Highlights: LOS ANGELES, April 25 /PRNewswire-FirstCall/ --

Preferred Bank (NASDAQ:PFBC), an independent commercial bank

focusing on the Chinese-American and diversified Southern

California market, today reported net income for the quarter ended

March 31, 2007. Net income totaled $6.5 million, a 26.8% increase

over net income of $5.1 million for the same period in 2006 while

diluted earnings per share increased 24.5% to $0.61 for the quarter

compared to $0.49 for the first quarter of 2006. Mr. Li Yu,

Chairman and President of Preferred Bank commented, "Although we

did not break the record earnings of fourth quarter 2006, I am

pleased with the bank's progress when considering the following: *

In the fourth quarter of 2006 we reduced our income tax provision

by $118,000 due to California enterprise zone tax credits and in

the first quarter of 2007 we booked a $36,000 receivable related to

enterprise zone tax credits from the 2003 tax year. This represents

a sequential quarter difference in enterprise zone credits of

$82,000. * First quarter of 2007 operating results included

employer-paid payroll taxes related to the payout of our annual

bonus and the after-tax effect to net income was $138,000. * The

bank accrues net interest income on a calendar day basis. While the

fourth quarter of 2006 has 92 calendar days, the first quarter of

2007 has only 90 days. Estimated difference to net interest income

after tax is approximately $170,000. "After an extraordinary

quarter of loan and deposit production in the fourth quarter of

2006, we are pleased with the continuous growth in loans and

deposits in this quarter. Our net interest margin remains very

adequate even with the increase in deposit costs caused by the

change in deposit mix," added Mr. Yu. Net Interest Income and Net

Interest Margin. Net interest income before provision for loan and

lease losses increased to $16.2 million, compared to $13.2 million

for the quarter ended March 31, 2006. The 22.6% increase was due to

the growth in the loan portfolio as well as previous increases in

the Prime lending rate. The Company's net interest margin

maintained at 5.16% for the first quarter of 2007, down slightly

from the 5.19% achieved in the fourth quarter of 2006 and 16 basis

points over the 5.00% for the first quarter of 2006. The net

interest margin was aided in the first quarter of 2007 by a large

prepayment penalty received on a loan payoff. Noninterest Income.

For the first quarter of 2007 noninterest income was $763,000

compared with $799,000 for the same quarter last year. The lower

noninterest income this quarter was due mainly to a decrease in

Trade Finance income of $104,000 partially offset by an increase in

other fees of $78,000. Noninterest Expense. Total noninterest

expense was $5,376,000 for the first quarter of 2007, compared to

$4,826,000 for the same period in 2006, a $550,000 or 11.4%

increase. Salaries and benefits increased by $668,000 to $3,600,000

for the first quarter of 2007 compared to $2,932,000 in the same

period of 2006. The increase was primarily due to staffing

increases in the business development area as well as an increase

in bonus expense as the bonus expense is directly tied to the

Company's pre-tax profit after certain ROE goals are met.

Professional services expense increased to $519,000 for the quarter

compared to $426,000 recorded in the same period of 2006 due

primarily to increased audit costs for the Company's compliance

with Section 404 of the Sarbanes-Oxley Act of 2002. Operating

Efficiency Ratio. For the quarter, the operating efficiency ratio

was 31.6% as compared to 34.4% for the same quarter in 2006. The

year-over-year improvement is primarily attributable to the

Company's ability to grow net interest income at a faster pace than

noninterest expense. Balance Sheet Summary Total gross loans and

leases at March 31, 2007 were $1.06 billion, a $59.3 million or

5.9% increase over the $997 million at December 31, 2006.

Commercial real estate loans decreased by $14.3 million or 3.3%,

construction loans increased $38.5 million or 14.2% and commercial

loans increased $23.2 million or 11.5%. Total deposits as of March

31, 2007 were $1.196 billion, an increase of $34.3 million or 3.0%

over the $1.161 billion at December 31, 2006. Noninterest-bearing

demand deposits increased by $5.5 million or 2.5%, interest-bearing

demand and savings deposits decreased by $5.8 million or 2.6% and

time deposits increased by $34.6 million or 4.9%. Total assets were

$1.39 billion, a 2.9% increase over the total of $1.35 billion as

of December 31, 2006. Asset Quality As of March 31, 2007 total

nonaccrual loans were $230,000 compared to $1.12 million as of

December 31, 2006 and $0 as of December 31, 2005. Total net

charge-offs were $200,000 or an annualized 0.08% of average loans

for the first quarter 2007. The allowance for loan loss at March

31, 2007 was $10.6 million or 1.01% of total loans compared to

$10.2 million and 1.03%, respectively at December 31, 2006.

