false

0001069533

0001069533

2024-01-29

2024-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): January 29, 2024

RGC RESOURCES, INC.

(Exact name of Registrant as specified in its charter)

|

Virginia

|

000-26591

|

54-1909697

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

519 Kimball Ave., N.E. Roanoke, Virginia

|

24016

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: 540-777-4427

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Trading

Symbol

|

Name of Each Exchange on Which Registered

|

|

Common Stock, $5 Par Value

|

RGCO

|

NASDAQ Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 if the Securities Exchange Act of 1934.

| |

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

ITEM 1.01

|

ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

|

The information required by this Item 1.01 is set forth in Item 5.02 below in respect of Timothy J. Mulvaney's Change in Control Agreement, which is incorporated herein by reference.

|

ITEM 5.02

|

DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS.

|

On January 29, 2024, RGC Resources, Inc. ("Resources" or the "Company") appointed Timothy J. Mulvaney, the current Interim Chief Financial Officer and Treasurer, as Vice President, Treasurer and Chief Financial Officer of Resources, effective February 1, 2024. Mr. Mulvaney has served as interim Chief Financial Officer and Treasurer of Resources since September 6, 2023. There is no arrangement or understanding between Mr. Mulvaney and any other person pursuant to which he was selected as an officer of the Company, and there is no family relationship between Mr. Mulvaney and any of the Company’s other directors or executive officers. Additional information about Mr. Mulvaney is provided below:

Mr. Mulvaney, 55 years old, previously served for more than five years as Senior Vice President, Chief Accounting Officer for LL Flooring Holdings, Inc. (“LL Flooring”), a flooring retailer, where he was responsible for the Company’s accounting records, external financial reporting and treasury functions. Mr. Mulvaney also served as the Interim Chief Financial Officer for LL Flooring in 2019. Prior to LL Flooring, Mr. Mulvaney was the Chief Accounting Officer and Controller at Media General, Inc., a multimedia company. He was with Media General for more than 20 years. He began his career in public accounting with Ernst and Young. Mr. Mulvaney is a licensed CPA in the Commonwealth of Virginia.

Mr. Mulvaney's annual base salary has been set at $250,000. His target bonus, split equally between cash and equity, has been set at 60% of this base salary. Mr. Mulvaney was also awarded 3,000 shares under the Restricted Stock Plan on February 1, 2024 at a price of $19.18 per share that vests ratably over a three-year period. He is eligible to participate in other employee benefits and programs based on the availability of those programs for similarly situated officers or employees.

Additionally, on February 1, 2024, Resources entered into a Change in Control Agreement with Mr. Mulvaney ("Executive") that provides certain benefits to him in the event of a "Change in Control." For the purposes of this agreement, a "Change in Control" occurs when (i) any person, corporation, partnership or other entity becomes the beneficial owner, directly or indirectly, of securities representing 50% or more of the combined voting power of the Company's voting securities; (ii) any other corporation or entity becomes the beneficial owner, directly or indirectly, of at least 50% of the voting securities of the surviving entity following a merger, recapitalization, reorganization, consolidation or sale of assets by the Company; or (iii) the consummation of the sale or disposition of substantially all of its assets; or (iv) the shareholders of the Company approve or the Board of Directors approves a plan of complete dissolution or liquidation of the Company except for a liquidation into a parent corporation. If a Change in Control occurs, the vesting periods of any equity awards or incentives held by the Executive shall be accelerated without limitation.

In the event that Mr. Mulvaney is terminated within 90 days prior to or within 24 months from a Change in Control, unless the termination is (a) because of the Executive's death or disability, (b) for Cause (as defined in the agreement) or (c) by the Executive other than for Good Reason (as defined in the agreement), then the Executive will receive a severance payment equal to 2.0 times his average annualized cash compensation based upon the annual rate of pay for the prior taxable year. This severance payment will be reduced to the extent necessary to avoid certain federal excise taxes. Also, in such event, the Company will continue the Executive's life insurance, medical, health and accident and disability plans, programs or arrangements until the earlier of 24 months after the date of the Change in Control, his death or the Executive's full-time employment. The agreement does not require Mr. Mulvaney to seek employment to mitigate any payments or benefits provided thereunder.

|

ITEM 5.07

|

SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

|

On January 29, 2024, the Company held its Annual Meeting of Shareholders to elect three directors and to hold a non-binding shareholder advisory vote on named executive compensation. The voting results are provided below.

