$ |

9,382,514 |

|

$ |

7,367,392 |

|

$ |

32,251,823 |

|

$ |

28,200,535 |

|

| Cost of services |

|

|

6,942,841 |

|

|

5,868,176 |

|

|

24,875,930 |

|

|

22,251,325 |

|

|

Gross profit |

|

|

2,439,673 |

|

|

1,499,216 |

|

|

7,375,893 |

|

|

5,949,210 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

572,002 |

|

|

337,649 |

|

|

1,475,328 |

|

|

1,292,419 |

|

|

Other expenses |

|

|

2,183,998 |

|

|

2,095,096 |

|

|

8,139,219 |

|

|

7,697,267 |

|

|

Depreciation and Amortization |

|

|

357,959 |

|

|

547,229 |

|

|

1,518,214 |

|

|

2,022,520 |

|

| Total operating expenses |

|

|

3,113,959 |

|

|

2,979,974 |

|

|

11,132,761 |

|

|

11,012,206 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating (loss) |

|

|

(674,286 |

) |

|

(1,480,758 |

) |

|

(3,756,868 |

) |

|

(5,062,996 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

36,592 |

|

|

15,315 |

|

|

59,392 |

|

|

81,790 |

|

|

PPP Loan forgiveness |

|

|

813,500 |

|

|

— |

|

|

813,500 |

|

|

— |

|

|

Other income (expense) |

|

|

(10 |

) |

|

(32,838 |

) |

|

902 |

|

|

(32,653 |

) |

|

Other income and (expense), net |

|

|

850,082 |

|

|

(17,523 |

) |

|

873,794 |

|

|

49,137 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) before income

taxes |

|

|

175,796 |

|

|

(1,498,281 |

) |

|

(2,883,074 |

) |

|

(5,013,859 |

) |

| Income taxes |

|

|

22,784 |

|

|

29,932 |

|

|

23,109 |

|

|

101,888 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income

(Loss) |

|

$ |

153,012 |

|

$ |

(1,528,213 |

) |

$ |

(2,906,183 |

) |

$ |

(5,115,747 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (Loss) Per

Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic (loss) per common

share: |

|

$ |

0.01 |

|

$ |

(0.12 |

) |

$ |

(0.19 |

) |

$ |

(0.39 |

) |

| Diluted (loss) per common

share: |

|

$ |

0.01 |

|

$ |

(0.12 |

) |

$ |

(0.19 |

) |

$ |

(0.39 |

) |

| Weighted average common shares

outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

19,940,784 |

|

|

13,086,516 |

|

|

15,428,798 |

|

|

12,958,067 |

|

|

Diluted |

|

|

19,940,784 |

|

|

13,086,516 |

|

|

15,428,798 |

|

|

12,958,067 |

|

USIO, INC.CONSOLIDATED

STATEMENTS OF CASH FLOWS

| |

|

December 31,2020 |

|

December 31,2019 |

|

|

Operating Activities |

|

|

|

|

|

|

|

| Net (loss) |

|

$ |

(2,906,183 |

) |

$ |

(5,115,747 |

) |

| Adjustments to reconcile net

(loss) to net cash provided (used) by operating activities: |

|

|

|

|

|

|

|

| Depreciation |

|

|

518,214 |

|

|

1,022,520 |

|

| Amortization |

|

|

1,000,000 |

|

|

1,000,000 |

|

| Provision for loss on note

receivable |

|

|

— |

|

|

108,750 |

|

| Non-cash stock-based

compensation |

|

|

1,475,328 |

|

|

1,292,419 |

|

| Amortization of stock warrant

costs |

|

|

35,943 |

|

|

35,940 |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(905,901 |

) |

|

(59,646 |

) |

|

Prepaid expenses and other |

|

|

(80,923 |

) |

|

(81,853 |

) |

|

Operating lease right-to-use assets |

|

|

(190,364 |

) |

|

(2,480,902 |

) |

|

Other assets |

|

|

35,977 |

|

|

(97,298 |

) |

|

Inventory |

|

|

(8,328 |

) |

|

— |

|

|

Accounts payable and accrued expenses |

|

|

534,893 |

|

|

619,505 |

|

|

Operating lease liabilities |

|

|

206,999 |

|

|

2,635,797 |

|

|

Prepaid card load obligations |

|

|

7,081,808 |

|

|

(7,045 |

) |

|

Merchant reserves |

|

|

(1,751,349 |

) |

|

(2,628,899 |

) |

|

Customer deposits |

|

|

1,305,296 |

|

|

— |

|

|

Deferred revenue |

|

|

(56,957 |

) |

|

103,529 |

|

|

Deferred rent |

|

|

— |

|

|

(79,748 |

) |

| Net cash provided (used) by

operating activities |

|

|

6,294,453 |

|

|

(3,732,678 |

) |

| |

|

|

|

|

|

|

|

| Investing

