Penns Woods Bancorp, Inc. (NASDAQ:PWOD) today reported that net

income from core operations (�operating earnings�), which excludes

net securities gains and losses, increased 14.1% to $2,403,000 for

the three months ended March 31, 2009 compared to $2,106,000 for

the same period of 2008. Operating earnings per share for the three

months ended March 31, 2009 increased 16.7% to $0.63 basic and

dilutive compared to $0.54 basic and dilutive for the three months

ended March 31, 2008. Return on average assets and return on

average equity calculated on the basis of operating earnings were

1.48% and 16.16% for the three months ended March 31, 2009 compared

to 1.34% and 11.87% for the corresponding period of 2008. Operating

earnings for the three months ended March 31, 2009 have been

positively impacted by continued emphasis on credit quality, loan

and deposit growth, solid non-interest operating income, and an

increasing net interest margin.

Net income, as reported under U.S. generally accepted accounting

principles, for the three months ended March 31, 2009 was $839,000

compared to $2,131,000 for the same period of 2008. Comparable

results were impacted by an increase in after-tax securities losses

of $1,589,000 (from a gain of $25,000 to a loss of $1,564,000) from

2008 to 2009 for the three month periods ended being compared.

Included within the change in after-tax securities losses are

pre-tax other than temporary impairment charges relating to certain

equity securities held in the investment portfolio for the three

months ended March 31, 2009 of $2,333,000 compared to $207,000 for

the three months ended March 31, 2008. Basic and dilutive earnings

per share for the three months ended March 31, 2009 were $0.22

compared to $0.55 for the corresponding period of 2008. Return on

average assets and return on average equity were 0.52% and 5.64%

for the three months ended March 31, 2009 compared to 1.36% and

12.01% for the corresponding period of 2008.

The net interest margin for the three months ended March 31,

2009 was 4.47% compared to 3.87% for the corresponding period of

2008. A decrease in the rate paid on interest bearing liabilities

of 105 basis points (bp) for the three months ended March 31, 2009

compared to the same period of 2008 positively impacted the net

interest margin. The decreasing cost of funds is primarily the

result of the rate paid on time deposits decreasing 138 bp for the

three month period ended March 31, 2009 compared to the same period

of 2008, while the cost of short-term borrowings decreased 231 bp,

over the same time period. In addition, lower cost core deposit

growth has allowed for higher cost long-term borrowings to be

reduced by an average balance of $18,756,000 for the three months

ended March 31, 2009 compared to 2008. The overall decline of the

rate paid on interest-bearing liabilities is the result of Federal

Open Market Committee (FOMC) actions to reduce interest rates

coupled with our strategic decision to shorten the duration of the

time deposit portfolio over the past year. The shortening of the

time deposit portfolio has resulted in an increased repricing

frequency which has allowed for the majority of the portfolio to be

repriced downward over the past twelve months.

�We remain focused on building a solid balance sheet that will

provide the foundation for continued core operating earnings

growth. The foundation continues to be expanded as core deposits

increased 15.5% year over year and 6.5% since December 31, 2008.

The growth in core deposits has provided a low cost source of

funding for the 8.3% growth in gross loans year over year. The

combination of solid loan growth coupled with the deposit growth

has paved the way for a net interest margin of 4.47% for the three

months ended March 31, 2009,� commented Ronald A. Walko, President

and Chief Executive Officer of Penns Woods Bancorp, Inc. �While the

foundation was being expanded, safety and soundness was not

overlooked. We remained steadfast in the management of the earning

asset portfolio. Focus remained on loan opportunities that met our

credit quality standards, while providing an adequate risk/return

trade-off. This commitment to quality resulted in our credit

quality continuing to be stable with a nonperforming loans to total

loans ratio of 0.59%, and net loan charge-offs to average loans of

only 0.04% for the three month period ended March 31, 2009. In

addition, the allowance for loan losses to loans remains sound at

1.15% of total loans,� added Mr. Walko.