Shareholders elected the nominees for Class C directors as listed below to serve a three-year term expiring at the Annual Meeting of Shareholders to be held in 2027:

|

Director

|

Shares For

|

Shares Withheld

|

|

T. Joe Crawford

|

6,212,707

|

478,955

|

|

Maryellen F. Goodlatte

|

5,565,774

|

1,125,888

|

|

Paul W. Nester

|

6,640,100

|

51,562

|

Abney S. Boxley, III, Elizabeth A. McClanahan and John B. Williamson, III continue to serve as Class A directors until the Annual Meeting of Shareholders to be held in 2025. Nancy Howell Agee, Jacqueline L. Archer, Robert B. Johnston and J. Allen Layman continue to serve as Class B directors until the Annual Meeting of Shareholders to be held in 2026.

Shareholders approved executive compensation through a non-binding advisory vote as indicated below:

|

Shares For

|

Shares Against

|

Shares Abstaining

|

|

6,497,252

|

147,072 |

47,338

|

The Company issued a press release on January 29, 2024, announcing, among other things, the election of three Directors at its annual meeting of shareholders held on January 29, 2024. At the meeting of the Board of Directors following the annual meeting of shareholders, the Board of Directors elected John B. Williamson, III as Chairman of the Board of Resources and Paul W. Nester as President and CEO of Resources.

The Board of Directors also elected the following senior officers of Resources: Timothy J. Mulvaney, Vice President, CFO and Treasurer, Lawrence T. Oliver, Senior Vice President, Regulatory and External Affairs and Secretary, and C. Brooke Miles, Vice President, Human Resources. In addition, the Board of Directors elected the following senior officers of Roanoke Gas Company: Paul W. Nester, President and CEO, Timothy J. Mulvaney, Vice President, CFO and Treasurer, Lawrence T. Oliver, Senior Vice President, Regulatory and External Affairs and Secretary, C. Jim Shockley, Jr., Vice President and Chief Operating Officer, and C. Brooke Miles, Vice President, Human Resources.

A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference. The information disclosed under this Item, including Exhibit 99.1, shall not be deemed "filed" for purposes of Section 18 of the Securities Act of 1934, nor shall they by deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference to such filing.

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

RGC RESOURCES, INC.

|

|

| |

|

|

|

|

Date: February 2, 2024

|

By:

|

/s/ Timothy J. Mulvaney

|

|

| |

|

Timothy J. Mulvaney |

|

| |

|

Vice President, Treasurer and Chief Financial Officer |

|

Exhibit 10.1

CHANGE IN CONTROL AGREEMENT

THIS AGREEMENT (the "Agreement") made as of the 1st of February, 2024 between RGC Resources, Inc. and subsidiaries ("the Corporation") and Timothy J. Mulvaney ("Executive"),

- W I T N E S S E T H -

WHEREAS the Corporation desires for the Executive to be able to perform his executive duties and functions on an impartial and objective basis in the event of activities preceding, associated with, or resulting from a change in control of the Corporation as hereinafter defined ("Change in Control");

NOW, THEREFORE, the parties agree as follows:

1. TERM. The Agreement is effective as of the date hereof and shall terminate, except to the extent that any obligation hereunder remains unpaid as of such time, upon the earliest of the following:

(i) the termination of the Executive's employment with the Corporation prior to or simultaneously with a Change in Control; or

(ii) three years from the date of a Change in Control; or

(iii) May 1, 2026, but only if no Change in Control has occurred as of such date.

