Repligen Corporation (NASDAQ:RGEN), a life sciences company focused

on bioprocessing technology leadership, today reported financial

results for its second quarter of 2019. Provided in this press

release are financial highlights for the three- and six-month

periods ended June 30, 2019, updated financial guidance for the

fiscal year 2019, and access information for today's webcast and

conference call.

Tony J. Hunt, President and Chief Executive Officer said, “We

are very pleased with the company’s performance during the second

quarter, which included record revenue and 46% organic

growth. In May, we closed on our acquisition of C

Technologies and then raised approximately $600M in two follow-on

financings, adding $290M to our balance sheet net of the C

Technologies acquisition and the redemption of the 2016 Notes due

2021. With strong market momentum and a healthy balance sheet, we

are well positioned to execute on our long-term growth strategy and

we remain very confident about our ability to grow and continue to

differentiate ourselves in the bioprocessing arena.”

Second Quarter 2019

Highlights

- Revenue increased by 48% year-over-year, and 46% organically,

to a record $70.7 million

- GAAP income from operations increased 670 bps to 15.6% of

revenue

- Adjusted (non-GAAP) income from operations increased 1,220 bps

to 28.4% of revenue

- GAAP fully-diluted EPS increased to $0.17 compared to $0.06 for

the second quarter of 2018

- Adjusted (non-GAAP) fully-diluted EPS increased to $0.31

compared to $0.14 for the second quarter of 2018

First Half 2019 Highlights

- Revenue increased by 42% year-over-year, and 42% organically,

to $131.3 million

- GAAP income from operations increased 580 bps to 16.9% of

revenue

- Adjusted (non-GAAP) income from operations increased 870 bps to

27.2% of revenue

- GAAP fully-diluted EPS increased to $0.34 compared to $0.14 for

the first half of 2018

- Adjusted (non-GAAP) fully-diluted EPS increased to $0.59

compared to $0.29 for the first half of 2018

Financial Details for the Second Quarter

and First Half of

2019 REVENUE

- Total revenue for the second quarter of 2019 increased to $70.7

million compared to $47.7 million for the second quarter of 2018, a

year-over-year gain of 48% as reported and 46% constant

currency.

- Total revenue for the first half of 2019 increased to $131.3

million compared to $92.6 million for the first half of 2018, a

year-over-year gain of 42% as reported and at constant

currency.

GROSS PROFIT and GROSS MARGIN

- Gross profit (GAAP) for the second quarter of 2019 was $40.0

million, a year-over-year increase of $13.3 million or 50%, and

representing 56.6% gross margin. Adjusted gross profit (non-GAAP)

for the second quarter of 2019 was $41.4 million, a year-over-year

increase of $14.6 million, or 54%, and representing 58.6% gross

margin.

- Gross profit (GAAP) for the first half of 2019 was $73.8

million, a year-over-year increase of $22.0 million or 42%, and

representing 56.2% gross margin. Adjusted gross profit (non-GAAP)

for the first half of 2019 was $75.4 million, a year-over-year

increase of $23.1 million, or 44%, and representing 57.4% gross

margin.

OPERATING INCOME

- Operating income (GAAP) for the second quarter of 2019 was

$11.1 million, which includes the impact of approximately $4.8

million in deal-related costs associated primarily with our

acquisition of C Technologies. This represents an increase of $6.8

million from the second quarter of 2018. Adjusted operating income

(non-GAAP) for the second quarter of 2019 was $20.1 million, an

increase of $12.3 million from the second quarter of 2018.

- Operating income (GAAP) for the first half of 2019 was $22.2

million, which includes the impact of approximately $6.1 million in

deal-related costs associated primarily with our acquisition of C

Technologies. This represents an increase of $12.0 million from the

first half of 2018. Adjusted operating income (non-GAAP) for the

first half of 2019 was $35.7 million, an increase of $18.6 million

from the first half of 2018.