Total assets increased $18,596,000 to $649,612,000 at March 31,

2009 compared to March 31, 2008. Net loans increased $29,296,000

despite a softening economy that has in general provided fewer loan

opportunities. However, due to our credit quality position and

overall balance sheet strength, we have been able to aggressively

pursue those loans that meet or exceed our credit standards. The

investment portfolio decreased $6,295,000 from March 31, 2008 to

March 31, 2009 due primarily to a decrease in the market value of

the portfolio. The majority of the price depreciation in investment

portfolio securities occurred within the tax-exempt bond segment of

the portfolio as the market for these bonds has dramatically

softened. In addition, during the three months ended March 31,

2009, the equity segment of the portfolio experienced write downs

of $2,333,000 and realized losses of $36,000. The write downs are

due to the turbulence in the equity markets, particularly the

financial sector, which has caused several of our investments in

regional and national financial institutions to be classified as

other than temporarily impaired. The impairment is the result of

their market price continuing to be depressed and actions taken,

such as decreased dividends, in an attempt to strengthen their

financial position. Continued turmoil in the capital markets may

lead to additional write downs as we move forward through 2009 due

to the severity of the market decline and uncertainty surrounding a

price recovery of financial sector equities and other securities.

Despite our ability to hold those investment positions that have

depreciated in value, each position has been and will continue to

be evaluated for other than temporary impairment, and a possible

exit due primarily to the ability to carry back tax losses.

Deposits have increased 13.3% or $52,682,000 to $448,807,000 at

March 31, 2009 compared to March 31, 2008 with core deposits

increasing 15.5% or $32,069,000. �The growth in deposits is a

testament to our standing in the community as a provider of quality

service and a safe trusted advisor. Members of the community

utilize our services for their complete banking needs, not only

higher cost time deposits. This is clearly illustrated by the

growth in core deposits over the past year. To further facilitate

deposit growth we have and will continue to introduce additional

tools aimed at providing a better customer experience. We are

actively marketing electronic delivery of statements, remote

deposit capture for commercial customers, and will be rolling out

an improved internet banking bill pay system along with mobile

banking for smart phones in the near future. Entwining technology

into our account offerings will further enhance our appeal to

customers, while providing additional avenues for customers to

access their accounts 24/7,� commented Mr. Walko.

Shareholders� equity decreased $10,570,000 to $58,584,000 at

March 31, 2009 compared to March 31, 2008 as accumulated

comprehensive loss increased $9,062,000 and $1,238,000 in common

stock was strategically repurchased as part of the previously

announced stock buyback plan. The decrease in accumulated other

comprehensive income is a result of a decline in the market value

of certain securities held in the investment portfolio at March 31,

2009 compared to March 31, 2008 resulting in a net unrealized loss

of $10,023,000 at March 31, 2009 compared to a net unrealized loss

of $3,366,000 at March 31, 2008. In addition, the net excess of the

projected benefit obligation over the market value of the plan

assets of the defined benefit pension plan increased $2,405,000 due

to a decline in the market value of the plan assets caused by the

significant downturn in the stock and bond markets over the past

year. The current level of shareholders� equity equates to a book

value per share of $15.29 at March 31, 2009 compared to $17.86 at

March 31, 2008 and an equity to asset ratio of 9.02% at March 31,

2009. Book value per share, excluding accumulated other

comprehensive loss, was $18.89 at March 31, 2009 compared to $19.08

at March 31, 2008. During the three months ended March 31, 2009

cash dividends of $0.46 per share were paid to shareholders

compared to $0.46 for the comparable period of 2008.

�The media has been focusing on the deteriorating capital

positions of many of the country�s financial institutions. However,

the media has not placed emphasis on the sound capital positions of

many community banks such as ours who did not seek TARP funds from

the government. We remain well capitalized according to regulatory

guidelines and will use our capital position to further the growth

of our institution. Core operating earnings continue to be at a

level that supports our strategic initiatives. Our philosophy of

capital management has been built over the past 75 years and has

been tested in various economic cycles. We will use the experience

and knowledge gathered to continue following our template of sound

balance sheet growth as we maneuver though the challenges that lie

ahead,� commented Mr. Walko.

Penns Woods Bancorp, Inc. is the parent company of Jersey Shore

State Bank, which operates twelve branch offices providing

financial services in Lycoming, Clinton, and Centre Counties.

Investment and insurance products are offered through the bank�s

subsidiary, The M Group, Inc. D/B/A The Comprehensive Financial

Group.

NOTE: This press release contains financial information

determined by methods other than in accordance with U.S. Generally

Accepted Accounting Principles ("GAAP"). Management uses the

non-GAAP measure of net income from core operations in its analysis

of the company's performance. This measure, as used by the Company,

adjusts net income determined in accordance with GAAP to exclude

the effects of special items, including significant gains or losses

that are unusual in nature such as net securities gains and losses.

