Raised $100 Million through Rights Offering

Paid Down $50 Million of Debt in the

Quarter

RumbleOn, Inc. (NASDAQ: RMBL), today announced results for its

quarter and full year ended December 31, 2023.

FOURTH QUARTER AND FULL YEAR 2023 HIGHLIGHTS

- Total Revenue was $311.1 million for the fourth quarter,

down 6.2% from the prior year fourth quarter. For the year, revenue

decreased 6.3% to $1.366 billion.

- Total Powersport Vehicle Retail Sales were down 5.8%

compared to the prior year fourth quarter, with a total of 15,596

units, including 11,293 new units and 4,303 pre-owned units sold in

this year's fourth quarter. For the year, total Powersport vehicle

retail sales were down 3.2% with a total of 67,546 units comprised

of 45,706 new units and 21,840 pre-owned units.

- Total Gross Profit of $71.2 million for the fourth

quarter was down $21.2 million from the prior year, of which $12.6

million related to a pre-owned inventory adjustment. For the year,

total company gross profit decreased 18.5% to $359.9 million

compared to 2022.

- Total Gross Margin of 22.9% for the fourth quarter

compared to 27.9% in the prior year fourth quarter. For the year,

total gross margin was 26.3%, down from 30.3% in 2022.

- Total SG&A expenses for the fourth quarter declined

$14.4 million, or 15.9%, from the prior year fourth quarter and

were down 2.0% for 2023 compared to 2022.

- Loss from Continuing Operations of $168.4 million with

Diluted Loss per Share from Continuing Operations of $7.81

for the fourth quarter and loss from continuing operations of

$214.4 million with diluted loss per share from continuing

operations of $12.09 for the year.

- Adjusted EBITDA was $3.1 million for the fourth quarter

after adjusting for an impairment of goodwill and franchise rights,

an inventory write-down, and other non-cash or non-recurring

charges, compared to $19.7 million in the fourth quarter of 2022.

For the year, Adjusted EBITDA was $50.6 million, which compares to

Adjusted EBITDA of $120.8 million in 2022.

- Total available liquidity of $212.6 million as of

December 31, 2023, comprised of unrestricted cash of $58.9 million,

restricted cash of $18.1 million and availability under Powersports

inventory financing credit facilities of $135.6 million.

- Paid down $50 million of long-term debt during the

quarter as a result of the $100 million rights offering completed

in December and for the year, the Company paid down a total of

$111.7 million of debt. In early 2024, the Company paid down

additional debt and received proceeds from the sale of the loan

portfolio for RumbleOn Finance, putting the Company's non-vehicle

net debt at $218.5 million as of February 29, 2024.

Management Commentary

Michael W. Kennedy, RumbleOn's Chief Executive Officer stated,

“During the quarter, we were able to accomplish several capital and

balance sheet initiatives that put us in a favorable position to

start 2024, including successfully completing a $100 million rights

offering, selling non-core assets, making significant progress to

integrate our prior acquisitions, right-sizing pre-owned inventory

values and reducing term debt. We are proud of what the RumbleOn

team has accomplished in such a short period and are confident that

the foundation that we built positions us well to implement and

deliver our plan.”

Kennedy continued, “Today we are introducing our 3-year

operating plan called Vision 2026, which is the result of the work

by our team over the last few months. We expect the following to be

achieved by calendar year 2026, while maintaining a healthy balance

sheet within our target ratio of 1.5x to 2.5x net debt/Adjusted

EBITDA:

- Annual revenue in excess of $1.7 billion,

- Annual Adjusted EBITDA of greater than $150 million, and

- Annual Adjusted Free Cash Flow of $90 million or more.

While we believe that the prior Adjusted EBITDA guidance of $80

million to $90 million for 2024 is within our sight, we have

decided to stop the practice of giving annual guidance. Instead,

we'll point investors to our Vision 2026 plan and how we expect to

be able to shape the business to drive per share value over the

coming years. As a result, we are withdrawing prior guidance for

2024.”

FOURTH QUARTER 2023 — TOTAL COMPANY RESULTS

Reconciliation of GAAP to non-GAAP financial measures are

provided in accompanying financial schedules.

Unless otherwise noted, all comparisons in the narrative are

fourth quarter of 2023, as compared to fourth quarter of 2022.

