false

0000861878

0000861878

2024-11-08

2024-11-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 8, 2024

Stericycle, Inc.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

1-37556 |

36-3640402 |

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

2355 Waukegan Road

Bannockburn, Illinois |

60015 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (847) 367-5910

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

SRCL |

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On November 8, 2024 (the

“Settlement Date”), Waste Management, Inc. (“WM”) completed its previously announced (i) private offer

to eligible holders to exchange (the “Exchange Offer”) any and all of the $500 million aggregate principal amount of outstanding

3.875% Senior Notes due 2029 (the “Stericycle Notes”) issued by Stericycle, Inc. (the “Company”) for new

notes issued by WM and cash, and (ii) related consent solicitation (the “Consent Solicitation”) made by WM,

on behalf of the Company, to adopt certain amendments (the “Amendments”) to the indenture governing the Stericycle Notes (the

“Indenture”). Pursuant to the Exchange Offer and Consent Solicitation, $485,416,000 aggregate principal amount of the Stericycle

Notes were validly tendered and subsequently accepted. Such accepted Stericycle Notes have been retired and canceled and will not be reissued.

Following such cancellation, $14,584,000 aggregate principal amount of the Stericycle Notes remain outstanding.

Prior to the settlement of

the Exchange Offer and Consent Solicitation and following receipt of the requisite consents to adopt the Amendments with respect to the

Stericycle Notes, the Company executed a supplemental indenture with the trustee and the guarantor party thereto (the “Supplemental

Indenture”) to eliminate substantially all of the restrictive covenants, restrictive provisions and events of default, other than

payment-related, guarantee-related and bankruptcy-related events of default, under the Indenture.

The Amendments became operative

upon the Settlement Date. The foregoing summary of the Indenture and the Supplemental Indenture does not purport to be complete and is

qualified in its entirety by reference to the full text of the Supplemental Indenture, a copy of which is filed as Exhibit 10.1 and

is incorporated herein by reference.

| Item 3.03 |

Material Modification to the Rights of Security Holders. |

The information set forth

in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits. |

Exhibit Index

Exhibit

Number |

|

Description |

| 10.1 |

|

Indenture, dated as of November 24, 2020, by and between Stericycle, Inc., as issuer, the guarantors party thereto, and U.S. Bank Trust Company, National Association, as trustee (incorporated by reference to Exhibit 4.1 to Stericycle, Inc.’s Current Report on Form 8-K filed November 24, 2020). |

| 10.2 |

|

Supplemental Indenture, dated as of November 5, 2024, by and between Stericycle, Inc., as issuer, the guarantor party thereto, and U.S. Bank Trust Company, National Association, as trustee. |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| |

STERICYCLE, INC. |

| |

|

|

| Date: November 8, 2024 |

By: |

/s/

Courtney A. Tippy |

| |

|

Courtney A. Tippy |

| |

|

Vice President and Secretary |

Exhibit 10.2

Execution Version

FIRST SUPPLEMENTAL INDENTURE

First Supplemental Indenture

(this “Supplemental Indenture”), dated as of November 5, 2024, among Stericycle, Inc., a Delaware corporation

(the “Company”), the Guarantor party thereto, and U.S. Bank Trust Company, National Association (as successor in interest

to U.S. Bank National Association), a national banking association, as trustee (the “Trustee”).

WITNESSETH:

WHEREAS, the Company and

the Guarantor have heretofore executed and delivered to the Trustee an Indenture (the “Indenture”), dated as of November 24,

2020, providing for the issuance of an unlimited aggregate principal amount of 3.875% Senior Notes due 2029 (the “Notes”);

WHEREAS, the Company has

entered into that certain Agreement and Plan of Merger, dated as of June 3, 2024, by and among Waste Management, Inc., a Delaware

corporation (“Waste Management”), Stag Merger Sub Inc., a Delaware corporation and an indirect wholly owned subsidiary

of Waste Management (“Merger Sub”), and the Company, pursuant to which, on the terms and subject to the conditions

set forth therein, Merger Sub will merge with and into the Company (the “Merger”), with the Company continuing as

the surviving corporation and as an indirect wholly owned subsidiary of Waste Management;

WHEREAS, in connection with

the Merger, pursuant to the terms and subject to the conditions set forth in the Exchange Offer Memorandum and Consent Solicitation Statement,

dated September 10, 2024 (as amended to date, the “Offering Memorandum”), Waste Management has offered to certain

eligible Holders of the Notes to exchange (the “Exchange Offer”) any and all of their $500 million aggregate principal

amount outstanding of the Notes for a series of new notes to be issued by Waste Management, and Waste Management, on behalf of the Company,

has solicited consents from such Holders of the Notes, to, among other things, amend certain provisions of the Indenture and the Notes

to eliminate certain of the covenants, restrictive provisions and events of default, as set forth in this Supplemental Indenture (the

