- Reports net product sales of $28.3 million for the third

quarter of 2024, an increase of 31% over net product sales for the

same period in 2023. Net product sales for the third quarter of

2024 included a special large order of premium-priced products by

our largest customer.

- Reports gross profit of $6.2 million for the third quarter of

2024, an increase of 183% over the same period in 2023.

- Achieves gross margin of 22% for the third quarter of 2024

compared to a gross margin of 9% for the same period in 2023.

- Generates $4.3 million in cash flow from operations for the

third quarter of 2024.

Rockwell Medical, Inc. (the "Company") (Nasdaq: RMTI), a

healthcare company that develops, manufactures, commercializes, and

distributes a portfolio of hemodialysis products to dialysis

providers worldwide, today announced financial and operational

results for the three and nine months ended September 30, 2024.

"We are incredibly pleased with our financial results for the

third quarter of 2024," said Mark Strobeck, Ph.D., Rockwell

Medical’s President and CEO. "Our achievements reflect the

continued improvements we are making here at Rockwell, building

upon a robust foundational business. We are working to expand our

hemodialysis product portfolio and introduce new products to the

market in 2025."

Rockwell Medical’s Quarterly Report on Form 10-Q for the

quarterly period ended September 30, 2024 will provide a full

analysis of the Company’s business strategy as well as its third

quarter of 2024 results.

THIRD QUARTER 2024 FINANCIAL HIGHLIGHTS

Net sales for the three and nine months ended September 30, 2024

consisted solely of concentrates products sales. Net sales for the

same periods in 2023 consisted of concentrates products sales and

the recognition of $1.5 million of deferred license revenue related

to the termination of the Baxter distribution agreement in the

first quarter of 2023, and $2.2 million of deferred license revenue

related to the termination of the Triferic (dialysate) distribution

agreement with Wanbang Biopharmaceuticals Co., Ltd. in the third

quarter of 2023. Additionally, in connection with the Wanbang

agreement, Rockwell Medical reserved $1.1 million of long-term

inventory for which the Company realized a net increase of $1.1

million in gross profit for the third quarter of 2023 as a result

of the termination of the Wanbang development effort.

The following financial highlights are for the three and nine

months ended September 30, 2024:

Net Sales

- Net sales for the three months ended September 30, 2024 were

$28.3 million, the highest quarterly concentrates products sales

generated to date for the Company. This represents a 19% increase

over net sales of $23.8 million for the same period in 2023.

Excluding deferred revenue, net sales for the three months ended

September 30, 2024 increased 31% over $21.6 million for the same

period in 2023. The increase of $6.7 million was driven by $4.5

million from a special large order of premium-priced products

purchased by our largest customer, as well as $2.5 million of

increased sales and price increases to existing customers.

- Net sales for the nine months ended September 30, 2024 were

$76.8 million, which represents a 25% increase over net sales of

$61.5 million for the same period in 2023. The increase in net

sales was primarily due to customers being added through the Evoqua

Water Technologies asset acquisition, a special large order of

premium-priced products purchased by our largest customer, as well

as increased sales and price increases to existing customers.

Excluding deferred revenue, net sales for the nine months ended

September 30, 2024 increased 33% over $57.7 million for the same

period in 2023.

Gross Profit

- Gross profit for the three months ended September 30, 2024 was

$6.2 million, which represents a 183% increase over $2.2 million

for the same period in 2023. Excluding the impact of deferred

revenue recognition, gross profit for the three months increased

464% over $1.1 million for the same period in 2023 driven by a

special large order of premium-priced products purchased by our

largest customer, as well as increased sales and price increases to

existing customers.

- Gross profit for the nine months ended September 30, 2024 was

$13.9 million, which represents a 137% increase over $5.8 million

for the same period in 2023. Excluding deferred revenue, gross

profit for the nine months ended September 30, 2024 increased 342%

over $3.1 million for the same period in 2023.

Gross Margin

- Gross margin for the three months ended September 30, 2024 was

22%, which represents an increase from 9%, or 5% excluding deferred

revenue, for the same period in 2023. The improvement in gross

margin was largely driven by improved operational efficiencies, a

special large order of premium-priced products purchased by our

largest customer, as well as increased sales and price increases to

existing customers.

- Gross margin for the nine months ended September 30, 2024 was

18%, which represents an increase from 9%, or 5% excluding deferred

revenue, for the same period in 2023.

Net Income

- Net income for the three months ended September 30, 2024 was

$1.7 million compared to a net loss of $1.9 million for the same

period in 2023. Excluding deferred revenue, net income for the

third quarter of 2024 represented a $4.6 million improvement over a

net loss of $3.0 million for the same period in 2023.

