PART

I

|

ITEM 1.

|

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT

AND ADVISERS

|

Not

applicable.

|

ITEM 2.

|

OFFER STATISTICS AND EXPECTED TIMETABLE

|

Not

applicable.

|

|

A.

|

SELECTED FINANCIAL

DATA

|

We

have derived the following selected consolidated statements of operations data for the years ended December 31, 2018, 2017,

and 2016 and the selected consolidated balance sheet data as of December 31, 2018 and 2017 from our audited consolidated

financial statements and notes included in this Annual Report. Our selected consolidated statements of operations data for

the years ended December 31, 2015 and 2014 and the selected consolidated balance sheet data as of December 31, 2016, 2015 and

2014, have been derived from audited consolidated financial statements not included in this Annual Report. We prepare our

consolidated financial statements in accordance with U.S. generally accepted accounting principles, or U.S. GAAP.

You

should read the selected consolidated financial data together with “Item 5—Operating and Financial Review and Prospects”

and our consolidated financial statements and related notes included elsewhere in this Annual Report. All references to “dollars,”

“U.S. dollars” or “$” in this Annual Report are to United States dollars. All references to

“NIS” are to the New Israeli Shekels.

|

Statement of Operations Data:

|

|

Year Ended December 31,

(in thousands of U.S. dollars, except share and per share data)

|

|

|

|

|

2018

|

|

|

2017

|

|

|

2016

|

|

|

2015

|

|

|

2014

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Products and related services

|

|

$

|

13,529

|

|

|

$

|

7,457

|

|

|

$

|

8,642

|

|

|

$

|

15,500

|

|

|

$

|

18,342

|

|

|

Projects

|

|

|

12,218

|

|

|

|

26,179

|

|

|

|

17,534

|

|

|

|

622

|

|

|

|

2,205

|

|

|

Warranty and Support

|

|

|

8,303

|

|

|

|

3,597

|

|

|

|

3,334

|

|

|

|

2,551

|

|

|

|

3,089

|

|

|

|

|

|

34,050

|

|

|

|

37,233

|

|

|

|

29,510

|

|

|

|

18,673

|

|

|

|

23,636

|

|

|

Cost of revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Products and related services

|

|

|

4,851

|

|

|

|

4,680

|

|

|

|

5,603

|

|

|

|

3,924

|

|

|

|

7,863

|

|

|

Projects

|

|

|

2,825

|

|

|

|

5,321

|

|

|

|

2,902

|

|

|

|

117

|

|

|

|

487

|

|

|

Warranty and Support

|

|

|

1,190

|

|

|

|

487

|

|

|

|

477

|

|

|

|

285

|

|

|

|

343

|

|

|

|

|

|

8,866

|

|

|

|

10,488

|

|

|

|

8,982

|

|

|

|

4,326

|

|

|

|

8,693

|

|

|

Gross profit

|

|

|

25,184

|

|

|

|

26,745

|

|

|

|

20,528

|

|

|

|

14,347

|

|

|

|

14,943

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

15,503

|

|

|

|

10,562

|

|

|

|

8,047

|

|

|

|

6,071

|

|

|

|

5,812

|

|

|

Less - royalty-bearing participation

|

|

|

1,648

|

|

|

|

1,599

|

|

|

|

1,693

|

|

|

|

1,582

|

|

|

|

1,664

|

|

|

Research and development, net

|

|

|

13,855

|

|

|

|

8,963

|

|

|

|

6,354

|

|

|

|

4,489

|

|

|

|

4,148

|

|

|

Sales and marketing, net

|

|

|

11,426

|

|

|

|

10,996

|

|

|

|

8,528

|

|

|

|

7,834

|

|

|

|

7,295

|

|

|

General and administrative

|

|

|

3,391

|

|

|

|

4,191

|

|

|

|

4,523

|

|

|

|

2,393

|

|

|

|

2,262

|

|

|

Total operating expenses

|

|

|

28,672

|

|

|

|

24,150

|

|

|

|

19,405

|

|

|

|

14,716

|

|

|

|

13,705

|

|

|

Operating income (loss)

|

|

|

(3,488

|

)

|

|

|

2,595

|

|

|

|

1,123

|

|

|

|

(369

|

)

|

|

|

1,238

|

|

|

Financial income (expenses), net

|

|

|

1,136

|

|

|

|

389

|

|

|

|

816

|

|

|

|

(433

|

)

|

|

|

(332

|

)

|

|

Income (loss) before taxes on income

|

|

|

(2,352

|

)

|

|

|

2,984

|

|

|

|

1,939

|

|

|

|

(802

|

)

|

|

|

906

|

|

|

Taxes on income

|

|

|

(63

|

)

|

|

|

(83

|

)

|

|

|

(24

|

)

|

|

|

(121

|

)

|

|

|

(180

|

)

|

|

Net income (loss)

|

|

$

|

(2,415

|

)

|

|

$

|

2,901

|

|

|

$

|

1,915

|

|

|

$

|

(923

|

)

|

|

$

|

726

|

|

|

Basic net income (loss) per ordinary share

|

|

$

|

(0.18

|

)

|

|

$

|

0.24

|

|

|

$

|

0.18

|

|

|

$

|

(0.11

|

)

|

|

$

|

0.09

|

|

|

Weighted average number of ordinary shares used to compute basic net income (loss) per ordinary share

|

|

|

13,630,793

|

|

|

|

12,039,176

|

|

|

|

10,406,897

|

|

|

|

8,572,681

|

|

|

|

8,088,974

|

|

|

Diluted net income (loss) per ordinary share

|

|

$

|

(0.18

|

)

|

|

$

|

0.23

|

|

|

$

|

0.18

|

|

|

$

|

(0.11

|

)

|

|

$

|

0.08

|

|

|

Weighted average number of ordinary shares used to compute diluted net income (loss) per ordinary share

|

|

|

13,630,793

|

|

|

|

12,351,566

|

|

|

|

10,779,547

|

|

|

|

8,572,681

|

|

|

|

8,592,387

|

|

|

Balance Sheet Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Working capital

|

|

$

|

76,860

|

|

|

$

|

74,842

|

|

|

$

|

38,854

|

|

|

$

|

9,643

|

|

|

$

|

10,062

|

|

|

Total assets

|

|

$

|

89,531

|

|

|

$

|

91,909

|

|

|

$

|

54,568

|

|

|

$

|

20,135

|

|

|

$

|

20,318

|

|

|

Shareholders’ equity

|

|

$

|

78,480

|

|

|

$

|

76,396

|

|

|

$

|

40,143

|

|

|

$

|

9,863

|

|

|

$

|

10,262

|

|

|

Share capital

|

|

$

|

643

|

|

|

$

|

628

|

|

|

$

|

523

|

|

|

$

|

372

|

|

|

$

|

361

|

|

Exchange

Rate Information

The

following table shows, for each of the months indicated the high and low exchange rates between the NIS and the U.S. dollar, expressed