“Amendments”);

WHEREAS, Section 9.02

of the Indenture provides that the Company and the Trustee may, subject to certain exceptions set forth in the Indenture, amend or supplement

the Indenture and the Notes with the consent of the Holders of at least a majority in principal amount of the Notes (including Additional

Notes, if any) then outstanding voting as a single class (including consents obtained in connection with a tender offer or exchange offer

for, or purchase of, the Notes) (the “Requisite Consents”);

WHEREAS, in accordance with

that certain Lien Release Acknowledgement, dated as of November 28, 2022, Stericycle Communications Solutions, Inc. was released

and discharged from its obligations under the Indenture and its Guarantee thereunder, in connection with Stericycle Communications Solutions, Inc.’s

release and discharge in full from all of its obligations under its Guarantee under that certain Amended and Restated Credit Agreement,

dated as of September 30, 2021, among the Company, certain subsidiaries of the Company party thereto, the lenders party thereto

and Bank of America, N.A., as administrative agent;

WHEREAS, as of 5:00 p.m.,

New York City time, on September 23, 2024, the Requisite Consents have been validly delivered by Holders and not validly revoked

and the Company has delivered to the Trustee sufficient evidence of the Requisite Consents to enter into this Supplemental Indenture

to effect the Amendments under the Indenture; and

WHEREAS, the execution and

delivery of this Supplemental Indenture has been duly authorized by the Company and the Guarantor, and all other acts and requirements

necessary to make this Supplemental Indenture a valid and binding supplement to the Indenture effectively amending the Indenture as set

forth herein (including receipt of the Requisite Consents) have been duly taken.

NOW THEREFORE, in consideration

of the foregoing and for other good and valuable consideration, the receipt of which is hereby acknowledged, the parties mutually covenant

and agree for the equal and ratable benefit of the Holders as follows:

(1) Capitalized Terms.

For all purposes of this Supplemental Indenture, except as otherwise expressly provided for or unless the context otherwise requires:

| (a) | Capitalized terms used herein that are

not defined herein, but are defined in the Indenture, shall have the respective meanings

given to them in the Indenture; |

| (b) | All references herein to Articles and

Sections, unless otherwise specified, refer to the corresponding Articles and Sections of

this Supplemental Indenture; and |

| (c) | The terms defined in this Supplemental

Indenture shall have the respective meanings assigned to them herein and, if the definition

of any of the terms defined herein differs from its respective definition set forth in the

Indenture, the definition set forth in this Supplemental Indenture shall control. |

(2) Amendments

to the Notes and the Indenture. From and after the Closing Date (as defined below), the Indenture shall hereby be amended

by deleting the following Sections or Clauses of the Indenture and all references and definitions related solely thereto in their entirety,

except to the extent otherwise provided below, and these Sections and Clauses shall be of no further force and effect, and shall no longer

apply to the Notes, and the words “[INTENTIONALLY DELETED]” shall be inserted, in each case, in place of the deleted text:

Section 4.03 (“Reports”)

Section 4.05 (“Taxes”)

Section 4.06 (“Stay, Extension

and Usury Laws”)

Section 4.07 (“Limitation

on Sale and Leaseback Transactions”)

Section 4.08 (“Liens”)

Section 4.09 (“Company

Existence”)

Section 4.10 (“Offer to

Repurchase Upon Change of Control Triggering Event”)

Section 4.11 (“Additional

Guarantees”)

Section 5.01 (“Merger,

Consolidation or Sale of Assets”)

Section 6.01(iii), (iv), (v),

(vi), (vii) and (viii) (“Events of Default”)

The failure to comply with

the terms of any of the Sections or Clauses of the Indenture set forth above shall no longer constitute a default or Event of Default

under the Indenture and shall no longer have any consequence under the Indenture.

(3) Effectiveness

of Supplemental Indenture. This Supplemental Indenture shall become effective upon execution and delivery of this instrument

by each of the parties hereto. Notwithstanding the foregoing sentence, the Amendments set forth in Section 2 hereof shall become

operative on and as of the date on which the Exchange Offer is consummated in accordance with the terms and conditions set forth in the

Offering Memorandum (the “Closing Date”). If the Exchange Offer is not consummated in accordance with the terms and

conditions set forth in the Offering Memorandum, the Amendments set forth in Section 2 hereof shall not become operative and shall

be null and void for all purposes under the Indenture and the Notes.

