0000714256

false

0000714256

2023-08-01

2023-08-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August

1, 2023

SANARA

MEDTECH INC.

(Exact name of registrant as specified in its charter)

| Texas |

|

001-39678 |

|

59-2219994 |

| (State or other jurisdiction of |

|

(Commission File Number) |

|

(IRS Employer |

| incorporation) |

|

|

|

Identification No.) |

|

1200 Summit Avenue, Suite 414

Fort Worth, Texas |

|

76102 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area

code: (817) 529-2300

(Former name or former address, if changed since last

report)

Not Applicable

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| |

☐ |

Written communications pursuant to

Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting material pursuant to Rule

14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

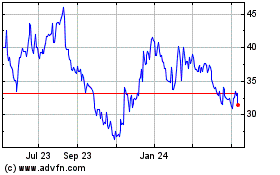

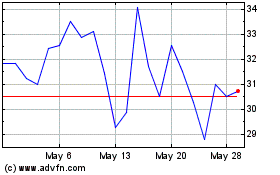

| Common Stock, $0.001 par value |

|

SMTI |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement. |

Asset Purchase Agreement

On August 1, 2023,

Sanara MedTech Inc., a Texas corporation (the “Company”), entered into an Asset Purchase Agreement (the “Purchase Agreement”)

by and among the Company, as guarantor, Sanara MedTech Applied Technologies, LLC, a Texas limited liability company and wholly

owned subsidiary of the Company (the “Purchaser”), The Hymed Group Corporation, a Delaware corporation (“Hymed”),

Applied Nutritionals, LLC, a Delaware limited liability company (“Applied” and, together with Hymed, the “Sellers”),

and Dr. George D. Petito (the “Owner”), pursuant to which the Purchaser acquired certain assets of the Sellers and the Owner,

including, among others, the Sellers’ and Owner’s inventory, intellectual property, manufacturing and related equipment,

goodwill, rights and claims, other than certain excluded assets, all as more specifically set forth in the Purchase Agreement (collectively,

the “Purchased Assets”), and assumed certain Assumed Liabilities (as defined in the Purchase Agreement), upon the terms and

subject to the conditions set forth in the Purchase Agreement (such transaction, the “Asset Purchase”). The Purchased Assets

include the rights to manufacture and sell CellerateRX Surgical Activated Collagen (Powder and Gel) (“CellerateRX Surgical”)

and HYCOL Hydrolyzed Collagen (Powder and Gel) (“HYCOL”) products for human wound care use.

The Purchased Assets

were purchased for an initial aggregate purchase price of $15.25 million, consisting of (i) $9.75 million in cash (the

“Cash Closing Consideration”), (ii) 73,809 shares of the Company’s common stock, par value $0.001 per share

(the “Stock Closing Consideration”), with an agreed upon value of $3.0 million and (iii) $2.5 million in cash (the “Installment

Payments”), to be paid in four equal installments on each of the next four anniversaries of the closing of the Asset Purchase (the

“Closing”).

Hymed is a contract

manufacturer specializing in the research and development of natural, innovative products. Hymed utilizes collagen and glycosaminoglycan

chemistry for the human and veterinary markets with applications in wound care, joint/tissue support, eye care, surgery, dental and dermatology.

As a sister company to Hymed, Applied manufactures state-of-the-art products with formulas based on collagen, hyaluronic acid and glycosaminoglycan

chemistry. The Company licenses certain of its products from Applied through a sublicense (the “Sublicense Agreement”)

with CGI Cellerate RX, LLC (“CGI Cellerate RX”). Pursuant to the Sublicense Agreement, the Company has an exclusive,

world-wide sublicense to distribute CellerateRX Surgical and HYCOL products into the surgical and wound care markets. The Company pays

royalties based on the annual Net Sales (as defined in the Sublicense Agreement) of licensed products consisting of 3% of all collected

Net Sales each year up to $12.0 million, 4% of all collected Net Sales each year that exceed $12.0 million up to $20.0 million, and 5%

of all collected Net Sales each year that exceed $20.0 million. In connection with the Asset Purchase, Applied assigned its license

agreement with CGI Cellerate RX to the Purchaser.

In addition to the

Cash Closing Consideration, Stock Closing Consideration and Installment Payments, the Purchase Agreement provides that the Sellers are

entitled to receive up to an additional $10.0 million (the “Earnout”), which is payable to the Sellers in cash, upon the

achievement of certain performance thresholds relating to the Purchaser’s collections from net sales of a collagen-based product

currently under development. Upon expiration of the seventh anniversary of the Closing, to the extent the Sellers have not earned

the entirety of the Earnout, the Purchaser shall pay the Sellers a pro-rata amount of the Earnout based on collections from net sales

of the product, with such amount to be due credited against any Earnout payments already made by the Purchaser (the “True-Up

Payment”). The Earnout, minus the True-Up Payment and any Earnout payments already made by the Purchaser, may be earned at any

point in the future, including after the True-Up Payment is made.

The Purchase Agreement contains

customary representations, warranties and obligations of the parties, including, among others, certain confidentiality and nonsolicitation

covenants. The parties each have customary indemnification obligations and rights under the terms of the Purchase Agreement, including

with respect to breaches of certain representations and warranties and failure to observe and perform certain covenants.

The foregoing description

of the Purchase Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full

text of the Purchase Agreement, a copy of which is filed as Exhibit 2.1 to this Current Report on Form 8-K (this “Current Report”)

and is incorporated by reference into this Item 1.01.

The Purchase Agreement attached

as Exhibit 2.1 hereto is included to provide investors and security holders with information regarding its terms, and it is not intended

to provide any other factual information about the Company, the Sellers, the Owner, the Purchaser or their respective subsidiaries and

affiliates. The representations, warranties and covenants contained in the Purchase Agreement were made only for the purposes of the Purchase

Agreement and only as of the date of the Purchase Agreement or such other date as is specified in the Purchase Agreement and are qualified

by information in confidential disclosure schedules provided by the Purchaser and the Sellers in connection with the signing of the Purchase

Agreement. These confidential disclosure schedules contain information that modifies, qualifies and creates exceptions to the representations

and warranties and certain covenants set forth in the Purchase Agreement. Moreover, certain representations and warranties in the Purchase

Agreement were used for the purpose of allocating risk between the Company, the Sellers, the Purchaser and the Owner rather than establishing

matters as facts. Information concerning the subject matter of the representations and warranties may change after the date of the Purchase

Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures. Accordingly, the

representations and warranties in the Purchase Agreement should not be relied upon as characterizations of the actual state of facts about

the Company, the Sellers, the Purchaser or the Owner, and the Purchase Agreement should be read in conjunction with the Company’s

Forms 10-K, Forms 10-Q and other documents that are filed with the Securities and Exchange Commission (the “SEC”).

Professional Services Agreement

In connection with

the Asset Purchase and pursuant to the Purchase Agreement, effective August 1, 2023 (the “Effective Date”),

the Company entered into a professional services agreement (the “Services Agreement”) with the Owner, pursuant to

which the Owner, as an independent contractor, agreed to provide certain services to the Company, including, among

other things, assisting with the development of products already in development and assisting with research, development, formulation,

invention and manufacturing of any future products (the “Services”). As consideration for the Services, the Owner is entitled

to receive: (i) a base salary of $12,000 per month during the term of the Services Agreement, (ii) a royalty payment equal to three percent

(3%) of the actual collections from net sales of certain products the Owner develops or co-develops that reach commercialization, (iii)

a royalty payment equal to five percent (5%) for the first $50.0 million in aggregate collections from net sales of certain future products

and a royalty payment of two and one-half percent (2.5%) on aggregate collections from net sales of certain future products on any amounts

exceeding $50.0 million but up to $100.0 million, (iv) $500,000 in cash in the event that 510(k) clearance is issued for any future product

accepted by the Company and (v) $1.0 million in cash in the event that a U.S. patent is issued for a certain product; provided

that with respect to the incentive payments described in (iv) and (v) of the foregoing, the Owner shall not earn more

than $2.5 million.

