As filed with the Securities and Exchange Commission

on November 18, 2022

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION

STATEMENT

UNDER

THE SECURITIES

ACT OF 1933

TOP SHIPS INC.

(Exact name of

registrant as specified in its charter)

Republic of

the Marshall Islands

(State or

other jurisdiction of incorporation or organization) |

N.A.

(I.R.S. Employer

Identification No.) |

TOP Ships Inc.

1 Vas. Sofias

and Meg. Alexandrou Str,

15124 Maroussi,

Greece

Tel: + 30 210

812 8107

(Address and telephone

number of Registrant’s principal executive offices)

With copy to:

Will Vogel

Watson Farley

& Williams LLP

250 West 55th

Street

New York, New

York 10019

(212) 922-2200

(telephone number)

(212) 922-1512

(facsimile number)

Will Vogel

Watson Farley

& Williams LLP

250 West 55th

Street

New York, New

York 10019

(212) 922-2200

(telephone number)

(212) 922-1512

(facsimile number)

(Name, address, and

telephone number of agent for service)

Approximate date

of commencement of proposed sale to the public: From time to time after this registration statement becomes effective as determined by

market conditions and other factors.

If any of the securities being registered

on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities

being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933,

check the following box. ☒

If this Form is

filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If this Form is

a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is

a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon

filing with the SEC pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is

a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities

or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. Emerging growth company ☐

If an emerging growth

company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not

to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to

Section 7(a)(2)(B) of the Securities Act. ☐

† The term “new or

revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting

Standards Codification after April 5, 2012.

The

registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective

on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete

and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission

is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any

jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED

NOVEMBER 18, 2022

PROSPECTUS

1,072,725 Common Shares

Issuable upon Exercise of Warrants

Offered by the Selling Shareholders

TOP Ships Inc.

This

prospectus relates to the resale, from time to time, by the selling shareholders identified in this prospectus under the caption “Selling

Shareholders,” or the Selling Shareholders, of up to 1,072,725 of our common shares, par value $0.01 per share, including related

preferred stock purchase rights, issuable upon exercise of certain outstanding warrants to purchase common shares, or the Warrants.

The Warrants were issued by us in a private placement pursuant to a letter agreement dated October 10, 2022, or the Warrant Purchase Agreement.

We

are not selling any common shares under this prospectus and will not receive any proceeds from the sale of common shares by the Selling

Shareholders. We will receive proceeds from cash exercise of the Warrants which, if exercised in cash with respect to all of the 1,072,725

common shares at the initial exercise price of $6.75 per common share, would result in gross proceeds of approximately $7.2 million to

us. The Selling Shareholders will bear all commissions and discounts, if any, attributable to the sale of the common shares.

The Selling Shareholders may sell the common shares

offered by this prospectus from time to time on terms to be determined at the time of sale through ordinary brokerage transactions or

through any other means described in this prospectus under the caption “Plan of Distribution.” The common shares may be sold

at fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market price or at negotiated prices.

Our common shares are traded on the Nasdaq Capital

Market under the symbol “TOPS”.

Investing in our securities

involves a high degree of risk. See “Risk Factors” below, beginning on page 4, and the other risk factors contained

in any applicable prospectus supplement and in the documents incorporated by reference herein or therein.

Neither the Securities and

Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2022.

TABLE OF CONTENTS

Page

ABOUT THIS PROSPECTUS

As

permitted under the rules of the U.S. Securities and Exchange Commission, or the SEC, this prospectus incorporates important information

about us that is contained in documents that we have previously filed with the SEC but that are not included in or delivered with this

prospectus. You may obtain copies of these documents, without charge, from the website maintained by the SEC at www.sec.gov, as well as

other sources. You may also obtain copies of the incorporated documents, without charge, upon written or oral request to TOP Ships Inc.,

1 Vasilisis Sofias and Megalou Alexandrou Str, 15124 Maroussi, Greece. The telephone number of our principal executive office is +30 210

812 8107. See “Where You Can Find More Information”.

You

should rely only on the information contained and incorporated by reference into this prospectus and in any free writing prospectus that

we authorize to be distributed to you. We have not, and the Selling Shareholders have not, authorized anyone to provide you with additional

or different information or to make representations other than those contained in this prospectus. If anyone provides you with different

or inconsistent information, you should not rely on it. This document may only be used where it is legal to sell these securities. You

should assume that the information appearing in this prospectus and any applicable supplement to this prospectus is accurate as of the

date on its respective cover, and that any information incorporated by reference is accurate only as of the date of the document incorporated

by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since

those dates.

Other than in the United States, no action has been

taken by us that would permit a public offering of the securities offered by this prospectus in any jurisdiction where action for that

purpose is required. The securities offered by this prospectus may not be offered or sold, directly or indirectly, nor may this prospectus

or any other offering material or advertisements in connection with the offer and sale of any such securities be distributed or published

in any jurisdiction, except under circumstances that will result in compliance with the applicable rules and regulations of that jurisdiction.

Persons into whose possession this prospectus comes are advised to inform themselves about and to observe any restrictions relating to

the offering and the distribution of this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer

to buy any securities offered by this prospectus in any jurisdiction in which such an offer or a solicitation is unlawful.

We obtained certain statistical data, market data

and other industry data and forecasts used or incorporated by reference into this prospectus from publicly available information. While

we believe that the statistical data, industry data, forecasts and market research are reliable, we have not independently verified the

data, and we do not make any representation as to the accuracy of the information.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus and the documents incorporated by

reference into this prospectus contain certain forward-looking statements made pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements regarding our or our management’s

expectations, hopes, beliefs, intentions or strategies regarding the future and other statements that are other than statements of historical

fact. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including

any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,”

“possible,” “potential,” “predict,” “project,” “should,” “would”

and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not

forward-looking.

The forward-looking statements in this prospectus

and the documents incorporated by reference into this prospectus are based upon various assumptions, many of which are based, in turn,

upon further assumptions, including without limitation, management’s examination of historical operating trends, data contained

in our records and other data available from third parties. Although we believe that these assumptions were reasonable when made, because

these assumptions are inherently subject to significant uncertainties and contingencies that are difficult or impossible to predict and

are beyond our control, we cannot assure you that we will achieve or accomplish these expectations, beliefs or projections. As a result,

you are cautioned not to rely on any forward-looking statements.