(4) Relationship

to the Indenture. This Supplemental Indenture constitutes an integral part of the Indenture. This Supplemental Indenture is

a supplemental indenture within the meaning of the Indenture. The Indenture, as supplemented and amended by this Supplemental Indenture,

is in all respects ratified, confirmed and approved and, with respect to the Notes, the Indenture, as supplemented and amended by this

Supplemental Indenture, shall be read, taken and construed as one and the same instrument. Except as expressly modified by this Supplemental

Indenture, the provisions of the Indenture shall govern the terms and conditions of the Notes. The provisions of this Supplemental Indenture

shall supersede any conflicting provisions of the Indenture with respect to the Notes. To the extent not expressly amended or modified

by this Supplemental Indenture, the Indenture shall remain in full force and effect.

(5) Trust

Indenture Act Controls. If any provision of this Supplemental Indenture limits, qualifies, or conflicts with the Trust Indenture

Act of 1939 (as amended, the “TIA”) or another provision which is required or deemed to be included in the Indenture

by the TIA, the TIA or such required or deemed provision, as applicable, shall control. If any provision of this Supplemental Indenture

modifies or excludes any provision of the TIA, that may be so modified or excluded, the provision on the TIA shall be deemed to apply

to the Indenture as so modified or shall be excluded, as the case may be.

(6) Governing Law.

THIS SUPPLEMENTAL INDENTURE WILL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK.

(7) Counterparts.

The parties may sign any number of copies of this Supplemental Indenture. Each signed copy shall be an original, but all of them together

represent the same agreement. This Supplemental Indenture may be executed in multiple counterparts, which, when taken together, shall

constitute one instrument. The exchange of copies of this Supplemental Indenture and of signature pages by facsimile or PDF transmissions

shall constitute effective execution and delivery of this Supplemental Indenture as to the parties hereto and may be used in lieu of

the original Supplemental Indenture for all purposes. Signatures of the parties hereto transmitted by facsimile or PDF shall be deemed

to be their original signatures for all purposes.

(8) Effect of Headings.

The Section headings herein are for convenience only and shall not affect the construction hereof.

(9) The Trustee.

The Trustee accepts the amendments of the Indenture effected by this Supplemental Indenture, but on the terms and conditions set forth

in the Indenture, including the terms and provisions defining and limiting the liabilities and responsibilities of the Trustee. Without

limiting the generality of the foregoing, the Trustee shall not be responsible in any manner whatsoever for or with respect to any of

the recitals or statements contained herein, all of which recitals or statements are made solely by the Company, or for or with respect

to (i) the validity or sufficiency of this Supplemental Indenture or any of the terms or provisions hereof, (ii) the proper

authorization hereof by the Company by action or otherwise, (iii) the due execution hereof by the Company or (iv) the consequences

of any amendment herein provided for, and the Trustee makes no representation with respect to any such matters.

(10) Successors.

All agreements of the Company in this Supplemental Indenture shall bind its successors, except as otherwise provided in this Supplemental

Indenture. All agreements of the Trustee in this Supplemental Indenture shall bind its successors.

IN WITNESS WHEREOF, the parties

hereto have caused this Supplemental Indenture to be duly executed, all as of the date first above written.

| |

STERICYCLE, INC. |

| |

|

| |

/s/ Leslie Nagy |

| |

Name: Leslie Nagy |

| |

Title: Vice President and Treasurer |

| |

|

| |

STERICYCLE INTERNATIONAL, LLC |

| |

|

| |

As Guarantor |

| |

|

| |

/s/ Leslie Nagy |

| |

Name: Leslie Nagy |

| |

Title: Vice President and Treasurer |

| |

|

| |

U.S. BANK TRUST COMPANY, NATIONAL ASSOCIATION,

not in its individual capacity but solely as Trustee |

| |

|

| |

By: |

/s/ Linda Garcia |

| |

|

Name: Linda Garcia |

| |

|

Title: Vice President |

[Signature Page to First Supplemental Indenture]

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

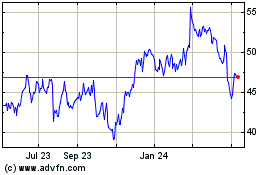

Stericycle (NASDAQ:SRCL)

Historical Stock Chart

From Dec 2024 to Jan 2025

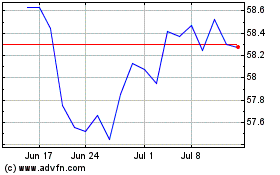

Stericycle (NASDAQ:SRCL)

Historical Stock Chart

From Jan 2024 to Jan 2025