Republic First Bancorp, Inc. (NASDAQ: FRBK), the holding company

for Republic Bank, today announced its financial results for the

period ended June 30, 2019.

Q2-2019

Highlights

- Total deposits increased by $394 million, or 18%, to $2.5

billion as of June 30, 2019 compared to $2.1 billion as of June 30,

2018.

- New stores opened since the beginning of the “Power of Red is

Back” expansion campaign are currently growing deposits at an

average rate of $25 million per year, while the average deposit

growth for all stores over the last twelve months was approximately

$14 million per store.

- Expansion into New York City began with the opening of our

first store located on the corner of 14th Street and 5th

Avenue.

- Total loans grew $191 million, or 15%, to $1.5 billion as of

June 30, 2019 compared to $1.3 billion at June 30, 2018.

- Net income declined to $0.8 million, or $0.01 per share, for

the six month period ended June 30, 2019 compared to $4.1 million,

or $0.07 per share for the six month period ended June 30,

2018.

“The Power of Red is Back” expansion

strategy launched in New York City with the opening of our newest

store on the corner of 14th Street and 5th Avenue. On July 12th we

celebrated the grand opening of our first store in New York by

welcoming Customers – and their pets – with a fun-filled day that

included live entertainment, music and gifts. We also continued our

expansion in Bucks County with the opening of our store in

Feasterville, PA during the second quarter.

Profitability in 2019 continues to be hampered

by a number of factors. Similar to the first quarter, net income in

the second quarter was impacted by the costs necessary to initiate

our expansion into New York City which includes the hiring of a

management and lending team for this new market, along with the

training and development costs for the new store openings. We also

continue to feel the effect of a flat or inverted yield curve which

has resulted in compression of the net interest margin.

Vernon W. Hill, II, Chairman of Republic

First Bancorp said:

“The Power of Red is Back in New York City. The

recent opening of our first store at 14th & 5th was a

tremendous success. We are thrilled to bring back the legendary

banking experience that our FANS in New York have been missing for

the last several years. At a time when most banks are shuttering

branches and retreating from the communities they serve, Republic

Bank continues in its relentless pursuit to deliver an unmatched

banking experience across every delivery channel. This not only

includes the in-store experience, but online and mobile options as

well.”

Harry D. Madonna, President and Chief

Executive Officer of Republic First Bancorp added:

“Our strong growth since the inception of our

expansion campaign demonstrates the success of the Republic model.

Assets, loans and deposits have consistently grown at levels

significantly above industry standards. We see significant

opportunities to expand our footprint and create new FANS as our

competitors continue to alienate customers with declining levels of

service and fewer branch locations.”

A summary of the financial results for the

period ended June 30, 2019 can be found in the following table:

|

|

Six Months Ended |

|

($ in millions, except per share data) |

06/30/19 |

|

06/30/18 |

|

% Change |

|

|

|

|

|

|

|

|

|

|

Assets |

$ |

2,941.0 |

|

$ |

2,552.9 |

|

15 |

% |

| Loans |

1,508.7 |

|

1,317.6 |

|

15 |

% |

| Deposits |

2,528.0 |

|

2,134.1 |

|

18 |

% |

| Total Revenue |

$ |

50.5 |

|

$ |

47.1 |

|

7 |

% |

| Income Before Tax |

1.0 |

|

5.1 |

|

(80 |

%) |

| Net Income |

0.8 |

|

4.1 |

|

(81 |

%) |

| Net

Income per Share |

$ |

0.01 |

|

$ |

0.07 |

|

(86 |

%) |

Financial Highlights for the Period Ended June 30,

2019

- Total assets increased by $388 million, or 15%, to $2.9 billion

as of June 30, 2019 compared to $2.6 billion as of June 30,

2018.

- We have twenty-eight convenient store locations open today.

During the second quarter of 2019 we continued our expansion into

Buck County with the opening of our new store in Feasterville, PA.

There are also multiple sites in various stages of

development for future store locations.

- Expansion into New York City began in July 2019 with the grand

opening of our first store location at 14th Street & 5th Avenue

in Manhattan. We’ve also started construction on our next site in

New York located at 51st Street & 3rd Avenue which is expected

to open during the fourth quarter.

- Net income remained at $0.4 million, or $0.01 per share, for

the three months ended June 30, 2019 compared to $0.4 million, or

$0.01 per share for the three months ended March 31, 2019 and

declined from $2.4 million, or $0.04 per share, for the three

months ended June 30, 2018.

- The net interest margin decreased by 25 basis points to 2.94%

for the three months ended June 30, 2019 compared to 3.19% for the

three months ended June 30, 2018. Margin compression was driven by

the flat and inverted yield curve experienced during the second

quarter of 2019.

- Asset quality continues to improve. The ratio of non-performing

assets to total assets declined to 0.53% as of June 30, 2019

compared to 0.81% as of June 30, 2018.

- The Company’s residential mortgage division, Oak Mortgage, is

serving the home financing needs of customers throughout its

footprint. The Oak Mortgage team has originated more than $370

million in mortgage loans over the last twelve months.

- Meeting the needs of small business customers continued to be

an important part of the Company’s lending strategy. More

than $27 million in new SBA loans were originated during the six

month period ended June 30, 2019. Republic Bank continues to be a

top SBA lender in our market area based on the dollar volume of

loan originations.

- The Company’s Total Risk-Based Capital ratio was 14.02% and

Tier I Leverage Ratio was 8.97% at June 30, 2019.

- Book value per common share increased to $4.27 as of June 30,

2019 compared to $4.01 as of June 30, 2018.