NET INCOME

- Net income (GAAP) for the second quarter of 2019 was $8.1

million, an increase of $5.4 million from $2.7 million for the

second quarter of 2018. Adjusted net income (non-GAAP) for the

second quarter of 2019 was $15.3 million, an increase of $9.1

million from $6.2 million for the second quarter of 2018.

- Net income (GAAP) for the first half of 2019 was $16.1 million,

an increase of $10.0 million from $6.2 million for the first half

of 2018. Adjusted net income (non-GAAP) for the first half of 2019

was $28.4 million, an increase of $15.4 million from $13.0 million

for the first half of 2018.

EARNINGS PER SHARE

- Earnings per share (GAAP) for the second quarter of 2019

increased to $0.17 on a fully diluted basis, compared to $0.06 for

the second quarter of 2018. Adjusted EPS (non-GAAP) for the second

quarter of 2019 increased to $0.31 per fully diluted share,

compared to $0.14 for the 2018 period.

- Earnings per share (GAAP) for the first half of 2019 increased

to $0.34 on a fully diluted basis, compared to $0.14 for the first

half of 2018. Adjusted EPS (non-GAAP) for the first half of 2019

increased to $0.59 per fully diluted share, compared to $0.29 for

the 2018 period.

EBITDA

- EBITDA, a non-GAAP financial measure, for the second quarter of

2019 was $15.2 million, an increase of 79% compared to $8.5 million

for the second quarter of 2018. Adjusted EBITDA for the second

quarter of 2019 was $21.7 million, an increase of 133% compared to

$9.3 million for the second quarter of 2018.

- EBITDA for the first half of 2019 was $30.9 million, an

increase of 68% compared to $18.5 million for the second quarter of

2018. Adjusted EBITDA for the first half of 2019 was $39.2 million,

an increase of 96% compared to $20.0 million for the second quarter

of 2018.

CASH

- Our cash, cash equivalents and marketable securities at June

30, 2019 were $208.9 million, an increase of $15.1 million from

$193.8 million at December 31, 2018.

All reconciliations of GAAP to adjusted

(non-GAAP) figures above, as well as EBITDA to adjusted EBITDA, are

detailed in the reconciliation tables included later in this press

release.

Financial Guidance for 2019

Our financial guidance for the fiscal year 2019 is based on

expectations for our existing business and includes the financial

impact of our acquisition of C Technologies (which closed on May

31, 2019). This guidance excludes the impact of potential

additional acquisitions and future fluctuations in foreign currency

exchange rates. We have not previously included in our

guidance the impact of C Technologies, which we expect to

contribute $16-$17 million in revenue and $0.06-$0.07 adjusted

earnings per fully diluted share over seven months of Repligen

ownership in 2019.

FISCAL YEAR 2019 GUIDANCE:

- Total revenue is projected to be in the range of $264-$268

million, an increase from our previous guidance of $235-$241

million. Our current guidance reflects overall revenue growth of

36%-38%, and organic revenue growth of 29%-31%.

- Gross margin is expected to be 55%- 56% basis, compared to our

previous guidance of 56%-57%. Adjusted gross margin is expected to

be 56%-57%, consistent with our previous guidance.

- Income from operations is expected to be in the range of

$33-$35 million on a GAAP basis, which includes the impact of $12.3

million in deal-related costs associated primarily with our

acquisition of C Technologies. This compares to our previous

guidance of $39-$42 million. Adjusted (non-GAAP) income from

operations is expected to be in the range of $60-$62 million, an

increase from our previous guidance of $52-$55 million.

- Net income is expected to be in the range of $17.0-$19.0

million on a GAAP basis, compared to our previous guidance of

$24.5-$27.5 million. Adjusted (non-GAAP) net income is expected to

be in the range of $47-$49 million, an increase from our previous

guidance of $41-$44 million. Our current guidance reflects a higher

expected tax rate of 24% on adjusted pre-tax net income compared to

our previous guidance of 20%.

