SPS Commerce, Inc. (Nasdaq: SPSC), a leader in retail cloud

services, today announced financial results for the fourth quarter

and year ended December 31, 2022.

Financial Highlights

Fourth Quarter 2022

Financial Highlights

- Revenue was $122.0 million in the fourth quarter of 2022,

compared to $102.8 million in the fourth quarter of 2021,

reflecting 19% growth.

- Recurring revenue grew 20% from the fourth quarter of

2021.

- Net income was $15.9 million or $0.43 per diluted share,

compared to net income of $12.8 million or $0.34 per diluted share

in the fourth quarter of 2021, reflecting 25% growth in period over

period net income.

- Non-GAAP income per diluted share was $0.63, compared to

non-GAAP income per diluted share of $0.46 in the fourth quarter of

2021.

- Adjusted EBITDA for the fourth quarter of 2022 increased 26% to

$35.0 million compared to the fourth quarter of 2021.

Fiscal Year 2022 Financial

Highlights

- Revenue was $450.9 million for the

year ended December 31, 2022, compared to $385.3 million for the

year ended December 31, 2021, reflecting 17% growth.

- Recurring revenue grew 18% from the year ended December 31,

2021.

- Net income was $55.1 million or $1.49 per diluted share for the

year ended December 31, 2022, compared to net income of $44.6

million or $1.21 per diluted share, for the comparable period in

2021, reflecting 24% growth in year over year net income.

- Non-GAAP income per diluted share was $2.35, compared to

non-GAAP income per diluted share of $1.82 in the year ended

December 31, 2021.

- Adjusted EBITDA for the year ended December 31, 2022 increased

24% to $132.3 million, compared to the year ended December 31,

2021.

“Over the years, SPS Commerce has consistently executed on our

mission to connect all retail trading partners through the

easiest-to-join and use network,” said Archie Black, CEO of SPS

Commerce. “We remained laser focused on improving customer

experience and made strategic investments which helped us build the

world’s largest cloud retail network and position SPS Commerce for

continued success.”

“SPS Commerce achieved strong fourth quarter and full year 2022

results. We continued to deliver profitable growth and invest in

the future to capitalize on existing and new opportunities across

our expanding addressable market,” said Kim Nelson, CFO of SPS

Commerce.

Guidance

First Quarter 2023

Guidance

- Revenue is expected to be in the range of $123.3 million to

$124.3 million.

- Net income per diluted share is expected to be in the range of

$0.26 to $0.27, with fully diluted weighted average shares

outstanding of 37.2 million shares.

- Non-GAAP income per diluted share is expected to be in the

range of $0.56 to $0.57.

- Adjusted EBITDA is expected to be in the range of $35.0 million

to $35.7 million.

- Non-cash, share-based compensation expense is expected to be

$12.0 million, depreciation expense is expected to be $4.8 million,

and amortization expense is expected to be $3.9 million.

Fiscal Year 2023 Guidance

- Revenue is expected to be in the range of $523.0 million to

$526.0 million, representing 16% to 17% growth over 2022.

- Net income per diluted share is expected to be in the range of

$1.49 to $1.55, with fully diluted weighted average shares

outstanding of 37.3 million shares.

- Non-GAAP income per diluted share is expected to be in the

range of $2.63 to $2.69.

- Adjusted EBITDA is expected to be in the range of $152.5 to

$154.5 million, representing 15% to 17% growth over 2022.

- Non-cash, share-based compensation expense is expected to be

$45.0 million, depreciation expense is expected to be $19.8

million, and amortization expense is expected to be $15.6

million.

The forward-looking measures and the underlying assumptions

involve significant known and unknown risks and uncertainties, and

actual results may vary materially. The Company does not present a

reconciliation of the forward-looking non-GAAP financial measures,

including Adjusted EBITDA, Adjusted EBITDA margin, and non-GAAP

income per share, to the most directly comparable GAAP financial

measures because it is impractical to forecast certain items

without unreasonable efforts due to the uncertainty and inherent

difficulty of predicting, within a reasonable range, the occurrence

and financial impact of and the periods in which such items may be

recognized.