Many of these statements are based on our assumptions

about factors that are beyond our ability to control or predict and are subject to risks and uncertainties that are described more fully

in “Item 3. Key Information—D. Risk Factors” of our Annual Report on Form 20-F for the year ended December 31,

2021, which is incorporated by reference herein. Any of these factors or a combination of these factors could materially affect our future

results of operations and the ultimate accuracy of the forward-looking statements. In addition to these important factors and matters

discussed elsewhere herein and in the documents incorporated by reference herein, important factors that, in our view, could cause actual

results to differ materially from those discussed in the forward-looking statements include, among other things:

| · | our ability to maintain or develop new and existing customer relationships with refined product importers and exporters, major crude

oil companies and major commodity traders, including our ability to enter into long-term charters for our vessels; |

| · | our future operating and financial results; |

| · | our future vessel acquisitions, our business strategy and expected and unexpected capital spending or operating expenses, including

any dry-docking, crewing, bunker costs and insurance costs; |

| · | our financial condition and liquidity, including our ability to pay amounts that we owe and to obtain financing in the future to fund

capital expenditures, acquisitions and other general corporate activities; |

| · | oil and chemical tanker industry trends, including fluctuations in charter rates and vessel values and factors affecting vessel supply

and demand; |

| · | our ability to take delivery of, integrate into our fleet, and employ any newbuildings we have ordered or may acquire or order in

the future and the ability of shipyards to deliver vessels on a timely basis; |

| · | the aging of our vessels and resultant increases in operation and dry-docking costs; |

| · | the ability of our vessels to pass classification inspections and vetting inspections by oil majors and big chemical corporations; |

| · | significant changes in vessel performance, including increased vessel breakdowns; |

| · | the creditworthiness of our charterers and the ability of our contract counterparties to fulfill their obligations to us; |

| · | our ability to repay outstanding indebtedness, to obtain additional financing and to obtain replacement charters for our vessels,

in each case, at commercially acceptable rates or at all; |

| · | changes to governmental rules and regulations or actions taken by regulatory authorities and the expected costs thereof; |

| · | our ability to maintain the listing of our common shares on Nasdaq or another trading market; |

| · | our ability to comply with additional costs and risks related to our environmental, social and governance policies; |

| · | potential liability from litigation, including purported class-action litigation; |

| · | changes in general economic and business conditions; |

| · | general domestic and international political conditions, international conflict or war (or threatened war), including between Russia

and Ukraine, potential disruption of shipping routes due to accidents, political events, including “trade wars”, piracy, acts

by terrorists or major disease outbreaks such as the recent worldwide coronavirus outbreak; |

| · | changes in production of or demand for oil and petroleum products and chemicals, either globally or in particular regions; |

| · | the strength of world economies and currencies, including fluctuations in charterhire rates and vessel values; |

| · | potential liability from future litigation and potential costs due to our vessel operations, including due to any environmental damage

and vessel collisions; |

| · | the length and severity of epidemics and pandemics, including the ongoing global outbreak of the novel coronavirus (“COVID-19”)

and its impact on the demand for commercial seaborne transportation and the condition of the financial markets; and |

| · | other important factors described from time to time in the reports filed by us with the U.S. Securities and Exchange Commission, or

the SEC. |

Should one or more of the foregoing risks or uncertainties

materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these

forward-looking statements. Consequently, there can be no assurance that actual results or developments anticipated by us will be realized

or, even if substantially realized, that they will have the expected consequences to, or effects on, us. Given these uncertainties, prospective

investors are cautioned not to place undue reliance on such forward-looking statements.

We undertake no obligation to publicly update or

revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under

applicable laws. If one or more forward-looking statements are updated, no inference should be drawn that additional updates will be made

with respect to those or other forward-looking statements.

ENFORCEABILITY OF CIVIL LIABILITIES

We are a Marshall Islands company, and our principal

executive office is located outside of the United States in Greece. Some of our directors, officers and the experts named in this registration

statement reside outside the United States. In addition, a substantial portion of our assets and the assets of certain of our directors,

officers and experts are located outside of the United States. As a result, it may be difficult or impossible for U.S. investors to serve

process within the United States upon us or any of these persons. You may also have difficulty enforcing, both in and outside the United

States, judgments you may obtain in United States courts against us or these persons in any action, including actions based upon the civil

liability provisions of United States federal or state securities laws.

Furthermore, there is substantial doubt that courts

in the countries in which we or our subsidiaries are incorporated or where our assets or the assets of our subsidiaries, directors or

officers and such experts are located (i) would enforce judgments of U.S. courts obtained in actions against us or our subsidiaries, directors

or officers and such experts based upon the civil liability provisions of applicable U.S. federal and state securities laws or (ii) would

enforce, in original actions, liabilities against us or our subsidiaries, directors or officers and such experts based on those laws.

SUMMARY

This section summarizes certain of the information

that is contained in this prospectus or the documents incorporated by reference herein, and this summary is qualified in its entirety

by that more detailed information. This summary may not contain all of the information that may be important to you. We urge you to carefully

read this entire prospectus and the documents incorporated by reference herein, including our financial statements and the related notes

and the information in the section entitled “Item 5. Operating and Financial Review and Prospects” in our Annual Report on

Form 20-F for the year ended December 31, 2021, which is incorporated by reference herein. As an investor or prospective investor, you

should review carefully the more detailed information that appears later in this prospectus and the information incorporated by reference

in this prospectus, including the section entitled “Risk Factors” herein.

Unless the context otherwise requires, as used

in this prospectus, the terms “Company,” “we,” “us,” and “our” refer to TOP Ships Inc.

and all of its subsidiaries, and “TOP Ships Inc.” refers only to TOP Ships Inc. and not to its subsidiaries.

We use the term deadweight ton, or dwt, in describing

the size of vessels. Dwt, expressed in metric tons each of which is equivalent to 1,000 kilograms, refers to the maximum weight of cargo

and supplies that a vessel can carry.

Our reporting currency is in the U.S. dollar

and all references in this prospectus to “$” or “dollars” are to U.S. dollars, and financial information presented

in this prospectus is derived from the financial statements incorporated by reference in this prospectus that were prepared in accordance

with accounting principles generally accepted in the United States, or U.S. GAAP. Further, unless otherwise indicated, the information

presented in this prospectus gives effect to the following reverse stock splits of our issued and outstanding common shares: a one-for-twenty

reverse stock split of our issued and outstanding common shares effective on August 22, 2019, a one-for-twenty-five reverse stock split

of our issued and outstanding common shares effective on August 10, 2020 and a one-for-twenty reverse stock split of our issued and outstanding

common shares effective on September 23, 2022.

Our Company

We are an international owner and operator of modern,

fuel efficient eco tanker vessels focusing on the transportation of crude oil, petroleum products (clean and dirty) and bulk liquid chemicals.

Our operating fleet has a total capacity of 1,435,000 deadweight tonnes (“dwt”). As of the date of this prospectus, our fleet

consists of one 50,000 dwt product/chemical tanker, the M/T Eco Marina Del Ray, five 157,000 dwt Suezmax tankers, the M/T Eco Oceano CA,

the M/T Eco Malibu, the M/T Eco West Coast, the M/T Eco Bel Air and the M/T Eco Beverly Hills, two 300,000 dwt Very Large Crude Carriers

(“VLCCs”), M/T Julius Caesar and M/T Legio X Equestris, and we also own 50% interests in two 50,000 dwt product/chemical tankers,

M/T Eco Yosemite Park and the M/T Eco Joshua Park. All of our vessels are certified by the International Maritime Organization, the United

Nations agency for maritime safety and the prevention of pollution by vessels (the “IMO”) and are capable of carrying a wide

variety of oil products including chemical cargos, which we believe make our vessels attractive to a wide base of charterers.

