If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

SUBJECT

TO COMPLETION, DATED AUGUST 12, 2022

PROSPECTUS

$200,000,000

of

Class

A Ordinary Shares

Debt

Securities

Warrants

Rights

and

Units

Pop

Culture Group Co., Ltd

We

may, from time to time, in one or more offerings, offer and sell up to $200,000,000 of our Class A ordinary shares, par value $0.001

per share (“Class A Ordinary Shares”), debt securities, warrants, rights, and units, or any combination thereof, together

or separately as described in this prospectus. In this prospectus, references to the term “securities” refers, collectively,

to our Class A Ordinary Shares, debt securities, warrants, rights, and units. The prospectus supplement for each offering of securities

will describe in detail the plan of distribution for that offering. For general information about the distribution of the securities

offered, please see “Plan of Distribution” in this prospectus.

This

prospectus provides a general description of the securities we may offer. We will provide the specific terms of the securities offered

in one or more supplements to this prospectus.

We

may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. You should read this

prospectus, any prospectus supplement, and any free writing prospectus before you invest in any of our securities. The prospectus supplement

and any related free writing prospectus may add, update, or change information contained in this prospectus. You should read carefully

this prospectus, the applicable prospectus supplement, and any related free writing prospectus, as well as the documents incorporated

or deemed to be incorporated by reference, before you invest in any of our securities. This prospectus may not be used to offer or sell

any securities unless accompanied by the applicable prospectus supplement.

Unless

otherwise stated, as used in this prospectus, the terms “we,” “us,” “our,” “Pop Culture Group,”

“our Company,” and the “Company” refer to Pop Culture Group Co., Ltd, an exempted company limited by shares incorporated

under the laws of the Cayman Islands; “Pop Culture HK” refers to Pop Culture (HK) Holding Limited, a Hong Kong corporation

and wholly owned subsidiary of Pop Culture Group; “Heliheng” refers to Heliheng Culture Co., Ltd., a limited liability company

organized under PRC laws and regulations, which company is wholly owned by Pop Culture

HK; “PRC subsidiaries” refers to Heliheng and Xiamen Pop Investment Co., Ltd., a limited liability company organized under

PRC laws and regulations, both of which are subsidiaries of Pop Culture HK; and “the PRC operating entities” refer to Xiamen

Pop Culture Co., Ltd., a limited liability company organized under PRC laws and regulations (“Xiamen Pop Culture” or the “VIE”)

and its subsidiaries. See “Prospectus Summary—Business Overview.”

We are a holding company incorporated in the

Cayman Islands and not a Chinese operating company. As a holding company with no material operations of our own, we conduct our operations

through the VIE and its subsidiaries in the PRC. For accounting purposes, we control and receive the economic benefits of the business

operations of the VIE and its subsidiaries through certain contractual arrangements (the “VIE Agreements”), which enables

us to consolidate the financial results of the VIE and its subsidiaries in our consolidated financial statements under generally accepted

accounting principles in the United States (“U.S. GAAP”), and the structure involves unique risks to investors. We have evaluated

the guidance in Financial Accounting Standards Board Accounting Standards Codification 810 and determined that we are regarded as the

primary beneficiary of the VIE for accounting purposes. Our securities offered in this offering are securities of Pop Culture Group,

the offshore holding company in the Cayman Islands, instead of securities of the VIE or its subsidiaries in the PRC. The VIE structure

provides contractual exposure to foreign investment in China-based companies where PRC laws and regulations prohibit direct foreign investment

in the operating companies. For a description of the VIE Agreements, see “Prospectus Summary—Our Corporate Structure—The

VIE Agreements.” As a result of our use of the VIE structure, you may never hold equity interests in the VIE or its subsidiaries.

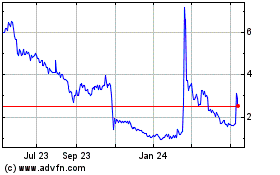

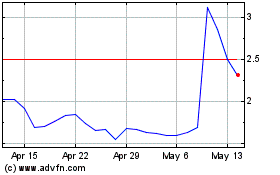

Our Class A Ordinary Shares are listed on

the Nasdaq Capital Market, or “Nasdaq,” under the symbol “CPOP.” On August 11, 2022, the last reported sale

price of our Class A Ordinary Shares on Nasdaq was $1.53 per share. The aggregate market value of our outstanding Class A Ordinary

Shares held by non-affiliates, or public float, as of August 12, 2022, was approximately $31.1 million,

which was calculated based on 18,053,923 Class A Ordinary Shares held by non-affiliates and the price of $1.72 per share, which was

the closing price of our Class A Ordinary Shares on Nasdaq on August 5, 2022. Pursuant to General Instruction I.B.5 of

Form F-3, in no event will we sell our securities in a public primary offering with a value exceeding more than one-third of

our public float in any 12-month period so long as our public float remains below $75 million. During the 12 calendar months prior

to and including the date of this prospectus, we have not offered or sold any securities pursuant to General Instruction I.B.5 of

Form F-3.

Investing

in our securities involves a high degree of risk. Before making an investment decision, please read the information under the heading

“Risk Factors” beginning on page 21 of this prospectus and risk factors set forth in our most recent annual report

on Form 20-F, in other reports incorporated herein by reference, and in an applicable prospectus supplement under the heading “Risk

Factors.”

We

may offer and sell the securities from time to time at fixed prices, at market prices, or at negotiated prices, to or through underwriters,

to other purchasers, through agents, or through a combination of these methods. If any underwriters are involved in the sale of any securities

with respect to which this prospectus or any prospectus supplements are being delivered, the names of such underwriters and any applicable

commissions or discounts will be set forth in the applicable prospectus supplement. The offering price of such securities and the net

proceeds we expect to receive from such sale will also be set forth in a prospectus supplement. See “Plan of Distribution”

elsewhere in this prospectus for a more complete description of the ways in which the securities may be sold.

Because we do not hold equity interests in

the VIE or its subsidiaries, we are subject to risks and uncertainties of the interpretations and applications of PRC laws and regulations,

including regulatory review of overseas listing of companies in the PRC through special purpose vehicles and the validity and enforcement

of the VIE Agreements. We are also subject to the risks and uncertainties about any future actions of the PRC government in this regard

that could disallow the VIE structure, which would likely result in a material change in our operations, and the value of all the securities

we are registering for sale may depreciate significantly or become worthless. The VIE Agreements have not been tested in a court of law

in the PRC as of the date of this prospectus. See “Risk Factors––Risks Relating to Our Corporate Structure––If

the PRC government determines that the VIE Agreements do not comply with PRC regulations, or if these regulations change or are interpreted

differently in the future, we may be unable to assert our contractual rights over the assets of the VIE, and our securities may decline

in value or become worthless.”

Hong Kong was established as a special administrative

region of the PRC in accordance with Article 31 of the Constitution of the PRC. The Basic Law of the Hong Kong Special Administrative

Region of the PRC (the “Basic Law”) was adopted and promulgated on April 4, 1990 and became effective on July 1, 1997,

when the PRC resumed the exercise of sovereignty over Hong Kong. Pursuant to the Basic Law, Hong Kong is authorized by the National People’s

Congress of the PRC to exercise a high degree of autonomy and enjoy executive, legislative, and independent judicial power, under the

principle of “one country, two systems,” and the PRC laws and regulations shall not be applied in Hong Kong except for those

listed in Annex III of the Basic Law (which is confined to laws relating to national defense, foreign affairs, and other matters that

are not within the scope of autonomy). However, there is no assurance that there will not be any changes in the economic, political,

and legal environment in Hong Kong in the future. If there is a significant change to current political arrangements between mainland

China and Hong Kong, or the applicable laws, regulations, or interpretations change, our Hong Kong subsidiary may become subject to PRC

laws or authorities. As a result, our Hong Kong subsidiary could incur material costs to ensure compliance, be subject to fines, experience

devaluation of securities or delisting, no longer conduct offerings to foreign investors, and no longer be permitted to continue its

current business operations.