- Fully diluted GAAP EPS is expected to be in the range of

$0.34-$0.38, compared to our previous guidance of

$0.50-$0.56. Adjusted (non-GAAP) fully diluted EPS is

expected to be in the range of $0.94-$0.98, an increase from our

previous guidance of $0.84-$0.90. Both GAAP and adjusted EPS

guidance include the impact of the equity component of our July

offering, and shares issued in conjunction with our acquisition of

C Technologies, which resulted in a weighted average addition of

2.6 million shares outstanding.

Our non-GAAP guidance for the fiscal year 2019

excludes the following items:

- $12.3 million estimated acquisition and integration expenses

associated with our acquisitions of Spectrum Inc. and C

Technologies.

- Inventory step-up charges of $1.5 million related to the

acquisition of C Technologies.

- $13.5 million estimated intangible amortization expense; $0.6

million in cost of product revenue and $12.9 million in

G&A.

- $7.4 million of non-cash interest expense (Other income

(expense)) related to our debt financings.

- $5.7 million of expense related to the extinguishment of our

2016 Notes due 2021.

Our non-GAAP guidance for the fiscal year 2019

includes:

- An income tax increase of $10.6 million, representing the tax

impact of acquisition costs and intangible amortization.

All reconciliations of GAAP to adjusted

(non-GAAP) guidance are detailed in the tables included later in

this press release.

Conference CallRepligen will host a conference

call and webcast today, August 1, 2019, at 8:30 a.m. EDT, to

discuss second quarter of 2019 financial results and corporate

developments. The conference call will be accessible by dialing

toll-free (844) 701-1063 for domestic callers or (412) 317-5487 for

international callers. No passcode is required for the live call.

In addition, a webcast will be accessible via the Investor

Relations section of the Company’s website. Both the conference

call and webcast will be archived for a period of time following

the live event. The replay dial-in numbers are (877) 344-7529 from

the U.S., (855) 669-9658 from Canada and (412) 317-0088 for

international callers. Replay listeners must provide the passcode

10133911.

Non-GAAP Measures of Financial Performance To

supplement our financial statements, which are presented on the

basis of U.S. generally accepted accounting principles (GAAP), the

following non-GAAP measures of financial performance are included

in this release: revenue growth rate at constant currency, adjusted

gross profit and adjusted gross margin, adjusted income from

operations and adjusted operating margin, earnings before interest,

taxes, depreciation and amortization (EBITDA), adjusted EBITDA,

adjusted net income, adjusted earnings per diluted share

(EPS), adjusted research & development expense, adjusted

selling, general and administrative expense and income tax expense.

The Company provides organic revenue growth rates in constant

currency to exclude the impact of both foreign currency

translation, and the impact of acquisition revenue for current year

periods that have no prior year comparable, in order to facilitate

a comparison of its current revenue performance to its past revenue

performance. The Company provides revenue growth rates in constant

currency in order to facilitate a comparison of its current revenue

performance to its past revenue performance. To calculate revenue

growth rates in constant currency, the Company converts actual net

sales from local currency to U.S. dollars using constant foreign

currency exchange rates in the current and prior period.

The Company’s non-GAAP financial results and/or non-GAAP

guidance exclude the impact of: acquisition and integration costs

related to the Company’s acquisitions of TangenX Technology

Corporation, Spectrum Lifesciences, LLC (formerly known as

Spectrum, Inc.), and C Technologies Inc.; inventory step-up

charges; intangible amortization costs; non-cash interest expense;

the impact on tax of intangible amortization and acquisition costs;

and, in the case of EBITDA, cash interest expense related to the

Company’s convertible debt. These costs are excluded because

management believes that such expenses do not have a direct

correlation to future business operations, nor do the resulting

charges recorded accurately reflect the performance of our ongoing

operations for the period in which such charges are recorded.

A reconciliation of GAAP to adjusted non-GAAP financial measures

is included as an attachment to this press release. When analyzing

the Company’s operating performance and guidance investors should

not consider non-GAAP measures as substitutable for the comparable

financial measures prepared in accordance with GAAP.

