0001653558false00016535582023-07-282023-07-28

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

July 28, 2023

Date of Report (Date of earliest event reported)

Priority Technology Holdings, Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-37872 | | 47-4257046 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 2001 Westside Parkway | | |

| Suite 155 | | |

| Alpharetta, | Georgia | | 30004 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant's telephone number, including area code: (800) 935-5961

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

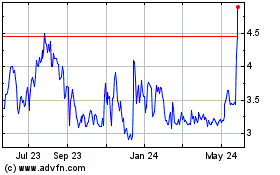

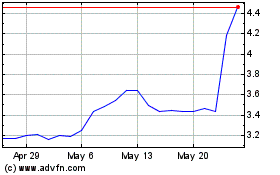

| Common stock, $0.001 par value | | PRTH | | Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of (1933 §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

The information regarding the Amendment, Side Letter Agreement and the Earnout Agreement (each as defined below) set forth in Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 1.01.

Item 2.01 Completion of Acquisition or Disposition of Assets.

On July 31, 2023, Priority Technology Holdings, Inc.’s (the “Company”) indirect subsidiary, Plastiq, Powered by Priority, LLC, a Delaware limited liability company (“Buyer”), completed the acquisition of (i) substantially all of the assets of Plastiq Inc., a Delaware corporation (“Plastiq”), PLV Inc., a Delaware corporation and subsidiary of Plastiq (“PLV”), and Nearside Business Corp., a Delaware corporation and subsidiary of Plastiq (“Nearside”, together with Plastiq and PLV, “Sellers”), and (ii) all of the equity of Plastiq Canada Inc. (“Plastiq Canada”), a wholly owned subsidiary of Plastiq (the “Sale”), pursuant to that certain Asset and Equity Purchase Agreement, dated May 23, 2023, among Buyer and Sellers (as amended, the “Purchase Agreement”). The Purchase Agreement was filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (the “Commission”) on May 24, 2023 (File No. 0001-37872).

As previously disclosed, on May 24, 2023, Sellers filed voluntary petitions for relief under Chapter 11 of Title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”). On July 27, 2023, the Bankruptcy Court approved the Sale under the Bankruptcy Code pursuant to the Purchase Agreement. The Bankruptcy Court’s order approved the sale of the Purchased Assets (as defined in the Purchase Agreement) to Buyer free and clear of all liens, claims and encumbrances pursuant to Section 363 of the Bankruptcy Code.

In connection with the Sale, the following agreements were entered into to supplement the terms of the Purchase Agreement:

•that certain Amendment No. 1 to Equity and Asset Purchase Agreement, dated as of July 31, 2023 (the "Amendment"), by and among Sellers and Buyer;

•that certain Side Letter Agreement, dated as of July 28, 2023 (the “Side Letter Agreement”), by and between Buyer and Colonnade Acquisition Corp. II, a Cayman Islands exempted company limited by shares (“Colonnade”); and

•that certain Earnout Agreement, entered into on July 31, 2023 (the “Earnout Agreement”), by and among Buyer, Sellers, Priority Holdings, LLC and Blue Torch Finance, LLC, a Delaware limited liability company (“Blue Torch”).

Pursuant to the terms and subject to the conditions of the Purchase Agreement, in addition to the assumption of Liabilities (as defined in the Purchase Agreement), the Purchase Agreement provided for consideration that consisted of: (i) $27,500,000 in cash at the consummation of the Sale (the “Closing”); (ii) payment of the consideration to Blue Torch as described in the Earnout Agreement; and (iii) payment of the consideration to Colonnade as described in the Side Letter Agreement.

A copy of the Amendment, Side Letter Agreement and the Earnout Agreement are attached hereto as Exhibit 10.1, Exhibit 10.2 and Exhibit 10.3, respectively, and are incorporated by reference herein.

Item 2.03 Creation of a Direct Financial Obligation or Obligation under an Off-Balance Sheet Obligation of a Registrant.

As previously disclosed, on June 30, 2023, Priority Holdings, LLC, as a borrower (the “Initial Borrower”), the other Credit Parties (as defined in the Third Amendment (as defined below)) party thereto, the 2023-1 Incremental Revolving Credit Lender (as defined in the Third Amendment), the 2023-2 Incremental Revolving Credit Lender (as defined in the Third Amendment) and Truist Bank, as administrative agent and collateral agent (the “Agent”), entered into the Third Amendment to the Credit and Guaranty Agreement (the “Third Amendment”), which amended the Credit and Guaranty Agreement, dated as of April 27, 2021 (as amended by the First Amendment to the Credit and Guaranty Agreement, dated as of May 21, 2021, the Second Amendment to the Credit and Guaranty Agreement, dated as of September 17, 2021 the “Credit Agreement”). Capitalized terms used but not defined in this Item 2.03 have the meaning given to them in the Credit Agreement. The Third Amendment amended the Credit Agreement to, among other things, provide for additional revolving commitments under the Credit Agreement in an aggregate principal amount of $25,000,000 (the “Additional Revolving Commitment”), $15,000,000 of which was available immediately upon effectiveness of the Third Amendment. In connection with the consummation of the Sale, the remaining $10,000,000 of the Additional Revolving Commitment was made available to the Borrowers. Proceeds from a drawing on the Revolving Commitments (as increased by the Additional Revolving Commitment) were used, together with the cash on hand, to fund the cash consideration for the Sale.

The foregoing description of the Third Amendment does not purport to be complete, and is qualified in its entirety by reference to the complete text of the Third Amendment filed as Exhibit 10.1 to the Current Report on Form 8-K filed with the Commission on July 3, 2023 (File No. 001-37872), the terms of which are incorporated herein by reference.

Item 8.01 Other Events.

On August 1, 2023, the Company issued a press release announcing the Closing. The Company’s press release is attached hereto as Exhibit 99.1 and the information set forth therein is incorporated herein by reference and constitutes a part of this Current Report.

Item 9.01 Financial Statements and Exhibits.

(a) Financial statements of businesses acquired — The financial statements required under this Item 9.01 are not included in this Current Report, and the Company will file an amendment to this Current Report containing the audited financial statements required within 71 calendar days.

(d) Exhibits — The following exhibit is furnished as part of this Current Report on Form 8-K.

| | | | | |

| Exhibit Number | Description |

| |

| |

| Earnout Agreement, dated July 31, 2023, by and among Plastiq, Powered by Priority, LLC, Plastiq Inc., PLV Inc., Nearside Business Corp., Blue Torch Finance, LLC and Priority Holdings, LLC. |

| |

| 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Dated: August 1, 2023 | |

| | |

| | PRIORITY TECHNOLOGY HOLDINGS, INC. |

| | |

| | By: /s/ Timothy O'Leary |

| | Name: Timothy O'Leary |

| | Title: Chief Financial Officer |

Execution Version AMENDMENT NO. 1 TO EQUITY AND ASSET PURCHASE AGREEMENT This AMENDMENT NO. 1 TO EQUITY AND ASSET PURCHASE AGREEMENT (this “Amendment No. 1”), is effective as of July 31, 2023, by and among PLASTIQ INC., PLV INC., NEARSIDE BUSINESS CORP. (collectively, “Sellers”) and PLASTIQ, POWERED BY PRIORITY, LLC (together with its permitted successors, designees and assigns, “Buyer”). Sellers and Buyer are referred to collectively herein as the “Parties.” Capitalized terms used and not otherwise defined herein shall have the meanings assigned to them in the Agreement (as defined below). WHEREAS, the Parties previously entered into that certain Equity and Asset Purchase Agreement, dated as of May 23, 2023 (the “Agreement”); WHEREAS, the Parties desire to amend the Agreement as set forth herein; and WHEREAS, pursuant to Section 9.5 of the Agreement, the Agreement may be amended by a writing signed by each Party; NOW THEREFORE, in consideration of the foregoing premises and other good and valuable consideration, the Parties, intending to be legally bound, agree as follows: 1. The sixth Whereas clause in the recitals to the Agreement is hereby amended and restated as follows: “WHEREAS, concurrently with the Closing, Buyer will enter into an earnout agreement substantially in the form attached hereto as Exhibit A (the “Earnout Agreement”) with Sellers and Blue Torch Finance LLC (“Blue Torch”), pursuant to which Sellers will have the right to receive cash consideration in the form of an earnout payment, in an amount to be calculated in accordance with the terms and conditions of the Earnout Agreement, which right to receive such earnout payment shall be assigned by Sellers to Blue Torch immediately following the Closing in exchange for Blue Torch’s release of any and all Liens, Claims and encumbrances on the Purchased Assets, whether under the Secured Debt, the DIP Agreement or otherwise, and in satisfaction of Sellers’ obligations under the Secured Debt and the DIP Agreement following any payments received by Blue Torch upon entry of the Sales Order by the Bankruptcy Court and consummation of the Contemplated Transactions;” 2. Section 2.5(b) of the Agreement (which was inadvertently made a part of Section 2.5(a) of the Agreement) is hereby amended and restated as follows: “(b) grant Sellers the right to receive the cash consideration in the form of an earnout payment as described in the Earnout Agreement attached hereto as Exhibit A, which right to receive such earnout payment shall be assigned by Sellers to Blue Torch immediately following the Closing in exchange for Blue Torch’s release of any and all Liens, Claims and encumbrances on the Purchased Assets, whether under the Secured Debt, the DIP Agreement or otherwise, and in satisfaction of Sellers’ obligations under the Secured Debt and the DIP Agreement, in each case in accordance with the terms and conditions of the Earnout Agreement; and” 3. The text on Exhibit A of the Agreement is hereby deleted in its entirety and replaced with the Earnout Agreement attached hereto as Exhibit A. 4. Section 7.1(h) of the Agreement is hereby amended and restated as follows:

