Amended Statement of Beneficial Ownership (sc 13d/a)

June 16 2021 - 5:10PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

13D

(Amendment

No. 4)*

TAOPING

INC.

(Name

of Issuer)

ORDINARY

SHARES, NO PAR VALUE

(Title

of Class of Securities)

G8675V119

(CUSIP

Number)

Jianghuai

Lin

21st

Floor, Everbright Bank Building

Zhuzilin,

Futian District

Shenzhen,

Guangdong, 518040

People’s

Republic of China

Telephone:

(+86) 755-8370-8333

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

June

9, 2021

(Date

of Event which Requires Filing Statement on Schedule 13D)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box [ ].

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7

for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

CUSIP

NO: G8675V 119

|

1.

|

NAMES

OF REPORTING PERSONS

IRS

IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Jianghuai

Lin

|

|

2.

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) [ ]

(b)

[ ]

|

|

3.

|

SEC

USE ONLY

|

|

4.

|

SOURCE

OF FUNDS

PF

|

|

5.

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO

ITEM 2(e) or 2(f)

[ ]

|

|

6.

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

People’s

Republic of China

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH

|

7.

|

SOLE

VOTING POWER

3,598,560 (1)

|

|

8.

|

SHARED

VOTING POWER

|

|

9.

|

SOLE

DISPOSITIVE POWER

3,598,560(1)

|

|

10.

|

SHARED DISPOSITIVE POWER

|

|

11.

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,598,560

ordinary shares(1)

|

|

12.

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN

SHARES [ ]

|

|

13.

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

26.9%(2)

|

|

14.

|

TYPE

OF REPORTING PERSON

IN

|

|

(1)

|

Including

21,250 ordinary shares underlying options that are vested within 60 days hereof.

|

|

|

|

|

(2)

|

Based

on 13,347,644 ordinary shares outstanding as of the date hereof.

|

This

Amendment No. 4 to Schedule 13D (this “Amendment No. 4”) relates to the ordinary shares, no par value (the “Ordinary

Shares”), of Taoping Inc., a British Virgin Islands company (the “Company”).

This

Amendment No. 4 is being filed by Jianghuai Lin (the “Reporting Person”) to amend and supplement the Schedule 13D previously

filed with the Securities and Exchange Commission (the “SEC”) on December 22, 2016 (as amended on January 17, 2017, February

23, 2017 and June 13, 2017, the “Schedule 13D”). Except as provided herein, this Amendment No. 4 does not modify any of the

information previously reported on the Schedule 13D. Capitalized terms used but not defined herein have the meanings assigned to them

in the Schedule 13D.

Item

1. Security and Issuer

This

Amendment No. 4 relates to the Ordinary Shares of the Company. The principal executive offices of the Company are located

at 21st Floor, Everbright Bank Building, Zhuzilin, Futian District, Shenzhen, Guangdong, 518040, People’s Republic of China.

The

Ordinary Shares are listed on the NASDAQ Capital Market under the symbol “TAOP.”

Item

2. Identity and Background

(a)

— (c) and (f) This Schedule 13D is filed by the Reporting Person. The Reporting Person is the Chairman and Chief Executive Officer

of the Company. He is a citizen of the People’s Republic of China and his principal occupation is Chairman and Chief Executive

Officer of the Company. The business address of the Reporting Person is 21st Floor, Everbright Bank Building, Zhuzilin, Futian District,

Shenzhen, Guangdong, 518040, People’s Republic of China.

(d)

– (e) During the five years preceding the date of this filing, the Reporting Person has not been (i) convicted in a criminal proceeding

(excluding traffic violations or similar misdemeanors) or (ii) a party to a civil proceeding of a judicial or administrative body of

competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations

of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such

laws.

Item

3. Source and Amount of Funds or Other Consideration.

Item

3 of Schedule 13D is supplemented by the following:

On

June 9, 2021, the Company acquired all of the equity interests in Taoping New Media Co., Ltd. (“TNM”), a limited liability

company organized under the laws of People’s Republic of China. In exchange, the Company issued 1,213,630 ordinary shares to the

shareholders of TNM, among which 614,369 ordinary shares were issued to the Reporting Person who owned approximately 50.6% of TNM (the

“Acquisition”). A detailed description of the Acquisition appears in the Company’s Report on Form 6-K furnished to

the SEC on March 19, 2021.

Item

4. Purpose of Transaction.

The

Reporting Person acquired Ordinary Shares as described in Item 3 above for investment purposes. Subject to applicable legal requirements,

the Reporting Person may purchase additional securities of the Company from time to time in open market or private transactions, depending

on his evaluation of the Company’s business, prospects and financial condition, the market for the Company’s securities,

other developments concerning the Company, and general economic, money market and stock market conditions. In addition, depending upon

the factors referred to above, the Reporting Person may dispose of all or a portion of the securities of the Company at any time.

Other

than as described above in Item 3 and Item 4 or as would occur upon completion of any of the actions discussed herein, including in any

Exhibits hereto, the Reporting Person does not have any plan or proposal relating to or that would result in any of the events or matters

described in part (a) through (j) of Item 4 of the Statement on Schedule 13D.

Item

5. Interest in Securities of the Issuer.

Item

5 is hereby amended and supplemented by the following:

(a)

– (b) As of the date of this Amendment No. 4, the Reporting Person beneficially owns 3,598,560 Ordinary Shares (including 21,250

Ordinary Shares underlying options that are vested within 60 days hereof), representing approximately 26.9% of the outstanding Ordinary

Shares of the Company (based on 13,347,644 Ordinary Shares outstanding as of the date hereof).

(c)

Other than the transactions discussed in this Amendment No. 4, the Reporting Person had not effected any transactions in the Company’s

securities during the past sixty days.

(d)

None.

(e)

Not applicable.

Item

6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

To

the best knowledge of the Reporting Person, except as provided herein and in the Schedule 13D, there are no other contracts, arrangements,

understandings or relationships (legal or otherwise) between the Reporting Person and any other person with respect to any securities

of the Company, joint ventures, loan or option arrangements, puts or calls, guarantees of profits, divisions of profits or loss, or the

giving or withholding of proxies, or a pledge or contingency, the occurrence of which would give another person voting power over the

securities of the Company.

Item

7. Material to be Filed as Exhibits.

SIGNATURES

After

reasonable inquiry and to the best of his knowledge and belief, the undersigned certifies that the information set forth in this statement

is true, complete and correct.

Dated:

June 16, 2021

|

/s/

Jianghuai Lin

|

|

|

Jianghuai

Lin

|

|

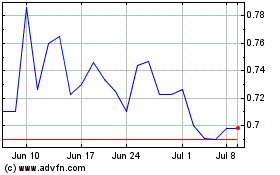

Taoping Inc BVI (NASDAQ:TAOP)

Historical Stock Chart

From Mar 2024 to Apr 2024

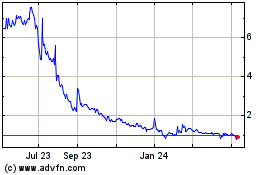

Taoping Inc BVI (NASDAQ:TAOP)

Historical Stock Chart

From Apr 2023 to Apr 2024