About Repligen CorporationRepligen Corporation

is a global bioprocessing company that develops and commercializes

highly innovative products that deliver cost and process

efficiencies to biological drug manufacturers worldwide. Repligen’s

corporate headquarters are in Waltham, MA (USA), with additional

administrative and manufacturing operations in Marlborough, MA;

Bridgewater, NJ; Rancho Dominguez, CA; Lund, Sweden; Breda, The

Netherlands and Ravensburg, Germany.

The following constitutes a “Safe Harbor” statement under the

Private Securities Litigation Reform Act of 1995: This press

release contains forward-looking statements, which are made

pursuant to the safe harbor provisions of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Investors are

cautioned that statements in this press release which are not

strictly historical statements, including, without limitation,

express or implied statements or guidance regarding current or

future financial performance and position, including cash and

investment position, demand in the markets in which we operate, the

expected performance of our business, the expected performance of

the C Technologies business, the expected performance and success

of our strategic partnerships, management’s strategy, plans and

objectives for future operations or acquisitions, product

development and sales, selling, general and administrative

expenditures, intellectual property, development and manufacturing

plans, availability of materials and product and adequacy of

capital resources and financing plans constitute forward-looking

statements identified by words like “believe,” “expect,” “may,”

“will,” “should,” “seek,” “anticipate,” or “could” and similar

expressions. Such forward-looking statements are subject to a

number of risks and uncertainties that could cause actual results

to differ materially from those anticipated, including, without

limitation, risks associated with: our ability to successfully grow

our bioprocessing business, including as a result of acquisition,

commercialization or partnership opportunities; our ability to

successfully integrate any acquisitions, our ability to develop and

commercialize products and the market acceptance of our products;

our ability to integrate the C Technologies business successfully

into our business and achieve the expected benefits of the

acquisition; reduced demand for our products that adversely impacts

our future revenues, cash flows, results of operations and

financial condition; our ability to compete with larger, better

financed bioprocessing, pharmaceutical and biotechnology companies;

our compliance with all U.S. Food and Drug Administration and EMEA

regulations; our volatile stock price; and other risks detailed in

Repligen’s most recent Annual Report on Form 10-K on file with the

Securities and Exchange Commission and the other reports that

Repligen periodically files with the Securities and Exchange

Commission. Actual results may differ materially from those

Repligen contemplated by these forward-looking statements. These

forward looking statements reflect management’s current views and

Repligen does not undertake to update any of these forward-looking

statements to reflect a change in its views or events or

circumstances that occur after the date hereof except as required

by law.

Repligen Contact: Sondra S. NewmanGlobal

Head of Investor Relations(781) 419-1881investors@repligen.com

|

|

|

REPLIGEN CORPORATION |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(Unaudited, amounts in thousands, except share and per