We are subject to certain legal and operational

risks associated with being based in the PRC, which could result in a material change in the VIE’s operations and/or the value

of the securities we are registering for sale, or could significantly limit or completely hinder our ability to offer or continue to

offer securities to investors and cause the value of such securities to significantly decline or be worthless. PRC laws and regulations

governing our current business operations are sometimes vague and uncertain. Recently, the PRC government adopted a series of regulatory

actions and issued statements to regulate business operations in the PRC with little advance notice, including cracking down on illegal

activities in the securities market, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in

anti-monopoly enforcement. For example, the General Office of the Central Committee of the Communist Party of China and the General Office

of the State Council jointly issued the Opinions on Severely Cracking Down on Illegal Securities Activities According to Law,

or the Opinions, which were made available to the public on July 6, 2021. The Opinions emphasized the need to strengthen the administration

over illegal securities activities and the need to strengthen the supervision over overseas listings by Chinese companies. As of the

date of this prospectus, we, our subsidiaries, and the PRC operating entities have not been involved in any investigations on cybersecurity

review initiated by any PRC regulatory authority, nor has any of them received any inquiry, notice, or sanction. As confirmed by our

PRC counsel, Jincheng Tongda & Neal Law Firm (“JT&N”), as of the date of this prospectus, we are not subject to cybersecurity

review with the Cyberspace Administration of China, or the CAC, under the Cybersecurity Review Measures that became effective on February

15, 2022, or if the Security Administration Draft is enacted as proposed, since (i) as companies that host entertainment events, operate

hip-hop related online programs, and provide event planning and execution services and marketing services to corporate clients, we and

the PRC operating entities are unlikely to be classified as critical information infrastructure operators (“CIIOs”) by the

PRC regulatory agencies; (ii) we and the PRC operating entities currently possess personal information of a relatively small number of

users in their business operations, significantly less than the one million user threshold set for a data processing operator applying

for listing on a foreign exchange that may be required to pass such cybersecurity review, and they do not anticipate that they will be

collecting over one million users’ personal information in the foreseeable future; and (iii) since we and the PRC operating entities

are in the hip-hop industry, data processed in their business is unlikely to have a bearing on national security and therefore is unlikely

to be classified as core or important data by the authorities. There remains uncertainty, however, as to how the Cybersecurity Review

Measures and the Security Administration Draft will be interpreted or implemented and whether the PRC regulatory agencies, including

the CAC, may adopt new laws, regulations, rules, or detailed implementation and interpretation related to the Cybersecurity Review Measures

and the Security Administration Draft. See “Risk Factors—Risks Relating to Doing Business in the PRC—Recent greater

oversight by the Cyberspace Administration of China over data security, particularly for companies seeking to list on a foreign exchange,

could adversely impact our business and our offering.” Furthermore, on December 24, 2021, the China Securities Regulatory Commission

(the “CSRC”) released the Administrative Provisions of the State Council Regarding the Overseas Issuance and Listing of Securities

by Domestic Enterprises (Draft for Comments) (the “Administrative Provisions”) and the Measures for the Overseas Issuance

of Securities and Listing Record-Filings by Domestic Enterprises (Draft for Comments) (the “Filing Measures” and, together

with the Administrative Provisions, the “Draft Rules Regarding Overseas Listings”), both of which had a comment period that

expired on January 23, 2022. The Administrative Provisions and the Filing Measures regulate overseas securities offering and listing

activities by domestic enterprises in direct or indirect form. The Administrative Provisions specify that the CSRC has regulatory authority

over the “overseas securities offering and listing by domestic enterprises,” and requires “domestic” enterprises

to complete filing procedures with the CSRC if they wish to list overseas. The Administrative Provisions also contain regulatory red

lines for overseas offerings and listings by “domestic” enterprises. The Filing Measures provide supplementary rules for

the Administrative Provisions by specifying the primary filing procedures for overseas offerings and listing by domestic enterprises.

If the Administrative Provisions and the Filing Measures are fully implemented in the current form, we may be required to file in accordance

with the Filing Measures. As of the date of this prospectus, these drafts have not been formally adopted, and, due to the lack of detailed

guidance or implementation rules, there are still uncertainties regarding the Administrative Provisions and the Filing Measures. Since

these statements and regulatory actions are newly published, however, official guidance and related implementation rules have not

been issued. It is highly uncertain what the potential impact such modified or new laws and regulations will have on the daily business

operations of our subsidiaries and the VIE, our ability to accept foreign investments, and our listing on an U.S. exchange. The Standing

Committee of the National People’s Congress or PRC regulatory authorities may in the future promulgate laws, regulations, or implementing

rules that require us, our subsidiaries, or the VIE to obtain regulatory approval from Chinese authorities for listing in the U.S.

See “Risk Factors—Risks Relating to Doing Business in the PRC—The Chinese government may exert more oversight and control

over overseas public offerings conducted by China-based issuers, which could significantly limit or completely hinder our ability to

offer or continue to offer our securities to investors and could cause the value of our securities to significantly decline or become

worthless.”

Since 2021, the Chinese government has strengthened

its anti-monopoly supervision, mainly in three aspects: (i) establishing the National Anti-Monopoly Bureau; (ii) revising and promulgating

anti-monopoly laws and regulations, including: the Anti-Monopoly Law of the PRC (amended on June 24, 2022 and effective on August 1,

2022), the anti-monopoly guidelines for various industries, and the Detailed Rules for the Implementation of the Fair Competition Review

System; and (iii) expanding the anti-monopoly law enforcement targeting Internet companies and large enterprises. As of the date of this

prospectus, the Chinese government’s recent statements and regulatory actions related to anti-monopoly concerns have not impacted

our or the PRC operating entities’ ability to conduct business, our ability to accept foreign investments or issue our securities

to foreign investors because neither we and our subsidiaries, nor the PRC operating entities engage in monopolistic behaviors that are

subject to these statements or regulatory actions.

As of the date of this prospectus, our PRC

subsidiaries and the PRC operating entities have received from PRC authorities all requisite licenses, permissions, and approvals needed

to engage in the businesses currently conducted in the PRC, and no permission or approval has been denied. These licenses, permissions,

and approvals, which have been successfully obtained, are: (i) business licenses; (ii) the Electronic Data Interchange (“EDI”)

and Internet Content Provider (“ICP”) Licenses; (iii) the Commercial Performance License; (iv) the Radio and Television Program

Production and Operation Permit; and (v) the filing-for-record procedures before engaging in non-commercial Internet content service

operations. Besides, the PRC operating entities are in the process of applying for the following licenses, permissions, or approvals,

which may be required for their new operations in the PRC: (i) the Internet Culture Business Operating License; (ii) the Internet Publication

License; (iii) the filing-for-record procedures with the CAC’s filing management system for blockchain information services; and

(iv) the filing-for-record procedures for artworks related business activities with local cultural administrative authorities. However,

we cannot assure you that any of these entities will be able to receive clearance of such compliance requirements in a timely manner,

or at all. Any failure of these entities to fully comply with such compliance requirements may cause our PRC subsidiaries or the PRC

operating entities to be unable to begin their new businesses or operations in the PRC, subject them to fines, relevant new businesses

or operations suspension for rectification, or other sanctions. See “Item 3. Key Information—D. Risk Factors—Risks

Relating to Doing Business in the PRC—If the PRC operating entities fail to obtain or renew any of the requisite approvals, licenses,

or permits applicable to our business, it could materially and adversely affect their business and results of operations” in our

most recent annual report on Form 20-F (the “2021 Annual Report”).

