Current Report Filing (8-k)

June 12 2023 - 4:21PM

Edgar (US Regulatory)

0001687187

false

--12-31

0001687187

2023-06-12

2023-06-12

0001687187

us-gaap:CommonStockMember

2023-06-12

2023-06-12

0001687187

METC:NinePercentageSeniorNotesDue2026Member

2023-06-12

2023-06-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): June 12,

2023

Ramaco Resources, Inc.

(Exact name of Registrant

as specified in its Charter)

| Delaware |

001-38003 |

38-4018838 |

(State

or other jurisdiction of

incorporation) |

(Commission

File Number) |

(IRS

Employer Identification No.) |

250 West Main Street, Suite 1900

Lexington, Kentucky 40507

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (859) 244-7455

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

METC |

NASDAQ Global Select Market |

| 9.00% Senior Notes due 2026 |

METCL |

NASDAQ Global Select Market |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 3.03. Material Modification to Rights

of Security Holders.

The information set forth in Item 5.03 of this

Current Report on Form 8-K is incorporated herein by reference.

Item 5.03. Amendments to Articles of Incorporation

or Bylaws.

On June 12, 2023, at a special meeting of

shareholders (the “Special Meeting”) of Ramaco Resources, Inc. (the “Company”), the Company’s shareholders

approved a proposal to amend and restate the Company’s existing certificate of incorporation with the Second Amended and Restated

Certificate of Incorporation of the Company to, among other things, (1) reclassify the Company’s existing common stock, par

value $0.01 per share (“Existing Common Stock”) as shares of Class A common stock, par value $0.01 per share (“Class A

Common Stock”), (2) create a separate Class B common stock, par value $0.01 per share (“Class B Common Stock”)

and (3) provide the board of directors of the Company the option, in its sole discretion, to exchange all outstanding shares of the

Class B Common Stock into shares of Class A Common Stock based on an exchange ratio determined by a 20-day trailing volume-weighted

average price for each class of stock (the “Charter Amendment Proposal”). The forgoing description of the Charter Amendment

Proposal does not purport to be complete and is qualified in its entirety by reference to the complete text of the Company’s Second

Amended and Restate Certificate of Incorporation, a copy which is filed as Exhibit 3.1 to this Current Report on Form 8-K and

is incorporated herein by reference.

The Company’s Second Amended and Restated

Certificate of Incorporation was filed with the office of the Secretary of State of Delaware on June 12, 2023, and became effective

upon filing. The information set forth in Item 5.07 of this Current Report on Form 8-K is incorporated herein by reference.

Item 5.07. Submission of Matters to a Vote

of Security Holders.

The Company held the Special Meeting on June 12,

2023. Prior to the Special Meeting, the Company delivered a definitive proxy statement (the “Proxy Statement”) to the holders

of 44,414,085 shares of Existing Common Stock, then entitled to vote as of April 21, 2023, the record date for the Special Meeting,

describing the Special Meeting, the Charter Amendment Proposal, and related information. The Proxy Statement was filed with the U.S. Securities

and Exchange Commission (the “SEC”) on April 26, 2023 and definitive additional proxy materials were filed with the SEC

on April 26, 2023, April 28, 2023 and June 8, 2023.

The Company shareholders approved the Charter

Amendment Proposal at the Special Meeting. As set forth in the Proxy Statement, the adjournment proposal would only be presented to the

Company’s shareholders, if necessary or appropriate, to solicit additional proxies if there are insufficient votes to adopt the

Charter Amendment Proposal at the time of the Special Meeting. Because the Charter Amendment Proposal was approved, there was no need

to present the adjournment proposal to the Company shareholders. The results of the matters voted upon at the Special Meeting, as more

fully described in the Proxy Statement, are set forth below.

Charter Amendment Proposal

| For |

|

Against |

|

Abstain |

| 32,914,092 |

|

210,587 |

|

25,014 |

Item 8.01. Other Events.

On June 12, 2023, the Company virtually held

the Special Meeting at which the Company shareholders approved and adopted the Charter Amendment Proposal.

On June 12, 2023, the Company issued a press

release announcing the results of the Special Meeting.

A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this Current Report on Form 8-K

may be considered forward-looking statements. Forward-looking statements generally relate to future events or the Company’s future

financial or operating performance, and other “forward-looking statements” (as such term is defined in the Private Securities

Litigation Reform Act of 1995), which include statements relating to the Charter Amendment Proposal. In some cases, you can identify forward-looking

statements by terminology such as “believe,” “may,” “will,” “estimate,” “continue,”

“anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,”

“potential,” “seem,” “seek,” “future,” “outlook,” or the negatives of these

terms or similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These

forward-looking statements are subject to a number of risks and uncertainties. If any of these risks materialize or the Company’s

assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements.

These forward-looking statements are based upon

estimates and assumptions that, while considered reasonable by the Company and its management, are inherently uncertain. Factors that

may cause actual results to differ materially from current expectations include, but are not limited to: (1) the inability to recognize

the anticipated benefits of the Charter Amendment Proposal; (2) costs related to the implementation of the Charter Amendment Proposal;

(3) changes in applicable laws or regulations; (4) the possibility that the Company may be adversely affected by other economic,

business and/or competitive factors; (5) the Company’s estimates of expenses and profitability; (6) the failure to realize

anticipated pro forma results or projections and underlying assumptions; and (7) other risks and uncertainties set forth in the sections

entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Company’s Annual

Report on Form 10-K for the year ended December 31, 2022, the Company’s Quarterly Report on Form 10-Q for the quarterly

period ended March 31, 2023, the Company’s form of prospectus included as part of the Registration Statement on Form S-1/A

filed with the SEC on June 8, 2023 relating to the Class B Tracking Stock, and in any subsequent filings with the SEC. There

may be additional risks that the Company does not presently know or currently believe are immaterial that could also cause actual results

to differ from those contained in the forward-looking statements.

Nothing in this Current Report on Form 8-K

should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any

of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking

statements, which speak only as of the date they are made. The Company does not undertake any duty, and the Company expressly disclaims

any obligation, to update or alter this Current Report on Form 8-K or any projections or forward-looking statements, whether as a

result of new information, future events or otherwise.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

RAMACO RESOURCES, INC. |

| |

|

| |

By: |

/s/ Randall W. Atkins |

| |

Name: |

Randall W. Atkins |

| |

Title: |

Chairman and Chief Executive Officer |

Dated: June 12, 2023

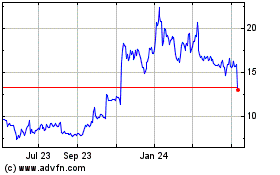

Ramaco Resources (NASDAQ:METC)

Historical Stock Chart

From Dec 2024 to Jan 2025

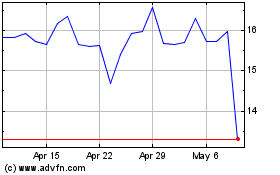

Ramaco Resources (NASDAQ:METC)

Historical Stock Chart

From Jan 2024 to Jan 2025