false

0001509470

0001509470

2023-11-08

2023-11-08

0001509470

SSSS:CommonStockParValue0.01PerShareMember

2023-11-08

2023-11-08

0001509470

SSSS:Sec6.00NotesDue2026Member

2023-11-08

2023-11-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current

Report

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 8, 2023

SURO CAPITAL CORP.

(Exact name of registrant as specified in its charter)

| Maryland |

1-35156 |

27-4443543 |

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

640 Fifth Avenue

12th Floor

New York, NY 10019

(Address of principal executive offices and zip

code)

Registrant’s telephone number, including

area code: (212) 931-6331

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class: |

Trading symbol: |

Name of each exchange on which

registered: |

| Common Stock, par value $0.01 per share |

SSSS |

Nasdaq Global Select Market |

| 6.00% Notes due 2026 |

SSSSL |

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| |

Item 2.02. |

Results of Operations and Financial Condition. |

On November 8, 2023, SuRo

Capital Corp. (the “Company”) issued a press release announcing its financial results for the fiscal quarter ended September

30, 2023 (the “Press Release”). A copy of the Press Release is included as Exhibit 99.1 to this Current Report on Form 8-K

and is incorporated into this Item 2.02 by reference.

The information disclosed

under this Item 2.02, including the information set forth in Exhibit 99.1 hereto, is being “furnished” and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or

otherwise. The information in this Item 2.02 shall not be incorporated by reference into any registration statement or other document

pursuant to the Securities Act of 1933, as amended, or into any filing or other document pursuant to the Exchange Act, except as otherwise

expressly stated in any such filing.

| |

Item 9.01. |

Financial Statements and Exhibits. |

* The press release attached hereto as Exhibit 99.1 is “furnished”

and not “filed,” as described in Item 2.02 of this Current Report on Form 8-K.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| Date: November 8, 2023 |

SURO CAPITAL CORP. |

| |

|

| |

|

| |

By: |

/s/ Allison Green |

| |

|

Allison Green

Chief Financial Officer, Chief Compliance Officer, Treasurer and Corporate Secretary |

Exhibit 99.1

SuRo Capital Corp. Reports Third Quarter 2023

Financial Results

Net Asset Value of $8.41 Per Share as of September

30, 2023

NEW YORK, NY,

November 8, 2023 (GLOBE NEWSWIRE) – SuRo Capital Corp. (“SuRo Capital”, the “Company”,

“we”, “us”, and “our”) (Nasdaq: SSSS) today announced its financial results for the quarter

ended September 30, 2023. Net assets totaled approximately $212.0 million, or $8.41 per share, at September 30, 2023, as compared to

$7.35 per share at June 30, 2023 and $7.83 per share at September 30, 2022.

“Rising interest rates throughout the third

quarter continued to drive volatility in the public markets. While private market valuations were continuing to converge with their public

comparables, the diminished volume, coupled with increased volatility and the general opacity inherent in the secondary markets, has led

to greater variability in trading prices. There are indications the Federal Reserve Bank has completed raising interest rates; however,

the war in Israel, coupled with a pullback in consumer spending, continue to drive volatility in the equity markets,” said Mark

Klein, Chairman, and Chief Executive Officer of SuRo Capital.

Mr. Klein continued, “Despite these cross

currents, we remain steadfast in our belief there are high-quality opportunities available at attractive prices that allow us to be both

opportunistic and judicious with the deployment of capital. We made four investments during the third quarter: two in new portfolio companies

and two in follow-on investments. Additionally, one of our SPAC sponsor investments closed its previously announced transaction and two

other SPAC sponsor investments announced definitive agreements."

“We continue

to believe the market is undervaluing our portfolio. As such, subject to regulatory trading restrictions, we remain active in repurchasing

shares pursuant to the Share Repurchase Program approved by our Board of Directors. Year-to-date, under both the Share Repurchase Program

and our Modified Dutch Auction Tender Offer, we have repurchased 3.2 million shares for approximately $14.2 million and have a remaining

$20.7 million approved to deploy via the Share Repurchase Program. As we have demonstrated throughout the preceding quarters and years,

we are highly focused on balancing deploying capital between new investment opportunities and share repurchases to maximize shareholder

value,” Mr. Klein concluded.