In

addition, all the securities we are registering for sale may be prohibited from trading on a national exchange or over-the-counter under

the Holding Foreign Companies Accountable Act, if the Public Company Accounting Oversight Board (United States) (the “PCAOB”)

is unable to inspect our auditor for three consecutive years beginning in 2021. Our auditor, WWC, P.C., is an independent registered

public accounting firm with the PCAOB, and as an auditor of publicly traded companies in the U.S., is subject to laws in the U.S., pursuant

to which the PCAOB conducts regular inspections to assess its compliance with the applicable professional standards. The PCAOB currently

has access to inspect the working papers of our auditor and our auditor is not subject to the determinations announced by the PCAOB on

December 16, 2021. If trading in our securities is prohibited under the Holding Foreign Companies Accountable Act in the future because

the PCAOB determines that it cannot inspect or fully investigate our auditor at such future time, Nasdaq may determine to delist our

Class A Ordinary Shares. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which,

if passed by the U.S. House of Representatives and signed into law, would reduce the period of time for foreign companies to comply with

PCAOB audits to two consecutive years instead of three, thus reducing the time period for triggering the delisting of our Company and

the prohibition of trading in our securities if the PCAOB is unable to inspect our accounting firm at such future time. See “Risk

Factors—Risks Relating to Doing Business in the PRC—Recent joint statement by the SEC and the PCAOB, rule changes by Nasdaq,

and the Holding Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market

companies upon assessing the qualification of their auditors. These developments could add uncertainties to our continued listing or

future offerings of our securities in the U.S.”

Cash is transferred among our Company, our

subsidiaries, and the VIE, in the following manners: (i) funds are transferred to Heliheng, our WFOE, from our Company as needed through

Pop Culture HK, our Hong Kong subsidiary, in the form of capital contributions or shareholder loans, as the case may be; (ii) funds may

be paid by the VIE to Heliheng, as service fees according to the VIE Agreements; (iii) dividends or other distributions may be paid by

Heliheng, to our Company through Pop Culture HK; and (iv) Heliheng and the VIE, lend to and borrow from each other from time to time

for business operation purposes. For more details, see “Prospectus Summary—Dividends or Distributions Made to Our Company

and U.S. Investors and Tax Consequences” and “Corporate History and Structure—The VIE Agreements.” As of the

date of this prospectus, our Company, our subsidiaries, and the VIE have not distributed any earnings or settled any amounts owed under

the VIE Agreements, nor do they have any plan to distribute earnings or settle amounts owed under the VIE Agreements in the foreseeable

future. As of the date of this prospectus, none of our subsidiaries or the VIE have made any dividends or distributions to our Company

and our Company has not made any dividends or distributions to our shareholders. We intend to keep any future earnings to finance the

expansion of our business, and we do not anticipate that any cash dividends will be paid in the foreseeable future. If we determine to

pay dividends on any of our Class A Ordinary Shares or Class B Ordinary Shares in the future, as a holding company, we will be dependent

on receipt of funds from our Hong Kong subsidiary, Pop Culture HK. Pop Culture HK will rely on payments made from Xiamen Pop Culture

to our PRC subsidiary, Heliheng, pursuant to the VIE Agreements, and the distribution of such payments to Pop Culture HK. There are no

laws or regulations that restrict us from providing funding to or receiving dividends from our Hong Kong subsidiary, except for the transfer

of funds involving money laundering and criminal activities. To the extent cash in the business is in the PRC, the funds may not be available

to fund operations or for other use outside of the PRC due to interventions in or the imposition of restrictions and limitations on the

ability of our Company, our subsidiaries, or the VIE by the PRC government to transfer cash. See “Risk Factors—Risks Relating

to Our Corporate Structure—To the extent cash in the business is in the PRC/Hong Kong or a PRC/Hong Kong entity, the funds may

not be available to fund operations or for other use outside of the PRC/Hong Kong due to interventions in or the imposition of restrictions

and limitations on the ability of our Company, our subsidiaries, or the VIE by the PRC government to transfer cash.” The Company’s

management is directly supervising cash management. Our finance department is responsible for establishing the cash management policies

and procedures among our subsidiaries and departments and the PRC operating entities. Each subsidiary, department, or PRC operating entity

initiates a cash request by putting forward a cash demand plan, which explains the specific amount and timing of cash requested, and

submitting it to designated management members of the Company, based on the amount and the use of cash requested. The designated management

member examines and approves the allocation of cash based on the sources of cash and the priorities of the needs, and submit it to the

cashier specialists of our finance department for a second review. Other than the above, we currently do not have other cash management

policies or procedures that dictate how funds are transferred. During the six months ended December 31, 2021 and the fiscal years ended

June 30, 2021, 2020, and 2019, cash transfers and transfers of other assets between Pop Culture Group, its subsidiaries, and the VIE

were as follows: in July 2020, Pop Culture Group transferred approximately $600,000 to its subsidiary in Hong Kong, which in turn transferred

approximately $599,000 to its PRC subsidiary; and in July 2021, Pop Culture Group transferred approximately $7,681,000 of the net proceeds

from our initial public offering to its Hong Kong subsidiary, which in turn transferred approximately $7,649,000 to its PRC subsidiary.

See “Prospectus Summary—Asset Transfers between Our Company, Our Subsidiaries, and the VIE,” “Prospectus Summary—Selected

Condensed Consolidated Financial Schedule of Pop Culture Group and its Subsidiaries and the VIE,” and our unaudited condensed consolidated

interim financial statements for the six months ended December 31, 2021 and our audited consolidated financial statements in the 2021

Annual Report.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved

of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2022.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, an applicable prospectus supplement, and our SEC filings that are incorporated by reference into this prospectus contain

or incorporate by reference forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E

of the Exchange Act. All statements other than statements of historical fact are “forward-looking statements,” including

any projections of earnings, revenue or other financial items, any statements of the plans, strategies, and objectives of management

for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic

conditions or performance, any statements of management’s beliefs, goals, strategies, intentions, and objectives, and any statements

of assumptions underlying any of the foregoing. The words “believe,” “anticipate,” “estimate,” “plan,”

“expect,” “intend,” “may,” “could,” “should,” “potential,” “likely,”

“projects,” “continue,” “will,” and “would” and similar expressions are intended to identify

forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements reflect

our current views with respect to future events, are based on assumptions, and are subject to risks and uncertainties. We cannot guarantee

that we actually will achieve the plans, intentions, or expectations expressed in our forward-looking statements and you should not place

undue reliance on these statements. There are a number of important factors that could cause our actual results to differ materially

from those indicated or implied by forward-looking statements. These important factors include those discussed under the heading “Risk

Factors” contained or incorporated by reference in this prospectus and in the applicable prospectus supplement and any free writing

prospectus we may authorize for use in connection with a specific offering. These factors and the other cautionary statements made in

this prospectus should be read as being applicable to all related forward-looking statements whenever they appear in this prospectus.

Except as required by law, we undertake no obligation to update publicly any forward-looking statements, whether as a result of new information,

future events, or otherwise.

Prospectus

Summary

Our

Corporate Structure

We are a holding company incorporated in the

Cayman Islands and not a Chinese operating company. As a holding company with no material operations of our own, we conduct our operations

through the VIE and its subsidiaries in the PRC. The VIE Agreements were entered into by and among Heliheng, Xiamen Pop Culture, and

the Xiamen Pop Culture Shareholders and include the Exclusive Services Agreement, Share Pledge Agreement, Exclusive Option Agreement,

Shareholders’ Powers of Attorney, and Spousal Consents. For a description of the VIE Agreements, see “—The VIE Agreements.”