(Unaudited)

$ in millions except per share amounts

Three Months Ended December

31

2023

2022

Change

Total Powersport Unit Sales (#) -

includes wholesale

17,591

17,550

0.2

%

Total Revenue

$

311.1

$

331.6

(6.2

)%

Gross Profit

71.2

92.4

(22.9

)%

Gross Margin

22.9

%

27.9

%

(500) bps

Income (loss) from continuing

operations

$

(168.4

)

$

(260.4

)

35.3

%

Diluted Earnings (Loss) per Share from

Continuing Operations

$

(7.81

)

$

(16.11

)

51.5

%

Non-GAAP Measure:

Adjusted EBITDA

$

3.1

$

19.7

(84.3

)%

Total Powersport Units Sold of 17,591 increased 0.2%.

Total Revenue of $311.1 million declined 6.2%, due to

lower selling prices on powersports vehicles sold.

Total Gross Profit of $71.2 million was down $21.2

million from the prior year, of which $12.6 million related to a

fourth quarter pre-owned inventory adjustment for certain pre-owned

vehicles that were purchased proactively at premium prices during a

challenging supply chain environment resulting from the COVID-19

pandemic. As demand has reached more pre-COVID-19 normalized

levels, powersports vehicles acquired at inflated prices during

that time period were written down to their net realizable

value.

Operating Expenses were $80.5 million, or 25.9% of

revenue, compared to $96.2 million, or 29.0% of revenue. Total

stock-based compensation was $1.1 million, or $1.0 million

lower.

Loss from Continuing Operations was $168.4 million,

including a $60.1 million pre-tax non-cash goodwill and franchise

rights impairment charge. Loss per diluted share was $7.81 compared

to $16.11.

Adjusted EBITDA was $3.1 million compared to $19.7

million. The decrease in Adjusted EBITDA was primarily driven by

lower selling prices and compressed margins in the Powersports

Segment.

Cash as of December 31, 2023, including restricted cash,

was approximately $77.0 million, and non-vehicle net debt was

$242.9 million. Availability under the Company's Powersports

inventory financing credit facilities totaled approximately $135.6

million.

Total Available Liquidity, defined as cash and cash

equivalents, including restricted cash, plus availability under

Powersports inventory financing credit facilities totaled

approximately $212.6 million.

Cash Flow used in Operating Activities was $38.9 million

for the year ended December 31, 2023.

Weighted Average Diluted Shares of Class B common stock

outstanding were 21,563,330 for the fourth quarter and 17,740,525

for the year. As of December 31, 2023, RumbleOn had 35,071,955

total shares of Class B common stock, reflecting an additional

18,181,818 shares issued under the rights offering, and 50,000

shares of Class A common stock outstanding.

Fourth Quarter 2023

Unless otherwise noted, all comparisons in the narrative are

fourth quarter of 2023, as compared to fourth quarter of 2022.

Powersports Segment

(Unaudited)

$ in millions except per unit

Three Months Ended December

31

2023

2022

Change

Units Sold (#)

New

11,293

10,633

6.2

%

Pre-owned (includes wholesale)

6,298

6,917

(8.9

)%

Total Powersports Units Sold

17,591

17,550

0.2

%

Revenue

New

$

157.0

$

149.8

4.8

%

Pre-owned

56.3

77.7

(27.5

)%

Finance & Insurance, net

27.4

27.6

(0.7

)%

Parts, Services, and Accessories

57.6

65.3

(11.8

)%

Total Powersports Revenue

$

298.3

$

320.4

(6.9

)%

Gross Profit

New

$

20.6

$

25.3

(18.6

)%

Pre-owned

(5.8

)

10.5

(155.2

)%

Finance & Insurance, net

27.4

27.6

(0.7

)%

Parts, Services, and Accessories

25.6

26.4

(3.0

)%

Total Powersports Gross Profit

$

67.8

$

89.8

(24.5

)%

Powersports GPU1

$

4,350

$

5,422

(19.8

)%

New Powersports Revenue increased 4.8% due primarily to

the increase in number of units sold.

New Powersports Gross Profit declined 18.6%, due

primarily to an unfavorable mix of powersports vehicles sold.

Pre-owned Powersports Units Sold, which includes

pre-owned retail and wholesale Powersports Units, declined 8.9%, as

we slowed down pre-owned vehicle acquisition.

