Rumble Inc. (Nasdaq: RUM) ("Rumble" or the "company"), the video

sharing platform and cloud services provider, today announced

financial results for the fiscal quarter ended September 30, 2023.

Q3 2023 Highlights and Key

Items

- Driven by higher

advertising and licensing and other revenue, third quarter revenue

increased 64% to $18.0 million, compared to $11.0 million in the

third quarter of 2022, and $25.0 million in the second quarter of

2023.

- Average global

Monthly Active Users (“MAUs”) of 58 million in the third quarter of

2023. Of the 58 million MAUs, 40 million were based in the U.S. and

Canada.

- Average

estimated Minutes Watched Per Month (“MWPM”) increased by 19% to

10.7 billion in the third quarter of 2023, compared to 9.0 billion

in the third quarter of 2022 and 11.8 billion in the second quarter

of 2023.

- Strong growth in

hours of uploaded video per day, increasing by 78% to 15,700 in the

third quarter of 2023, compared to 8,796 in the third quarter of

2022 and 13,229 in the second quarter of 2023.

- As of September

30, 2023, Rumble’s balance of cash, cash equivalents and marketable

securities was approximately $267.0 million.

- Launched the

beta release of Rumble Cloud with a robust product set which

includes cloud compute, storage, and networking. Rumble Cloud is

well-positioned to provide a new revenue stream for Rumble by

capturing a share of the public cloud market by serving a growing

segment of businesses that are looking for alternatives to ‘big

tech.’

- Hosted exclusive

livestreams for the first two Republican presentation primary

debates, gaining over an estimated 700,000 concurrent viewers

across all Rumble platforms during the first debate on August 23,

2023.

- Expanded

exclusive-to-Rumble content to include RiceGum in a strategic

effort to continue the momentum with Gen Z viewership.

- Expanded

Rumble’s comedic library with the addition of widely followed

comedian JP Sears’ weekly show “Lies You Can Trust.”

- Increased

creator visibility through Rumble’s livestream format of Jimmy

Corsetti’s popular show “Bright Insight with Jimmy Corsetti.”

- Top streamer

Steven Crowder surpassed $7.5 million in subscription payments to

his ‘Mug Club’ subscriber community within five months of launch.

Because Rumble recognizes subscription revenue proportionally over

the respective subscription term and given that the majority of Mug

Club subscriptions is annual, the full $7.5 million is not

recognized as revenue in Rumble’s financial statements at the time

funds are collected.

- Strong progress

on the video platform: launched new app for Samsung Smart TVs,

implemented new video player on the web, improved categorization

features and navigation, and improved video sharing

capabilities.

- The third

quarter of 2023 marks the completion of Rumble’s first year as a

publicly traded company.

Subsequent to Quarter End

Highlights

- On November 7,

2023, announced the Beta launch of its new livestreaming tool,

Rumble Studio, simplifying the livestreaming experience for Rumble

creators, allowing them to easily stream video to multiple

platforms, invite guests, and engage with audiences.

- Served as the

exclusive livestream partner for the third Republican presidential

primary debate on November 8, 2023, and subsequently announced

Rumble as the exclusive livestream partner for the fourth

Republican presidential primary debate to be held on December 6,

2023.

- Accomplished

dual strategic initiatives by expanding Rumble’s selection of

exclusive movies through the company’s Locals subscription platform

with the release of “Police State” from leading creator Dinesh

D’Souza in collaboration with Dan Bongino.

- Announced

upcoming Christmas comedy from executive producers Logan Sekulow

and Sean Hannity to premiere exclusively on Rumble on November 23,

2023.

Management Commentary

Rumble’s Chairman and CEO Chris Pavlovski

commented, “Our third quarter topline revenue grew 64% year over

year as we continue to receive early positive indications of

tangible revenue dollars from the successful implementation of

Rumble Advertising Center, or RAC. Meanwhile, we continue to focus

on establishing Rumble as the platform that can position streamers

for optimal earnings. With average Monthly Active Users of 58

million, we have a strong user base that is ripe for monetization,

which in turn will allow us to curb our creator incentives. With

the proven functionality in place to transition creators onto the

Rumble Studio, in addition to the capabilities of RAC, we believe

we have the tools to take our earnings to the next level. Simply

put, our recent spend on creators, including sports leagues, has

successfully diversified our user base. This diverse user base has

already attracted numerous brand advertisers and created traction

with top-tier advertising agencies. We are seeing the fruits of our

labors, and our focus remains on monetization and a pathway to

profitability.”