Income Statement

The major components of the income statement are

as follows (dollars in thousands, except per share data):

|

|

Three Months Ended |

Three Months Ended |

|

|

06/30/19 |

03/31/19 |

% Change |

|

06/30/19 |

06/30/18 |

% Change |

|

|

Net Interest Income |

$ |

19,371 |

$ |

19,140 |

1 |

% |

|

$ |

19,371 |

$ |

18,662 |

4 |

% |

| Non-interest Income |

|

7,026 |

|

4,945 |

42 |

% |

|

|

7,026 |

|

5,768 |

22 |

% |

| Provision for Loan Losses |

|

- |

|

300 |

n/m |

|

|

|

- |

|

800 |

n/m |

|

| Non-interest Expense |

|

25,911 |

|

23,627 |

10 |

% |

|

|

25,911 |

|

20,729 |

25 |

% |

| Income Before Taxes |

|

486 |

|

518 |

(6 |

%) |

|

|

486 |

|

2,901 |

(83 |

%) |

| Provision (Benefit) for

Taxes |

|

105 |

|

92 |

14 |

% |

|

|

105 |

|

530 |

(80 |

%) |

| Net Income |

|

381 |

|

426 |

(11 |

%) |

|

|

381 |

|

2,371 |

(84 |

%) |

| Net

Income per Share |

$ |

0.01 |

$ |

0.01 |

(0 |

%) |

|

$ |

0.01 |

$ |

0.04 |

(75 |

%) |

|

|

Six Months Ended |

|

|

|

06/30/19 |

06/30/18 |

% Change |

|

|

Net Interest Income |

$ |

38,511 |

$ |

36,778 |

5 |

% |

| Non-interest Income |

|

11,971 |

|

10,303 |

16 |

% |

| Provision for Loan Losses |

|

300 |

|

1,200 |

(75 |

%) |

| Non-interest Expense |

|

49,178 |

|

40,831 |

20 |

% |

| Income Before Taxes |

|

1,004 |

|

5,050 |

(80 |

%) |

| Provision (Benefit) for

Taxes |

|

197 |

|

902 |

(78 |

%) |

| Net Income |

|

807 |

|

4,148 |

(81 |

%) |

| Net

Income per Share |

$ |

0.01 |

$ |

0.07 |

(86 |

%) |

| |

|

|

|

|

|

|

The Company reported net income of $381

thousand, or $0.01 per share, for the three month period ended June

30, 2019, compared to $426 thousand, or $0.01 per share for the

three month period ended March 31, 2019 and $2.4 million, or $0.04

per share, for the three month period ended June 30, 2018.

Net income for the six month period ended June 30, 2019 was $807

thousand, or $0.01 per share, compared to net income of $4.1

million, or $0.07 per share, for the six months ended June 30,

2018.

On a linked quarter basis net income was

consistent at $0.4 million for the first and second quarter of

2019. Year over year net income declined to $0.4 million in the

second quarter of 2019 from $2.4 in the second quarter of 2018.

Current year profitability has been impacted by the expenses

incurred to expand into the New York market and continued

compression of the net interest margin.

Interest income increased by $3.9 million, or

18%, to $26.2 million for the quarter ended June 30, 2019 compared

to $22.3 million for the quarter ended June 30, 2018. The increase

in interest income is attributable to the growth in

interest-earning assets over the last twelve months driven by the

Company’s “Power of Red is Back” expansion strategy. However,

interest expense increased by $3.2 million, or 88%, to $6.9 million

for the quarter ended June 30, 2019 compared to $3.7 million for

the quarter ended June 30, 2018. The increase in interest expense

was driven by multiple increases in the fed funds rate during 2018

which resulted in a higher cost of funds on deposit balances and

led to compression in the net interest margin. The net interest

margin for the three month period ended June 30, 2019 decreased by

25 basis points to 2.94% compared to 3.19% for the three month

period ended June 30, 2018.

Non-interest income increased by $1.3 million,

or 22%, to $7.0 million for the three month period ended June 30,

2019, compared to $5.8 million for the three month period ended

June 30, 2018. The increase is primarily attributable to higher

service fees on deposit accounts which is driven by growth in

deposit balances and an increase in the number of deposit accounts.

An increase in gains on sales of SBA loans and investment

securities also contributed to the increase in non-interest income

during the second quarter of 2019.

Non-interest expenses increased by 25%, to $25.9

million during the quarter ended June 30, 2019 compared to $20.7

million during the quarter ended June 30, 2018. The growth in

expenses was mainly caused by an increase in salaries and employee

benefits driven by annual merit increases along with increased

staffing levels related to our growth and expansion strategy.

Occupancy and equipment expenses associated with the growth

strategy also contributed to the increase in non-interest expenses.

We’ve also begun to incur costs related to the expansion into the

New York market as we hire a management and lending team and

commence rent payments for the build out of our store

locations.

The provision for income taxes was $105 thousand

for the three month period ended June 30, 2019 compared to a

provision for income taxes in the amount of $530 thousand for the

three month period ended June 30, 2018.

Balance Sheet

The major components of the balance sheet are as

follows (dollars in thousands):

|

Description |

06/30/19 |

06/30/18 |

% Change |

03/31/19 |

% Change |

|

|

|

|

|

|

|

|

Total assets |

$ |

2,940,986 |

$ |

2,552,920 |

15 |

% |

$ |

2,805,060 |

5 |

% |

|

Total loans (net) |

|

1,500,664 |

|

1,310,012 |

15 |

% |

|

1,469,186 |

2 |

% |

|

Total deposits |

|

2,527,977 |

|

2,134,141 |

18 |

% |

|

2,478,953 |

2 |

% |

Total assets increased by $388.1 million, or

15%, as of June 30, 2019 when compared to June 30, 2018.

Deposits grew by $393.8 million to $2.5 billion as of June 30, 2019

compared to $2.1 billion as of June 30, 2018. The number of deposit

accounts has grown by 27% during the past twelve months. The strong

growth in assets, loans and deposits has been driven by the

addition of new stores and the successful execution of the

Company’s aggressive growth strategy referred to as “The Power of

Red is Back.”