Quarterly Conference Call

To access the call, please dial 1-833-816-1382, or outside the

U.S. 1-412-317-0475 at least 15 minutes prior to the 3:30 p.m. CT

start time. Please ask to be joined into the SPS Commerce Q4 2022

conference call. A live webcast of the call will also be available

at http://investors.spscommerce.com under the Events and

Presentations menu. The replay will also be available on our

website at http://investors.spscommerce.com.

About SPS Commerce

SPS Commerce is the world’s leading retail network, connecting

trading partners around the globe to optimize supply chain

operations for all retail partners. We support data-driven

partnerships with innovative cloud technology, customer-obsessed

service and accessible experts so our customers can focus on what

they do best. To date, more than 115,000 companies in retail,

grocery, distribution, supply, and logistics have chosen SPS as

their retail network. SPS has achieved 88 consecutive quarters of

revenue growth and is headquartered in Minneapolis. For additional

information, contact SPS at 866-245-8100 or visit

www.spscommerce.com.

SPS COMMERCE, SPS, SPS logo, 1=INFINITY logo, AS THE NETWORK

GROWS, SO DOES YOUR OPPORTUNITY, INFINITE RETAIL POWER, MASTERING

THE RETAIL GAME and RSX are marks of SPS Commerce,

Inc. and Registered in the U.S. Patent and Trademark

Office. IN:FLUENCE, and others are further marks of SPS

Commerce, Inc. These marks may be registered or otherwise

protected in other countries.

SPS-F

Use of Non-GAAP Financial Measures

To supplement our consolidated financial statements, we provide

investors with Adjusted EBITDA, Adjusted EBITDA Margin, and

non-GAAP income per share, all of which are non-GAAP financial

measures. We believe that these non-GAAP financial measures provide

useful information to our management, board of directors, and

investors regarding certain financial and business trends relating

to our financial condition and results of operations.

Our management uses these non-GAAP financial measures to compare

our performance to that of prior periods for trend analyses and

planning purposes. Adjusted EBITDA is also used for purposes of

determining executive and senior management incentive compensation.

We believe these non-GAAP financial measures are useful to an

investor as they are widely used in evaluating operating

performance. Adjusted EBITDA and Adjusted EBITDA Margin are used to

measure operating performance without regard to items such as

depreciation and amortization, which can vary depending upon

accounting methods and the book value of assets, and to present a

meaningful measure of corporate performance exclusive of capital

structure and the method by which assets were acquired.

These non-GAAP financial measures should not be considered a

substitute for, or superior to, financial measures calculated in

accordance with GAAP. These non-GAAP financial measures exclude

significant expenses and income that are required by GAAP to be

recorded in our consolidated financial statements and are subject

to inherent limitations. Investors should review the

reconciliations of non-GAAP financial measures to the comparable

GAAP financial measures that are included in this press

release.

Adjusted EBITDA Measures:

Adjusted EBITDA consists of net income adjusted for income tax

expense, depreciation and amortization expense, stock-based

compensation expense, realized gain or loss from foreign currency

on cash and investments held, investment income or loss, and other

adjustments as necessary for a fair presentation.

Adjusted EBITDA Margin consists of Adjusted EBITDA divided by

revenue. Margin, the comparable GAAP measure of financial

performance, consists of net income divided by revenue.

Non-GAAP Income Per Share Measure:

Non-GAAP income per share consists of net income adjusted for

stock-based compensation expense, amortization expense related to

intangible assets, realized gain or loss from foreign currency on

cash and investments held, other adjustments as necessary for a

fair presentation, and the corresponding tax impacts of the

adjustments to net income, divided by the weighted average number

of shares of common and diluted stock outstanding during each

period.

To quantify the tax effects, we recalculated income tax expense

excluding the direct book and tax effects of the specific items

constituting the non-GAAP adjustments. The difference between this

recalculated income tax expense and GAAP income tax expense is

presented as the income tax effect of the non-GAAP adjustments.

