Additional Proxy Soliciting Materials - Non-management (definitive) (dfan14a)

December 10 2021 - 5:28PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

|

|

☐

|

Preliminary Proxy Statement

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

☐

|

Definitive Proxy Statement

|

|

|

☐

|

Definitive Additional Materials

|

|

|

☒

|

Soliciting Material Under Rule 14a-12

|

|

REPUBLIC FIRST BANCORP, INC.

|

|

(Name of Registrant as Specified in Its Charter)

|

|

|

|

DRIVER MANAGEMENT COMPANY LLC

DRIVER OPPORTUNITY PARTNERS I LP

J. ABBOTT R. COOPER

PETER B. BARTHOLOW

PAMELA D. BUNDY

RICHARD H. SINKFIELD III

|

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

☐

|

Fee paid previously with preliminary materials:

|

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

Driver Management Company LLC, together with the other participants named herein (collectively,

“Driver”), intends to file a preliminary proxy statement and accompanying WHITE proxy card with the Securities and Exchange

Commission to be used to solicit votes for the election of its slate of highly-qualified

director nominees at the 2022 annual meeting of shareholders of Republic First Bancorp, Inc., a Pennsylvania corporation (the “Company”).

Item 1: On December 9,

2021, the Philadelphia Business Journal reported upon an interview with J. Abbott R. Cooper, Managing Member of Driver Management Company

LLC, and his quotes related to the Company are pasted below:

Cooper then fired off letters to the bank’s board

on Oct. 29 and Nov. 1 saying raising capital now at the bank’s current valuation “to support undisciplined and ill-advised

growth” would be a serious mistake.

Most immediately, Cooper wants the bank to hold off

on its capital raise. Then he would like to see it “restore order” to its balance sheet and look at a potential sale. Cooper

said last month the capital raise will dilute the value for existing shareholders if and when the bank sells.

In announcing Driver’s board slate, Cooper said

Hill “is intent on pursuing a business plan that we think is highly likely to continue to destroy shareholder value and that the

board is unwilling or unable to oversee Mr. Hill, despite the obvious damage previous capital raises caused shareholders."

Cooper went on to say that while Hill “in many

ways revolutionized retail banking, we view his fanatical, inflexible and intransigent commitment to a business model that has failed

to adapt to current market dynamics and economic conditions as neither in the best interests of the company, nor its shareholders.”

Item 2: On December 10,

2021, American Banker reported upon an interview with J. Abbott R. Cooper, Managing Member of Driver Management Company LLC, and his quotes

related to the Company are pasted below:

Hill, who gained fame

for building Cherry Hill, New Jersey-based Commerce Bancorp into a retail powerhouse prior to its sale to TD Bank in 2008, “has

done a good job building a deposit-gathering mechanism, but if you’re not going to do anything on the asset side, what’s the

point?” Driver said Thursday.

Longer term, Republic First’s “best outcome”

is a sale, Cooper said. “There are some really great asset-generating businesses out there. You kind of fit them together with [Republic

First] and it could be a home run.”

Item 3: On December 10,

2021, The Philadelphia Business Journal reported upon an interview with J. Abbott R. Cooper, Managing Member of Driver Management Company

LLC, and his quotes related to the Company are pasted below:

Cooper’s proxy

contest follows two letters to Republic First’s board in late October and early November calling for the bank to shelve plans for

a capital raise in favor of shrinking the balance sheet. He said raising capital now at the bank’s current valuation “to

support undisciplined and ill-advised growth” would be a serious mistake and will dilute the value for existing shareholders if

and when the bank sells.

In response to Republic

First’s press release and disclosure of the recent correspondence, Cooper called it posturing. He said Driver has no obligation

to let the board interview its candidates and “conventional wisdom in these types of things is that it is a damned if you do, damned

if you don’t type of proposition — albeit as a matter of gamesmanship. If we allow the nominees to be interviewed, it is pretty

easy for the board to say 'we interviewed Driver’s candidates and they are not as good as our current directors.’ While, if

we don’t (since we kind of know how it is likely to play out), FRBK can claim that they wanted to see if the nominees are suitable.

None of this actually makes a hill of beans worth of difference, since I don’t think anyone would expect that directors that we

are trying to unseat would recommend that they very people we are trying to unseat them with.”

Cooper noted that Republic

First certainly did not offer a quid pro quo of letting Driver interview its nominees.

“The bottom line is that, in my view, this is

just a way for the company to distract people from the actual issues,” Cooper said. “The notion that any board, particularly

one with Vernon Hill calling the shots, would, after interviewing nominees proposed by an activist shareholder, simply say 'wow, these

are some great candidates — certainly better than the guys we currently have on the board’ — is pretty silly. If FRBK

had anything to counter our complaints — that the proposed capital raise would be harmful to shareholders, that Vernon’s strategy

is destroying shareholder value, etc — then that is what they would be responding with. Not this nonsense.”

“The notion that any board, particularly one

with Vernon Hill calling the shots, would, after interviewing nominees proposed by an activist shareholder, simply say 'wow, these are

some great candidates — certainly better than the guys we currently have on the board’ — is pretty silly. If FRBK had

anything to counter our complaints — that the proposed capital raise would be harmful to shareholders, that Vernon’s strategy

is destroying shareholder value, etc — then that is what they would be responding with. Not this nonsense.”

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Driver Management Company LLC, together with

the other participants named herein (collectively, “Driver”), intends to file a preliminary proxy statement and accompanying

WHITE proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of its slate of highly-qualified

director nominees at the 2022 annual meeting of shareholders of Republic First Bancorp, Inc., a Pennsylvania Company (the “Company”).

DRIVER STRONGLY ADVISES ALL SHAREHOLDERS

OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV.

IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON

REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

The participants in the proxy solicitation

are anticipated to be Driver Management Company LLC (“Driver Management”), Driver Opportunity Partners I LP (“Driver

Opportunity”), J. Abbott R. Cooper, Peter B. Bartholow, Pamela D. Bundy and Richard H. Sinkfield III.

As of the date hereof, the participants

in the proxy solicitation beneficially own in the aggregate 668,842 shares of Common Stock, par value $0.01 per share, of the Company

(the “Common Stock”). As of the date hereof, Driver Opportunity beneficially owns directly 339,335 shares of Common Stock.

As the investment advisor of certain managed accounts (the “Managed Accounts”), Driver Management may be deemed to beneficially

own 310,575 shares of Common Stock (consisting of shares of Common Stock held in the Managed Accounts). Driver Management, as the general

partner of Driver Opportunity, may be deemed to beneficially own the shares of Common Stock directly beneficially owned by Driver Opportunity

and held in the Managed Accounts. Mr. Cooper, as the Managing Member of Driver Management, may be deemed to beneficially own the shares

of Common Stock directly beneficially owned by Driver Opportunity and held in the Managed Accounts. As of the date hereof, Mr. Bartholow

directly beneficially owns 6,000 shares of Common Stock. As of the date hereof, Ms. Bundy directly beneficially owns 10,000 shares of

Common Stock. As of the date hereof, Mr. Sinkfield directly beneficially owns 2,932 shares of Common Stock.

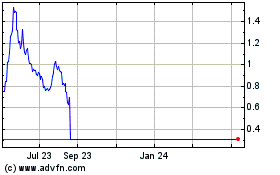

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jul 2024 to Aug 2024

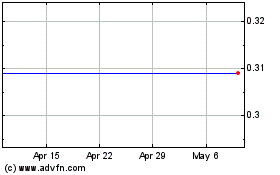

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Aug 2023 to Aug 2024