Capitalization Preferred Bank continues to be "well capitalized"

under all regulatory requirements, with a Tier 1 leverage ratio of

11.60% and a total risk based capital ratio of 12.19% at March 31,

2007. Conference Call and Webcast A conference call with

simultaneous webcast to discuss Preferred Bank's first quarter 2007

financial results will be held today, April 25, at 5:00 p.m.

Eastern / 2:00 p.m. Pacific. Interested participants and investors

may access the conference call by dialing (866) 249-6463 (domestic)

or (303) 262-2050 (international). There will also be a live

webcast of the call available at the Investor Relations section of

Preferred Bank's web site at http://www.preferredbank.com/. Web

participants are encouraged to go to the web site at least 15

minutes prior to the start of the call to register, download and

install any necessary audio software. Preferred Bank's Chairman and

CEO Li Yu, Chief Credit Officer, Walt Duchanin and Chief Financial

Officer Edward Czajka will be present to discuss Preferred Bank's

financial results, business highlights and outlook. After the live

webcast, a replay will remain available in the Investor Relations

section of Preferred Bank's web site. A replay of the call will be

available at 800-405-2236 (domestic) or 303-590-3000

(international) through May 2, 2007; the pass code is 11088551.

About Preferred Bank Preferred Bank is one of the largest

independent commercial banks in California focusing on the

Chinese-American market. The bank is chartered by the State of

California, and its deposits are insured by the Federal Deposit

Insurance Corporation, or FDIC, to the maximum extent permitted by

law. The Company conducts its banking business from its main office

in Los Angeles, California, and through ten full-service branch

banking offices in Alhambra, Century City, Chino Hills, City of

Industry, Torrance, Arcadia, Irvine, Diamond Bar, Santa Monica and

Valencia, California. Preferred Bank offers a broad range of

deposit and loan products and services to both commercial and

consumer customers. The bank provides personalized deposit services

as well as real estate finance, commercial loans and trade finance

to small and mid-sized businesses, entrepreneurs, real estate

developers, professionals and high net worth individuals. Preferred

Bank continues to benefit from the significant migration to

Southern California of ethnic Chinese from China and other areas of

East Asia. While its business is not solely dependent on the

Chinese-American market, it represents an important element of the

bank's operating strategy, especially for its branch network and

deposit products and services. Preferred Bank believes it is well

positioned to compete effectively with the smaller Chinese-American

community banks, the larger commercial banks and other major banks

operating in Southern California by offering a high degree of

personal service and responsiveness, experienced multi-lingual

staff and substantial lending limits. Forward-Looking Statements

This press release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

Such statements include, but are not limited to, statements about

the Bank's future financial and operating results, the Bank's

plans, objectives, expectations and intentions and other statements

that are not historical facts. Such statements are based upon the

current beliefs and expectations of the Bank's management and are

subject to significant risks and uncertainties. Actual results may

differ from those set forth in the forward-looking statements. The

following factors, among others, could cause actual results to

differ from those set forth in the forward-looking statements:

changes in economic conditions; changes in the California real

estate market; the loss of senior management and other employees;

natural disasters or recurring energy shortage; changes in interest

rates; competition from other financial services companies;

ineffective underwriting practices; inadequate allowance for loan

and lease losses to cover actual losses; risks inherent in

construction lending; adverse economic conditions in Asia; downturn

in international trade; inability to attract deposits; inability to

raise additional capital when needed or on favorable terms;

inability to manage growth; inadequate communications, information,

operating and financial control systems, technology from fourth

party service providers; the U.S. government's monetary policies;

government regulation; environmental liability with respect to

properties to which the bank takes title; and the threat of

terrorism. Additional factors that could cause the Bank's results

to differ materially from those described in the forward-looking

statements can be found in the Bank\'s 2006 Annual Report on Form

10-K filed with the Federal Deposit Insurance Corporation. The

forward-looking statements in this press release speak only as of

the date of the press release, and the Bank assumes no obligation

to update the forward-looking statements or to update the reasons

why actual results could differ from those contained in the

forward-looking statements. For additional information about

Preferred Bank, please visit the Bank's website at

http://www.preferredbank.com/. AT THE COMPANY: AT FINANCIAL

RELATIONS BOARD: Edward J. Czajka Lasse Glassen Senior Vice

President General Information Chief Financial Officer (310)

