Reliance Global Group, Inc. (Nasdaq:

RELI) (“Reliance”, “we” or the “Company”) today provided a

business update and reported financial results for the three and

six months ended June 30, 2024.

Ezra Beyman, Reliance’s Chairman and Chief

Executive Officer, commented, "We are pleased to report consistent

and sustained revenue levels for the first three and six months

ended June 30, 2024, with revenues of $3.2 million and $7.3

million, which represent 1% and 3% growth from the same periods in

the prior year, respectively. We’ve also been decreasing our

operating expenses with the Company. As a result, we’ve seen 13%

efficiencies for the second quarter of 2024 over the same period in

2023, and our $1.5 million net loss from continuing operations for

the second quarter has improved by 62% from the same period in the

prior year. AEBITDA, our key non-GAAP metric, came in at a nominal

loss of $178,000, or just under 6% of revenues, for the second

quarter of 2024.

"Building on the Company's strong performance in

the first quarter, the second quarter of 2024 continued our trend

of sustained organic growth. Throughout the quarter, we continued

to emphasize our foundational ‘OneFirm’ strategy, uniting our nine

owned and operated agencies nationwide to function as one cohesive

business unit. OneFirm has provided the Company with access to

higher commission tiers and has created broad cross-selling

opportunities which has, and we believe will continue to, drive

material revenue growth. Additionally, cross-collaboration is a key

OneFirm initiative and spotlights cross-utilization of our

exceptional talent employed across our organization, in addition to

promoting enhanced data access and sharing and the segmentation of

specialized support services. As part of OneFirm, we continue to

consolidate our vendor relationships and contracts, thereby

reducing our overall operating spend, as is illustrated in our

second quarter financial results.

“The pending acquisition of Spetner Associates,

which we now believe will be even more impactful than we initially

expected, continues to progress smoothly toward an anticipated

closing in the second half of 2024. Since first announcing our

acquisition plans, Spetner’s BenManage voluntary benefit insurance

segment has experienced impressive growth, now covering over 85,000

employees, a significant increase from their 45,000 covered

employees when we initially announced the planned transaction. This

acquisition will be one of the largest in our Company's history and

will mark a pivotal moment for Reliance, with projections

suggesting it will close to double our annual revenues to around

$28 million and significantly boost our AEBITDA. We believe that

Spetner’s wide array of unique voluntary benefits programs and its

extensive market reach offer considerable synergistic

opportunities, especially in expanding our personal insurance lines

through the RELI Exchange platform.”

Mr. Beyman continued, “In early July, we

initiated the formation of a new division within Reliance focused

on acquiring multi-family and commercial real estate properties.

Abe Miller, a successful real estate investor and M&A

executive, has joined the Company to lead this division and provide

strategic guidance for our future real estate projects. With a

remarkable track record that includes creating a $3 billion real

estate portfolio through strategic acquisitions, his expertise in

enhancing asset value and navigating complex market dynamics to

generate substantial investment returns will be invaluable. We

anticipate that the new real estate division, set to launch

following the closing of the Spetner acquisition, will align

perfectly with our strategy of pursuing accretive and cash

flow-positive deals, an area where we have a proven track record,

especially in the insurance brokerage sector. Additionally, we

expect this division to broaden our Company’s portfolio by

diversifying into multiple business lines and asset categories.

Through this expansion into real estate, we expect that Reliance

will be well positioned to leverage non-dilutive financing sources,

supported by the intrinsic value of the assets and our operational

cash flows.

“Finally, as previously announced, pursuant to

exercises of all outstanding Series B and Series G warrants,

Reliance has vastly simplified its capital structure by removing

the Series B derivative instrument from its balance sheet, and by

eliminating the potentially perceived significant warrant overhang

which may also have adversely impacted our publicly traded share

price. We are confident that our enhanced capital table will

resonate well with our current shareholders and future investors,

as we continue to advance our key initiatives through 2024 and

beyond.”

Mr. Beyman concluded, “Our mission remains to

build a multi-billion dollar, highly profitable business enterprise

that delivers substantial returns to our shareholders. We are

confident that the developments and efforts discussed herein,

firmly set us on this trajectory and we look forward to continuing

this onward journey with mutually beneficial financial

results.”

Conference Call

Reliance Global Group will host a conference

call today at 4:30 PM Eastern Time to discuss the Company’s

financial results for the quarter ended June 30, 2024, as well as

the Company’s corporate progress and other developments.