The Services Agreement

has an initial term of three years and is subject to automatic successive one-month renewals unless earlier terminated in accordance

with its terms. The Services Agreement may be terminated upon the Owner’s death or disability or by the Company or the

Owner “For Cause” (as defined in the Services Agreement); provided, however, that the base salary described in (i) of the foregoing paragraph shall survive termination

through the three-year initial term and the royalty payments and incentive

payments described in (ii)-(v) of the foregoing paragraph shall survive termination of the Services Agreement. The Services Agreement

contains customary representations, warranties and obligations of the parties, including, among others, certain confidentiality, indemnification,

noncompetition and nonsolicitation covenants.

The foregoing summary of the Services

Agreement is a summary only and does not purport to be complete and is subject to, and qualified in its entirety by, the full text of

the Services Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report and is incorporated by reference into this Item

1.01.

Loan Agreement

In connection with

the entry into the Purchase Agreement, on August 1, 2023, the Purchaser, as borrower, and the Company, as guarantor, entered into

a Loan Agreement (the “Loan Agreement”) with Cadence Bank (the “Bank”) providing for, among other things, an

advancing term loan in the aggregate principal amount of $12.0 million (the “Term Loan”), which was evidenced by an advancing

promissory note (the “Advancing Term Note”). Pursuant to the Loan Agreement, the Bank agreed to make, at any time and

from time to time prior to February 1, 2024, one or more advances to the Purchaser.

The proceeds of the

advances under the Loan Agreement will be used for working capital and for purposes of financing up to one hundred percent (100%)

of the Cash Closing Consideration and Installment Payments for the Asset Purchase and related fees and expenses, including any subsequent

payments that may be due to the Sellers after the Closing. On the Effective Date, the Bank, at the request of the Purchaser, made an

advance for $9.75 million. The proceeds from the advance were used to fund the Cash Closing Consideration for the Asset

Purchase.

Advances under

the Term Loan will begin amortizing in monthly installments commencing on August 5, 2024. All remaining unpaid balances under

the Term Loan are due and payable in full on August 1, 2028 (the “Maturity Date”). The Purchaser may prepay amounts

due under the Term Loan. All accrued but unpaid interest on the unpaid principal balance of outstanding advances is due and payable

monthly, beginning on September 5, 2023 and continuing monthly on the fifth day of each month thereafter until the Maturity Date.

The unpaid principal balance of outstanding advances bears interest, subject to certain conditions, at the lesser of the Maximum

Rate (as defined in the Loan Agreement) or the Base Rate, which is for any day, a rate per annum equal to the term secured overnight

financing rate (Term SOFR) (as administered by the Federal Reserve Bank of New York) for a one-month tenor in effect on such day plus

three percent (3.0%).

The obligations of the Purchaser

under the Loan Agreement and the other loan documents delivered in connection therewith are guaranteed by the Company and are secured

by a first priority security interest in substantially all of the existing and future assets of the Purchaser.

The Loan Agreement

contains customary representations and warranties and certain covenants that limit (subject to certain exceptions) the ability of the

Purchaser and the Company to, among other things, (i) create, assume or guarantee certain liabilities, (ii) create, assume or suffer

liens securing indebtedness, (iii) make or permit loans and advances, (iv) acquire any assets outside the ordinary course of business,

(v) consolidate, merge or sell all or a material part of its assets, (vi) pay dividends or other distributions on, or redeem or repurchase,

interest in an obligor, (vii) cease, suspend or materially curtail business operations or (viii) engage in certain affiliate transactions.

In addition, the Loan Agreement contains financial covenants that require the Purchaser to maintain (i) a minimum Debt Services Coverage

Ratio and (ii) a maximum Cash Flow Leverage Ratio, in each case, as defined and calculated according to the procedures set forth in the

Loan Agreement. Pursuant to the Loan Agreement, in the event that the Purchaser fails to comply with the financial covenants described

above, the Company is required to contribute cash to the Purchaser in an amount equal to the amount required to satisfy the financial

covenants.

The Loan Agreement also contains

customary events of default. If such an event of default occurs, the Bank would be entitled to take various actions, including the acceleration

of amounts due under the Loan Agreement and actions permitted to be taken by a secured creditor.

The foregoing summary of the Loan

Agreement is a summary only and does not purport to be complete and is subject to, and qualified in its entirety by, the full text of

the Loan Agreement, a copy of which is filed as Exhibit 10.2 to this Current Report and is incorporated by reference into this Item 1.01.

| Item 2.01 |

Completion of Acquisition or Disposition of Assets. |

The information set forth in Item

1.01 regarding the Asset Purchase is incorporated by reference into this Item 2.01.

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information set forth in Item

1.01 regarding the Loan Agreement and the Advancing Term Note is incorporated by reference into this Item 2.03.

| Item 3.02 |

Unregistered Sales of Equity Securities. |

The information set forth under

Item 1.01 with respect to the issuance of the Stock Closing Consideration to the Owner pursuant to the Purchase Agreement is incorporated

herein by reference. The issuance of the Stock Closing Consideration was undertaken in reliance upon the exemption from the registration

requirements of the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Section 4(a)(2) thereof and Rule

506 of Regulation D promulgated thereunder.

| Item 7.01 |

Regulation FD Disclosure. |

On August

2, 2023, the Company issued a press release announcing the Asset Purchase. A copy of the press release is furnished as Exhibit

99.1 to this Current Report and is incorporated by reference herein.

The information included under

Item 7.01 (including Exhibit 99.1) is furnished pursuant to Item 7.01 and shall not be deemed “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), or otherwise be subject to the liabilities of that

section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act, whether made

before or after the date hereof and regardless of any general incorporation language in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit No. |

|

Description |

| 2.1* |

|

Asset Purchase Agreement, dated August 1, 2023, by and among Sanara MedTech Inc., Sanara MedTech Applied Technologies, LLC, The Hymed Group Corporation, Applied Nutritionals, LLC and Dr. George D. Petito. |

| 10.1** |

|

Professional Services Agreement, dated August 1, 2023, by and between Sanara MedTech Inc. and Dr. George D. Petito. |

| 10.2** |

|

Loan Agreement, dated August 1, 2023, between Sanara MedTech Applied Technologies, LLC, Sanara MedTech Inc. and Cadence Bank. |

| 99.1 |

|

Press Release of Sanara MedTech Inc., issued August 2, 2023 (furnished pursuant to Item 7.01). |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

* Certain schedules and exhibits to this

agreement have been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule or exhibit will be furnished

supplementally to the SEC or its staff upon request. Certain confidential information has been excluded pursuant to Item 601(b)(2)(ii)

of Regulation S-K. Such excluded information is not material and is the type that the Company treats as private or confidential.

**

Certain schedules and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule or exhibit

will be furnished supplementally to the SEC or its staff upon request. Certain confidential information has been excluded pursuant to

Item 601(b)(10)(iv) of Regulation S-K. Such excluded information is not material and is the type that the Company treats as private or

confidential.