Activities |

|

|

|

|

|

|

|

| Purchases of property and

equipment |

|

|

(855,394 |

) |

|

(647,383 |

) |

| Purchase of Information

Management Solutions, LLC (IMS) |

|

|

(5,907,408 |

) |

|

— |

|

| Net cash (used) by investing

activities |

|

|

(6,762,802 |

) |

|

(647,383 |

) |

| |

|

|

|

|

|

|

|

| Financing

Activities |

|

|

|

|

|

|

|

| Proceeds from PPP Loan

Program |

|

|

813,500 |

|

|

— |

|

| Forgiveness of PPP Loan |

|

|

(813,500 |

) |

|

— |

|

| Proceeds from public offering,

net of expenses |

|

|

7,257,925 |

|

|

1,793,905 |

|

| Proceeds from private

offering |

|

|

3,000,000 |

|

|

— |

|

| Purchases of treasury

stock |

|

|

(280,269 |

) |

|

(71,906 |

) |

| Net cash provided by financing

activities |

|

|

9,977,656 |

|

|

1,721,999 |

|

| |

|

|

|

|

|

|

|

| Change in cash, cash

equivalents, prepaid card load assets, customer deposits and

merchant reserves |

|

|

9,509,307 |

|

|

(2,658,062 |

) |

| Cash, cash equivalents,

prepaid card load assets, customer deposits and merchant reserves,

beginning of year |

|

|

12,682,918 |

|

|

15,340,980 |

|

| |

|

|

|

|

|

|

|

| Cash, Cash

Equivalents, Prepaid Card Load Assets, Customer Deposits and

Merchant Reserves, End of Year |

|

$ |

22,192,225 |

|

$ |

12,682,918 |

|

| |

|

|

|

|

|

|

|

| Supplemental

disclosures of cash flow information |

|

|

|

|

|

|

|

| Cash paid during the period

for: |

|

|

|

|

|

|

|

|

Interest |

|

$ |

- |

|

$ |

- |

|

|

Income taxes |

|

|

93,525 |

|

|

82,206 |

|

| Non-cash transactions: |

|

|

|

|

|

|

|

|

Issuance of stock warrants in exchange for purchase of IMS |

|

|

552,283 |

|

|

— |

|

|

Issuance of deferred stock compensation |

|

|

1,937,620 |

|

|

273,000 |

|

USIO, INC.STATEMENT OF

CHANGES in STOCKHOLDERS' EQUITY

| |

|

Common Stock |

|

AdditionalPaid- In |

|

Treasury |

|

|

Deferred |

|

|

Accumulated |

|

|

TotalStockholders' |

|

| |

|

Shares |

|

Amount |

|

Capital |

|

Stock |

|

|

Compensation |

|

|

Deficit |

|

|

Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December

31, 2018 |

|

17,129,680 |

|

$ |

185,561 |

|

$ |

74,568,627 |

|

$ |

(1,813,546 |

) |

|

$ |

(6,270,675 |

) |

|

$ |

(57,036,241 |

) |

|

$ |

9,633,726 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of common stock,

public offering |

|

769,230 |

|

|

769 |

|

|

1,793,136 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,793,905 |

|

| Issuance of common stock,

employees, restricted |

|

175,000 |

|

|

175 |

|

|

272,825 |

|

|

— |

|

|

|

(273,000 |

) |

|

|

— |

|

|

|

— |

|

| Issuance of common stock under

equity incentive plan |

|

156,667 |

|

|

157 |

|

|

397,999 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

398,156 |

|

| Reversal of deferred

compensation amortization that did not vest |

|

(6,000 |

) |

|

(6 |

) |

|

(13,254 |

) |

|

— |

|

|

|

13,260 |

|

|

|

— |

|

|

|

— |

|

| Warrant compensation cost |

|

— |

|

|

— |

|

|

35,940 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

35,940 |

|

| Deferred compensation

amortization |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

894,261 |

|

|

|

— |

|

|

|

894,261 |

|

| Purchase of treasury

stock |

|

— |

|

|

— |

|

|

— |

|

|

(71,906 |

) |

|

|

— |

|

|

|

— |

|

|

|

(71,906 |

) |

| Net (loss) for the year |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

(5,115,747 |

) |

|

|

(5,115,747 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December

31, 2019 |

|

18,224,577 |

|

$ |

186,656 |

|

$ |

77,055,273 |

|

$ |

(1,885,452 |

) |

|

$ |

(5,636,154 |

) |

|

$ |

(62,151,988 |

) |

|

$ |

7,568,335 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of common stock under