Our Current Fleet

The following tables present our fleet list as

of the date of this prospectus:

Operating MR Tanker Vessels on sale and leaseback financing agreements

(“SLBs”) (treated as financings):

| Name |

Deadweight |

Charterer |

End of firm

period |

Charterer’s Optional

Periods |

Gross Rate fixed

period/ options |

| M/T Eco Marina Del Ray |

50,000 |

Cargill |

March 2024 |

none |

$15,100 |

Operating Suezmax Vessels on SLBs (treated as operating leases):

| Name |

Deadweight |

Charterer |

End of firm

period |

Charterer’s

Optional Periods |

Gross Rate fixed

period/ options |

| M/T Eco Bel Air |

157,000 |

Trafigura |

March 2024 |

9 months |

$24,000 / $24,000 |

| M/T Eco Beverly Hills |

157,000 |

Trafigura |

May 2024 |

7 months |

$24,000 / $24,000 |

Operating Suezmax Vessels on SLBs (treated as financings):

| Name |

Deadweight |

Charterer |

End of firm

period |

Charterer’s

Optional Periods |

Gross Rate fixed

period/ options |

| M/T Eco Oceano CA |

157,000 |

Central Tankers Chartering Inc. |

March 2037 |

none |

$24,500 |

Operating Suezmax Vessels financed via senior loan facilities:

| Name |

Deadweight |

Charterer |

End of firm

period |

Charterer’s

Optional Periods |

Gross Rate fixed

period/ options |

| M/T Eco West Coast |

157,000 |

Clearlake |

March 2024 |

1+1 years |

$33,950 / $34,750 / $36,750 |

| M/T Eco Malibu |

157,000 |

Clearlake |

May 2024 |

1+1 years |

$33,950 / $34,750 / $36,750 |

Operating VLCC Vessels on SLBs (treated as financings):

| Name |

Deadweight |

Charterer |

End of firm

period |

Charterer’s

Optional Periods |

Gross Rate fixed

period/ options |

| M/T Julius Caesar |

300,000 |

Trafigura |

January 2025 |

1+1 years |

$36,000 / $39,000 / $41,500 |

| M/T Legio X Equestris |

300,000 |

Trafigura |

February 2025 |

1+1 years |

$35,750 / $39,000 / $41,500 |

Operating Joint Venture MR Tanker fleet (50% owned):

| Name |

Deadweight |

Charterer |

End of firm

period |

Charterer’s

Optional Periods |

Gross Rate fixed

period/ options |

| M/T Eco Yosemite Park |

50,000 |

Clearlake |

March 2025 |

5+1+1 years |

$17,400 / $18,650 / $19,900 |

| M/T Eco Joshua Park |

50,000 |

Clearlake |

March 2025 |

5+1+1 years |

$17,400 / $18,650 / $19,900 |

All the vessels in our fleet are equipped with

engines of modern design with improved Specific Fuel Oil Consumption (“SFOC”) and in compliance with the latest emission requirements,

fitted with energy saving improvements in the hull, propellers and rudder as well as equipment that further reduces fuel consumption and

emissions certified with an improved Energy Efficiency Design Index (Phase 2 compliance level as minimum). Vessels with this combination

of technologies, introduced from certain shipyards, are commonly referred to as eco vessels. We believe that recent advances in shipbuilding

design and technology makes these latest generation vessels more fuel-efficient than older vessels in the global fleet that compete with

our vessels for charters, providing us with a competitive advantage. Furthermore, all of our vessels are fitted with ballast water treatment

equipment and exhaust gas cleaning systems (scrubbers).

We believe we have established a reputation in

the international ocean transport industry for operating and maintaining vessels with high standards of performance, reliability and safety.

We have assembled a management team comprised of executives who have extensive experience operating large and diversified fleets of tankers

and who have strong ties to a number of national, regional and international oil companies, charterers and traders.

Corporate Information

Our predecessor, Ocean Holdings Inc., was formed

as a corporation in January 2000 under the laws of the Republic of the Marshall Islands and renamed Top Tankers Inc. in May 2004. In December

2007, Top Tankers Inc. was renamed TOP Ships Inc.

Our common shares are currently listed on the Nasdaq Capital Market

under the symbol “TOPS.” The current address of our principal executive office is 1 Vasilisis Sofias and Megalou Alexandrou

Str, 15124 Maroussi, Greece. The telephone number of our principal executive office is +30 210 812 8107. Our corporate website address

is www.topships.org. The information contained on our website does not constitute part of this prospectus. The Commission maintains a

website that contains reports, proxy and information statements, and other information that we file electronically at www.sec.gov.

THE OFFERING

| |

Common shares issued and outstanding as of November 18, 2022 |

|

3,544,906 common shares. |

| |

|

|

|

| |

Common shares offered by the Selling Shareholders |

|

1,072,725 common shares. These are the shares underlying the Warrants, issued by us in a private placement pursuant to the Warrant Purchase Agreement. |

| |

|

|

|

| |

Common shares to be outstanding immediately after this offering |

|

4,617,631 common shares, assuming the exercise of all of the Warrants for cash and without adjustment. |

| |

|

|

|

| |

Terms of the offering |

|

The Selling Shareholders, including their transferees, donees, pledgees, assignees and successors-in-interest, may sell, transfer or otherwise dispose of any or all of the common shares offered by this prospectus from time to time on the Nasdaq Capital Market or any other stock exchange, market or trading facility on which the shares are traded or in private transactions. The common shares may be sold at fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market price or at negotiated prices. |

| |

|

|

|

| |

Use of proceeds |

|

The Selling Shareholders will receive all of the proceeds from the sale of any ordinary shares sold by them pursuant to this prospectus. We will not receive any proceeds from the sale of the common shares by the Selling Shareholders. See “Use of Proceeds” in this prospectus. |

| |

|

|

|

| |

Listing

|

|

Our common shares are listed on the Nasdaq Capital Market under the symbol “TOPS”. There is no established trading market for the Warrants and we do not intend to list the Warrants on any exchange or other trading system. |

| |

|

|

|

| |

Risk factors

|

|

Investing in our securities involves a high degree of risk. See “Risk Factors” below, beginning on page 4, and in our Annual Report on Form 20-F for the year ended December 31, 2021, which is incorporated by reference herein, to read about the risks you should consider before investing in our securities. |

| |

|

|

|

The number

of our common shares that will be outstanding immediately after this offering as shown above excludes 5,095,455 common shares issuable

upon conversion of our Series E Preferred Shares, calculated as of the date of this prospectus.