854-8313 (213) 891-1188 Financial Tables to Follow PREFERRED BANK

Condensed Statements of Income (unaudited) (in thousands, except

for net income per share and shares) For the Three Months Ended

March 31, December 31, March 31, 2007 2006 2006 Interest income:

Loans, including fees $22,993 $22,505 $15,984 Investment securities

2,727 2,412 1,881 Fed funds sold 794 960 1,409 Total interest

income 26,514 25,877 19,274 Interest expense: Interest-bearing

demand 667 659 521 Savings 761 811 319 Time certificates of

$100,000 or more 6,006 7,068 4,202 Other time certificates 2,632

1,036 801 Fed funds purchased 31 42 11 FHLB borrowings 183 187 183

Total interest expense 10,280 9,803 6,037 Net interest income

16,234 16,074 13,237 Provision for credit losses 600 700 560 Net

interest income after provision for loan losses 15,634 15,374

12,677 Noninterest income: Fees & service charges on deposit

accounts 421 432 436 Trade finance income 145 160 249 BOLI income

84 84 79 Other income 113 60 35 Total noninterest income 763 736

799 Noninterest expense: Salary and employee benefits 3,600 3,105

2,932 Net occupancy expense 591 554 594 Business development and

promotion expense 46 149 104 Professional services 519 468 426

Office supplies and equipment expense 188 245 220 Other 432 524 550

Total noninterest expense 5,376 5,045 4,826 Income before provision

for income taxes 11,021 11,065 8,650 Provision for income taxes

4,528 4,431 3,529 Net income $6,493 $6,634 $5,121 Other

comprehensive income: Unrealized net gains (losses) on securities

available-for-sale 564 29 193 Income taxes related to items of

other comprehensive income (237) (13) (81) Other comprehensive

income (loss), net of tax 327 16 112 Comprehensive income 6,820

6,650 5,233 Net income per share - basic $0.63 $0.65 $0.51 Net

income per share - diluted $0.61 $0.62 $0.49 Weighted-average

common shares outstanding Basic 10,364,874 10,272,949 10,045,428

Diluted 10,682,401 10,630,473 10,504,735 PREFERRED BANK Condensed

Statements of Financial Condition (unaudited) (in thousands) March

31, December 31, Change 2007 2006 % Assets Cash and due from banks

$23,992 $26,878 (10.7) Fed funds sold 85,800 103,700 (17.3) Cash

and cash equivalents 109,792 130,578 (15.9) Securities

available-for-sale, at fair value 201,919 198,689 1.6 Loans and

leases 1,056,627 997,317 5.9 Less allowance for loan and lease

losses (10,636) (10,236) 3.9 Less net deferred loan fees (1,643)

(1,759) (6.6) Net loans and leases 1,044,348 985,322 6.0 Customers'

liability on acceptances 306 268 14.2 Bank furniture and fixtures,

net 1,647 1,711 (3.7) Bank-owned life insurance 7,963 7,896 0.8

Accrued interest receivable 8,691 8,633 0.7 Federal Home Loan Bank

("FHLB") stock 3,736 3,682 1.5 Deferred tax assets 9,577 9,544 0.3

Other asset 629 2,518 (75.0) Total assets $1,388,608 $1,348,841 2.9

Liabilities and Stockholders' Equity Liabilities: Deposits: Demand

230,525 224,982 2.5 Interest-bearing demand 132,077 124,094 6.4

Savings 86,230 100,011 (13.8) Time certificates of $100,000 or more

655,681 619,110 5.9 Other time certificates 91,158 93,147 (2.1)

