PHILADELPHIA, April 25 /PRNewswire-FirstCall/ -- Republic First

Bancorp, Inc. (NASDAQ:FRBK), (the "Company") the holding company

for Republic First Bank (PA), today reported that first quarter

2008 earnings were impacted by an increased loan loss provision and

OREO charges which amounted to $4.4 million or $.41 per share on an

after-tax basis. Without those provisions and charges, earnings

would have been $1.6 million or $.15 per diluted share compared to

$2.1 million or $.20 per diluted share for the same quarter in

2007. The referenced loan loss provision and OREO charges reduced

net income to a negative $2.8 million or a loss of $.26 per share.

Harry D. Madonna, Chairman and Chief Executive Officer, stated, "As

we advised in past press releases and in regulatory filings, the

Bank experienced a significant increase in non-performing loans

during the second half of 2007. The non-performing loan numbers

were exacerbated by the problems in the general economy and the

deterioration of real estate values which represent a substantial

portion of the collateral for the non-performing loans. Management

has been working to take control of all collateral securing the

non-performing loans. This process includes working through

bankruptcy and foreclosure proceedings, as well as obtaining "deeds

in lieu" from borrowers. We also have been carefully reviewing our

entire loan portfolio for potential problems. "The first quarter

numbers reflect the Bank's progress in selling a number of the

properties collateralizing non-performing loans, moving collateral

into real estate owned, taking appropriate charge offs to reflect

present market value of all real estate owned, and making

significant additions to our allowance for loan losses, which

should mitigate further losses from such loans. We will continue

the process of selling the real estate owned and the assets which

collateralize the remaining non-performing loans." Total

shareholders' equity stood at $77.7 million with a book value per

share of $7.48 at March 31, 2008, based on outstanding common

shares of approximately 10.4 million. The Company continues to be

well capitalized. Republic First Bank (PA) is a full-service,

state-chartered commercial bank, whose deposits are insured by the

Federal Deposit Insurance Corporation (FDIC). The Bank provides

diversified financial products through its eleven offices located

in Abington, Ardmore, Bala Cynwyd, Plymouth Meeting, Media and

Philadelphia, Pennsylvania and Voorhees, New Jersey. The Company

may from time to time make written or oral "forward-looking

statements", including statements contained in this release and in

the Company's filings with the Securities and Exchange Commission.

These forward- looking statements include statements with respect

to the Company's beliefs, plans, objectives, goals, expectations,

anticipations, estimates, and intentions that are subject to

significant risks and uncertainties and are subject to change based

on various factors, many of which are beyond the Company's control.

The words "may", "could", "should", "would", "believe",

"anticipate", "estimate", "expect", "intend", "plan", and similar

expressions are intended to identify forward-looking statements.

All such statements are made in good faith by the Company pursuant

to the "safe harbor" provisions of the Private Securities

Litigation Reform Act of 1995. The Company does not undertake to

update any forward-looking statement, whether written or oral, that

may be made from time to time by or on behalf of the Company.

Attachment #1 Republic First Bancorp, Inc. Condensed Income

Statement (Dollar amounts in thousands except per share data)

(unaudited) Three Months Ended March 31, 2008 2007 Net Interest

Income $7,222 $7,565 Provision for Loan Losses 5,812 80

Non-interest Income 665 640 Non-interest Expenses 6,448 4,995

Provision for income taxes (1,595) 1,026 Net Income $(2,778) $2,104

Diluted EPS $(0.26) $0.20 Republic First Bancorp, Inc. Condensed

Balance Sheet (Dollar amounts in thousands) (unaudited) Assets

March 31, December 31, March 31, 2008 2007 2007 Federal Funds Sold

and Other Interest Bearing Cash $55,734 $62,229 $27,138 Investment

Securities 86,360 90,299 109,518 Commercial and Other Loans 797,501

821,549 832,442 Allowance for Loan Losses (10,156) (8,508) (8,355)