Because certain of these items and their impact on the Company�s

performance are difficult to predict, management believes

presentation of financial measures excluding the impact of such

items provides useful supplemental information in evaluating the

operating results of the Company�s core businesses. These

disclosures should not be viewed as a substitute for net income

determined in accordance with GAAP, nor are they necessarily

comparable to non-GAAP performance measures that may be presented

by other companies.

This press release may contain certain �forward-looking

statements� including statements concerning plans, objectives,

future events or performance and assumptions and other statements,

which are statements other than statements of historical fact. The

Company cautions readers that the following important factors,

among others, may have affected and could in the future affect

actual results and could cause actual results for subsequent

periods to differ materially from those expressed in any

forward-looking statement made by or on behalf of the Company

herein: (i) the effect of changes in laws and regulations,

including federal and state banking laws and regulations, and the

associated costs of compliance with such laws and regulations

either currently or in the future as applicable; (ii) the effect of

changes in accounting policies and practices, as may be adopted by

the regulatory agencies as well as by the Financial Accounting

Standards Board, or of changes in the Company�s organization,

compensation and benefit plans; (iii) the effect on the Company�s

competitive position within its market area of the increasing

consolidation within the banking and financial services industries,

including the increased competition from larger regional and

out-of-state banking organizations as well as non-bank providers of

various financial services; (iv) the effect of changes in interest

rates; and (v) the effect of changes in the business cycle and

downturns in the local, regional or national economies. For a list

of other factors which could affect the Company�s results, see the

Company�s filings with the Securities and Exchange Commission,

including �Item�1A. Risk Factors,� set forth in the Company�s

Annual Report on Form�10-K for the fiscal year ended December�31,

2008.

You should not place undue reliance on any forward-looking

statements. These statements speak only as of the date of this

press release, even if subsequently made available by the Company

on its website or otherwise. The Company undertakes no obligation

to update or revise these statements to reflect events or

circumstances occurring after the date of this press release.

Previous press releases and additional information can be

obtained from the Company�s website at www.jssb.com.

THIS INFORMATION IS SUBJECT TO YEAR-END AUDIT ADJUSTMENT

�

PENNS WOODS BANCORP, INC. CONSOLIDATED BALANCE

SHEET (UNAUDITED) � � (In Thousands, Except Share Data)

� March 31, 2009 � 2008 � % Change � ASSETS Noninterest-bearing

balances $ 12,886 $ 16,440 -21.6 % Interest-bearing deposits in

other financial institutions � 23 � � 12 � 91.7 % Total cash and

cash equivalents 12,909 16,452 -21.5 % � Investment securities,

available for sale, at fair value 201,651 207,777 -2.9 % Investment

securities held to maturity (fair value of $111 and $281) 110 279

-60.6 % Loans held for sale 2,514 3,254 -22.7 % Loans 387,192

357,609 8.3 % Less: Allowance for loan losses � 4,441 � � 4,154 �

6.9 % Loans, net 382,751 353,455 8.3 % Premises and equipment, net

7,733 7,381 4.8 % Accrued interest receivable 3,370 3,122 7.9 %

Bank-owned life insurance 14,750 13,209 11.7 % Investment in

limited partnerships 5,286 5,261 0.5 % Goodwill 3,032 3,032 0.0 %

Deferred tax asset 12,614 5,738 119.8 % Other assets � 2,892 � �

12,056 � -76.0 % TOTAL ASSETS $ 649,612 � $ 631,016 � 2.9 % �

LIABILITIES Interest-bearing deposits $ 376,844 $ 324,463 16.1 %

Noninterest-bearing deposits � 71,963 � � 71,662 � 0.4 % Total

deposits 448,807 396,125 13.3 % � Short-term borrowings 45,268

61,766 -26.7 % Long-term borrowings, Federal Home Loan Bank (FHLB)

86,778 96,778 -10.3 % Accrued interest payable 1,193 1,626 -26.6 %

Other liabilities � 8,982 � � 5,567 � 61.3 % TOTAL LIABILITIES �

591,028 � � 561,862 � 5.2 % � SHAREHOLDERS' EQUITY

Common stock, par value $8.33,

10,000,000 shares authorized; 4,011,251 and 4,007,652 shares

issued

33,427 33,397 0.1 % Additional paid-in capital 17,970 17,904 0.4 %

Retained earnings 27,254 27,620 -1.3 % Accumulated other

comprehensive loss: Net unrealized loss on available for sale

securities (10,023 ) (3,366 ) -197.8 % Defined benefit plan (3,780

) (1,375 ) -174.9 % Less: Treasury stock at cost, 179,028 and

135,599 shares � (6,264 ) � (5,026 ) 24.6 % TOTAL SHAREHOLDERS'