For accounting purposes, we control and receive the economic benefits of the business operations of the VIE and its subsidiaries through

the VIE Agreements, which enables us to consolidate the financial results of the VIE and its subsidiaries in our consolidated financial

statements under U.S. GAAP, and the structure involves unique risks to investors. Our securities offered in this offering are securities

of Pop Culture Group, the offshore holding company in the Cayman Islands, instead of securities of the VIE or its subsidiaries in the

PRC. The VIE structure provides contractual exposure to foreign investment in China-based companies where PRC laws and regulations prohibit

direct foreign investment in the operating companies. As a result of our use of the VIE structure, you may never hold equity interests

in the VIE or its subsidiaries.

The

following diagram illustrates our corporate structure, including our subsidiaries and the PRC operating entities, as of the date of this

prospectus:

Notes:

All percentages reflect the voting ownership interests instead of the equity interests held by each of our shareholders given that each

holder of Class B Ordinary Shares is entitled to seven votes per one Class B Ordinary Share and each holder of Class A Ordinary Shares

is entitled to one vote per one Class A Ordinary Share.

| |

(1) |

Represents

5,763,077 Class B Ordinary Shares indirectly held by Zhuoqin Huang, the 100% owner of Joya Enterprises Limited, as of the date of

this prospectus. |

| |

|

|

| |

(2) |

Represents

233,000 Class A Ordinary Shares indirectly held by Weiyi Lin, the 100% owner of Victory Quest Industries Limited, as of the date

of this prospectus. |

| |

(3) |

Represents

an aggregate of 755,089 Class A Ordinary Shares held by five shareholders of Pop Culture Group, each one of which holds less than

5% of our voting ownership interests, as of the date of this prospectus. |

| |

(4) |

As of the date of this prospectus, Xiamen Pop Culture is held by

Zhuoqin Huang as to 61.58%, Weiyi Lin as to 10.02%, Rongdi Zhang as to 9.10%, Chunxiao Cui as to 6.11%, Xiayu Cui as to 6.11%, Junlong

He as to 4.42%, Yu Huang as to 2.42%, Azhen Lin as to 0.12%, and Wuyang Chen as to 0.12%, respectively, together holding 100% of

the shares. |

| |

|

|

| |

(5) |

Xiamen Sikai Culture Media Co., Ltd., an unrelated third party,

holds 49% of the equity interests in Xiamen Pop Sikai Interactive Technology Co., Ltd. (“Pop Sikai”). |

| |

|

|

| |

(6) |

Fujian Zhongshi Communication Co., Ltd., Wenxiu Yu, and Bo Lan,

three unrelated third parties, collectively hold 49% of the equity interests in Zhongpu Shuyuan (Xiamen) Digital Technology Co.,

Ltd. (“Zhongpu Shuyuan”). |

| |

|

|

| |

(7) |

Aoyun Capital Investment Management Pte. Ltd. and Jungu (Xiamen)

Brand Management Co., Ltd., two unrelated third parties, collectively hold 70% of the equity interests in Junpu Era (Xiamen) Digital

Industry Co., Ltd. (“Junpu Era”). |

| |

|

|

| |

(8) |

Shaobing Jiang, an unrelated third party, holds 30% of the equity

interests in Xiamen Pop Shuzhi Culture Communication Co., Ltd. (“Xiamen Shuzhi”). |

| |

|

|

| |

(9) |

Fuzhou Xinsiyu Culture Communication Co., Ltd., an unrelated third

party, holds 49% of the equity interests in Fujian Shuzhi Fuxin Exhibition Co., Ltd. (“Fujian Shuzhi”). |

| |

|

|

| |

(10) |

Shenzhen HipHopJust Information Technology Co., Ltd. and Zhaowei

Wu, two unrelated third parties, collectively hold 40% of the equity interests in Shenzhen Jam Box Technology Co., Ltd. (“Shenzhen

Jam Box”). |

Investors

are purchasing securities of Pop Culture Group, the offshore holding company in the Cayman Islands, instead of securities of the PRC

operating entities, Xiamen Pop Culture and its subsidiaries.

The

VIE Agreements

Neither

we nor our subsidiaries own any share in Xiamen Pop Culture or its subsidiaries. Instead, for accounting purposes, we control and receive

the economic benefits of the business operations of the VIE and its subsidiaries through the VIE Agreements, which enables us to consolidate

the financial results of the VIE and its subsidiaries in our consolidated financial statements under U.S. GAAP. Heliheng, Xiamen Pop

Culture, and the Xiamen Pop Culture Shareholders entered into the VIE Agreements on March 30, 2020, which were amended and restated on

February 19, 2021. The VIE Agreements are designed to provide Heliheng with the power, rights, and obligations to Xiamen Pop Culture

as set forth under the VIE Agreements. We have evaluated the guidance in Financial Accounting Standards Board Accounting Standards Codification

810 and determined that we are regarded as the primary beneficiary of the VIE for accounting purposes, as a result of our direct ownership

in Heliheng and the provisions of the VIE Agreements.

Each

of the VIE Agreements is described in detail below:

Exclusive

Business Cooperation Agreement

Pursuant

to the Exclusive Services Agreement between Xiamen Pop Culture and Heliheng, Heliheng provides Xiamen Pop Culture with technical support,

intellectual services, and other management services relating to its day-to-day business operations and management, on an exclusive basis,

utilizing its advantages in technology, human resources, and information. For services rendered to Xiamen Pop Culture by Heliheng under

the Exclusive Services Agreement, Heliheng is entitled to collect a service fee equal to 100% of the net income of Xiamen Pop Culture,

which is Xiamen Pop Culture’s earnings before tax after deducting relevant costs and reasonable expenses.

The

Exclusive Services Agreement became effective on March 30, 2020, was amended and restated on February 19, 2021, and will remain effective

unless otherwise terminated as required by laws or regulations, or by relevant governmental or regulatory authorities. Nevertheless,

the Exclusive Services Agreement will be terminated after all shares in Xiamen Pop Culture held by the Xiamen Pop Culture Shareholders

and/or all the assets of Xiamen Pop Culture have been legally transferred to Heliheng and/or its designee in accordance with the Exclusive

Option Agreement.

The

Exclusive Services Agreement does not prohibit related party transactions. Our audit committee is required to review and approve in advance

any related party transactions, including transactions involving Heliheng or Xiamen Pop Culture.

Share

Pledge Agreement

Under

the Share Pledge Agreement between Heliheng and the Xiamen Pop Culture Shareholders, together holding 100% of the shares in Xiamen

Pop Culture, the Xiamen Pop Culture Shareholders pledged their shares in Xiamen Pop Culture to Heliheng to guarantee the performance

of Xiamen Pop Culture’s obligations under the Exclusive Services Agreement. Under the terms of the Share Pledge Agreement, in

the event that Xiamen Pop Culture or the Xiamen Pop Culture Shareholders breach their respective contractual obligations under the

Exclusive Services Agreement, Heliheng, as pledgee, will be entitled to certain rights, including, but not limited to, the right to

collect dividends generated by the pledged shares. The Xiamen Pop Culture Shareholders also agreed that upon occurrence of any event

of default, as set forth in the Share Pledge Agreement, Heliheng is entitled to dispose of the pledged shares in accordance with

applicable PRC laws and regulations. The Xiamen Pop Culture Shareholders further agreed not to dispose of the pledged shares or take

any action that would prejudice Heliheng’s interest.

The

Share Pledge Agreement is effective until the full payment of the service fees under the Exclusive Services Agreement and upon termination

of Xiamen Pop Culture’s obligations under the Exclusive Services Agreement, or upon the transfer of shares under the Exclusive

Option Agreement.

The

purposes of the Share Pledge Agreement are to (1) guarantee the performance of Xiamen Pop Culture’s obligations under the Exclusive

Services Agreement and (2) make sure the Xiamen Pop Culture Shareholders do not transfer or assign the pledged shares, or create or allow

any encumbrance that would prejudice Heliheng’s interests without Heliheng’s prior written consent. In the event Xiamen Pop

Culture breaches its contractual obligations under the Exclusive Services Agreement, Heliheng will be entitled to dispose of the pledged

shares in accordance with relevant PRC laws and regulations.