2. CHANGE IN CONTROL. For purposes of the Agreement, a Change in Control shall be deemed to have occurred if (i) any person (individual, corporation, partnership or other entity) is or becomes the beneficial owner, directly or indirectly, of securities of the Corporation representing 50 percent or more of the combined voting power of the outstanding securities ordinarily (and apart from rights accruing under special circumstances) having the right to vote at elections of directors ("Voting Securities"), (ii) the consummation of a merger, recapitalization, reorganization or consolidation (or any combination thereof) of the Corporation with any other corporation or entity, other than a transaction that would result in the Voting Securities of the Corporation outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity or its parent) at least fifty percent (50%) of the total voting power represented by the Voting Securities of the Corporation or such surviving entity or its parent outstanding immediately after such transaction, (iii) the consummation of the sale or disposition by the Corporation of all or substantially all of the Corporation’s assets, or (iv) the shareholders of the Corporation approve or the Board of Directors of the Corporation (the “Board”) approves a plan of complete dissolution or liquidation of the Corporation, or a complete dissolution or liquidation of the Corporation otherwise occurs, except for a liquidation into a parent corporation. The first day upon which there exists a Change in Control shall be referred to herein as the "Operative Date." If a Change in Control occurs, the vesting periods of any equity awards or incentives held by the Executive shall be accelerated, including without limitation any Options as defined under the Amended and Restated Key Employee Stock Option Plan of RGC Resources, Inc. or restricted stock granted under the RGC Resources, Inc. Stock Bonus Plan or the RGC Resources, Inc. Restricted Stock Plan.

3. TERMINATION FOLLOWING CHANGE IN CONTROL. If a Change in Control shall have occurred, the Executive will be entitled to the benefits provided in Section 4 below if, within 90 days prior to the Operative Date or within the two-year period beginning on the Operative Date, the Executive's employment with the Corporation is terminated unless such termination is (a) because of his death, (b) by the Corporation for Cause or Disability, or (c) by the Executive other than for Good Reason, all as hereinafter more particularly defined for purpose of the Agreement.

(i) Disability. “Disability” means that, due to the Executive's incapacity due to physical or mental illness, he shall have been absent from his duties with the Corporation on a full-time basis for six (6) months and within thirty (30) days after written notice of termination is given he shall not have returned to the full-time performance of his duties.

(ii) Cause. "Cause" means (A) the willful and continued failure by the Executive to substantially perform his duties with the Corporation (other than any such failure resulting from his/her incapacity due to physical or mental illness) after a written demand for substantial performance is delivered to the Executive by the Corporation which specifically identifies the manner that the Executive has not substantially performed his duties or (B) the willful engaging by the Executive in gross misconduct materially and demonstrably injurious to the Corporation. For purposes of this paragraph, no act, or failure to act, on the Executive's part shall be considered "willful" unless done, or omitted to be done, by him not in good faith and without reasonable belief that his action or omission was in the best interests of the Corporation. Notwithstanding the foregoing, the Executive shall not be deemed to have been terminated for Cause based upon clauses (A) or (B) above unless and until there shall have been delivered to him a copy of a resolution, duly adopted by the affirmative vote of not less than two-thirds of the entire membership of the Board at a meeting of the Board called and held for the purpose (after reasonable notice to the Executive and an opportunity for him, together with his counsel, to be heard before the Board), finding that in the good faith opinion of the Board the Executive was guilty of conduct set forth above in clauses (A) or (B) and specifying the particulars thereof in detail.

