Amended Tender Offer Statement by Issuer (sc To-i/a)

December 23 2020 - 9:11AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) or 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 1)

SUNPOWER

CORPORATION

(NAME OF SUBJECT COMPANY (ISSUER) AND FILING PERSON (AS OFFEROR))

0.875% SENIOR CONVERTIBLE DEBENTURES DUE 2021

(Title of Class of Securities)

867652 AJ8

with respect

to the 0.875% Senior Convertible Debentures due 2021 held in book-entry form through DTC

867652 AH2

with respect to the 0.875% Senior Convertible Debentures due 2021 held by Total Solar INTL SAS

(CUSIP Numbers of Class of Securities)

Kenneth Mahaffey, Esq.

Executive Vice President, General Counsel and Corporate Secretary

SunPower Corporation

51

Rio Robles

San Jose, California 95134

(408) 240-5500

(Name, address, and telephone number of person authorized to receive notices and communications on behalf of filing persons)

with copies to:

Bradley C. Brasser

Jones

Day

77 W. Wacker, Suite 3500

Chicago, Illinois 60601

(312) 782-3939

CALCULATION

OF FILING FEE

|

|

|

|

|

Transaction Valuation (1)

|

|

Amount of Filing Fee (2)

|

|

$301,583,000.00

|

|

$32,902.71

|

|

|

|

(1)

|

Calculated solely for purposes of determining the amount of the filing fee. The transaction valuation assumes

that all $301,583,000 aggregate principal amount of the issuer’s outstanding 0.875% Senior Convertible Debentures due 2021 are purchased at the tender offer price of $1,000 per $1,000 principal amount of such Convertible Debentures.

|

|

(2)

|

The amount of the filing fee was calculated in accordance with Rule

0-11 of the Securities Exchange Act of 1934, as amended, and equals $109.10 for each $1,000,000 of the value of the transaction.

|

|

☒

|

Check the box if any part of the fee is offset as provided by Rule

0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

Amount Previously Paid: $32,902.71

|

|

Filing Party: SunPower Corporation

|

|

Form or Registration No.: Schedule TO

|

|

Date Filed: November 24, 2020

|

|

☐

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a

tender offer.

|

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

|

☐

|

third-party tender offer subject to Rule 14d-1.

|

|

|

☒

|

issuer tender offer subject to Rule 13e-4.

|

|

|

☐

|

going-private transaction subject to Rule 13e-3.

|

|

|

☐

|

amendment to Schedule 13D under Rule 13d-2.

|

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☒

INTRODUCTORY STATEMENT

This Amendment No. 1 filed with the Securities and Exchange Commission (the “Commission”) on December 23, 2020

(this “Amendment”) amends and supplements the Tender Offer Statement filed on Schedule TO (together with any subsequent amendments and supplements thereto, the “Schedule TO”) with the Commission on November 24,

2020 by SunPower Corporation, a Delaware corporation (the “Company”). The Schedule TO relates to the Company’s offer to purchase any and all of its issued and outstanding 0.875% Senior Convertible Debentures due 2021 for cash

(the “Convertible Debentures”), at a purchase price equal to $1,000 per $1,000 principal amount of Convertible Debentures, upon the terms and subject to the conditions set forth in the Offer to Purchase dated November 24, 2020 (the

“Offer to Purchase”) and the accompanying Letter of Transmittal (the “Letter of Transmittal”), a copies of which were previously filed as Exhibit (a)(1)(i) and Exhibit (a)(1)(ii), respectively, to the Schedule TO

(the “Tender Offer”).

This Amendment is being filed solely to report the final results of the Tender Offer and is

intended to satisfy the requirements of Rule 13e-4(c)(4) under the Securities Exchange Act of 1934, as amended. Only those items amended or supplemented are reported in this Amendment. Except as specifically

provided herein, the information contained in the Schedule TO remains unchanged, and this Amendment does not modify any of the information previously reported on the Schedule TO. You should read this Amendment together with the Schedule TO, the

Offer to Purchase and the Letter of Transmittal.

Item 11. Additional Information.

Item 11 of the Schedule TO is hereby amended and supplemented as follows:

On December 23, 2020, the Company issued a press release announcing the final results of the Tender Offer, which expired at 12:00

midnight, New York City time (the last minute of the day), on December 22, 2020. A copy of such press release is filed as Exhibit (a)(5)(ii) to this Schedule TO and is incorporated herein by reference.

Item 12. Exhibit Index.