Q3 Financial Summary (Unaudited)

|

For the three months ended September 30, 2023 |

|

2023 |

|

2022 |

|

Variance ($) |

Variance (%) |

|

|

|

|

|

|

|

|

|

|

Revenues |

$ |

17,982,150 |

$ |

10,983,182 |

$ |

6,998,968 |

64 |

% |

| Expenses |

|

|

|

|

|

|

|

|

Cost of services (content, hosting and other) |

$ |

39,751,475 |

$ |

12,287,183 |

$ |

27,464,292 |

224 |

% |

|

General and administrative |

|

9,688,129 |

|

2,861,787 |

|

6,826,342 |

239 |

% |

|

Research and development |

|

5,111,748 |

|

1,724,347 |

|

3,387,401 |

196 |

% |

|

Sales and marketing |

|

3,182,903 |

|

1,460,177 |

|

1,722,726 |

118 |

% |

For the third quarter of 2023, revenue was $18.0

million, compared to $11.0 million in the third quarter of 2022, an

increase of 64%. The increase is due to a $2.3 million increase in

advertising revenue and a $4.7 million increase in licensing and

other revenue. The increase in advertising revenue was driven by an

increase in consumption, as well as the introduction of new

advertising solutions for creators, publishers and advertisers

through RAC. The increase in licensing and other revenue was driven

by subscriptions as well as licensing creator content, tipping,

cloud and platform hosting fees.

Cost of services was $39.8 million for the

quarter, compared to $12.3 million in the third quarter of 2022.

The increase was due to an increase in programming and content

costs of $26.1 million, hosting expenses of $0.7 million, and other

service costs of $0.7 million.

General and administrative expense was $9.7

million for the quarter, compared to $2.9 million in the third

quarter of 2022. The increase was due to a $2.9 million increase in

staffing-related costs, share-based compensation of $1.1 million

related to the recognition of rights to contingent consideration in

connection with the Callin acquisition, as well as other

administrative expenses of $2.8 million, most of which are public

company-related, including accounting, legal, investor relations,

insurance and other administrative services.

Research and development expense was $5.1

million for the quarter, compared to $1.7 million in the third

quarter of 2022. The increase was due to a $3.0 million increase in

staffing-related costs, as well as a $0.4 million increase in costs

related to computer software and hardware, and other administrative

expenses.

Sales and marketing expense was $3.2 million for

the quarter, compared to $1.5 million in the third quarter of 2022.

The increase was due to a $0.8 million increase in staffing-related

and consulting service costs, as well as a $0.9 million increase in

other marketing and public relations activities.

Liquidity

As of September 30, 2023, Rumble had cash, cash

equivalents and marketable securities of approximately $267.0

million.

Conference Call Webcast Information

Rumble will host a conference call at 5:00 p.m.

Eastern Time today, Monday, November 13, 2023, to discuss its

quarterly results. Access to the live webcast and replay of the

conference call will be available here and on Rumble's Investor

Relations website at investors.rumble.com under 'News &

Events’.

Chris Pavlovski, the Chairman and CEO of Rumble,

will also be interviewed by Matt Kohrs this evening at 7:00 p.m.

Eastern Time. The interview will be accessible here and streamed

live on the Matt Kohrs Rumble channel at rumble.com/MattKohrs.

Notes on KPIs

Monthly Active Users ("MAUs").

We use MAUs as a measure of audience engagement to help us

understand the volume of users engaged with our content on a

monthly basis. MAUs represent the total web, mobile app, and

connected TV users of Rumble for each month, which allows us to

measure our total user base calculated from data provided by

Google, a third-party analytics provider. Google defines “active

users” as the “[n]umber of distinct users who visited your website

or application.” We have used the Google analytics systems since we

first began publicly reporting MAU statistics, and the resulting

data have not been independently verified.