Execution Version “(h) the Earnout Agreement shall be in full force and effect; and” 5. All other references to “Exchange Agreement” in the Agreement and not specifically identified in this Amendment are hereby amended to “Earnout Agreement”. 6. All other references to “Exchange Agreement Terms” in the Agreement and not specifically identified in this Amendment are hereby deleted. 7. Except as specifically amended by this Amendment, the Agreement remains in full force and effect. 8. This Amendment may be executed in one or more counterparts, each of which shall be deemed an original but all of which together shall constitute one and the same instrument. This Amendment or any counterpart may be executed and delivered by facsimile or email with scan attachment copies, each of which shall be deemed an original. [Signature Page Follows]

[Signature Page to Amendment No. 1] IN WITNESS WHEREOF, the Parties have caused this Amendment No. 1 to be duly executed as of the date first above written. SELLERS: PLASTIQ INC. By:_____________________________ Name: Vladimir Kasparov Title: Chief Restructuring Officer PLV INC. By:_____________________________ Name: Vladimir Kasparov Title: Chief Restructuring Officer NEARSIDE BUSINESS CORP. By:_____________________________ Name: Vladimir Kasparov Title: Chief Restructuring Officer BUYER: PLASTIQ, POWERED BY PRIORITY, LLC By:_____________________________ Name: Title:

[Signature Page to Amendment No. 1] IN WITNESS WHEREOF, the Parties have caused this Amendment No. 1 to be duly executed as of the date first above written. SELLERS: PLASTIQ INC. By:_____________________________ Name: Title: PLV INC. By:_____________________________ Name: Title: NEARSIDE BUSINESS CORP. By:_____________________________ Name: Title: BUYER: PLASTIQ, POWERED BY PRIORITY, LLC By:_____________________________ Thomas C. Priore Chief Executive Officer & President

EXHIBIT A Form of Earnout Agreement [attached]

EARNOUT AGREEMENT This Earnout Agreement (this “Agreement”) is entered into as of July 31, 2023, by and among Plastiq, Powered by Priority, LLC, a Delaware limited liability company (“Buyer”), Plastiq Inc., PLV Inc., and Nearside Business Corp. (collectively, “Sellers”), Blue Torch Finance LLC, a Delaware limited liability company, in its capacity as administrative agent and collateral agent for the Lenders (as defined below; “Blue Torch”), and, solely for purposes of Section 4(a), Priority Holdings, LLC, a Delaware limited liability company (“Parent”). Buyer, Sellers and Blue Torch each are a “Party” and are sometimes collectively referred to herein as the “Parties.” Capitalized terms not otherwise defined herein shall have the meanings ascribed to such terms in the Purchase Agreement (as hereinafter defined). WHEREAS, reference is made to (i) that certain Financing Agreement, dated November 14, 2022 (as amended, restated, supplemented, waived or otherwise modified from time to time, the “Financing Agreement”), by and among Plastiq and each of its subsidiaries listed as “Borrowers” and/or “Guarantors” thereunder, the lenders from time to time party thereto (the “Pre-Petition Lenders”) and Blue Torch, as Collateral Agent and Administrative Agent for the Pre-Petition Lenders, and (ii) that certain Debtor-In- Possession Credit Agreement between the Plastiq, the lenders from time to time party thereto (the “DIP Lenders”; and together with the Pre-Petition Lenders, the “Lenders”) and Blue Torch, as Collateral Agent and Administrative Agent for the DIP Lenders, dated May 25, 2023 (as amended, restated, supplemented, waived or otherwise modified from time to time, the “DIP Agreement”); and WHEREAS, in connection with and subject to the Closing of the transactions contemplated by that certain Equity and Asset Purchase Agreement, dated May 23, 2023, by and among Sellers and Buyer (as amended, the “Purchase Agreement”), Sellers shall have the right to receive the Earnout Payment (as defined below), which right to receive the Earnout Payment shall be assigned by Sellers to Blue Torch (for the benefit of the Lenders) immediately following the Closing in accordance with this Agreement, in exchange for Blue Torch and the Lenders releasing any and all Liens, Claims and encumbrances on the Purchased Assets, and in satisfaction of Sellers’ obligations under the Financing Agreement and the DIP Agreement remaining after Blue Torch receives the cash payment pursuant to the Purchase Agreement and in accordance with the Bankruptcy Court’s Sale Order approving the same (the “Cash Payment”); NOW, THEREFORE, for and in consideration of the mutual benefits to be derived by the Parties hereunder and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by each of the Parties, the Parties, intending to be legally bound, do hereby agree as follows: 1. Earnout Payment. (a) Simultaneously with the Closing, Sellers hereby have the right to receive the Earnout Payment (subject to adjustment as set forth in Section 1(c)). (b) Immediately following the Closing, Sellers hereby transfer, assign, convey and deliver to Blue Torch the right to receive the Earnout Payment (subject to adjustment as set forth in Section 1(c)), with such rights, powers, preferences and privileges as provided herein, in exchange for Blue Torch and the Lenders releasing any and all Liens, Claims and encumbrances on the Purchased Assets, and in satisfaction of Sellers’ obligations under the Financing Agreement and the DIP Agreement remaining after Blue Torch receives the Cash Payment. (c) The amount payable to Sellers (as further assigned to Blue Torch) pursuant to this Agreement shall be $23,111,459 (the “Earnout Payment”).

2 (d) Following the assignment contemplated by Section 1(a), the Earnout Payment shall be paid by Buyer to Blue Torch from time to time, by wire transfer of immediately available funds to the account or accounts designated by Blue Torch prior to any such payment, as follows: i. Buyer shall make quarterly cash payments to Blue Torch equal to 75% of Cash Available for Earnout Payment (as defined below), until such time as Buyer has paid to Blue Torch the full amount of the Earnout Payment. ii. Concurrently with delivery of the quarterly financial statements in accordance with Section 4(e)(ii), Buyer shall provide to Blue Torch its calculation of Cash Available for Earnout Payment for the relevant quarter, along with all reasonable supporting documentation used to prepare such calculation. Payment of each such quarterly cash payment shall be made within five (5) Business Days after delivery of the quarterly financial statements in accordance with Section 4(e)(ii) and the calculation of Cash Available for Earnout Payment in accordance with this Section 1(d)(ii). iii. For purposes hereof, “Cash Available for Earnout Payment” means, without duplication, (A) the gross cash receipts of Buyer resulting from the operations of Buyer, less (ii) the portion of gross cash receipts used to pay, or establish reserves for, all operating expenses (including shared services expenses), capitalized and other cash expenditures, working capital, debt service payments and other liabilities and contingencies of Buyer. (e) Prepayment. i. Buyer Option to Prepay. At any point following the assignment contemplated by Section 1(a), Buyer shall have the option to prepay all or any portion of the Earnout Payment. ii. Blue Torch Right to Prepayment. (A) Upon (x) a Change of Control of Buyer or any parent company of Buyer or (y) Buyer’s repurchase of Units (as defined in the LLC Agreement) other than Units held by any Managers, Officers (each as defined in the LLC Agreement), employees, consultants, or other service providers to Buyer or any of its Subsidiaries in connection with the termination of service of such Manager, Officer, employee, consultant, or other service provider to Buyer or any of its Subsidiaries (a “Buyer Repurchase”), Blue Torch shall have the right to demand Buyer prepay all outstanding amounts of the Earnout Payment. Blue Torch’s right to demand prepayment pursuant to Section 1(e)(ii)(A)(y) shall be limited to a pro rata portion of the Earnout Payment, which shall be equal to the product of (I) the outstanding amount of the Earnout Payment and (II) a fraction (1) the numerator of which is equal to the aggregate number of Units that Buyer proposes to buy and (2) the denominator of which is equal to the number of Units on a Fully Diluted Basis (as defined in the LLC Agreement) held by such Members (as defined in the LLC Agreement) that Buyer is repurchasing from.