The conference call will be available via telephone by dialing

toll-free +1 888-506-0062 for U.S. callers or +1 973-528-0011 for

international callers and entering access code 246542. A webcast of

the call may be accessed at

https://www.webcaster4.com/Webcast/Page/2381/50932 or on the

investor relations section of the Company’s website,

https://relianceglobalgroup.com/events-and-presentations/.

A webcast replay will be available on the

investor relations section of the Company’s website at

https://relianceglobalgroup.com/events-and-presentations/ through

July 25, 2025. A telephone replay of the call will be available

approximately one hour following the call, through August 8, 2024,

and can be accessed by dialing +1 877-481-4010 for U.S. callers or

+1 919-882-2331 for international callers and entering access code

50932.

About Reliance Global Group,

Inc.

Reliance Global Group, Inc. (NASDAQ: RELI) is an

InsurTech pioneer, leveraging artificial intelligence (AI), and

cloud-based technologies, to transform and improve efficiencies in

the insurance agency/brokerage industry. The Company’s

business-to-business InsurTech platform, RELI Exchange, provides

independent insurance agencies an entire suite of business

development tools, enabling them to effectively compete with

large-scale national insurance agencies, whilst reducing

back-office cost and burden. The Company’s business-to-consumer

platform, 5minuteinsure.com, utilizes AI and data mining, to

provide competitive online insurance quotes within minutes to

everyday consumers seeking to purchase auto, home, and life

insurance. In addition, the Company operates its own portfolio of

select retail “brick and mortar” insurance agencies which are

leaders and pioneers in their respective regions throughout the

United States, offering a wide variety of insurance products.

Further information about the Company can be found at

https://www.relianceglobalgroup.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1995. Statements other than

statements of historical facts included in this press release may

constitute forward-looking statements and are not guarantees of

future performance, condition or results and involve a number of

risks and uncertainties. In some cases, forward-looking statements

can be identified by terminology such as “may,” “should,”

“potential,” “continue,” “expects,” “anticipates,” “intends,”

“plans,” “believes,” “estimates,” and similar expressions and

include statements such as the Company having built a best-in-class

InsurTech platform, making RELI Exchange an even more compelling

value proposition and further accelerating growth of the platform,

rolling out several other services in the near future to RELI

Exchange agency partners, building RELI Exchange into the largest

agency partner network in the U.S., the Company moving in the right

direction and the Company’s highly scalable business model driving

significant shareholder value. Actual results may differ materially

from those in the forward-looking statements as a result of a

number of factors, including those described from time to time in

our filings with the Securities and Exchange Commission and

elsewhere and risks as and uncertainties related to: the Company’s

ability to generate the revenue anticipated and the ability to

build the RELI Exchange into the largest agency partner network in

the U.S., and the other factors described in the Company’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2023, as

the same may be updated from time to time. The foregoing review of

important factors that could cause actual events to differ from

expectations should not be construed as exhaustive and should be

read in conjunction with statements that are included herein and

elsewhere, including the risk factors included in the Company's

Annual Report on Form 10-K for the fiscal year ended December 31,

2023, the Company’s Quarterly Reports on Form 10-Q, the Company’s

Current Reports on Form 8-K and other subsequent filings with the

Securities and Exchange Commission. The Company undertakes no duty

to update any forward-looking statement made herein. All

forward-looking statements speak only as of the date of this press

release.

Contact:

Crescendo Communications, LLCTel: +1 (212) 671-1020Email:

RELI@crescendo-ir.com

INFORMATION REGARDING A NON-GAAP MEASURE

We exclude the following items when calculating

AEBITDA, and the following items define our non-GAAP financial

measure AEBITDA:

