Increased hash rate capacity by over 21%

month-over-month to 4 EH/s as of April 30, 2023.

Self-mined 239 BTC in April and 771 BTC year to

date in 2023.

Fully deployed 50 MW of self-mining capacity at

the Nautilus facility ahead of schedule.

TeraWulf Inc. (Nasdaq: WULF) (“TeraWulf” or the “Company”),

owners and operators of vertically integrated, domestic bitcoin

mining facilities powered by more than 91% zero-carbon energy,

today provided an unaudited monthly production and operations

update for April 2023.

April 2023 Highlights

- Fully energized its 50 MW stake at the Nautilus facility, the

first Bitcoin mining facility powered by 100% nuclear power in the

U.S.

- Self-mined 239 bitcoin in April with an average production rate

of 8 bitcoin per day.

- Power cost averaged $7.6k per bitcoin produced, or

approximately $0.030/kWh in April.

- Deployed fleet of 34,500 miners, comprised of 18,500 miners at

its wholly owned Lake Mariner facility in New York and 16,000

self-miners at the nuclear-powered Nautilus facility in

Pennsylvania.

- Completing construction on Building 2 at the Lake Mariner

facility, where an additional 50 MW of self-mining capacity remains

on target to come online in Q2 2023.

Key Metrics 1

April 2023

Bitcoin Self-Mined 2

239

Self-Mining Revenue Equivalent ($M) 3

$6.9

Hosting Revenue ($M) 4

$0.4

Power Cost ($M) 5

$2.0

Avg. Operating Hash Rate (EH/s)6

3.3

Revenue per Bitcoin

$28,808

Power Cost per Bitcoin

$7,602

________________________________

1 Unaudited monthly results are based on

estimates, which remain subject to standard month end adjustments.

The Company’s share of the earnings or losses of the Nautilus

facility is reflected in the caption “Equity in net loss of

investee, net of tax” in the consolidated statements of operations.

Operations at Nautilus do not impact the revenue or cost of goods

sold lines in TeraWulf’s consolidated statements of operations.

2 Includes BTC earned from profit sharing

associated with short-term hosting agreement at the Lake Mariner

facility and TeraWulf’s net share of BTC produced at the Nautilus

facility.

3 Includes TeraWulf’s net share of BTC

revenue generated at the Nautilus facility and profit sharing from

hosting agreement.

4 Excludes BTC earned from profit sharing

associated with short-term hosting agreement at the Lake Mariner

facility.

5 Includes TeraWulf’s net share of power

cost incurred at the Nautilus facility.

6 Includes gross total hash rate of miners

hosted on short-term agreement at the lake Mariner facility.

Management Commentary

“The increase in our hash rate this month more than offsets

April’s significant increase in network difficulty, enabling the

Company to deliver a month-over-month increase in bitcoin

produced,” stated Kerri Langlais, Chief Strategy Officer of

TeraWulf. “Additionally, with a realized average cost of power of

only three cents per kilowatt hour coupled with an average

availability during the month in excess of 98%, we steadily

increased profit margins month over month despite challenging

market conditions.” added Langlais.

“From an operational perspective, we are eager and diligently

preparing for the energization of Building 2 at Lake Mariner in the

coming weeks, which will nearly double the size of our existing

operations in New York from 60 MW to more than 110 MW, and bring

the Company’s total operational mining capacity to 160 MW and 5.5

EH/s.”

Production and Operations Update

As of April 30, 2023, the Company had an operational miner fleet

of approximately 34,500 of the latest generation miners, comprised

of 18,500 miners at its wholly owned Lake Mariner facility in New

York (5,000 of which are hosted) and 16,000 self-miners at the

nuclear-powered Nautilus facility in Pennsylvania.

TeraWulf is in the final stages of construction on Building 2,

which will increase Lake Mariner’s operational capacity to over 110

MW in the coming weeks. Combined, the Company expects to have a

total operational capacity of 50,000 miners (5.5 EH/s) in Q2 2023,

representing approximately 160 MW of power demand.