as NIS per U.S. dollar and based upon the daily representative rate of exchange as published by the Bank of Israel:

|

Month

|

|

High (NIS)

|

|

|

Low (NIS)

|

|

|

April (through April 15, 2019)

|

|

|

3.626

|

|

|

|

3.561

|

|

|

March 2019

|

|

|

3.636

|

|

|

|

3.600

|

|

|

February 2019

|

|

|

3.662

|

|

|

|

3.604

|

|

|

January 2019

|

|

|

3.746

|

|

|

|

3.642

|

|

|

December 2018

|

|

|

3.781

|

|

|

|

3.718

|

|

|

November 2018

|

|

|

3.743

|

|

|

|

3.668

|

|

|

October 2018

|

|

|

3.721

|

|

|

|

3.620

|

|

|

September 2018

|

|

|

3.627

|

|

|

|

3.564

|

|

On

April 15, 2019, the daily representative rate of exchange between the NIS and U.S. dollar as published by the Bank of Israel was

NIS 3.561 to $1.00.

The

following table shows, for each of the periods indicated, the average exchange rate between the NIS and the U.S. dollar, expressed

as NIS per U.S. dollar, calculated based on the average of the representative daily rate of exchange during the relevant period

as published by the Bank of Israel:

|

Year

|

|

Average (NIS)

|

|

|

2019 (through April 15, 2019)

|

|

|

3.638

|

|

|

2018

|

|

|

3.597

|

|

|

2017

|

|

|

3.600

|

|

|

2016

|

|

|

3.841

|

|

|

2015

|

|

|

3.884

|

|

|

2014

|

|

|

3.577

|

|

The

effect of exchange rate fluctuations on our business and operations is discussed in “Item 5.A—Operating and Financial

Review and Prospects—Operating Results—Impact of Inflation and Foreign Currency Fluctuations.”

|

|

B.

|

CAPITALIZATION

AND INDEBTEDNESS

|

Not

applicable.

|

|

C.

|

REASONS FOR THE OFFER AND USE OF PROCEEDS

|

Not

applicable.

Investing

in our ordinary shares involves a high degree of risk. You should carefully consider the risks described below before investing

in our ordinary shares.

Our

business, operating results and financial condition could be seriously harmed due to any of the following risks, among others. If

we do not successfully address the risks to which we are subject, we could experience a material adverse effect on our business,

results of operations and financial condition and our share price may decline. We cannot assure you that we will successfully

address any of these risks.

Risks

Related to Our Business and Our Industry

Our

business is dependent on a limited number of significant customers and the loss of a significant customer could materially adversely

affect our results of operations.

Our

business is dependent on a limited number of significant customers. For example, our two largest customers accounted for approximately

66% of our revenue in fiscal 2018 and 78% in fiscal 2017. The loss of any significant customer, a significant decrease in business

from any such customer, or a reduction in customer revenue due to adverse changes in the terms of our contractual arrangements,

market conditions, customer circumstances or other factors could have a material adverse effect on our results of operations and

financial condition. Revenue from individual customers may fluctuate from time to time based on the commencement, scope and completion

of projects or other engagements, the timing and magnitude of which may be affected by market or other conditions.

The

pace in which we grow our business depends on our customers’ internal processes and decisions regarding the transition to

NFV.

The

pace of transition to NFV and timeframe for reaching a mature infrastructure for NFV is dependent on CSPs’ internal decisions

regarding NFV technology implementation, timing, nature of virtualization and budgeting. Such decisions may be affected by the

overall pace of NFV adoption in the industry as well as by other technology trends such as the deployment of 5G networks. The

pace in which we deploy our solutions is directly affected by the pace of CSPs’ internal processes and the pace of maturation

of the NFV market. To the extent that CSPs require more time to reach the decision to virtualize, decide to delay virtualization

while the market develops, or elect not to transition to NFV, our sales cycles may lengthen, and the growth of our business may

be adversely affected.

A

reduction in some CSPs’ revenues and profitability could lead to decreased investment in capital equipment and infrastructure

which may, in turn, affect our revenues and results of operations. A continued slowdown in our customers’ investment in

capital equipment and infrastructure might materially and adversely affect our revenues and results of operations.

Our

future success is dependent upon the continued growth of the telecommunications industry as well as the specific sectors that

we target, which currently include NFV transformation, 4G cellular, Triple Play networks, VoLTE, 5G and Internet of Things, or

IoT. During the last few years, some of the CSPs have experienced a reduction in their revenues from subscribers and lower profitability,

which affected their spending budgets. This trend may continue. The global telecommunications industry and various sectors within

the industry are evolving rapidly and it is difficult to predict its potential growth rate or future trends in technology development.

Our

future success also depends upon the increased utilization of our solutions by next-generation network operators and specifically

virtualized networks, who may not adopt our technology.

During

the last few years, developments in the telecommunications industry have had a material effect on our existing and/or potential

customers and may continue to have such an effect in the future. Such developments include changes in general global economic

conditions, industry consolidation, emergence of new competitors, commoditization of voice services, regulatory changes, and changes

in the plans of CSPs to shift, transform and adapt their network operations to NFV. Over the last few years, the telecommunications

industry has experienced financial pressures that have caused many in the industry to reduce investment in capital intensive projects,

and in some cases, have led to restructurings. While the transformation of network operations to NFV arises out of the desire

of CSPs to reduce network infrastructure expense, thus creating opportunities for us, it also creates a downward pressure on the

prices of our solutions.

The

market for our solutions is characterized by rapidly changing technology and we may be materially adversely affected if we do

not respond promptly and effectively to such changes.

The

telecommunications industry is characterized by rapidly changing technology, network infrastructure, and customer requirements

and by evolving industry standards and frequent new product introductions. These changes require us to constantly adapt and improve

our solutions to meet changing industry requirements. If we are unable to stay ahead of industry trends or to timely and successfully

complete the development of solutions supporting new standards and technologies such as 5G, our business may be affected as new

requirements could reduce or shift the market for our solutions or require us to develop new solutions.

Additionally,

because new or enhanced telecommunications and data communications-related products developed by other companies could be incompatible

with our solutions, our timely access to information concerning changes in technology, in customer requirements, and in industry

standards, as well as our ability to anticipate such changes and develop and market new and enhanced solutions successfully and

on a timely basis, will be significant factors in our ability to remain competitive.

Our

future success will depend on our ability to develop and maintain long-term relationships with our customers and to meet their

expectations in providing solutions and related services.