Forward-Looking Statements

This press release may contain forward-looking statements,

including information about management's view of SPS Commerce's

future expectations, plans and prospects, including our views

regarding future execution within our business, the opportunity we

see in the retail supply chain world and our performance for the

first quarter and fiscal year of 2023, within the safe harbor

provisions under The Private Securities Litigation Reform Act of

1995. These statements involve known and unknown risks,

uncertainties and other factors which may cause the results of SPS

Commerce to be materially different than those expressed or implied

in such statements. Certain of these risk factors and others are

included in documents SPS Commerce files with the Securities and

Exchange Commission, including but not limited to, SPS Commerce's

Annual Report on Form 10-K for the year ended December 31, 2021, as

well as subsequent reports filed with the Securities and Exchange

Commission. Other unknown or unpredictable factors also could have

material adverse effects on SPS Commerce's future results. The

forward-looking statements included in this press release are made

only as of the date hereof. SPS Commerce cannot guarantee future

results, levels of activity, performance or achievements.

Accordingly, you should not place undue reliance on these

forward-looking statements. Finally, SPS Commerce expressly

disclaims any intent or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events, or otherwise.

|

SPS COMMERCE, INC.CONSOLIDATED BALANCE

SHEETS(Unaudited; in thousands, except shares) |

| |

December 31, |

| |

|

2022 |

|

|

|

2021 |

|

|

ASSETS |

|

|

|

| Current

assets |

|

|

|

|

Cash and cash equivalents |

$ |

162,893 |

|

|

$ |

207,552 |

|

|

Short-term investments |

|

51,412 |

|

|

|

49,758 |

|

|

Accounts receivable |

|

42,501 |

|

|

|

38,811 |

|

|

Allowance for credit losses |

|

(3,066 |

) |

|

|

(4,249 |

) |

|

Accounts receivable, net |

|

39,435 |

|

|

|

34,562 |

|

|

Deferred costs |

|

52,755 |

|

|

|

44,529 |

|

|

Other assets |

|

16,319 |

|

|

|

16,042 |

|

|

Total current assets |

|

322,814 |

|

|

|

352,443 |

|

| Property and

equipment, net |

|

35,458 |

|

|

|

31,901 |

|

| Operating lease

right-of-use assets |

|

9,170 |

|

|

|

10,851 |

|

| Goodwill |

|

197,284 |

|

|

|

143,663 |

|

| Intangible

assets, net |

|

88,352 |

|

|

|

58,587 |

|

| Other assets |

|

|

|

|

Deferred costs, non-current |

|

17,424 |

|

|

|

15,191 |

|

|

Deferred income tax assets |

|

227 |

|

|

|

182 |

|

|

Other assets, non-current |

|

2,185 |

|

|

|

3,028 |

|

|

Total assets |

$ |

672,914 |

|

|

$ |

615,846 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| Current

liabilities |

|

|

|

|

Accounts payable |

$ |

11,256 |

|

|

$ |

8,330 |

|

|

Accrued compensation |

|

30,235 |

|

|

|

31,661 |

|

|

Accrued expenses |

|

7,451 |

|

|

|

8,345 |

|

|

Deferred revenue |

|

57,423 |

|

|

|

50,428 |

|

|

Operating lease liabilities |

|

4,277 |

|

|

|

4,108 |

|

|

Total current liabilities |

|

110,642 |

|

|

|

102,872 |

|

| Other

liabilities |

|

|

|

|

Deferred revenue, non-current |

|

4,771 |

|

|

|

5,144 |

|

|

Operating lease liabilities, non-current |

|

13,009 |

|

|

|

16,426 |

|

|

Deferred income tax liabilities |

|

7,419 |

|

|

|

7,145 |

|

|

Total liabilities |

|

135,841 |

|

|

|

131,587 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders'

equity |

|

|

|

|

Preferred stock |

|

— |

|

|

|

— |

|

|

Common stock |

|

38 |

|

|

|

38 |

|

|

Treasury Stock |

|

(128,892 |

) |

|

|

(85,677 |

) |

|

Additional paid-in capital |

|

476,117 |

|

|

|

433,258 |

|

|

Retained earnings |

|

193,221 |

|

|

|

138,087 |

|

|

Accumulated other comprehensive loss |

|

(3,411 |

) |

|

|

(1,447 |

) |

|

Total stockholders’ equity |

|

537,073 |

|

|

|

484,259 |

|

|

Total liabilities and stockholders’ equity |

$ |

672,914 |

|

|

$ |

615,846 |

|

Results presented are unaudited and thus, are subject to

adjustment. Audited results will be included within the 10-K

filing.