Pre-owned Powersports Revenue declined 27.5%.

Pre-owned Powersports Gross Profit declined $16.3 million,

due primarily to the previously mentioned $12.6 million correction

on inventory prices and lower units sold.

Powersports GPU was $4,350, as compared to $5,422.1

Vehicle Logistics

Segment

(Unaudited)

$ in millions

Three-Months Ended December

31

2023

2022

Change

Vehicles Transported (#)

21,599

17,840

21.1

%

Vehicle Logistics Revenue

$

12.9

$

11.2

15.2

%

Vehicle Logistics Gross Profit

3.4

2.7

25.9

%

Revenue from Vehicle Logistics was up 15.2%, due

primarily to volume.

Gross profit for this business was up 25.9%, driven by

the increase in vehicles transported.

CONFERENCE CALL AND WEBCAST DETAILS

RumbleOn will host a conference call on March 14, 2024 at 7:00

a.m. Central Time (8:00 a.m. Eastern Time) to discuss its fourth

quarter 2023 results. To participate in the call, please dial

1-877-407-9716 (or 1-201-493-6779 for callers outside of the United

States) and enter Conference ID 13743245. A live webcast will be

available on the Investor Relations section of RumbleOn's website

at www.rumbleon.com. Please visit the webcast at least 20 minutes

before the call begins to register, download and install any

necessary audio software. A replay of the conference call and

archive of the webcast will be available shortly after the call on

the Investor Relations section of the Company's website at

www.rumbleon.com.

ABOUT RUMBLEON

RumbleOn, Inc. (NASDAQ: RMBL), operates through two operating

segments: the RideNow Powersports dealership group and Wholesale

Express, LLC, an asset-light transportation services provider

focused on the automotive industry. RideNow Powersports is the

largest powersports retail group in the United States (as measured

by reported revenue, major unit sales and dealership locations),

offering over 500 powersports franchises representing 52 different

brands of products. RideNow Powersports sells a wide selection of

new and pre-owned products, including parts, apparel, accessories,

finance & insurance products and services, and aftermarket

products. We are the largest purchaser of pre-owned powersports

vehicles in the United States and utilize our proprietary Cash

Offer technology to acquire vehicles directly from consumers.

To learn more, please visit us online at

https://www.rumbleon.com.

1 Calculated as total powersports gross profit divided by new

and used retail powersports units sold.

Cautionary Note on Forward-Looking Statements

This press release may contain “forward-looking statements” as

that term is defined under the Private Securities Litigation Reform

Act of 1995, which statements may be identified by words such as

“expects,” “plans,” “projects,” “will,” “may,” “anticipates,”

“believes,” “should,” “intends,” “estimates,” and other words of

similar meaning. Readers are cautioned not to place undue reliance

on these forward-looking statements, which are based on our

expectations as of the date of this press release and speak only as

of the date of this press release and are advised to consider the

factors listed under the heading “Forward-Looking Statements” and

“Risk Factors” in the Company's SEC filings, as may be updated and

amended from time to time. We undertake no obligation to publicly

update or revise any forward-looking statements, whether as a

result of new information, future events, or otherwise, except as

required by law.

Other

As disclosed in a Form 12b-25 filed today, the Company is unable

to file its Annual Report on Form 10-K for the year ended December

31, 2023 (“2023 Form 10-K”) by the prescribed due date. The

Company's management is continuing to evaluate the effectiveness of

certain internal controls over financial reporting. Management has

identified certain deficiencies, but the classification of these

deficiencies has not been conclusively determined. The Company does

not expect that the final determination will impact the financial

information reported in the press release.

The Company has performed additional analyses and procedures

that have led management to conclude that the financial information

included in this press release fairly presents, in all material

respects, the Company's financial condition and results of

operations as of the end of and for the quarterly period and year

ended December 31, 2023. The Company expects that the 2023 Form

10-K, along with the audited financial statements for the year

ended December 31, 2023, will be filed within the 15-day extension

period provided by Rule 12b-25.

Use of Non-GAAP Financial Measures

As required by the rules of the Securities and Exchange

Commission (“SEC”), we provide reconciliations of the non-GAAP

financial measures contained in this press release to the most

directly comparable measure under GAAP, which are set forth in the

financial tables attached to this release.