share data) |

|

|

|

|

|

|

|

|

|

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

Revenue: |

|

|

|

|

|

|

|

|

Product revenue |

$ |

70,670 |

|

|

$ |

47,743 |

|

|

$ |

131,282 |

|

|

$ |

92,542 |

|

|

Royalty and other revenue |

|

22 |

|

|

|

(12 |

) |

|

|

44 |

|

|

|

19 |

|

|

Total revenue |

|

70,692 |

|

|

|

47,731 |

|

|

|

131,326 |

|

|

|

92,561 |

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

Cost of product revenue |

|

30,708 |

|

|

|

21,088 |

|

|

|

57,553 |

|

|

|

40,756 |

|

|

Research and development |

|

5,231 |

|

|

|

5,780 |

|

|

|

8,851 |

|

|

|

9,068 |

|

|

Selling, general and administrative |

|

23,699 |

|

|

|

16,590 |

|

|

|

42,697 |

|

|

|

32,488 |

|

|

|

|

59,638 |

|

|

|

43,458 |

|

|

|

109,101 |

|

|

|

82,312 |

|

|

Income from operations |

|

11,054 |

|

|

|

4,273 |

|

|

|

22,225 |

|

|

|

10,249 |

|

|

Investment income |

|

1,005 |

|

|

|

512 |

|

|

|

1,718 |

|

|

|

693 |

|

|

Interest expense |

|

(1,743 |

) |

|

|

(1,669 |

) |

|

|

(3,469 |

) |

|

|

(3,321 |

) |

|

Other income, net |

|

(697 |

) |

|

|

251 |

|

|

|

(339 |

) |

|

|

321 |

|

|

Income before income taxes |

|

9,619 |

|

|

|

3,367 |

|

|

|

20,135 |

|

|

|

7,942 |

|

|

Income tax provision |

|

1,524 |

|

|

|

629 |

|

|

|

3,987 |

|

|

|

1,757 |

|

|

Net income |

$ |

8,095 |

|

|

$ |

2,738 |

|

|

$ |

16,148 |

|

|

$ |

6,185 |

|

|

Earnings per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.17 |

|

|

$ |

0.06 |

|

|

$ |

0.36 |

|

|

$ |

0.14 |

|

|

Diluted |

$ |

0.17 |

|

|

$ |

0.06 |

|

|

$ |

0.34 |

|

|

$ |

0.14 |

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

46,367,187 |

|

|

|

43,743,356 |

|

|

|

45,174,134 |

|

|

|

43,682,650 |

|

|

Diluted |

|

49,055,814 |

|

|

|

45,015,720 |

|

|

|

47,691,772 |

|

|

|

44,694,745 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet Data: |

June 30,2019 |

|

December 31,2018 |

|

|

|

|

|

Cash, cash equivalents and marketable securities |

$ |

208,888 |

|

|

$ |

193,822 |

|

|

|

|

|

|

Working capital |

|

175,581 |

|

|

|

145,897 |

|

|

|

|

|

|

Total assets |

|

1,068,267 |

|

|

|

774,621 |

|

|

|

|

|

|

Long-term obligations |

|

48,386 |

|

|

|

29,211 |

|

|

|

|

|

|

Accumulated earnings (deficit) |

|

580 |

|

|

|

(15,568 |

) |

|

|

|

|

|

Stockholders' equity |

|

878,968 |

|

|

|

615,568 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REPLIGEN CORPORATION |

|

RECONCILIATION OF GAAP INCOME FROM OPERATIONS TONON-GAAP

(ADJUSTED) INCOME FROM OPERATIONS |

|

(Unaudited, amounts in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

GAAP INCOME FROM OPERATIONS |

$ |

11,054 |

|

|

$ |

4,273 |

|

|

$ |

22,225 |

|

|

$ |

10,249 |

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTMENTS TO INCOME FROM OPERATIONS: |

|

|

|

|

|

|

|

|

|

Acquisition and integration costs |

|

4,822 |

|

|

|

853 |

|

|

|

6,621 |

|

|

|

1,508 |

|

|

|

Intangible amortization |

|

3,051 |

|

|

|

2,634 |

|

|

|

5,662 |

|

|

|

5,298 |

|

|

|

Inventory step-up charges |

|

1,169 |

|

|

|

- |

|

|

|

1,169 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTED INCOME FROM OPERATIONS |

$ |

20,096 |

|

|

$ |

7,760 |

|

|

$ |

35,677 |

|

|

$ |

17,055 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REPLIGEN CORPORATION |

|

RECONCILIATION OF GAAP NET INCOME TO NON-GAAP (ADJUSTED)

