The outlook for the restaurant industry is steadily improving

despite the macroeconomic overhang, with the easing in food cost

inflation and increase in same-store sales giving the group’s

near-term earnings prospects a boost. The outlook for the rest of

the year is optimistic given easy year-over-year comparisons.

Statistics bear out this relatively favorable environment. A recent

survey by the National Restaurant Association revealed that the

Restaurant Performance Index (RPI), measuring the present condition

and outlook on the U.S. restaurant industry was 101.0 in April, up

0.4% sequentially. The RPI level was the highest in the last 10

months. The figure also exceeded the 100 mark for the third time in

the last four months.

Current Situation Index, which measures comparable store sales,

traffic count, labor costs and capital expenditures in the

restaurant industry, was 100.1 in April, up 0.3% sequentially. The

Current Situation Index stood above the 100 level for the first

time in eight months, signifying the underlying strength in the

industry.

The Expectations Index, which measures the restaurant operators'

six-month outlook on the above indicators, was 101.9 in April, up

0.5% sequentially. The level was also the highest in 11 months. All

three indices managed to beat the safety threshold of 100,

reaffirming operators' positive outlook on the industry for the

near term.

Yearly hikes in dividends on a regular basis by some industry

leaders like

McDonald's Corp. (MCD),

Yum!

Brands Inc. (YUM) and

Brinker International

Inc. (EAT) underscore their efforts to consistently return

shareholder and franchisee value irrespective of the economic peaks

and valleys. Another restaurateur,

Cracker Barrel Old

Country Store Inc. (CBRL), has doubled its dividend since

Apr 2012.

Moreover, the Conference Board came out with its Consumer

Confidence Index -- a barometer of U.S. consumer health -- on May

28, 2013. The index improved consecutively in April and May. The

Index stood at 76.2, up from 69.0 in April, and this also marks the

five-year high level.

The sentiment was also upbeat for the labor and housing market.

Fuel prices are hovering below year-ago levels. All these

culminate to the general optimism in the sector. That said, we

believe, issues like new stipulations related to "Obamacare," and

excess supply may cloud the long-term picture. An extensive focus

on value proposition along with moderate pricing power could also

prove unfavorable to margins if exercised on a long-term basis.

Zacks Industry Rank

Within the Zacks Industry classification, the restaurant industry

is grouped within the broader Retail sector. We rank all the 260

plus industries in the 16 Zacks sectors based on the earnings

outlook and fundamental strength of the constituent companies in

each industry. To learn more visit: About Zacks Industry Rank

http://www.zacks.com/zrank/about_ind_rank.php.

As a guideline, the outlook for industries in the top 1/3rd of all

Industry Ranks or a Zacks Industry Rank of #88 and lower is

'Positive,' the middle 1/3rd or industries with Zacks Industry Rank

between #89 and #176 is 'Neutral' and the bottom 1/3rd or Zacks

Industry Rank of #177 and higher is 'Negative.'

The Zacks Industry Rank for the restaurant industry is currently

#43, down 6 spots in the last week. This is in the top 1/3rd of all

industries ranked, highlighting the group’s near-term Positive

outlook. The group’s favorable Zacks Rank placement is essentially

a function of many restaurant companies’ improved earnings picture

that prompted analysts to raise their estimates.

Key Performers in First-Quarter 2013

Not all companies performed equally well in the quarter. While some

were laggards, others posted solid results mostly on their

individual strength. Thanks to favorable weather last year, many

restaurateurs faced tough comparisons in the first quarter and

failed to exceed the year-ago quarter's solid comparable sales

numbers. Most of the chains posted weaker-than-expected revenue

numbers, but, on a bullish note, managed to score on earnings owing

to cost savings and policies such as share repurchase. Operators

blamed a softer economic trend for the insignificant growth in

revenues.

Industry behemoth McDonald’s delivered weaker-than-expected results

in the first quarter on both counts, while another renowned

operator, Yum! Brands, registered weak sales owing to the recent

ordeals in its China business. However, we believe both companies

will rebound over the longer term, once global issues subside.

Some other notable companies like Brinker beat earnings but missed

revenues.