- Net income for the nine months ended September 30, 2024 was

$0.3 million, which represents an improvement of $7.2 million over

a net loss of $6.9 million for the same period in 2023. Excluding

deferred revenue, net loss for the nine months ended September 30,

2024 improved by $9.9 million over net loss of $9.6 million the

same period in 2023.

Adjusted EBITDA

- Adjusted EBITDA for the three months ended September 30, 2024

was $2.8 million compared with a negative adjusted EBITDA of $1.2

million for the same period in 2023.

- Adjusted EBITDA for the nine months ended September 30, 2024

was $3.8 million compared with a negative adjusted EBITDA of $4.4

million for the same period in 2023. Excluding deferred revenue,

adjusted EBITDA for the nine months ended September 30, 2024

increased by $9.7 million over the same period in 2023.

Cash and Cash Equivalents

- Cash and cash equivalents and investments available-for-sale at

September 30, 2024 increased to $18.3 million, which was driven by

$4.3 million in cash flow from operations, compared to cash and

cash equivalents and investments available-for-sale of $11.9

million at June 30, 2024.

Three Months Ended

September 30,

Nine Months Ended

September 30,

(In Millions, Except Per Share

Amounts)

2024

2023(a)

2024

2023(a)(b)

Net Sales

$

28.3

$

23.8

$

76.8

$

61.5

Gross Profit

6.2

2.2

13.9

5.8

Operating Income (Loss)

1.9

(1.7

)

1.1

(6.1

)

Net Income (Loss)

1.7

(1.9

)

0.3

(6.9

)

Adjusted EBITDA(d)

2.8

(1.2

)

3.8

(4.4

)

Basic Net Income (Loss) per

Share(c)

$

0.05

$

(0.07

)

$

0.01

$

(0.32

)

Adjusted EPS(d)

$

0.09

$

(0.04

)

$

0.12

$

(0.21

)

(a)

Includes $1.5 million of deferred license

revenue related to the termination of the Baxter distribution

agreement in the first quarter of 2023.

(b)

Includes $2.2 million of deferred revenue

related to the termination of the Wanbang Biopharmaceuticals Co.,

Ltd. distribution agreement in the third quarter of 2023.

(c)

See Note 3 for more details related to

Basic and Diluted Weighted Average Shares Outstanding on Form 10-Q

filed November 12, 2024.

(d)

See reconciliation to GAAP financial

measures in the tables below.

THIRD QUARTER 2024 OPERATING HIGHLIGHTS

- During the third quarter of 2024, net product sales included a

special large order of premium-priced products purchased by the

Company's largest customer (the "Customer"). Additionally, Rockwell

Medical received a Notice of Extension of Term (the "Extension") of

the Amended and Restated Products Purchase Agreement (the "Amended

Agreement"), dated September 21, 2023, which amended and restated

the Products Purchase Agreement, dated July 1, 2019, with the

Customer. The Extension extends the term of the Amended Agreement

through December 31, 2025 (the "Extension Term"), during which

Extension Term product pricing will increase under the terms of the

Amended Agreement. The Customer has indicated to the Company that

the Customer expects volumes to decline during the Extension Term

as the Customer works to diversify its supplier base. Rockwell

Medical is working with the Customer to focus volume reductions on

products that the Company believes are least profitable for

Rockwell Medical. Currently, the Company believes that the

Customer's net sales in 2025 will decline between approximately $31

million and $38 million. The Customer is required to provide

Rockwell Medical with a binding twelve-month forecast on or before

December 15, 2024, at which time the Company will be able to

determine the actual impact on net sales in 2025. Under the terms

of the Amended Agreement, the Customer is committed to purchasing

at least the amount provided in the binding forecast. The profit

margin associated with the Customer's product purchases has

historically ranged between a gross loss to a single-digit gross

margin, excluding the special large order of premium-priced

products purchased by the Customer. The Company is working to make

up this projected revenue gap with new, higher margin customer

contracts, product purchase agreements, distribution agreements,

standard price increases, and hemodialysis product opportunities

that would diversify the Company's portfolio of offerings — several

of which are already in late-stage contract negotiations. Despite

the expected year-over-year decline in revenue from the Customer,

Rockwell Medical believes that the Company will be profitable in

2025 on an Adjusted EBITDA basis.

