Trico Bancshares / - Current report filing

August 24 2007 - 6:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest

event reported):

August 21, 2007

TriCo Bancshares

(Exact name of registrant as specified in its charter)

California 0-10661 94-2792841

------------------------ --------------- --------------------

(State or other (Commission File No.) (I.R.S. Employer

jurisdiction of Identification No.)

|

incorporation or organization)

63 Constitution Drive, Chico, California 95973

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code:(530) 898-0300

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

[ ] Soliciting material pursuant to rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Item 8.01: Other Events

On August 21, 2007, the Board of Directors of TriCo Bancshares (NASDAQ: TCBK),

parent company of Tri Counties Bank, announced the completion of its stock

repurchase plan adopted on July 31, 2003 and amended on April 9, 2004 and

adopted a new stock repurchase plan for the repurchase of up to 500,000 shares

of the common stock of TriCo Bancshares on the open market. These events are

described in greater detail in the press release dated August 21, 2007, a copy

of which is attached as Exhibit 99.1.

Item 9.01: Financial Statements and Exhibits

(c) Exhibits

99.1 Press release dated August 21, 2007

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned thereunto duly authorized.

TRICO BANCSHARES

Date: August 22, 2007 By: /s/ Thomas J. Reddish

--------------------------------------

Thomas J. Reddish, Executive Vice

President and Chief Financial Officer

(Principal Financial and Accounting

Officer)

|

Exhibit 99.1

TRICO BANCSHARES ANNOUNCES NEW STOCK REPURCHASE PLAN

PRESS RELEASE Contact: Thomas J. Reddish,

FOR IMMEDIATE RELEASE Vice President & CFO

(530) 898-0300

|

CHICO, Calif. - (August 21, 2007) - TriCo Bancshares (NASDAQ: TCBK), parent

company of Tri Counties Bank, today announced that it has completed its stock

repurchase plan originally adopted on July 31, 2003 and amended on April 9,

2004. Under this plan, the Company repurchased a total of 500,000 shares of its

common stock with the final 105,629 shares being repurchased during August 2007

at an average price of $20.97 per share. The Company has repurchased a total of

1,337,600 shares under repurchase plans since July 2000.

In addition the Board of Directors adopted a new plan to repurchase, as

conditions warrant, up to 500,000 shares of the Company's common stock on the

open market. The timing of purchases and the exact number of shares to be

purchased will depend on market conditions. The 500,000 shares authorized for

repurchase under this new stock repurchase plan represent approximately 3.2% of

the Company's 15,814,662 currently outstanding common shares. This new stock

repurchase plan has no expiration date.

President and CEO Richard P. Smith stated that this new stock repurchase plan is

being implemented to provide management with an additional tool to optimize the

Company's use of equity capital and enhance shareholder value. At June 30, 2007,

the Company's total assets were $1,887,027,000 and shareholders' equity was

$178,600,000.

TriCo Bancshares and Tri Counties Bank are headquartered in Chico, California.

Tri Counties Bank has a 31-year history in the banking industry. Tri Counties

Bank operates 32 traditional branch locations and 23 in-store branch locations

in 22 California counties. Tri Counties Bank offers financial services and

provides a diversified line of products and services to consumers and

businesses, which include demand, savings and time deposits, consumer finance,

online banking, mortgage lending, and commercial banking throughout its market

area. It operates a network of 62 ATMs and a 24-hour, seven days a week

telephone customer service center. Brokerage services are provided at the Bank's

offices by the Bank's association with Raymond James Financial, Inc. For further

information please visit the Tri Counties Bank web-site at

http://www.tricountiesbank.com.

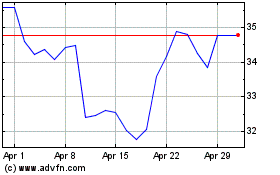

TriCo Bancshares (NASDAQ:TCBK)

Historical Stock Chart

From Jun 2024 to Jul 2024

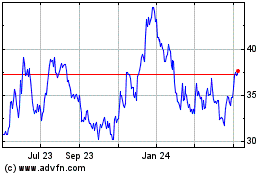

TriCo Bancshares (NASDAQ:TCBK)

Historical Stock Chart

From Jul 2023 to Jul 2024