As of July 1, 2023, Universal Analytics (“UA”),

Google’s analytics platform on which we historically relied for

calculating MAUs using company-set parameters, was phased out by

Google and ceased processing data. At that time, Google Analytics 4

(“GA4”) succeeded UA as Google’s next-generation analytics

platform, which we used to determine MAUs for the third quarter of

2023 which we expect to continue to use to determine MAUs in future

periods. Although Google has disclosed certain information

regarding the transition to GA4, Google does not currently make

available sufficient information relating to its new GA4 algorithm

for us to determine the full effect of the switch from UA to GA4 on

our reported MAUs. Because Google has publicly stated that metrics

in UA “may be more or less similar” to metrics in GA4, and “[i]t is

not unusual for there to be apparent discrepancies” between the two

systems, we are unable to determine whether the transition from UA

to GA4 has a positive or negative effect, or the magnitude of such

effect, if any, on our reported MAUs. It is therefore possible that

MAUs that we reported based on the UA methodology for periods prior

to July 1, 2023 cannot be meaningfully compared to MAUs based on

the GA4 methodology in subsequent periods.

Estimated Minutes Watched Per Month

("MWPM"). We use estimated MWPM as a measure of audience

engagement to help us understand the volume of users engaged with

our content on a monthly basis and the intensity of users’

engagement with the platform. Estimated MWPM represents the monthly

average of minutes watched per user within a quarterly period,

which helps us measure user engagement. Estimated MWPM is

calculated by converting actual bandwidth consumption into minutes

watched, using our management’s best estimate of video resolution

quality mix and various encoding parameters. We continually seek to

improve our best estimates based on our observations of creator and

user behavior on the Rumble platform, which changes based on the

introduction of new product features, including livestreaming. We

are currently limited, however, in our ability to collect data from

certain aspects of our systems while we improve our measurement

capabilities. These limits may result in errors that are difficult

to quantify, especially as the proportion of livestreaming on the

Rumble platform increases over time, and as we improve the quality

of various video formats by increasing bit rates, until we are able

to measure MWPM directly. Bandwidth consumption includes video

traffic across the entire Rumble platform (website, apps, embedded

video, connected TV, etc.), as well as what our management believes

is a nominal amount of non-video traffic, a nominal amount of

traffic from customers hosted on Rumble’s infrastructure, and an

unknown amount of consumption of Rumble videos outside of the

Rumble video player. Starting in the second quarter of 2022 we

began transitioning a portion of Locals’ bandwidth consumption to

our infrastructure. While Locals’ bandwidth consumption currently

represents an immaterial amount of consumption, we expect this

figure to grow in the coming quarters.

Hours of Uploaded Video Per

Day. We use the amount of hours of uploaded video per day

as a measure of content creation to help us understand the volume

of content being created and uploaded to us on a daily basis. We

regularly review, have adjusted in the past, and may in the future

adjust our processes for calculating our key business metrics to

improve their accuracy, including through the application of new

data or technologies or product changes that may allow us to

identify previously undetected spam activity. As a result of such

adjustments, our key business metrics may not be comparable

period-over-period.

About Rumble

Rumble is a high-growth neutral video platform and cloud

services provider that is creating the rails and independent

infrastructure designed to be immune to cancel culture. Rumble's

mission is to restore the Internet to its roots by making it free

and open once again. For more information, visit

corp.rumble.com.

Forward-Looking Statements

Certain statements in this press release and the

associated conference call constitute “forward-looking statements”

within the meaning of the U.S. Private Securities Litigation Reform

Act of 1995. Statements contained in this press release that are

not historical facts are forward-looking statements and include,

for example, results of operations, financial condition and cash

flows (including revenues, operating expenses, and net income

(loss)); our ability to meet working capital needs and cash

requirements over the next 12 months; and our expectations

regarding future results and certain key performance indicators.