Total deposits $1,195,671 $1,161,344 3.0 Acceptances outstanding

306 268 14.2 Advances from Federal Home Loan Bank 20,000 20,000 --

Accrued interest payable 5,027 5,272 (4.7) Other liabilities 14,769

16,025 (7.8) Total liabilities 1,235,773 1,202,909 2.7 Commitments

and contingencies Stockholders' equity: Preferred stock. Authorized

5,000,000 shares; no share issued and outstanding at March 31,2007

and December 31, 2006 -- -- Common stock, no par value. Authorized

100,000,000 shares; issued 71,110 69,658 2.1 and outstanding

10,414,132 and 10,274,632 shares at March 31, 2007 and December 31,

2006, respectively Additional paid-in-capital 1,902 1,502 26.6

Retained earnings 79,943 75,219 6.3 Accumulated other comprehensive

loss: Unrealized loss on securities available-for-sale, net of tax

(120) (447) (73.2) Total stockholders' equity 152,835 145,932 4.7

Total liabilities and stockholders' equity $1,388,608 $1,348,841

2.9 PREFERRED BANK Selected Financial Information (unaudited) (in

thousands, except for ratios) For the Three Months Ended March 31,

March 31, December 31, 2007 2006 2006 For the period: Return on

average assets 1.99% 1.86% 2.07% Return on average equity 17.55%

16.49% 18.39% Net interest margin (Fully-taxable equivalent) 5.16%

5.00% 5.19% Noninterest expense to average assets 1.65% 1.75% 1.57%

Efficiency ratio 31.63% 34.38% 30.01% Net charge-offs to average

loans (annualized) 0.08% 0.16% 0.03% Period end: Tier 1 leverage

capital ratio 11.60% 11.54% 11.50% Tier 1 risk-based capital ratio

11.40% 12.30% 11.52% Total risk-based capital ratio 12.19% 13.19%

12.33% Nonperforming assets to total assets 0.02% 0.60% 0.08%

Nonaccrual loans to total loans 0.02% 0.06% 0.11% Allowance for

loan and lease losses to total loans 1.01% 1.11% 1.03% Allowance

for loan and lease losses to nonaccrual loans 4624.35% 1894.56%

913.93% Average balances: Total loans and leases $1,010,148

$777,291 $969,877 Earning assets 1,281,814 1,079,513 1,233,616

Total assets 1,320,501 1,118,791 1,272,501 Total deposits 1,127,321

953,921 1,082,129 Period end: Loans and Leases: Real estate -

multifamily/commercial $423,997 $398,508 $438,280 Real estate -

construction 309,479 196,487 271,021 Commercial 224,547 157,775

201,385 Trade finance 98,109 76,579 86,067 Other 495 905 564 Total

gross loans and leases 1,056,627 830,254 997,317 Allowance for loan

and lease losses (10,636) (9,184) (10,236) Net deferred loan fees

(1,643) (1,902) (1,759) Net loans and leases $1,044,348 $819,168

$985,322 Deposits: Noninterest-bearing demand $230,525 $216,405

$224,982 Interest-bearing demand and savings 218,307 206,965

224,105 Total core deposits 448,832 423,370 449,087 Time deposits

746,839 571,940 712,257 Total deposits $1,195,671 $995,310

$1,161,344 DATASOURCE: Preferred Bank CONTACT: Edward J. Czajka,

Senior Vice President, Chief Financial Officer of Preferred Bank,

+1-213-891-1188; or General Information, Lasse Glassen of Financial

Relations Board, +1-310-854-8313, , for Preferred Bank Web site:

http://www.preferredbank.com/

Copyright

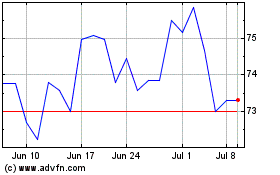

Preferred Bank (NASDAQ:PFBC)

Historical Stock Chart

From Jun 2024 to Jul 2024

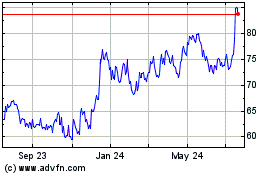

Preferred Bank (NASDAQ:PFBC)

Historical Stock Chart

From Jul 2023 to Jul 2024