3 (B) Buyer shall provide a written notice (the “Prepayment Notice”) to Blue Torch no more than ten (10) Business Days after the execution and delivery by all of the parties thereto of the definitive agreement entered into with respect to the Change of Control or Buyer Repurchase, as applicable, and, in any event, no later than twenty (20) Business Days prior to the closing date of such Change in Control or Buyer Repurchase, as applicable. (C) Blue Torch shall exercise its right under this Section 1(e)(ii) by providing Buyer with written notice of Blue Torch’s intent to demand prepayment within ten (10) Business Days of receiving the Prepayment Notice. (D) If Blue Torch does not deliver notice of its intent to exercise its right to prepayment in compliance with Section 1(e)(ii)(C), Blue Torch shall be deemed to have waived all of such rights to demand Buyer prepay the Earnout Payment with respect to the event specified in the Prepayment Notice, and Buyer thereafter shall be free to effect the Change of Control or Buyer Repurchase identified in the Prepayment Notice, without any further obligation to Blue Torch. iii. Payment. Buyer shall pay all or a portion of the outstanding amount of the Earnout Payment (as applicable) by wire transfer of immediately available funds within thirty (30) days of Buyer’s election pursuant to Section 1(e)(i) or Blue Torch’s demand pursuant to Section 1(e)(ii), as applicable. Buyer and Blue Torch shall execute and deliver all certificates and instruments necessary to effectuate the transaction contemplated herein. 2. Tax Treatment. (a) For U.S. federal and state income tax purposes, the assignment of Sellers’ rights under this Agreement to Blue Torch shall, along with the Cash Payment, be treated as a payment by Sellers to Blue Torch in exchange for Blue Torch and the Lenders releasing any and all Liens, Claims and encumbrances on the Purchased Assets, and in satisfaction of Sellers’ obligations under the Financing Agreement and the DIP Agreement. (b) For U.S. federal and state income tax purposes, the Parties agree that the fair market value of the right to receive the Earnout Payment as of the Closing Date is an amount to be determined within thirty (30) days from the date hereof based upon a discounted cash flow of the free cash flows provided to Blue Torch on July 31, 2023 and a mutually agreeable methodology utilizing a weighted average cost of capital for a discount rate, and the Parties agree to file any tax returns or related reporting in a manner consistent with such treatment. 3. Representations and Warranties. Buyer hereby represents and warrants to Blue Torch and Sellers, Sellers hereby represent and warrant to Buyer and Blue Torch, and Blue Torch hereby represents and warrants to Buyer and Sellers as follows: (a) Authority. Each Party has the full right, power and authority to execute and deliver this Agreement and to perform all of its obligations hereunder.

4 (b) Enforceability. Upon each Party’s execution and delivery of this Agreement, it shall constitute the legal, valid and binding obligation of such Party and shall be enforceable against such Party in accordance with its terms, subject to applicable bankruptcy, insolvency, moratorium or other similar laws relating to creditors’ rights and general principles of equity. (c) No Conflicts. Each Party’s execution and delivery of this Agreement, consummation of the transactions contemplated hereby, and compliance with any of the provisions hereof, shall not constitute a breach or default under Applicable Law or any agreement or other instrument or obligation to which each Party is a party or is otherwise bound. 4. Blue Torch Rights. Concurrently with the assignment of the Earnout Payment to Blue Torch as contemplated in Section 1(a), Blue Torch shall be entitled to the following rights and privileges. (a) Right of First Offer. i. If at any point while the outstanding amount of the Earnout Payment is greater than zero, Parent determines it wishes to sell Buyer in a single transaction or a series of related transactions that would trigger the drag-along or tag-along provisions set forth in the LLC Agreement, Parent shall provide Blue Torch with notice of Parent’s intent to sell Buyer, and, for a period of ten (10) Business Days after the delivery of such notice (the “ROFO Notice Period”), Blue Torch shall have the right of first offer to purchase Buyer and use the outstanding amount of the Earnout Payment as a credit (on a dollar for dollar basis) towards the purchase price. For example, if the purchase price to acquire Buyer is $50 million and the then- outstanding amount of the Earnout Payment is $15 million, Blue Torch would have a credit toward the purchase price of $15 million and would be able to acquire Buyer for $35 million in cash. ii. If Blue Torch elects to make an offer to purchase Buyer during the ROFO Notice Period, Parent and Blue Torch shall negotiate in good faith for a period of thirty (30) days (as may be extended upon mutual agreement of Parent and Blue Torch, the “ROFO Sale Period”) to attempt to agree on definitive terms acceptable to Parent and Blue Torch for the sale of Buyer to Blue Torch. If, at the end of the ROFO Sale Period, Parent and Blue Torch are unable to agree on definitive terms for the sale of Buyer, Parent will have the right, within ninety (90) days following the ROFO Sale Period (the “Third Party Sale Period”) to consummate a sale of Buyer to an unaffiliated third party at a per Unit price that is no less than the applicable per Unit price offered to Blue Torch and on other terms and conditions which are not in the aggregate materially more favorable to the unaffiliated third party than those negotiated between Parent and Blue Torch during the ROFO Sale Period. iii. If a transaction is not consummated with a third party during the Third Party Sale Period, Parent may not effect a sale of Buyer without again fully complying with the provisions of this Section 4(a). (b) Blue Torch Approvals. For so long as any portion of the Earnout Payment remains outstanding, Buyer shall not (directly or indirectly through any of its Subsidiaries) engage in or cause any of

5 the following transactions or take any of the following actions, and the Board (as defined in the LLC Agreement) shall not authorize, permit, or cause Buyer (directly or indirectly through any of its Subsidiaries) to engage in, take, or cause any such action in each case without the prior approval of Blue Torch: i. any amendment, alteration or repeal of any provision of the LLC Agreement or the Certificate of Formation (as defined in the LLC Agreement) so as to have a material adverse effect on the rights, preferences or privileges of Blue Torch under this Agreement; ii. the authorization or payment of any Distribution (as defined in the LLC Agreement) to any holder of any Units or Unit Equivalents, other than in accordance with Section 7.01 of the LLC Agreement; iii. Buyer’s entry into any Related Party Agreement (as defined in the LLC Agreement) that is not in compliance with Section 8.10 of the LLC Agreement, provided that such consent shall not be unreasonably withheld; iv. the sale of any assets of Buyer or its Subsidiaries (A) to an Affiliate (as defined in the LLC Agreement) (other than sales of non-core or de minimus assets up to $500,000, individually or in the aggregate) or (B) to an unaffiliated third party where less than 100% of the sale proceeds will be distributed to reduce the outstanding amount of the Earnout Payment; v. the designation of Buyer as a restricted subsidiary under any of Buyer’s Affiliates’ debt documents; vi. Buyer’s entry in a material way into new lines of business that are not substantially similar to any existing line of business of Buyer or a fundamental change to Buyer’s business unless such change results in a business that is substantially similar to Buyer’s current business; and vii. Buyer’s creation, incurrence or assumption of any advancement, loan, investment, lien or indebtedness, other than a working capital facility not to exceed $5 million in the aggregate. (c) Additional Covenants. In addition to the matters set forth in Section 4(b), for so long as any portion of the Earnout Payment remains outstanding, Buyer will, unless Blue Torch approves in writing otherwise: i. provide Blue Torch with written notice within twenty (20) days of any default under any indebtedness of Buyer; ii. comply with all requirements of Applicable Law, judgments and awards (including any settlement of any claim that, if breached, could give rise to any of the foregoing), except to the extent the failure to so comply could not reasonably be expected to have a material adverse effect;

