January Was a Record-Breaking Month for Oil Industry

March 01 2019 - 10:00AM

InvestorsHub NewsWire

January Was a Record-Breaking Month

for Oil Industry

March 1, 2019 -- InvestorsHub NewsWire -- Microcap Speculators

-- The US natural gas and oil industry broke several records

in January, according to the latest Monthly Statistical Report from

the American Petroleum Institute. US total petroleum demand,

as measured by total domestic petroleum deliveries, was 20.7

million b/d in January, which was down 0.2% from December but up

1.1% compared with January 2018. This was the strongest petroleum

demand for January since 2005. January’s gasoline demand of

8.9 million b/d was the strongest on record since 1945. Gasoline

prices fell in January even as the crude oil price rose.

These numbers are promising for oil & gas securities, here’s a

few to research.

One company that has reported some exciting numbers themselves,

Camber Energy (AMEX:

CEI), turned a nearly 30 million shareholders’ deficit

into $2.3 million of positive shareholders’ equity, increasing

liquidity and extinguishing debt.

Today we are highlighting: Camber Energy,

Inc. (AMEX:

CEI), W&T Offshore, Inc. (NYSE:

WTI), Seadrill Limited (SDRL), Patterson-UTI Energy, Inc.

(NASDAQ:

PTEN), and Concho Resources, Inc. (NYSE:

CXO).

We mentioned above that Camber Energy, Inc. (AMEX:

CEI) (Market Cap:

$5.264M,

Share Price:

$0.4174)

spent a lot of 2018 cleaning up the company and improving its

efficiency. Along with extinguishing shareholder debt, the

company completed a one-for-twenty-five reverse stock split, among

several other steps which is why CEI recently received a letter

from the NYSE American about regaining compliance with several of

the NYSE American’s continued-listing standards.

Oil & Gas investors seeking competent fiscal management and

efficient operations should research CEI.

_______

W&T Offshore, Inc. (NYSE:

WTI) (Market Cap: $724.991M, Share Price:

$5.21) reported adjusted fourth-quarter 2018 earnings

(excluding onetime items) of 22 cents per share improving from 17

cents a year ago. Revenues increased to $143.4 million in the

quarter from $129.1 million a year ago. Higher oil and

natural gas price realizations primarily supported the strong

fourth-quarter results.

_______

Seadrill Limited (SDRL) (Market Cap: $863M, Share

Price: $8.63) ore earnings for the fourth quarter

exceeded the company's own guidance, boosted by lower costs and

one-off items, while the market outlook for drilling rigs was

improving, the Oslo and New York-listed firm said on Tuesday. The

company reported $73 million in quarterly adjusted EBITDA, more

than double the $35 million forecast it made in November.

However, adjusted EBITDA is expected to ease to around $60 million

in the first quarter, the company added.

_______

Patterson-UTI Energy, Inc. (NASDAQ:

PTEN) (Market Cap: $2.833B, Share Price:

$13.26) recently reported fourth-quarter adjusted net

loss per share of 4 cents. The better-than-expected results can be

attributed to increase in day rates and rig margins, which in turn

supported its contract drilling segment. The company’s performance

also improved from the year-ago loss of 10 cents per

share.

_______

Concho Resources, Inc. (NYSE:

CXO) (Market Cap: $22.065B, Share Price:

$110.00) filed its latest 10-K with SEC for

the fiscal year ended on December 31, 2018. Concho Resources Inc is

an oil and natural gas company. It is engaged in the acquisition,

development, exploitation and exploration of producing oil and

natural gas properties. It operates in the Delaware Basin.

Legal Disclaimer:

This article was written by Regal Consulting, LLC (“Regal

Consulting”). Regal Consulting has agreed to a six-month term

consulting agreement with CEI dated 11/15/18. The agreement

calls for $28,000 in cash, and 200,000 restricted 144 shares of CEI

per month. All payments were made directly by Camber Energy, Inc.

to Regal Consulting, LLC. to provide investor relations services,

of which this article is a part of. Regal Consulting also

paid one thousand dollars cash to microcapspeculators.com to

distribute this article. Regal Consulting may have a position

in the securities mentioned in this article at the time of

publication, and may increase or decrease its position without

notice. This article is based on public information and the

opinions of Regal Consulting. CEI was given an opportunity to edit

this article. This article contains forward-looking statements that

are subject to certain risks and uncertainties that could cause

actual results to differ materially from any results predicted

herein. Regal Consulting is not registered with any financial

or securities regulatory authority, and does not provide or claim

to provide investment advice.

http://www.regalconsultingllc.com/full

legal disclaimer/

Microspeculators.com Full Legal Disclaimer Click Here.

Contact Information:

Company Name: Microcap Speculators

Contact Person: Media Manager

Email: info@microcapspeculators.com

Phone: 1-702-720-6310

Country: United States

Website: http://microcapspeculators.com/

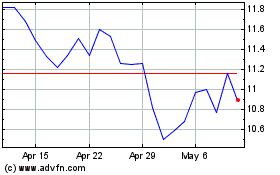

Patterson UTI Energy (NASDAQ:PTEN)

Historical Stock Chart

From Aug 2024 to Sep 2024

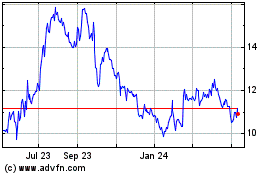

Patterson UTI Energy (NASDAQ:PTEN)

Historical Stock Chart

From Sep 2023 to Sep 2024