Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

April 10 2023 - 7:31AM

Edgar (US Regulatory)

Filed by Baytex Energy Corp.

(Commission File No. 1-32754)

pursuant to Rule 425 of the Securities Act of 1933

Subject Companies: Ranger

Oil Corporation

(Commission File No. 1-13283)

| 82%

Acc

2retion

0

to Fre%e Cash Flow per

share & return of capital per share

50%

Free Cash Flow for direct

shareholder returns

Operated production increases to

Baytex's board of directors unanimously recommends that shareholders of Baytex

vote FOR the issuance of common shares of Baytex in connection with the transaction.

ENHANCE DIRECT SHAREHOLDER RETURNS

$0.09

Anticipated Annualized Dividend

per Baytex common share

MAINTAIN A STRONG BALANCE SHEET AND

PRUDENT FINANCIAL FLEXIBILITY

1.0X

Total Debt to EBITDA

BECOME A LEADER IN RESPONSIBLE

ENERGY PRODUCTION

16%

Average GHG Emissions intensity

BAYTEX TO ACQUIRE RANGER OIL

BUILDING A QUALITY NORTH AMERICAN OIL-WEIGHTED E&P

BUILD A STRONG AND RESILIENT OPERATING PLATFORM

IN THE EAGLE FORD

741

Net undrilled locations

12-15

Years of high quality Inventory

Ranger's Assets represent

ANNUAL AND SPECIAL MEETING: MAY 15, 2023

Please refer to the information circular and proxy statement of Baytex dated April 3, 2023 (the "Information Circular")

for complete details on the transaction.

1

2

1

3

5

1 & 4

Or contact Kingsdale Advisors toll free at

1.866.851.2743, collect at 416.867.2272 or

via email at contactus@kingsdaleadvisors.com.

www.BaytexASM.com

HAVE QUESTIONS? NEED HELP VOTING?

6 |

| NOTES:

(1)

(2)

(4)

(3)

(5)

Accretion metrics based on the 12-month period from closing of the merger, July 1, 2023 to June 30, 2024, and the

following commodity prices: WTI - US$75/bbl; MEH premium to WTI - US$2/bbl, WCS differential to WTI - US$17.50/bbl;

NYMEX Gas - US$3.50/MMbtu; Exchange Rate (CAD/USD) - 1.35. Based on the weighted average common shares of

Baytex outstanding before and after giving effect to the merger. Pro forma forecast production includes Baytex

production of 88,000 to 90,000 boe/d (working interest) and Baytex's internal estimate for Ranger production of 67,000

to 70,000 boe/d (working interest).

EBITDA is calculated in accordance with the Baytex's credit facilities agreement which is available on SEDAR at

www.sedar.com. Total Debt to EBITDA ratio based on estimated total debt for Baytex and Ranger on closing of the

merger, including estimated transaction costs. EBITDA based on the 12-month period from closing, July 1, 2023 to June

30, 2024.

Based on Baytex's closing share price on February 24, 2023 of $5.74. Following closing of the transaction, management

expects to recommend that a dividend, to be paid quarterly, be set at $0.0225 per share ($0.09 per share annualized),

which is subject to the review and approval of the Baytex board of directors and there is no guarantee such dividend

will be declared by the Baytex board of directors. See "Dividend Advisory" in the Information Circular.

Specified financial measure that does not have any standardized meaning prescribed by IFRS (as defined in the

Information Circular) and may not be comparable with the calculation of similar measures presented by other entities.

See "Specified Financial Measures" in the Information Circular.

See "Advisory Regarding Oil and Gas Information" in the Information Circular.

HAVE QUESTIONS? NEED HELP VOTING?

Or contact Kingsdale Advisors toll free at

1.866.851.2743, collect at 416.867.2272 or

via email at contactus@kingsdaleadvisors.com.

www.BaytexASM.com

(6) See "Advisories" and "Advisories – Forward-Looking Information" in the Information Circular. |

IMPORTANT INFORMATION FOR SHAREHOLDERS

Important Information for Shareholders and Where to Find It

No Offer or Solicitation

This communication relates

to the proposed acquisition by Baytex Energy Corp. (“Baytex”) of certain assets from Ranger Oil Corporation

(“Ranger”) (the “Transaction”). This communication is not intended to and does not

constitute an offer to sell or the solicitation of an offer to subscribe for or buy any securities or a solicitation of any vote or approval

with respect to the Transaction or otherwise, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in

which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction. No offer of securities in the United States shall be made except by means of a prospectus meeting the requirements of Section

10 of the Securities Act of 1933.

Important Additional Information and Where to Find It

In connection with the proposed

Transaction, Baytex filed a registration statement on Form F-4 (the “Registration Statement”) with the Securities

and Exchange Commission (the “SEC”) on April 7, 2023 to register the Baytex securities to be issued in connection

with the proposed Transaction (including a prospectus therefor). Baytex and Ranger also plan to file other documents with the SEC regarding

the proposed Transaction. This communication is not a substitute for the Registration Statement or the prospectus or for any other document

that Baytex or Ranger may file with the SEC in connection with the Transaction. U.S. INVESTORS AND U.S. HOLDERS OF BAYTEX AND RANGER

SECURITIES ARE URGED TO READ THE REGISTRATION STATEMENT AND OTHER DOCUMENTS RELATING TO THE PROPOSED TRANSACTION (INCLUDING ALL AMENDMENTS

AND SUPPLEMENTS TO THOSE DOCUMENTS) THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BAYTEX, RANGER AND THE PROPOSED TRANSACTION. Shareholders can obtain free copies of the

Registration Statement, prospectus and other documents containing important information about Baytex and Ranger once such documents are

filed with the SEC, through the website maintained by the SEC at http://www.sec.gov. Copies

of such documents may also be obtained from Baytex and Ranger without charge.

Participants in the Solicitation

Baytex, Ranger and certain

of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the

solicitation of proxies from the Baytex’s shareholders and the solicitation of proxies from Ranger’s shareholders, in each

case with respect to the Transaction. Information about Baytex’s directors and executive officers is available in the Annual Information

Form published February 23, 2023 and in the proxy statement/prospectus. Information about the Ranger’s directors and executive

officers is available in its definitive proxy statement for its 2022 annual meeting filed with the SEC on April 1, 2022, and in the

proxy statement/prospectus. Other information regarding the participants in the solicitations and a description of their direct and indirect

interests, by security holdings or otherwise, is contained in the Registration Statement, the proxy statement/prospectus and other relevant

materials to be filed with the SEC regarding the Transaction when they become available. Shareholders, potential investors and other readers

should read the proxy statement/prospectus carefully before making any voting or investment decisions.

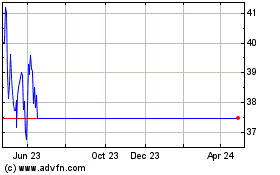

Ranger Oil (NASDAQ:ROCC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Ranger Oil (NASDAQ:ROCC)

Historical Stock Chart

From Jan 2024 to Jan 2025