6 iii. pay in full before delinquency, all taxes imposed upon Buyer, except (i) unpaid taxes in an aggregate amount at any one time not in excess of $200,000, and (ii) taxes contested in good faith by proper proceedings which stay the imposition of any lien resulting from the non-payment thereof and with respect to which adequate reserves have been set aside for the payment thereof in accordance with GAAP; iv. maintain and preserve its existence, rights and privileges, and become or remain, duly qualified and in good standing in each jurisdiction in which the character of the properties owned or leased by it or in which the transaction of its business makes such qualification necessary, except, in each case, to the extent that the failure to be so qualified and/or in good standing could not reasonably be expected to have a material adverse effect; v. keep adequate records and books of account, with complete entries made to permit the preparation of financial statements in accordance with GAAP; vi. maintain and preserve all of its properties which are necessary in the proper conduct of its business in good working order and condition, ordinary wear and tear and casualty and condemnations excepted, and comply, and cause each of its Subsidiaries to comply, at all times with the provisions of all leases to which it is a party as lessee or under which it occupies property, so as to prevent any loss or forfeiture thereof or thereunder; vii. maintain insurance with responsible and reputable insurance companies or associations (including, without limitation, commercial general liability, worker’s compensation and business interruption insurance) with respect to Buyer’s properties (including all real property leased or owned by it) and business, in such amounts and covering such risks as is (A) carried generally in accordance with sound business practice by companies in similar businesses similarly situated or (B) required by Applicable Law; and viii. obtain, maintain and preserve and take all necessary action to timely renew, all permits, licenses, authorizations, approvals, entitlements and accreditations that are necessary or useful in the proper conduct of its business, in each case, except to the extent the failure to obtain, maintain, preserve or take such action could not reasonably be expected to have a material adverse effect. (d) Board Observer. For so long as any portion of the Earnout Payment remains outstanding, Blue Torch shall have the right to designate one (1) individual, subject to the approval of the Common Members (as defined in the LLC Agreement), which such approval shall not be unreasonably withheld, to attend meetings of the Board (including any meetings of committees thereof) in a nonvoting, nonparticipating capacity (the “Observer”), who shall initially be Ryan O’Donnell. The Observer will be entitled to such compensation and reimbursement of expenses as granted to a Manager in accordance with Section 8.08(a) of the LLC Agreement. The Observer shall be entitled to receive notice of all meetings of the Board and all written materials distributed to the Managers at the same time as such notice or materials are provided or distributed to each Manager.

7 (e) Information. For so long as any portion of the Earnout Payment remains outstanding, Buyer shall furnish to Blue Torch the following financial statements and reports: i. Unaudited Annual Financial Statements. As soon as available, and in any event within one hundred twenty (120) days after the end of each Fiscal Year, unaudited consolidated balance sheets of Buyer and its Subsidiaries as at the end of each such Fiscal Year and unaudited consolidated statements of income, cash flows, and Members’ equity for such Fiscal Year, in each case setting forth in comparative form the figures for the p revious Fiscal Year, all in reasonable detail and all prepared in accordance with GAAP, consistently applied (subject to normal year- end audit adjustments and the absence of notes thereto), and certified by the principal financial or accounting officer of Buyer that such financial statements fairly present in all material respects the financial condition of Buyer and its Subsidiaries as of the dates thereof and the results of their operations and changes in their cash flows and Members’ equity for the periods covered thereby. ii. Quarterly Financial Statements. As soon as available, and in any event within forty-five (45) days after the end of each quarterly accounting period in each Fiscal Year, unaudited consolidated balance sheets of Buyer and its Subsidiaries as at the end of each such fiscal quarter and for the current Fiscal Year to date and unaudited consolidated statements of income, cash flows, and Members’ equity for such fiscal quarter and for the current Fiscal Year to date, in each case setting forth in comparative form the figures for the corresponding periods of the previous fiscal quarter, all in reasonable detail and all prepared in accordance with GAAP, consistently applied (subject to normal year-end audit adjustments and the absence of notes thereto), and certified by the principal financial or accounting officer of Buyer. iii. Monthly Financial Statements. As soon as available, and in any event within thirty (30) days after the end of each monthly accounting period in each Fiscal Year, unaudited consolidated balance sheets of Buyer and its Subsidiaries as at the end of each such month and for the current Fiscal Year to date and unaudited consolidated statements of income, cash flows, and Members’ equity for such month and for the current Fiscal Year to date, in each case setting forth in comparative form the figures for the corresponding periods of the previous month, all in reasonable detail and all prepared in accordance with GAAP, consistently applied (subject to normal year-end audit adjustments and the absence of notes thereto), and certified by the principal financial or accounting officer of Buyer. iv. Budget. Within forty-five (45) days after the commencement of each Fiscal Year, the Chief Executive Officer (as defined in the LLC Agreement) or his delegee shall prepare, submit to, and obtain the approval of the Board of a business plan and monthly and annual operating budgets for Buyer in detail for the upcoming Fiscal Year, including capital and operating expense budgets, cash flow projections, and profit and loss projections, all itemized in reasonable detail (collectively, the “Budget”). Promptly after approval, Buyer shall deliver the approved Budget to Blue Torch. Buyer shall use commercially reasonable efforts to operate in all material respects in accordance with the Budget

8 5. Certain Defined Terms. (a) “Affiliate” means, with respect to any Person, any other Person who, directly or indirectly (including through one or more intermediaries), controls, is controlled by, or is under common control with, such Person. For purposes of this definition, “control,” when used with respect to any specified Person, shall mean the power, direct or indirect, to direct or cause the direction of the management and policies of such Person, whether through ownership of voting securities or partnership or other ownership interests, by contract, or otherwise and the terms “controlling” and “controlled” shall have correlative meanings. Notwithstanding the foregoing, the term “Affiliate,” when used with respect to a Member or Manager, shall not include Buyer or its Subsidiaries. (b) “Applicable Law” means all applicable provisions of (a) constitutions, treaties, statutes, laws (including the common law), rules, regulations, decrees, ordinances, codes, proclamations, declarations, or orders of any Governmental Authority; (b) any consents or approvals of any Governmental Authority; and (c) any orders, decisions, advisory, or interpretative opinions, injunctions, judgments, awards, decrees of, or agreements with, any Governmental Authority. (c) “Business Day” means a day other than a Saturday, Sunday, or other day on which commercial banks in the City of New York are authorized or required to close. (d) “Change of Control” means: (a) the sale of all or substantially all of the consolidated assets of Buyer and any of its Subsidiaries to a Third Party Purchaser; (b) a sale resulting in no less than a majority of Units on a Fully Diluted Basis being held by a Third Party Purchaser; or (c) a merger, consolidation, recapitalization, or reorganization of Buyer with or into a Third Party Purchaser that results in the inability of the Members to designate or elect a majority of the Managers (or the board of directors (or its equivalent) of the resulting entity or its parent company). (e) “Fiscal Year” means the calendar year, unless Buyer is required to have a taxable year other than the calendar year, in which case Fiscal Year shall be the period that conforms to its taxable year. (f) “GAAP” means United States generally accepted accounting principles in effect from time to time. (g) “Governmental Authority” means any federal, state, local, or foreign government or political subdivision thereof, or any agency or instrumentality of such government or political subdivision, or any self-regulated organization or other non-governmental regulatory authority or quasi- governmental authority (to the extent that the rules, regulations, or orders of such organization or authority have the force of law), or any arbitrator, court, or tribunal of competent jurisdiction. (h) “LLC Agreement” means that certain Amended and Restated Limited Liability Company Agreement of Buyer, dated as of July 31, 2023. (i) “Person” means an individual, corporation, partnership, joint venture, limited liability company, Governmental Authority, unincorporated organization, trust, association, or other entity. (j) “Subsidiary” means, with respect to any Person, any other Person of which a majority of the outstanding shares or other equity interests having the power to vote for directors or comparable managers are owned, directly or indirectly, by the first Person.