About TeraWulf

TeraWulf (Nasdaq: WULF) owns and operates vertically integrated,

environmentally clean Bitcoin mining facilities in the United

States. Led by an experienced group of energy entrepreneurs, the

Company currently has two Bitcoin mining facilities: the wholly

owned Lake Mariner facility in New York, and Nautilus Cryptomine

facility in Pennsylvania, a joint venture with Cumulus Coin, LLC.

TeraWulf generates domestically produced Bitcoin powered by

nuclear, hydro, and solar energy with a goal of utilizing 100%

zero-carbon energy. With a core focus on ESG that ties directly to

its business success, TeraWulf expects to offer attractive mining

economics at an industrial scale.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, as amended. Such

forward-looking statements include statements concerning

anticipated future events and expectations that are not historical

facts. All statements, other than statements of historical fact,

are statements that could be deemed forward-looking statements. In

addition, forward-looking statements are typically identified by

words such as “plan,” “believe,” “goal,” “target,” “aim,” “expect,”

“anticipate,” “intend,” “outlook,” “estimate,” “forecast,”

“project,” “continue,” “could,” “may,” “might,” “possible,”

“potential,” “predict,” “should,” “would” and other similar words

and expressions, although the absence of these words or expressions

does not mean that a statement is not forward-looking.

Forward-looking statements are based on the current expectations

and beliefs of TeraWulf’s management and are inherently subject to

a number of factors, risks, uncertainties and assumptions and their

potential effects. There can be no assurance that future

developments will be those that have been anticipated. Actual

results may vary materially from those expressed or implied by

forward-looking statements based on a number of factors, risks,

uncertainties and assumptions, including, among others: (1)

conditions in the cryptocurrency mining industry, including

fluctuation in the market pricing of bitcoin and other

cryptocurrencies, and the economics of cryptocurrency mining,

including as to variables or factors affecting the cost, efficiency

and profitability of cryptocurrency mining; (2) competition among

the various providers of cryptocurrency mining services; (3)

changes in applicable laws, regulations and/or permits affecting

TeraWulf’s operations or the industries in which it operates,

including regulation regarding power generation, cryptocurrency

usage and/or cryptocurrency mining; (4) the ability to implement

certain business objectives and to timely and cost-effectively

execute integrated projects; (5) failure to obtain adequate

financing on a timely basis and/or on acceptable terms with regard

to growth strategies or operations; (6) loss of public confidence

in bitcoin or other cryptocurrencies and the potential for

cryptocurrency market manipulation; (7) the potential of

cybercrime, money-laundering, malware infections and phishing

and/or loss and interference as a result of equipment malfunction

or break-down, physical disaster, data security breach, computer

malfunction or sabotage (and the costs associated with any of the

foregoing); (8) the availability, delivery schedule and cost of

equipment necessary to maintain and grow the business and

operations of TeraWulf, including mining equipment and

infrastructure equipment meeting the technical or other

specifications required to achieve its growth strategy; (9)

employment workforce factors, including the loss of key employees;

(10) litigation relating to TeraWulf, RM 101 f/k/a IKONICS

Corporation and/or the business combination; and (11) other risks

and uncertainties detailed from time to time in the Company’s

filings with the Securities and Exchange Commission (“SEC”).

Potential investors, stockholders and other readers are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the date on which they were made. TeraWulf

does not assume any obligation to publicly update any

forward-looking statement after it was made, whether as a result of

new information, future events or otherwise, except as required by

law or regulation. Investors are referred to the full discussion of

risks and uncertainties associated with forward-looking statements

and the discussion of risk factors contained in the Company’s

filings with the SEC, which are available at www.sec.gov.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230504005472/en/

info@terawulf.com (410) 770-9500

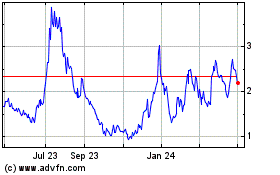

TeraWulf (NASDAQ:WULF)

Historical Stock Chart

From Mar 2024 to Apr 2024

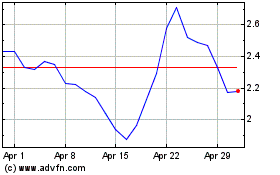

TeraWulf (NASDAQ:WULF)

Historical Stock Chart

From Apr 2023 to Apr 2024