As

of the date of this prospectus, the share pledges under the Share Pledge Agreement have been registered with the competent PRC regulatory

authority.

Exclusive

Option Agreement

Under

the Exclusive Option Agreement, the Xiamen Pop Culture Shareholders, together holding 100% of the shares in Xiamen Pop Culture, irrevocably

granted Heliheng (or its designee) an exclusive option to purchase, to the extent permitted under PRC laws and regulations, once or at multiple times,

at any time, part or all of their shares in Xiamen Pop Culture. The option price is RMB10 or the minimum amount to the extent permitted

under PRC laws and regulations, whichever is lower.

Under

the Exclusive Option Agreement, Heliheng may at any time under any circumstances, purchase or have its designee purchase, at its discretion,

to the extent permitted under PRC laws and regulations, all or part of the Xiamen Pop Culture Shareholders’ shares in Xiamen Pop Culture. The Exclusive

Option Agreement, together with the Share Pledge Agreement, the Exclusive Services Agreement, and the Shareholders’ Powers of Attorney,

enable us to consolidate the financial results of Xiamen Pop Culture and its subsidiaries in our consolidated financial statements under

U.S. GAAP.

The

Exclusive Option Agreement remains effective until all the equity of Xiamen Pop Culture is legally transferred under the name of Heliheng

and/or other entity or individual designated by it, unless terminated earlier by Heliheng with a 30-day prior notice.

Shareholders’

Powers of Attorney

Under

each of the Powers of Attorney, the Xiamen Pop Culture Shareholders authorized Heliheng to act on their behalf as their exclusive agent

and attorney with respect to all rights as shareholders, including but not limited to: (a) attending shareholders’ meetings; (b)

exercising all the shareholder’s rights, including voting, that shareholders are entitled to under PRC laws and regulations and the Articles

of Association, including but not limited to the sale or transfer or pledge or disposition of shares in part or in whole; and (c) designating

and appointing on behalf of shareholders the legal representative, the executive director, supervisor, the chief executive officer, and

other senior management members of Xiamen Pop Culture.

The

Powers of Attorney are irrevocable and continuously valid from the date of execution of the Powers of Attorney, so long as the Xiamen

Pop Culture Shareholders are shareholders of Xiamen Pop Culture.

Spousal

Consents

The

spouses of certain of the Xiamen Pop Culture Shareholders agreed, via a spousal consent, to the execution of the “Transaction Documents”

including: (a) Exclusive Option Agreement entered into with Heliheng and Xiamen Pop Culture; (b) Share Pledge Agreement entered into

with Heliheng; and (c) Powers of Attorney executed by the Xiamen Pop Culture Shareholders, and the disposal of the shares of Xiamen Pop

Culture held by the Xiamen Pop Culture Shareholders and registered in their names.

The

spouses of certain of the Xiamen Pop Culture Shareholders further undertook not to make any assertions in connection with the shares

of Xiamen Pop Culture which are held by the Xiamen Pop Culture Shareholders. The spouses of certain of the Xiamen Pop Culture Shareholders

confirmed that the Xiamen Pop Culture Shareholders can perform, amend, or terminate the Transaction Documents without their authorization

or consent. They undertook to execute all necessary documents and take all necessary actions to ensure appropriate performance of the

agreements.

The

spouses of certain of the Xiamen Pop Culture Shareholders also undertook that if they obtain any share of Xiamen Pop Culture which are

held by the Xiamen Pop Culture Shareholders for any reasons, they will be bound by the Transaction Documents and comply with the obligations

thereunder as shareholders of Xiamen Pop Culture. For this purpose, upon Heliheng’s request, they will sign a series of written

documents in substantially the same format and content as the Transaction Documents and Exclusive Services Agreement (as amended from

time to time).

Risks

Associated with Our Corporate Structure and the VIE Agreements

Because we do not directly hold equity interests

in the VIE and its subsidiaries, we are subject to risks and uncertainties of the interpretations and applications of PRC laws and regulations,

including but not limited to, regulatory review of overseas listing of companies in the PRC through special purpose vehicles, and the

validity and enforcement of the VIE Agreements. We are also subject to the risks and uncertainties about any future actions of the PRC

government in this regard that could disallow the VIE structure, which would likely result in a material change in the VIE’s operations,

and the value of all the securities we are registering for sale may depreciate significantly or become worthless. The VIE Agreements

have not been tested in a court of law in the PRC as of the date of this prospectus.

The VIE Agreements may not be effective as

direct ownership in providing operational control. For instance, Xiamen Pop Culture and the Xiamen Pop Culture Shareholders could breach

their VIE Agreements with Heliheng by, among other things, failing to conduct their operations in an acceptable manner or taking other

actions that are detrimental to our interests. The Xiamen Pop Culture Shareholders may not act in the best interests of our Company or

may not perform their obligations under these contracts. Such risks exist throughout the period in which we intend to operate certain

portions of our business through the VIE Agreements with Xiamen Pop Culture. In the event that Xiamen Pop Culture or the Xiamen Pop Culture

Shareholders fail to perform their respective obligations under the VIE Agreements, we may have to incur substantial costs and expend

additional resources to enforce such arrangements. In addition, even if legal actions are taken to enforce such arrangements, there is

uncertainty as to whether the courts of the PRC would recognize or enforce judgments of U.S. courts against us or such persons predicated

upon the civil liability provisions of the securities laws of the United States or any state. See “Risk Factors—Risks Relating

to Our Corporate Structure—If the PRC government determines that the VIE Agreements do not comply with PRC regulatory restrictions

on foreign investment in the relevant industries, or if these regulations or the interpretation of existing regulations change in the

future, we could be subject to severe penalties or be forced to relinquish our interests in those operations,” and “Item

3. Key Information—D. Risk Factors—Risks Relating to Our Corporate Structure—The VIE Agreements with Xiamen Pop Culture

and the Xiamen Pop Culture Shareholders may not be effective in providing control over Xiamen Pop Culture” and “Item 3. Key

Information—D. Risk Factors—Risks Relating to Our Corporate Structure—Our VIE Agreements are governed by the laws of

the PRC and we may have difficulty in enforcing any rights we may have under these contractual arrangements” in the 2021 Annual

Report.

On

December 28, 2021, 13 governmental departments of the PRC, including the CAC, issued the revised Cybersecurity Review Measures, which

became effective on February 15, 2022. The Cybersecurity Review Measures require that an online platform operator which possesses the

personal information of at least one million users must apply for a cybersecurity review by the CAC if it intends to be listed in foreign

countries. Such requirement is reiterated on the Security Administration Draft, which was released by the CAC on November 14, 2021 for

public consultation. As advised by our PRC counsel, JT&N, as of the date of this prospectus, we are not subject to cybersecurity

review or network data security review by the CAC, since (i) as companies that host entertainment events, operate hip-hop related online

programs, and provide event planning and execution services and marketing services to corporate clients, we and the PRC operating entities

are unlikely to be classified as CIIOs by the PRC regulatory agencies; (ii) we and the PRC operating entities currently possess personal

information of a relatively small number of users in our business operations, significantly less than the one million user threshold

set for a data processing operator applying for listing on a foreign exchange that may be required to pass such cybersecurity review,

and we do not anticipate that we will be collecting over one million users’ personal information in the foreseeable future; and

(iii) since we and the PRC operating entities are in the hip-hop industry, data processed in our business is unlikely to have a bearing

on national security and therefore is unlikely to be classified as core or important data by the authorities. There remains uncertainty,

however, as to how the Cybersecurity Review Measures and the Security Administration Draft will be interpreted or implemented and whether

the PRC regulatory agencies, including the CAC, may adopt new laws, regulations, rules, or detailed implementation and interpretation

related to the Cybersecurity Review Measures and the Security Administration Draft. See “Risk Factors—Risks Relating to Doing

Business in the PRC—Recent greater oversight by the Cyberspace Administration of China over data security, particularly for companies

seeking to list on a foreign exchange, could adversely impact our business and our offering.”