9 (k) “Third Party Purchaser” means any Person who, immediately prior to the contemplated transaction, (a) does not, directly or indirectly, own or have the right to acquire any outstanding Units or Unit Equivalents; or (b) is not an Affiliate of any Person who, directly or indirectly, owns or has the right to acquire any Units or Unit Equivalents. (l) “Unit Equivalents” means any security or obligation that is by its terms, directly or indirectly, convertible into, exchangeable, or exercisable for Units, and any option, warrant, or other right to subscribe for, purchase, or acquire Units. 6. Assignment. This Agreement shall be binding upon and inure to the benefit of the Parties and their respective successors and permitted assigns (including, with respect to Section 4(b), any Permitted Transferees (as defined in the LLC Agreement) of Parent). Neither Party may assign this Agreement nor any of its rights, interests or obligations hereunder without the prior written approval of the other Party. 7. Waiver; Modification. Failure by any Party to insist upon or enforce any of its rights shall not constitute a waiver thereof. Each Party hereto may waive the benefit of any provision or condition for its benefit contained in this Agreement. No oral modification hereof shall be binding upon the Parties, and any modification shall be in writing and signed by the Parties. 8. Survival. Each of the representations and warranties of the Parties set forth in this Agreement will terminate effective immediately as of the Closing such that no claim for breach of any such representation, warranty, covenant or agreement, detrimental reliance or other right or remedy (whether in contract, in tort or at law or in equity) may be brought with respect thereto after the Closing. Each covenant and agreement that explicitly contemplates performance after the Closing, will, in each case and to such extent, expressly survive the Closing in accordance with its terms. 9. Construction. Each Party hereto hereby acknowledges that all Parties hereto participated equally in the drafting of this Agreement and that, accordingly, no court construing this Agreement shall construe it more stringently against one Party than the other. 10. Governing Law. This Agreement shall be governed by, and construed under, the laws of the State of Delaware, without giving effect to any choice or conflict of law provision or rule (whether of the State of Delaware or any other jurisdiction) that would cause the application of the Laws of any jurisdiction other than the State of Delaware. The Parties specifically agree that all actions or proceedings arising directly or indirectly hereunder shall have venue in the State of Delaware and the local, state and/or federal courts of New Castle County, Delaware shall have jurisdiction over any such action or proceeding. 11. Section Headings. The Section headings as herein used are for convenience or reference only and shall not be deemed to vary the content of this Agreement or the covenants, agreements, representations and warranties herein set forth or to limit the provisions or scope of any Section. 12. Counterparts. This Agreement may be executed in counterparts and it shall not be necessary that each party hereto execute every counterpart. This Agreement or any counterpart may be executed and delivered by facsimile or email with scan attachment copies, each of which shall be deemed an original. 13. Further Assurances. The Parties shall execute and deliver such other reasonable documents, certificates and agreements reasonably required by the other Party to evidence the transactions contemplated herein.

10 [Signature page follows]

IN WITNESS WHEREOF, the Parties hereto have executed this Agreement as of the date first above written. BUYER: PLASTIQ, POWERED BY PRIORITY, LLC, a Delaware limited liability company By: Thomas Priore Chief Executive Officer & President SELLERS: PLASTIQ INC. By:_____________________________ Name: Title: PLV INC. By:_____________________________ Name: Title: NEARSIDE BUSINESS CORP. By:_____________________________ Name: Title: BLUE TORCH: BLUE TORCH FINANCE, LLC, a Delaware limited liability company By: Kevin Genda Chief Executive Officer

Solely for purposes of Section 4(a): PRIORITY HOLDINGS, LLC By: Thomas Priore President

Execution Version SIDE LETTER AGREEMENT This Side Letter Agreement (this “Agreement”) is entered into as of July 28, 2023, by and between Plastiq, Powered by Priority, LLC, a Delaware limited liability company (“Buyer”), and Colonnade Acquisition Corp. II, a Cayman Islands exempted company limited by shares (“Colonnade”). Buyer and Colonnade each are a “Party” and are sometimes collectively referred to herein as the “Parties.” Capitalized terms not otherwise defined herein shall have the meanings ascribed to such terms in the Purchase Agreement (as hereinafter defined). WHEREAS, in connection with and subject to the closing of the transactions contemplated by that certain Equity and Asset Purchase Agreement, dated May 23, 2023, by and among Plastiq, Inc., a Delaware corporation (“Plastiq”), PLV Inc., a Delaware corporation and wholly owned subsidiary of Plastiq, Nearside Business Corp., a Delaware corporation and wholly owned subsidiary of Plastiq, and Buyer (the “Purchase Agreement”), Buyer intends to (i) issue 5% of common units of Buyer (the “Common Units”) to Colonnade, and (ii) pay Colonnade a total cash component of $2 million in exchange for Colonnade releasing all claims and causes of action against the Purchased Assets and Plastiq, including its affiliates, subsidiaries, officers, directors, shareholders, agents, attorneys, advisors, and employees, past and present (together with Plastiq, the “Plastiq Parties”) arising from or relating to that certain Agreement and Plan of Merger, by and between, Colonnade and Plastiq, dated as of August 3, 2022 (the “Merger Agreement”); NOW, THEREFORE, for and in consideration of the mutual benefits to be derived by the Parties hereunder and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by each of the Parties, the Parties, intending to be legally bound, do hereby agree as follows: 1. Exchange of Common Units. Subject to the terms and conditions of this Agreement: (a) effective upon Closing (as hereinafter defined) Colonnade fully and forever releases and discharges the Plastiq Parties and Buyer, including its affiliates, subsidiaries, officers, directors, shareholders, agents, attorneys, advisors, and employees, past and present (together with Buyer, the “Buyer Parties”), from any and all claims, demands, liens, agreements, contracts, covenants, suits, actions, causes of action, obligations, controversies, debts, costs, expenses, damages, judgements, orders and liabilities, of any kind and of every nature whatsoever, direct or indirect, whether known or unknown, or whether asserted or unasserted, which Colonnade now has against the Purchased Assets, the Plastiq Parties or Buyer Parties, or hereafter can, shall or may have, arising from or relating to the Merger Agreement (collectively, the “Claims”); and (b) in exchange for Colonnade’s release in Section 1(a), Buyer shall (i) issue Colonnade 5,000 Common Units (the “Colonnade Common Units”) at Closing with a maximum liquidation value cap equal to the difference of (A) $15 million minus (B) amounts paid under subsection (ii) hereof at the time of a liquidation event (the “Liquidation Cap”), and with such rights, powers, preferences and privileges as provided herein and in Buyer’s amended and restated limited liability company agreement attached hereto as Exhibit A (the “LLC Agreement”); and (ii) subject to the occurrence of the Closing, pay Colonnade a total of $2 million, with $1 million to be paid in U.S. dollars at Closing by wire transfer of immediately available funds to an account designated by Colonnade and $1 million to be paid via distribution from Buyer in the manner described in Section 7.02 of the LLC Agreement. Notwithstanding anything contained herein and except as otherwise stipulated and agreed on the record at the hearing on approval of the Sale Order (as defined in the Purchase Agreement) on July 27, 2023, and as may also be set forth in the final Sale Order, the foregoing release shall not deprive or extinguish Colonnade’s right to defensively assert rights, counter-claims and defenses in any litigation brought against

2 Colonnade in connection with the Merger Agreement or otherwise, including, without limitation, any right of recoupment or set off, all such rights, counter-claims and defenses being expressly preserved and reserved by Colonnade. 2. Closing. The closing of this Agreement shall occur simultaneously with the closing of the transactions of the Purchase Agreement on the Closing Date (as defined in the Purchase Agreement) (the “Closing”). 3. Representations and Warranties. Buyer hereby represents and warrants to Colonnade and Colonnade hereby represents and warrants to Buyer as follows: (a) Authority. Each Party has the full right, power and authority to execute and deliver this Agreement and to perform all of its obligations hereunder. (b) Enforceability. Upon each Party’s execution and delivery of this Agreement, it shall constitute the legal, valid and binding obligation of such Party and shall be enforceable against such Party in accordance with its terms, subject to applicable bankruptcy, insolvency, moratorium or other similar laws relating to creditors’ rights and general principles of equity. (c) No Conflicts. Each Party’s execution and delivery of this Agreement, consummation of the transactions contemplated hereby, and compliance with any of the provisions hereof, shall not constitute a breach or default under applicable law or any agreement or other instrument or obligation to which each Party is a party or is otherwise bound. It shall not be considered a breach of this Side Letter Agreement or this sub-paragraph if the rights and obligations of the LLC Agreement conflict with this Side Letter Agreement. 4. Covenants. (a) Repurchase. (i) Buyer Repurchase. Buyer shall have the right on or after the third (3rd) anniversary of Closing to repurchase all or a portion of the Colonnade Common Units at Fair Market Value (as hereinafter defined). (ii) Colonnade Repurchase Demand. From the period commencing three (3) years after Closing and provided that: (1) the unreturned capital contribution on the Earnout Payment (as defined in the LLC Agreement) is reduced to zero; and (2) after giving effect to the repurchase contemplated hereunder as if Buyer had funded such repurchase solely with debt, Buyer’s pro forma leverage ratio is less than 3.0x, Colonnade shall have the right to demand that Buyer purchase all of the Colonnade Common Units at Fair Market Value. (iii) Fair Market Value. For purposes of this Agreement, “Fair Market Value” means the purchase price that a willing buyer having all relevant knowledge would pay a willing seller