Burger King's (BKW) earnings were

in-line but revenues outperformed.

Krispy Kreme Doughnuts

Inc. (KKD),

Domino’s Pizza Inc. (DPZ) and

Texas Roadhouse (TXRH) beat both revenues and

earnings. Same-store sales growth at Krispy Kreme, Domino’s, Jamba,

AFC Enterprises and Panera deserves a mention.

Road Ahead

According to the National Restaurant Association, the restaurant

industry is projected to expand in 2013 on the back of U.S.

recovery, albeit at a slow pace. Like 2012, focus on cost

containment, extra value-for-price and international expansion will

be on most restaurateurs' wish-list to tide over the some macro

difficulties this year.

According to the National Restaurant Association, as much as 41% of

restaurant operators expect to see an uptick in sales in the coming

six months on an improving economy. Restaurant operators' capital

spending plans are also riding uphill, reaffirming their positive

outlook. We are optimistic of bottom-line expansion in the near

term.

The National Restaurant Association estimates a 3.8% year over year

increase in total restaurant sales to $660.5 billion in 2013.

However, inflation-adjusted sales suggest only 0.8% growth. If

realized, this would mark the third straight year of above $600

billion total industry sales. The limited-service eating-place

segment will likely grow faster than the full-service restaurant

segment.

Favorable Outlook for the Upcoming Quarter

A faster pace of recovery in the U.S., easy year-over-year

comparison and events such as Mothers’ Day will likely boost the

second-quarter same-store sales of most of the companies.

Darden’s successful value proposition and its gradual positioning

in the upscale segment, solid first-quarter earnings and revenue

growth along with raised full-year guidance at Cracker Barrel, Papa

John’s International and Krispy Kreme, reinvigoration of Yum!’s

Taco Bell and Domino’s Pizza’s entry into the pan pizza category

are likely to prove beneficial.

However, the shift in Easter from second quarter last year to first

quarter this year will likely be a drag on the sales. Further,

companies like Yum! and McDonald’s, which have considerable

exposure in the Chinese market, could face a setback owing to the

recent outbreak of the Avian Flu scare.

OPPORTUNITIES

Cooling Commodity Inflation in the US

The food cost inflation seems to have lessened despite the severe

drought in the Midwest growing region last year. Food costs account

for about one-third of restaurant sales, thus making the industry

vulnerable to food cost inflation.

As suggested by the U.S. Department of Agriculture (USDA) report,

price inflation for all food is expected at 2.5-3.5% in 2013 down

from the prior expectation of 3-4% level. Commodities like fish and

seafood, dairy products, fats and oils, cereals and bakery products

and other foods will likely witnessed a decline in prices.

However, prices for beef, pork and poultry are expected to remain

firm in 2013, with beef prices being the highest. The drought in

the Midwest growing region last year resulted in steeper grain

costs, which in turn pushed up the feed costs. Companies like Red

Robin Burger (RRGB), McDonald's and Texas Roadhouse have the higher

exposure to the beef market and will likely feel the brunt of beef

inflation.

But there is some good news. The market is abuzz with assumptions

that feed prices will cool off with the new harvest season and that

could lead to lower chicken prices in 2014.

Continued Job Growth in the Sector

The restaurant industry has been one of the major contributors to

job growth in the U.S. over the last couple of years. The sector

employs around 10% of the U.S. workforce. According to the National

Restaurant Association, in 2011 and 2012, total U.S. employment

grew a respective of 1.0% and 1.4% while restaurant employment

increased 1.9% and 3.0%.

The National Restaurant Association expects this industry to create

2.4% additional jobs compared to a projected 1.5% gain for total

U.S. employment.

Domestic and International Unit Expansion

Emerging from a lackluster economy from more than three years back,

most of the companies have accelerated their pace of restaurant

openings. A relative recovery in consumer confidence has also

encouraged companies to return to unit expansion.

Besides spreading out in their home country, the companies also aim

to test waters in foreign shores. Restaurateurs are primarily

concentrating on emerging markets that provide ample opportunities

for expansion. The burgeoning middle income population in emerging

countries encourages the companies to shift their spotlight from

the somewhat saturated domestic market.