|

SPS COMMERCE, INC.CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME(Unaudited; in thousands, except per share

amounts) |

|

|

| |

Three Months EndedDecember

31, |

|

Year EndedDecember 31, |

| |

|

2022 |

|

|

2021 |

|

|

|

2022 |

|

|

2021 |

|

| Revenues |

$ |

122,018 |

|

$ |

102,756 |

|

|

$ |

450,875 |

|

$ |

385,276 |

|

| Cost of

revenues |

|

41,541 |

|

|

35,635 |

|

|

|

153,065 |

|

|

131,678 |

|

|

Gross profit |

|

80,477 |

|

|

67,121 |

|

|

|

297,810 |

|

|

253,598 |

|

| Operating

expenses |

|

|

|

|

|

|

|

|

Sales and marketing |

|

27,201 |

|

|

22,658 |

|

|

|

101,772 |

|

|

88,044 |

|

|

Research and development |

|

12,480 |

|

|

10,579 |

|

|

|

45,748 |

|

|

39,038 |

|

|

General and administrative |

|

17,950 |

|

|

16,119 |

|

|

|

67,340 |

|

|

61,305 |

|

|

Amortization of intangible assets |

|

3,832 |

|

|

2,392 |

|

|

|

11,768 |

|

|

10,126 |

|

|

Total operating expenses |

|

61,463 |

|

|

51,748 |

|

|

|

226,628 |

|

|

198,513 |

|

| Income from

operations |

|

19,014 |

|

|

15,373 |

|

|

|

71,182 |

|

|

55,085 |

|

| Other income

(expense), net |

|

1,752 |

|

|

(120 |

) |

|

|

142 |

|

|

(1,544 |

) |

| Income before

income taxes |

|

20,766 |

|

|

15,253 |

|

|

|

71,324 |

|

|

53,541 |

|

|

Income tax expense |

|

4,851 |

|

|

2,488 |

|

|

|

16,190 |

|

|

8,944 |

|

| Net income |

$ |

15,915 |

|

$ |

12,765 |

|

|

$ |

55,134 |

|

$ |

44,597 |

|

| |

|

|

|

|

|

|

|

| Net income per

share |

|

|

|

|

|

|

|

|

Basic |

$ |

0.44 |

|

$ |

0.35 |

|

|

$ |

1.53 |

|

$ |

1.24 |

|

|

Diluted |

$ |

0.43 |

|

$ |

0.34 |

|

|

$ |

1.49 |

|

$ |

1.21 |

|

| |

|

|

|

|

|

|

|

| Weighted average

common shares used to compute net income per share |

|

|

|

|

|

|

|

|

Basic |

|

36,159 |

|

|

36,091 |

|

|

|

36,117 |

|

|

35,928 |

|

|

Diluted |

|

36,971 |

|

|

37,135 |

|

|

|

36,953 |

|

|

36,962 |

|

Results presented are unaudited and thus, are subject to

adjustment. Audited results will be included within the 10-K

filing.