(iii) Good Reason. "Good Reason" means:

(A) Without the Executive's express written consent, the assignment to him of any duties materially inconsistent with his duties and responsibilities with the Corporation immediately prior to a Change in Control;

(B) A reduction by the Corporation in the Executive's annual base compensation below his total base compensation applicable to the 12 months preceding the Operative Date or as increased after such date;

(C) The failure by the Corporation to provide the Executive with benefits whose aggregate value is at least as favorable as the aggregate value of benefits enjoyed by him under any thrift, incentive or compensation plan, or any pension, life insurance, health and accident or disability plan in which he is participating at the time of a Change in Control, or the taking of any action by the Corporation which would adversely affect his participation in or materially reduce his benefits under any of such plans at the time of a Change in Control, unless such reduction relates to a reduction in benefits applicable to all employees generally;

(D) The failure by the Corporation to provide the Executive with any other material fringe benefit enjoyed by him at the time of the Change in Control;

(E) Any purported termination of the Executive's employment which is not effected pursuant to a Notice of Termination satisfying the requirements of subparagraph (iv) below (and, if applicable, subparagraph (ii) above) and, for purposes of the Agreement, no such purported termination shall be effective;

(F) Breach by the Corporation of its obligations under the Agreement; or

(G) The Corporation’s requiring the Executive to be based at an office that is both more than 50 miles from where his office is located immediately prior to the Change in Control and further from his then current residence, except for required travel on the Corporation’s business to an extent substantially consistent with the business travel obligations which the Executive undertook on behalf of the Corporation prior to the Change in Control.

If any of the events occur which would entitle the Executive to terminate his employment for Good Reason hereunder and he does not so exercise his right to terminate his employment, any such failure shall not operate to waive his right to terminate his employment for that or any subsequent action or actions, whether similar or dissimilar, which would constitute Good Reason.

(iv) Notice of Termination. Any termination by the Corporation for Cause or Disability or by the Executive for Good Reason shall be communicated by written Notice of Termination. For purposes of the Agreement, a "Notice of Termination" shall mean a notice which shall indicate the specific termination provision in the Agreement relied upon and shall set forth in reasonable detail the facts and circumstances claimed to provide a basis for termination of the Executive's employment under the provision so indicated.

(v) Date of Termination. "Date of Termination" shall mean (a) if the Agreement is terminated for Disability, thirty (30) days after Notice of Termination is given (provided that the Executive shall not have returned to the performance of his duties on a full-time basis during such thirty-day period), (b) if his employment is terminated pursuant to subparagraph (iii) above, the date specified in the Notice of Termination, and (c) if his employment is terminated for any other reason, the date on which a Notice of Termination is given. Notwithstanding any provision herein to the contrary, the Date of Termination shall not occur, and the Executive’s employment with the Corporation shall not be deemed to have occurred, until the Executive shall have a Separation from Service. The following definitions shall apply for purposes of this Agreement:

"Code" shall mean the Internal Revenue Code of 1986, as amended from time to time. A reference to any section or provision of the Code shall also be deemed to be a reference to any applicable regulations and rulings thereunder, as well as to comparable provisions of future laws.

"Leave of Absence" means a military leave, sick leave or other bona fide leave of absence of the Executive which does not exceed six months (or such longer period for which the Executive retains a right to reemployment with the Corporation or a Related Entity under an applicable statute or by contract), but only if there is a reasonable expectation that the Executive will return to perform services for the Corporation or a Related Entity.

"Related Entity" means any entity which is aggregated with the Corporation pursuant to Section 414(b) or 414(c) of the Code or would be so aggregated if the language "at least 50 percent" were used instead of "at least 80 percent" each place it appears in Section 1563(a)(1), (2) and (3) of the Code and Treasury Regulations Section 1.414(c)-2.

"Separation from Service" means the Executive’s separation from service (as such term is used for purposes of Section 409A of the Code) with the Corporation and any Related Entities. The Executive shall be deemed to have a Separation from Service on a date only if the Corporation and the Executive reasonably anticipate that (a) no further services will be performed for the Corporation or any Related Entities after such date or (b) the level of bona fide services the Executive will perform for the Corporation or any Related Entities after such date (whether as an employee or as an independent contractor) will permanently decrease to no more than 20% of the average level of bona fide services performed (whether as an employee or as an independent contractor) over the immediately preceding 36-month period (or the full period of services to the Corporation and any Related Entities if the Executive has then been providing services to the Corporation and any Related Entities for less than 36 months). For purposes of this section, for periods during which the Executive is on a paid Leave of Absence and has not otherwise terminated employment, the Executive shall be treated as providing bona fide services at a level equal to the level of services that he would have been required to perform to receive the compensation paid with respect to such Leave of Absence. Also for purposes of this section, periods during which the Executive is on an unpaid Leave of Absence and has not otherwise terminated employment shall be disregarded (including for purposes of determining the 36-month, or shorter, period).