Deposits

Deposits by type of account are as follows

(dollars in thousands):

|

Description |

06/30/19 |

06/30/18 |

% Change |

03/31/19 |

%Change |

2nd Qtr 2019 Cost of Funds |

|

|

|

|

|

|

|

|

|

Demand noninterest-bearing |

$ |

544,406 |

$ |

526,650 |

3 |

% |

$ |

525,645 |

4 |

% |

0.00 |

% |

|

Demand interest-bearing |

|

1,072,415 |

|

785,513 |

37 |

% |

|

1,101,129 |

(3 |

%) |

1.47 |

% |

|

Money market and savings |

|

719,075 |

|

698,182 |

3 |

% |

|

691,351 |

4 |

% |

0.94 |

% |

|

Certificates of deposit |

|

192,081 |

|

123,796 |

55 |

% |

|

160,828 |

19 |

% |

1.95 |

% |

| Total deposits |

$ |

2,527,977 |

$ |

2,134,141 |

18 |

% |

$ |

2,478,953 |

2 |

% |

1.06 |

% |

|

|

|

|

|

|

|

|

Deposits increased to $2.5 billion at June 30,

2019 compared to $2.1 billion at June 30, 2018 as the Company moves

forward with its growth strategy to increase the number of stores

and expand the reach of its banking model which focuses on high

levels of customer service and convenience and drives the gathering

of low-cost, core deposits. The Company recognized strong growth in

demand deposit balances and certificates of deposit, year over year

as a result of the successful execution of its strategy.

Lending

Loans by type are as follows (dollars in

thousands):

|

Description |

06/30/19 |

% of Total |

06/30/18 |

% of Total |

03/31/19 |

% ofTotal |

|

|

|

|

|

|

|

|

|

Commercial real estate |

$ |

553,644 |

37 |

% |

$ |

489,574 |

37 |

% |

$ |

527,004 |

36 |

% |

| Construction and land

development |

|

111,474 |

7 |

% |

|

120,165 |

9 |

% |

|

124,124 |

8 |

% |

|

Commercial and industrial |

|

189,632 |

13 |

% |

|

188,254 |

14 |

% |

|

204,637 |

14 |

% |

|

Owner occupied real estate |

|

381,852 |

25 |

% |

|

335,871 |

26 |

% |

|

376,845 |

26 |

% |

|

Consumer and other |

|

98,155 |

6 |

% |

|

83,606 |

6 |

% |

|

92,728 |

6 |

% |

|

Residential mortgage |

|

173,963 |

12 |

% |

|

100,108 |

8 |

% |

|

151,748 |

10 |

% |

|

Gross loans |

$ |

1,508,720 |

100 |

% |

$ |

1,317,578 |

100 |

% |

$ |

1,477,086 |

100 |

% |

|

|

|

|

|

|

|

|

Gross loans increased by $191 million, or 15%,

to $1.5 billion at June 30, 2019 compared to $1.3 billion at June

30, 2018 as a result of the steady flow in quality loan demand over

the last twelve months and continued success with the relationship

banking model. The Company experienced strongest growth in

commercial real estate, owner occupied real estate and residential

mortgage loans year over year.

Asset Quality

The Company’s asset quality ratios are

highlighted below:

|

|

Three Months Ended |

|

|

06/30/19 |

03/31/19 |

06/30/18 |

|

|

|

|

|

|

Non-performing assets / capital and reserves |

6 |

% |

7 |

% |

9 |

% |

|

Non-performing assets / total assets |

0.53 |

% |

0.60 |

% |

0.81 |

% |

|

Quarterly net loan charge-offs / average loans |

(0.04 |

%) |

0.28 |

% |

(0.04 |

%) |

|

Allowance for loan losses / gross loans |

0.53 |

% |

0.53 |

% |

0.57 |

% |

|

Allowance for loan losses / non-performing loans |

86 |

% |

74 |

% |

54 |

% |

The percentage of non-performing assets to total

assets decreased to 0.53% at June 30, 2019, compared to 0.81% at

June 30, 2018. The ratio of non-performing assets to capital

and reserves decreased to 6% at June 30, 2019 compared to 9% at

June 30, 2018 primarily as a result of decreases in non-performing

assets over the last 12 months.

Capital

The Company’s capital ratios at June 30, 2019

were as follows:

|

|

Actual06/30/19Bancorp |

Actual06/30/19Bank |

Regulatory Guidelines“Well

Capitalized” |

|

|

|

|

|

|

Leverage Ratio |

8.97 |

% |

8.57 |

% |

5.00 |

% |

|

Common Equity Ratio |

13.01 |

% |

12.99 |

% |

6.50 |

% |

|

Tier 1 Risk Based Capital |

13.59 |

% |

12.99 |

% |

8.00 |

% |

|

Total Risk Based Capital |

14.02 |

% |

13.42 |

% |

10.00 |

% |

|

Tangible Common Equity |

8.39 |

% |

8.27 |

% |

n/a |

|

Total shareholders’ equity increased to $251

million at June 30, 2019 compared to $235 million at June 30, 2018.

Book value per common share increased to $4.27 at June 30, 2019

compared to $4.01 per share at June 30, 2018.

Analyst and Investor Call

An analyst and investor call will be held on the

following date and time:

|

|

|

|

Date: |

July 29, 2019 |

|

Time: |

10:00am

(EDT) |

|

From the U.S. dial: |

(888)

771-4371 [Toll Free] or (847) 585-4405 |

|

Participant Pin: |

48871378# |

|

|

|

An operator will assist you in joining the call. |

About Republic Bank

Republic Bank, a subsidiary of Republic First

Bancorp, Inc., is a full-service, state-chartered commercial bank,

whose deposits are insured up to the applicable limits by the

Federal Deposit Insurance Corporation (FDIC). The Bank provides

diversified financial products through its twenty-eight stores

located in the Greater Philadelphia, Southern New Jersey and New

York City markets. Republic Bank stores are open 7 days a

week, 361 days a year, with extended lobby and drive-thru hours

providing customers with the most convenient hours compared to any

bank in its market. The Bank offers free checking, free coin

counting, ATM/Debit cards issued on the spot and access to more

than 55,000 surcharge free ATMs worldwide via the Allpoint Network.