Investment Portfolio as of September 30, 2023

At September 30, 2023, SuRo Capital held positions

in 39 portfolio companies – 34 privately held and 5 publicly held – with an aggregate fair value of approximately $193.5 million,

excluding short-term US treasuries. The Company’s top five portfolio company investments accounted for approximately 61% of the

total portfolio at fair value as of September 30, 2023.

Top Five Investments as of September 30, 2023

| Portfolio Company ($ in millions) | |

Cost Basis | | |

Fair Value | | |

% of Total Portfolio | |

| Learneo, Inc. (f/k/a Course Hero, Inc.) | |

$ | 15.0 | | |

$ | 65.4 | | |

| 33.8 | % |

| PSQ Holdings, Inc. (d/b/a PublicSq.) | |

| 2.7 | | |

| 18.1 | | |

| 9.4 | |

| ServiceTitan, Inc. | |

| 10.0 | | |

| 11.9 | | |

| 6.2 | |

| Blink Health, Inc. | |

| 15.0 | | |

| 11.6 | | |

| 6.0 | |

| StormWind, LLC | |

| 6.4 | | |

| 10.3 | | |

| 5.3 | |

| Total | |

$ | 49.1 | | |

$ | 117.4 | | |

| 60.7 | % |

Note: Total may not sum due to rounding.

Third Quarter 2023 Investment Portfolio Activity

During the three months ended September 30, 2023,

SuRo Capital made the following new and follow-on investments, excluding short-term US treasuries:

| Portfolio Company | |

Investment | |

Transaction Date | |

Amount |

| FourKites, Inc. | |

Common Shares | |

Various | |

$5.8 million |

| Shogun Enterprises, Inc. (d/b/a Hearth) | |

Series B-4 Preferred & Warrants | |

7/12/2023 | |

$0.5 million |

| Stake Trade, Inc. (d/b/a Prophet Exchange)(1) | |

Simple Agreement for Future Equity (SAFE) | |

7/26/2023 | |

$1.0 million |

| (1) | Investment made through SuRo Capital Sports, LLC. |

During the three months ended September 30, 2023,

SuRo Capital exited or received proceeds from the following investments, excluding short-term US treasuries:

| Portfolio Company | |

Transaction

Date | |

Quantity | |

Average Net

Share Price(1) | |

Net

Proceeds | |

Realized

Loss |

| Nextdoor Holdings, Inc.(2) | |

Various | |

589,996 | |

$3.09 | |

$1.8 million | |

$(1.4 million) |

| Residential Homes For Rent, LLC (d/b/a Second Avenue)(3) | |

Various | |

N/A | |

N/A | |

$0.3 million | |

$- |

| (1) | The average net share price is the net share price realized after deducting all commissions and fees on the sale(s), if applicable. |

| (2) | As of September 30, 2023, SuRo Capital held 262,420 remaining Nextdoor Holdings, Inc. public common shares. |

| (3) | During the three months ended September 30, 2023, approximately $0.3 million was received from Residential

Homes For Rent, LLC (d/b/a Second Avenue) related to the 15% term loan due December 23, 2023. Of the proceeds received, approximately

$0.3 million repaid a portion of the outstanding principal and the remaining was attributed to interest. |