We

believe that our future success will depend to a significant extent on our ability to develop and maintain long-term relationships

with successful CSPs who have the financial and other resources required to invest in significant ongoing Service Assurance and

Customer Experience Management, or CEM, solutions. Our business and our results of operations could be adversely affected if we

are unable to develop sustainable customer relationships, or to meet customers’ expectations in providing solutions and

related services.

We

may enter into long-term sales agreements with large customers. Such agreements may prove unprofitable as our costs and product

mix shift over the terms of the agreements.

We

may enter from time to time into long-term sales agreements with large customers. We may be required under such agreements to

sell our solutions at fixed prices over the terms of the agreements. The costs we incur in fulfilling the agreements may vary

substantially from our initial cost estimates. Any cost overruns that we cannot pass on to our customers could adversely affect

our results of operations.

In

the future, we may also be required under such agreements to sell solutions that we may otherwise wish to discontinue, thereby

diverting our resources from developing more profitable or strategically important solutions.

Our

large customers have substantial negotiating leverage, which may require that we agree to terms and conditions that may have an

adverse effect on our business.

Large

CSPs have substantial purchasing power and leverage in negotiating contractual arrangements with us. These customers may require

us to develop additional features and may impose penalties on us for failure to deliver such features on a timely basis, or failure

to meet performance standards. As we seek to increase our sales to large CSPs, we may be required to agree to unfavorable terms

and conditions which may decrease our revenues and/or increase the time it takes to convert orders into revenues and could result

in an adverse effect on our business, financial condition and results of operations. Similarly, some of our contracts may contain

change in control provisions which may have an adverse effect on our business and results if exercised following a change in control

transaction or, in the alternative, may act as an impediment to certain change in control transactions.

Global

economic conditions may adversely affect our business.

Changes

in global economic conditions could have a negative impact on business around the world and on the telecommunications sector.

Conditions may be depressed, or may be subject to deterioration, which could lead to a reduction in consumer and customer spending

overall and may in turn have an adverse impact on sales of our solutions. A disruption in the ability of our significant

customers to access liquidity could cause serious disruptions or an overall deterioration of their businesses, which could lead

to a significant reduction in their orders of our solutions and the inability or failure on their part, to meet their payment

obligations to us, any of which could have an adverse effect on our business, financial condition, results of operations and liquidity. In

addition, any disruption in the ability of our customers to access liquidity could require us to assume greater credit risk relating

to our receivables or could limit our ability to collect receivables related to purchases by affected customers. As a result,

we may have to defer recognition of revenues, our reserves for doubtful accounts and write-offs of accounts receivable may increase

and we may incur losses.

Our

plans to focus most of our sales efforts on tier 1 and other leading CSPs in the North American, European and select other markets

may not be successful.

We

believe that the significant share of NFV deployment activity is expected to take place in North America, Europe, select CSPs

in Asia-Pacific and select CSPs in developing markets such as Latin America. We have accordingly enhanced our presence and focused

our sales and marketing resources in these markets. While we expect the selection of our NFV solutions by AT&T and another

tier 1 CSP to enhance the opportunities available to us, we may not be successful in expanding our business as we plan.

Our

expectation that the NFV market will gain momentum may not materialize.

We

believe that most of the industry’s leading CSPs will transform their network to NFV or are at the very least, evaluating

their transformation to NFV. Our expectation is that the NFV market will materialize and gain momentum. However, our expectations

may not be correct, and the actual pace of NFV transformation may take longer than we anticipate or may not occur at all. If the

demand for NFV does not continue to grow, our business, financial condition and results of operations may suffer.

We

have a history of quarterly fluctuations and unpredictability in our results of operations and expect these fluctuations to continue. This

may cause our share price to fluctuate and/or to decline.

We

have experienced, and in the future may also experience, significant fluctuations in our quarterly results of operations. Factors

that may contribute to fluctuations in our quarterly results of operations include:

|

|

●

|

the

variation in size and timing of individual purchases by our customers;

|

|

|

●

|

seasonal

factors that may affect capital spending by customers, such as the varying fiscal year-ends

of customers;

|

|

|

●

|

the

relatively long sales cycles for our solutions;

|

|

|

●

|

the

request for longer payment terms from us or long-term financing of customers’ purchases

from us, as well as additional conditions tied to such payment terms;

|

|

|

●

|

competitive

conditions in our markets;

|

|

|

●

|

the

timing of the introduction and market acceptance of new solutions or enhancements by

us and by our customers, competitors and suppliers;

|

|

|

●

|

changes

in the level of operating expenses relative to revenues;

|

|

|

●

|

changes

in global or regional economic conditions or in the telecommunications industry;

|

|

|

●

|

delays

in or cancellation of projects by customers;

|

|

|

●

|

changes

in the product mix;

|

|

|

●

|

the

size and timing of approval of grants from the Government of Israel; and

|

|

|

●

|

foreign

currency exchange rates.

|

Our

costs of revenues consist of variable costs, which include labor and related costs, including costs incurred in software development

customization for projects and deployment costs, the use of hardware, inventory write-offs, packaging, importation taxes, shipping

and handling costs, license fees for software components of third parties, warranty expenses, allocation of overhead expenses,

subcontractors’ expenses, royalties to the Israel Innovation Authority, or IIA, and share-based compensation. A major part

of our costs of sales is relatively variable and determined based on our anticipated revenues. We believe, therefore, that quarter-to-quarter

comparisons of our operating results may not be a reliable indication of future performance.

Our

revenues in any quarter generally have been, and may continue to be, derived from a relatively small number of orders with relatively

high average revenues per order. Therefore, the loss of any order or a delay in closing a transaction could have a more significant

impact on our quarterly revenues and results of operations, than on those of companies with relatively high volumes of sales or

low revenues per order.

We

may experience a delay in generating or recognizing revenues for several reasons, including revenue recognition accounting requirements.

In many cases, we cannot recognize revenue from an order prior to customer acceptance, which may take three to 12 months from

the commencement of the engagement. Therefore, a major part of the revenue for any fiscal quarter may be derived from a backlog

of orders under delivery and may not correlate to the date of a customer’s order or the delivery date.

Our

revenues for a specific quarter may also be difficult to predict and may be affected if we experience a non-linear sales pattern. We

generally experience significantly higher levels of sales orders towards the end of a quarter as a result of customers submitting

their orders late in the quarter. Furthermore, orders received towards the end of the quarter are usually not delivered within

the same quarter and are usually only recognized as revenue at a later stage.

If

our revenues in any quarter remain level or decline in comparison to any prior quarter, our financial results for that quarter

could be adversely affected.

Due

to the factors described above, as well as other unanticipated factors, in future quarters our results of operations could fail

to meet guidance we may give to the public from time to time or the expectations of public market analysts or investors. If this

occurs, the price of our ordinary shares may be adversely affected.