The Bank also offers a wide range of residential mortgage products

through its mortgage division which does business under the name of

Oak Mortgage Company. For more information about Republic Bank,

visit www.myrepublicbank.com.

Forward Looking Statements

The Company may from time to time make written

or oral “forward-looking statements”, including statements

contained in this release and in the Company's filings with the

Securities and Exchange Commission. The forward-looking statements

contained herein, are subject to certain risks and uncertainties

that could cause actual results to differ materially from those

projected in the forward-looking statements. For example,

risks and uncertainties can arise with changes in: general economic

conditions, including turmoil in the financial markets and related

efforts of government agencies to stabilize the financial system;

the adequacy of our allowance for loan losses and our methodology

for determining such allowance; adverse changes in our loan

portfolio and credit risk-related losses and expenses;

concentrations within our loan portfolio, including our exposure to

commercial real estate loans, and to our primary service area;

changes in interest rates; business conditions in the financial

services industry, including competitive pressure among financial

services companies, new service and product offerings by

competitors, price pressures and similar items; deposit flows; loan

demand; the regulatory environment, including evolving banking

industry standards, changes in legislation or regulation; impact of

the Dodd-Frank Wall Street Reform and Consumer Protection Act; our

securities portfolio and the valuation of our securities;

accounting principles, policies and guidelines as well as estimates

and assumptions used in the preparation of our financial

statements; rapidly changing technology; litigation liabilities,

including costs, expenses, settlements and judgments; and other

economic, competitive, governmental, regulatory and technological

factors affecting our operations, pricing, products and

services. You should carefully review the risk factors

described in the Form 10-K for the year ended December 31, 2018 and

other documents the Company files from time to time with the

Securities and Exchange Commission. The words “would be,” “could

be,” “should be,” “probability,” “risk,” “target,” “objective,”

“may,” “will,” “estimate,” “project,” “believe,” “intend,”

“anticipate,” “plan,” “seek,” “expect” and similar expressions or

variations on such expressions are intended to identify

forward-looking statements. All such statements are made in good

faith by the Company pursuant to the “safe harbor” provisions of

the U.S. Private Securities Litigation Reform Act of 1995. The

Company does not undertake to update any forward-looking statement,

whether written or oral, that may be made from time to time by or

on behalf of the Company, except as may be required by applicable

law or regulations.

Source: Republic First

Bancorp, Inc.

Contact: Frank A.

Cavallaro, CFO(215) 735-4422

| |

|

|

|

|

|

| Republic

First Bancorp, Inc. |

|

|

|

|

|

|

Consolidated Balance Sheets |

|

|

|

|

|

| (Unaudited) |

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

June 30, |

|

|

|

March 31, |

|

|

|

June 30, |

|

| (dollars in

thousands, except per share amounts) |

|

2019 |

|

|

|

2019 |

|

|

|

2018 |

|

| |

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

| |

Cash and due from

banks |

$ |

38,770 |

|

|

$ |

31,511 |

|

|

$ |

29,363 |

|

| |

Interest-bearing

deposits and federal funds sold |

|

90,744 |

|

|

|

54,394 |

|

|

|

29,991 |

|

|

|

|

Total cash and cash equivalents |

|

129,514 |

|

|

|

85,905 |

|

|

|

59,354 |

|

| |

|

|

|

|

|

|

|

| |

Securities -

Available for sale |

|

338,286 |

|

|

|

287,694 |

|

|

|

502,021 |

|

| |

Securities - Held

to maturity |

|

718,534 |

|

|

|

742,435 |

|

|

|

503,742 |

|

| |

Restricted

stock |

|

5,130 |

|

|

|

2,097 |

|

|

|

8,379 |

|

| |

|

Total investment

securities |

|

1,061,950 |

|

|

|

1,032,226 |

|

|

|

1,014,142 |

|

| |

|

|

|

|

|

|

|

| |

Loans held for

sale |

|

23,412 |

|

|

|

15,742 |

|

|

|

39,301 |

|

| |

|

|

|

|

|

|

|

| |

Loans

receivable |

|

1,508,720 |

|

|

|

1,477,086 |

|

|

|

1,317,578 |

|

| |

Allowance for loan

losses |

|

(8,056 |

) |

|

|

(7,900 |

) |

|

|

(7,566 |

) |

| |

|

Net loans |

|

1,500,664 |

|

|

|

1,469,186 |

|

|

|

1,310,012 |

|

| |

|

|

|

|

|

|

|

| |

Premises and

equipment |

|

105,311 |

|

|

|

94,390 |

|

|

|

80,069 |

|

| |

Other real estate

owned |

|

6,406 |

|

|

|

6,088 |

|

|

|

6,559 |

|

| |

Other assets |

|

113,729 |

|

|

|

101,523 |

|

|

|

43,483 |

|

| |

|

|

|

|

|

|

|

| |

Total Assets |

$ |

2,940,986 |

|

|

$ |

2,805,060 |

|

|

$ |

2,552,920 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

| |

Non-interest

bearing deposits |

$ |

544,406 |

|

|

$ |

525,645 |

|

|

$ |

526,650 |

|

| |

Interest bearing

deposits |

|

1,983,571 |

|

|

|

1,953,308 |

|

|

|

1,607,491 |

|

| |

|

Total deposits |

|

2,527,977 |

|

|

|

2,478,953 |

|

|

|

2,134,141 |

|

| |

|

|

|

|

|

|

|

| |

Short-term

borrowings |

|

68,979 |

|

|

|

- |

|

|

|

161,669 |

|

| |

Subordinated

debt |

|

11,262 |

|

|

|

11,260 |

|

|

|

11,256 |

|

| |

Other

liabilities |

|

81,410 |

|

|

|

66,462 |

|

|

|

10,520 |

|

| |

|

|

|

|

|

|

|

| |

Total

Liabilities |

|

2,689,628 |

|

|

|

2,556,675 |

|

|

|

2,317,586 |

|

| |

|

|

|

|

|

|

|

| SHAREHOLDERS'