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: |

August

2, 2023 |

|

|

| |

|

|

|

| |

|

Sanara MedTech Inc. |

| |

|

|

|

| |

|

By: |

/s/ Michael D. McNeil |

| |

|

|

Name: Michael D. McNeil |

| |

|

|

Title: Chief Financial Officer |

Exhibit

2.1

CERTAIN

INFORMATION CONTAINED IN THIS DOCUMENT, MARKED AT THE APPROPRIATE PLACE WITH FIVE ASTERISKS [*****], HAS BEEN OMITTED BECAUSE IT IS BOTH

(I) NOT MATERIAL AND (II) THE TYPE THAT THE REGISTRANT TREATS AS CONFIDENTIAL.

ASSET

PURCHASE AGREEMENT

THIS

ASSET PURCHASE AGREEMENT (this “Agreement”) is dated as of August 1, 2023, by and among SanARA

MEDTECH Applied technologies, llc, a Texas limited liability company (“Purchaser”), SANARA MEDTECH INC., a

Texas business corporation entering herein for the sole purpose of guaranteeing the performance and obligations of Purchaser (“Guarantor”),

and THE HYMED GROUP CORPORATION, a Delaware corporation (“Hymed”), APPLIED NUTRITIONALS, LLC, a Delaware limited liability

company (“Applied”) (Hymed and Applied each referred to as “Seller” and collectively as “Sellers”),

and DR. GEORGE D. PETITO (“Owner”) entering solely for Sections 1.2(b) and 1.3, Article 2, Sections 7.3 and 7.4, and

Article 8.

RECITALS

WHEREAS,

Hymed develops certain products for use in human and veterinary markets with applications in wound care, joint/tissue support, eye

care, surgery, dental and dermatology (“Hymed Business”), and Applied develops products based on collagen, hyaluronic

acid and glycosaminoglycan chemistry (the “Applied Business,” and together with the Hymed Business, the “Businesses”);

WHEREAS,

Owner is the owner, directly or indirectly, of Hymed and Applied;

WHEREAS,

Sellers desire to sell to Purchaser, and Purchaser desires to purchase from Sellers, certain assets used or held for use in the operation

or conduct of the Businesses on the terms and conditions set forth in this Agreement (the “Acquisition”);

WHEREAS,

certain capitalized terms used in this Agreement are defined in Article 9.

NOW,

THEREFORE, in consideration of the above and the mutual warranties, representations, covenants, and agreements set forth herein,

the parties agree as follows:

ARTICLE

1

PURCHASE

OF RIGHTS AND ASSETS

1.1

Agreement to Purchase and Sell. Subject to the terms and conditions set forth herein and except for the Retained Assets, at the

Closing, but effective as of the Effective Time, Sellers and Owner shall sell, convey, transfer, assign, and deliver to Purchaser, and

Purchaser shall acquire, all right, title, and interest in and to the following itemized listing of properties and rights owned by Sellers

and specified in this Agreement (collectively, the “Rights and Assets”), free and clear of all Liens whatsoever:

(a)

inventory used or held for use in the operation of the Businesses with respect to the Products (as later defined herein), as further

described in Section 1.2(d);

(b)

title to all manufacturing and related equipment related to collagen human wound care, and products and associated usages as set forth

on Schedule 1.1(b) (each the “Current Products” and “Future Products” as noted on Schedule

1.1(b), and collectively the “Products”),

(c)

certain intangible assets relating to the operation of the Businesses, specifically, all patents, patent applications, regulatory 510(k)s,

trademarks, tradenames and intellectual properties set forth on Schedule 1.1(c) hereto, and, proprietary rights, going concern

value, and the goodwill in or arising from the operation thereof (including, without limitation, goodwill associated with all trademarks

and tradenames listed in Schedule 1.1(c) collectively, the “Transferred IP”). Purchaser shall have primary

responsibility for transfer of UDI codes and similar regulatory information and Seller shall reasonably cooperate in furtherance of said

process; and

(d)

assignment of that certain Exclusive License Agreement dated May 18, 2018 by and between Applied and CGI Cellerate Rx, LLC (the “License

Agreement”).

Notwithstanding

the foregoing, the transfer of the Rights and Assets shall not include the assumption of any Liability related to the Rights and Assets

unless expressly assumed by Purchaser in Section 1.6.

1.2

Closing Consideration and Post-Closing Payments.

(a)

Closing Consideration. The initial aggregate purchase price for the Rights and Assets shall be Fifteen Million Two Hundred Fifty

Thousand Dollars ($15,250,000) (the “Purchase Price”). On the Closing Date, Purchaser shall deliver to Sellers and

Owner, as applicable, an amount equal to the following; (i) Nine Million Seven Hundred Fifty Thousand Dollars ($9,750,000) in cash by

wire transfer of immediately available funds to such account or accounts specified in writing by Sellers less any amounts required to

satisfy all third party indebtedness for purposes of releasing any Liens, and (ii) Three Million Dollars ($3,000,000) of common stock

of Guarantor (Trading Symbol - SMTI), the number of shares to be computed as of the Effective Time based upon the simple average closing

price of such common stock quoted on the Nasdaq Capital Market for the twenty (20) trading days immediately preceding the Effective Time

and rounded up to the nearest whole number to avoid the issuance of a fractional share (collectively the “Closing Payment”).

The balance of the Purchase Price shall be paid in four (4) equal annual installments of Six Hundred Twenty Five Thousand Dollars ($625,000)

with the first installment due on the first anniversary of the Effective Time and annually thereafter (collectively the “Installment

Payments”).

(b)

Common Stock Sale Restrictions. The number of Guarantor shares granted to Owner in Section 1.2(a)(ii) shall be subject to the

following restrictions:

(i)

Only ten percent (10%) of the total shares received may be sold only after twelve (12) months from the Effective Time;

(ii)

An additional forty percent (40%) of the total shares received may only be sold after eighteen (18) months from the Effective Time; and

(iii)

The remaining fifty percent (50%) of the total shares received may only be sold after twenty four (24) months from the Effective Time.

(c)

Earnouts. Sellers shall also receive earnout payments in addition to the Purchase Price as follows; (i) Two Million Five Hundred

Thousand Dollars ($2,500,000) if and when Purchaser’s collections from net sales of the Future Product [*****] which was

developed in conjunction with the Transferred IP (“[*****]”) equal Twenty Five Million Dollars ($25,000,000), (ii)

Two Million Five Hundred Thousand Dollars ($2,500,000) if and when Purchaser’s collections from net sales of [*****] equal

Fifty Million Dollars ($50,000,000), (iii) Two Million Five Hundred Thousand Dollars ($2,500,000) if and when Purchaser’s collections

from net sales of [*****] equal Seventy Five Million Dollars ($75,000,000), and (iv) Two Million Five Hundred Thousand Dollars

($2,500,000) if and when Purchaser’s collections from net sales of [*****] equal One Hundred Million Dollars ($100,000,000)

(collectively the “Earnouts”). Upon expiration of the seventh (7th) anniversary from the Effective Date,

to the extent Sellers have not earned the entirety of the Earnouts, Purchaser shall pay Sellers a pro-rata amount of the Earnouts based

on collections from net sales of [*****], with such amount to be due credited with any payments of Earnouts already made by Purchaser.

By way of example, if collections from net sales at the 7th anniversary from the Effective Date equal Thirty Five Million

Dollars ($35,000,000), Sellers will have already received the payment in subsection (c)(i), therefore the pro-rata payout would equal

One Million Dollars ($1,000,000) [$10,000,000/$25,000,000 x $2,500,000]. The calculation and payment shall be performed and made by Purchaser

within sixty (60) days after expiration of the seventh (7th) anniversary from the Effective Date.