We

expect our gross margins to vary over time and we may not be able to sustain or improve upon our recent levels of gross margin

which may have a material adverse effect on our future profitability.

We

may not be able to sustain or improve upon our recent levels of gross margin. Our gross margins may be adversely affected by numerous

factors, including:

|

|

●

|

increased

price competition;

|

|

|

●

|

local

sales taxes which may be incurred for direct sales;

|

|

|

●

|

increased

industry consolidation among our customers, which may lead to decreased demand for and

downward pricing pressure on our solutions;

|

|

|

●

|

changes

in customer, geographic or product mix;

|

|

|

●

|

increases

in costs such as employment costs or third-party service or component costs;

|

|

|

●

|

changes

in distribution channels;

|

|

|

●

|

losses

on customer contracts; and

|

|

|

●

|

increases

in warranty costs.

|

Further

deterioration in gross margins, due to these or other factors, may have a material adverse effect on our business, financial condition

and results of operations.

Our

sales derived from emerging market countries may be materially adversely affected by economic, exchange rates, regulatory and

political developments in those countries.

In

parallel to our increased sales focus going forward in North America, Western Europe and additional developed markets, we plan

to continue to generate revenue from various emerging market countries. As these countries represent a portion of our existing

business and our expected growth, economic or political turmoil in these countries could materially adversely affect our revenues

and results of operations. Our investments in emerging market countries may also be subject to risks and uncertainties, including

unfavorable taxation treatment, exchange rates, challenges in protecting our intellectual property rights, nationalization, inflation,

currency fluctuations, or the absence of, or unexpected changes in, regulation as well as other unforeseeable operational risks.

Most

of our customers usually require a detailed and comprehensive evaluation process before they order our solutions. Our sales process

may be subject to delays that could significantly decrease our revenues and result in the eventual cancellations of some sale

opportunities.

We

derive all of our revenues from the sale of solutions and related services for CSPs. As common practice in our industry, our solutions

generally undergo a lengthy evaluation process before we can sell them. In recent years, our customers have been conducting a

more stringent and detailed evaluation of our solutions and decisions are subject to additional levels of internal review. As

a result, the sales cycle may be longer than anticipated. The following factors, among others, affect the length of the approval

process:

|

|

●

|

the

time involved for our customers to determine and announce their specifications;

|

|

|

●

|

the

time required for our customers to process approvals for purchasing decisions;

|

|

|

●

|

the

complexity of the solutions involved;

|

|

|

●

|

the

technological priorities and budgets of our customers; and

|

|

|

●

|

the

need for our customers to obtain or comply with any required regulatory approvals.

|

If

customers delay project approval or extend anticipated decision-making timelines, or if continued delays result in the eventual

cancellation of any sale opportunities, it may have a material adverse effect on our business, financial condition and results

of operations.

We

have experienced periods of growth of our business. If we cannot adequately manage our business, our results of operations may

suffer.

During

2016, 2017, and 2018 we increased the size of our workforce and we may continue to do so, during 2019, in order to enable us to

meet our obligations, continue enhancing our products and solutions, and grow our business. There is no guarantee that these efforts

to increase our work force will have a positive effect on our business. Future growth may place a significant strain on our managerial,

operational and financial resources.

We

cannot be sure that our systems, procedures and managerial controls will be adequate to support our operations. Any delay in implementing,

or transitioning to, new or enhanced systems, procedures or controls may adversely affect our ability to record and report financial

and management information on a timely and accurate basis. We believe that significant growth may require us to hire additional

personnel. Moreover, competition for qualified personnel can be intense in the areas where we operate, and the processes of locating,

training and successfully integrating qualified personnel into our operations can be lengthy and expensive. If we are unable to

successfully manage our expansion, including by attracting, incentivizing and retaining highly skilled personnel, we may not succeed

in expanding our business, our expenses may increase, and our results of operations may be adversely affected.

In

addition, employees may seek future employment with our business partners, customers or competitors. We cannot be sure that the

confidential nature of our proprietary information will not be compromised by any such employees who terminate their employment

with us.

We

may lose significant market share as a result of intense competition in the market for our existing and future solutions.

Many

companies compete with us in the market for service assurance and CEM solutions. We expect that competition will increase

in the future, both with respect to solutions that we currently offer and solutions that we are developing. Moreover,

manufacturers of data communications and telecommunications equipment with whom we partner or may partner may in the future incorporate

into their products capabilities similar to ours, thus reducing the demand for our solutions.

Some

of our existing and potential competitors have substantially greater resources, including financial, technological, engineering,

manufacturing, and marketing and distribution capabilities, and several of them may enjoy greater market recognition than us. We

may not be able to compete effectively with our competitors. A failure to do so could adversely affect our revenues and profitability.

Our

non-competition agreements with our employees may not be enforceable under Israeli law. If any of these employees leaves

us and joins a competitor, our competitor could benefit from the expertise our former employee gained while working for us.

We

generally enter into non-competition agreements with our key employees. These agreements prohibit those employees, while they

work for us and for a specified length of time after they cease to work for us, from directly competing with us or working for

our competitors for a limited period. Under applicable Israeli law, we may be unable to enforce these agreements or any part thereof

against our Israeli employees. If we cannot enforce our non-competition agreements against our Israeli (or any other) employees,

then we may be unable to prevent our competitors from benefiting from the expertise of these former employees, which could impair

our business, results of operations and ability to capitalize on our proprietary information.

Our

business could be harmed if we were to lose the services of one or more members of our senior management team, or if we are unable

to attract and retain qualified personnel.

Our

future growth and success depend to an extent upon the continuing services of our executive officers and other key employees including

our Chief Executive Officer, Mr. Yaron Ravkaie, the Chief Executive Officer of our U.S. subsidiary, RADCOM, Inc., or RADCOM US,

Mr. Eyal Harari, and our Vice President of Research and Development, Mr. Hilik Itman. We do not have long-term employment agreements

with any of our employees. Competition for qualified management and other high-level telecommunications industry personnel is

intense, and we may not be successful in attracting and retaining qualified personnel. If we lose the services of any key employees,

we may not be able to manage our business successfully or to achieve our business objectives.

Our

success also depends on our ability to identify, attract and retain qualified technical, sales, finance and management personnel.

We have experienced, and may continue to experience, difficulties in hiring and retaining candidates with appropriate qualifications.

If we do not succeed in hiring and retaining candidates with appropriate qualifications, our revenues and product development

efforts could be harmed.

The

complexity and scope of the solutions we provide to larger CSPs is increasing. Larger projects entail greater operational risk

and an increased chance of failure.