|

SPS COMMERCE, INC.CONSOLIDATED STATEMENTS

OF CASH FLOWS(Unaudited; in thousands) |

| |

|

| |

Year EndedDecember 31, |

| |

|

2022 |

|

|

|

2021 |

|

| Cash flows from

operating activities |

|

|

|

|

Net income |

$ |

55,134 |

|

|

$ |

44,597 |

|

|

Reconciliation of net income to net cash provided by operating

activities |

|

|

|

|

Deferred income taxes |

|

(3,732 |

) |

|

|

3,881 |

|

|

Depreciation and amortization of property and equipment |

|

16,421 |

|

|

|

14,788 |

|

|

Amortization of intangible assets |

|

11,768 |

|

|

|

10,126 |

|

|

Provision for credit losses |

|

3,359 |

|

|

|

4,717 |

|

|

Stock-based compensation |

|

33,399 |

|

|

|

27,574 |

|

|

Other, net |

|

220 |

|

|

|

323 |

|

|

Changes in assets and liabilities, net of effects of

acquisitions |

|

|

|

|

Accounts receivable |

|

(6,435 |

) |

|

|

(4,959 |

) |

|

Deferred costs |

|

(10,646 |

) |

|

|

(9,299 |

) |

|

Other current and non-current assets |

|

2,632 |

|

|

|

(6,181 |

) |

|

Accounts payable |

|

144 |

|

|

|

2,259 |

|

|

Accrued compensation |

|

(3,786 |

) |

|

|

6,775 |

|

|

Accrued expenses |

|

(2,829 |

) |

|

|

1,017 |

|

|

Deferred revenue |

|

5,965 |

|

|

|

14,483 |

|

|

Operating leases |

|

(1,562 |

) |

|

|

2,792 |

|

|

Net cash provided by operating activities |

|

100,052 |

|

|

|

112,893 |

|

| Cash flows from

investing activities |

|

|

|

|

Purchases of property and equipment |

|

(19,880 |

) |

|

|

(19,588 |

) |

|

Purchases of investments |

|

(160,427 |

) |

|

|

(121,242 |

) |

|

Maturities of investments |

|

158,937 |

|

|

|

111,193 |

|

|

Acquisitions of businesses, net |

|

(91,420 |

) |

|

|

(17,066 |

) |

|

Net cash used in investing activities |

|

(112,790 |

) |

|

|

(46,703 |

) |

| Cash flows from

financing activities |

|

|

|

|

Repurchases of common stock |

|

(43,215 |

) |

|

|

(20,430 |

) |

|

Net proceeds from exercise of options to purchase common stock |

|

4,908 |

|

|

|

9,374 |

|

|

Net proceeds from employee stock purchase plan activity |

|

6,676 |

|

|

|

4,737 |

|

|

Payment for contingent consideration |

|

— |

|

|

|

(2,042 |

) |

|

Net cash used in financing activities |

|

(31,631 |

) |

|

|

(8,361 |

) |

| Effect of foreign

currency exchange rate changes on cash and cash equivalents |

|

(290 |

) |

|

|

31 |

|

| Net increase

(decrease) in cash and cash equivalents |

|

(44,659 |

) |

|

|

57,860 |

|

| Cash and cash

equivalents at beginning of year |

|

207,552 |

|

|

|

149,692 |

|

| Cash and cash

equivalents at end of year |

$ |

162,893 |

|

|

$ |

207,552 |

|

Results presented are unaudited and thus, are subject to

adjustment. Audited results will be included within the 10-K

filing.