- Rockwell Medical entered into a multi-million dollar

distribution agreement with Nipro Medical Corporation. Under the

terms of the agreement, Rockwell Medical will continue to supply

Nipro with the Company's liquid and dry acid and bicarbonate

hemodialysis concentrates, as well as its dry acid concentrates

mixer, for which Nipro has the right to distribute the Company's

products globally, excluding the United States. The agreement will

remain in effect for two years with the option to extend the

agreement for an additional one-year period and includes product

purchasing minimums of $5.0 million for the first year and

incremental increases each subsequent year.

- Rockwell Medical announced a product purchase agreement with a

leading at-home and acute care dialysis manufacturer in the United

States. Under the terms of the agreement, Rockwell Medical will

supply this customer with the Company's liquid acid RenalPure® and

liquid bicarbonate SteriLyte®, both of which will be packaged in

either the Company's four-per-case packaging for larger dialysis

settings or the Company's two-per-case convenience pack for smaller

acute care and at-home care settings.

- Rockwell Medical renewed its supply agreement with aQua

Dialysis. As part of the renewal, the Company expanded the

distribution of its liquid and dry acid and bicarbonate

hemodialysis concentrates and other associated products offered by

Rockwell Medical to all of aQua Dialysis' Texas-based clinics.

- Rockwell Medical was named a 2024 Fortune Best Workplaces in

Manufacturing and ProductionTM List.

GUIDANCE

Rockwell Medical is increasing its 2024 guidance projections as

follows:

Updated 2024

Guidance (As of November 12, 2024)

Updated 2024 Guidance (As of

August 8, 2024)

Updated 2024 Guidance (As of

May 14, 2024)

Original 2024 Guidance (As of

March 21, 2024)

Net (Product) Sales

$98.0M to $101.0M

$95.0M to $98.0M

$90.0M to $94.0M

$84.0M to $88.0M

Gross Profit

$15.0M to $17.0M

$14.0M to $16.0M

$13.0M to $15.0M

$12.0M to $14.0M

Gross Margin

16% to 18%

14% to 17%

14% to 16%

14% to 16%

Adjusted EBITDA

$4.0M to $5.0M

$0.75M to $1.5M

$0.5M to $1.0M

$0M to $0.5M

CONFERENCE CALL AND WEBCAST DETAILS

Date: Tuesday, November 12, 2024

Time: 8:00am ET Live Number: (888) 660-6347 //

(International) 1 (929) 201-6594 Conference Call ID: 4944610

Webcast and Replay: www.RockwellMed.com/Results

Speakers:

- Mark Strobeck, Ph.D. — President and Chief Executive Officer;

and

- Jesse Neri — SVP, Finance.

Format: Discussion of third quarter

2024 financial and operational results followed by Q&A.

NON-GAAP FINANCIAL MEASURES

To supplement Rockwell Medical’s unaudited condensed

consolidated statements of operations and unaudited condensed

consolidated balance sheets, which are prepared in conformity with

generally accepted accounting principles in the United States of

America (“GAAP”), this press release also includes references to

Adjusted EBITDA, a non-GAAP financial measure that is defined as

net income (loss) before net interest income (expense), net other

income (expense), income tax expenses (benefit), depreciation and

amortization, impairment charges, stock-based compensation expense,

and other items that are considered unusual or not representative

of underlying trends of our business, including but not limited to

one-time severance costs, deferred revenue and inventory reserve

amounts, if applicable for the periods presented. The Company has

provided a reconciliation of net loss, the most directly comparable

GAAP financial measure, to Adjusted EBITDA at the end of this press

release. In addition, the Company has excluded deferred revenue

from the three-month and nine-month calculations of net sales,

gross profit, gross margin and net loss. Each of these adjusted

measures is a non-GAAP financial measure. The Company has provided

reconciliations to the GAAP measures at the end of this press

release.

Adjusted EBITDA is a key measure used by Rockwell Medical to

understand and evaluate operating performance and trends, to

prepare and approve its annual budget and to develop short- and

long-term operating plans. The Company provides Adjusted EBITDA

because it believes the metric is helpful in highlighting trends in

its operating results because it excludes items that are not

indicative of Rockwell Medical’s core operating performance. In

particular, the Company believes that the exclusion of the items

eliminated in calculating Adjusted EBITDA provides useful measures

for period-to-period comparisons of Rockwell Medical’s business.

Adjusted net sales, gross profit, gross margin and net loss is used

by Rockwell Medical to understand growth within its hemodialysis

concentrates business by excluding a one-time item that is not

indicative of its core operating performance.

Adjusted EBITDA and net sales, gross profit, gross margin, net

income, and net loss should not be considered in isolation of, or

as an alternative to, measures prepared in accordance with GAAP.

