Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

November 29 2023 - 9:12AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE

ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16 UNDER

THE SECURITIES EXCHANGE ACT

OF 1934

For the month of November 2023

Commission File Number:

001-39738

UCOMMUNE INTERNATIONAL LTD

(Exact name of registrant as

specified in its charter)

Floor B1, Tower D

No 2 Guang Hua Road

Chaoyang District, Beijing

100026

People’s Republic

of China

(Address of principal executive

office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

UCOMMUNE INTERNATIONAL LTD |

| |

|

| |

By: |

/s/ Zirui Wang |

| |

Name: |

Zirui Wang |

| |

Title: |

Chief Executive Officer and Chief Risk Officer |

Date: November 29, 2023

[Signature Page to Form 6-K]

2

Exhibit 99.1

Ucommune Announces Extraordinary General Meeting

Results and Share Consolidation

BEIJING, November 29, 2023 /PRNewswire/ -- Ucommune International Ltd

(NASDAQ: UK) (“Ucommune” or the “Company”), a leading co-working office space manager and provider in China, today

announced that at an extraordinary general meeting of the Company held at 10 A.M. on November 29, 2023, Beijing time (9 P.M. on November

28, 2023, U.S. Eastern time) (the “Meeting”), its shareholders approved:

| (1) | an increase of authorized share capital from US$50,000.00

divided into 25,000,000 ordinary shares of par value of US$0.002 each, comprising (i) 20,000,000 Class A ordinary shares of par value

of US$0.002 each and (ii) 5,000,000 Class B ordinary shares of par value of US$0.002 each, to US$600,000.00 divided into 300,000,000

ordinary shares of par value of US$0.002 each, comprising (i) 240,000,000 Class A ordinary shares of par value of US$0.002 each and (ii)

60,000,000 Class B ordinary shares of par value of US$0.002 each, by creating additional 220,000,000 authorized but unissued Class A

ordinary shares and 55,000,000 authorized but unissued Class B ordinary shares (the “Increase of Share Capital”); |

| (2) | a share consolidation of 12 ordinary shares with par value

of US$0.002 each in the Company’s issued and unissued share capital into one ordinary share with par value of US$0.024 (the “Share

Consolidation”), so that the authorized share capital of the Company will be US$600,000.00 divided into 25,000,000 ordinary shares

of par value of US$0.024 each, comprising (i) 20,000,000 Class A ordinary shares of par value of US$0.024 each and (ii) 5,000,000 Class

B ordinary shares of par value of US$0.024 each; and |

| (3) | an amendment of the Company’s memorandum and articles

of association currently in effect to (i) reflect the Increase of Share Capital and the Share Consolidation and (ii) change the voting

power of the Class B ordinary shares of par value of US$0.024 each (the “Class B Ordinary Shares”) from thirty-five (35)

votes for each Class B Ordinary Share to fifty-five (55) votes for each Class B Ordinary Share. |

Holders of Class B ordinary shares approved such variation of rights

of Class B ordinary shares on October 10, 2023 pursuant to the Current M&A. As a result, with immediate effect, each Class A ordinary

shares, par value of US$0.024 each, of the Company shall be entitled to one (1) vote on all matters subject to vote at general and special

meetings of the Company and each Class B Ordinary Share shall be entitled to fifty-five (55) votes on all matters subject to vote at general

and special meetings of the Company.

The Share Consolidation will be effective at 5 P.M. on November 29,

2023, U.S. Eastern time. As a result of the Share Consolidation, each 12 pre-split ordinary shares outstanding will automatically combine

and convert to one issued and outstanding ordinary share without any action on the part of the shareholders, and the terms of the outstanding

warrants, unit purchase options and awards under share incentive plans of the Company will be adjusted automatically without any action

on the part of the holders of those warrants, unit purchase options and awards under share incentive plans.

Beginning with the opening of trading on November 30, 2023, U.S. Eastern

time, the Company’s Class A ordinary shares will begin trading on a post-Share Consolidation basis on the Nasdaq Capital Market

under the same symbol “UK” but under a new CUSIP number of G9449A 134. No fractional shares will be issued in connection with

the Share Consolidation. All fractional shares will be rounded up to the whole number of shares.

About Ucommune International Ltd

Ucommune is China’s leading co-working office space manager and

provider. Founded in 2015, Ucommune has created a large-scale intelligent office ecosystem covering economically vibrant regions throughout

China to empower its members with flexible and cost-efficient office space solutions.

Safe Harbor Statements

This press release contains forward-looking statements within the meaning

of Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are made under the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements can be identified by terminology such as “will,”

“expects,” “anticipates,” “future,” “intends,” “plans,” “believes,”

“estimates,” “potential,” “continue,” “ongoing,” “targets,” “guidance”

and similar statements. The Company may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities

and Exchange Commission (the “SEC”), in its annual report to shareholders, in press releases and other written materials and

in oral statements made by its officers, directors or employees to third parties. Any statements that are not historical facts, including

statements about the Company’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent

risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking

statement, including but not limited to the following: the Company’s growth strategies; its future business development, results

of operations and financial condition; its ability to understand members’ needs and provide products and services to attract and

retain members; its ability to maintain and enhance the recognition and reputation of its brand; its ability to maintain and improve quality

control policies and measures; its ability to establish and maintain relationships with members and business partners; trends and competition

in China’s co-working office space market; changes in its revenues and certain cost or expense items; the expected growth of China’s

co-working office space market; PRC governmental policies and regulations relating to the Company’s business and industry, and general

economic and business conditions in China and globally and assumptions underlying or related to any of the foregoing. Further information

regarding these and other risks, uncertainties or factors is included in the Company’s filings with the SEC. All information provided

in this press release and in the attachments is as of the date of this press release, and the Company undertakes no obligation to update

any forward-looking statement, except as required under applicable law.

For investor and media inquiries, please contact:

Ucommune International Ltd

ir@ucommune.com

SOURCE Ucommune International Ltd

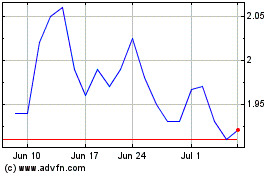

Ucommune (NASDAQ:UK)

Historical Stock Chart

From Dec 2024 to Jan 2025

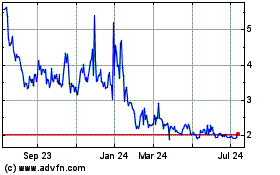

Ucommune (NASDAQ:UK)

Historical Stock Chart

From Jan 2024 to Jan 2025