(d)

Inventory and Products. Within three (3) business days after Sellers produce a balance sheet prepared in accordance with GAAP

for the most recent month-end prior to Closing, Purchaser shall deliver a payment to Sellers equal to the net book value of inventory

and Current Products not reasonably deemed obsolete upon inspection by Purchaser. Prior to Closing, representatives of Purchaser shall

work with Sellers to obtain an estimate and quality of the inventory and Current Products. For purposes of clarity, the payment made

for inventory and Current Products shall exclude any and all amounts for which Purchaser or its Affiliates have prepaid for any such

inventory and/or Current Products owned by Sellers.

1.3

Retained Assets. Notwithstanding the generality of any other provision herein to the contrary, the parties expressly agree that

Sellers shall retain all assets not otherwise identified for purchase in Section 1.1, and shall maintain the exclusive right to utilize

the Rights associated with the Products for all other purposes (except for collagen based human wound care) including, without limitation,

nutritional supplements, food, dental and non-collagen based human wound care (the “Retained Assets”). Sellers may hereafter

sell, transfer, license or assign any interest in the Retained Assets to any third party, without limitation. Further, the parties agree

that certain dual use equipment, supplies and inventory shall be shared between the parties as set forth in Schedule 1.3.

1.4

Allocation of Consideration. With respect to each trade or business (within the meaning of Code Section 1060 and the treasury

regulations promulgated thereunder) acquired under this Agreement, all amounts constituting consideration within the meaning of, and

for the purposes of, Code Section 1060 and the treasury regulations thereunder shall be allocated among the Rights and Assets in the

manner required by Code Section 1060 and the treasury regulations issued thereunder and all applicable laws. Within one hundred eighty

(180) calendar days after the Closing Date, Purchaser shall prepare and provide Sellers with a schedule (the “Allocation Schedule”)

allocating all such consideration in the manner described by the preceding sentence. Sellers shall have thirty (30) days following receipt

of the Allocation Schedule during which to notify Purchaser of any dispute of any item contained therein, which notice shall set forth

in detail the basis for such dispute. In the event Sellers fail to notify Purchaser of any dispute during such thirty (30)-day period,

the Allocation Schedule delivered by Purchaser shall be final and binding upon the parties. Purchaser and Sellers shall cooperate in

good faith to resolve any such dispute as promptly as possible. Upon such resolution, a revised Allocation Schedule shall be prepared

in accordance with the agreement of Purchaser and Sellers and the allocation of consideration based thereon shall be final and binding

on the parties. If, however, Purchaser and Sellers are unable to resolve any dispute with respect to the Allocation Schedule within fifteen

(15) days of Sellers’ notice of objection, such dispute shall be resolved by an independent valuation firm selected by Purchaser

(the “Allocation Referee”). In resolving any such dispute, the Allocation Referee shall consider only those items

or amounts in the Allocation Schedule as to which the parties have disagreed. The Allocation Referee’s determination of the disputed

items and the resulting Allocation Schedule shall be final and binding on the parties to this Agreement. The Allocation Referee shall

use commercially reasonable efforts to complete its work within thirty (30) days following its engagement. The fees and expenses of the

Allocation Referee shall be borne equally by Purchaser and Sellers. Each of the parties hereto shall (a) prepare and timely file all

Tax Returns, including, without limitation, Form 8594 (and all supplements thereto) in a manner consistent with the final and binding

Allocation Schedule and (b) otherwise act in accordance with the final and binding Allocation Schedule for all income Tax purposes. Purchaser

shall prepare a revised Allocation Schedule to the extent necessary to reflect any post-Closing payment made pursuant to or in connection

with this Agreement, and provide such revised Allocation Schedule to Sellers, as applicable.

1.5

Retained Liabilities. Sellers shall retain all Liabilities of Sellers and all Liabilities directly or indirectly arising out of

or related to the operation of the Businesses prior to the Effective Time including any and all short and long term debt, and any payables

and accrued expenses, including but not limited to payables tied to any inventory or Current Products, if such Liabilities are known

disclosed or undisclosed, matured or unmatured, accrued, absolute, or contingent on and as of the Effective Time (collectively, the “Retained

Liabilities”). Without limiting the generality of the preceding sentence, Purchaser shall not assume or become liable for any

obligations or Liabilities of Sellers not specifically described in Section 1.6.

1.6

Assumed Liabilities. Purchaser shall assume any liabilities of Sellers, as may be created after the Effective Date arising out

of or related to the Rights and Assets (the “Assumed Liabilities”), but not any assets unrelated to the Rights and

Assets or known before the Effective Date. Purchaser shall be liable for any cause of action by any party and/or any regulatory compliance

fee, fine, cost or penalty due to the Products arising after the Effective Date, even if based in whole or in parts on facts existing

prior to the Effective Date, including without limitation anything arising from the notices referenced in Section 2.7(b) below. Additionally,

Purchaser shall be liable for anticipated expenses related to the Future Products and testing and regulatory approval thereof, which

have been ordered but are not yet payable or invoiced. At this time, a reasonable estimate of said expenses is One Hundred Ten Thousand

Dollars ($110,000.00), with such amount subject to changes based on interim results of said testing and processes. Purchaser shall pay

the final amount when due and payable. Seller initiated an investigation for patent defense referenced in 2.5 below, and Purchaser shall

reimburse Seller for such expense up to $10,000.00 for any subsequent successful defense in the form of a non-appealable judgment obtained

by Purchaser.

1.7

Time and Place of Closing.

(a)

The parties shall consummate the Acquisition (the “Closing”) via the electronic exchange of documents and signature

pages and other required documentation, in no event later than ten (10) days after the date specified in the header of this Agreement

(the date on which the Closing actually occurs is hereinafter referred to as the “Closing Date”).

(b)

The parties hereto agree that the effective time and date of the transactions shall be 12:01 a.m., local time for the Businesses on the

Closing Date (the “Effective Time”).

1.8

Deliveries. All deliveries, payments, and other transactions and documents relating to the Closing (a) shall be independent and

shall not be effective unless and until all are effective (except to the extent that the party entitled to the benefit thereof has waived

satisfaction or performance thereof as a condition precedent to the Closing), and (b) shall be deemed to be consummated simultaneously.

1.9

Termination of Existing Contracts. As of the Effective Time, any and all agreements currently in effect and set forth on Schedule

1.9 between the parties and/or its Affiliates shall terminate effective immediately notwithstanding any other terms or conditions

set forth therein.

ARTICLE

2

REPRESENTATIONS

AND WARRANTIES OF SELLERS AND OWNER

Sellers

and Owner jointly and severally represent and warrant the following to Purchaser:

2.1

Organization, Qualification, and Ownership. Hymed is duly incorporated and validly existing as a business corporation under the

laws of the state of Delaware. Applied is duly organized and validly existing as a limited liability company under the laws of the state

of Delaware. Each Seller is duly qualified to do business and is in good standing in its state of organization and in each other state

or other jurisdictions in which either ownership or use of the rights, assets, and properties of each Seller (including the Rights and

Assets), as they are currently being used, or the conduct of the businesses of each Seller (including the Businesses) as currently conducted,

requires such qualification.

2.2

Authority and Validity.

(a)

Each Seller has the full power and authority necessary to (i) execute, deliver, and perform its obligations under the Acquisition Documents

to be executed and delivered by it, (ii) carry on the Businesses as it has been and is now being conducted, and (iii) own and lease the

rights, properties, and assets which it now owns or leases (including the Rights and Assets). The execution, delivery, and performance

of the Acquisition Documents have been duly authorized by all necessary action of the governing body or owners of each Seller. The Acquisition

Documents to which each Seller is a party have been or will be, as the case may be, duly executed and delivered by duly authorized officers

of each Seller and constitute or will constitute the legal, valid, and binding obligations of each Seller, enforceable in accordance

with their respective terms, except as may be limited by bankruptcy, insolvency, or other laws affecting creditors’ rights generally,

or by the effect of rules of law and equitable limitations on the availability of specific remedies (regardless of whether such enforceability

is considered in a proceeding at law or in equity) (the “Enforceability Exceptions”).