3 for the Colonnade Common Units in an arm’s length transaction, as determined in good faith by either (i) Buyer and Colonnade based on such factors as Buyer and Colonnade, in the exercise of their reasonable judgment and in good faith, consider relevant which shall include a deduction from the aggregate Fair Market Value of Buyer (unless already considered in the determination of Fair Market Value) an amount equal to five percent (5%) of Priority’s outstanding additional contributions contemplated by Section 4(b) hereof, or (ii) by an Independent Third-Party Appraiser (as hereinafter defined) pursuant to Section 4(a)(iv), based on such factors as the Independent Third-Party Appraiser, in exercise of its reasonable judgment, considers relevant which shall include a deduction from the aggregate Fair Market Value of Buyer (unless already considered in the determination of Fair Market Value) an amount equal to five percent (5%) of Priority’s outstanding additional contributions contemplated by Section 4(b) hereof; provided, however, that in no event shall the Fair Market Value for the Colonnade Common Units exceed the Liquidation Cap. The Parties agree that the use of a fair market value agreement shall not cause the covenants and agreements contained herein to fail as a matter of law due to lack of a material term. Pursuant to Section 1(b), such amount payable to Colonnade will be subject to the Liquidation Cap. For definition purposes only, “Priority’s outstanding additional contributions” shall mean Priority Member’s Unreturned Capital Value that has not been paid pursuant to Section 7.02(b) of the LLC Agreement. (iv) Independent Third-Party Appraiser. If Buyer and Colonnade fail to reach an agreement with respect to Fair Market Value of the Colonnade Common Units in the event Buyer or Colonnade exercise its right to repurchase or demand repurchase, respectively, within ten (10) Business Days of the respective Party’s notice of its intent to exercise such right, the determination of Fair Market Value of the Colonnade Common Units shall be submitted to an agreed upon impartial, nationally recognized valuation firm which firm shall be other than the Colonnade’s accountants or Buyer’s accountants or a firm or expert with any prior business relationship with either Party for the prior two (2) years (the “Independent Third-Party Appraiser”) who, acting as an expert and not arbitrator, shall determine Fair Market Value. The Parties agree that the Fair Market Value determination of the Independent Third-Party Appraiser shall be binding on the Parties absent manifest error. For the avoidance of doubt, should the Independent Third-Party Appraiser’s determination of Fair Market Value of the Colonnade Common Units exceed the Liquidation Cap, the Fair Market Value shall be adjusted down to equal the Liquidation Cap. (v) Closing of Repurchase. Closing of a repurchase under Section 4(a)(i) or (ii) shall take place in accordance with Section 10.05 of the LLC Agreement. (b) Capital Contributions. The Parties acknowledge and agree that from time-to-time a parent company or affiliate of Buyer will contribute additional capital to the Buyer and that such additional capital contributions will not increase Priority Holdings, LLC’s (inclusive of any parent company or affiliate of Buyer) percentage ownership of Common Units or decrease Colonnade’s percentage ownership of Common Units. (c) Permitted Actions by Colonnade in Bankruptcy. In connection with Plastiq’s bankruptcy filing, prior to the Closing, subject to applicable law, Colonnade may, in its sole discretion (i) file proofs of claim in connection with the Claims and vote such Claims in any bankruptcy case of Plastiq or any of its subsidiaries; (ii) take such other actions as it may deem necessary or advisable

4 for the exercise or enforcement of any of its rights and interests with respect to the Claims; (iii) exercise any rights that may be exercised by creditors generally with respect to the Claims; (iv) serve on the unsecured creditors’ committee of Plastiq; and (v) disclose the Agreement and the terms thereof in any such bankruptcy case. 5. Conditions. The Parties’ obligations to consummate the transactions as contemplated in this Agreement in connection with Closing is subject to satisfaction or waiver of the following conditions: (a) As of the date hereof and as of the Closing each representation and warranty contained in Section 3 shall be true and correct in all respects, except where the failure of such representations and warranties to be true and correct, individually or in the aggregate with other such failures, has not had, and would not reasonably be expected to have, a material adverse effect. (b) The Parties shall have performed and complied with their covenants and agreements hereunder to the extent required to be performed prior to the Closing in all material respects. (c) The execution and delivery of the LLC Agreement by each of the Parties, Priority Holdings, LLC and Blue Torch Finance, LLC, on or prior to the date of Closing. (d) Except as otherwise stipulated and agreed on the record at the hearing on approval of the Sale Order (as defined in the Purchase Agreement) on July 27, 2023, and as may also be set forth in the final Sale Order, the Bankruptcy Court shall have entered the Sale Order and the transactions contemplated thereby and in the Purchase Agreement shall have been closed and consummated in such a manner as to not result in any material diminution in the rights and benefits provided to Colonnade under the Purchase Agreement, including the provisions set forth in Section 2.5(c) of the Purchase Agreement and the provisions described in the Letter Agreement Terms attached to the Purchase Agreement as Exhibit B regarding payment to Colonnade. 6. Assignment. This Agreement shall be binding upon and inure to the benefit of the Parties and their respective successors and permitted assigns. Neither Party may assign this Agreement nor any of its rights, interests or obligations hereunder without the prior written approval of the other Party which consent shall not be unreasonably conditioned or withheld. 7. Waiver; Modification. Failure by any Party to insist upon or enforce any of its rights shall not constitute a waiver thereof. Each Party hereto may waive the benefit of any provision or condition for its benefit contained in this Agreement. No oral modification hereof shall be binding upon the Parties, and any modification shall be in writing and signed by the Parties. 8. Survival. Each of the representations and warranties and the covenants and agreements (to the extent such covenant or agreement contemplates or requires performance by such Party prior to the Closing) of the Parties set forth in this Agreement or in any other document contemplated hereby, or in any certificate delivered hereunder or thereunder, will terminate effective four (4) years after the Closing such that no claim for breach of any such representation, warranty, covenant or agreement, detrimental reliance or other right or remedy (whether in contract, in tort or at law or in equity) may be brought with respect thereafter. Each covenant and agreement that explicitly contemplates performance after the Closing, will, in each case and to such extent, expressly survive the Closing in accordance with its terms. Colonnade’s Release shall no longer be effective as to Colonnade if Closing does not occur.