Certain of these forward-looking statements can be identified by

using words such as “anticipates,” “believes,” “intends,”

“estimates,” “targets,” “expects,” “endeavors,” “forecasts,”

“could,” “a pathway to,” “will,” “may,” “future,” “likely,” “on

track to deliver,” “accelerate,” “forward trajectory,” “continues

to,” “looks forward to,” “begins to focus on,” “plans,” “projects,”

“assumes,” “should” or other similar expressions. Such

forward-looking statements involve known and unknown risks and

uncertainties, and our actual results could differ materially from

future results expressed or implied in these forward-looking

statements. The forward-looking statements included in this release

are based on our current beliefs and expectations of our management

as of the date of this release. These statements are not guarantees

or indicative of future performance. Important assumptions and

other important factors that could cause actual results to differ

materially from those forward- looking statements include, but are

not limited to, our ability to recognize the anticipated benefits

of becoming a publicly traded company , which may be affected by,

among other things, our ability to grow and manage growth

profitably, maintain relationships with customers, compete within

our industry and retain key employees; the possibility that we may

be adversely impacted by economic, business, and/or competitive

factors; our limited operating history making it difficult to

evaluate our business and prospects; our inability to effectively

manage future growth and achieve operational efficiencies; our

recent and rapid growth not being indicative of future performance;

our inability to achieve revenue growth consistent with or better

than our current annual revenue run rate, including due to our

failure to onboard sufficient new content creators and content

and/or fully launch RAC or, even if RAC is fully launched, our

inability to achieve the monetization of creators through RAC

and/or Rumble Studio consistent with our expectations; our

inability to grow or maintain our active user base; our inability

to successfully launch our Cloud business; our inability to achieve

or maintain profitability; the possibility that we may be unable to

monetize our expansion into live sports as currently anticipated,

including with respect to our relationships with Power Slap, SLS,

NRX and BKFC; the possibility that we may be unable to reach

definitive agreements with either or both Kai Cenat and IShowSpeed

(each of whom has signed a binding term sheet with us), or if

definitive agreements are entered into, the possibility that we may

be unable to monetize such relationships with our content creators

as currently anticipated; the possibility that we may be adversely

impacted by negative media campaigns; real or perceived

inaccuracies in our performance metrics; our failure to comply with

applicable privacy laws; occurrence of a cyber incident resulting

in information theft, data corruption, operational disruption

and/or financial loss; potential liability for hosting a variety of

tortious or unlawful materials uploaded by third parties; negative

publicity for removing, or declining to remove, certain content,

regardless of whether such content violated any law; impediment of

access to our content and services on the Internet; significant

market competition that we face; changes to our existing content

and services resulting in failure to attract traffic and

advertisers or to generate revenue; our dependence on third party

vendors; our inability to realize the expected benefits of

financial incentives that we offer to our content creators;

potential diversion of management's attention and consumption of

resources as a result of acquisitions of other companies and

success in integrating and otherwise achieving the benefits of

recent and potential acquisitions; failure to maintain adequate

operational and financial resources or raise additional capital or

generate sufficient cash flows; adverse effect on our business by

compliance obligations imposed by new privacy laws, laws regulating

social media platforms and online speech in the U.S. and Canada;

regulations regarding paid endorsements by content creators; and

those additional risks, uncertainties and factors described in more

detail under the caption “Risk Factors” in our Annual Report on

Form 10-K for the year ended December 31, 2022, Quarterly Report on

Form 10-Q for the quarter ended September 30, 2023, and in our

other filings with the Securities and Exchange Commission. We do

not intend, and, except as required by law, we undertake no

obligation, to update any of our forward-looking statements after

the issuance of this release to reflect any future events or

circumstances. Given these risks and uncertainties, readers are

cautioned not to place undue reliance on such forward-looking

statements.

Rumble on Social Media

Investors and others should note that we

announce material financial and operational information to our

investors using our investor relations website

(investors.rumble.com), press releases, SEC filings and public

conference calls and webcasts. We also intend to use certain social

media accounts as a means of disclosing information about us and

our services and for complying with our disclosure obligations

under Regulation FD: the @rumblevideo X (formerly Twitter) account

(twitter.com/rumblevideo), the @rumble TRUTH Social account

(truthsocial.com/@rumble), the @chrispavlovski X (formerly Twitter)

account (twitter.com/chrispavlovski), and the @chris TRUTH Social

account (truthsocial.com/@chris), which Chris Pavlovski, our

Chairman and Chief Executive Officer, also uses as a means for

personal communications and observations. The information we post

through these social media channels may be deemed material.