Other companies, including companies in the same industry, may

calculate similarly titled non-GAAP financial measures differently

or may use other measures to evaluate their performance, all of

which could reduce the usefulness of Adjusted EBITDA and adjusted

net sales, gross profit, gross margin and net loss as tools for

comparison. There are a number of limitations related to the use of

these non-GAAP financial measures rather than the most directly

comparable financial measures calculated in accordance with GAAP.

When evaluating the Company’s performance, you should consider

Adjusted EBITDA and adjusted net sales, gross profit, gross margin

and net loss alongside other financial performance measures,

including net loss and other GAAP results. Adjusted EBITDA is our

best proxy for cash burn. Adjusted net sales, gross profit, gross

margin and net loss enable us to understand growth within our

hemodialysis concentrates business by excluding a one-time item

that is not indicative of our core operating performance.

ABOUT ROCKWELL MEDICAL

Rockwell Medical, Inc. (Nasdaq: RMTI) is a healthcare company

that develops, manufactures, commercializes, and distributes a

portfolio of hemodialysis products for dialysis providers

worldwide. Rockwell Medical's mission is to provide dialysis

clinics and the patients they serve with the highest quality

products supported by the best customer service in the industry.

Rockwell is focused on innovative, long-term growth strategies that

enhance its products, its processes, and its people, enabling the

Company to deliver exceptional value to the healthcare system and

provide a positive impact on the lives of hemodialysis patients.

Hemodialysis is the most common form of end-stage kidney disease

treatment and is usually performed at freestanding outpatient

dialysis centers, at hospital-based outpatient centers, at skilled

nursing facilities, or in a patient’s home. Rockwell Medical's

products are vital to vulnerable patients with end-stage kidney

disease, and the Company is relentless in providing unmatched

reliability and customer service. Certified as a Great Place to

Work® in 2023 and 2024 and named Fortune Best Workplaces in

Manufacturing & ProductionTM in 2024, Rockwell Medical is

Driven to Deliver Life-Sustaining Dialysis SolutionsTM. For more

information, visit www.RockwellMed.com.

FORWARD-LOOKING STATEMENTS

Certain statements in this press release may constitute

"forward-looking statements" within the meaning of the federal

securities laws. Words such as, "may," "might," "will," "should,"

"believe," "expect," "anticipate," "estimate," "continue," "could,"

"can," "would," "develop," "plan," "potential," "predict,"

"forecast," "project," "intend," "look forward to," "remain

confident," “feel confident,” “guidance,” or the negative of these

terms, and similar expressions, or statements regarding intent,

belief, or current expectations, are forward looking statements.

These statements include (without limitation) statements regarding:

the ability to improve profit margins under the Amended Agreement;

the Company’s ability to compensate for the revenue decline under

the Amended Agreement in 2025; plans to expand our global

footprint; the impact of our strategy on our top and bottom line

and building upon our financial results; the growth of our

business; the impact of attaining profitability on the trajectory

of our business; guidance for expenses, net sales, gross profit,

gross margin and adjusted EBITDA. While Rockwell Medical believes

these forward-looking statements are reasonable, undue reliance

should not be placed on any such forward-looking statements, which

are based on information available to us on the date of this

release. These forward-looking statements are based upon current

estimates and assumptions and are subject to various risks and

uncertainties (including, without limitation, those set forth in

Rockwell Medical's SEC filings), many of which are beyond our

control and subject to change. Actual results could be materially

different. Risks and uncertainties include but are not limited to

those risks more fully discussed in the "Risk Factors" section of

our Annual Report on Form 10-K for the year ended December 31,

2023, as such description may be amended or updated in any

subsequent reports filed with the SEC. Rockwell Medical expressly

disclaims any obligation to update our forward-looking statements,

except as may be required by law.

Financial Tables Follow

ROCKWELL MEDICAL, INC. AND SUBSIDIARIES CONDENSED

CONSOLIDATED BALANCE SHEETS (Dollars In Thousands)