Other Assets 69,724 50,739 46,277 Total Assets $999,163 $1,016,308

$1,007,020 Liabilities and Shareholders' Equity: Transaction

Accounts $322,433 $357,920 $457,903 Time Deposit Accounts 427,099

422,935 356,225 FHLB Advances and Trust Preferred Securities

164,008 144,774 102,982 Other Liabilities 7,946 10,212 12,984

Shareholders' Equity 77,677 80,467 76,926 Total Liabilities and

Shareholders' Equity $999,163 $1,016,308 $1,007,020 Attachment #2

Republic First Bancorp, Inc. March 31, 2008 (unaudited) At or For

the Three Months Ended March 31, March 31, Financial Data: 2008

2007 Return on average assets -1.16 % 0.88 % Return on average

equity -13.90 % 11.26 % Share information: Book value per share

$7.48 $7.36 Actual shares outstanding at period end, net of

treasury shares (416,303) 10,384,000 10,446,000 Average diluted

shares outstanding 10,504,000 10,758,000 Attachment #3 Republic

First Bancorp, Inc. March 31, 2008 (Dollars in thousands)

(unaudited) Credit Quality Ratios: March 31, December 31, March 31,

2008 2007 2007 Non-accrual and loans accruing, but past due 90 days

or more $3,067 $22,280 $9,089 Restructured loans - - - Total

non-performing loans 3,067 22,280 9,089 Other real estate owned

16,378 3,681 572 Total non-performing assets $19,445 $25,961 $9,661

Three Twelve Three Months Months Months Ended Ended Ended March 31,

December 31, March 31, 2008 2007 2007 Allowance for Loan Losses

Balance at beginning of period $8,508 $8,058 $8,058 Charge-offs:

Commercial and construction 4,344 1,503 - Tax refund loans - - -

Consumer 8 3 - Total charge-offs 4,352 1,506 - Recoveries:

Commercial and construction 117 81 9 Tax refund loans 69 283 207

Consumer 2 2 1 Total recoveries 188 366 217 Net charge-offs

(recoveries) 4,164 1,140 (217) Provision for loan losses 5,812

1,590 80 Balance at end of period $10,156 $8,508 $8,355

Non-performing loans as a percentage of total loans 0.38% 2.71%

1.09% Nonperforming assets as a percentage of total assets 1.95%

2.55% 0.96% Allowance for loan losses to total loans 1.27% 1.04%

1.00% Allowance for loan losses to total non-performing loans

331.14% 38.19% 91.92% Attachment #4 Republic First Bancorp, Inc.

March 31, 2008 (Dollars in thousands) (unaudited) Quarter-to-Date

Average Balance Sheet Three months ended Three months ended March

31, 2008 March 31, 2007 Interest-Earning Average Average Assets:

Average Yield/ Average Yield/ Balance Interest Cost Balance

Interest Cost Commercial and other loans $817,702 $13,453 6.62 %

$798,716 $15,300 7.77 % Investment securities 87,545 1,252 5.72

109,568 1,542 5.63 Federal funds sold 12,271 96 3.15 19,767 235

4.82 Total interest- earning assets 917,518 14,801 6.49 928,051

17,077 7.46 Other assets 42,977 37,416 Total assets $960,495

$14,801 $965,467 $17,077 Interest-Bearing Liabilities:

Interest-bearing deposits $633,604 $6,253 3.97 % $642,386 $7,393

4.67 % Borrowed funds 151,552 1,326 3.52 155,348 2,119 5.53

Interest-bearing liabilities 785,156 7,579 3.88 797,734 9,512 4.84

Non-interest and interest-bearing funding 868,549 7,579 3.51

875,553 9,512 4.41 Other liabilities: 11,558 14,118 Total

liabilities 880,107 889,671 Shareholders' equity 80,388 75,796

Total liabilities & shareholders' equity $960,495 $965,467 Net

interest income $7,222 $7,565 Net interest margin 3.17 % 3.31 %

DATASOURCE: Republic First Bancorp, Inc. CONTACT: Paul Frenkiel,

CFO of Republic First Bancorp, Inc., +1-215-735-4422, ext. 5255

Copyright

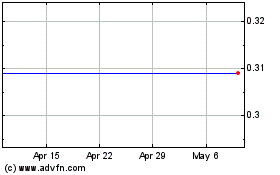

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jun 2024 to Jul 2024

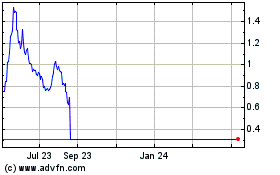

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jul 2023 to Jul 2024