NET INCOME |

|

(Unaudited, amounts in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

GAAP NET INCOME |

$ |

8,095 |

|

|

$ |

2,738 |

|

|

$ |

16,148 |

|

|

$ |

6,185 |

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTMENTS TO NET INCOME: |

|

|

|

|

|

|

|

|

|

Acquisition and integration costs |

|

5,322 |

|

|

|

853 |

|

|

|

7,121 |

|

|

|

1,508 |

|

|

|

Inventory step-up charges |

|

1,169 |

|

|

|

- |

|

|

|

1,169 |

|

|

|

- |

|

|

|

Intangible amortization |

|

3,051 |

|

|

|

2,634 |

|

|

|

5,662 |

|

|

|

5,298 |

|

|

|

Non-cash interest expense |

|

1,124 |

|

|

|

1,053 |

|

|

|

2,231 |

|

|

|

2,089 |

|

|

|

Tax effect of intangible amortization and acquisition costs(1) |

|

(3,444 |

) |

|

|

(1,076 |

) |

|

|

(3,961 |

) |

|

|

(2,108 |

) |

|

|

|

|

|

|

|

|

|

|

|

ADJUSTED NET INCOME |

$ |

15,317 |

|

|

$ |

6,202 |

|

|

$ |

28,370 |

|

|

$ |

12,972 |

|

|

|

|

|

|

|

|

|

|

|

|

(1 |

) |

Effective as of the quarter ended June 30, 2019, the Company

changed its methodology for calculating its non-GAAP financial

measures to reflect certain tax effects related to acquisition and

integration costs, inventory step-up charges, intangible

amortization and non-cash interest expense. Accordingly, the

non-GAAP financial measures for the three and six months ended June

30, 2018 have been updated to be consistent with the methodology

used to calculate such measures for the current periods. |

|

|

|

|

|

REPLIGEN CORPORATION |

|

RECONCILIATION OF GAAP NET INCOME PER SHARE TONON-GAAP

(ADJUSTED) NET INCOME PER SHARE |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

GAAP NET INCOME PER SHARE - DILUTED |

$ |

0.17 |

|

|

$ |

0.06 |

|

|

$ |

0.34 |

|

|

$ |

0.14 |

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTMENTS TO NET INCOME PER SHARE - DILUTED: |