Subsequent to quarter-end through November 8,

2023, SuRo Capital made the following follow-on investments, excluding short-term US treasuries:

| Portfolio Company | |

Investment | |

Transaction Date | |

Amount |

| Xgroup Holdings Limited (d/b/a Xpoint)(1) | |

Convertible Note | |

10/26/2023 | |

$0.3 million |

| (1) | Investment made through SuRo Capital Sports, LLC. |

Subsequent to quarter-end through November 8,

2023, SuRo Capital exited or received proceeds from the following investments, excluding short-term US treasuries:

| Portfolio Company | |

Transaction

Date | |

Quantity | |

Average Net

Share Price(1) | |

Net

Proceeds | |

Realized

Gain |

| PSQ Holdings, Inc. (d/b/a PublicSq.) – Public Warrants (2) | |

Various | |

67,931 | |

$1.01 | |

<$0.1 million | |

<$0.1 million |

| Residential Homes For Rent, LLC (d/b/a Second Avenue)(3) | |

10/23/2023 | |

N/A | |

N/A | |

$0.1 million | |

$- |

| (1) | The average net share price is the net share price realized after deducting all commissions and fees on the sale(s), if applicable. |

| (2) | As of November 8, 2023, SuRo Capital held 2,632,069 remaining PSQ Holdings, Inc. (d/b/a PublicSq.) public

warrants. |

| (3) | Subsequent

to September 30, 2023, $0.1 million was received from Residential Homes for Rent, LLC (d/b/a Second Avenue) related to the 15% term loan

due December 23, 2023. Of the proceeds received, $0.1 million repaid a portion of the outstanding principal and the remaining proceeds

were attributed to interest. |

Third Quarter 2023 Financial Results

| | |

Quarter Ended

September 30, 2023 | | |

Quarter Ended

September 30, 2022 | |

| | |

$ in millions | | |

per share(1) | | |

$ in millions | | |

per share(1) | |

| Net investment loss | |

$ | (2.7 | ) | |

$ | (0.11 | ) | |

$ | (3.8 | ) | |

$ | (0.13 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net realized loss on investments | |

| (1.5 | ) | |

| (0.06 | ) | |

| (5.1 | ) | |

| (0.17 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net change in unrealized appreciation/(depreciation) of investments | |

| 29.3 | | |

| 1.16 | | |

| (37.0 | ) | |

| (1.24 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net change in net assets resulting from operations – basic(2) | |

$ | 25.2 | | |

$ | 0.99 | | |

$ | (45.9 | ) | |

$ | (1.54 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Repurchase of common stock(3) | |

| (0.7 | ) | |

| 0.04 | | |

| (13.2 | ) | |

| 0.11 | |

| | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation | |

| 0.8 | | |

| 0.03 | | |

| 0.7 | | |

| 0.02 | |

| | |

| | | |

| | | |

| | | |

| | |

| Increase/(decrease) in net asset value(2) | |

$ | 25.3 | | |

$ | 1.06 | | |

$ | (58.4 | ) | |

$ | (1.41 | ) |

| (1) | Based on weighted-average number of shares outstanding for the relevant period. |

| (2) | Totals may not sum due to rounding. |

| (3) | During the quarter ended September 30, 2023 the Company repurchased 186,493 shares of SuRo Capital common

stock for approximately $0.7 million in cash under the Share Repurchase Program. During the quarter ended September 30, 2022 the Company

repurchased 2,000,000 shares of SuRo Capital common stock for approximately $13.2 million in cash under the Modified Dutch Auction Tender

Offer. The use of cash in connection with the repurchases decreased net asset value as of quarters-end; however, the reduction in shares

outstanding as of quarters-end resulted in an increase in the net asset value per share. |

Weighted-average common basic shares outstanding

were approximately 25.4 million and 29.8 million for the quarters ended September 30, 2023, and 2022, respectively. As of September 30,

2023, there were 25,209,108 shares of the Company’s common stock outstanding.

SuRo Capital’s liquid assets were approximately

$105.4 million as of September 30, 2023, consisting of cash, short-term US treasuries, and securities of publicly traded portfolio companies

not subject to lock-up restrictions at quarter-end.

Share Repurchase Program

On August 7, 2023, the Company’s Board of

Directors authorized an extension, and a $5.0 million expansion, of the Share Repurchase Program to $60.0 million.