EQUITY |

|

|

|

|

|

| |

Common stock -

$0.01 par value |

|

594 |

|

|

|

593 |

|

|

|

593 |

|

| |

Additional paid-in

capital |

|

270,789 |

|

|

|

270,155 |

|

|

|

267,974 |

|

| |

Accumulated

deficit |

|

(7,909 |

) |

|

|

(8,290 |

) |

|

|

(13,195 |

) |

| |

Treasury stock at

cost |

|

(3,725 |

) |

|

|

(3,725 |

) |

|

|

(3,725 |

) |

| |

Stock held by

deferred compensation plan |

|

(183 |

) |

|

|

(183 |

) |

|

|

(183 |

) |

| |

Accumulated other

comprehensive loss |

|

(8,208 |

) |

|

|

(10,165 |

) |

|

|

(16,130 |

) |

| |

|

|

|

|

|

|

|

| |

Total

Shareholders' Equity |

|

251,358 |

|

|

|

248,385 |

|

|

|

235,334 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Total Liabilities

and Shareholders' Equity |

$ |

2,940,986 |

|

|

$ |

2,805,060 |

|

|

$ |

2,552,920 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Republic

First Bancorp, Inc. |

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Income |

|

|

|

|

|

|

|

|

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended |

|

Six Months Ended |

| |

|

|

|

June 30, |

|

|

March 31, |

|

|

June 30, |

|

|

|

June 30, |

|

|

June 30, |

|

| (in thousands,

except per share amounts) |

|

2019 |

|

|

2019 |

|

|

2018 |

|

|

|

2019 |

|

|

2018 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| INTEREST

INCOME |

|

|

|

|

|

|

|

|

|

| |

Interest and fees

on loans |

$ |

18,569 |

|

$ |

17,800 |

|

$ |

15,457 |

|

|

$ |

36,369 |

|

$ |

29,726 |

|

| |

Interest and

dividends on investment securities |

|

7,158 |

|

|

7,383 |

|

|

6,804 |

|

|

|

14,541 |

|

|

13,262 |

|

| |

Interest on other

interest earning assets |

|

518 |

|

|

336 |

|

|

63 |

|

|

|

854 |

|

|

235 |

|

|

|

|

Total interest income |

|

26,245 |

|

|

25,519 |

|

|

22,324 |

|

|

|

51,764 |

|

|

43,223 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| INTEREST

EXPENSE |

|

|

|

|

|

|

|

|

|

| |

Interest on

deposits |

|

6,695 |

|

|

6,014 |

|

|

3,089 |

|

|

|

12,709 |

|

|

5,687 |

|

| |

Interest on

borrowed funds |

|

179 |

|

|

365 |

|

|

573 |

|

|

|

544 |

|

|

758 |

|

| |

|

Total interest expense |

|

6,874 |

|

|

6,379 |

|

|

3,662 |

|

|

|

13,253 |

|

|

6,445 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Net interest

income |

|

19,371 |

|

|

19,140 |

|

|

18,662 |

|

|

|

38,511 |

|

|

36,778 |

|

| |

Provision for loan

losses |

|

- |

|

|

300 |

|

|

800 |

|

|

|

300 |

|

|

1,200 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Net interest

income after provision for loan losses |

|

19,371 |

|

|

18,840 |

|

|

17,862 |

|

|

|

38,211 |

|

|

35,578 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| NON-INTEREST

INCOME |

|

|

|

|

|

|

|

|

|

| |

Service fees on

deposit accounts |

|

1,848 |

|

|

1,612 |

|

|

1,326 |

|

|

|

3,460 |

|

|

2,501 |

|

| |

Mortgage banking

income |

|

3,031 |

|

|

2,220 |

|

|

3,182 |

|

|

|

5,251 |

|

|

5,368 |

|

| |

Gain on sale of

SBA loans |

|

1,147 |

|

|

502 |

|

|

846 |

|

|

|

1,649 |

|

|

1,838 |

|

| |

Gain (loss) on

sale of investment securities |

|

261 |

|

|

322 |

|

|

(1 |

) |

|

|

583 |

|

|

(1 |

) |

| |

Other non-interest

income |

|

739 |

|

|

289 |

|

|

415 |

|

|

|

1,028 |

|

|

597 |

|

| |

|

Total non-interest income |

|

7,026 |

|

|

4,945 |

|

|

5,768 |

|

|

|

11,971 |

|

|

10,303 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| NON-INTEREST

EXPENSE |

|

|

|

|

|

|

|

|

|

| |

Salaries and

employee benefits |

|

13,705 |

|

|

12,359 |

|

|

10,883 |

|

|

|

26,064 |

|

|

21,528 |

|

| |

Occupancy and

equipment |

|

4,221 |

|

|

4,015 |

|

|

3,353 |

|

|

|

8,236 |

|

|

6,823 |

|

| |

Legal and

professional fees |

|

1,058 |

|

|

707 |

|

|

859 |

|

|

|

1,765 |

|

|

1,618 |

|

| |

Foreclosed real

estate |

|

517 |

|

|

337 |

|

|

192 |

|

|

|

854 |

|

|

503 |

|

| |

Regulatory

assessments and related fees |

|

421 |

|

|

421 |

|

|

395 |

|

|

|

842 |

|

|

862 |

|

| |

Other operating

expenses |

|

5,989 |

|

|

5,428 |

|

|

5,047 |

|

|

|

11,417 |

|

|

9,497 |

|

| |

|

Total non-interest

expense |

|

25,911 |

|

|

23,267 |

|

|

20,729 |

|

|

|

49,178 |

|

|

40,831 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Income before

provision for income taxes |

|

486 |

|

|

518 |

|

|

2,901 |

|

|

|

1,004 |

|

|

5,050 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Provision for

income taxes |

|

105 |

|

|

92 |

|

|

530 |

|

|

|

197 |