(b)

Owner has the full power and authority necessary to execute, deliver, and perform its obligations under the Acquisition Documents to

be executed and delivered by it. The Acquisition Documents to which Owner is a party have been or will be, as the case may be, duly executed

and delivered and constitute or will constitute the legal, valid, and binding obligations of Owner and enforceable in accordance with

their respective terms, except as may be limited by the Enforceability Exceptions.

2.3

Absence of Conflicting Agreements or Required Consents. The execution, delivery, and performance by Sellers and the Owner of the

Acquisition Documents to be executed and delivered by it (a) will not require the consent of or notice to any Governmental Authority

or any other third party, (b) will not conflict with any provision of either Seller’s organizational documents (including articles

of organization or operating agreements), (c) will not conflict with or result in a violation of any Law, ruling, judgment, order, or

injunction of any court or Governmental Authority to which each Seller or the Owner is subject or by which each Seller and the Owner,

or any of its rights, assets, or properties, (including the Rights and Assets) are bound, (d) will not conflict with, constitute grounds

for termination of, result in a breach of, constitute a default under, require any notice under, or accelerate or permit the acceleration

of any performance required by the terms of any contract, agreement, instrument, license, or permit to which each Seller or such Owner

is a party or by which each Seller or such Owner or any of its rights, assets, or properties (including the Rights and Assets), are bound,

and (e) will not create any Lien upon any of the Rights and Assets, or otherwise result in the acceleration of the maturity of any payment

date of any of the Assumed Liabilities.

2.4

No Undisclosed Liabilities. Sellers have no Liabilities with respect to the Businesses, or any of the Rights and Assets except

as incurred in the ordinary course of operating the Businesses.

2.5

Litigation and Claims. Except as listed on Schedule 2.5, (a) there are no claims, lawsuits, actions, arbitrations, or administrative

or other proceedings pending by or against Sellers or the Owner with respect or related to the Businesses or the Rights and Assets, (b)

to the Knowledge of each Seller, no such claim, lawsuit, action, arbitration, or administrative or other proceeding is threatened, (c)

to the Knowledge of each Seller, there are no governmental or administrative investigations or inquiries pending that specifically involve

the Businesses or the operation thereof, or the Rights and Assets, (d) there are no judgments against or consent decrees binding on either

Seller or the Owner with respect to the Businesses or the Rights and Assets, or, to the Knowledge of either Seller, any licensed professional

employed by or contracted for, or otherwise relating to the Businesses, (except for attorney investigation for defense of patent tied

to one of the Products) and (e) no basis for any such matter exists that could reasonably be expected to have a material adverse effect

on the Businesses.

2.6

No Violation of Law.

(a)

With respect to the Rights and Assets, neither Sellers nor the Owner has been within the previous three (3) years or is not currently

in violation of any applicable Law, order, injunction, or decree, or any other requirement of any Governmental Authority or court binding

on it.

(b)

With respect to the Rights and Assets, neither Sellers nor the Owner is currently subject to any Liability or disability as the result

of a failure to comply with any requirement of a Law, order, injunction, or decree, or any other requirement of any Governmental Authority

or court, and neither Sellers nor the Owner has received any notice of such noncompliance.

2.7

Licenses, Authorizations and Patents.

(a)

Sellers and Owner, as applicable, are the holder of all valid licenses and other rights, permits, and authorizations required by Law

or any Governmental Authority necessary to operate the Businesses, including any patents, and FDA approvals related to Current Products.

Sellers and Owner, as applicable, have supplied a correct and complete list of all licenses, permits, patents for Current Products, authorizations,

and FDA approvals for Current Products, and true, complete, and correct copies of any documentation evidencing the foregoing have been

provided to Purchaser.

(b)

No violation, default, order, or deficiency exists with respect to any of the items described in this Section 2.7. Neither Sellers nor

Owner have received any notice of any action pending or recommended by any Governmental Authority having jurisdiction over the items

described in this Section 2.7, either to revoke, limit, withdraw, or suspend any license, right, or authorization of Sellers, Owner or

the Businesses.

2.8

Securities Matters.

(a)

Owner acknowledges that the information supplied by Owner in the warranties contained herein will be relied upon by Purchaser in concluding

that the common stock issued to Owner pursuant to Section 1.2(a)(ii) (“Stock Consideration”) has been issued pursuant to

Section 4(a)(2) of the Securities Act or another exemption from the registration requirement of the Securities Act.

(b)

Owner is:

(i)

an “accredited investor” as defined in Rule 501(a) of Regulation D;

(ii)

not receiving the Stock Consideration as a result of any “general solicitation” or “general advertising” (as

those terms are defined in Regulation D); and

(iii)

receiving the Stock Consideration for his own account with no intention of distributing the Stock Consideration or an amount thereof,

or any arrangement or understanding with any other Person regarding the distribution of such Stock Consideration or otherwise.

(c)

Owner is sufficiently aware of Purchaser’s business affairs and financial condition to reach an informed and knowledgeable decision

to receive the Stock Consideration. Owner acknowledges that information regarding Purchaser is publicly available via the SEC’s

website (www.sec.gov). Owner has made his own investment decision to receive the Stock Consideration based on his own knowledge

and information which is publicly available, including Purchaser SEC documents, with respect to the Stock Consideration of Purchaser.

2.9

Inventories. All items of inventory and Products of Sellers consist, and will consist at the Closing, of items of a quality and

quantity usable and saleable in the ordinary course of business, and shall not be subject to any prepaid orders by third parties.

2.10

Statements True and Correct. No representation or warranty made by Sellers or Owner in this Agreement or in any statement, certificate,

or instrument to be furnished to Purchaser by Sellers pursuant to any Acquisition Document contains or will contain any untrue statement

of material fact or omits or will omit to state a material fact necessary to make these statements contained herein and therein not misleading.

ARTICLE

3

REPRESENTATIONS

AND WARRANTIES OF PURCHASER

Purchaser

hereby represents and warrants to Sellers and Owner as follows:

3.1

Organization, Authority, and Capacity. Purchaser is a limited liability company organized, validly existing, and in good standing

under the laws of the state of Texas. Purchaser has the full power and authority necessary to (i) execute, deliver, and perform its obligations

under the Acquisition Documents to be executed and delivered by it and (ii) carry on its business as it has been and is now being conducted

and to own and lease the rights, properties, and assets which it now owns or leases. Purchaser is duly qualified to do business and is

in good standing in each jurisdiction in which a failure to be so qualified or in good standing would have a material adverse effect

on its ability to perform its obligations under the Acquisition Documents to be executed and delivered by it.

3.2

Authorization and Validity. The execution, delivery, and performance of the Acquisition Documents to be executed and delivered

by Purchaser have been duly authorized by all necessary action by Purchaser. The Acquisition Documents to be executed and delivered by

Purchaser have been or will be, as the case may be, duly executed and delivered by Purchaser and constitute or will constitute the legal,

valid, and binding obligations of Purchaser, enforceable in accordance with their respective terms, except as may be limited by the Enforceability

Exceptions.

3.3

Absence of Conflicting Agreements or Required Consents. The execution, delivery, and performance by Purchaser of the Acquisition

Documents to be executed and delivered by Purchaser (i) do not require the consent of or notice to any Governmental Authority or any

other third party, (ii) will not conflict with any provision of Purchaser’s organizational documents, and (iii) will not conflict

with or result in a violation of any Law, ruling, judgment, order, or injunction of any Governmental Authority to which Purchaser is

subject or by which Purchaser or any of its rights, assets, or properties are bound.

