Current Report Filing (8-k)

March 02 2023 - 4:11PM

Edgar (US Regulatory)

FALSE000109269900010926992023-03-012023-03-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

March 1, 2023

Date of report (Date of earliest event reported)

SPS COMMERCE, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-34702 | | 41-2015127 |

| (State of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

333 South Seventh Street, Suite 1000 Minneapolis, Minnesota | | 55402 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(612) 435-9400

(Registrant's Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.001 per share | SPSC | The Nasdaq Stock Market LLC

(Nasdaq Global Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act

☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On March 2, 2023, SPS Commerce, Inc. (the “Company”) announced that its Chief Executive Officer, Archie Black, will retire from his position as Chief Executive Officer and transition to the newly created position of Executive Chair of the Board, effective upon his successor’s appointment as the Company’s Chief Executive Officer. The Board of Directors of the Company has approved the appointment of Philip Soran, the current Chair of the Board, to the position of lead independent director of the Board, effective as of the date Archie Black assumes the role of Executive Chair. The Board has commenced a search for a new Chief Executive Officer.

In addition, the Company and Mr. Black entered into an amendment (the “Black Amendment”), dated as of March 1, 2023, to his Amended and Restated Executive Severance and Change in Control Agreement dated effective as of February 13, 2020 (the “Black Agreement”), which provides that, in order to qualify as a “Retirement” under the Black Agreement, the services that Mr. Black must perform during the six-month notice period will include substantive services as agreed upon between the Company and Mr. Black (which the Company and Mr. Black have agreed to be services associated with Mr. Black continuing to be employed in the newly created position of Executive Chair of the Board), and that the Company may, in its sole discretion, designate a termination date earlier than the retirement date identified by Mr. Black. As a result, if Mr. Black remains in the role of Executive Chair of the Board until his retirement date as Executive Chair of the Board, then he will receive the benefits under the retirement provisions of the Black Agreement, including that (a) all of Mr. Black’s unvested equity awards with solely a service-based vesting condition will become fully vested, (b) for any equity awards whose vesting or settlement is subject to the satisfaction of performance goals over a performance period, he will be entitled to have those awards vest on each originally scheduled vesting date for such award in an amount equal to the number of shares, share units or share equivalents subject to the equity award that would otherwise have been determined to have been earned by him had he remained continuously employed by the Company through the originally scheduled vesting date based on the degree to which the applicable performance goals were satisfied during the applicable performance period through the originally scheduled vesting date, and (c) Mr. Black will receive a pro-rated portion of his target annual cash incentive bonus for the fiscal year in which the termination occurs (payable in a lump sum no later than 60 calendar days after the date of termination).

The foregoing descriptions of the Black Amendment and the Black Agreement are summaries, do not purport to be complete and are qualified in their entirety by reference to the Black Amendment and the Black Agreement, which are attached as Exhibit 10.1 and Exhibit 10.2, respectively, to this report and are incorporated herein by reference.

In addition, on March 1, 2023, the Company entered into an amendment to the Amended and Restated Executive Severance and Change in Control Agreement with each of Kimberly Nelson, the Company’s Chief Financial Officer, and James Frome, the Company’s President and Chief Operating Officer (the “Amendments”). The Amendments provide that, in order to qualify as a “Retirement” under the applicable severance and change in control agreements for Ms. Nelson and Mr. Frome, the services that the officer must perform during the six-month notice period may include such other services as agreed between the Company and the officer, and that the Company may, in its sole discretion, designate a termination date earlier than the retirement date identified by the officer. This description of the Amendments is a summary, does not purport to be complete and is qualified in its entirety by reference to the form of Amendment, which is attached as Exhibit 10.3 to this report and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On March 2, 2023, the Company issued a press release announcing the matters described in Item 5.02 above. A copy of the press release is attached hereto as Exhibit 99.1.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set forth by specific reference in that filing.

Item 8.01. Other Events.

The Company’s Board of Directors has initiated an executive search for the next Chief Executive Officer. Once appointed, Archie Black will transition from his position as Chief Executive Officer to the newly created role of Executive Chair of the Board. Mr. Black will remain in the role of Chief Executive Officer through the completion of the search for his successor and through the transition process to ensure a seamless succession.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements, including information about future expectations, plans and prospects, including views regarding anticipated continuity, timing and effectiveness of the Chief Executive Officer transition, within the safe harbor provisions under The Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors which may cause the results of the Company to be materially different than those expressed or implied in such statements. Certain of these risk factors and others are included in documents the Company files with the Securities and Exchange Commission, including but not limited to, the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, as well as subsequent reports filed with the Securities and Exchange Commission. In addition, these forward-looking statements are subject to factors and uncertainties related to the Company’s Chief Executive Officer transition, including disruptions and uncertainties related thereto, the ability of a successor to have the desired level of experience and expertise, the potential impact on the Company’s business and future strategic direction resulting from the Chief Executive Officer transition, and the Company’s ability to retain other key members of senior management. Other unknown or unpredictable factors also could have material adverse effects on the Company’s future results. The forward-looking statements included in this press release are made only as of the date hereof. The Company cannot guarantee future results, levels of activity, performance or achievements. Accordingly, you should not place undue reliance on these forward-looking statements. Finally, the Company expressly disclaims any intent or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Exhibit |

| | | |

| 10.1 | | |

| 10.2 | | |

| 10.3 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | SPS COMMERCE, INC. |

| | | |

| | | |

| Date: March 2, 2023 | By: | /s/ KIMBERLY NELSON |

| | | Kimberly Nelson |

| | | Executive Vice President and Chief Financial Officer |

| | | |

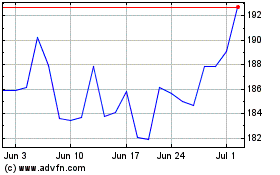

SPS Commerce (NASDAQ:SPSC)

Historical Stock Chart

From Aug 2024 to Sep 2024

SPS Commerce (NASDAQ:SPSC)

Historical Stock Chart

From Sep 2023 to Sep 2024