The

complexity and scope of the solutions we provide to larger CSPs is increasing. The larger and more complex such projects are,

the greater the operational risks associated with such projects. These potential risks include failure to successfully deliver

our solution, failure to fully integrate our solutions with third party products and complex environments in the CSP’s network,

and our dependence on subcontractors and partners for the successful and timely completion of such projects. Failure to complete

a larger project successfully could expose us to potential contractual penalties, claims for breach of contract and in extreme

cases, to cancellation of the entire project, and may result in difficulty in collecting payment and recognizing revenues from

such project.

We

could be subject to claims under our warranties and extended maintenance and support agreements which may affect our financial

condition.

Our

solutions are complex and may sometimes contain undetected errors which can delay introductions or necessitate redesign. In

addition, we are dependent on other suppliers for key components that are incorporated in our solutions. Failures in networks

in which our solutions are deployed arising out of our solutions may result in customer dissatisfaction, contractual claims and,

potentially, liability claims being filed against us. Our warranties require us to correct any errors or defects in our solutions.

The warranty period is mostly for one year but could be extended either in the initial purchase of our solution or after the initial

warranty period ends through the purchase of extended support and maintenance. Any failure of a network in which our solutions

are deployed (whether or not our solutions are the cause) and any customer claims against us, along with any associated negative

publicity, could result in the loss of, or delay in, market acceptance of our solutions and harm to our business. In addition,

under the warranty and extended maintenance agreements, we need to meet certain service levels and if we fail to meet them, we

may be exposed to penalties.

We

incorporate open source technology in our solutions which may expose us to liability and have a material impact on our product

development and sales.

Some

of our solutions utilize open source technologies. These technologies are licensed to us under varying license structures. These

licenses pose a potential risk to our solution in the event they are inappropriately integrated. If we have not, or do not in

the future, properly integrate software that is subject to such licenses into our solutions, we may be required to disclose our

own source code to the public, which could enable our competitors to eliminate any technological advantage that our solutions

may have over theirs. Any such requirement to disclose our source code or other confidential information related to our solutions

could, therefore, materially adversely affect our competitive advantage and impact our business, financial condition and results

of operations.

We

depend on limited sources for key components and if we are unable to obtain these components when needed we may experience delays

in delivering our solutions.

We

currently obtain key components of our software solutions from a limited number of suppliers. With some of our suppliers,

we do not have long-term supply contracts. We may be subject to the following risks:

|

|

●

|

delays

in delivery could interrupt and delay delivery and result in cancellations of orders;

|

|

|

●

|

suppliers

could increase component prices significantly and with immediate effect;

|

|

|

●

|

we

may not be able to locate alternatives for such components; and

|

|

|

●

|

suppliers

could discontinue the supply or support of such components which may require us to modify

our solutions, and cause delays in delivery, increased development costs and increased

solution prices.

|

Our

proprietary technology is difficult to protect and unauthorized use of our proprietary technology by third parties may impair

our ability to compete effectively.

Our

success and ability to compete depend in large part upon protecting our proprietary technology. We rely upon a combination

of contractual rights, software licenses, trade secrets, copyrights, non-disclosure agreements and technical measures to establish

and protect our intellectual property rights in our solutions and technologies. In addition, we sometimes enter into non-competition,

non-disclosure and confidentiality agreements with our employees, distributors, sales representatives and certain suppliers with

access to sensitive information. We currently have one registered patent, five pending patent applications and we are in

the process of filing additional patent applications. However, these measures may not be adequate to protect our technology from

third-party infringement. Additionally, effective intellectual property protection may not be available in every country

in which we offer, or intend to offer, our solutions.

We

may expand our business or enhance our technology through partnerships and acquisitions that could result in diversion of resources

and extra expenses. This could disrupt our business and adversely affect our financial condition.

Part

of our growth strategy may be to selectively pursue partnerships and acquisitions that provide us access to complementary technologies

and accelerate our penetration into new markets. The negotiation of acquisitions, investments or joint ventures, as well as the

integration of acquired or jointly developed businesses or technologies, could divert our management’s time and resources.

Acquired businesses, technologies or joint ventures may not be successfully integrated with our solutions and operations. We may

not realize the intended benefits of any acquisition, investment or joint venture and we may incur future losses from any acquisition,

investment or joint venture.

In

addition, acquisitions could result in, among other things:

|

|

●

|

substantial

cash expenditures;

|

|

|

●

|

potentially

dilutive issuances of equity securities;

|

|

|

●

|

the

incurrence of debt and contingent liabilities;

|

|

|

●

|

a

decrease in our profit margins; and

|

|

|

●

|

amortization

of intangibles and potential impairment of goodwill.

|

If

we implement our growth strategy by acquiring other businesses, and this disrupts our operations, our business, financial condition

and results of operations could be adversely affected. As of the date of this Annual Report, we have not proceeded with such acquisitions.

Certain

privacy and data security laws and regulations may affect the use of our solutions.

Our

solutions and their use may be subject to certain laws and regulations regarding privacy and data security including United States

federal and state laws and recently enacted European privacy laws. Generally, attention to privacy and data security requirements

is increasing worldwide and is resulting in increased regulation. Such regulations may impose significant penalties for non-compliance,

such as the penalties proposed under the European data protection regulations which became effective in May 2018. Use of our solutions

could be subject to such new regulation, which could significantly increase the cost of implementing our solutions and impact

our ability to compete in the marketplace. Such regulations could also impose additional data security requirements which will

impact the cost of developing new solutions and limit the return we can expect to achieve on past and future investments in our

solutions.

If

security measures for our solutions are compromised and as a result, our customers’ data or our systems are accessed improperly,

made unavailable, or improperly modified, our solutions may be perceived as vulnerable, which may materially affect our business

and result in potential liability.

Despite

our efforts to implement appropriate security measures, we cannot guarantee that our solutions and systems are fully protected

from vulnerabilities such as viruses, worms and other malicious software programs, attacks, break-ins and similar

disruptions from unauthorized tampering by computer hackers and others seeking to gain unauthorized access to digital systems

for purposes of misappropriating assets or sensitive information, corrupting data, or causing operational disruption. If a cyber-attack

or other security incident were to result in unauthorized access to, or deletion of, and/or modification and/or exfiltration of

our customers’ data, other external data or our own data or our systems or if the use of the solutions we provide to our

customers was disrupted, customers could lose confidence in the security and reliability of our solutions and perceive them not

to be secure. This in turn could lead to fewer customers using our solutions and result in reduced revenue and earnings. The costs

we would incur to address and fix these security incidents would increase our expenses. Additionally, the occurrence of a cyber-attack

or security incident with respect to our solutions could cause our customers to make claims against us for damages allegedly resulting

from a security breach, and security incidents could also lead to data or privacy breaches, regulatory investigations and claims,

all of which could increase our liability. These risks may increase as we grow our customer base and increase instances of deployment

and use of our solutions.

