Current Report Filing (8-k)

July 01 2022 - 4:44PM

Edgar (US Regulatory)

0001509261

false

0001509261

2022-06-30

2022-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of report (Date of earliest event

reported): June 30, 2022

REZOLUTE, INC.

(Exact Name of Registrant as Specified in Charter)

| Nevada |

|

001-39683 |

|

27-3440894 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

201 Redwood Shores Pkwy, Suite 315, Redwood

City, CA 94065

(Address of Principal Executive Offices,

and Zip Code)

650-206-4507

Registrant’s Telephone Number, Including

Area Code

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| |

¨ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which

registered |

| Common Stock, par value $0.001 per share |

RZLT |

Nasdaq Capital Market |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.02 Termination of a Material Definitive

Agreement.

On April 14, 2021, Rezolute, Inc.

(“Rezolute”) entered into a $30.0 million Loan and Security Agreement (such Loan and Security Agreement, the “Terminated

Loan Agreement”) with Solar Investment Corp., fka Solar Capital Ltd. (“SLR”), as Collateral Agent (“Agent”),

and the parties signing the Terminated Loan Agreement from time to time as Lenders, including SLR in its capacity as a lender.

On June 30, 2022, Rezolute

paid off the outstanding loan amount of $15 million in full and the Terminated Loan Agreement terminated in accordance with its terms.

Rezolute paid a prepayment fee equal to 2.00% of the outstanding principal balance for a total of $300,000. In addition, Rezolute was

obligated to pay a final fee equal to 4.75% of the aggregate amount of the term loans funded for a total of $712,500. The Terminated Loan

Agreement was secured by substantially all of the Rezolute’s assets. The security interests and liens granted in connection with

the Terminated Loan Agreement were terminated in connection with the Company’s discharge of indebtedness thereunder.

Rezolute continues to be obligated

to pay additional fees under the Exit Fee Agreement (the “Exit Fee Agreement”) dated as of April 14, 2021 by and among

Rezolute, SLR as Agent, and the lenders. The Exit Fee Agreement survives the termination of the Terminated Loan Agreement and has a term

of 10 years. Rezolute will be obligated to pay an exit fee equal to 4.00% of the principal amount of the term loans funded upon the occurrence,

prior to April 13, 2031, of (a) any liquidation, dissolution or winding up of Rezolute, (b) a consolidation, merger or

reverse merger of Rezolute with or into another entity or similar transaction which results in stockholders which were not stockholders

of Rezolute immediately prior to such transaction owning more than 35% of the outstanding capital stock of the surviving entity; (c) a

sale, lease, transfer, exclusive license, exchange, dividend or other disposition of all or substantially all of the assets of Rezolute;

(d) the issuance and/or sale by Rezolute in one or a series of related transactions of shares of its common stock constituting more

than 35% of the shares of its common stock outstanding immediately following such issuance to parties other than its then existing investors;

and (e) any other form of acquisition or business combination where Rezolute is the target and where a change of control occurs such

that the person that acquires Rezolute has the power to elect a majority of the board of directors of Rezolute as a result of such transaction.

Item 2.04. Triggering Events That Accelerate

or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

The information contained

in the first and second paragraphs under Item 1.02 regarding the repayment of the Term Loans, the Terminated Loan Agreement and the prepayment

fee and exit fee paid by the Company is hereby incorporated by reference in its entirety into this Item 2.04.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

REZOLUTE, INC. |

| |

|

|

| DATE: July 1, 2022 |

By: |

/s/ Nevan Elam |

| |

|

Nevan Elam

Chief Executive Officer |

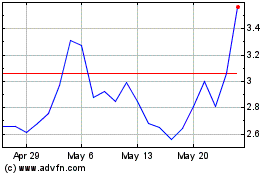

Rezolute (NASDAQ:RZLT)

Historical Stock Chart

From Mar 2024 to Apr 2024

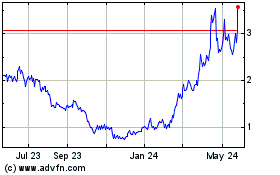

Rezolute (NASDAQ:RZLT)

Historical Stock Chart

From Apr 2023 to Apr 2024