| |

● |

Interest and related party interest expense: Unrelated to core

Company operations and excluded to provide more meaningful

supplemental information regarding the Company’s core operational

performance. |

| |

● |

Depreciation and amortization: Non-cash charge, excluded to provide

more meaningful supplemental information regarding the Company’s

core operational performance. |

| |

● |

Goodwill and/or asset impairments: Non-cash charge, excluded to

provide more meaningful supplemental information regarding the

Company’s core operational performance. |

| |

● |

Equity-based compensation: Non-cash compensation provided to

employees and service providers, excluded to provide more

meaningful supplemental information regarding the Company’s core

cash impacted operational performance. |

| |

● |

Change in estimated acquisition earn-out payables: An earn-out

liability is a liability to the seller upon an acquisition which is

contingent on future earnings. These liabilities are valued at each

reporting period and the changes are reported as either a gain or

loss in the change in estimated acquisition earn-out payables

account in the consolidated statements of operations. The gain or

loss is non-cash, can be highly volatile and overall is not deemed

relevant to ongoing operations, thus, it’s excluded to provide more

meaningful supplemental information regarding the Company’s core

operational performance. |

| |

● |

Recognition and change in fair value of warrant liabilities: This

account includes changes to derivative warrant liabilities which

are valued at each reporting period and could result in either a

gain or loss. The period changes do not impact cash, can be highly

volatile, and are unrelated to ongoing operations, and thus are

excluded to provide more meaningful supplemental information

regarding the Company’s core operational performance. |

| |

● |

Other income (expense), net: Includes non-routine income or

expenses and other individually de minimis items and is thus

excluded as unrelated to core operations of the company. |

| |

● |

Transactional costs: This includes expenses related to mergers,

acquisitions, financings and refinancings, and amendments or

modification to indebtedness. Thes costs are unrelated to primary

Company operations and are excluded to provide more meaningful

supplemental information regarding the Company’s core operational

performance. |

| |

● |

Non-recuring costs: This account includes non-recurring

non-operational items, related to costs incurred for a legal suit

the Company has filed against one of the third parties involved in

the discontinued operations and was excluded to provide more

meaningful supplemental information regarding the Company’s core

operational performance. |

| |

● |

Loss from discontinued operations before tax: This account includes

the net results from discontinued operations, and since

discontinued, are unrelated to the Company’s ongoing operations and

thus excluded to provide more meaningful supplemental information

regarding the Company’s core operational performance. |

| |

|

|

The following table provides a reconciliation from net loss to

AEBITDA for the periods ended June 30, 2024, and June 30, 2023:

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(1,489,395 |

) |

|

$ |

(1,055,286 |

) |

|

$ |

(6,836,057 |

) |

|

$ |

(2,843,824 |

) |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and related party interest expense |

|

|

403,495 |

|

|

|

422,058 |

|

|

|

813,780 |

|

|

|

815,091 |

|

|

Depreciation and amortization |

|

|

469,788 |

|

|

|

655,449 |

|

|

|

1,003,941 |

|

|

|

1,309,227 |

|

|

Asset impairment |

|

|

- |

|

|

|

- |

|

|

|

3,922,110 |

|

|

|

- |

|

|

Share-based compensation to employees, directors and service

providers |

|

|

333,897 |

|

|

|

413,362 |

|

|

|

488,808 |

|

|

|

457,158 |

|

|

Change in estimated acquisition earn-out payables |

|

|

- |

|

|

|

543,233 |

|

|

|

47,761 |

|

|

|

1,019,925 |

|

|

Other (income) expense, net |

|

|

(11 |

) |

|

|

16,979 |

|

|

|

(22 |

) |

|

|

13,297 |

|

|

Transactional costs |

|

|

119,203 |

|

|

|

- |

|

|

|

373,096 |

|

|

|

- |

|

|

Nonrecurring costs |

|

|

45,724 |

|

|

|

47,513 |

|

|

|

90,963 |

|

|

|

47,513 |

|

|

Recognition and change in fair value of warrant liabilities |

|

|

(60,667 |

) |

|

|

1,592,509 |

|

|

|

(156,000 |

) |

|

|

(2,673,723 |

) |

|

(Income) loss from discontinued operations before tax |

|

|

- |

|

|

|

(2,814,445 |

) |

|

|

- |

|

|

|

1,846,048 |

|

| Total adjustments |

|

|

1,311,429 |

|

|

|

876,657 |

|

|

|

6,584,437 |

|

|

|

2,834,536 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AEBITDA |

|

$ |

(177,966 |

) |

|

$ |

(178,630 |

) |

|

$ |

(251,620 |

) |

|

$ |

(9,288 |

) |

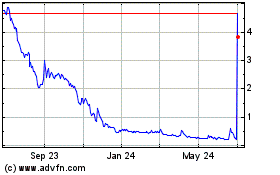

Reliance Global (NASDAQ:RELI)

Historical Stock Chart

From Jan 2025 to Feb 2025

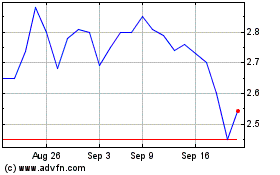

Reliance Global (NASDAQ:RELI)

Historical Stock Chart

From Feb 2024 to Feb 2025