Because

we received grants from the IIA, we are subject to ongoing restrictions.

We

have received an aggregate of $44.8 million in royalty-bearing grants from the IIA for certain research and development activities

pursuant to an incentive program. Accordingly, we are obligated to pay royalties to the IIA on revenues from products developed

pursuant to the program or deriving therefrom. In addition, under the terms of the program our ability to transfer any resulting

know-how, especially to parties outside of Israel, is subject to certain terms and conditions. The Law for the Encouragement of

Research, Development and Technological Innovation in the Industry, 1984-5744, or the R&D Law, generally requires a grant

recipient and its controlling shareholders to notify the IIA of changes in the ownership of the recipient company and to undertake

to the IIA to observe the laws governing the grant programs.

Additionally,

in May 2010, we received a notice from the IIA regarding alleged miscalculations in the amount of royalties paid by us to the

IIA for the years 1992 through 2009 and the revenues on which the Company must pay royalties. During 2011, we reviewed with the

IIA these alleged miscalculations. We believe that all royalties due to the IIA from the sale of products developed with funding

provided by the IIA during such years were properly paid or were otherwise accrued as of December 31, 2018. However, we cannot

be sure that the IIA will accept our arguments mentioned above, which, if not accepted, may result in the expenditure of financial

resources.

We

may be subject to claims of infringement of third-party intellectual property which may have an adverse effect on our business.

Third

parties may from time to time assert against us infringement claims or claims that we have violated a patent or infringed a copyright,

trademark or other proprietary right belonging to them. If such infringement were found to exist, we might be required

to modify our products or intellectual property or to obtain a license or right to use such technology or intellectual property. Any

infringement claim, even if not meritorious, could result in the expenditure of significant financial and managerial resources.

Zohar

Zisapel and Yehuda Zisapel beneficially own, in the aggregate, approximately 24% of our ordinary shares and therefore have significant

influence over the outcome of matters requiring shareholder approval including the election of directors.

As

of April 15, 2019, Zohar Zisapel (the former Chairman of our Board of Directors) and Yehuda Zisapel, who are brothers, may be

deemed to beneficially own an aggregate of 3,226,481 ordinary shares, including options exercisable for 14,000 ordinary shares

that are exercisable within 60 days of April 15, 2019, representing approximately 24% of our outstanding ordinary shares. As

a result, despite the fact that each one of them, to our knowledge, operates independently from the other with respect to his

respective shareholding of our shares, Zohar Zisapel and Yehuda Zisapel have significant influence over the outcome of various

actions that require shareholder approval including the election of our directors. In addition, Zohar Zisapel and Yehuda

Zisapel may be able to delay or prevent a transaction in which shareholders might receive a premium over the prevailing market

price for their shares and prevent changes in control or in management.

We

engage in transactions and may compete with companies controlled by Zohar Zisapel and Yehuda Zisapel which may result in potential

conflicts.

We

are engaged in, and expect to continue to be engaged in, numerous transactions with companies controlled by Zohar Zisapel and/or

Yehuda Zisapel. We believe that such transactions are beneficial to us and are generally conducted upon terms that

are no less favorable to us than would be available from unaffiliated third parties. Nevertheless, these transactions may

result in a conflict of interest between what is best for us and the interests of the other parties in such transactions. Furthermore,

in some cases we may compete, or buy third party components from other companies who compete, with companies controlled by Zohar

Zisapel and/or Yehuda Zisapel.

For

more information, see “Item 7.B-Major Shareholders and Related Party Transactions—Related Party Transactions”

and “Item 10.B-Fiduciary Duties of Shareholders.”

We

incurred net losses in the past and may not achieve or sustain profitability in the future.

In

2018 we incurred a net loss of approximately $2.4 million. Although we were profitable in 2017 and 2016, we may continue to incur

losses in the future or may be unable to sustain profitability, which could materially affect our cash and liquidity and could

adversely affect the value and market price of our shares.

Our

growing international presence exposes us to risks associated with varied and changing political, cultural, legal and economic

conditions worldwide and if we fail to adapt appropriately to the challenges associated with operating internationally the expected

growth of our business may be impeded, and our operating results may be affected.

While

we are headquartered in Israel, approximately 98% of our sales in 2018, 90% of our sales in 2017, and 98% of our sales in 2016

were generated outside of Israel. Our international sales will be limited if we cannot continue to establish and maintain relationships

with international distributors and resellers, set up additional foreign operations, expand international sales channel management,

hire additional personnel, develop relationships with international CSPs and operate adequate after-sales support internationally.

Even

if we are able to successfully expand our international operations, we may not be able to maintain or increase international

market demand for our solutions. Our international operations are subject to a number of risks, including:

|

|

●

|

legal,

language and cultural differences in the conduct of business;

|

|

|

●

|

challenges

in staffing and managing foreign operations due to the limited number of qualified candidates

and due to employment laws and business practices in foreign countries;

|

|

|

●

|

our

inability to comply with import/export, environmental and other trade compliance and

other regulations of the countries in which we do business including additional

labor laws, particularly in Brazil and India, together with unexpected changes in such

regulations;

|

|

|

●

|

insufficient

measures to ensure that we design, implement, and maintain adequate controls over our

financial processes and reporting in the future;

|

|

|

●

|

our

failure to adhere to laws, regulations, and contractual obligations relating to customer

contracts in various countries;

|

|

|

●

|

our

inability to maintain a competitive list of distributors and resellers for indirect sales;

|

|

|

●

|

tariffs

and other trade barriers;

|

|

|

●

|

economic

and political instability in foreign markets;

|

|

|

●

|

wars,

acts of terrorism and political unrest;

|

|

|

●

|

lack

of integration of foreign operations;

|

|

|

●

|

variations

in effective income tax rates among countries where we conduct business;

|

|

|

●

|

potential

foreign and domestic tax consequences and withholding taxes that limit the repatriation

of earnings;

|

|

|

●

|

technology

standards that differ from those on which our solutions are based, which could require

expensive redesign and retention of personnel familiar with those standards;

|

|

|

●

|

laws

and business practices favoring local competitors;

|

|

|

●

|

longer

accounts receivable payment cycles and possible difficulties in collecting payments;

and

|

|

|

●

|

failure

to meet certification requirements.

|

Any

of these factors could harm our international operations and have an adverse effect on our business, operating efficiency, results

of operations, financial performance and financial condition. The continuing weakness in foreign economies could have a significant

negative effect on our future operating results.

Because

our revenues are generated primarily in foreign currencies (mostly in U.S. dollars but also in other currencies), but a significant

portion of our expenses are incurred in New Israeli Shekels, our results of operations may be seriously harmed by currency fluctuations.