|

SPS COMMERCE, INC.NON-GAAP

RECONCILIATION(Unaudited; in thousands, except per share

amounts) |

|

Adjusted EBITDA |

| |

Three Months Ended December

31, |

|

Year Ended December 31, |

| |

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Net income |

$ |

15,915 |

|

|

$ |

12,765 |

|

|

$ |

55,134 |

|

|

$ |

44,597 |

|

|

Income tax expense |

|

4,851 |

|

|

|

2,488 |

|

|

|

16,190 |

|

|

|

8,944 |

|

|

Depreciation and amortization of property and equipment |

|

4,438 |

|

|

|

3,799 |

|

|

|

16,421 |

|

|

|

14,788 |

|

|

Amortization of intangible assets |

|

3,832 |

|

|

|

2,392 |

|

|

|

11,768 |

|

|

|

10,126 |

|

|

Stock-based compensation expense |

|

7,763 |

|

|

|

6,301 |

|

|

|

33,399 |

|

|

|

27,574 |

|

|

Realized (gain) loss from foreign currency on cash and investments

held |

|

(984 |

) |

|

|

(36 |

) |

|

|

1,026 |

|

|

|

1,456 |

|

|

Investment income |

|

(864 |

) |

|

|

(36 |

) |

|

|

(1,670 |

) |

|

|

(278 |

) |

|

Other |

|

— |

|

|

|

21 |

|

|

|

— |

|

|

|

(192 |

) |

| Adjusted

EBITDA |

$ |

34,951 |

|

|

$ |

27,694 |

|

|

$ |

132,268 |

|

|

$ |

107,015 |

|

|

Adjusted EBITDA Margin |

|

|

Three Months EndedDecember

31, |

|

Year EndedDecember 31, |

| |

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Revenue |

$ |

122,018 |

|

|

$ |

102,756 |

|

|

$ |

450,875 |

|

|

$ |

385,276 |

|

| |

|

|

|

|

|

|

|

| Net income |

|

15,915 |

|

|

|

12,765 |

|

|

|

55,134 |

|

|

|

44,597 |

|

| Margin |

|

13 |

% |

|

|

12 |

% |

|

|

12 |

% |

|

|

12 |

% |

| |

|

|

|

|

|

|

|

| Adjusted

EBITDA |

|

34,951 |

|

|

|

27,694 |

|

|

|

132,268 |

|

|

|

107,015 |

|

| Adjusted EBITDA

Margin |

|

29 |

% |

|

|

27 |

% |

|

|

29 |

% |

|

|

28 |

% |

|

Non-GAAP Income |

|

|

Three Months Ended December

31, |

|

Year Ended December 31, |

| |

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Net income |

$ |

15,915 |

|

|

$ |

12,765 |

|

|

$ |

55,134 |

|

|

$ |

44,597 |

|

|

Stock-based compensation expense |

|

7,763 |

|

|

|

6,301 |

|

|

|

33,399 |

|

|

|

27,574 |

|

|

Amortization of intangible assets |

|

3,832 |

|

|

|

2,392 |

|

|

|

11,768 |

|

|

|

10,126 |

|

|

Realized (gain) loss from foreign currency on cash and investments

held |

|

(984 |

) |

|

|

(36 |

) |

|

|

1,026 |

|

|

|

1,456 |

|

|

Other |

|

— |

|

|

|

21 |

|

|

|

— |

|

|

|

(192 |

) |

|

Income tax effects of adjustments |

|

(3,063 |

) |

|

|

(4,302 |

) |

|

|

(14,639 |

) |

|

|

(16,454 |

) |

| Non-GAAP

income |

$ |

23,463 |

|

|

$ |

17,141 |

|

|

$ |

86,688 |

|

|

$ |

67,107 |

|

| |

|

|

|

|

|

|

|

| Shares used to

compute non-GAAP income per share |

|

|

|

|

|

|

|

|

Basic |

|

36,159 |

|

|

|

36,091 |

|

|

|

36,117 |

|

|

|

35,928 |

|

|

Diluted |

|

36,971 |

|

|

|

37,125 |

|

|

|

36,953 |

|

|

|

36,962 |

|

| |

|

|

|

|

|

|

|

| Non-GAAP income

per share |

|

|

|

|

|

|

|

|

Basic |

$ |

0.65 |

|

|

$ |

0.47 |

|

|

$ |

2.40 |

|

|

$ |

1.87 |

|

|

Diluted |

$ |

0.63 |

|

|

$ |

0.46 |

|

|

$ |

2.35 |

|

|

$ |

1.82 |

|

Results presented are unaudited and thus, are subject to

adjustment. Audited results will be included within the 10-K

filing.

Contact:Investor RelationsThe Blueshirt GroupIrmina Blaszczyk

& Lisa LaukkanenSPSC@blueshirtgroup.com415-217-4962

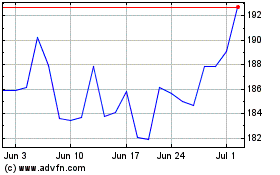

SPS Commerce (NASDAQ:SPSC)

Historical Stock Chart

From May 2024 to Jun 2024

SPS Commerce (NASDAQ:SPSC)

Historical Stock Chart

From Jun 2023 to Jun 2024