4. COMPENSATION AND BENEFITS UPON TERMINATION. Upon termination of the Executive's employment within 90 days prior to the Operative Date or within twenty-four (24) months following the Operative Date, unless such termination is because of the Executive's death, or by the Corporation for Cause or Disability or by the Executive other than for Good Reason, the Corporation shall pay or provide to the Executive the following:

(i) The Corporation shall pay the Executive his full salary (whether such salary has been paid by the Corporation or by any of its subsidiaries) through the Date of Termination at the rate in effect at the time Notice of Termination is given and all other unpaid amounts, if any, to which the Executive is entitled as of the Date of Termination under any plan or other arrangement of the Company, at the time such payments are due (and in any event within 90 days after the Separation from Service);

(ii) The Corporation shall pay to the Executive an amount equal to 2.0 multiplied by the Executive's annualized cash compensation based upon the annual rate of pay for the prior taxable year (including any bonus compensation and adjusted for any increase that was expected to continue indefinitely), provided, however, that if any of such payment is or will be subject to the excise tax imposed by Section 4999 of the Code or any similar tax that may hereafter be imposed ("Excise Tax"), such payment shall be reduced to a smaller amount, even to zero, which smaller amount shall be the largest amount payable under this paragraph that would not be subject in whole or in part to the Excise Tax after considering all other payments to the Executive required to be considered under Sections 4999 or 280G of the Code. Such payment shall be referred to as the "Severance Payment." Payment of the Severance Payment shall be in accordance with the following terms:

(A) The Severance Payment shall be made in a lump sum within 90 days after the Separation from Service and all payments hereunder shall be subject to standard payroll withholdings.

(B) In the event that the Severance Payment is subsequently determined to be less than the amount actually paid hereunder, the Executive shall repay the excess to the Corporation at the time that the proper amount is finally determined, plus interest on the amount of such repayment at the Applicable Federal Rate. In the event that the Severance Payment is determined to exceed the amount actually paid hereunder, the Corporation shall pay the Executive such difference plus interest on the amount of such additional payment at the Applicable Federal Rate at the time that the amount of such difference is finally determined.

(C) In the event that the amount of the Severance Payment exceeds or is less than the amount initially paid, such difference shall constitute a loan by the Corporation to the Executive, or by the Executive to the Corporation, as the case may be, payable on the fifth (5th) day after demand (together with interest at the Applicable Federal Rate).

(D) The amount of any payment provided for in this Section 4 shall not be reduced, offset or subject to recovery by the Company or the Company's Successor by reason of any compensation earned by the Executive as the result of employment by another Corporation after the Date of Termination, or otherwise.

(ii) The Corporation shall also pay to the Executive all legal fees and related expenses incurred by the Executive in connection with this Agreement if the Executive prevails (including, without limitation, all such fees and expenses, if any, incurred in contesting or disputing any such termination or in seeking to obtain or enforce any right or benefit provided by this Agreement).

(iii) The Corporation shall provide the Executive with reasonable outplacement services for up to 12 months following the Date of Termination of the Executive.

(iv) The Executive shall not be eligible to receive any compensation or benefits provided in this Section 4 (other than payments under Section 4(i)) unless the Executive first executes a written release and agreement provided by the Corporation releasing the Corporation of any and all claims the Executive might have against the Corporation.