Adjusted EBITDA, non-vehicle net debt, and Adjusted Free Cash

Flow are non-GAAP financial measures and should not be considered

as alternatives to operating income or net income as a measure of

operating performance or cash flows or as a measure of liquidity.

Non-GAAP financial measures are not necessarily calculated the same

way by different companies and should not be considered a

substitute for or superior to U.S. GAAP.

We define Adjusted EBITDA as net income (loss) adjusted to add

back interest expense, depreciation and amortization, the impact of

income taxes, discontinued operations, non-cash stock-based

compensation costs, the non-cash impairment of goodwill and

franchise rights, transaction costs, certain litigation expenses

not associated with our ongoing operations, and other non-recurring

costs and credits, such as the gain on the sale of a dealership,

insurance proceeds and costs attributable to an abandoned project,

as such we do not consider such recoveries, charges and expenses to

be a part of our core business operations, and they not necessarily

an indicator of ongoing, future company performance.

Adjusted EBITDA is one of the primary metrics used by management

to evaluate the financial performance of our business. We present

Adjusted EBITDA because we believe it is frequently used by

analysts, investors and other interested parties to evaluate

companies in our industry. Further, we believe it is helpful in

highlighting trends in our operating results, because it excludes,

among other things, certain results of decisions that are outside

the control of management, while other measures can differ

significantly depending on long-term strategic decisions regarding

capital structure and capital investments.

We define non-vehicle net debt as the principal balance of our

term debt, convertible notes, and finance portfolio line of credit,

not inclusive of reductions for debt discount and unamortized

issuance costs, less unrestricted cash. We present non-vehicle net

debt because we believe it is frequently used by analysts,

investors and other interested parties to evaluate companies in our

industry.

We define Adjusted Free Cash Flow as cash flows from operating

activities plus cash flows from investing activities, excluding

cash flows used or received in acquisitions or divestitures.

With respect to our 2026 Adjusted EBITDA and Adjusted Free Cash

Flow targets, a reconciliation of these non-GAAP measures to the

corresponding GAAP measures is not available without unreasonable

effort due to the complexity of the reconciling items that we

exclude from the non-GAAP measure or the variables going into the

calculation of operating cash flows.

RumbleOn, Inc.

Condensed Consolidated

Statements of Operations

(Unaudited)

(in millions, except per share

amounts)

Three Months Ended December

31,

Twelve Months Ended December

31,

2023

2022

2023

2022

Revenue:

Powersports vehicles

$

213.2

$

227.5

$

951.4

$

1,033.9

Parts, service and accessories

57.6

65.3

241.8

247.6

Finance and insurance, net

27.4

27.6

117.0

123.4

Vehicle logistics

12.9

11.2

56.2

54.0

Total revenue

311.1

331.6

1,366.4

1,458.9

Cost of revenue:

Powersports vehicles

198.4

191.9

832.5

839.7

Parts, service and accessories

32.0

38.9

131.5

135.3

Vehicle logistics

9.5

8.4

42.5

42.2

Total cost of revenue

239.9

239.2

1,006.5

1,017.2

Gross profit

71.2

92.4

359.9

441.7

Selling, general and administrative

75.7

90.1

347.3

354.5

Impairment of goodwill and franchise

rights

60.1

324.3

60.1

324.3

Depreciation and amortization

4.8

6.1

22.0

23.0

Operating income (loss)

(69.4

)

(328.1

)

(69.5

)

(260.1

)

Non-operating income (expense):

Interest expense

(21.4

)

(16.5

)

(77.2

)

(52.1

)

Other income (expense)

(8.6

)

4.0

(8.4

)

4.2

PPP loan forgiveness

—

—

—

2.5

Total non-operating expense

(30.0

)

(12.5

)

(85.6

)

(45.4

)

Loss from continuing operations before

income taxes

(99.4

)

(340.6

)

(155.1

)

(305.5

)

Income tax expense (benefit)

69.0

(80.2

)

59.3

(72.0

)

Loss from continuing operations

(168.4

)

(260.4

)

(214.4

)

(233.5

)

Loss from discontinued operations, net

(0.1

)

(27.2

)

(1.1

)

(28.0

)

Net loss

$

(168.5

)

$

(287.6

)

$

(215.5

)

$

(261.5

)

Weighted average common shares

outstanding

21.56

16.16

17.74

15.87

Diluted loss per share from continuing

operations

$

(7.81

)

$

(16.11

)

$

(12.09

)

(14.71

)

RumbleOn, Inc.