September 30, September 30,

2024

2023

Cash, Cash Equivalents & Investments

available-for-sale

$

18,272

$

11,730

Total Assets

$

57,084

$

52,607

Total Liabilities

$

27,949

$

31,088

Total Stockholders’ Equity

$

29,135

$

21,519

Common Stock Outstanding

32,318,806

28,489,663

Common stock and common stock equivalents*

40,076,855

35,554,361

*Common stock and common stock equivalents: Common stock

32,318,806

28,489,663

Preferred stock converted

1,363,636

1,363,636

Options to purchase common stock

1,874,729

1,367,493

Restricted stock awards

891

891

Restricted stock units

534,309

287,400

Common stock warrants

3,984,484

4,045,278

Total common stock and common stock equivalents

40,076,855

35,554,361

ROCKWELL MEDICAL, INC. AND SUBSIDIARIES UNAUDITED

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS (In

Thousands, Except Shares and Per Share Amounts) Three

MonthsEndedSeptember 30, 2024 Three MonthsEndedSeptember 30,

2023 Nine MonthsEndedSeptember 30, 2024 Nine

MonthsEndedSeptember 30, 2023 Net Sales

$

28,316

$

23,771

$

76,824

$

61,519

Cost of Sales

22,077

21,569

62,971

55,685

Gross Profit

6,239

2,202

13,853

5,834

Research and Product Development

-

494

18

939

Selling and Marketing

726

556

1,906

1,584

General and Administrative

3,577

2,889

10,802

9,434

Operating Income (Loss)

1,936

(1,737

)

1,127

(6,123

)

Other (Expense) Income Realized Gain on Investments

-

220

51

220

Interest Expense

(302

)

(411

)

(965

)

(1,193

)

Interest Income

30

56

63

169

Total Other Expense

(272

)

(135

)

(851

)

(804

)

Net Income (Loss)

$

1,664

$

(1,872

)

$

276

$

(6,927

)

Basic Net Income (Loss) per Share

$

0.05

$

(0.07

)

$

0.01

$

(0.32

)

Basic Weighted Average Shares Outstanding

31,551,805

27,521,088

30,447,588

21,526,978

Reconciliation to GAAP Financial Measures (In

Thousands, Except Shares and Per Share Amounts) Three

Months Ended Nine Months Ended September 30

September 30

2024

2023

2024

2023

Net Income (Loss)

$

1,664

$

(1,872

)

$

276

$

(6,927

)

Income taxes

-

-

-

-

Interest expense

302

410

965

1,193

Depreciation and amortization

541

564

1,633

892

EBITDA

2,507

(898

)

2,874

(4,842

)

Severance costs

-

576

9

777

Stock-based compensation

321

212

910

717

Wanbang deferred revenue

-

(2,197

)

-

(2,197

)

Wanbang inventory reserve

-

1,098

-

1,098

Adjusted EBITDA

$

2,828

$

(1,209

)

$

3,792

$

(4,447

)

Adjusted EPS

$

0.09

$

(0.04

)

$

0.12

$

(0.21

)

Basic Weighted Average Shares Outstanding

31,551,805

27,521,088

30,447,588

21,526,978

Reconciliation to GAAP Financial Measures (Dollars in

Thousands) Three Months Ended Nine Months

Ended September 30 September 30

2024

2023

2024

2023

Net Sales

$

28,316

$

23,771

$

76,824

$

61,519

Deferred Baxter License Revenue

-

-

-

(1,472

)

Deferred Triferic License Revenue

(11

)

(2,197

)

(34

)

(2,327

)

Net Sales excluding Deferred Revenue

28,305

21,574

76,790

57,721

Gross Profit

6,239

2,202

13,853

5,834

Deferred Baxter License Revenue

-

-

-

(1,472

)

Deferred Triferic License Gross Profit

(11

)

(1,099

)

12

(1,228

)

Gross Profit excluding Deferred Revenue

6,228

1,103

13,865

3,135

Net Income (Loss)

1,664

(1,872

)

276

(6,927

)

Deferred Baxter License Revenue

-

-

-

(1,472

)

Deferred Triferic License Gross Profit

(11

)

(1,099

)

12

(1,228

)

Net Income excluding Deferred Revenue

1,653

(2,971

)

288

(9,626

)

Adjusted EBITDA

2,828

(1,209

)

3,792

(4,447

)

Deferred Baxter License Revenue

-

-

-

(1,472

)

Net Income excluding Deferred Revenue

2,828

(1,209

)

3,792

(5,919

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112007562/en/

Heather R. Hunter SVP, Chief Corporate Affairs Officer (248)

432-1362 IR@RockwellMed.com

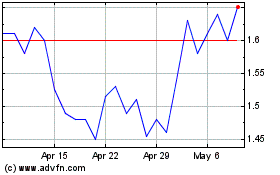

Rockwell Medical (NASDAQ:RMTI)

Historical Stock Chart

From Feb 2025 to Mar 2025

Rockwell Medical (NASDAQ:RMTI)

Historical Stock Chart

From Mar 2024 to Mar 2025