(v) The Corporation shall maintain in full force and effect, for the Executive's continued benefit until the earlier of (A) the death of the Executive; (B) the Executive's commencement of full-time employment with a new employer; or (C) within 90 days prior to the Operative Date or twenty-four (24) months following the Operative Date, all life insurance, medical, health and accident, and disability plans, programs or arrangements in which the Executive was entitled to participate immediately prior to the Operative Date, provided that the Executive's continued participation is possible under the general terms and provisions of such plans and programs. In the event that the Executive's participation in any such plan or program is barred, the Company shall arrange to provide the Executive with benefits substantially similar to those which the Executive is entitled to receive under such plans and programs. In the case of any insurance provided the Executive pursuant to this subparagraph (v), each premium therefor shall be paid after, but no later than 30 days after, the Corporation’s receipt of the invoice for such premium. No coverage shall be provided to the Executive under a self-insured medical plan of the Corporation after the Separation from Service; provided that such coverage may be provided during the period of time during which the Executive would be entitled to continuation coverage under such plan pursuant to Section 4980A of the Code if the Executive elected such continuation coverage and paid the applicable premiums. Except for coverage permitted by the preceding sentence, no benefits shall be provided pursuant to this subparagraph (v) other than through the purchase of insurance by the Corporation.

(vi) The Executive shall not be required to mitigate the amount of any payment provided under the Agreement by seeking other employment or otherwise. It is specifically understood that any compensation the Executive receives from the Corporation or any other person for services rendered prior to or after termination of employment, such as a payment under any deferred compensation plan maintained by the Corporation, will not reduce or offset the benefits to which he is entitled hereunder.

(vii) The Agreement shall inure to the benefit of and be enforceable by the Executive's personal or legal representatives, executors, administrators, successors, heirs, distributees, devisees and legatees. If the Executive should die while any amounts would still be payable to him hereunder if he had continued to live, all such amounts, unless otherwise provided herein, shall be paid in accordance with the terms of the Agreement to his devisee, legatee, or other designee or, if there be no such designee, to his estate.

5. AGREEMENT BINDING ON SUCCESSORS. The Corporation will require any successor (whether direct or indirect, by purchase, merger, share exchange, consolidation or otherwise) to all or substantially all of the business and/or assets of the Corporation, to expressly assume and agree to perform this Agreement. Failure of the Corporation to obtain such agreement prior to or simultaneously with a Change in Control shall be a breach of the Agreement which shall entitle the Executive to terminate his employment for Good Reason under Section 3(iii) on or after the Operative Date, except that, for purposes of implementing the foregoing, the date of his Notice of Termination shall be deemed the Date of Termination.

6. NOTICE. For the purposes of the Agreement, notices and all other communications provided for in the Agreement shall be in writing and shall be deemed to have been duly given on the date hand delivered or the date mailed by United States registered mail, return receipt requested, postage prepaid, addressed to the Executive at his residence address and to the Corporation directed to the attention of the Chief Executive Officer of the Corporation, or to such other address as either party may have furnished to the other in writing in accordance herewith, except that notices of change of address shall be effective only upon receipt.

7. MODIFICATION AND WAIVER. No provisions of the Agreement may be modified, waived or discharged unless such waiver, modification or discharge is agreed to in writing signed by the Executive and the Corporation. No waiver by any party hereto at any time or the breach by the other party hereto or of compliance with any condition or provision of the Agreement to be performed by such other party shall be deemed a waiver of similar or dissimilar provisions or conditions at the same or at any prior or subsequent time. No agreements of representations, oral or otherwise, express or implied, with respect to the subject matter hereof have been made by either party which are not set forth expressly in the Agreement. Nothing herein is intended to change or modify Executive’s status as an at-will employee of the Corporation.

8. VALIDITY. The invalidity or unenforceability of any provisions of the Agreement shall not affect the validity or enforceability of any other provisions of the Agreement and such other provisions shall remain in full force and effect.

9. COUNTERPARTS AND GOVERNING LAW. The Agreement may be executed by electronic transmission and in one or more counterparts, each of which shall be deemed to be an original but all of which together will constitute one and the same instrument. The Agreement shall be governed by the laws of the Commonwealth of Virginia, excepting its principles of conflict of laws.