Condensed Consolidated Balance

Sheets

(Unaudited)

($ in millions)

December 31, 2023

December 31, 2022

ASSETS

Current assets:

Cash

$

58.9

$

46.8

Restricted cash

18.1

10.0

Accounts receivable, net

50.3

28.0

Loans receivable held for sale

—

33.7

Inventory

347.5

323.5

Prepaid expense and other current

assets

6.0

7.4

Current assets of discontinued

operations

—

11.4

Total current assets

480.8

460.8

Property and equipment, net

76.8

76.1

Right-of-use assets

163.9

161.8

Goodwill

0.8

21.1

Intangible assets, net

202.5

247.4

Deferred tax assets

—

58.1

Other assets

1.5

1.9

Total assets

926.3

1,027.2

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable and other current

liabilities

67.8

79.5

Vehicle floor plan note payable

291.3

220.1

Current portion of long-term debt

35.6

3.7

Current liabilities of discontinued

operations

0.3

8.4

Total current liabilities

395.0

311.7

Long-term liabilities:

Long-term debt

286.7

374.4

Operating lease liabilities

134.1

126.7

Deferred taxes

0.4

—

Other long-term liabilities

4.5

8.4

Total long-term liabilities

425.7

509.5

Total liabilities

820.7

821.2

Stockholders’ equity:

Class A common stock

—

—

Class B common stock

—

—

Additional paid-in capital

701.0

585.9

Accumulated deficit

(591.1

)

(375.6

)

Treasury stock

(4.3

)

(4.3

)

Total stockholders’ equity

105.6

206.0

Total liabilities and stockholders’

equity

$

926.3

$

1,027.2

RumbleOn, Inc.

Condensed Consolidated

Statements of Cash Flows

(Unaudited)

($ in Millions)

2023

2022

CASH FLOWS FROM OPERATING

ACTIVITIES

Net income (loss)

$

(215.5

)

$

(261.5

)

Loss from discontinued operations

(1.1

)

(28.0

)

Income (loss) from continuing

operations

(214.4

)

(233.5

)

Adjustments to reconcile income (loss)

from continuing operations to net cash provided by (used in)

operating activities:

Depreciation and amortization

22.0

23.0

Amortization of debt discount and deferred

financing costs

10.4

6.4

Inventory write-down

12.6

—

Forgiveness of PPP loan

—

(2.5

)

Stock based compensation expense

12.0

9.4

Impairment loss on goodwill and franchise

rights

60.1

324.3

Deferred taxes

58.5

(76.7

)

Valuation allowance charge for loans

receivable held for sale

7.6

—

Originations of loan receivables, net of

principal payments received

6.3

(27.9

)

Changes in operating assets and

liabilities, net of acquisitions:

Accounts receivable

(2.4

)

(4.6

)

Inventory

(31.7

)

(120.4

)

Prepaid expenses and other current

assets

1.4

(0.4

)

Other assets

0.3

0.3

Other liabilities

(3.7

)

1.6

Accounts payable and accrued

liabilities

(4.4

)

(6.0

)

Floor plan trade note borrowings

26.5

60.3

Net cash used in operating activities of

continuing operations

(38.9

)

(46.7

)

CASH FLOWS FROM INVESTING

ACTIVITIES

Acquisitions, net of cash received

(3.3

)

(69.6

)

Purchase of property and equipment

(13.7

)

(5.6

)

Technology development

(2.1

)

(7.0

)

Net cash used in investing activities of

continuing operations

(19.1

)

(82.2

)

CASH FLOWS FROM FINANCING

ACTIVITIES

Net proceeds from common stock rights

offering

98.4

—

Proceeds from sale-leaseback

transaction

50.0

—

Proceeds from debt issuances

2.2

84.5

Repayment of debt, including finance

lease

(111.7

)

(51.2

)

Net borrowings from non-trade floor

plans

42.5

77.9

Proceeds from RumbleOn Finance (“ROF”)

credit facility

—

25.0

Shares redeemed for employee tax

obligations

(1.4

)

—

Debt issuance costs

(1.8

)

—

Net cash provided by financing activities

for continuing operations

78.2

136.2

CASH FLOWS FROM DISCONTINUED

OPERATIONS

Net cash provided by operating activities

of discontinued operations

3.4

27.8

Net cash used in financing activities of

discontinued operations

(5.2

)

(28.5

)

Net cash used in discontinued

operations

(1.8

)

(0.7

)

NET CHANGE IN CASH

18.4

6.6

Cash and restricted cash at beginning of

period

58.6

52.0

Cash and restricted cash at end of

period

$

77.0

$

58.6

RumbleOn, Inc.