Accordingly, investors should monitor these social media channels

in addition to following our press releases, SEC filings and public

conference calls and webcasts. The social media channels that we

intend to use as a means of disclosing the information described

above may be updated from time to time as listed on our investor

relations website.

For investor inquiries, please contact:Shannon

DevineMZ Group, MZ North

America203-741-8811investors@rumble.com

Source: Rumble Inc.

| |

|

Condensed Consolidated Interim Statements of Operations

(Unaudited) |

| |

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

$ |

17,982,150 |

|

$ |

10,983,182 |

|

$ |

60,571,579 |

|

$ |

19,427,259 |

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

Cost of services (content, hosting, other) |

$ |

39,751,475 |

|

$ |

12,287,183 |

|

$ |

106,615,656 |

|

$ |

20,213,175 |

|

|

General and administrative |

|

9,688,129 |

|

|

2,861,787 |

|

|

27,482,408 |

|

|

6,164,406 |

|

|

Research and development |

|

5,111,748 |

|

|

1,724,347 |

|

|

12,078,168 |

|

|

3,721,156 |

|

|

Sales and marketing |

|

3,182,903 |

|

|

1,460,177 |

|

|

10,215,780 |

|

|

3,422,304 |

|

|

Acquisition-related transaction costs |

|

445,833 |

|

|

- |

|

|

1,150,035 |

|

|

1,341,056 |

|

|

Amortization and depreciation |

|

1,353,071 |

|

|

410,388 |

|

|

3,077,705 |

|

|

924,974 |

|

|

Changes in fair value of contingent consideration |

|

(1,335,177 |

) |

|

- |

|

|

(1,709,173 |

) |

|

- |

|

|

|

|

|

|

|

|

|

|

|

| Total

expenses |

|

58,197,982 |

|

|

18,743,882 |

|

|

158,910,579 |

|

|

35,787,071 |

|

|

|

|

|

|

|

|

|

|

|

| Loss from

operations |

|

(40,215,832 |

) |

|

(7,760,700 |

) |

|

(98,339,000 |

) |

|

(16,359,812 |

) |

|

Interest income |

|

3,620,882 |

|

|

211,728 |

|

|

10,499,232 |

|

|

234,534 |

|

|

Other income (expense) |

|

104,339 |

|

|

(24,980 |

) |

|

85,939 |

|

|

(49,548 |

) |

|

Changes in fair value of warrant liability |

|

7,485,695 |

|

|

5,715,500 |

|

|

643,195 |

|

|

5,715,500 |

|

|

|

|

|

|

|

|

|

|

|

| Loss

before income taxes |

|

(29,004,916 |

) |

|

(1,848,452 |

) |

|

(87,110,634 |

) |

|

(10,459,326 |

) |

| Income tax expense |

|

(16,126 |

) |

|

- |

|

|

(32,601 |

) |

|

- |

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

$ |

(29,021,042 |

) |

$ |

(1,848,452 |

) |

$ |

(87,143,235 |

) |

$ |

(10,459,326 |

) |

|

|

|

|

|

|

|

|

|

|

| Loss per share – basic and

diluted |

$ |

(0.14 |

) |

$ |

(0.01 |

) |

$ |

(0.43 |

) |

$ |

(0.06 |

) |

| Weighted-average number of