Since inception of the Share Repurchase Program

in August 2017, SuRo Capital has repurchased over 6.0 million shares of its common stock for an aggregate purchase price of approximately

$39.3 million. This does not include repurchases under various tender offers during this time period. During the quarter ended September

30, 2023, under the Share Repurchase Program, the Company repurchased 186,493 shares of its common stock for approximately $0.7 million.

The dollar value of shares that may yet be purchased by the Company under the Share Repurchase Program is approximately $20.7 million.

The Share Repurchase Program is authorized through October 31, 2024.

Under the Share Repurchase Program, the Company

may repurchase its outstanding common stock in the open market, provided it complies with the prohibitions under its insider trading policies

and procedures and the applicable provisions of the Investment Company Act of 1940, as amended, and the Securities Exchange Act of 1934,

as amended.

Conference Call and Webcast

Management

will hold a conference call and webcast for investors at 2:00 p.m. PT (5:00 p.m. ET). The conference call access number for U.S. participants

is 866-580-3963, and the conference call access number for participants outside the U.S. is +1 786-697-3501. The conference ID number

for both access numbers is 4506259. Additionally, interested parties can listen to a live webcast of the call from the "Investor

Relations" section of SuRo Capital’s website at www.surocap.com. An archived replay of the webcast will also be available for

12 months following the live presentation.

A replay

of the conference call may be accessed until 5:00 p.m. PT (8:00 p.m. ET) on November 15, 2023 by dialing 866-583-1035 (U.S.) or +44 (0)

20 3451 9993 (International) and using conference ID number 4506259.

Forward-Looking Statements

Statements included herein, including statements

regarding SuRo Capital's beliefs, expectations, intentions, or strategies for the future, may constitute "forward-looking statements".

SuRo Capital cautions you that forward-looking statements are not guarantees of future performance and that actual results or developments

may differ materially from those projected or implied in these statements. All forward-looking statements involve a number of risks and

uncertainties, including the impact of any market volatility that may be detrimental to our business, our portfolio companies, our industry,

and the global economy, that could cause actual results to differ materially from the plans, intentions, and expectations reflected in

or suggested by the forward-looking statements. Risk factors, cautionary statements, and other conditions which could cause SuRo Capital's

actual results to differ from management's current expectations are contained in SuRo Capital's filings with the Securities and Exchange

Commission. SuRo Capital undertakes no obligation to update any forward-looking statement to reflect events or circumstances that may

arise after the date of this press release.

About SuRo Capital Corp.

SuRo

Capital Corp. (Nasdaq: SSSS) is a publicly traded investment fund that seeks to invest

in high-growth, venture-backed private companies. The fund seeks to create a portfolio of high-growth emerging private companies via

a repeatable and disciplined investment approach, as well as to provide investors with access to such companies through its publicly

traded common stock. SuRo Capital is headquartered in New York, NY and has offices in San Francisco, CA. Connect with the company on

Twitter, LinkedIn, and at www.surocap.com.

Contact

SuRo Capital Corp.

(212) 931-6331

IR@surocap.com

SURO CAPITAL CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF ASSETS

AND LIABILITIES (UNAUDITED)

| | |

September 30, 2023 | | |

December 31, 2022 | |

| ASSETS | |

| | | |

| | |

| Investments at fair value: | |

| | | |

| | |

| Non-controlled/non-affiliate investments (cost of $162,899,416 and $155,103,810, respectively) | |