5 9. Termination. Except as specified in Section 8, this Agreement will automatically terminate and be of no further force and effect upon the earlier of (a) the mutual written agreement of the parties hereto, (b) the termination of the Asset Purchase Agreement, and (c) the 90th day after the Effective Date if the Closing has not occurred prior to such date; the 90 day period shall be extended by the same number of days that Closing under the Purchase Agreement is extended by agreement or otherwise. 10. Construction. This Agreement supersedes and replaces the Term Sheet by and between the Parties dated as of May 23, 2023. This Agreement is to be read in conjunction with the LLC Agreement and the Purchase Agreement, however, to the extent there is any conflict between this Agreement and the LLC Agreement or the Purchase Agreement, this Agreement shall control. It being agreed that this Agreement shall not be considered to have supplanted any of the rights or obligations of Articles IX and X of the LLC Agreement. Each Party hereto hereby acknowledges that all Parties hereto participated equally in the drafting of this Agreement and that, accordingly, no court construing this Agreement shall construe it more stringently against one Party than the other. 11. Governing Law. This Agreement shall be governed by, and construed under, the laws of the State of Delaware, without giving effect to any choice or conflict of law provision or rule (whether of the State of Delaware or any other jurisdiction) that would cause the application of the Laws of any jurisdiction other than the State of Delaware. The Parties specifically agree that all actions or proceedings arising directly or indirectly hereunder shall have venue in the State of Delaware and the local, state and/or federal courts of New Castle County, Delaware shall have jurisdiction over any such action or proceeding. 12. Section Headings. The Section headings as herein used are for convenience or reference only and shall not be deemed to vary the content of this Agreement or the covenants, agreements, representations and warranties herein set forth or to limit the provisions or scope of any Section. 13. Counterparts. This Agreement may be executed in counterparts and it shall not be necessary that each party hereto execute every counterpart. This Agreement or any counterpart may be executed and delivered by facsimile or email with scan attachment copies, each of which shall be deemed an original. This Agreement shall be effective and binding upon any and all the Parties when the last signatory hereto affixes its signature to this Agreement (the “Effective Date”) 14. Further Assurances. The Parties shall execute and deliver such other reasonable documents, certificates and agreements reasonably required by the other Party to evidence the transactions contemplated herein. [Signature page follows]

IN WITNESS WHEREOF, the Parties hereto have executed this Agreement as of the date first above written. PLASTIQ, POWERED BY PRIORITY, LLC, a Delaware limited liability company By: Thomas C. Priore Chief Executive Officer & President COLONNADE ACQUISITION CORP. II, a Cayman Islands exempted company limited by shares By: Remy W. Trafalet Chief Executive Officer

EXHIBIT A LLC Agreement [attached]

EXHIBIT 10.3

Execution Version

EARNOUT AGREEMENT

This Earnout Agreement (this “Agreement”) is entered into as of July 31, 2023, by and among Plastiq, Powered by Priority, LLC, a Delaware limited liability company (“Buyer”), Plastiq Inc., PLV Inc., and Nearside Business Corp. (collectively, “Sellers”), Blue Torch Finance LLC, a Delaware limited liability company, in its capacity as administrative agent and collateral agent for the Lenders (as defined below; “Blue Torch”), and, solely for purposes of Section 4(a), Priority Holdings, LLC, a Delaware limited liability company (“Parent”). Buyer, Sellers and Blue Torch each are a “Party” and are sometimes collectively referred to herein as the “Parties.” Capitalized terms not otherwise defined herein shall have the meanings ascribed to such terms in the Purchase Agreement (as hereinafter defined).

WHEREAS, reference is made to (i) that certain Financing Agreement, dated November 14, 2022 (as amended, restated, supplemented, waived or otherwise modified from time to time, the “Financing Agreement”), by and among Plastiq and each of its subsidiaries listed as “Borrowers” and/or “Guarantors” thereunder, the lenders from time to time party thereto (the “Pre-Petition Lenders”) and Blue Torch, as Collateral Agent and Administrative Agent for the Pre-Petition Lenders, and (ii) that certain Debtor-In-Possession Credit Agreement between the Plastiq, the lenders from time to time party thereto (the “DIP Lenders”; and together with the Pre-Petition Lenders, the “Lenders”) and Blue Torch, as Collateral Agent and Administrative Agent for the DIP Lenders, dated May 25, 2023 (as amended, restated, supplemented, waived or otherwise modified from time to time, the “DIP Agreement”); and

WHEREAS, in connection with and subject to the Closing of the transactions contemplated by that certain Equity and Asset Purchase Agreement, dated May 23, 2023, by and among Sellers and Buyer (as amended, the “Purchase Agreement”), Sellers shall have the right to receive the Earnout Payment (as defined below), which right to receive the Earnout Payment shall be assigned by Sellers to Blue Torch (for the benefit of the Lenders) immediately following the Closing in accordance with this Agreement, in exchange for Blue Torch and the Lenders releasing any and all Liens, Claims and encumbrances on the Purchased Assets, and in satisfaction of Sellers’ obligations under the Financing Agreement and the DIP Agreement remaining after Blue Torch receives the cash payment pursuant to the Purchase Agreement and in accordance with the Bankruptcy Court’s Sale Order approving the same (the “Cash Payment”);

NOW, THEREFORE, for and in consideration of the mutual benefits to be derived by the Parties hereunder and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by each of the Parties, the Parties, intending to be legally bound, do hereby agree as follows:

1.Earnout Payment.

(a)Simultaneously with the Closing, Sellers hereby have the right to receive the Earnout Payment (subject to adjustment as set forth in Section 1(c)).

(b)Immediately following the Closing, Sellers hereby transfer, assign, convey and deliver to Blue Torch the right to receive the Earnout Payment (subject to adjustment as set forth in Section 1(c)), with such rights, powers, preferences and privileges as provided herein, in exchange for Blue Torch and the Lenders releasing any and all Liens, Claims and encumbrances on the Purchased Assets, and in satisfaction of Sellers’ obligations under the Financing Agreement and the DIP Agreement remaining after Blue Torch receives the Cash Payment.

(c)The amount payable to Sellers (as further assigned to Blue Torch) pursuant to this Agreement shall be $23,111,459 (the “Earnout Payment”).

(d)Following the assignment contemplated by Section 1(a), the Earnout Payment shall be paid by Buyer to Blue Torch from time to time, by wire transfer of immediately available funds to the account or accounts designated by Blue Torch prior to any such payment, as follows:

i.Buyer shall make quarterly cash payments to Blue Torch equal to 75% of Cash Available for Earnout Payment (as defined below), until such time as Buyer has paid to Blue Torch the full amount of the Earnout Payment.

ii.Concurrently with delivery of the quarterly financial statements in accordance with Section 4(e)(ii), Buyer shall provide to Blue Torch its calculation of Cash Available for Earnout Payment for the relevant quarter, along with all reasonable supporting documentation used to prepare such calculation. Payment of each such quarterly cash payment shall be made within five (5) Business Days after delivery of the quarterly financial statements in accordance with Section 4(e)(ii) and the calculation of Cash Available for Earnout Payment in accordance with this Section 1(d)(ii).

iii.For purposes hereof, “Cash Available for Earnout Payment” means, without duplication, (A) the gross cash receipts of Buyer resulting from the operations of Buyer, less (ii) the portion of gross cash receipts used to pay, or establish reserves for, all operating expenses (including shared services expenses), capitalized and other cash expenditures, working capital, debt service payments and other liabilities and contingencies of Buyer.

(e)Prepayment.

i.Buyer Option to Prepay. At any point following the assignment contemplated by Section 1(a), Buyer shall have the option to prepay all or any portion of the Earnout Payment.

ii.Blue Torch Right to Prepayment.

(A)Upon (x) a Change of Control of Buyer or any parent company of Buyer or (y) Buyer’s repurchase of Units (as defined in the LLC Agreement) other than Units held by any Managers, Officers (each as defined in the LLC Agreement), employees, consultants, or other service providers to Buyer or any of its Subsidiaries in connection with the termination of service of such Manager, Officer, employee, consultant, or other service provider to Buyer or any of its Subsidiaries (a “Buyer Repurchase”), Blue Torch shall have the right to demand Buyer prepay all outstanding amounts of the Earnout Payment. Blue Torch’s right to demand prepayment pursuant to Section 1(e)(ii)(A)(y) shall be limited to a pro rata portion of the Earnout Payment, which shall be equal to the product of (I) the outstanding amount of the Earnout Payment and (II) a fraction (1) the numerator of which is equal to the aggregate number of Units that Buyer proposes to buy and (2) the denominator of which is equal to the number of Units on a Fully Diluted Basis (as defined in the LLC Agreement) held by such Members (as defined in the LLC Agreement) that Buyer is repurchasing from.

(B)Buyer shall provide a written notice (the “Prepayment Notice”) to Blue Torch no more than ten (10) Business Days after the execution and delivery by all of the parties thereto of the definitive agreement entered into with respect to the Change of Control or Buyer Repurchase, as applicable, and, in any event, no later than twenty (20) Business Days prior to the closing date of such Change in Control or Buyer Repurchase, as applicable.

(C)Blue Torch shall exercise its right under this Section 1(e)(ii) by providing Buyer with written notice of Blue Torch’s intent to demand prepayment within ten (10) Business Days of receiving the Prepayment Notice.