|

|

902 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net income |

$ |

381 |

|

$ |

426 |

|

$ |

2,371 |

|

|

$ |

807 |

|

$ |

4,148 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net Income per

Common Share |

|

|

|

|

|

|

|

|

|

| |

Basic |

$ |

0.01 |

|

$ |

0.01 |

|

$ |

0.04 |

|

|

$ |

0.01 |

|

$ |

0.07 |

|

| |

Diluted |

$ |

0.01 |

|

$ |

0.01 |

|

$ |

0.04 |

|

|

$ |

0.01 |

|

$ |

0.07 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Average Common

Shares Outstanding |

|

|

|

|

|

|

|

|

|

| |

Basic |

|

58,841 |

|

|

58,805 |

|

|

58,746 |

|

|

|

58,823 |

|

|

57,927 |

|

| |

Diluted |

|

59,401 |

|

|

59,587 |

|

|

59,911 |

|

|

|

59,501 |

|

|

59,147 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Republic First

Bancorp, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average

Balances and Net Interest Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

For the three months ended |

|

For the three months ended |

|

For the three months ended |

| (dollars in thousands) |

June 30, 2019 |

|

March 31, 2019 |

|

June 30, 2018 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Interest |

|

|

|

|

|

Interest |

|

|

|

|

|

Interest |

|

|

| |

Average |

|

Income/ |

|

Yield/ |

|

Average |

|

Income/ |

|

Yield/ |

|

Average |

|

Income/ |

|

Yield/ |

| |

Balance |

|

Expense |

|

Rate |

|

Balance |

|

Expense |

|

Rate |

|

Balance |

|

Expense |

|

Rate |

| Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Federal funds sold and

other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

interest-earning assets |

$ |

85,920 |

|

$ |

518 |

|

2.42 |

% |

|

$ |

55,369 |

|

$ |

336 |

|

2.46 |

% |

|

$ |

13,412 |

|

$ |

63 |

|

1.88 |

% |

| Securities |

|

1,067,185 |

|

|

7,184 |

|

2.69 |

% |

|

|

1,085,910 |

|

|

7,420 |

|

2.73 |

% |

|

|

1,048,291 |

|

|

6,838 |

|

2.61 |

% |

| Loans receivable |

|

1,509,177 |

|

|

18,681 |

|

4.96 |

% |

|

|

1,468,640 |

|

|

17,911 |

|

4.95 |

% |

|

|

1,304,244 |

|

|

15,557 |

|

4.78 |

% |

| Total interest-earning

assets |

|

2,662,282 |

|

|

26,383 |

|

3.97 |

% |

|

|

2,609,919 |

|

|

25,667 |

|

3.99 |

% |

|

|

2,365,947 |

|

|

22,458 |

|

3.81 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other assets |

|

217,685 |

|

|

|

|

|

|

190,855 |

|

|

|

|

|

|

129,077 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

$ |

2,879,967 |

|

|

|

|

|

$ |

2,800,774 |

|

|

|

|

|

$ |

2,495,024 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing

liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Demand non

interest-bearing |

$ |

525,336 |

|

|

|

|

|

$ |

512,172 |

|

|

|

|

|

$ |

481,548 |

|

|

|

|

| Demand interest-bearing |

|

1,144,783 |

|

|

4,206 |

|

1.47 |

% |

|

|

1,113,758 |

|

|

3,938 |

|

1.43 |

% |

|

|

844,405 |

|

|

1,549 |

|

0.74 |

% |

| Money market &

savings |

|

697,279 |

|

|

1,628 |

|

0.94 |

% |

|

|

675,506 |

|

|

1,452 |

|

0.87 |

% |

|

|

699,136 |

|

|

1,174 |

|

0.67 |

% |

| Time deposits |

|

176,750 |

|

|

861 |

|

1.95 |

% |

|

|

153,832 |

|

|

624 |

|

1.65 |

% |

|

|

125,607 |

|

|

366 |

|

1.17 |

% |

| Total deposits |

|

2,544,148 |

|

|

6,695 |

|

1.06 |

% |

|

|

2,455,268 |

|

|

6,014 |

|

0.99 |

% |

|

|

2,150,696 |

|

|

3,089 |

|

0.58 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total interest-bearing

deposits |

|

2,018,812 |

|

|

6,695 |

|

1.33 |

% |

|

|

1,943,096 |

|

|

6,014 |

|

1.26 |

% |

|

|

1,669,148 |

|

|

3,089 |

|

0.74 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other borrowings |

|

19,864 |

|

|

179 |

|

3.61 |

% |

|

|

46,969 |

|

|

365 |

|

3.15 |

% |

|

|

101,829 |

|

|

573 |

|

2.26 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total interest-bearing

liabilities |

|

2,038,676 |

|

|

6,874 |

|

1.35 |

% |

|

|

1,990,065 |

|

|

6,379 |

|

1.30 |

% |

|

|

1,770,977 |

|

|

3,662 |

|

0.83 |

% |

| Total deposits and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| other borrowings |

|

2,564,012 |

|

|

6,874 |

|

1.08 |

% |

|

|

2,502,237 |

|

|

6,379 |

|

1.03 |

% |

|

|

2,252,525 |

|

|

3,662 |

|

0.65 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non interest-bearing

liabilities |

|

66,780 |

|

|

|

|

|

|

52,037 |

|

|

|

|

|

|

8,952 |

|

|

|

|

| Shareholders' equity |

|

249,175 |

|

|

|

|

|

|

246,500 |

|

|

|

|

|

|

233,547 |

|

|

|

|

| Total liabilities and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| shareholders' equity |