We

sell in markets throughout the world and most of our revenues are generated in U.S. dollars. We also generate revenues in Brazilian

real, or BRL, euro and other currencies. Financing activities are also made in U.S. dollars. Accordingly, we consider the U.S.

dollar to be our functional currency. However, a significant portion of our expenses is in NIS, mainly related to employee expenses.

Therefore, fluctuations in exchange rates between the NIS and the U.S. dollar as well as between other currencies and the U.S.

dollar may have an adverse effect on our results of operations and financial condition. As of today, we have not entered into

any hedging transactions in order to mitigate these risks.

Moreover,

as our revenues are currently denominated primarily in U.S. dollars, devaluation in the local currencies of our customers relative

to the U.S. dollar could cause customers to default on payment. Also, as a portion of our revenues is denominated in BRL, devaluation

in this currency may cause financial expenses related to our intercompany short-term balances. In the future, additional revenues

may be denominated in currencies other than U.S. dollars, thereby exposing us to gains and losses on non-U.S. currency transactions.

In

addition, a material portion of our leases are denominated in currencies other than the U.S. dollar, mainly in NIS. In accordance

with the new lease accounting standard, which became effective on January 1, 2019, the associated lease liabilities will be remeasured

using the current exchange rate in the future reporting periods, which may result in material foreign exchange gains or losses.

Our

international sales and operations are subject to complex laws relating to foreign corrupt practices and bribery, among many other

subjects. A violation of, or change in, these laws could adversely affect our business, financial condition or results of operations.

Our

operations in countries outside the United States are subject, among others, to the Foreign Corrupt Practices Act of 1977 as amended

from time to time, or FCPA, which prohibits U.S. companies or foreign companies whose shares traded on a U.S. stock exchange,

or their agents and employees, from providing anything of value to a foreign public official, as defined in the FCPA, for the

purposes of influencing any act or decision of these individuals in their official capacity to help obtain or retain business,

direct business to any person or corporate entity, or obtain any unfair advantage. We have internal control policies and procedures

with respect to the FCPA. However, we cannot assure that our policies and procedures will always protect us from reckless or criminal

acts that may be committed by our employees or agents. Violations of the FCPA may result in severe criminal or civil sanctions,

and we may be subject to other liabilities, which could have a material adverse effect on our business, results of operations

and financial condition. In addition, investigations by governmental authorities as well as legal, social, economic and political

issues in countries where we operate could have a material adverse effect on our business and results of operations. We are also

subject to the risks that our employees or agents outside of the United States may fail to comply with other applicable laws.

The costs of complying with these and similar laws may be significant and may require significant management time and focus. Any

violation of these or similar laws, intentional or unintentional, could have a material adverse effect on our business, financial

condition or results of operations.

Any

inability to comply with Section 404 of the Sarbanes-Oxley Act of 2002 regarding effective internal control procedures may negatively

impact the report on our financial statements to be provided by our independent auditors.

Pursuant

to rules of the U.S. Securities and Exchange Commission, or SEC, adopted pursuant to Section 404, or Section 404, of the Sarbanes-Oxley

Act of 2002, or the Sarbanes-Oxley Act, we are required to include in our annual report a report of management on our internal

control over financial reporting including an assessment by management of the effectiveness of our internal control over financial

reporting. In addition, because we qualify as an accelerated filer under the SEC rules, our independent registered public

accounting firm is required to attest to and report on the effectiveness of our internal control over financial reporting. Our

management or our auditors may conclude that our internal control over financial reporting is not effective. Such conclusion could

result in a loss of investor confidence in the reliability of our financial statements, which could negatively impact the market

price of our shares. Further, our auditors or we may identify material weaknesses or significant deficiencies in our assessments

of our internal control over financial reporting. Failure to maintain effective internal control over financial reporting

could result in investigation or sanctions by regulatory authorities and could have an adverse effect on our business, financial

condition and results of operations, and on investor confidence in our reported financial information.

If

we determine that we are not in compliance with Section 404, we may be required to implement new internal controls and procedures

and re-evaluate our financial reporting. We may experience higher than anticipated operating expenses as well as third party advisory

fees during the implementation of these changes and thereafter. Further, we may need to hire additional qualified personnel in

order to comply with Section 404. If we are unable to implement these changes effectively or efficiently, it could have a

material adverse effect on our business, financial condition, results of operations, financial reporting or financial results

and could result in our conclusion that our internal controls over financial reporting are not effective.

Risks

Related to our Ordinary Shares

Wide

fluctuations in the market price of our ordinary shares could adversely affect us and our shareholders.

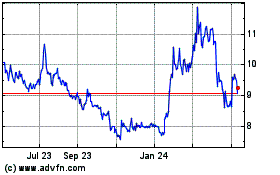

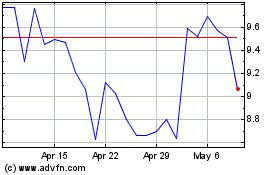

Between

January 1, 2018 and April 15, 2019, our ordinary shares have traded on the Nasdaq Capital Market, or the Nasdaq, as high as $21.50

and as low as $7.10 per share. As of April 15, 2019, the closing price of our ordinary shares on Nasdaq was $7.93 per share. The

market price of our ordinary shares has been and is likely to continue to be highly volatile and could be subject to wide fluctuations

in response to numerous factors, including those risks identified in “Item 3.D-Risk Factors”.

In

addition, the stock market in general, and the market for Israeli and technology companies in particular, has been highly volatile. Many

of these factors are beyond our control and may materially adversely affect the market price of our ordinary shares, regardless

of our performance. Shareholders may not be able to resell their ordinary shares following periods of volatility because

of the market’s adverse reaction to such volatility.

From

time to time we may choose to raise funds. If adequate financing is not available on terms favorable to us or to our shareholders,

our operations and growth strategy may be affected.

From

time to time we may choose to raise funds in connection with our operations and growth strategy. We do not know whether additional

financing will be available when needed, or whether it will be available on terms favorable to us. Any such financings may

dilute the ownership of existing shareholders and could adversely affect the market price of our ordinary shares. In addition,

if adequate financing is not available on terms favorable to us or to our shareholders, our operations and growth strategy may

be affected.

The

trading volume of our shares is relatively low and it may be low in the future.

Our

shares have been traded at low volumes in the past and may be traded at low volumes in the future for reasons related or unrelated

to our performance. This low trading volume may result in lesser liquidity and lower than expected market prices for our ordinary

shares, and our shareholders may not be able to resell their shares for more than they paid for them. This low trading volume

may also result in greater share price volatility as result of short trading activities or the acquisition or disposition of shares

by any single larger or institutional shareholder.

Risks

Related to Our Location in Israel

Conditions

in Israel affect our operations and may limit our ability to produce and sell our solutions.