(D)If Blue Torch does not deliver notice of its intent to exercise its right to prepayment in compliance with Section 1(e)(ii)(C), Blue Torch shall be deemed to have waived all of such rights to demand Buyer prepay the Earnout Payment with respect to the event specified in the Prepayment Notice, and Buyer thereafter shall be free to effect the Change of Control or Buyer Repurchase identified in the Prepayment Notice, without any further obligation to Blue Torch.

iii.Payment. Buyer shall pay all or a portion of the outstanding amount of the Earnout Payment (as applicable) by wire transfer of immediately available funds within thirty (30) days of Buyer’s election pursuant to Section 1(e)(i) or Blue Torch’s demand pursuant to Section 1(e)(ii), as applicable. Buyer and Blue Torch shall execute and deliver all certificates and instruments necessary to effectuate the transaction contemplated herein.

2.Tax Treatment.

(a)For U.S. federal and state income tax purposes, the assignment of Sellers’ rights under this Agreement to Blue Torch shall, along with the Cash Payment, be treated as a payment by Sellers to Blue Torch in exchange for Blue Torch and the Lenders releasing any and all Liens, Claims and encumbrances on the Purchased Assets, and in satisfaction of Sellers’ obligations under the Financing Agreement and the DIP Agreement.

(b)For U.S. federal and state income tax purposes, the Parties agree that the fair market value of the right to receive the Earnout Payment as of the Closing Date is an amount to be determined within thirty (30) days from the date hereof based upon a discounted cash flow of the free cash flows provided to Blue Torch on July 31, 2023 and a mutually agreeable methodology utilizing a weighted average cost of capital for a discount rate, and the Parties agree to file any tax returns or related reporting in a manner consistent with such treatment.

3.Representations and Warranties. Buyer hereby represents and warrants to Blue Torch and Sellers, Sellers hereby represent and warrant to Buyer and Blue Torch, and Blue Torch hereby represents and warrants to Buyer and Sellers as follows:

(a)Authority. Each Party has the full right, power and authority to execute and deliver this Agreement and to perform all of its obligations hereunder.

(b)Enforceability. Upon each Party’s execution and delivery of this Agreement, it shall constitute the legal, valid and binding obligation of such Party and shall be enforceable against such Party in accordance with its terms, subject to applicable bankruptcy, insolvency, moratorium or other similar laws relating to creditors’ rights and general principles of equity.

(c)No Conflicts. Each Party’s execution and delivery of this Agreement, consummation of the transactions contemplated hereby, and compliance with any of the provisions hereof, shall not constitute a breach or default under Applicable Law or any agreement or other instrument or obligation to which each Party is a party or is otherwise bound.

4.Blue Torch Rights. Concurrently with the assignment of the Earnout Payment to Blue Torch as contemplated in Section 1(a), Blue Torch shall be entitled to the following rights and privileges.

(a)Right of First Offer.

i.If at any point while the outstanding amount of the Earnout Payment is greater than zero, Parent determines it wishes to sell Buyer in a single transaction or a series of related transactions that would trigger the drag-along or tag-along provisions set forth in the LLC Agreement, Parent shall provide Blue Torch with notice of Parent’s intent to sell Buyer, and, for a period of ten (10) Business Days after the delivery of such notice (the “ROFO Notice Period”), Blue Torch shall have the right of first offer to purchase Buyer and use the outstanding amount of the Earnout Payment as a credit (on a dollar for dollar basis) towards the purchase price. For example, if the purchase price to acquire Buyer is $50 million and the then-outstanding amount of the Earnout Payment is $15 million, Blue Torch would have a credit toward the purchase price of $15 million and would be able to acquire Buyer for $35 million in cash.

ii.If Blue Torch elects to make an offer to purchase Buyer during the ROFO Notice Period, Parent and Blue Torch shall negotiate in good faith for a period of thirty (30) days (as may be extended upon mutual agreement of Parent and Blue Torch, the “ROFO Sale Period”) to attempt to agree on definitive terms acceptable to Parent and Blue Torch for the sale of Buyer to Blue Torch. If, at the end of the ROFO Sale Period, Parent and Blue Torch are unable to agree on definitive terms for the sale of Buyer, Parent will have the right, within ninety (90) days following the ROFO Sale Period (the “Third Party Sale Period”) to consummate a sale of Buyer to an unaffiliated third party at a per Unit price that is no less than the applicable per Unit price offered to Blue Torch and on other terms and conditions which are not in the aggregate materially more favorable to the unaffiliated third party than those negotiated between Parent and Blue Torch during the ROFO Sale Period.

iii.If a transaction is not consummated with a third party during the Third Party Sale Period, Parent may not effect a sale of Buyer without again fully complying with the provisions of this Section 4(a).

(b)Blue Torch Approvals. For so long as any portion of the Earnout Payment remains outstanding, Buyer shall not (directly or indirectly through any of its Subsidiaries) engage in or cause any of the following transactions or take any of the following actions, and the Board (as defined in the LLC Agreement) shall not authorize, permit, or cause Buyer (directly or indirectly through any of its Subsidiaries) to engage in, take, or cause any such action in each case without the prior approval of Blue Torch:

i.any amendment, alteration or repeal of any provision of the LLC Agreement or the Certificate of Formation (as defined in the LLC Agreement) so as to have a material adverse effect on the rights, preferences or privileges of Blue Torch under this Agreement;

ii.the authorization or payment of any Distribution (as defined in the LLC Agreement) to any holder of any Units or Unit Equivalents, other than in accordance with Section 7.01 of the LLC Agreement;

iii.Buyer’s entry into any Related Party Agreement (as defined in the LLC Agreement) that is not in compliance with Section 8.10 of the LLC Agreement, provided that such consent shall not be unreasonably withheld;

iv.the sale of any assets of Buyer or its Subsidiaries (A) to an Affiliate (as defined in the LLC Agreement) (other than sales of non-core or de minimus assets up to

$500,000, individually or in the aggregate) or (B) to an unaffiliated third party where less than 100% of the sale proceeds will be distributed to reduce the outstanding amount of the Earnout Payment;

v.the designation of Buyer as a restricted subsidiary under any of Buyer’s Affiliates’ debt documents;

vi.Buyer’s entry in a material way into new lines of business that are not substantially similar to any existing line of business of Buyer or a fundamental change to Buyer’s business unless such change results in a business that is substantially similar to Buyer’s current business; and

vii.Buyer’s creation, incurrence or assumption of any advancement, loan, investment, lien or indebtedness, other than a working capital facility not to exceed $5 million in the aggregate.

(c)Additional Covenants. In addition to the matters set forth in Section 4(b), for so long as any portion of the Earnout Payment remains outstanding, Buyer will, unless Blue Torch approves in writing otherwise:

i.provide Blue Torch with written notice within twenty (20) days of any default under any indebtedness of Buyer;

ii.comply with all requirements of Applicable Law, judgments and awards (including any settlement of any claim that, if breached, could give rise to any of the foregoing), except to the extent the failure to so comply could not reasonably be expected to have a material adverse effect;

iii.pay in full before delinquency, all taxes imposed upon Buyer, except (i) unpaid taxes in an aggregate amount at any one time not in excess of $200,000, and (ii) taxes contested in good faith by proper proceedings which stay the imposition of any lien resulting from the non-payment thereof and with respect to which adequate reserves have been set aside for the payment thereof in accordance with GAAP;

iv.maintain and preserve its existence, rights and privileges, and become or remain, duly qualified and in good standing in each jurisdiction in which the character of the properties owned or leased by it or in which the transaction of its business makes such qualification necessary, except, in each case, to the extent that the failure to be so qualified and/or in good standing could not reasonably be expected to have a material adverse effect;

v.keep adequate records and books of account, with complete entries made to permit the preparation of financial statements in accordance with GAAP;

vi.maintain and preserve all of its properties which are necessary in the proper conduct of its business in good working order and condition, ordinary wear and tear and casualty and condemnations excepted, and comply, and cause each of its Subsidiaries to comply, at all times with the provisions of all leases to which it is a party as lessee or under which it occupies property, so as to prevent any loss or forfeiture thereof or thereunder;

vii.maintain insurance with responsible and reputable insurance companies or associations (including, without limitation, commercial general liability, worker’s

compensation and business interruption insurance) with respect to Buyer’s properties (including all real property leased or owned by it) and business, in such amounts and covering such risks as is (A) carried generally in accordance with sound business practice by companies in similar businesses similarly situated or (B) required by Applicable Law; and