PATHFINDER BANCORP, INC.false000160906500016090652024-10-302024-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 30, 2024

(Exact name of Registrant as specified in its charter)

Commission File Number: 001-36695

|

|

Maryland |

38-3941859 |

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification Number) |

214 West First Street, Oswego, NY 13126

(Address of Principal Executive Office) (Zip Code)

(315) 343-0057

(Issuer's Telephone Number including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

|

|

|

☐ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $0.01 par value |

PBHC |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

|

|

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 2 – Financial Information

Item 2.02 – Results of Operations and Financial Condition

On October 30, 2024, Pathfinder Bancorp, Inc. issued a press release disclosing its third quarter 2024 financial results. A copy of the press release is included as Exhibit 99.1 to this report.

The information in Item 2.02 to this Form 8-K and Exhibit 99.1 shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set forth in such filing.

Item 9.01 – Financial Statements and Results

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

|

|

|

|

|

|

PATHFINDER BANCORP, INC. |

|

|

|

|

|

Date: |

October 30, 2024 |

|

By: |

/s/ James A. Dowd |

|

|

|

|

James A. Dowd |

|

|

|

|

President and Chief Executive Officer |

Investor/Media Contacts

James A. Dowd, President, CEO

Justin K. Bigham, Senior Vice President, CFO

Telephone: (315) 343-0057

Pathfinder Bancorp, Inc. Announces Third Quarter 2024 Results

Results reflect branch-acquisition-related expenses, as well as provision expense resulting from a

comprehensive loan portfolio review that significantly reduced nonperformers, as

Pathfinder positions the Bank for organic growth in its Central New York markets

OSWEGO, N.Y., October 30, 2024 (GLOBE NEWSWIRE) -- Pathfinder Bancorp, Inc. (“Pathfinder” or the “Company”) (NASDAQ: PBHC) announced its financial results for the third quarter ended September 30, 2024.

The holding company for Pathfinder Bank (“the Bank”) reported a third quarter 2024 net loss attributable to common shareholders of $4.6 million or $0.75 per share, compared to net income available to common shareholders of $2.0 million or $0.32 per share in the second quarter of 2024 and $2.2 million or $0.35 per share in the third quarter of 2023.

Third Quarter 2024 Highlights and Key Developments

•The net loss reflected $9.0 million in provision expense that primarily resulted from a comprehensive loan portfolio review that the Bank elected to undertake as part of its commitment to continuously improve its credit risk management approach. Following its conclusion, the Company recorded net charge offs of $8.7 million in the quarter and reduced nonperforming loans by 34.0% to $16.2 million at period end, or 1.8% of total loans. The allowance for credit losses on September 30, 2024 represented 1.87% and 106.8% of total and nonperforming loans, respectively.

•Net interest income increased for the third consecutive quarter to $11.7 million, including the benefit of a catch-up interest payment of $887,000. Net interest income increased $2.3 million from $9.5 million in the linked quarter ended June 30, 2024 and $1.7 million from $10.1 million in the third quarter of 2023. Net interest margin (“NIM”) expanded for the third consecutive quarter to 3.34%, including the benefit of 25 basis points from the catch-up interest payment. NIM increased 56 basis points from the linked quarter and 27 basis points from the year-ago period.

•Non-interest income was $1.7 million, including a net death benefit of $175,000 on bank owned life insurance ("BOLI"), compared to $1.2 million in each of the linked and year-ago quarters.

•Non-interest expense was $10.3 million, including $1.6 million in transaction-related expenses for the previously announced July 2024 closing of the East Syracuse branch acquisition, in addition to third quarter 2024 operating costs of approximately $462,000 associated with Pathfinder’s newest location. Non-interest expense was $7.9 million in the linked quarter and $7.7 million in the year-ago period.

•Pre-tax, pre-provision net income was $3.4 million, including the effect of transaction-related expenses, compared to $2.8 million in the linked quarter and $3.6 million in the year-ago period. Pre-tax, pre-provision net income, which is not a financial metric under generally accepted accounting principles

(“GAAP”), is a measure that the Company believes is helpful to understanding profitability without giving effect to income taxes and provision for credit losses.