In

addition, on December 24, 2021, the CSRC and relevant departments of the State Council issued the Draft Rules Regarding Overseas Listings,

which aim to regulate overseas securities offerings and listings by China-based companies, for public consultation. According to the

Draft Rules Regarding Overseas Listings, among other things, after making initial applications with overseas stock markets for initial

public offerings or listings, or after the completion of issuance of overseas listed securities by the overseas listed issuer, all China-based

companies shall file the required filing materials with the CSRC within three working days. In addition, overseas offerings and listings

may be prohibited for such China-based companies when any of six occasions occur. As of the date of this prospectus, the Draft Rules

Regarding Overseas Listings have been released for public comment only and have not been formally promulgated, and neither we nor any

of the PRC operating entities have been required to complete the filing procedures. There remain, however, uncertainties as to the enactment

or future interpretations and implementations of the Draft Rules Regarding Overseas Listings. See “Risk Factors—Risks Relating

to Doing Business in the PRC—The Chinese government may exert more oversight and control over overseas public offerings conducted

by China-based issuers, which could significantly limit or completely hinder our ability to offer or continue to offer our securities

to investors and could cause the value of our securities to significantly decline or become worthless.”

In

addition, all of the securities we are offering may be prohibited from trading on a national exchange or over-the-counter under the Holding

Foreign Companies Accountable Act if the PCAOB is unable to inspect our auditor for three consecutive years beginning in 2021. Our auditor,

WWC, P.C., is an independent registered public accounting firm with the PCAOB, and as an auditor of publicly traded companies in the

U.S., is subject to laws in the U.S., pursuant to which the PCAOB conducts regular inspections to assess its compliance with the applicable

professional standards. The PCAOB currently has access to inspect the working papers of our auditor and our auditor is not subject to

the determinations announced by the PCAOB on December 16, 2021. If trading in our Class A Ordinary Shares is prohibited under the Holding

Foreign Companies Accountable Act in the future because the PCAOB determines that it cannot inspect or fully investigate our auditor

at such future time, Nasdaq may determine to delist our Class A Ordinary Shares. On June 22, 2021, the U.S. Senate passed the Accelerating

Holding Foreign Companies Accountable Act, which, if passed by the U.S. House of Representatives and signed into law, would reduce the

period of time for foreign companies to comply with PCAOB audits to two consecutive years instead of three, thus reducing the time period

for triggering the delisting of our Company and the prohibition of trading in our securities if the PCAOB is unable to inspect our accounting

firm at such future time. See “Risk Factors—Risks Relating to Doing Business in the PRC—Recent joint statement by the

SEC and the PCAOB, rule changes by Nasdaq, and the Holding Foreign Companies Accountable Act all call for additional and more stringent

criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors

who are not inspected by the PCAOB. These developments could add uncertainties to our continued listing or future offerings of our securities

in the U.S.”

Business

Overview

We conduct our business in the PRC through

the PRC operating entities. The following description of our business is a description of the business of the PRC operating entities.

See “—Our Corporate Structure—The VIE Agreements” for a summary of the VIE Agreements.

With

the values of hip-hop culture at their core and the younger generation as their primary target audience, the PRC operating entities host

entertainment events, operate hip-hop related online programs, and provide event planning and execution services and marketing services

to corporate clients. They seek to create value for stakeholders in all parts of the hip-hop ecosystem, from fans to artists, corporate

clients, and sponsors.

The PRC operating entities have in recent

years focused on developing and hosting their own hip-hop events. The PRC operating entities own an extensive portfolio of intellectual

property rights related to hip-hop events, including a stage play, three dance competitions or events, two cultural and musical festivals,

and two promotional parties that feature live hip-hop performances in karaoke bars or amusement parks to promote hip-hop culture, and

they cooperate with music companies and artists to host various concerts in the PRC; starting from March 2020, the PRC operating entities

have been developing and operating hip-hop related online programs (collectively, “Event Hosting”). The PRC operating entities’

concerts and hip-hop events generated an aggregate attendance of approximately 203,230 and their online hip-hop programs generated over

156 million views during the six months ended December 31, 2021. The PRC operating entities’ concerts and hip-hop events generated

an aggregate attendance of 159,200, 127,930, and 122,000 during the fiscal years ended June 30, 2021, 2020, and 2019, respectively, and

their online hip-hop programs generated over 314 million and 100 million views during the fiscal years ended June 30, 2021 and 2020,

respectively. The PRC operating entities generate revenue from their Event Hosting business by providing sponsorship packages to advertisers

in exchange for sponsorship fees and by selling tickets for those concerts.

The

PRC operating entities help corporate clients with the design, logistics, and layout of events, coordinate and supervise the actual event

set-up and implementation, and generate revenue through service fees (“Event Planning and Execution”). Their services feature

significant hip-hop elements and cover each aspect of corporate and marketing events, including communication, planning, design, production,

reception, execution, and analysis. During the six months ended December 31, 2021, the PRC operating entities served 11 clients in 23

events with respect to event planning and execution. During the fiscal years ended June 30, 2021, 2020, and 2019, the PRC operating entities

served 24, 16, and 35 clients in 59, 49, and 43 events with respect to event planning and execution, respectively.

The

PRC operating entities provide marketing services, including (i) brand promotion services, such as trademark and logo design, visual

identity system design, brand positioning, brand personality design, and digital solutions, and (ii) other services, primarily advertisement

distribution, to corporate clients for service fees (“Marketing”).

We

believe that the main reason corporate clients hire the PRC operating entities to plan and execute events and provide marketing services

geared towards the younger generation is for their deep understanding of the taste and preferences of this generation.

For

the six months ended December 31, 2021, we had total revenue of $20,148,203 and net income of $4,116,908. Revenue derived from the Event

Hosting business, the Event Planning and Execution business, and the Marketing business accounted for 59%, 33%, and 7% of our total revenue

for the period, respectively.

For the fiscal years ended June 30, 2021, 2020,

and 2019, we had total revenue of $25,526,557, $15,688,080, and $19,031,766, and net income of $4,267,542, $2,625,817, and $3,831,758,

respectively. Revenue derived from the Event Hosting business accounted for 59%, 49%, and 34% of our total revenue for those fiscal years,

respectively. Revenue derived from the Event Planning and Execution business accounted for 36%, 35%, and 52% of our total revenue for

those fiscal years, respectively. Revenue derived from the Marketing business accounted for 5%, 16%, and 14% of our total revenue for

those fiscal years, respectively.

Recent

Development

On December 3, 2021, we incorporated a wholly

owned subsidiary, Pop Culture Global Operations Inc. (“Pop Culture Global”), in California. As of the date of this prospectus,

Pop Culture Global has not been operative, nor has it generated any revenue.

On January 25, 2022, Heliheng and Xiamen Pop Culture

established a subsidiary, Xiamen Pop Investment Co., Ltd. (“Pop Investment”), under PRC laws and regulations. Heliheng holds

60% equity interests in Pop Investment and Xiamen Pop Culture holds 40%. Pop Investment is engaged in cross-border funds management for

the Company.

On March 30, 2022, Xiamen Pop Culture established

a subsidiary, Zhongpu Shuyuan, under PRC laws and regulations. Xiamen Pop Culture holds 51% equity interests in Zhongpu Shuyuan. Zhongpu

Shuyuan is engaged in digital collection and metaverse related business and launched a non-fungible token digital collection trading platform

in China, Shuyuan Meta, on May 3, 2022 for the development, promotion, and distribution of digital collections.