EQUITY � 58,584 � � 69,154 � -15.3 % TOTAL LIABILITIES AND

SHAREHOLDERS' EQUITY $ 649,612 � $ 631,016 � 2.9 % � �

PENNS

WOODS BANCORP, INC. CONSOLIDATED STATEMENT OF INCOME

(UNAUDITED) � � (In Thousands, Except Per Share Data) �

Three Months Ended March 31, 2009 � 2008 � % Change � INTEREST AND

DIVIDEND INCOME: Loans including fees $ 6,219 $ 6,380 -2.5 %

Investment securities: Taxable 1,363 1,190 14.5 % Tax-exempt 1,246

1,226 1.6 % Dividend and other interest income � 89 � � 252 -64.7 %

TOTAL INTEREST AND DIVIDEND INCOME � 8,917 � � 9,048 -1.4 % �

INTEREST EXPENSE: Deposits 2,005 2,541 -21.1 % Short-term

borrowings 158 429 -63.2 % Long-term borrowings, FHLB � 917 � �

1,197 -23.4 % TOTAL INTEREST EXPENSE � 3,080 � � 4,167 -26.1 % �

NET INTEREST INCOME 5,837 4,881 19.6 % � PROVISION FOR LOAN LOSSES

� 126 � � 60 110.0 % � NET INTEREST INCOME AFTER PROVISION FOR LOAN

LOSSES � 5,711 � � 4,821 18.5 % � NON-INTEREST INCOME: Deposit

service charges 525 570 -7.9 % Securities (losses) gains, net

(2,369 ) 38 -6334.2 % Bank-owned life insurance 162 155 4.5 % Gain

on sale of loans 118 152 -22.4 % Insurance commissions 354 580

-39.0 % Other � 434 � � 419 3.6 % TOTAL NON-INTEREST INCOME � (776

) � 1,914 -140.5 % � NON-INTEREST EXPENSE: Salaries and employee

benefits 2,482 2,451 1.3 % Occupancy, net 339 338 0.3 % Furniture

and equipment 307 285 7.7 % Pennsylvania shares tax 171 105 62.9 %

Amortization of investments in limited partnerships 142 178 -20.2 %

Other � 1,204 � � 1,088 10.7 % TOTAL NON-INTEREST EXPENSE � 4,645 �

� 4,445 4.5 % � INCOME BEFORE INCOME TAX (BENEFIT) PROVISION 290

2,290 -87.3 % INCOME TAX (BENEFIT) PROVISION � (549 ) � 159 -445.3

% NET INCOME $ 839 � $ 2,131 -60.6 % � EARNINGS PER SHARE - BASIC $

0.22 � $ 0.55 -60.0 % � EARNINGS PER SHARE - DILUTED $ 0.22 � $

0.55 -60.0 % � WEIGHTED AVERAGE SHARES OUTSTANDING - BASIC �

3,831,747 � � 3,874,741 -1.1 % � WEIGHTED AVERAGE SHARES

OUTSTANDING - DILUTED � 3,831,747 � � 3,874,931 -1.1 % � DIVIDENDS

PER SHARE $ 0.46 � $ 0.46 0.0 % � �

PENNS WOODS BANCORP,

INC. AVERAGE BALANCES AND INTEREST RATES � � � For the

Three Months Ended (Dollars in Thousands) March 31, 2009 � March

31, 2008 Average Balance � Interest � Average Rate Average Balance

� Interest � Average Rate ASSETS: Tax-exempt loans $ 16,052 $ 265

6.70 % $ 8,013 $ 126 6.32 % All other loans � 373,878 � 6,044 �

6.56 % � 354,715 � 6,297 7.14 % Total loans � 389,930 � 6,309 �

6.56 % � 362,728 � 6,423 7.12 % � Taxable securities 101,890 1,452

5.70 % 100,730 1,442 5.73 % Tax-exempt securities � 101,654 � 1,888

� 7.43 % � 114,590 � 1,857 6.48 % Total securities � 203,544 �

3,340 � 6.56 % � 215,320 � 3,299 6.13 % � Interest bearing deposits

� 23 � - � 0.00 % � 38 � - 0.00 % � Total interest-earning assets

593,497 � 9,649 � 6.56 % 578,086 � 9,722 6.75 % � Other assets �

55,256 � 48,692 � TOTAL ASSETS $ 648,753 $ 626,778 � LIABILITIES

AND SHAREHOLDERS' EQUITY: Savings $ 59,642 78 0.53 % $ 58,561 109

0.75 % Super Now deposits 53,890 129 0.97 % 46,367 155 1.34 % Money

market deposits 41,276 212 2.08 % 23,324 127 2.18 % Time deposits �

205,110 � 1,586 � 3.14 % � 190,927 � 2,150 4.52 % Total Deposits �

359,918 � 2,005 � 2.26 % � 319,179 � 2,541 3.20 % � Short-term

borrowings 61,487 158 1.03 % 51,113 429 3.34 % Long-term borrowings

� 86,778 � 917 � 4.23 % � 105,534 � 1,197 4.49 % Total borrowings �

148,265 � 1,075 � 2.90 % � 156,647 � 1,626 4.11 % � Total

interest-bearing liabilities 508,183 � 3,080 � 2.45 % 475,826 �

4,167 3.50 % � Demand deposits 71,321 70,243 Other liabilities

9,760 9,726 Shareholders' equity � 59,489 � 70,983 � TOTAL

LIABILITIES AND SHAREHOLDERS' EQUITY $ 648,753 $ 626,778 Interest

rate spread � 4.12 % 3.25 % Net interest income/margin $ 6,569 �

4.47 % $ 5,555 3.87 % � � For the Three Months Ended March 31, �

2009 2008 � Total interest income $ 8,917 $ 9,048 Total interest

expense � 3,080 � 4,167 � � Net interest income 5,837 4,881 Tax

equivalent adjustment � 732 � 674 � � Net interest income (fully

taxable equivalent) $ 6,569 $ 5,555 � � �

Quarter Ended � �

� � (Dollars in Thousands, Except Per Share Data)