Reconciliation of Net Income

(Loss) to Adjusted EBITDA

(Unaudited)

($ in Millions)

Three Months Ended

Year Ended

Dec 31,

Dec 31,

Dec 31,

Dec 31,

2023

2022

2023

2022

Net income (loss)

$

(168.5

)

$

(287.6

)

$

(215.5

)

$

(261.5

)

Loss from discontinued operations,

net

(0.1

)

(27.2

)

(1.1

)

(28.0

)

Income (loss) from continuing

operations, net

(168.4

)

(260.4

)

(214.4

)

(233.5

)

Add back:

Interest expense

21.4

16.5

77.2

52.1

Depreciation and amortization

4.8

6.1

22.0

23.0

Interest income and miscellaneous

income

—

—

—

—

Income tax provision (benefit)

69.0

(80.2

)

59.3

(72.0

)

EBITDA

(73.2

)

(318.0

)

(55.9

)

(230.4

)

Adjustments:

Stock-based compensation expense

1.1

2.1

12.0

9.4

Transaction costs for acquisitions(1)

—

0.4

—

1.9

Purchase accounting related

—

0.1

—

0.2

Pre-owned vehicle inventory valuation

adjustment(2)

12.6

—

12.6

—

Lease expense associated with favorable

related party leases in excess of contractual lease payments

0.3

0.6

1.1

1.3

Charges related to proxy contest and

reorganization of the Board of Directors(3)

—

—

5.1

—

Loss related to sale of RumbleOn

receivables

1.6

7.6

—

Impairment of goodwill and franchise

rights

60.1

324.3

60.1

324.3

Litigation settlement expenses(4)

—

8.4

0.1

8.4

PPP Loan forgiveness(5)

—

—

—

(2.5

)

Costs attributable to abandoned

fulfillment center project(6)

—

2.1

—

2.1

Personnel restructuring costs

—

—

5.3

—

Other non-recurring costs(7)

0.6

3.6

2.7

10.0

Gain on sale of dealership

—

(3.9

)

—

(3.9

)

Adjusted EBITDA

$

3.1

$

19.7

$

50.6

$

120.8

(1)

Transaction costs associated with the

RideNow and Freedom Powersports acquisitions, which primarily

include professional fees and third-party costs

(2)

Reflects write-down to net realizable

value for pre-owned inventory purchased at elevated pandemic prices

that are no longer supported.

(3)

Charges in 2023 related to the shareholder

proposals for the Company's annual meeting of shareholders and

costs related to the reorganization in 2023 of our Board of

Directors

(4)

Charges associated with litigation outside

of our ongoing operations

(5)

Forgiveness of the Paycheck Protection

Program ("PPP") loan

(6)

Expenses attributable to a discontinued

project in Fort Worth, Texas

(7)

Other non-recurring costs, which include

one-time expenses incurred. In 2023, amounts primarily included

integration costs and professional fees associated with

acquisitions. Amounts in 2022 primarily included a death benefit to

the estate of a former officer and director and various integration

costs and professional fees associated with the Freedom Powersports

and RideNow acquisitions, technology implementation and the

establishment of the RumbleOn Finance secured loan facility.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240314492716/en/

Investor Relations Contact: investors@rumbleon.com

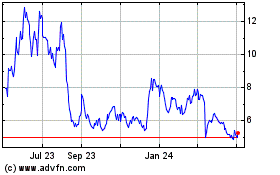

RumbleOn (NASDAQ:RMBL)

Historical Stock Chart

From Dec 2024 to Jan 2025

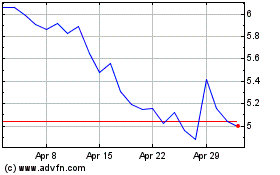

RumbleOn (NASDAQ:RMBL)

Historical Stock Chart

From Jan 2024 to Jan 2025