Form 8-K - Current report

November 17 2023 - 9:30AM

Edgar (US Regulatory)

0001822145

false

0001822145

2023-11-17

2023-11-17

0001822145

PRST:CommonStockParValue0.0001PerShareMember

2023-11-17

2023-11-17

0001822145

PRST:WarrantsEachWholeWarrantExercisableForOneShareOfCommonStockMember

2023-11-17

2023-11-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

Exchange Act of 1934

Date of earliest event reported: November 17, 2023

Presto Automation Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-39830 |

|

84-2968594 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

985 Industrial Road

San Carlos, CA |

|

94070 |

| (Address of principal executive offices) |

|

(Zip Code) |

| (650) 817-9012 |

| (Registrant’s telephone number, including area code) |

| |

| N/A |

| (Former name or former address if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

PRST |

|

The Nasdaq Stock Market LLC |

| Warrants, each whole warrant exercisable for one share of common stock |

|

PRSTW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

PRESTO AUTOMATION, INC. |

| |

|

|

| Date: November 17, 2023 |

By: |

/s/ Susan Shinoff |

| |

|

Name: |

Susan Shinoff |

| |

|

Title: |

General Counsel and Corporate Secretary |

2

Exhibit 99.1

Presto Raises Capital from

Remus Investor Group, Announces Addition of Two Board Members, and Significant Cost Reductions

SAN CARLOS, Calif., Nov. 17, 2023 (GLOBE NEWSWIRE)

-- Presto Automation Inc. (NASDAQ: PRST), one of the largest AI and automation technology providers to the restaurant industry,

today announced it had entered into agreements with a Remus Capital-affiliated syndicate of investors to sell 7,000,000 shares of common

stock of the company in a registered offering that the company anticipates will result in gross proceeds of approximately $7.0 million.

This capital comes in addition to the previously disclosed $3 million invested by Cleveland Avenue, founded by Don Thompson, the former

CEO of McDonald’s Corporation, and a $3 million upsize of the company’s existing credit facility with Metropolitan Partners

Group. As part of the transaction, Remus Capital has appointed two additional directors to Presto's Board of Directors. Northland

Capital Markets, Chardan, and The Benchmark Company are acting as the placement agents for the offering.

Presto also announced today that it would

take further steps in its ongoing efforts to reduce costs, improve profitability, and streamline operations by implementing a reduction

in force of its global full-time employee base by approximately 17%. The Company estimates that this initiative, along with

other cost-saving initiatives, will reduce monthly expenditures by approximately $0.4 million, rising to approximately $1.2 million after

approximately eight months.

"This equity commitment by a group of sophisticated investors demonstrates the strength of our strategic plans and market position,”

said Xavier Casanova, CEO of Presto. “This funding, along with our efficiency initiatives, will enable us to continue leaning

into the growth we are experiencing in our Presto Voice AI platform and will support our ability to maximize shareholder value

with Presto Touch. We recently announced we have $17M of revenue opportunity at franchisee customers that are part of restaurant groups

with signed MSAs or pilots and $100M of revenue opportunity at brands with signed MSAs or pilots; we intend to use this capital toward

capturing that opportunity.”

“I have greater conviction in Presto

than I've ever had before, as AI and automation technology gains significant traction among restaurant operators,” said Krishna

Gupta, Chairman of Presto and CEO of Remus Capital. “The market is shifting from a ‘lead adopter’ to a ‘fast follower’

one, which fuels our optimism about Presto’s near and long-term growth prospects. We believe this transaction – done without

warrants in this macroeconomic climate – should give the market confidence as we continue to unlock value in both Presto Voice and

Presto Touch.

Remus is also appointing two additional individuals to the board: Tewfik Cassis, who was the first investor in Presto alongside Mr. Gupta,

and Sasha Hoffman, another individual Presto investor and long-time business associate of Mr. Gupta’s. Both Mr. Cassis and Ms.

Hoffman are entrepreneurial operators who will add significant product, technology, and financial expertise gained across their careers

– Mr. Cassis at Facebook and McKinsey, and Ms. Hoffman at Uber and Goldman Sachs.

“I am delighted to make these additions

to the board. I am confident that, as shareholders themselves, they will augment the board’s focus on maximizing shareholder value.

Their appointment will also make Presto’s board 50% diverse; I believe having additional diversity of perspective and experience

should further enable the Company’s success.” said Mr. Gupta.

The offering also includes the issuance to

a Remus Capital-affiliated investor who led the investment round of an additional 750,000 shares, for a total of 7,750,000 shares issued

in the offering, which together with 3,000,000 shares included above lowers its cost basis in our stock to approximately $3.00.

About Presto

Presto (Nasdaq:

PRST) provides enterprise-grade AI and automation solutions to the restaurant enterprise technology industry. Our solutions are

designed to decrease labor costs, improve staff productivity, increase revenue, and enhance the guest experience. We offer our AI

solution, Presto Voice, to quick service restaurants (QSR) and our pay-at-table tablet solution, Presto Touch, to casual dining

chains. Some of the most recognized restaurant names in the United States are among our customers, including Carl’s Jr.,

Hardee’s, and Checkers for Presto Voice and Applebee’s, Chili’s, and Red Lobster for Presto Touch.

About

Remus Capital

Remus Capital is an early-stage venture capital firm that helps build, not bet on, companies transforming massive

industries. Founded in an MIT dorm room during the Great Recession, Remus has helped build industry leaders across multiple sectors,

with a focus on companies in applied AI and healthcare: two of the greatest value drivers of the next decade. Learn more at

remuscap.com.

Contact

Investors:

investor@presto.com

Media:

Brian Ruby

media@presto.com

v3.23.3

Cover

|

Nov. 17, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 17, 2023

|

| Entity File Number |

001-39830

|

| Entity Registrant Name |

Presto Automation Inc.

|

| Entity Central Index Key |

0001822145

|

| Entity Tax Identification Number |

84-2968594

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

985 Industrial Road

|

| Entity Address, City or Town |

San Carlos

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94070

|

| City Area Code |

(650)

|

| Local Phone Number |

817-9012

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

PRST

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each whole warrant exercisable for one share of common stock |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of common stock

|

| Trading Symbol |

PRSTW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PRST_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PRST_WarrantsEachWholeWarrantExercisableForOneShareOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

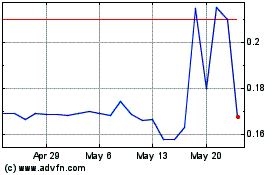

Presto Technologies (NASDAQ:PRST)

Historical Stock Chart

From Apr 2024 to May 2024

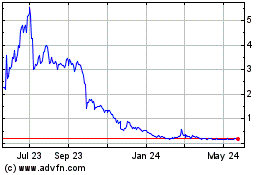

Presto Technologies (NASDAQ:PRST)

Historical Stock Chart

From May 2023 to May 2024