3.4

Transferred IP. At all times after Closing, Purchaser and Guarantor shall use “Commercially Reasonable Efforts” efforts

to keep any and all of the Transferred IP specified on Schedule 1.1(c) fully paid and recognized by applicable Governmental Agencies

as the proper title holder of the foregoing with no limitations on use or loss of rights to same. For these purposes, “Commercially

Reasonable Efforts” shall mean the exercise of prudent scientific and business judgment and a level of effort and resources consistent

with the judgment, efforts and resources that the party who bears the performance obligation or a comparable third party in the industry

would employ for assets of similar strategic importance and commercial value that result from its own research efforts taking into consideration

conditions in effect at the time the party’s obligations are carried out. The obligations of Purchaser and Guarantor under this

Section shall continue for the duration of the maximum period permitted by law applicable to each such item of Transferred IP (including

any renewal thereof). In the event of a breach of this Section, Sellers and Owners shall be entitled to seek all remedies available under

this Agreement, in law or in equity. The time limits under Article 8 below shall not apply to this Section.

ARTICLE

4

ADDITIONAL

AGREEMENTS

4.1

Access to Information. At all times prior to the Closing, Sellers will afford the authorized representatives of Purchaser and

its Affiliates access upon reasonable notice and during normal business hours to all of Sellers’ properties, assets, books, and

records that relate to or concern the Rights and Assets. Sellers will also furnish such parties with such additional financial, operating,

and other information relating to the Rights and Assets as such parties may from time to time reasonably request. Purchaser and its Affiliates

shall also be allowed access, upon reasonable notice, to consult with the officers, employees, accountants, counsel, and agents of Sellers

in connection with such investigation of the Rights and Assets. No such investigation shall diminish or otherwise affect any of the representations,

warranties, covenants, or agreements of any party under this Agreement.

4.2

No-Shop. Unless and until this Agreement is terminated pursuant to Article 7, Sellers and Owner shall not directly or indirectly

through any officer, director, employee, agent, intermediary, or otherwise, (a) solicit, initiate, or encourage submission of proposals

or offers from any Person relating to any purchase of an interest in the Rights and Assets, or (b) participate in any discussions or

negotiations regarding, or furnish to any other Person, any information with respect to, or otherwise respond to, cooperate or encourage,

any effort or attempt by any other Person to purchase any interest in Sellers, in the Rights and Assets, or (c) approve or undertake

any of the foregoing transactions without the prior written consent of Purchaser. If any Seller or any of its agents or intermediaries

receives an offer or proposal relating to any purchase of an interest in Sellers, of the Rights and Assets, the recipient shall notify

Purchaser of the receipt of such offer and shall disclose the terms thereof.

4.3

Affirmative Covenants of Sellers and Owner. From the date hereof until the earlier of the Closing Date or the termination of this

Agreement, unless the prior written consent of Purchaser shall have been obtained, and except as otherwise expressly contemplated herein,

Sellers and the Owner shall:

(a)

use commercially reasonable efforts to preserve intact the rights, assets, properties, licenses, permits, patents, and FDA approvals,

(b)

keep and maintain the Rights and Assets in their present condition, repair, and working order, except for normal depreciation and wear

and tear, and maintain all insurance, rights, and licenses therein,

(c)

keep in full force and effect present insurance policies or other comparable insurance coverage insuring the Rights and Assets, and

(d)

notify Purchaser of (i) any event or circumstance which is reasonably likely to have a material adverse effect on the Rights and Assets

or would reasonably be likely to cause or constitute a breach of any of either Seller’s representations, warranties, or covenants

contained herein, (ii) any unexpected change in the normal course of business or in the operation of the Rights and Assets, and (iii)

any governmental complaints, investigations, or hearings (or communications indicating that the same may be contemplated), adjudicatory

proceedings, budget meetings, or submissions involving any aspect of the Rights and Assets, and keep Purchaser fully informed of such

events and permit representatives of Purchaser and its affiliates to have prompt access to all materials prepared in connection therewith.

4.4

Negative Covenants of Sellers and Owner. From the date hereof until the earlier of the Closing Date or the termination of this

Agreement, Sellers and the Owner will not do any of the following without the prior written consent of Purchaser, which consent shall

not be unreasonably withheld:

(a)

take any action that would (i) adversely affect the ability of any party to the Acquisition Documents to obtain any consents required

for the transactions contemplated thereby, (ii) adversely affect the ability of any party hereto to perform their covenants and agreements

under the Acquisition Documents, or (iii) adversely affect the ability of any party to consummate the transactions contemplated by the

Acquisition Documents,

(b)

impose, or suffer the imposition, on the Rights and Assets of any Lien, or permit any such Lien to exist,

(c)

incur any Liability, except in the ordinary course of business and consistent with past practices,

(d)

except for sales of inventory in the ordinary course of business and other than pursuant to the Acquisition Documents, sell, or enter

into any contract to sell, any interest in any of the Rights and Assets,

(e)

take any action, or omit to take any action, which would cause any of the representations and warranties contained in Article 2 to be

untrue or incorrect.

4.5

Confidentiality, Public Announcements. Each party hereto agrees (i) not to disclose any aspect of the discussions, negotiations,

terms, status, or conditions relating to the transactions contemplated herein to any third party other than their respective officers,

directors, authorized employees, and authorized representatives, and as necessary in order to obtain any consent required hereunder,

and then only on a need to know basis, (ii) to cause and require all such persons to whom such information is disclosed to abide by the

provisions of this Section 4.5, and (iii) not to issue any press release or other general public announcement (including in any trade

journal or other publication) of the transactions, in any case, without the prior written consent of the other party, in each case except

to the extent that disclosure may be required by Law, in which case the party required to made such disclosure will give the other party

prior written notice and an opportunity to review and comment upon such disclosure or press release prior to its disclosure or issuance.

Sellers acknowledge that only Purchaser may issue a press release after the execution of this Agreement that discloses the existence

of this Agreement, and may issue another press release promptly after the consummation of the Acquisition. Sellers hereby consent to

the issuance of such press releases. In the event that the Acquisition is not consummated, any information concerning Sellers and the

Businesses that Purchaser and its representatives may acquire during the course of negotiations, conducting due diligence, and transition

planning with respect to the Acquisition shall be treated as confidential, and in the event the Acquisition is not consummated, all such

information shall, upon request, be returned to Sellers or destroyed, with such destruction certified in writing by Purchaser.

4.6

Bulk Transfer Act. The parties hereby waive compliance with the bulk transfer provisions of the Uniform Commercial Code, or any

similar law enacted in any jurisdiction, to the extent that it may be applicable to the transactions contemplated hereby.

4.7

Retained Liabilities. Sellers shall promptly pay and discharge any and all Retained Liabilities, as and when due. Sellers further

covenant and agree that it will not take any action that is likely to adversely affect Purchaser’s or its Affiliate’s relationship

with any third-party related to the Rights and Assets.

4.8

Conditions to Closing. Sellers (with respect to Article 5) and Purchaser (with respect to Article 6) agree to use their commercially

reasonable efforts to satisfy the conditions to the Closing by August 1, 2023, and if not by such time, as soon thereafter as possible.

4.9

Risk of Loss. Sellers shall retain all risk of condemnation, destruction, loss, or damage due to fire or other casualty from the

date of this Agreement until the Closing. If the condemnation, destruction, loss, or damage is such that the Rights and Assets are materially

affected, then Purchaser shall have the right to terminate this Agreement.