On April 12, 2022, Zhongpu Shuyuan entered into

a share purchase agreement with Mouqing He and Lin Jiang, the two former shareholders of Xiamen Qiqin Technology Co., Ltd. (“Xiamen

Qiqin”), pursuant to which Zhongpu Shuyuan acquired 100% of Xiamen Qiqin’s equity interests. As a result, Xiamen Qiqin became

a wholly owned subsidiary of Zhongpu Shuyuan on April 12, 2022. Xiamen Qiqin is still in the process of exploring its business plan. As

of the date of this prospectus, Xiamen Qiqin has not been operative, nor has it generated any revenue since its acquisition by Zhongpu

Shuyuan.

On April 14, 2022, Xiamen Pop Culture established

a wholly owned subsidiary, Hualiu Digital Entertainment (Beijing) International Culture Media Co., Ltd. (“Hualiu Digital”),

under the PRC laws and regulations. Hualiu Digital is still in the process of exploring its business plan. As of the date of this prospectus,

Hualiu Digital has not been operative, nor has it generated any revenue.

On

May 16, 2022, Guangzhou Shuzhi Culture Communication Co., Ltd. (“Guangzhou Shuzhi”), a wholly owned subsidiary of Xiamen

Pop Culture, established a wholly owned subsidiary, Xiamen Shuzhi, under PRC laws and regulations. Xiamen Shuzhi is still in the process

of exploring its business plan. As of the date of this prospectus, Xiamen Shuzhi has not been operative, nor has it generated any revenue.

On

May 18, 2022, Guangzhou Shuzhi established a subsidiary, Fujian Shuzhi, under PRC laws and regulations. Guangzhou Shuzhi holds 51% equity

interests in Fujian Shuzhi. Fujian Shuzhi is still in the process of exploring its business plan. As of the date of this prospectus,

Fujian Shuzhi has not been operative, nor has it generated any revenue.

On

June 20, 2022, Xiamen Pop Culture established a wholly owned subsidiary, Xiamen Pupu Digital Technology Co., Ltd. (“Pupu Digital”),

under PRC laws and regulations. Pupu Digital is still in the process of exploring its business plan. As of the date of this prospectus,

Pupu Digital has not been operative, nor has it generated any revenue.

On June 28, 2022, Xiamen Pop Network Technology

Co., Ltd. (“Pop Network”) and two unrelated third parties established Junpu Era under PRC laws and regulations. Pop Network

holds 30% of the equity interests in Junpu Era. Junpu Era is still in the process of exploring its business plan. As of the date of

this prospectus, Junpu Era has not been operative, nor has it generated any revenue.

On July 21, 2022, Pop Culture HK established a wholly owned subsidiary,

Fujian Pupu Shuzhi Sports Industry Development Co., Ltd. (“Shuzhi Sports”), under PRC laws and regulations. Shuzhi Sports

is still in the process of exploring its business plan. As of the date of this prospectus, Shuzhi Sports has not been operative, nor

has it generated any revenue.

COVID-19

Impact

The

COVID-19 pandemic has resulted in the implementation of significant governmental measures, including lockdowns, closures, quarantines,

and travel bans, intended to control the spread of the virus. The Chinese government has ordered quarantines, travel restrictions, and

the temporary closure of stores and facilities. Companies are also taking precautions, such as requiring employees to work remotely,

imposing travel restrictions and temporarily closing businesses.

Since

the PRC operating entities primarily engage in the businesses of hosting events and providing services related to events, their results

of operations and financial condition for the six months ended December 31, 2021 were adversely affected by the spread of COVID-19 as

the Chinese government took a number of actions, including encouraging employees of enterprises to work remotely from home and cancelling

public activities. In particular, at certain periods or in certain cities, all of the offline events the PRC operating entities expected

to host or plan and execute were suspended because governmental authorities-imposed restrictions on large scale in-person gatherings

and the PRC operating entities also suffered a decrease in the marketing business because of the sluggish demand for advertising or marketing

activities, resulting in lower growth rate of revenue and net income from the event planning and execution, and a decrease revenue from

other services, during the six months ended December 31, 2021. The PRC operating entities also experienced difficulties in collecting

accounts receivable during the first half of fiscal 2022.

The

COVID-19 pandemic may continue to materially and adversely affect our business operations and condition and operating results for fiscal

2022, including delays in their execution of offline events, material negative impact on their total revenue, slower collection of accounts

receivable, and additional allowance for doubtful accounts. The extent to which COVID-19 impacts the PRC operating entities’ results

of operations during 2022 will depend on the future developments of the pandemic, including new information concerning the global severity

of and actions taken to contain the pandemic, which are highly uncertain and unpredictable.

Summary

of Risk Factors

Investing

in our securities involves significant risks. You should carefully consider all of the information in this prospectus before making an

investment in our securities. Below please find a summary of the principal risks we face, organized under relevant headings. These risks

are discussed more fully under “Item 3. Key Information—D. Risk Factors” in the 2021 Annual Report and in the section

titled “Risk Factors” beginning on page 21 of this prospectus.

Risks

Relating to Our Corporate Structure (for a more detailed discussion, see “Item 3. Key Information—D. Risk Factors—Risks

Relating to Our Corporate Structure” in the 2021 Annual Report and “Risk Factors—Risks Relating to Our Corporate Structure”

of this prospectus)

Risks

and uncertainties related to our business include, but are not limited to, the following:

| ● | our VIE Agreements with

Xiamen Pop Culture and the Xiamen Pop Culture Shareholders may not be effective in providing control over Xiamen Pop Culture (see

“Item 3. Key Information—D. Risk Factors—Risks Relating to Our Corporate Structure—Our VIE Agreements with

Xiamen Pop Culture and the Xiamen Pop Culture Shareholders may not be effective in providing control over Xiamen Pop Culture”

on page 3 of the 2021 Annual Report); |

| ● | our

VIE Agreements are governed by the laws of the PRC and we may have difficulty in enforcing any rights we may have under these contractual

arrangements (see “Item 3. Key Information—D. Risk Factors—Risks Relating to Our Corporate Structure—Our VIE

Agreements are governed by the laws of the PRC and we may have difficulty in enforcing any rights we may have under these contractual

arrangements” on page 3 of the 2021 Annual Report); |

| ● | we

may not be able to consolidate the financial results of Xiamen Pop Culture or such consolidation could materially and adversely affect

our operating results and financial condition (see “Item 3. Key Information—D. Risk Factors—Risks Relating to Our Corporate

Structure— We may not be able to consolidate the financial results of Xiamen Pop Culture or such consolidation could materially

and adversely affect our operating results and financial condition” on page 4 of the 2021 Annual Report); |

| ● | the

VIE Agreements may result in adverse tax consequences (see “Item 3. Key Information—D. Risk Factors—Risks Relating

to Our Corporate Structure—The VIE Agreements may result in adverse tax consequences” on page 4 of the 2021 Annual Report); |

| ● | the

Xiamen Pop Culture Shareholders have potential conflicts of interest with our Company, which may adversely affect our business and financial

condition (see “Item 3. Key Information—D. Risk Factors—Risks Relating to Our Corporate Structure—The Xiamen

Pop Culture Shareholders have potential conflicts of interest with our Company which may adversely affect our business and financial

condition” on page 5 of the 2021 Annual Report); |

| ● | we

rely on the approvals, certificates, and business licenses held by Xiamen Pop Culture and any deterioration of the relationship between

Heliheng and Xiamen Pop Culture could materially and adversely affect our overall business operations (see “Item 3. Key Information—D.