$ |

2,879,967 |

|

|

|

|

|

$ |

2,800,774 |

|

|

|

|

|

$ |

2,495,024 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

|

$ |

19,509 |

|

|

|

|

|

$ |

19,288 |

|

|

|

|

|

$ |

18,796 |

|

|

| Net interest spread |

|

|

|

|

2.62 |

% |

|

|

|

|

|

2.69 |

% |

|

|

|

|

|

2.98 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin |

|

|

|

|

2.94 |

% |

|

|

|

|

|

3.00 |

% |

|

|

|

|

|

3.19 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Note: The above

tables are presented on a tax equivalent basis. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Republic First

Bancorp, Inc. |

|

|

|

|

|

|

|

|

|

|

|

| Average

Balances and Net Interest Income |

|

|

|

|

|

|

|

|

|

|

| (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

For the six months ended |

|

For the six months ended |

| (dollars in thousands) |

June 30, 2019 |

|

June 30, 2018 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Interest |

|

|

|

|

|

Interest |

|

|

| |

Average |

|

Income/ |

|

Yield/ |

|

Average |

|

Income/ |

|

Yield/ |

| |

Balance |

|

Expense |

|

Rate |

|

Balance |

|

Expense |

|

Rate |

| Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Federal funds sold and

other |

|

|

|

|

|

|

|

|

|

|

|

|

interest-earning assets |

$ |

70,729 |

|

$ |

854 |

|

2.43 |

% |

|

$ |

26,844 |

|

$ |

235 |

|

1.77 |

% |

| Securities |

|

1,076,496 |

|

|

14,604 |

|

2.71 |

% |

|

|

1,032,038 |

|

|

13,325 |

|

2.58 |

% |

| Loans receivable |

|

1,489,020 |

|

|

36,592 |

|

4.96 |

% |

|

|

1,269,875 |

|

|

29,922 |

|

4.75 |

% |

| Total interest-earning

assets |

|

2,636,245 |

|

|

52,050 |

|

3.98 |

% |

|

|

2,328,757 |

|

|

43,482 |

|

3.77 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Other assets |

|

204,344 |

|

|

|

|

|

|

128,045 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

$ |

2,840,589 |

|

|

|

|

|

$ |

2,456,802 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing

liabilities: |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Demand non

interest-bearing |

$ |

518,790 |

|

|

|

|

|

$ |

456,530 |

|

|

|

|

| Demand interest-bearing |

|

1,129,356 |

|

|

8,144 |

|

1.45 |

% |

|

|

868,832 |

|

|

2,806 |

|

0.65 |

% |

| Money market &

savings |

|

686,453 |

|

|

3,080 |

|

0.90 |

% |

|

|

693,508 |

|

|

2,146 |

|

0.62 |

% |

| Time deposits |

|

165,354 |

|

|

1,485 |

|

1.81 |

% |

|

|

127,740 |

|

|

735 |

|

1.16 |

% |

| Total deposits |

|

2,499,953 |

|

|

12,709 |

|

1.03 |

% |

|

|

2,146,610 |

|

|

5,687 |

|

0.53 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Total interest-bearing

deposits |

|

1,981,163 |

|

|

12,709 |

|

1.29 |

% |

|

|

1,690,080 |

|

|

5,687 |

|

0.68 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Other borrowings |

|

33,341 |

|

|

544 |

|

3.29 |

% |

|

|

71,360 |

|

|

758 |

|

2.14 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Total interest-bearing

liabilities |

|

2,014,504 |

|

|

13,253 |

|

1.33 |

% |

|

|

1,761,440 |

|

|

6,445 |

|

0.74 |

% |

| Total deposits and |

|

|

|

|

|

|

|

|

|

|

|

| other borrowings |

|

2,533,294 |

|

|

13,253 |

|

1.05 |

% |

|

|

2,217,970 |

|

|

6,445 |

|

0.59 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Non interest-bearing

liabilities |

|

59,505 |

|

|

|

|

|

|

9,171 |

|

|

|

|

| Shareholders' equity |

|

247,790 |

|

|

|

|

|

|

229,661 |

|

|

|

|

| Total liabilities and |

|

|

|

|

|

|

|

|

|

|

|

| shareholders' equity |

$ |

2,840,589 |

|

|

|

|

|

$ |

2,456,802 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

|

$ |

38,797 |

|

|

|

|

|

$ |

37,037 |

|

|

| Net interest spread |

|

|

|

|

2.65 |

% |

|

|

|

|

|

3.03 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin |

|

|

|

|

2.97 |

% |

|

|

|

|

|

3.21 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Note: The above

tables are presented on a tax equivalent basis. |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Republic First

Bancorp, Inc. |

|

|

|

|

|

|

|

|

|

|

|

| Summary of

Allowance for Loan Losses and Other Related Data |

|

|

|

|

|

|

|

|

| (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

Year |

|

|

|

|

| |

Three months ended |

|

ended |

|

Six months ended |

| |

|

June 30, |

|

|

|

March 31, |

|

|

|

June 30, |

|

|

|

Dec 31 |

|

|

|

June 30, |

|

|

|

June 30, |

|

|

(dollars in thousands) |

|

2019 |

|

|

|

2018 |

|

|

|

2018 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Balance at beginning of

period |

$ |

7,900 |

|

|

$ |

8,615 |

|

|

$ |

6,650 |

|

|

$ |

8,599 |

|

|

$ |

8,615 |

|

|

$ |

8,599 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Provision charged to operating