RISK FACTORS

An investment

in our securities involves a high degree of risk. Before making an investment in our securities, you should carefully consider all of

the information included or incorporated by reference into this prospectus, including the risks described under the heading “Item

3. Key Information—D. Risk Factors” in our Annual Report on Form 20-F for the year ended December 31, 2021, which is incorporated

by reference herein, and as updated by annual and other reports and documents we file with the Commission after the date of this prospectus

and that are incorporated by reference herein. Please see the section of this prospectus entitled “Where You Can Find Additional

Information.” The occurrence of one or more of those risk factors could adversely impact our business, financial condition

or results of operations. When we offer and sell any securities pursuant to this prospectus, we may include additional risk factors relevant

to such securities in future filings.

Risks Relating to this Offering and Our Common Shares and Warrants

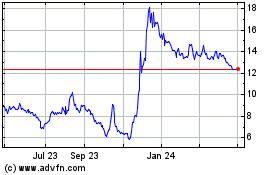

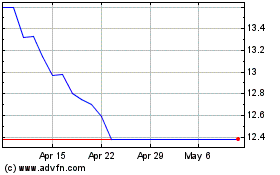

Our share price may continue to be highly

volatile, which could lead to a loss of all or part of a shareholder’s investment.

The market price of our

common shares has fluctuated widely since our common shares began trading in July of 2004 on the Nasdaq Stock Market LLC.

The market price of our common

shares is affected by a variety of factors, including:

| · | fluctuations in interest rates; |

| · | fluctuations in the availability or the price of oil and chemicals; |

| · | fluctuations in foreign currency exchange rates; |

| · | announcements by us or our competitors; |

| · | changes in our relationships with customers or suppliers; |

| · | actual or anticipated fluctuations in our semi-annual and annual results and those

of other public companies in our industry; |

| · | changes in United States or foreign tax laws; |

| · | international sanctions, embargoes, import and export restrictions, nationalizations,

piracy and wars or other conflicts, including the war in Ukraine. |

| · | actual or anticipated fluctuations in our operating results from period to period; |

| · | shortfalls in our operating results from levels forecast by securities analysts; |

| · | market conditions in the shipping industry and the general state of the securities

markets; |

| · | business interruptions caused by the ongoing outbreak of COVID-19; |

| · | mergers and strategic alliances in the shipping industry; |

| · | changes in government regulation; |

| · | a general or industry-specific decline in the demand for, and price of, shares of

our common shares resulting from capital market conditions independent of our operating performance; |

| · | the loss of any of our key management personnel; |

| · | our failure to successfully implement our business plan; |

| · | stock splits / reverse stock splits. |

In addition, over the

last few years, the stock market has experienced price and volume fluctuations, including due to factors relating to the ongoing outbreak

of COVID-19 and the war in Ukraine, and this volatility has sometimes been unrelated to the operating performance of particular companies.

As a result, there is a potential for rapid and substantial decreases in the price of our common shares, including decreases unrelated

to our operating performance or prospects. During 2022 and through November 18, 2022, the closing price of our common shares experienced

a high of $29.80 in March and a low of $2.34 in September. This market and share price volatility relating to the effects of COVID-19,

the ongoing war in Ukraine, as well as general economic, market or political conditions, has and could further reduce the market price

of our common shares in spite of our operating performance and could also increase our cost of capital, which could prevent us from accessing

debt and equity capital on terms acceptable to us or at all.

In addition, a possible

“short squeeze” due to a sudden increase in demand of our common stock that largely exceeds supply may lead to further price

volatility in our common shares. Investors may purchase our common shares to hedge existing exposure in our common shares or to speculate

on the price of our common shares. Speculation on the price of our common shares may involve long and short exposures. To the extent aggregate

short exposure exceeds the number of common shares available for purchase in the open market, investors with short exposure may have to

pay a premium to repurchase our common shares for delivery to lenders of our common shares. Those repurchases may in turn, dramatically

increase the price of our common shares until investors with short exposure are able to purchase additional common shares to cover their

short position. This is often referred to as a “short squeeze.” Following such a short squeeze, once investors purchase the

shares necessary to cover their short position, the price of our common shares may rapidly decline. A short squeeze could lead to volatile

price movements in our shares that are not directly correlated to the performance or prospects of our company.

We issued common shares in the past through

various transactions, and we may do so in the future without shareholder approval, which may dilute our existing shareholders, depress

the trading price of our securities and impair our ability to raise capital through subsequent equity offerings.

We have already sold large

quantities of our common shares, and securities convertible into common shares, pursuant to previous public and private offerings of our

equity and equity-linked securities. We currently have an effective registration statement on Form F-3 (333-267170), for the registered

sale of $200 million of our securities. We also have 13,452 Series E Preferred Shares outstanding, which are convertible into 5,095,455

shares, calculated as of the date of this prospectus, outstanding. All of the Series E Preferred Shares and the common shares issuable

on conversion of the Series E Preferred Shares are beneficially owned by the Lax Trust, an irrevocable trust established for the benefit

of certain family members of Mr. Evangelos J. Pistiolis, our President, Chief Executive Officer and Director. In addition, the Warrants

are exercisable to purchase up to 1,072,725 common shares at an exercise price of $6.75 per share.

Purchasers of the common shares

we sell, as well as our existing shareholders, will experience significant dilution if we sell shares at prices significantly below the

price at which they invested. In addition, we may issue additional common shares or other equity securities of equal or senior rank in

the future in connection with, among other things, debt prepayments, future vessel acquisitions, redemptions of our Series E or Series

F Preferred Shares, or any future equity incentive plan, without shareholder approval, in a number of circumstances. Our existing shareholders

may experience significant dilution if we issue shares in the future at prices below the price at which previous shareholders invested.

Our issuance of additional common shares upon the exercise of the pre-funded warrants would cause the proportionate ownership interest

in us of our existing shareholders, other than the exercising warrant holders, to decrease; the relative voting strength of each previously

outstanding common share held by our existing shareholders to decrease; and the market price of our common shares could decline.

Our

issuance of additional shares of common shares or other equity securities of equal or senior rank would have the following effects:

| |

· |

our existing shareholders’ proportionate ownership interest in us will decrease; |

| |

· |

the amount of cash available for dividends payable on the shares of our common shares may decrease; |

| |

· |

the relative voting strength of each previously outstanding common share may be diminished; and |

| |

· |

the market price of the shares of our common shares may decline. |

The market price of our common

shares could decline due to sales, or the announcements of proposed sales, of a large number of common shares in the market, including

sales of common shares by our large shareholders or by holders of securities convertible into common shares, or the perception that these

sales could occur. These sales or the perception that these sales could occur could also depress the market price of our common shares

and impair our ability to raise capital through the sale of additional equity securities or make it more difficult or impossible for us

to sell equity securities in the future at a time and price that we deem appropriate. We cannot predict the effect that future sales of

common shares or other equity-related securities would have on the market price of our common shares.