common shares used in computing net loss per share

- basic and diluted |

|

201,810,477 |

|

|

177,663,321 |

|

|

201,287,948 |

|

|

174,915,525 |

|

| |

|

|

|

|

|

|

|

|

| Share-based

compensation expense included in expenses: |

|

|

|

|

|

|

|

|

| Cost of services (content,

hosting, other) |

$ |

737,878 |

|

$ |

- |

|

$ |

1,936,685 |

|

$ |

- |

|

| General and

administrative |

|

3,085,754 |

|

|

175,159 |

|

|

7,523,812 |

|

|

182,113 |

|

| Research and development |

|

365,026 |

|

|

6,455 |

|

|

730,300 |

|

|

19,366 |

|

| Sales and marketing |

|

132,493 |

|

|

7,053 |

|

|

300,240 |

|

|

21,160 |

|

| |

|

|

|

|

|

|

|

|

| Total share-based

compensation expense |

|

4,321,151 |

|

|

188,667 |

|

|

10,491,037 |

|

|

222,639 |

|

| |

|

Condensed Consolidated Interim Balance Sheets

(Unaudited) |

| |

| |

September 30, |

|

December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

Cash and cash equivalents |

$ |

265,883,872 |

|

$ |

337,169,279 |

|

|

Marketable securities |

|

1,135,200 |

|

|

1,100,000 |

|

|

Accounts receivable, net |

|

6,152,166 |

|

|

4,748,189 |

|

|

Income taxes receivable |

|

1,359 |

|

|

- |

|

|

Prepaid expenses and other |

|

13,185,162 |

|

|

9,342,691 |

|

|

|

|

286,357,759 |

|

|

352,360,159 |

|

|

|

|

|

|

|

| Prepaid expenses and

other, long term |

|

1,858,711 |

|

|

547,589 |

|

| Property and

equipment, net |

|

17,878,498 |

|

|

8,844,232 |

|

| Right-of-use assets,

net |

|

1,844,385 |

|

|

1,356,454 |

|

| Intangible assets,

net |

|

10,814,386 |

|

|

3,211,305 |

|

| Goodwill |

|

12,648,045 |

|

|

662,899 |

|

|

|

$ |

331,401,784 |

|

$ |

366,982,638 |

|

|

|

|

|

|

|

| Liabilities and

Shareholders' Equity |

|

|

|

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

Accounts payable and accrued liabilities |

$ |

33,513,993 |

|

$ |

14,324,696 |

|

|

Deferred revenue |

|

7,487,591 |

|

|

1,040,619 |

|

|

Lease liabilities |

|

670,789 |

|

|

583,186 |

|

|

Contingent consideration |

|

980,975 |

|

|

- |

|

|

Income taxes payable |

|

- |

|

|

934 |

|

|

Deferred tax liability |

|

1,629,180 |

|

|

- |

|

|

|

|

44,282,528 |

|

|

15,949,435 |

|

|

|

|

|

|

|

| Lease liabilities,

long-term |

|

1,251,244 |

|

|

835,924 |

|

| Contingent

consideration, net of current portion |

|

801,593 |

|

|

- |

|

| Warrant

liability |

|

9,419,305 |

|

|

10,062,500 |

|

| Other

liability |

|

500,000 |

|

|

500,000 |

|

|

|

|

56,254,670 |

|

|

27,347,859 |

|

| |

|

|

|

|

| Commitments and contingencies

(Note 15) |

|

|

|

|

|

|

|

|

|

|

| Shareholders'