expense |

|

- |

|

|

|

300 |

|

|

|

800 |

|

|

|

2,300 |

|

|

|

300 |

|

|

|

1,200 |

|

| |

|

7,900 |

|

|

|

8,915 |

|

|

|

7,450 |

|

|

|

10,899 |

|

|

|

8,915 |

|

|

|

9,799 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Recoveries on loans

charged-off: |

|

|

|

|

|

|

|

|

|

|

|

| Commercial |

|

154 |

|

|

|

1 |

|

|

|

129 |

|

|

|

152 |

|

|

|

155 |

|

|

|

129 |

|

| Consumer |

|

3 |

|

|

|

1 |

|

|

|

1 |

|

|

|

2 |

|

|

|

4 |

|

|

|

1 |

|

| Total recoveries |

|

157 |

|

|

|

2 |

|

|

|

130 |

|

|

|

154 |

|

|

|

159 |

|

|

|

130 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Loans charged-off: |

|

|

|

|

|

|

|

|

|

|

|

| Commercial |

|

(1 |

) |

|

|

(929 |

) |

|

|

- |

|

|

|

(2,219 |

) |

|

|

(930 |

) |

|

|

(2,151 |

) |

| Consumer |

|

- |

|

|

|

(88 |

) |

|

|

(14 |

) |

|

|

(219 |

) |

|

|

(88 |

) |

|

|

(212 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Total charged-off |

|

(1 |

) |

|

|

(1,017 |

) |

|

|

(14 |

) |

|

|

(2,438 |

) |

|

|

(1,018 |

) |

|

|

(2,363 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net charge-offs |

|

156 |

|

|

|

(1,015 |

) |

|

|

116 |

|

|

|

(2,284 |

) |

|

|

(859 |

) |

|

|

(2,233 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Balance at end of period |

$ |

8,056 |

|

|

$ |

7,900 |

|

|

$ |

7,566 |

|

|

$ |

8,615 |

|

|

$ |

8,056 |

|

|

$ |

7,566 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net charge-offs as a

percentage of |

|

|

|

|

|

|

|

|

|

|

|

| average loans

outstanding |

|

(0.04 |

%) |

|

|

0.28 |

% |

|

|

(0.04 |

%) |

|

|

0.17 |

% |

|

|

0.12 |

% |

|

|

0.35 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Allowance for loan losses as a

percentage |

|

|

|

|

|

|

|

|

|

|

|

| of period-end

loans |

|

0.53 |

% |

|

|

0.53 |

% |

|

|

0.57 |

% |

|

|

0.60 |

% |

|

|

0.53 |

% |

|

|

0.57 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Republic First

Bancorp, Inc. |

|

|

|

|

|

|

|

|

|

| Summary of

Non-Performing Loans and Assets |

|

|

|

|

|

|

|

|

| (unaudited) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

June 30, |

|

March 31, |

|

December 31, |

|

September 30, |

|

June 30, |

|

(dollars in thousands) |

|

2019 |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2018 |

|

|

|

2018 |

|

| |

|

|

|

|

|

|

|

|

|

| Non-accrual loans: |

|

|

|

|

|

|

|

|

|

| Commercial real

estate |

$ |

7,545 |

|

|

$ |

8,096 |

|

|

$ |

9,463 |

|

|

$ |

12,661 |

|

|

$ |

13,297 |

|

| Consumer and other |

|

1,777 |

|

|

|

836 |

|

|

|

878 |

|

|

|

818 |

|

|

|

809 |

|

| Total non-accrual loans |

|

9,322 |

|

|

|

8,932 |

|

|

|

10,341 |

|

|

|

13,479 |

|

|

|

14,106 |

|

| |

|

|

|

|

|

|

|

|

|

| Loans past due 90 days or

more |

|

|

|

|

|

|

|

|

|

| and still accruing |

|

- |

|

|

|

1,744 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

| Total non-performing

loans |

|

9,322 |

|

|

|

10,676 |

|

|

|

10,341 |

|

|

|

13,479 |

|

|

|

14,106 |

|

| |

|

|

|

|

|

|

|

|

|

| Other real estate owned |

|

6,406 |

|

|

|

6,088 |

|

|

|

6,223 |

|

|

|

6,768 |

|

|

|

6,559 |

|

| |

|

|

|

|

|

|

|

|

|

| Total non-performing

assets |

$ |

15,728 |

|

|

$ |

16,764 |

|

|

$ |

16,564 |

|

|

$ |

20,247 |

|

|

$ |

20,665 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Non-performing loans to total

loans |

|

0.62 |

% |

|

|

0.72 |

% |

|

|

0.72 |

% |

|

|

0.98 |

% |

|

|

1.07 |

% |

| |

|

|

|

|

|

|

|

|

|

| Non-performing assets to total

assets |

|

0.53 |

% |

|

|

0.60 |

% |

|

|

0.60 |

% |

|

|

0.76 |

% |

|

|

0.81 |

% |

| |

|

|

|

|

|

|

|

|

|

| Non-performing loan

coverage |

|

86.42 |

% |

|

|

74.00 |

% |

|

|

83.31 |

% |

|

|

59.97 |

% |

|

|

53.64 |

% |

| |

|

|

|

|

|

|

|

|

|

| Allowance for loan losses as a

percentage |

|

|

|

|

|

|

|

|

|

| of total period-end

loans |

|

0.53 |

% |

|

|

0.53 |

% |

|

|

0.60 |

% |

|

|

0.59 |

% |

|

|

0.57 |

% |

| |

|

|

|

|

|

|

|

|

|

| Non-performing assets /

capital plus |

|

|

|

|

|

|

|

|

|

| allowance for loan

losses |

|

6.06 |

% |

|

|

6.54 |

% |

|

|

6.53 |

% |

|

|

8.30 |

% |

|

|

8.51 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

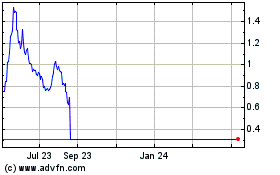

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jul 2023 to Jul 2024