|

|

|

|

|

|

|

|

|

Acquisition and integration costs |

|

0.11 |

|

|

|

0.02 |

|

|

|

0.15 |

|

|

$ |

0.03 |

|

|

|

Inventory step-up charges |

|

0.02 |

|

|

|

- |

|

|

|

0.02 |

|

|

$ |

- |

|

|

|

Intangible amortization |

|

0.06 |

|

|

|

0.06 |

|

|

|

0.12 |

|

|

$ |

0.12 |

|

|

|

Non-cash interest expense |

|

0.02 |

|

|

|

0.02 |

|

|

|

0.05 |

|

|

$ |

0.04 |

|

|

|

Tax effect of intangible amortization and acquisition costs(1) |

|

(0.07 |

) |

|

|

(0.02 |

) |

|

|

(0.09 |

) |

|

$ |

(0.05 |

) |

|

|

|

|

|

|

|

|

|

|

|

ADJUSTED NET INCOME PER SHARE - DILUTED |

|

0.31 |

|

|

$ |

0.14 |

|

|

$ |

0.59 |

|

|

$ |

0.29 |

|

|

|

|

|

|

|

|

|

|

|

|

Totals may not add due to rounding. |

|

|

|

|

|

|

|

|

(1 |

) |

Effective as of the quarter ended June 30, 2019, the Company

changed its methodology for calculating its non-GAAP financial

measures to reflect certain tax effects related to acquisition and

integration costs, inventory step-up charges, intangible

amortization and non-cash interest expense. Accordingly, the

non-GAAP financial measures for the three and six months ended June

30, 2018 have been updated to be consistent with the methodology

used to calculate such measures for the current periods. |

|

|

|

|

|

|

|

|

|

|

|

|

|

REPLIGEN CORPORATION |

|

RECONCILIATION OF GAAP NET INCOME TO ADJUSTED

EBITDA |

|

(Unaudited, amounts in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

GAAP NET INCOME |

$ |

8,095 |

|

|

$ |

2,738 |

|

|

$ |

16,148 |

|

|

$ |

6,185 |

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTMENTS: |

|

|

|

|

|

|

|

|

|

Investment Income |

|

(1,005 |

) |

|

|

(512 |

) |

|

|

(1,718 |

) |

|

|

(693 |

) |

|

|

Interest Expense |

|

1,743 |

|

|

|

1,669 |

|

|

|

3,469 |

|

|

|

3,321 |

|

|

|

Tax Provision |

|

1,524 |

|

|

|

629 |

|

|

|

3,987 |

|

|

|

1,757 |

|

|

|

Depreciation |

|

1,762 |

|

|

|

1,314 |

|

|

|

3,337 |

|

|

|

2,598 |

|

|

|

Amortization(1) |

|

3,079 |

|

|

|

2,634 |

|

|

|

5,716 |

|

|

|

5,298 |

|

|

EBITDA |

|

15,198 |

|

|

|

8,472 |

|

|

|

30,939 |

|

|

|

18,466 |

|

|

|

|

|

|

|

|

|

|

|

|

OTHER ADJUSTMENTS: |

|

|

|

|

|

|

|

|

|

Acquisition and integration costs |

|

5,322 |

|

|

|

853 |

|

|

|

7,121 |

|

|

|

1,508 |

|

|

|

Inventory step-up charges |

|

1,169 |

|

|

|

- |

|

|

|

1,169 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTED EBITDA |

$ |

21,689 |

|

|

$ |

9,325 |

|

|

$ |

39,229 |

|

|

$ |

19,974 |

|

|

|

|

|

|

|

|

|

|

|

|

(1 |

) |

Fiscal 2019 includes amortization of milestone payments in

accordance with GAAP of $28 and $56 for the three- and six-month

periods, respectively. |

|

|

|

|

|

|

|

|

|

|

|

|

|

REPLIGEN CORPORATION |

|

RECONCILIATION OF GAAP COST OF SALES TO NON-GAAP (ADJUSTED)

COST OF SALES |

|

(Unaudited, amounts in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

GAAP COST OF SALES |

$ |

30,708 |

|

|

$ |

21,088 |

|

|

$ |

57,553 |

|

|

$ |

40,756 |

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTMENT TO COST OF SALES: |

|

|

|

|

|

|

|

|

|

Acquisition and integration costs |

|

(133 |

) |

|

|

(64 |

) |

|

|

(151 |

) |

|

|

(110 |

) |

|

|

Inventory step-up charges |

|

(1,169 |

) |

|

|

- |

|

|

|

(1,169 |

) |

|

|

- |

|

|

|

Intangible amortization |

|

(130 |

) |

|

|

(142 |

) |

|

|

(264 |

) |

|

|

(293 |

) |

|

|

|

|

|

|

|

|

|

|

|

ADJUSTED COST OF SALES |

$ |

29,276 |

|

|

$ |

20,882 |

|

|

$ |

55,969 |

|

|

$ |

40,353 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REPLIGEN CORPORATION |

|

RECONCILIATION OF GAAP R&D EXPENSE TO NON-GAAP

(ADJUSTED) R&D EXPENSE |

|

(Unaudited, amounts in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

GAAP R&D EXPENSE |

$ |

5,231 |

|

|

$ |

5,780 |

|

|

$ |

8,851 |

|

|

$ |

9,068 |

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTMENTS TO R&D EXPENSE: |

|

|

|

|

|

|

|

|

|

Acquisition and integration costs |

|

(100 |

) |

|

|

(55 |

) |

|

|

(127 |

) |

|

|

(73 |

) |

|

|

|

|

|

|

|

|

|

|

|

ADJUSTED R&D EXPENSE |

$ |

5,131 |

|

|

$ |

5,725 |

|

|

$ |

8,724 |

|

|

$ |

8,995 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REPLIGEN CORPORATION |