Our Third Amended and Restated

Articles of Incorporation, as amended, authorizes our Board of Directors to, among other things, issue additional shares of common or

preferred stock or securities convertible or exchangeable into equity securities, without shareholder approval. We may issue such additional

equity or convertible securities to raise additional capital. The issuance of any additional shares of common or preferred stock or convertible

securities could be substantially dilutive to our shareholders. Moreover, to the extent that we issue restricted stock units, stock appreciation

rights, options or warrants to purchase our common shares in the future and those stock appreciation rights, options or warrants are exercised

or as the restricted stock units vest, our shareholders may experience further dilution. Holders of shares of our common shares have no

preemptive rights that entitle such holders to purchase their pro rata share of any offering of shares of any class or series and, therefore,

such sales or offerings could result in increased dilution to our shareholders.

Nasdaq may delist our common shares

from its exchange which could limit your ability to make transactions in our securities and subject us to additional trading restrictions.

On March 11, 2019, we received

written notification from Nasdaq, indicating that because the closing bid price of our common shares for the last 30 consecutive business

days was below $1.00 per share, we no longer met the minimum bid price requirement for the Nasdaq Capital Market, set forth in Nasdaq

Listing Rule 5450(a)(1). On August 22, 2019 we effectuated a one-for-twenty reverse stock split in order to regain compliance with Nasdaq

Listing Rule 5450(a)(1). As a result, we regained compliance on September 5, 2019.

On December 26, 2019, we received

a written notification from Nasdaq indicating that because the closing bid price of our common shares for the last 30 consecutive business

days was below $1.00 per share, we no longer met the minimum bid price requirement under Nasdaq rules. On April 17, 2020 we received a

written notification from Nasdaq granting an extension to the grace period for regaining compliance. On August 7, 2020 we effectuated

a one-for-twenty-five reverse stock split in order to regain compliance with Nasdaq Listing Rule 5450(a)(1). As a result, we regained

compliance on August 25, 2020.

On January 26, 2022, we received

a written notification from Nasdaq indicating that because the closing bid price of our common shares for the preceding 30 consecutive

business days was below$1.00 per share, we no longer met the minimum bid price requirement under Nasdaq rules. On March 22, 2022, we announced

that Nasdaq had notified us that we had regained compliance with the minimum bid price requirement.

On May 18, 2022, we received

a written notification from Nasdaq indicating that because the closing bid price of our common shares for the last 30 consecutive business

days was below $1.00 per share, we no longer met the minimum bid price requirement under Nasdaq rules. Pursuant to the Nasdaq Listing

Rules, the applicable grace period to regain compliance is 180 days, or until November 14, 2022. On September 23, 2022 we effectuated

a one-for-twenty reverse stock split in order to regain compliance with Nasdaq Listing Rule 5450(a)(1). As a result, we regained compliance

on October 7, 2022.

A continued decline in the

closing price of our common shares on Nasdaq could result in suspension or delisting procedures in respect of our common shares. The commencement

of suspension or delisting procedures by an exchange remains, at all times, at the discretion of such exchange and would be publicly announced

by the exchange. If a suspension or delisting were to occur, there would be significantly less liquidity in the suspended or delisted

securities. In addition, our ability to raise additional necessary capital through equity or debt financing would be greatly impaired.

Furthermore, with respect to any suspended or delisted common shares, we would expect decreases in institutional and other investor demand,

analyst coverage, market making activity and information available concerning trading prices and volume, and fewer broker-dealers would

be willing to execute trades with respect to such common shares. A suspension or delisting would likely decrease the attractiveness of

our common shares to investors and constitutes a breach under certain of our credit agreements as well as constitutes an event of default

under certain classes of our preferred stock and would cause the trading volume of our common shares to decline, which could result in

a further decline in the market price of our common shares.

Finally, if the volatility

in the market continues or worsens, it could have a further adverse effect on the market price of our common shares, regardless of our

operating performance.

USE OF PROCEEDS

We will not receive any proceeds

from the sale of the common shares by the Selling Shareholders.

The Selling Shareholders will

receive all of the net proceeds from the sale of any common shares offered by them under this prospectus. See “Selling Shareholders”.

The Selling Shareholders will pay any underwriting discounts and commissions and expenses incurred by the Selling Shareholders for brokerage,

accounting, tax, legal services or any other expenses incurred by the Selling Shareholders in disposing of these common shares. We will

bear all other costs, fees and expenses incurred in effecting the registration of the common shares covered by this prospectus.

CAPITALIZATION

The following table sets forth our consolidated capitalization as of

June 30, 2022:

| 2. | on an as adjusted basis to give effect to the following transactions which occurred between June 30, 2022 and November 18, 2022: |

| · | the redemption of 865,558 of the Series F Preferred Shares in July 2022 for an aggregate amount of approximately $10.4 million, resulting

in 6,334,442 of the Series F Preferred Shares remaining outstanding; |

| · | the cancellation of 6,435 of common shares due to the reverse stock split effected on September 23, 2022 and the payment of $15.5

thousand in cash-in-lieu remuneration to the fractional common shareholders; |

| · | the exercise of 9,603,000 pre-funded warrants for $960 in July 2022 that resulted in the issuance of 480,150 of our common shares; |

| · | $5.7 million of scheduled debt repayments under the ABN Amro, the Cargill, the second AVIC, second CMBFL and the Alpha Bank facilities; |

| · | the issuance in October 2022 of 715,150 common shares upon exercise of common share purchase warrants issued on June 7, 2022, for

net proceeds of approximately $4.5 million; |

| 3. | on an as further adjusted basis, to give effect to the exercise of all of the Warrants for cash without adjustment resulting in the

issuance of 1,072,725 common shares and in net proceeds of $7.2 million. |

|

(Unaudited, Expressed in thousands of U.S. Dollars, except number

of shares and

per share data) |

Actual |

As Adjusted |

As Further

Adjusted |

| Debt:(1) (2) |

|

|

| Current portion of long term debt |

14,949 |

14,986 |

14,986 |

| Non-current portion of long term debt |

229,509 |

223,805 |

223,805 |

| Total debt |

244,458 |

238,791 |

238,791 |

| Mezzanine equity: |

|

|

|

Preferred stock Series E, $0.01 par value; 13,452 shares issued and

outstanding at June 30, 2022, as adjusted and as further adjusted and Preferred stock Series F,

$0.01 par value; 7,200,000 shares issued and outstanding at June 30,

2022 and 6,334,442 as adjusted and as further adjusted |

102,542 |

92,155 |

92,155 |

| Shareholders’ equity: |

|

|

| Common stock, $0.01 par value, 1,000,000,000 shares authorized; 2,356,041 shares issued and outstanding at June 30, 2022, 3,544,906 common shares issued and outstanding as adjusted and 4,617,631 common shares issued and outstanding as further adjusted |

23 |

35 |

46 |

| Preferred stock Series D, $0.01 par value; 100,000 shares issued and outstanding at June 30, 2022 as adjusted and as further adjusted |