Item 12 of the Schedule TO

is hereby amended and supplemented to add the following exhibit to the exhibit index:

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

(a)(5)(ii)

|

|

Press Release dated December 23, 2020.

|

- 2 -

Item 12. Exhibit Index.

|

|

|

|

|

(a)(1)(i)

|

|

Offer to Purchase dated November 24, 2020.*

|

|

|

|

|

(a)(1)(ii)

|

|

Letter of Transmittal.*

|

|

|

|

|

(a)(5)(i)

|

|

Press Release dated November 24, 2020.*

|

|

|

|

|

(a)(5)(ii)

|

|

Press Release dated December 23, 2020.

|

|

|

|

|

(b)

|

|

None.

|

|

|

|

|

(d)(1)

|

|

Indenture, dated as of June 11, 2014 by and between SunPower Corporation and Wells Fargo Bank, National Association, as Trustee (filed as Exhibit 4.1 to the Company’s Current Report on Form

8-K filed on June 11, 2014 and incorporated by reference)

|

|

|

|

|

(d)(2)

|

|

Affiliation Agreement, dated April 28, 2011, between SunPower Corporation and Total Gas & Power USA, SAS (filed as Exhibit 99.6 to the Company’s Quarterly Report on Form

10-Q filed on May 12, 2011 and incorporated by reference).

|

|

|

|

|

(d)(3)

|

|

Amendment to Affiliation Agreement, dated April 28, 2011, between SunPower Corporation and Total Gas & Power USA, SAS (filed as Exhibit 10.2 to the Company’s Current Report on Form

8-K filed on June 7, 2011 and incorporated by reference).

|

|

|

|

|

(d)(4)

|

|

Second Amendment to Affiliation Agreement, dated December 23, 2011, by and between Total G&P and SunPower Corporation (filed as Exhibit 10.4 to the Company’s Current Report on Form

8-K filed on December 23, 2011 and incorporated by reference).

|

|

|

|

|

(d)(5)

|

|

Amendment No. 3 to Affiliation Agreement, dated February 28, 2012, by and between SunPower Corporation and Total Gas & Power USA, SAS (filed as Exhibit 10.91 to the Company’s Annual Report on Form 10-K filed on February 29, 2012 and incorporated by reference).

|

|

|

|

|

(d)(6)

|

|

Amendment No. 4 to Affiliation Agreement, dated August 10, 2012, by and between SunPower Corporation and Total Gas & Power USA, SAS (filed as Exhibit 10.2 to the Company’s Quarterly Report on Form 10-Q filed on November 2, 2012 and incorporated by reference).

|

|

|

|

|

(d)(7)

|

|

Affiliation Agreement Guaranty, dated April 28, 2011, between SunPower Corporation and Total S.A. (filed as Exhibit 99.7 to the Company’s Quarterly Report on Form 10-Q filed on

May 12, 2011 and incorporated by reference).

|

|

|

|

|

(d)(8)

|

|

SunPower Corporation 2015 Omnibus Incentive Plan (filed as Exhibit 10.1 to the Company’s Registration Statement on Form S-8 (File

No. 333-205207), filed on June 25, 2015 and incorporated by reference).

|

|

|

|

|

(d)(9)

|

|

Forms of agreements under SunPower Corporation 2015 Omnibus Incentive Plan (filed as Exhibit 10.60 to the Company’s Quarterly Report on Form 10-Q filed on May 6, 2016 and

incorporated by reference).

|

- 3 -

|

|

|

|

|

(d)(10)

|

|

Manavendra Sial - Final Letter Agreement (filed as Exhibit 10.4 to the Company’s Quarterly Report on Form 10-Q filed on August 1, 2019 and incorporated by reference).

|

|

|

|

|

(d)(11)

|

|

Debenture Repurchase Agreement, dated February 14, 2020, by and between SunPower Corporation and Total Solar INTL SAS (filed as Exhibit 10.1 to the Company’s Quarterly Report on Form

10-Q filed on May 8, 2020 and incorporated by reference).

|

|

|

|

|

(d)(12)

|

|

Form of Employment Agreement for Executive Officers (filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on July 27, 2020 and incorporated by

reference).

|

|

|

|

|

(d)(13)

|

|

2019 Management Career Transition Plan as amended July 24, 2020 (filed as Exhibit 99.2 to the Company’s Current Report on Form 8-K filed on July 27, 2020 and incorporated by

reference).

|

|

|

|

|

(g)

|

|

None.

|

|

|

|

|

(h)

|

|

None.

|

|

|

|

|

*

|

|

Previously filed.

|

- 4 -

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

|

December 23, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUNPOWER CORPORATION

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Kenneth Mahaffey

|

|

|

|

|

|

|

|

Name:

|

|

Kenneth Mahaffey

|

|

|

|

|

|

|

|

Title:

|

|

Executive Vice President, General Counsel and Corporate Secretary

|

- 5 -

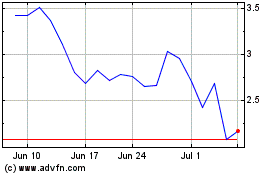

SunPower (NASDAQ:SPWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

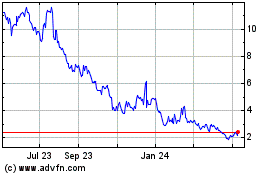

SunPower (NASDAQ:SPWR)

Historical Stock Chart

From Apr 2023 to Apr 2024