Several food chains, including

Denny's Corp.

(DENN),

Pollo Tropical of Carrols Restaurant

(TAST),

Starbucks Corp. (SBUX) and Krispy Kreme

are tapping the fast-growing Indian market. McDonald's Corp. and

Yum! already have considerable coverage in India and are now

aggressively expanding in China to capitalize on the fast-paced

economic growth there. Latin America has also become a preferable

venue for expansion.

Refranchising, Revamp & Menu Innovations – a Common

Trend

Though refranchising was common in the restaurant sector, it has

gotten a boost of late given the benefits of this business model

even in an anemic economy. The franchise-centric model helps to

reduce volatility in earnings and enhances cash flow generation.

Companies like

DineEquity Inc. (DIN) and

Burger King Worldwide Inc. (BKW) are some examples

of highly franchised brands.

Additionally, restaurants are responding in a variety of ways to

address heightened competition in a somewhat over-supplied domestic

market. Most industry players are remodeling their restaurants to

give an up-market feel as well as rolling out new and smaller

prototypes to augment the perception of value and drive traffic,

thereby reducing construction and occupancy costs and enhancing

returns on capital. Operators like McDonald's,

The Wendy's

Company (WEN),

Darden Restaurants Inc.

(DRI) and Jamba are working along these lines.

This is not the end. Having stabilized their financial positions,

the operators are constantly striving to add offerings to their

menu card in order to cater to the ever-changing palates of

customers. Limited Time Offers, loyalty programs and social media

are also drawing attention as marketing tools.

Restaurateurs are offering loyalty programs at their units to

enhance value dining as well as hone sales when customers are

spending less enthusiastically on dining yet seeking incentives for

doing so. Most of the operators rely on social media for promotions

by incorporating

Facebook (FB), online review

sites, Twitter and blogs aggressively into their marketing mix.

National Television advertising is also an important tool for

promotion.

Focus on Hispanic Guests

In a bid to tap the rapidly growing Hispanic customer base in the

U.S., many restaurant units are launching a new language setting in

their ordering app for smartphones. The restaurants are also

introducing a national online marketing campaign targeting Hispanic

guests. These brands are

Dunkin' Brands Group

(DNKN), Domino’s Pizza, The Wendy’s and Denny's.

As per data published by market researcher NPD Group in Feb. 2012,

the Hispanic community accounts for about 16% of the U.S.

population based on the 2010 U.S. Census. The U.S. Census projects

the Hispanic population in the country to increase 34% from 2010 to

2020. This encouraging data might have shifted several

restaurateurs’ attention towards this community.

Breakfast & Beverage: A Breakout

Breakfast has accounted for nearly 60% of the U.S. restaurant

industry and remains a key driver of traffic growth in recent

years. Leveraging the trend, McDonald’s,

Jamba

Inc. (JMBA), DineEquity and Yum! have all broadened their

breakfast menus.

Non-alcoholic beverages remain another sweet spot in the U.S.

eateries. The market also has the ability to grow further through

innovation, especially in healthier solutions. We see juicing giant

Jamba geared up to leverage the trend by adding all-fruits to its

line-up. Apart from Juicing, both Jamba and Starbucks are brewing

more opportunities in the tea category.

M&A Activity Gaining Precedence

Merger and acquisition activity is also gaining momentum in the

sector. The companies are looking at potential business partners to

foray into different zones and unlock value. Private equity firms

are citing potential in the restaurant industry and accordingly

making buyout deals. One of the latest acquisition deals worth

mentioning is the buyout of Caribou Coffee Company by JAB

Group.

Apart from acquisitions, the companies are also divesting their

relatively slow-moving brands in order to spur growth. One of the

latest divesture deals that warrants a look is the sell-off of

Mimi's Café concept of

Bob Evans Farms Inc. (BOBE)

to LeDuff America.

Currently,

CEC Entertainment Inc. (CEC) and

Bloomin' Brands Inc. (BLMN) carry a Zacks Rank #1

(Strong Buy). Companies with a Zacks #2 Rank (short-term Buy

rating) include Krispy Kreme, AFC enterprises, Burger King,

Cheesecake Factory,

Chuys Holdings (CHUY), Cracker

Barrel, Texas Roadhouse, Wendy’s, and

Sonic Corp.