1 |

1 |

1 |

| Additional paid-in capital |

416,717 |

421,207 |

428,407 |

| Accumulated deficit |

(328,149) |

(328,149) |

(328,149) |

| Total Shareholders’ and Mezzanine equity |

191,134 |

185,249 |

192,460 |

| Total capitalization |

435,592 |

424,040 |

431,251 |

| (1) | The capitalization table does not take into account any loan fees for the new loans and sale and leaseback financings or any amortization

of deferred finance fees incurred after June 30, 2022. |

| (2) | Our indebtedness (both current and non-current portions), is secured by titles on our vessels and/or by mortgages on our vessels and

is guaranteed by us. |

DESCRIPTION OF CAPITAL STOCK

Our authorized

capital stock consists of 1,000,000,000 common shares, par value $0.01 per share, of which 3,544,906 common shares were issued and outstanding

as of the date of this prospectus, and 20,000,000 preferred shares with par value of $0.01, of which 100,000 Series D Preferred Shares,

13,452 Series E Preferred Shares, and 6,334,442 Series F Preferred Shares were issued and outstanding as of the date of this prospectus.

For a description

of our capital stock, please see “Item 10. Additional Information” in our Annual Report on Form 20-F for the fiscal year ended

December 31, 2021 which is incorporated by reference herein.

PRIVATE PLACEMENT TRANSACTION

On October 10, 2022, we entered

into the Warrant Purchase Agreement with an accredited investor that was an existing holder of certain of our outstanding warrants issued

in June 2022, wherein the investor agreed to exercise all of such outstanding warrants at an exercise price reduced from $10.00 per share

to $6.75 per share, in consideration for the issuance, in a private placement, of the Warrants to purchase up to an aggregate of 1,072,725

common shares for a purchase price of $6.75 per common share. We granted customary registration rights covering the resale of the common

shares issuable upon exercise of the Warrants. We refer to this transaction as the Private Placement Transaction.

The following is a summary

of the material terms and provisions of the Warrants. This summary is subject to and qualified in its entirety by the form of the Warrants,

which is incorporated by reference herein.

The Warrants are not being

registered under the Securities Act, are not being offered pursuant to this prospectus and were sold pursuant to the exemption provided

in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder. Accordingly, the holders of the Warrants may only

sell common shares issued upon exercise of the Warrants pursuant to an effective registration statement under the Securities Act covering

the resale of those shares, an exemption under Rule 144 under the Securities Act or another applicable exemption under the Securities

Act.

Exercisability.

The Warrants are exercisable until June 7, 2027, commencing on the date of issuance. The Warrants will be exercisable, at the option of

each holder, in whole or in part by delivering to us a duly executed exercise notice with payment in full in immediately available funds

for the number of common shares purchased upon such exercise. If a registration statement registering the resale of the common shares

underlying the Warrants under the Securities Act is not effective or available at any time after the six month anniversary of the date

of issuance of the Warrants, the holder may, in its sole discretion, elect to exercise the warrant through a cashless exercise, in which

case the holder would receive upon such exercise the net number of common shares determined according to the formula set forth in the

warrant.

Exercise Limitation.

A holder will not have the right to exercise any portion of the warrant if the holder (together with its affiliates) would beneficially

own in excess of 9.99% of the number of our common shares outstanding immediately after giving effect to the exercise, as such percentage

of beneficial ownership is determined in accordance with the terms of the Warrants. However, any holder may increase or decrease such

percentage, but not in excess of 9.99%, provided that any increase will not be effective until the 61st day after such election.

Exercise Price Adjustment.

The exercise price of the Warrants is subject to appropriate adjustment in the event of certain stock dividends and distributions, stock

splits, stock combinations, reclassifications or similar events affecting our common shares and also upon any distributions of assets,

including cash, stock or other property to our stockholders.

Exchange Listing.

There is no established trading market for the Warrants and we do not expect a market to develop. In addition, we do not intend to apply

for the listing of the Warrants on any national securities exchange or other trading market.

Fundamental Transactions.

If a fundamental transaction occurs, then the successor entity will succeed to, and be substituted for us, and may exercise every right

and power that we may exercise and will assume all of our obligations under the Warrants with the same effect as if such successor entity

had been named in the warrant itself. If holders of our common shares are given a choice as to the securities, cash or property to be

received in a fundamental transaction, then the holder shall be given the same choice as to the consideration it receives upon any exercise

of the warrant following such fundamental transaction. In addition, the successor entity, at the request of warrant holders, will be obligated

to purchase any unexercised portion of the Warrants in accordance with the terms of such Warrants. Additionally, as more fully described

in the Warrants, in the event of certain fundamental transactions, the holders of those Warrants will be entitled to receive consideration

in an amount equal to the Black Scholes value of the Warrants on the date of consummation of such transaction.

Rights as a

Shareholder. Except as otherwise provided in the Warrants or by virtue of such holder’s ownership of our common shares, the

holder of a warrant will not have the rights or privileges of a holder of our common shares, including any voting rights, until the holder

exercises the warrant.

Resale/Registration Rights.

Pursuant to the Warrant Purchase Agreement, we are required to file a registration statement providing for the resale of the common shares

issued and issuable upon the exercise of the Warrants. Subject to certain exceptions, we are required to use commercially reasonable efforts

to cause such registration to become effective and to keep such registration statement effective at all times until no investor owns any

Warrants or common shares issuable upon exercise thereof.

SELLING SHAREHOLDERS

This prospectus relates to

up to 1,072,725 common shares that the Selling Shareholders may sell in one or more offerings upon exercise of some or all of the Warrants

that the Selling Shareholders have purchased from us in the Private Placement Transaction.

The

registration of these common shares does not mean that the Selling Shareholders will sell or otherwise dispose of all or any of those

securities. The Selling Shareholders may sell or otherwise dispose of all, a portion or none of such common shares from time to time.

We do not know the number of common shares, if any, that will be offered for sale or other disposition by any of the Selling Shareholders

under this prospectus. The Selling Shareholders identified below may currently hold or acquire our common shares or warrants to

purchase our common shares in addition to the Warrants or the common shares registered hereby. In addition, the Selling Shareholders identified

below may sell, transfer, assign or otherwise dispose of some or all of the common shares covered hereby in private placement transactions

exempt from or not subject to the registration requirements of the Securities Act.

To

our knowledge, the Selling Shareholders do not have nor have had within the past three years, any position, office or other material relationship

with us or any of our predecessors or affiliates, other than their ownership of our common shares.

The

following table sets forth certain information with respect to each Selling Shareholder, including (i) the common shares beneficially

owned by the Selling Shareholder prior to this offering (excluding the common shares underlying the Warrants), (ii) the number of common

shares underlying the Warrants and being offered by the Selling Shareholder pursuant to this prospectus and (iii) the Selling Shareholder’s

beneficial ownership after completion of this offering, assuming that all of the common shares covered hereby (but none of the other common

shares, if any, held by the Selling Shareholders) are sold.