$ | 152,267,563 | | |

$ | 130,901,546 | |

| Non-controlled/affiliate investments (cost of $32,911,517 and $41,140,804, respectively) | |

| 30,297,127 | | |

| 12,591,162 | |

| Controlled investments (cost of $17,168,157 and $19,883,894, respectively) | |

| 10,928,028 | | |

| 13,695,870 | |

| Total Portfolio Investments | |

| 193,492,718 | | |

| 157,188,578 | |

| Investments in U.S. Treasury bills (cost of $19,990,216 and $84,999,598, respectively) | |

| 20,265,064 | | |

| 85,056,817 | |

| Total Investments (cost of $232,969,306 and $301,128,106, respectively) | |

| 213,757,782 | | |

| 242,245,395 | |

| Cash | |

| 73,503,279 | | |

| 40,117,598 | |

| Escrow proceeds receivable | |

| 309,484 | | |

| 628,332 | |

| Interest and dividends receivable | |

| 100,860 | | |

| 138,766 | |

| Deferred financing costs | |

| 611,736 | | |

| 555,761 | |

| Prepaid expenses and other assets(1) | |

| 693,687 | | |

| 727,006 | |

| Total Assets | |

| 288,976,828 | | |

| 284,412,858 | |

| LIABILITIES | |

| | | |

| | |

| Accounts payable and accrued expenses(1) | |

| 3,162,468 | | |

| 708,827 | |

| Dividends payable | |

| 188,357 | | |

| 296,170 | |

| 6.00% Notes due December 30, 2026(2) | |

| 73,654,960 | | |

| 73,387,159 | |

| Total Liabilities | |

| 77,005,785 | | |

| 74,392,156 | |

| | |

| | | |

| | |

| Net Assets | |

$ | 211,971,043 | | |

$ | 210,020,702 | |

| NET ASSETS | |

| | | |

| | |

| Common stock, par value $0.01 per share (100,000,000 authorized; 25,209,108 and 28,429,499 issued and outstanding, respectively) | |

$ | 252,091 | | |

$ | 284,295 | |

| Paid-in capital in excess of par | |

| 318,691,954 | | |

| 330,899,254 | |

| Accumulated net investment loss | |

| (75,528,136 | ) | |

| (64,832,605 | ) |

| Accumulated net realized gain/(loss) on investments, net of distributions | |

| (11,989,672 | ) | |

| 2,552,465 | |

| Accumulated net unrealized appreciation/(depreciation) of investments | |

| (19,455,194 | ) | |

| (58,882,707 | ) |

| Net Assets | |

$ | 211,971,043 | | |

$ | 210,020,702 | |

| Net Asset Value Per Share | |

$ | 8.41 | | |

$ | 7.39 | |

| (1) | This balance includes a right of use asset and corresponding operating lease liability, respectively. |

| (2) | As of September 30, 2023, the 6.00% Notes due December 30, 2026 (effective interest rate of 6.53%) had

a face value $75,000,000. As of December 31, 2022, the 6.00% Notes due December 30, 2026 (effective interest rate of 6.53%) had a face

value $75,000,000. |

SURO CAPITAL CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(UNAUDITED)

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| INVESTMENT INCOME | |

| | | |

| | | |

| | | |

| | |

| Non-controlled/non-affiliate investments: | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

$ | 28,070 | | |

$ | 26,747 | | |

$ | 117,939 | | |

$ | 338,484 | |

| Dividend income | |

| 63,145 | | |

| 107,764 | | |

| 189,435 | | |

| 429,758 | |

| Controlled investments: | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 400,000 | | |