4.10

Certain Tax Matters. Purchaser, on the one hand, and Sellers, on the other hand, shall provide the other party to this Agreement,

at the expense of the requesting party, with such assistance as may reasonably be requested by any of them in connection with the preparation

of any Tax Return, any audit or other examination by any Governmental Authority, or any judicial or administrative proceedings relating

to Liability for Taxes, and each will retain for the applicable statute of limitations, and to provide the requesting party, any records

or information that may be relevant to any of the foregoing.

4.11

Reasonable Assistance. To the extent that any rights under any contract, permit, or other Rights and Assets to be assigned to

Purchaser hereunder may not be assigned without the consent of another Person which, despite either Seller’s commercially reasonable

efforts, has not been obtained prior to the Closing, and Purchaser has, in its sole discretion, waived the closing condition in Section

5.3, this Agreement shall not constitute an agreement to assign the same if an attempted assignment would constitute a breach thereof

or be unlawful. Sellers, at the request and sole cost and expense of Purchaser, shall use its commercially reasonable efforts at all

times from and after the Closing Date to assist Purchaser in obtaining any such required consent(s) as promptly as possible. If any such

consent shall not be obtained or if any attempted assignment would be ineffective or would impair Purchaser’s rights under the

Rights and Assets in question so that Purchaser would not in effect acquire the benefit of all such rights, Sellers, to the maximum extent

permitted by Law and the specific Rights and Assets, and at the sole cost and expense of Purchaser, shall (a) act on and after the Closing

Date as Purchaser’s agent in order to obtain the benefits thereunder, and (b) cooperate, to the maximum extent permitted by Law

and the specific Rights and Assets, with Purchaser in any other reasonable arrangement designed to provide such benefits to Purchaser,

including any sublease or subcontract or similar arrangement.

4.12

Retention of Rights by Sellers and Owner. Whereas Purchaser is obtaining certain Rights and Assets from Owner and Sellers, and

whereas those Rights and Assets include certain patent rights that fall within a field of use that is of interest to Purchaser and that

also fall within a field of use that is of interest to Owner and Sellers, Purchaser, Owner and Sellers agree that Purchaser’s field

of use shall include “collagen compositions for human wound care” and that Purchaser shall provide to Sellers and Owner a

fully paid up, irrevocable, transferrable, and exclusive license to all fields other than Purchaser’s desired field of use for

all patent rights assigned to Purchaser pursuant to this Agreement (to include for example, use in treating non-human animals and the

like). Said license to Sellers and Owner shall include a first right, but not an obligation, to take action in the prosecution, prevention,

or termination of any infringement falling within the licensed field of use. The license shall provide that Sellers and Owner shall notify

Purchaser of any such action in advance, and keep Purchaser reasonably informed of the progress of any such actions. However, such actions

shall be undertaken and directed by Sellers and/or Owner’s sole discretion and at Sellers’ and/or Owner’s cost. Thus,

any and all compensation from any action brought by Sellers and/or Owner to enforce these rights shall be the sole property of Sellers

and/or Owner. The license shall further provide that Purchaser will cooperate fully in any action brought by Sellers and/or Owner seeking

to enforce the patent rights licensed to Sellers and/or Owner.

ARTICLE

5

CONDITIONS

TO OBLIGATION OF PURCHASER

The

obligation of Purchaser to consummate the Acquisition is subject to the satisfaction or waiver by Purchaser, except as otherwise set

forth below, at or prior to the Closing, of each of the following conditions:

5.1

Representations and Warranties. The representations and warranties of Sellers and the Owner set forth in this Agreement, or any

document or instrument delivered to Purchaser hereunder, shall be true and correct in all material respects as of the Closing Date with

the same force and effect as if such representations and warranties had been made at and as of the Closing Date; provided that, for purposes

of this Section 5.1, if any representation or warranty made by Sellers and Owner includes within its terms a materiality qualifier, such

representation or warranty shall be true and correct in all respects on and as of the Closing Date; provided further that, with respect

to any of such representations and warranties referring to a state of facts existing on a specified date prior to the Closing Date, it

shall be sufficient if at the Closing Date such representation and warranty continues to describe accurately the state of facts that

existed on the date so specified.

5.2

Performance; Covenants. All of the terms, covenants, and agreements of the Acquisition Documents to be complied with or performed

by Sellers at or prior to Closing shall have been complied with and performed in all material respects, including, but not limited to,

the delivery of the following documents:

(a)

a certificate of good standing for Sellers issued by the state or other jurisdiction of its formation or incorporation, and operation,

as applicable, and dated within three (3) business days of the Closing Date,

(b)

a Bill of Sale executed by Sellers, in the form attached hereto as Exhibit 5.2(b),

(c)

an IP Assignment Agreement executed by Sellers, the forms of which are attached hereto as Exhibit 5.2(c) (the “IP Assignment

and Assumption Agreement”)

(d)

a certificate dated as of the Closing Date signed by a duly authorized officer of Sellers certifying the satisfaction of the conditions

set forth in Section 5.1 and Section 5.4 and that Sellers have duly performed and complied in all material respects with all of the covenants

and agreements of this Agreement to be performed by it prior to Closing,

(e)

written consents of all third parties necessary for the consummation of the transactions contemplated by the Acquisition Documents,

(f)

a professional services agreement executed by Owner, and a professional services agreement executed by Anita Petito, each in the forms

substantially attached hereto as Exhibit 5.2(f);

(g)

any documents needed to evidence the assignment and assumption of the License Agreement and contract cancellations contemplated by Section

1.9, forms of which are attached hereto as Exhibit 5.2(g); and

(h)

such other documents as may be reasonably necessary to consummate the transactions contemplated by this Agreement, as requested by Purchaser

or its counsel.

5.3

Necessary Consents and Approvals. To the extent required, Purchaser and Sellers shall have obtained all regulatory approvals,

governmental licenses, consents of Governmental Authorities, and permits to which Purchaser shall be legally entitled to continue to

use the Rights and Assets as currently used by the Businesses so long as it properly files necessary applications and cooperates with

state regulatory bodies. The parties shall have provided all necessary notices under applicable Law, and all waiting periods required

by Law shall have expired, necessary in order for Purchaser and Sellers to consummate the Acquisition.

5.4

No Material Adverse Change. There shall not have occurred any material adverse change in the Rights and Assets or in the Liabilities

in each case between the date hereof and the Closing Date, and a certificate of a duly authorized officer of Sellers shall have been

delivered to Purchaser to such effect.

5.5

No Injunction, Etc. No action, proceeding, investigation, or legislation shall have been instituted, threatened, or proposed before

any court, Governmental Authority, or legislative body to enjoin, restrain, prohibit, or obtain substantial damages in respect of, or

which is related to or arises out of, this Agreement or the consummation of the Acquisition, or which is related to or arises out of

the business or operations of Sellers, if such action, proceeding, investigation, or legislation, in the reasonable judgment of Purchaser

or its counsel, would make it inadvisable to consummate such transactions.

5.6

Due Diligence. Purchaser shall in all respects be reasonably satisfied with the results of its due diligence investigation of

the Rights and Assets. Additionally, Purchaser shall in all respects be reasonably satisfied with its continuing review of matters contained

in the Schedules.

5.7

Lien Releases. Purchaser shall have received evidence, satisfactory to it, that Sellers have identified the Liens on the Rights

and Assets and discharged all such Liens.

