Nearly six-in-10 employees (59%) who are not contributing to

their 401(k) or other workplace retirement plan think they are,

according to the latest Principal® Retirement Security Survey.

Three out of every four of those employees (77%) believed they

started saving upon becoming eligible to contribute. This

misperception, compounded by persistent inflation and elevated

interest rates, makes it harder for Americans to reach their

retirement goals, according to Principal®.

Among survey respondents who said they were not contributing to

workplace retirement plans, despite being eligible, the top reasons

cited for not saving included high monthly expenses (39%), paying

off debt (36%), and insufficient income (34%).

“American workers are balancing a lot right now and it can feel

overwhelming to employees who are trying to meet their needs today

and invest in their long-term financial security,” said Chris

Littlefield, president of Retirement and Income Solutions at

Principal. “We are committed to working with employers to help

their employees fully understand the retirement benefits available

to them, the value of participating in the plan, and how investing

in their retirement today can set them up for success in the

future. Through good plan design features like automatic enrollment

and regular communication, we have seen significantly improved

savings and participant engagement.”

The Impact of Automated Features

Employers who leverage plan features that simplify and automate

the enrollment process into retirement plans can produce better

outcomes for their employees. Automated features include auto

enrollment, auto increase of an employee’s contribution rate, and

auto-sweep, which re-enrolls existing employees who are not

contributing.

In the Principal® Retirement Security Survey, 62% of employees

said they would continue to save in their workplace retirement plan

if automatically enrolled by their employer.1 Additionally, plans

using automatic enrollment are at least twice as likely to achieve

90% participation versus plans that do not automatically enroll

participants – with less than 10% of workers opting out of

retirement plans when automatically enrolled by employers upon

being hired.2

Employers utilizing automated features also help eliminate

uncertainty around the percentage of pay workers believe is right

to contribute, which can lead to inaction. One-third (34%) of

employees surveyed have not thought about how much they need to

save to maintain their standard of living in retirement. Of those

who have thought about it, 44% believe they should be saving

10-25%.

“A good rule of thumb for the average working American is to

save at least 15% of their income per year towards retirement,

including the employer match,” said Teresa Hassara, senior vice

president of workplace savings and retirement solutions at

Principal. “We recognize this may not be possible for all people,

but it is our industry’s shared responsibility with employers to

ensure the access, tools, and plan features are in place to make it

easy for people to start saving for retirement – and continue

saving through different life moments.”

About the Principal® Retirement Security Survey

The Principal® Retirement Security Survey was an online survey

conducted by Principal Financial Group. The research was focused

specifically on eligible, not participating employees and why they

are not contributing to their workplace retirement plan. The first

survey was conducted from August 23, 2023, to September 6, 2023. A

second survey was conducted similarly between October 20, 2023, and

November 2, 2023. Respondents included nearly 2,050 workers.

Principal conducts periodic “pulse” surveys with customers and

financial professionals to gain insight into timely topics. The

survey findings reported here explore consumer concerns and

possible actions surrounding saving and planning for retirement as

well as financial behaviors related to market volatility and

current events.

About Principal Financial Group®

Principal Financial Group® (Nasdaq: PFG) is a global financial

company with nearly 20,000 employees3 passionate about improving

the wealth and well-being of people and businesses. In business for

more than 140 years, we’re helping approximately 62 million

customers4 plan, protect, invest, and retire, while working to

support the communities where we do business, and build a diverse,

inclusive workforce. Principal® is proud to be recognized as

one of the 2024 World’s Most Ethical Companies® by Ethisphere5, a

member of the Bloomberg Gender Equality Index, and a “Best Place to

Work in Money Management6.” Learn more about Principal and our

commitment to building a better future at principal.com.

Insurance products issued by Principal National Life Insurance

Co (except in NY) and Principal Life Insurance Company®. Plan

administrative services offered by Principal Life. Principal Funds,

Inc. is distributed by Principal Funds Distributor, Inc. Securities

offered through Principal Securities, Inc., member SIPC and/or

independent broker/-dealers. Principal Global Investors leads

global asset management. Referenced companies are members of the

Principal Financial Group®, Des Moines, Iowa 50392.

© 2024 Principal Financial Services, Inc. Principal®, Principal

Financial Group®, and Principal and the logomark design are

registered trademarks of Principal Financial Services, Inc., a

Principal Financial Group company, in the United States and are

trademarks and services marks of Principal Financial Services,

Inc., in various countries around the world.

1 According to employees who identified they were not saving

from retirement; N=681. 2 Principal® proprietary data as of

December 31, 2023; plan-level participation rates. 3 As of March

31, 2024 4 As of March 31, 2024 5 Ethisphere, 2024 6 Pensions &

Investments, 2023

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240606237693/en/

Phillip Nicolino, 515-362-0239,

nicolino.phillip@principal.com

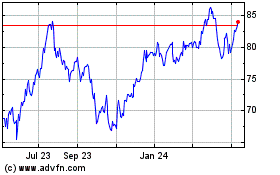

Principal Financial (NASDAQ:PFG)

Historical Stock Chart

From Oct 2024 to Nov 2024

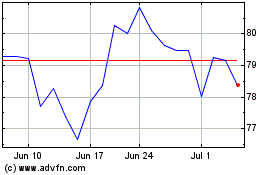

Principal Financial (NASDAQ:PFG)

Historical Stock Chart

From Nov 2023 to Nov 2024