| 385,000 | | |

| 954,425 | | |

| 1,225,000 | |

| Interest income from U.S. Treasury bills | |

| 974,531 | | |

| — | | |

| 2,875,247 | | |

| — | |

| Total Investment Income | |

| 1,465,746 | | |

| 519,511 | | |

| 4,137,046 | | |

| 1,993,242 | |

| OPERATING EXPENSES | |

| | | |

| | | |

| | | |

| | |

| Compensation expense | |

| 2,123,704 | | |

| 1,836,808 | | |

| 6,378,330 | | |

| 5,456,771 | |

| Directors’ fees | |

| 161,661 | | |

| 161,661 | | |

| 483,887 | | |

| 514,055 | |

| Professional fees | |

| 277,075 | | |

| 565,411 | | |

| 2,184,488 | | |

| 2,916,583 | |

| Interest expense | |

| 1,215,248 | | |

| 1,202,748 | | |

| 3,642,801 | | |

| 3,630,301 | |

| Income tax expense | |

| — | | |

| 74,497 | | |

| 620,606 | | |

| 82,238 | |

| Other expenses | |

| 356,484 | | |

| 487,619 | | |

| 1,522,465 | | |

| 1,238,120 | |

| Total Operating Expenses | |

| 4,134,172 | | |

| 4,328,744 | | |

| 14,832,577 | | |

| 13,838,068 | |

| Net Investment Loss | |

| (2,668,426 | ) | |

| (3,809,233 | ) | |

| (10,695,531 | ) | |

| (11,844,826 | ) |

| Realized Loss on Investments: | |

| | | |

| | | |

| | | |

| | |

| Non-controlled/non-affiliated investments | |

| (1,461,281 | ) | |

| (5,141,097 | ) | |

| (3,597,113 | ) | |

| (3,940,668 | ) |

| Non-controlled/affiliate investments | |

| — | | |

| — | | |

| (10,945,024 | ) | |

| (70,379 | ) |

| Net Realized Loss on Investments | |

| (1,461,281 | ) | |

| (5,141,097 | ) | |

| (14,542,137 | ) | |

| (4,011,047 | ) |

| Change in Unrealized Appreciation/(Depreciation) of Investments: | |

| | | |

| | | |

| | | |

| | |

| Non-controlled/non-affiliated investments | |

| 27,760,743 | | |

| (34,763,904 | ) | |

| 13,544,366 | | |

| (101,639,973 | ) |

| Non-controlled/affiliate investments | |

| 1,568,324 | | |

| (1,866,488 | ) | |

| 25,939,147 | | |

| (2,228,109 | ) |

| Controlled investments | |

| (6,000 | ) | |

| (321,528 | ) | |

| (56,000 | ) | |

| (61,528 | ) |

| Net Change in Unrealized Appreciation/(Depreciation) of Investments | |

| 29,323,067 | | |

| (36,951,920 | ) | |

| 39,427,513 | | |

| (103,929,610 | ) |

| Net Change in Net Assets Resulting from Operations | |

$ | 25,193,360 | | |

$ | (45,902,250 | ) | |

$ | 14,189,845 | | |

$ | (119,785,483 | ) |

| Net Change in Net Assets Resulting from Operations per Common Share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.99 | | |

$ | (1.54 | ) | |

$ | 0.53 | | |

$ | (3.92 | ) |

| Diluted(1) | |

$ | 0.99 | | |

$ | (1.54 | ) | |

$ | 0.53 | | |

$ | (3.92 | ) |

| Weighted-Average Common Shares Outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 25,351,306 | | |

| 29,781,801 | | |

| 26,549,672 | | |

| 30,542,611 | |

| Diluted(1) | |

| 25,351,306 | | |

| 29,781,801 | | |

| 26,549,672 | | |

| 30,542,611 | |

| (1) | For the three and nine months ended September 30, 2023 and September 30, 2022, there were no potentially

dilutive securities outstanding. |

SURO CAPITAL CORP. AND SUBSIDIARIES

FINANCIAL HIGHLIGHTS (UNAUDITED)