We

have prepared the following table based on information supplied to us by the Selling Shareholders on or prior to November 18, 2022,

and we have not sought to verify such information. Ownership and percentage ownership are determined in accordance with the rules and

regulations of the SEC regarding beneficial ownership and include voting or investment power with respect to common shares. This information

does not necessarily indicate beneficial ownership for any other purpose. In computing the number of common shares beneficially owned

by a Selling Shareholder and the percentage ownership of that Selling Shareholder, common shares underlying warrants held by that selling

stockholder that are exercisable as of November 18, 2022, or exercisable within 60 days after November 18, 2022, are deemed

outstanding. Such common shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other

person. The calculation of percentage of beneficial ownership is based on 3,544,906 common shares issued and outstanding as of November

18, 2022. The number of common shares owned prior to this offering and the number of common shares owned following this offering in the

table below do not give effect to the beneficial ownership limitation contained in the Warrants held by the Selling Shareholders, but the

percentages in the table below do give effect to such beneficial ownership limitation.

| Selling Shareholder |

|

|

Total Number of

Common Shares

Owned Prior to

This Offering(1) |

|

|

Total Number of Common Shares Underlying the Warrants and Offered Hereby |

Percentage of

Outstanding

Shares Owned

Prior to This

Offering(2) |

|

|

Maximum

Number of

Common

Shares Which

May Be Sold in

This Offering |

|

|

Number of Shares

Owned Following

This Offering |

|

|

Percentage of

Outstanding Shares

Owned Following

This Offering(2) |

| Armistice Capital Master Fund Ltd.(3) |

|

|

1,072,725 |

|

|

1,072,725 |

9.99% |

|

|

1,072,725 |

|

|

0 |

|

|

0% |

| (1) |

The number of common shares owned prior to this offering and the number of common shares owned following

this offering in the table do not give effect to the beneficial ownership limitation contained in the Warrants held by the Selling

Shareholders, but the percentages in the table do give effect to such beneficial ownership limitation. |

| (2) |

The terms of the Warrants held by the Selling Shareholders include a beneficial ownership limitation that

restricts exercise to the extent the securities beneficially owned by the selling stockholder and its affiliates would represent

beneficial ownership in excess of 9.99% of our common shares outstanding immediately after giving effect to such exercise, subject

to the holder’s option upon notice to us to increase or decrease this beneficial ownership limitation; provided that any

increase of such beneficial limitation percentage shall only be effective upon 61 days’ prior notice to us and such increased

beneficial ownership percentage shall not exceed 9.99% of our common shares. |

| (3) |

The common shares are directly held by Armistice Capital Master Fund Ltd. (the “Master Fund”), a Cayman Islands exempted

company, and may be deemed to be indirectly beneficially owned by Armistice Capital, LLC (“Armistice”), as the investment

manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. Armistice and Steven Boyd disclaim

beneficial ownership of the reported securities except to the extent of their respective pecuniary interest therein. The address

of the Master Fund is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022. |

PLAN OF DISTRIBUTION

We

are registering the shares offered by this prospectus on behalf of the Selling Shareholders. The Selling Shareholders, which, as used

herein, includes donees, pledgees, transferees, or other successors-in-interest selling common shares or interests in common shares received

after the date of this prospectus from the Selling Shareholders as a gift, pledge, partnership distribution, or other non-sale related

transfer, may, from time to time, sell, transfer, or otherwise dispose of any or all of their common shares on any stock exchange, market

or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing

market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale,

or at negotiated prices.

The

Selling Shareholders may, from time to time, pledge or grant a security interest in some or all of the common shares owned by such shareholder

and, if he defaults in the performance of his secured obligations, the pledgees or secured parties may offer and sell the common shares,

from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision

of the Securities Act amending the list of Selling Shareholders to include the pledgee, transferee, or other successors in interest as

Selling Shareholders under this prospectus. The Selling Shareholders may use any one or more of the following methods when disposing of

their shares:

| · | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| · | block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and

resell a portion of the block as principal to facilitate the transaction; |

| · | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| · | an exchange distribution in accordance with the rules of the applicable exchange; |

| · | privately negotiated transactions; |

| · | short sales effected after the effective date of the registration statement of which this prospectus forms

a part; |

| · | through the writing or settlement of options or other hedging transactions, whether through an options

exchange or otherwise; |

| · | broker-dealers may agree with the Selling Shareholders to sell a specified number of such shares at a

stipulated price per share; |

| · | a combination of any such methods of sale; and |

| · | any other method permitted pursuant to applicable law. |

In

connection with the sale of common shares or interests therein, the Selling Shareholders may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the common shares in the course of hedging the positions they

assume. The Selling Shareholders may also sell common shares short and deliver these securities to close out their short positions, or

loan or pledge the common shares to broker-dealers that in turn may sell these securities. The Selling Shareholders may also enter into

option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities

which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such

broker-dealer or other financial institution may resell pursuant to this prospectus (as amended to reflect such transaction).

If

the common shares are sold through broker dealers, the Selling Shareholders will be responsible for discounts or commissions or agent’s

commissions. The aggregate proceeds to the Selling Shareholders from the sale of the common shares offered by them will be the purchase

price of the common shares less discounts or commissions, if any. The Selling Shareholders reserve the right to accept and, together with

their respective agents from time to time, to reject, in whole or in part, any proposed purchase of common shares to be made directly

or through agents. We will not receive any of the proceeds from this offering.

The

Selling Shareholders also may resell all or a portion of the common shares in open market transactions in reliance upon Rule 144 under

the Securities Act or any other exemption from registration under the Securities Act, provided that they meet the criteria and conform

to the requirements of any such rule or exemption.

The

Selling Shareholders and any underwriters, broker-dealers, or agents that participate in the sale of our common shares or interests therein

may be deemed to be “underwriters” within the meaning of Section 2(a)(11) of the Securities Act. Any discounts, commissions,

concessions, or profit they earn on any resale of the shares may be deemed to be underwriting discounts and commissions under the Securities

Act. If a Selling Shareholder is deemed an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act, he

will be subject to the prospectus delivery requirements of the Securities Act. We will make copies of this prospectus (as it may be amended

from time to time) available to the Selling Shareholders for the purpose of satisfying the prospectus delivery requirements of the Securities

Act.

To

the extent required, the common shares to be sold, the respective purchase prices and public offering prices, the names of any agents,

dealers, or underwriters, and any applicable commissions or discounts with respect to a particular offer will be set forth, if appropriate,

in a post-effective amendment to the registration statement that includes this prospectus.

In

order to comply with the securities laws of some states, if applicable, the common shares may be sold in these jurisdictions only through

registered or licensed brokers or dealers. In addition, in some states the common shares may not be sold unless they have been registered

or qualified for sale or an exemption from registration or qualification requirements is available and is complied with.