3/31/2009 �

12/31/2008 �

9/30/2008 �

6/30/2008 �

3/31/2008 � � � � � � � � � � � � � � � � � � �

Operating Data � � � � � � � � � � � � � � � � � � � � � � �

� � � � � � � � � � � � � � � Net income $ 839 � � $ 2,263 � � $

1,552 � � $ 2,057 � � $ 2,131 � Net interest income � 5,837 � � �

5,726 � � � 5,513 � � � 5,156 � � � 4,881 � Provision for loan

losses � 126 � � � 145 � � � 110 � � � 60 � � � 60 � Net security

gains (losses) � (2,369 ) � � (314 ) � � (1,504 ) � � (251 ) � � 38

� Non-interest income, ex. net security gains (losses) � 1,593 � �

� 1,763 � � � 1,976 � � � 1,872 � � � 1,876 � Non-interest expense

� 4,645 � � � 4,542 � � � 4,451 � � � 4,511 � � � 4,445 � � � � � �

� � � � � � � � � � � � � �

Performance Statistics � � � � �

� � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �

Net interest margin � 4.47 % � � 4.42 % � � 4.23 % � � 4.01 % � �

3.87 % Annualized return on average assets � 0.52 % � � 1.43 % � �

0.98 % � � 1.30 % � � 1.36 % Annualized return on average equity �

5.64 % � � 15.20 % � � 9.43 % � � 11.73 % � � 12.01 % Annualized

net loan charge-offs to avg loans � 0.04 % � � 0.06 % � � 0.05 % �

� 0.01 % � � 0.04 % Net charge-offs � 41 � � � 57 � � � 49 � � � 7

� � � 36 � Efficiency ratio � 62.5 % � � 60.7 % � � 59.4 % � � 64.2

% � � 65.8 % � � � � � � � � � � � � � � � � � � �

Per Share

Data � � � � � � � � � � � � � � � � � � � � � � � � � � � � �

� � � � � � � � � Basic earnings per share $ 0.22 � � $ 0.59 � � $

0.40 � � $ 0.53 � � $ 0.55 � Diluted earnings per share � 0.22 � �

� 0.59 � � � 0.40 � � � 0.53 � � � 0.55 � Dividend declared per

share � 0.46 � � � 0.46 � � � 0.46 � � � 0.46 � � � 0.46 � Book

value � 15.29 � � � 15.93 � � � 15.47 � � � 16.72 � � � 17.86 �

Common stock price: � � � � � � � � � � � � � � � � � � � High �

25.61 � � � 30.40 � � � 35.00 � � � 33.15 � � � 33.47 � Low � 23.00

� � � 23.00 � � � 29.00 � � � 30.01 � � � 29.66 � Close � 25.42 � �

� 23.03 � � � 29.00 � � � 31.25 � � � 33.15 � Weighted average

common shares: � � � � � � � � � � � � � � � � � � � Basic � 3,832

� � � 3,843 � � � 3,855 � � � 3,866 � � � 3,875 � Fully Diluted �

3,832 � � � 3,843 � � � 3,855 � � � 3,866 � � � 3,875 �

End-of-period common shares: � � � � � � � � � � � � � � � � � � �

Issued � 4,011 � � � 4,011 � � � 4,010 � � � 4,009 � � � 4,008 �

Treasury � 179 � � � 179 � � � 159 � � � 150 � � � 136 � � � �

Quarter Ended � � � � (Dollars in Thousands, Except Per

Share Data)

3/31/2009 �

12/31/2008 �

9/30/2008 �

6/30/2008 �

3/31/2008 � � � � � � � � � � � � � � � � � � �

Financial Condition Data: � � � � � � � � � � � � � � � � �

� �

General � � � � � � � � � � � � � � � � � � � Total

assets $ 649,612 � � $ 652,803 � � $ 632,244 � � $ 634,504 � � $

631,016 � Loans, net � 382,751 � � � 377,122 � � � 367,279 � � �

361,748 � � � 353,455 � Intangibles � 3,032 � � � 3,032 � � � 3,032

� � � 3,032 � � � 3,032 � Total deposits � 448,807 � � � 421,368 �

� � 430,571 � � � 437,921 � � � 396,125 � Noninterest-bearing �

71,963 � � � 76,035 � � � 73,586 � � � 79,908 � � � 71,662 � � � �

� � � � � � � � � � � � � � � � Savings � 60,764 � � � 58,668 � � �

62,591 � � � 62,847 � � � 59,985 � NOW � 55,816 � � � 53,821 � � �

56,391 � � � 52,948 � � � 50,193 � Money Market � 50,476 � � �

35,848 � � � 39,627 � � � 28,860 � � � 25,110 � Time Deposits �

209,788 � � � 196,996 � � � 198,376 � � � 213,358 � � � 189,175 �

Total interest-bearing deposits � 376,844 � � � 345,333 � � �

356,985 � � � 358,013 � � � 324,463 � � � � � � � � � � � � � � � �

� � � � Core deposits* � 239,019 � � � 224,372 � � � 232,195 � � �

224,563 � � � 206,950 � Shareholders' equity � 58,584 � � � 61,027

� � � 59,561 � � � 64,522 � � � 69,154 � � � � � � � � � � � � � �

� � � � � �

Asset Quality � � � � � � � � � � � � � � � � �

� � � � � � � � � � � � � � � � � � � � � Non-performing assets $

2,269 � � $ 1,735 � � $ 941 � � $ 909 � � $ 1,427 � Non-performing

assets to total assets � 0.35 % � � 0.27 % � � 0.15 % � � 0.14 % �

� 0.23 % Allowance for loan losses � 4,441 � � � 4,356 � � � 4,268

� � � 4,207 � � � 4,154 � Allowance for loan losses to total loans

� 1.15 % � � 1.14 % � � 1.15 % � � 1.15 % � � 1.16 %

Allowance for loan losses to

non-performing loans

� 195.72 % � � 251.07 % � � 453.56 % � � 462.82 % � � 291.10 %

Non-performing loans to total loans � 0.59 % � � 0.46 % � � 0.25 %

� � 0.25 % � � 0.40 % � � � � � � � � � � � � � � � � � � �

Capitalization � � � � � � � � � � � � � � � � � � � � � � �

� � � � � � � � � � � � � � � Shareholders' equity to total assets

� 9.02 % � � 9.35 % � � 9.42 % � � 10.17 % � � 10.96 % � * Core

deposits are defined as total deposits less time deposits �

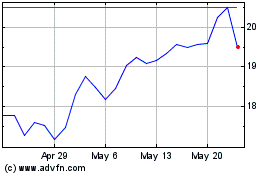

Penns Woods Bancorp (NASDAQ:PWOD)

Historical Stock Chart

From Jun 2024 to Jul 2024

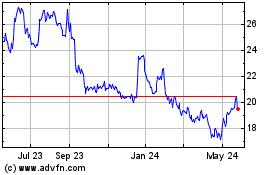

Penns Woods Bancorp (NASDAQ:PWOD)

Historical Stock Chart

From Jul 2023 to Jul 2024