equity incentive plan |

|

1,956,858 |

|

|

1,958 |

|

|

2,556,087 |

|

|

— |

|

|

|

(1,937,620 |

) |

|

|

— |

|

|

|

620,425 |

|

| Warrant compensation cost |

|

— |

|

|

— |

|

|

588,224 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

588,224 |

|

| Cashless warrant exercise |

|

27,051 |

|

|

27 |

|

|

(27 |

) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Reversal of deferred

compensation amortization that did not vest |

|

(450,000 |

) |

|

(450 |

) |

|

(791,550 |

) |

|

— |

|

|

|

594,900 |

|

|

|

— |

|

|

|

(197,100 |

) |

| Issuance of common stock,

public offering |

|

4,705,883 |

|

|

4,705 |

|

|

7,253,222 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

7,257,927 |

|

| Issuance of common stock,

private offering |

|

1,796,407 |

|

|

1,796 |

|

|

2,998,204 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,000,000 |

|

| Deferred compensation

amortization |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

1,052,002 |

|

|

|

— |

|

|

|

1,052,002 |

|

| Purchase of treasury

stock |

|

— |

|

|

— |

|

|

— |

|

|

(280,269 |

) |

|

|

— |

|

|

|

— |

|

|

|

(280,269 |

) |

| Net (loss) for the year |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

(2,906,183 |

) |

|

|

(2,906,183 |

) |

| Balance at December

31, 2020 |

|

26,260,776 |

|

$ |

194,692 |

|

$ |

89,659,433 |

|

$ |

(2,165,721 |

) |

|

$ |

(5,926,872 |

) |

|

$ |

(65,058,171 |

) |

|

$ |

16,703,361 |

|

RECONCILIATION OF GAAP TO NON-GAAP

FINANCIAL MEASURES

| |

|

Three Months Ended (unaudited) |

|

|

Twelve Months Ended |

|

| |

|

December 31,2020 |

|

|

December 31,2019 |

|

|

December 31,2020 |

|

|

December 31,2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation from Operating

(Loss) to Adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating (Loss) |

|

$ |

(674,286 |

) |

|

$ |

(1,480,758 |

) |

|

$ |

(3,756,868 |

) |

|

$ |

(5,062,996 |

) |

|

Depreciation and amortization |

|

|

357,959 |

|

|

|

547,229 |

|

|

|

1,518,214 |

|

|

|

2,022,520 |

|

|

EBITDA |

|

|

(316,327 |

) |

|

|

(933,529 |

) |

|

|

(2,238,654 |

) |

|

|

(3,040,476 |

) |

| Non-cash stock-based

compensation expense, net |

|

|

572,002 |

|

|

|

337,649 |

|

|

|

1,475,328 |

|

|

|

1,292,419 |

|

|

Adjusted EBITDA |

|

$ |

255,675 |

|

|

$ |

(595,880 |

) |

|

$ |

(763,326 |

) |

|

$ |

(1,748,057 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Calculation of Adjusted EBITDA

margins: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

9,382,514 |

|

|

$ |

7,367,392 |

|

|

$ |

32,251,823 |

|

|

$ |

28,200,535 |

|

| Adjusted EBITDA |

|

|

255,675 |

|

|

|

(595,880 |

) |

|

|

(763,326 |

) |

|

|

(1,748,057 |

) |

| Adjusted EBITDA

margins |

|

|

2.7 |

% |

|

|

(8.1 |

)% |

|

|

(2.4 |

)% |

|

|

(6.2 |

)% |

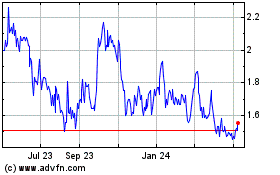

Usio (NASDAQ:USIO)

Historical Stock Chart

From Aug 2024 to Sep 2024

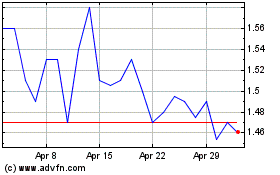

Usio (NASDAQ:USIO)

Historical Stock Chart

From Sep 2023 to Sep 2024