|

RECONCILIATION OF GAAP SG&A EXPENSE TO NON-GAAP

(ADJUSTED) SG&A EXPENSE |

|

(Unaudited, amounts in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

GAAP SG&A EXPENSE |

$ |

23,699 |

|

|

$ |

16,590 |

|

|

$ |

42,697 |

|

|

$ |

32,488 |

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTMENTS TO SG&A EXPENSE: |

|

|

|

|

|

|

|

|

|

Acquisition and integration costs |

|

(4,590 |

) |

|

|

(734 |

) |

|

|

(6,343 |

) |

|

|

(1,325 |

) |

|

|

Intangible amortization |

|

(2,921 |

) |

|

|

(2,492 |

) |

|

|

(5,398 |

) |

|

|

(5,005 |

) |

|

|

|

|

|

|

|

|

|

|

|

ADJUSTED SG&A EXPENSE |

$ |

16,188 |

|

|

$ |

13,364 |

|

|

$ |

30,956 |

|

|

$ |

26,158 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REPLIGEN CORPORATION |

|

RECONCILIATION OF GAAP NET INCOME GUIDANCE TO ADJUSTED

(NON-GAAP NET INCOME GUIDANCE) |

|

|

|

|

|

|

|

(in thousands) |

Twelve months ending December 31, 2019 |

|

|

|

Low End |

|

High End |

|

GUIDANCE ON NET INCOME |

$ |

17,000 |

|

|

$ |

19,000 |

|

|

ADJUSTMENTS TO GUIDANCE ON NET INCOME: |

|

|

|

|

|

Acquisition and integration costs |

|

12,284 |

|

|

|

12,284 |

|

|

|

Inventory step-up charges |

|

1,483 |

|

|

|

1,483 |

|

|

|

Anticipated pre-tax amortization of |

|

|

|

|

|

acquisition-related intangible assets |

|

13,469 |

|

|

|

13,469 |

|

|

|

Non-cash interest expense |

|

7,365 |

|

|

|

7,365 |

|

|

|

Loss on debt extinguishment |

|

5,666 |

|

|

|

5,666 |

|

|

|

Tax effect of intangible amortization and integration |

|

(10,645 |

) |

|

|

(10,645 |

) |

|

|

Guidance rounding adjustment |

|

378 |

|

|

|

378 |

|

|

GUIDANCE ON ADJUSTED NET INCOME |

$ |

47,000 |

|

|

$ |

49,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REPLIGEN CORPORATION |

|

RECONCILIATION OF GAAP NET INCOME PER SHARE GUIDANCE

TO |

|

ADJUSTED (NON-GAAP) NET INCOME PER SHARE

GUIDANCE |

|

|

|

|

|

|

|

|

|

Twelve months ending December 31, 2019 |

|

|

|

Low End |

|

High End |

|

GUIDANCE ON NET INCOME PER SHARE - DILUTED |

$ |

0.34 |

|

|

$ |

0.38 |

|

|

ADJUSTMENTS TO GUIDANCE ON NET INCOME PER SHARE - DILUTED: |

|

|

|

|

Acquisition and integration costs |

$ |

0.25 |

|

|

$ |

0.25 |

|

|

|

Inventory step-up charges |

$ |

0.03 |

|

|

$ |

0.03 |

|

|

|

Anticipated pre-tax amortization of |

|

|

|

|

|

acquisition-related intangible assets |

$ |

0.27 |

|

|

$ |

0.27 |

|

|

|

Non-cash interest expense |

$ |

0.15 |

|

|

$ |

0.15 |

|

|

|

Loss on debt extinguishment |

$ |

0.11 |

|

|

$ |

0.11 |

|

|

|

Tax effect of intangible amortization and integration |

$ |

(0.21 |

) |

|

$ |

(0.21 |

) |

|

|

Guidance rounding adjustment |

$ |

0.01 |

|

|

$ |

0.01 |

|

|

GUIDANCE ON ADJUSTED NET INCOME PER SHARE - DILUTED |

|

$ |

0.98 |

|

|

|

|

|

|

|

|

Totals may not add due to rounding. |

|

|

|

|

|

|

|

|

|

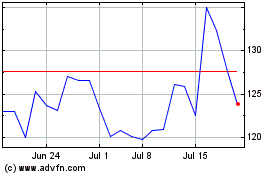

Repligen (NASDAQ:RGEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Repligen (NASDAQ:RGEN)

Historical Stock Chart

From Apr 2023 to Apr 2024