(SONC). These companies have positive earnings estimate revision

trends, highlighting the favorable momentum in their underlying

businesses.

WEAKNESSES

Bleak Global Economic Backdrop

The strengths aside, the companies are caught up with macroeconomic

tensions like implementation of austerity measures in Europe owing

to the sovereign debt crisis and decelerating growth in Asia.

The recent same-store sales performance of McDonald’s is indicative

of a slowdown in the Asian countries like China and India as well

as European nations like France and Germany. Japan also continues

to be a dampener as it is still on the way to recovery from last

year's earthquake.

Affordable Care Act to Hurt Margins

Since the sector plays a key role in the nation's employment

picture, the recent Affordable Care Act by president Obama,

commonly known as Obamacare, is expected to have an adverse impact

on the operators' margins starting in 2014.

The law entails companies to provide coverage for workers or face

government penalties, though not applicable for employees who log

less than 30 hours per week on average.

To avoid these austerities, most companies are trying out different

labor models like involving more part-timers and cutting work hours

in advance of the implementation of the healthcare reform. Darden

Restaurants is one of these.

Rising energy cost is another risk faced by restaurateurs. The

industry accounts for one-third of the energy used by the retail

sector in the U.S., as per the Green Restaurant Association.

Stringent Food Standards

Consumers’ inclination toward fresh organic menu and the fuss about

nutrition pose challenges. Consumers generally tend to visit

restaurants offering locally produced food. Focus on child

nutrition is also a priority. While these criteria are giving a

competitive advantage to companies like Chipotle Mexican Grill,

others often find it difficult to meet these standards.

There are some names that induce our cautious outlook. These

include Red Robin Gourmet Burgers, Yum!,

Kona Grill

Inc. (KONA), Brinker,

Buffalo Wild Wings

Inc. (BWLD),

Panera Bread Co. (PNRA),

Chipotle Mexican Grill Inc. (CMG),

Cosi

Inc. (COSI), BJ’s restaurants all of which retain the

Zacks #3 Rank (Hold). McDonald’s still carries a Zacks Rank #4

(Sell) due to persistent deceleration in comparable store

sales.

AFC ENTERPRISES (AFCE): Free Stock Analysis Report

BJ'S RESTAURANT (BJRI): Free Stock Analysis Report

BUFFALO WLD WNG (BWLD): Free Stock Analysis Report

CHEESECAKE FACT (CAKE): Free Stock Analysis Report

CRACKER BARREL (CBRL): Free Stock Analysis Report

CHIPOTLE MEXICN (CMG): Free Stock Analysis Report

COSI INC (COSI): Free Stock Analysis Report

DINEEQUITY INC (DIN): Free Stock Analysis Report

DUNKIN BRANDS (DNKN): Free Stock Analysis Report

DOMINOS PIZZA (DPZ): Free Stock Analysis Report

DARDEN RESTRNT (DRI): Free Stock Analysis Report

BRINKER INTL (EAT): Free Stock Analysis Report

JAMBA INC (JMBA): Free Stock Analysis Report

KRISPY KREME (KKD): Free Stock Analysis Report

MCDONALDS CORP (MCD): Free Stock Analysis Report

PANERA BREAD CO (PNRA): Free Stock Analysis Report

RED ROBIN GOURM (RRGB): Free Stock Analysis Report

YUM! BRANDS INC (YUM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

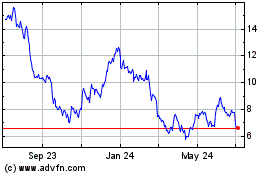

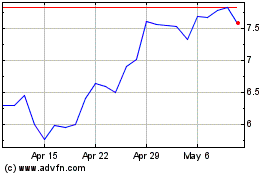

Red Robin Gourmet Burgers (NASDAQ:RRGB)

Historical Stock Chart

From Jun 2024 to Jul 2024

Red Robin Gourmet Burgers (NASDAQ:RRGB)

Historical Stock Chart

From Jul 2023 to Jul 2024