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Per Basic Share Data | |

| | | |

| | | |

| | | |

| | |

| Net asset value at beginning of period | |

$ | 7.35 | | |

$ | 9.24 | | |

$ | 7.39 | | |

$ | 11.72 | |

| Net investment loss(1) | |

| (0.11 | ) | |

| (0.13 | ) | |

| (0.40 | ) | |

| (0.39 | ) |

| Net realized loss on investments(1) | |

| (0.06 | ) | |

| (0.17 | ) | |

| (0.55 | ) | |

| (0.13 | ) |

| Net change in unrealized appreciation/(depreciation) of investments(1) | |

| 1.16 | | |

| (1.24 | ) | |

| 1.49 | | |

| (3.40 | ) |

| Dividends declared | |

| — | | |

| — | | |

| — | | |

| (0.11 | ) |

| Issuance of common stock from public offering(1) | |

| — | | |

| — | | |

| — | | |

| 0.01 | |

| Repurchase of common stock(1) | |

| 0.04 | | |

| 0.11 | | |

| 0.41 | | |

| 0.08 | |

| Stock-based compensation(1) | |

| 0.03 | | |

| 0.02 | | |

| 0.07 | | |

| 0.05 | |

| Net asset value at end of period | |

$ | 8.41 | | |

$ | 7.83 | | |

$ | 8.41 | | |

$ | 7.83 | |

| Per share market value at end of period | |

$ | 3.62 | | |

$ | 3.87 | | |

$ | 3.62 | | |

$ | 3.87 | |

| Total return based on market value(2) | |

| 13.13 | % | |

| (39.53 | )% | |

| (4.74 | )% | |

| (68.91 | )% |

| Total return based on net asset value(2) | |

| 14.42 | % | |

| (15.26 | )% | |

| 13.80 | % | |

| (32.25 | )% |

| Shares outstanding at end of period | |

| 25,209,108 | | |

| 28,333,661 | | |

| 25,209,108 | | |

| 28,333,661 | |

| Ratios/Supplemental Data: | |

| | | |

| | | |

| | | |

| | |

| Net assets at end of period | |

$ | 211,971,043 | | |

$ | 221,783,611 | | |

$ | 211,971,043 | | |

$ | 221,783,611 | |

| Average net assets | |

$ | 204,284,971 | | |

$ | 278,994,914 | | |

$ | 206,224,853 | | |

$ | 340,160,110 | |

| Ratio of net operating expenses to average net assets(3) | |

| 8.03 | % | |

| 5.14 | % | |

| 9.62 | % | |

| 4.89 | % |

| Ratio of net investment loss to average net assets(3) | |

| (5.18 | )% | |

| (4.66 | )% | |

| (6.93 | )% | |

| (4.52 | )% |

| Portfolio Turnover Ratio | |

| 1.17 | % | |

| 0.85 | % | |

| 4.93 | % | |

| 3.47 | % |

| (1) | Based on weighted-average number of shares outstanding for the relevant period. |

| (2) | Total return based on market value is based upon the change in market price per share between the opening

and ending market values per share in the period, adjusted for dividends and equity issuances. Total return based on net asset value is

based upon the change in net asset value per share between the opening and ending net asset values per share in the period, adjusted for

dividends and equity issuances. |

| (3) | Financial highlights for periods of less than one year are annualized and the ratios of operating expenses

to average net assets and net investment loss to average net assets are adjusted accordingly. Because the ratios are calculated for the

Company’s common stock taken as a whole, an individual investor’s ratios may vary from these ratios. |

v3.23.3

Cover

|

Nov. 08, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 08, 2023

|

| Entity File Number |

1-35156

|

| Entity Registrant Name |

SURO CAPITAL CORP.

|

| Entity Central Index Key |

0001509470

|

| Entity Tax Identification Number |

27-4443543

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

640 Fifth Avenue

|

| Entity Address, Address Line Two |

12th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10019

|

| City Area Code |

212

|

| Local Phone Number |

931-6331

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, par value $0.01 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

SSSS

|

| Security Exchange Name |

NASDAQ

|

| 6.00% Notes due 2026 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.00% Notes due 2026

|

| Trading Symbol |

SSSSL

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SSSS_CommonStockParValue0.01PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SSSS_Sec6.00NotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

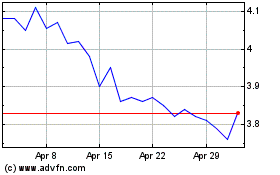

SuRo Capital (NASDAQ:SSSS)

Historical Stock Chart

From Dec 2024 to Jan 2025

SuRo Capital (NASDAQ:SSSS)

Historical Stock Chart

From Jan 2024 to Jan 2025