Risk Factors—Risks Relating to Our Corporate Structure—We rely on the approvals, certificates, and business licenses held

by Xiamen Pop Culture and any deterioration of the relationship between Heliheng and Xiamen Pop Culture could materially and adversely

affect our overall business operations” on page 5 of the 2021 Annual Report); |

| ● | the

exercise of our option to purchase part or all of the shares in Xiamen Pop Culture under the exclusive option agreement might be subject

to certain limitations and substantial costs (see “Item 3. Key Information—D. Risk Factors—Risks Relating to Our Corporate

Structure—The exercise of our option to purchase part or all of the shares in Xiamen Pop Culture under the exclusive option agreement

might be subject to certain limitations and substantial costs” on page 6 of the 2021 Annual Report); and |

| ● | if

the PRC government determines that the VIE Agreements do not comply with PRC regulations, or if these regulations change or are interpreted

differently in the future, we may be unable to assert our contractual rights over the assets of the VIE, and our securities may decline

in value or become worthless (see “Risk Factors––Risks Relating to Our Corporate Structure––If the PRC

government determines that the VIE Agreements do not comply with PRC regulations, or if these regulations change or are interpreted differently

in the future, we may be unable to assert our contractual rights over the assets of the VIE, and our securities may decline in value

or become worthless” on page 21 of this prospectus). |

Risks

Relating to Doing Business in the PRC (for a more detailed discussion, see “Item 3. Key Information—D. Risk Factors—Risks

Relating to Doing Business in the PRC” in our 2021 Annual Report and “Risk Factors—Risks Relating to Doing Business

in the PRC” of this prospectus)

We

face risks and uncertainties relating to doing business in the PRC in general, including, but not limited to, the following:

| ● | there

are uncertainties under the Foreign Investment Law relating to the status of businesses in China controlled by foreign invested projects

primarily through contractual arrangements, such as our business (see “Item 3. Key Information—D. Risk Factors––Risks

Relating to Doing Business in PRC––There are uncertainties under the Foreign Investment Law relating to the status of businesses

in China controlled by foreign invested projects primarily through contractual arrangements, such as our business” on page 6 of

the 2021 Annual Report); |

| ● | changes

in China’s economic, political, social conditions, or government policies could have a material adverse effect on the PRC operating

entities’ business and operations (see “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business

in the PRC—Changes in China’s economic, political, or social conditions or government policies could have a material adverse

effect on our PRC operating entities’ business and operations” on page 7 of the 2021 Annual Report); |

| ● | you

may experience difficulties in effecting service of legal process, enforcing foreign judgments, or bringing actions in China against

us or our management named in this annual report based on foreign laws. It may also be difficult for you or overseas regulators to conduct

investigations or collect evidence within China (see “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing

Business in the PRC—You may experience difficulties in effecting service of legal process, enforcing foreign judgments, or bringing

actions in China against us or our management named in this annual report based on foreign laws. It may also be difficult for you or

overseas regulators to conduct investigations or collect evidence within China” on page 8 of the 2021 Annual Report); |

| ● | the

opinions recently issued by the General Office of the Central Committee of the Communist Party of China and the General Office of the

State Council may subject us to additional compliance requirement in the future (see “Item 3. Key Information—D. Risk Factors—Risks

Relating to Doing Business in the PRC—The opinions recently issued by the General Office of the Central Committee of the Communist

Party of China and the General Office of the State Council may subject us to additional compliance requirement in the future” on

page 10 of the 2021 Annual Report); |

| ● | increases

in labor costs in the PRC may adversely affect our PRC operating entities’ business and profitability (see “Item 3. Key Information—D.

Risk Factors—Risks Relating to Doing Business in the PRC—Increases in labor costs in the PRC may adversely affect our PRC

operating entities’ business and profitability” on page 11 of the 2021 Annual Report); |

| ● | if

our PRC operating entities fail to obtain or renew any of the requisite approvals, licenses, or permits applicable to our business, it

could materially and adversely affect their business and results of operations (see “Item 3. Key Information—D. Risk Factors—Risks

Relating to Doing Business in the PRC—if our PRC operating entities fail to obtain or renew any of the requisite approvals, licenses,

or permits applicable to our business, it could materially and adversely affect their business and results of operations” on page

12 of the 2021 Annual Report); |

| ● | our

PRC operating entities have not made adequate social insurance and housing fund contributions for all employees as required by PRC regulations,

which may subject them to penalties (see “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business

in the PRC—Our PRC operating entities have not made adequate social insurance and housing fund contributions for all employees

as required by PRC regulations, which may subject them to penalties” on page 12 of the 2021 Annual Report); |

| ● | PRC

regulations relating to offshore investment activities by PRC residents may limit our ability to acquire PRC companies or inject capital

into the PRC subsidiary and could adversely affect our business. PRC regulations relating to offshore investment activities by PRC residents

may limit our PRC subsidiary’s ability to increase its registered capital or distribute profits to us, or otherwise expose us or

our PRC resident shareholders to liabilities or penalties (see “Item 3. Key Information—D. Risk Factors—Risks Relating

to Doing Business in the PRC—PRC regulations relating to offshore investment activities by PRC residents may subject our PRC resident

beneficial owners or our PRC subsidiary to liability or penalties, limit our ability to inject capital into our PRC subsidiary, limit

our PRC subsidiary’s ability to increase its registered capital or distribute profits to us, or may otherwise adversely affect

us” on page 13 of the 2021 Annual Report); |

| ● | PRC

regulation of parent/subsidiary loans and direct investment by offshore holding companies to PRC entities may delay or prevent us from

using the proceeds of offshore offerings to make loans or additional capital contributions to our PRC subsidiary and to make loans to

Xiamen Pop Culture, which could materially and adversely affect their liquidity and their ability to fund and expand their business (see

“Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business in the PRC—PRC regulation of parent/subsidiary

loans and direct investment by offshore holding companies to PRC entities may delay or prevent us from using the proceeds of offshore

offerings to make loans or additional capital contributions to our PRC subsidiary and to make loans to Xiamen Pop Culture, which could

materially and adversely affect their liquidity and their ability to fund and expand their business” on page 14 of the 2021 Annual

Report); |

| ● | we

face uncertainty with respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies

(see “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business in the PRC—We face uncertainty

with respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies” on page

17 of the 2021 Annual Report); |

| ● | fluctuations

in exchange rates could have a material and adverse effect on our results of operations and the value of your investment (see “Item

3. Key Information—D. Risk Factors—Risks Relating to Doing Business in the PRC—Fluctuations in exchange rates could

have a material and adverse effect on our results of operations and the value of your investment” on page 15 of the 2021 Annual

Report); |

| ● | under

the PRC Enterprise Income Tax Law, we may be classified as a “resident enterprise” of China, which could result in unfavorable

tax consequences to us and our non-PRC shareholders and have a material adverse effect on our results of operations and the value of

your investment (see “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business in the PRC—Under

the PRC Enterprise Income Tax Law, we may be classified as a PRC “resident enterprise” for PRC enterprise income tax purposes.

Such classification would likely result in unfavorable tax consequences to us and our non-PRC shareholders and have a material adverse

effect on our results of operations and the value of your investment” on page 16 of the 2021 Annual Report); |

| ● | we

face uncertainty with respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies

(see “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business in the PRC—We face uncertainty

with respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies” on page

17 of the 2021 Annual Report); |

| ● | our

PRC subsidiary is subject to restrictions on paying dividends or making other payments to us, which may have a material adverse effect

on our ability to conduct our business (see “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business

in the PRC—Our PRC subsidiary is subject to restrictions on paying dividends or making other payments to us, which may have a material

adverse effect on our ability to conduct our business” on page 17 of the 2021 Annual Report); |

| ● | governmental

control of currency conversion may affect the value of your investment and our payment of dividends (see “Item 3. Key Information—D.

Risk Factors—Risks Relating to Doing Business in the PRC—Governmental control of currency conversion may affect the value