The

Selling Shareholders and any other person participating in a distribution of the common shares covered by this prospectus will be subject

to the applicable provisions of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the rules and regulations thereunder,

including Regulation M, which may limit the timing of purchases and sales of any of the common shares by the Selling Shareholders and

any other such person. To the extent applicable, Regulation M may also restrict the ability of any person engaged in the distribution

of the common shares to engage in market-making activities with respect to the common shares.

EXPENSES

We

estimate the expenses in connection with the issuance and distribution of the common shares being registered under the registration statement

of which this prospectus forms a part, all of which will be paid by us.

| Commission registration fee |

|

$ |

395 |

|

| Legal fees and expenses |

|

$ |

15,000 |

|

| Accounting fees and expenses |

|

$ |

10,000 |

|

| Miscellaneous fees and expenses |

|

$ |

4,605 |

|

| Total |

|

$ |

30,000 |

|

LEGAL MATTERS

The

validity of the securities offered by this prospectus and certain other legal matters relating to United States and Marshall Islands law

are being passed upon for us by Watson Farley & Williams LLP, New York, New York.

EXPERTS

The consolidated financial statements

of Top Ships Inc. as of December 31, 2021 and 2020, and for each of the three years in the period ended December 31, 2021, incorporated

by reference in this Prospectus, and the effectiveness of Top Ship Inc.’s internal control over financial reporting have been audited

by Deloitte Certified Public Accountants S.A., an independent registered public accounting firm, as stated in their reports. Such financial

statements are incorporated by reference in reliance upon the reports of such firm, given their authority as experts in accounting and

auditing. The offices of Deloitte Certified Public Accountants S.A. are located at Fragoklissias 3a & Granikou Str., 15125 Maroussi,

Athens, Greece.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement

with respect to the securities offered hereby. This prospectus is a part of that registration statement, which includes additional information.

This prospectus does not contain all of the information set forth in the registration statement. Each statement made in this prospectus

concerning a document filed as an exhibit to the registration statement is qualified by reference to that exhibit for a complete statement

of its provisions. The registration statement, including its exhibits and schedules, may be inspected and copied at the public reference

facilities maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the public

reference room by calling 1 (800) SEC-0330, and you may obtain copies at prescribed rates from the Public Reference Section of the SEC

at its principal office in Washington, D.C. 20549. The SEC maintains a website (http://www.sec.gov) that contains reports, proxy and information

statements and other information regarding registrants that file electronically with the SEC.

Information Provided by the Company

We will furnish holders of our common shares with

annual reports containing audited financial statements and a report by our independent registered public accounting firm. The audited

financial statements will be prepared in accordance with U.S. GAAP. As a “foreign private issuer,” we are exempt from the

rules under the Exchange Act prescribing the furnishing and content of proxy statements to shareholders. While we furnish proxy statements

to shareholders in accordance with the rules of Nasdaq, those proxy statements do not conform to Schedule 14A of the proxy rules promulgated

under the Exchange Act. In addition, as a “foreign private issuer,” our officers and directors are exempt from the rules under

the Exchange Act relating to short swing profit reporting and liability.

DOCUMENTS INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference”

into this prospectus the information we file with, and furnish to it, which means that we can disclose important information to you by

referring you to those filed or furnished documents. The information incorporated by reference is considered to be a part of this prospectus.

However, statements contained in this prospectus or in documents that we file with or furnish to the SEC and that are incorporated by

reference into this prospectus will automatically update and supersede information contained in this prospectus, including information

in previously filed or furnished documents or reports that have been incorporated by reference into this prospectus, to the extent the

new information differs from or is inconsistent with the old information. We hereby incorporate by reference the documents listed below:

| · |

our registration statement on Form 8-A12G, as amended, filed with the Commission on July 21, 2004, registering our common stock under Section 12(g) of the Exchange Act, including any subsequent amendments or reports filed for the purpose of updating the description of common stock and/or preferred stock purchase rights contained therein; |

| |

|

| · |

our registration statement on Form 8-A12B, as amended, filed with the Commission on September 22, 2016, registering our preferred stock purchase rights under Section 12(b) of the Exchange Act, including any subsequent amendments or reports filed for the purpose of updating the description of common stock and/or preferred stock purchase rights contained therein; |

| |

|

| · |

our Annual Report on Form 20-F for the year ended December 31, 2021, filed with the Commission on April 15, 2022 and as amended on May 6, 2022; |

We are also incorporating by reference any documents

that we file with the SEC after the date of the filing of this post-effective amendment to the registration statement of which the prospectus

forms a part and prior to the subsequent effectiveness of that registration statement, and all subsequent annual reports on Form 20-F

that we file with the SEC and certain current reports on Form 6-K that we file with or furnish to the SEC pursuant to Section 13(a),

13(c) or 15(d) of the Exchange Act subsequent to the date of this prospectus until we file a post-effective amendment indicating that

the offering of the securities made by this prospectus has been terminated.

You should rely only on the information

contained or incorporated by reference in this prospectus and any accompanying prospectus supplement. We have not authorized any other

person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely

on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume

that the information appearing in this prospectus and any accompanying prospectus supplement as well as the information we previously

filed with the SEC and incorporated by reference, is accurate as of the dates on the front cover of those documents only. Our business,

financial condition and results of operations and prospects may have changed since those dates.

We will provide without charge to each

person, including any beneficial owner, to whom this prospectus is delivered, upon his or her written or oral request, a copy of any or

all documents referred to above which have been or may be incorporated by reference into this prospectus. You may obtain a copy of these

documents by writing to or telephoning us at the following address:

Top Ships Inc.

1 Vas. Sofias and Meg.

Alexandrou

Str, 15124 Maroussi,

Greece

+ 30 210 812 8107 (telephone number)

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

|

Item 8. |

Indemnification of Directors and Officers |

The Amended and Restated Bylaws

of the Company provide that any person who is or was a director or officer of the Registrant, or is or was serving at the request of the

Registrant as a director or officer of another partnership, joint venture, trust or other enterprise shall be entitled to be indemnified

by the Company upon the same terms, under the same conditions, and to the same extent as authorized by Section 60 of the Business Corporation

Act of the Republic of The Marshall Islands, if he acted in good faith and in a manner he reasonably believed to be in or not opposed

to the best interests of the Registrant, and, with respect to any criminal action or proceeding, had reasonable cause to believe his conduct

was unlawful.

There is currently no pending material

litigation or proceeding involving any of our directors, officers or employees for which indemnification is sought.

Section 60 of the BCA provides as follows:

| (1) | Actions not by or in right of the corporation. A corporation shall have the power to indemnify any

person who was or is a party or is threatened to be made a party to any threatened, pending, or completed action, suit or proceeding whether

civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the fact that

he is or was a director or officer of the corporation, or is or was serving at the request of the corporation as a director or officer

of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments,

fines and amounts paid in settlement actually and reasonably incurred by him in connection with such action, suit or proceeding if he

acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation, and, with

respect to any criminal action or proceeding, had no reasonable cause to believe that his conduct was unlawful. The termination of any