Equity |

|

|

|

|

|

Preferred shares |

|

- |

|

|

- |

|

|

Common shares |

|

768,522 |

|

|

768,357 |

|

|

Accumulated Deficit |

|

(115,925,936 |

) |

|

(28,782,701 |

) |

|

Additional paid-in capital |

|

390,304,528 |

|

|

367,649,123 |

|

|

|

|

275,147,114 |

|

|

339,634,779 |

|

|

|

$ |

331,401,784 |

|

$ |

366,982,638 |

|

| |

|

Condensed Consolidated Interim Statements of Cash Flows

(Unaudited) |

| |

|

For the nine months ended September 30, |

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

| Cash flows provided by

(used in) |

|

|

|

|

|

|

|

|

|

|

| Operating

activities |

|

|

|

|

|

Net loss for the period |

$ |

(87,143,235 |

) |

$ |

(10,459,326 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

Amortization and depreciation |

|

3,077,705 |

|

|

924,974 |

|

|

Share-based compensation |

|

10,491,037 |

|

|

222,639 |

|

|

Non-cash portion interest expense |

|

33,255 |

|

|

28,145 |

|

|

Non-cash portion of operating lease costs |

|

481,542 |

|

|

383,915 |

|

|

Change in fair value of warrants |

|

(643,195 |

) |

|

(5,715,500 |

) |

|

Change in fair value of contingent consideration |

|

(1,709,173 |

) |

|

- |

|

|

|

|

(75,412,064 |

) |

|

(14,615,153 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

Accounts receivable |

|

(1,785,330 |

) |

|

(6,047,258 |

) |

|

Prepaid expenses and other |

|

(4,952,942 |

) |

|

(3,048,405 |

) |

|

Accounts payable and accrued liabilities |

|

16,375,555 |

|

|

6,059,222 |

|

|

Deferred revenue |

|

6,446,972 |

|

|

338,725 |

|

|

Income taxes payable (receivable) |

|

- |

|

|

256,095 |

|

|

Operating lease liabilities |

|

(502,923 |

) |

|

(342,870 |

) |

|

|

|

(59,830,732 |

) |

|

(17,399,644 |

) |

| |

|

|

|

|

| Investing

activities |

|

|

|

|

|

Purchase of property and equipment |

|

(11,008,811 |

) |

|

(5,830,881 |

) |

|

Purchase of intangible assets |

|

(910,399 |

) |

|

- |

|

|

Purchase of marketable securities |

|

(1,135,200 |

) |

|

- |

|

|

Sale and maturities of marketable securities |

|

1,100,000 |

|

|

- |

|

|

Cash acquired in connection with Callin acquisition |

|

1,000,989 |

|

|

- |

|

|

|

|

(10,953,421 |

) |

|

(5,830,881 |

) |

|

|

|

|

|

|

| Financing

activities |

|

|

|

|

|

Taxes paid from net share settlement for share-based

compensation |

|

(462,658 |

) |

|

- |

|

|

Repayment of Sponsor loan in connection with Qualifying

Transaction |

|

- |

|

|

(2,173,353 |

) |

|

Repurchase of Class C Common Stock |

|

- |

|

|

(11,000,000 |

) |

|

Proceeds from Qualifying Transaction |

|

- |

|

|

399,807,596 |

|

|

Proceeds from other liabilities |

|

- |

|

|

250,000 |

|

|

Share issuance costs |

|

(40,478 |

) |

|

(53,866,750 |

) |

| |

|

(503,136 |

) |

|

333,017,493 |

|

| |

|

|

|

|

| Effect of exchange

rate changes on cash and cash equivalents |

|

1,882 |

|

|

45,707 |

|

| Decrease in cash and

cash equivalents during the period |

|

(71,285,407 |

) |

|

309,832,675 |

|

| Cash and cash

equivalents, beginning of period |

|

337,169,279 |

|

|

46,847,375 |

|

|

Cash and cash equivalents, end of

period |

$ |

265,883,872 |

|

$ |

356,680,050 |

|

|

|

|

|

|

|

| Supplemental cash flow

information |

|

|

|

|

|

Cash paid for income taxes |

$ |

32,601 |

|

$ |

4,831 |

|

|

Cash paid for interest |

|

4,212 |

|

|

54 |

|

|

Cash paid for lease liabilities |

|

466,550 |

|

|

314,674 |

|

| |

|

|

|

|

| Non-cash investing and

financing activities: |

|

|

|

|

|

Property and equipment in accounts payable and accrued

liabilities |

|

1,522,938 |

|

|

341,895 |

|

|

Settlement of loan receivable in exchange for Class A Common

Stock |

|

391,235 |

|

|

- |

|

|

Non-cash consideration related to the acquisition of Callin |

|

18,226,572 |

|

|

- |

|

|

Recognition of operating right-of-use assets in exchange for

operating lease liabilities

|

|

969,473 |

|

|

368,831 |

|

|

|

|

|

|

|

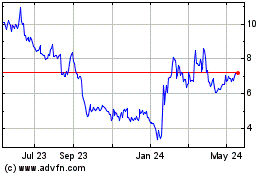

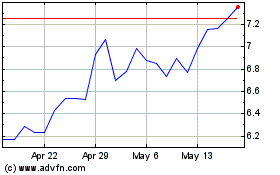

Rumble (NASDAQ:RUM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rumble (NASDAQ:RUM)

Historical Stock Chart

From Jul 2023 to Jul 2024