ARTICLE

6

CONDITIONS

TO OBLIGATION OF SELLERS AND OWNER

The

obligation of Sellers and Owner to close the Acquisition is subject to the satisfaction or waiver by Sellers and Owner, except as otherwise

set forth below, at or prior to the Closing, of each of the following conditions:

6.1

Representations and Warranties. The representations and warranties of Purchaser set forth in this Agreement, or any document or

instrument delivered to any party hereunder, shall be true and correct in all material respects as of the Closing Date with the same

force and effect as if such representations and warranties had been made at and as of the Closing Date; provided that, for purposes of

this Section 6.1, if any representation or warranty made by Purchaser includes within its terms a materiality qualifier, such representation

or warranty shall be true and correct in all respects on and as of the Closing Date; provided further that, with respect to any of such

representations and warranties referring to a state of facts existing on a specified date prior to the Closing Date, it shall be sufficient

if at the Closing Date such representation and warranty continues to describe accurately the state of facts that existed on the date

so specified.

6.2

Performance; Covenants. All of the terms, covenants, and agreements of this Agreement to be complied with or performed by Purchaser

at or prior to the Closing shall have been complied with and performed in all material respects, including, but not limited to delivery

of the following documents:

(a)

the Bill of Sale

(b)

the IP Assignment and Assumption Agreement executed by Purchaser,

(c)

a certificate dated as of the Closing Date signed by a duly authorized officer of Purchaser certifying the satisfaction of the conditions

set forth in Section 6.1 and that Purchaser has duly performed and complied in all material respects with all of the covenants and agreements

of this Agreement to be performed by Purchaser prior to Closing,

(d)

a professional services agreement with Owner, and a professional services agreement with Anita Petito, executed by Purchaser, and

(e)

such other documents as may be reasonably necessary to consummate the transactions contemplated by this Agreement, as reasonably requested

by Sellers or its counsel.

6.3

No Injunction, Etc. No action, proceeding, investigation, or legislation shall have been instituted, threatened, or proposed before

any court, Governmental Authority, or legislative body to enjoin, restrain, prohibit, or obtain substantial damages in respect of, or

which is related to or arises out of, this Agreement or the consummation of the Acquisition, if such action, proceeding, investigation,

or legislation, would lead a reasonable person to conclude that it would be inadvisable to consummate such transactions.

6.4

Payments. Purchaser shall have delivered the Closing Payment to Sellers and Owner in accordance with Section 1.2.

ARTICLE

7

TERMINATION

AND POST-CLOSING COVENANTS

7.1

Right of Termination. This Agreement and the Acquisition may be terminated at any time prior to the Closing Date:

(a)

by the mutual written consent of Purchaser and Sellers,

(b)

by Purchaser in the event that the conditions set forth in Article 5 shall not have been satisfied or waived by August 1, 2023, unless

such satisfaction shall have been frustrated or made impossible by any act or failure to act of Purchaser,

(c)

By Sellers or Purchaser if the Closing shall not have occurred by August 1, 2023,

(d)

By Purchaser in accordance with Section 4.9, or

(e)

by either Purchaser or Sellers in the event (i) consent of any Governmental Authority required for consummation of the Acquisition and

the other transactions contemplated hereby shall have been denied by final, non-appealable action of such authority or if any action

taken by such authority is not appealed within the time limit for appeal or (ii) any Law or order permanently restraining, enjoining

or otherwise prohibiting the consummation of the Acquisition shall have become final and non-appealable.

7.2

Effect of Termination. Except as set forth in this Section 7.2, in the event of termination in accordance with Section 7.1, this

Agreement shall become void and of no further force or effect, without any liability on the part of any of the parties hereto or their

respective owners, directors, officers, employees, heirs, estates, or agents, except the obligations of each party to preserve the confidentiality

of documents, certificates, and information furnished to such party pursuant thereto and for any obligation or liability of any party

based on or arising from any breach or default by such party with respect to its representations, warranties, covenants, or agreements

prior to the effective date of termination. The provisions of Section 4.2, Section 7.2, Article 9 and Article 10 will survive any such

termination.

7.3

Non-Competition.

(a)

Sellers and Owner acknowledge that the Rights and Assets in its possession would enable it to establish goodwill with the patients, customers,

potential customers, and suppliers who provide products and services on behalf of the Businesses or who receive products and services

from the Businesses and that the Rights and Assets constitute a valuable asset of the Businesses. Sellers and Owner further acknowledge

that they have developed relationships with certain of the Businesses’ suppliers, contractors or potential contractors, consultants

or potential consultants, and sources or potential sources of product usage. Accordingly, Sellers and Owner agree that it and its Affiliates

will comply with the terms within this Section 7.3 for the period beginning on the Effective Date and ending on the fifth (5th) anniversary

thereof. During such five (5)-year period, Sellers and Owner agree that it and its Affiliates shall not, directly or indirectly, engage

in, render services to or become interested in any manner, as manager, employee, officer, consultant, owner, or partner, or through stock

ownership (other than holding less than two percent (2%) of the outstanding equity securities of a Person having securities that are

listed for trading on a national securities exchange), or otherwise, either alone or in association with others, in any business that

develops, provides and/or supplies collagen based products for human wound care use similar to those currently owned or under development

by Purchaser as of the Effective Date in the United States (the “Restricted Territory”) with respect to the Market (as later

defined). By way of example, and without limitation, Sellers and Owner may consult or contract with a company that participates in the

Market, if such consultation or contract does not relate to the Market, such as veterinary or other markets related to the Retained Assets.

The foregoing restrictive covenant shall not apply to any of the Retained Assets. During the five (5) year period beginning with the

Effective Date, Purchaser and its Affiliates shall not, directly or indirectly, utilize any of the Transferred IP in any market included

within the scope of the Retained Assets. For the avoidance of doubt, Purchaser and its Affiliates may utilize the Transferred IP on human

wounds including below the skin wounds and damaged skin as these applications are considered by the parties to be inclusive within the

general understanding of the term “wound” utilized within this Agreement and applied for human use only.

(b)

Sellers and Owner acknowledge and agree that the restrictive covenants set forth above are reasonable and valid in time and scope and

in all other respects. The covenants set forth in this Agreement shall be considered and construed as separate and independent covenants.

Should any part or provision of any covenant be held invalid, void, or unenforceable in any court of competent jurisdiction, such invalidity,

voidness, or unenforceability shall not render invalid, void, or unenforceable any other part or provision of this Agreement.

(c)

The parties hereto agree that it is their intention that the restrictive covenants be enforced in accordance with their terms to the

maximum extent possible under applicable law. The parties further agree that, in the event any court of competent jurisdiction shall

find that any of the foregoing provisions is invalid or unenforceable, the invalid or unreasonable term shall be redefined, or a new

enforceable term provided, such that the intent of the parties in agreeing to the provisions of this Agreement will not be impaired and

the provision in question shall be enforceable to the fullest extent of the applicable laws.

(d)

Without limiting the remedies available to Purchaser, the parties hereto acknowledge that a breach of any of the covenants contained

herein may result in material, irreparable injury for which there is no adequate remedy at law, that it will not be possible to measure

damages for such injuries precisely and that, in the event of such a breach or threat thereof by Sellers, Owner or any Affiliate of Sellers

and/or Owner, Purchaser shall be entitled to obtain a temporary restraining order and/or a preliminary or permanent injunction restraining

Sellers and/or Owner from engaging in activities prohibited by this Agreement or such other relief as may be required to specifically

enforce any of the covenants hereof without the necessity of posting any bond.

7.4

Agreements Regarding Guarantor Common Stock.

(a)

Owner irrevocably agrees, in consideration of the benefit that the transactions contemplated hereby will confer, that following the Closing,

Owner shall not transfer any shares of the common stock received as Stock Consideration (the “Lockup Securities”),

at any time during the periods commencing on the Effective Time and ending on the timeframes set forth in Section 1.2(b) (the “Lockup

Period”) without Guarantor’s prior written consent. For purposes of this Section 7.4, “transfer” (and all