We

are incorporated under Israeli law and our principal offices and research and development facilities are located in Israel. Accordingly,

security, political and economic conditions in the Middle East in general, and in Israel in particular, may directly affect our

business.

Over

the past several decades, a number of armed conflicts have taken place between Israel and its Arab neighbors and a state of hostility,

varying in degree and intensity, has led to security and economic problems for Israel. From time to time since late 2000, there

has also been a high level of violence between Israel and the Palestinians. In addition, since 2010 political uprisings and conflicts

in various countries in the Middle East, including Egypt and Syria, are affecting the political stability of those countries.

Any armed conflicts or political instability in the region, including acts of terrorism or any other hostilities involving or

threatening Israel, could affect business conditions and could make it more difficult for us to conduct our operations in Israel,

which could increase our costs and adversely affect our financial results.

Further,

in the past, the State of Israel and Israeli companies have been subjected to economic boycotts. Several countries still restrict

business with the State of Israel and with Israeli companies. These restrictive laws and policies may have an adverse impact on

our operating results, financial conditions or the expansion of our business.

We

currently benefit from government programs that may be discontinued or reduced.

We

currently receive grants under Government of Israel programs. In order to maintain our eligibility for these programs, we

must continue to meet specific conditions and pay royalties with respect to grants received. In addition, some of these

programs restrict our ability to develop particular products outside of Israel or to transfer particular technology. If we

fail to comply with these conditions in the future, the benefits received could be canceled and we could be required to refund

any payments previously received under these programs. Additionally, these programs may be discontinued or curtailed in the future. If

we do not receive these grants in the future, we will have to allocate funds to product development at the expense of other operational

costs. If the Government of Israel discontinues or curtails these programs, our business, financial condition and results

of operations could be materially adversely affected. For more information, see “Item 4.B—Information on

the Company—Business Overview—Israel Innovation Authority.”

Provisions

of Israeli law may delay, prevent or make difficult a merger or acquisition of us, which could prevent a change of control and

depress the market price of our shares.

The

Israeli Companies Law, 5759-1999, or the Israeli Companies Law, regulates acquisitions of shares through tender offers, requires

special approvals for transactions involving shareholders holding 25% or more of the company’s capital, and regulates other

matters that may be relevant to these types of transactions. These provisions of Israeli law could have the effect of delaying

or preventing a change in control and may make it more difficult for a third party to acquire us, even if doing so would be beneficial

to our shareholders. These provisions may limit the price that investors may be willing to pay in the future for our ordinary

shares. Furthermore, Israeli tax considerations may make potential transactions undesirable to us or to some of our shareholders.

Our

results of operations may be negatively affected by the obligation of our personnel to perform military service.

Some

of our employees are required to perform annual military reserve duty in Israel and may be called to active duty at any time under

certain circumstances. Our operations could be disrupted by the absence for a significant period of one or more of our executive

officers or other key employees due to military service. Any disruption to our operations would harm our business.

It

may be difficult to effect service of process, assert U.S. securities laws claims and enforce U.S. judgments in Israel against

us or our directors, officers and auditors named in this Annual Report.

We

were incorporated in Israel. All our directors reside outside of the United States, and most of our assets are located outside

of the United States. Therefore, a judgment obtained against us, or any of these persons, including a judgment based on the civil

liability provisions of the U.S. federal securities laws, may not be collectible in the United States and may not necessarily

be enforced by an Israeli court. It also may be difficult to effect service of process on these persons in the United States or

to assert U.S. securities law claims in original actions instituted in Israel. Additionally, it may be difficult for an investor,

or any other person or entity, to initiate an action with respect to United States securities laws in Israel. Israeli courts may

refuse to hear a claim based on an alleged violation of United States securities laws reasoning that Israel is not the most appropriate

forum in which to bring such a claim. In addition, even if an Israeli court agrees to hear a claim, it may determine that Israeli

law and not United States law is applicable to the claim. If United States law is found to be applicable, the content of applicable

United States law must be proven as a fact by expert witnesses, which can be a time consuming and costly process. Certain matters

of procedure will also be governed by Israeli law. There is little binding case law in Israel that addresses the matters described

above. As a result of the difficulty associated with enforcing a judgment against us in Israel, you may not be able to collect

any damages awarded by either a United States or foreign court.

As

a foreign private issuer whose shares are listed on the Nasdaq, we may follow certain home country corporate governance practices

instead of certain Nasdaq requirements.

As

a foreign private issuer whose shares are listed on the Nasdaq, we are permitted to follow certain home country corporate governance

practices instead of certain requirements of the Nasdaq Stock Market Rules including requirements regarding the composition of

the board of directors, compensation of officers, director nomination process and quorum at shareholders’ meetings. In addition,

we may follow home country practice instead of the Nasdaq requirement to obtain shareholder approval for certain dilutive events

(such as for the establishment or amendment of certain equity-based compensation plans, an issuance that will result in a change

of control of the company, certain transactions other than a public offering involving issuances of a 20% or more interest in

the company and certain acquisitions of the stock or assets of another company).

Accordingly,

our shareholders may not be afforded the same protection as provided under Nasdaq’s corporate governance rules. For more

information, see “Item 16G—Corporate Governance”.

The

rights and responsibilities of our shareholders are governed by Israeli law and differ in some respects from those under Delaware

law.

Because

we are an Israeli company, the rights and responsibilities of our shareholders are governed by our articles of association and

by Israeli law. These rights and responsibilities differ in some respects from the rights and responsibilities of shareholders

in a Delaware corporation. In particular, a shareholder of an Israeli company has a duty to act in good faith towards the company

and other shareholders and to refrain from abusing his, her or its power in the company, including, among other things, in voting

at the general meeting of shareholders on certain matters. Israeli law provides that these duties are applicable to shareholder

votes on, among other things, amendments to a company’s articles of association, increases in a company’s authorized

share capital, mergers and interested party transactions requiring shareholder approval. In addition, a shareholder who knows

that it possesses the power to determine the outcome of a shareholders’ vote or to appoint or prevent the appointment of

a director or executive officer of the company has a duty of fairness towards the company. However, Israeli law does not define

the substance of this duty of fairness. There is little case law available to assist in understanding the implications of these

provisions that govern shareholder behavior.

|

ITEM

4.

|

INFORMATION ON

THE COMPANY

|

|

|

A.

|

HISTORY AND DEVELOPMENT

OF THE COMPANY

|

Both

our legal and commercial name is RADCOM Ltd., and we are an Israeli company. We were incorporated in 1985 under the laws

of the State of Israel and commenced operations in 1991. The principal legislation under which we operate is the Israeli

Companies Law. Our principal executive offices are located at 24 Raoul Wallenberg Street, Tel Aviv 69719, Israel, and our telephone