IN WITNESS WHEREOF, the parties have executed the Agreement as of the date first above written.

| |

RGC Resources, Inc. |

|

Executive |

| |

|

|

|

|

|

|

| |

By: |

/s/ Nancy Howell Agee |

|

By: |

/s/ Timothy J. Mulvaney |

|

| |

Name: |

Nancy Howell Agee |

|

Name: |

Timothy J. Mulvaney |

|

| |

Title: |

Chair, Compensation Committee |

|

Title: |

Vice President, Treasurer and CFO |

|

8

Exhibit 99.1

NEWS RELEASE

RGC RESOURCES, INC.

| Release Date: |

January 29, 2024 |

| Contact: |

Paul W. Nester |

| |

President and CEO |

| Telephone: |

540-777-3837 |

RGC RESOURCES HOLDS

ANNUAL SHAREHOLDERS MEETING

ROANOKE, Va. (January 29, 2024)--RGC Resources, Inc. (NASDAQ: RGCO) announced the election of Directors at its shareholders meeting held on January 29, 2024. Shareholders elected T. Joe Crawford, Maryellen F. Goodlatte, and Paul W. Nester for three-year terms.

At a meeting of the Board of Directors, following the annual shareholders meeting, John B. Williamson, III was elected Chairman of the Board and Paul W. Nester was elected President and CEO of RGC Resources, Inc. The following RGC Resources senior officers were also elected: Timothy J. Mulvaney, Vice President, CFO and Treasurer, Lawrence T. Oliver, Senior Vice President, Regulatory and External Affairs and Secretary, and C. Brooke Miles, Vice President, Human Resources. In addition, Roanoke Gas Company, the largest subsidiary of RGC Resources, elected the following senior officers: Paul W. Nester, President and CEO, Timothy J. Mulvaney, Vice President, CFO and Treasurer, Lawrence T. Oliver, Senior Vice President, Regulatory and External Affairs and Secretary, C. Jim Shockley, Jr., Vice President and Chief Operating Officer, and C. Brooke Miles, Vice President, Human Resources.

RGC Resources, Inc. provides energy and related products and services to customers in Virginia through its operating subsidiaries including Roanoke Gas Company and RGC Midstream, LLC.

From time to time, the Company may publish forward-looking statements relating to such matters as anticipated financial performance, business prospects, technological developments, new products, research and development activities and similar matters. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements. In order to comply with the terms of the safe harbor, the Company notes that a variety of factors could cause the Company’s actual results and experience to differ materially from the anticipated results or other expectations expressed in the Company’s forward-looking statements. Past performance is not necessarily a predictor of future results.

v3.24.0.1

Document And Entity Information

|

Jan. 29, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

RGC RESOURCES, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 29, 2024

|

| Entity, Incorporation, State or Country Code |

VA

|

| Entity, File Number |

000-26591

|

| Entity, Tax Identification Number |

54-1909697

|

| Entity, Address, Address Line One |

519 Kimball Ave., N.E.

|

| Entity, Address, City or Town |

Roanoke

|

| Entity, Address, State or Province |

VA

|

| Entity, Address, Postal Zip Code |

24016

|

| City Area Code |

540

|

| Local Phone Number |

777-4427

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $5 Par Value

|

| Trading Symbol |

RGCO

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001069533

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

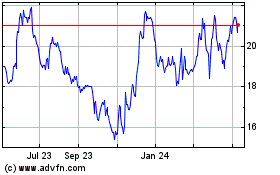

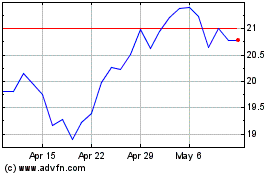

RGC Resources (NASDAQ:RGCO)

Historical Stock Chart

From Apr 2024 to May 2024

RGC Resources (NASDAQ:RGCO)

Historical Stock Chart

From May 2023 to May 2024