•Total deposits were $1.20 billion at period end, compared to $1.10 billion on June 30, 2024 and $1.13 billion on September 30, 2023. The Bank’s loan-to-deposit ratio was 77.1% on September 30, 2024.

•Total loans were $921.7 million at period end, compared to $888.3 million on June 30, 2024 and $896.1 million on September 30, 2023.

“Pathfinder is well positioned for organic growth opportunities in our attractive Central New York markets, having closed the third quarter with significantly reduced levels of nonperformers, healthy reserves, strong capital ratios, and abundant liquidity,” said President and Chief Executive Officer James A. Dowd. “Having completed a thorough, top-to-bottom review of the loan portfolio at the end of September, we believe it is sufficiently collateralized and reserved. Going forward, we intend to take a more exacting loss-mitigation approach, and Pathfinder's ongoing underwriting and credit risk management processes can be expected to reflect the combined expertise of our entire management team and professional staff, including our recently appointed Chief Credit Officer Joseph Serbun and Chief Financial Officer Justin Bigham.”

Dowd added, “Our financial performance also reflects the positive impact of Pathfinder Bank’s in-market core deposit franchise and immediate contributions from our recent East Syracuse branch acquisition, including higher loan and deposit balances, lower funding costs, revenue growth, and NIM expansion. Looking ahead, as we end 2024 and begin the new year, we intend to tightly manage operating expenses and expect continued benefits from our core deposit franchise as a source of low-cost, relationship-based funding for commercial and retail loan growth in our local markets.”

East Syracuse Branch Acquisition

As previously announced, Pathfinder Bank completed the purchase of its East Syracuse branch on July 19, 2024, assuming $186.0 million in associated deposits and acquiring $30.6 million in assets including $29.9 million in loans. Acquired assets include a core deposit intangible (“CDI”) valued at $6.3 million, and the valuation of acquired loans resulted in an estimated discount of $1.8 million.

The addition of the East Syracuse branch significantly increased the Bank's customer base, which expanded the number of Pathfinder's relationships by approximately 25% and grew non-brokered deposits by 21.5%.

At acquisition, the average cost of deposits assumed with the branch acquisition was 1.99% (excluding the CDI) and as of September 30, 2024, the Bank retained approximately 97% of deposit balances. The Company utilized a portion of the low-cost liquidity provided by the transaction to pay down $74.4 million in borrowings and $106.0 million in high-cost brokered deposits during the third quarter of 2024.

Insurance Business Divestiture

On October 15, 2024, Pathfinder announced that it sold its interest in the FitzGibbons Agency, LLC, which contributed $28,000 to the Company’s net income and 24 basis points to its consolidated efficiency ratio in the third quarter of 2024, to Marshall & Sterling Enterprises, Inc. Reflecting an active insurance brokerage market and the FitzGibbons Agency’s success since initiating its partnership with the Bank 13 years ago, Pathfinder will

receive approximately $2.0 million from the sale, which closed on October 1, 2024, and the Company expects to recognize a portion of that amount as a net gain in the fourth quarter of 2024.

Net Interest Income and Net Interest Margin

Third quarter 2024 net interest income was $11.7 million, an increase of 23.8% from the second quarter of 2024. An increase in interest and dividend income of $2.2 million was primarily attributed to average yield increases of 67 basis points on loans including 39 basis points from an $887,000 catch-up interest payment associated with purchased loan pool positions, 97 basis points on fed funds sold and interest-earning deposits, and 45 basis points on all earning assets. The corresponding increase in loan interest income and federal funds sold and interest-earning deposits was $1.9 million and $371,000, respectively. A decrease in interest expense of $75,000 was attributed to reductions in brokered deposits and short-term borrowings expense associated with paydowns of brokered deposits and borrowings utilizing a portion of the low-cost liquidity provided by the Bank’s East Syracuse branch acquisition.

Net interest margin was 3.34% in the third quarter of 2024 compared to 2.78% in the second quarter of 2024. The increase of 56 basis points was driven by improvements in earning asset yields and funding costs, as well as 25 basis points attributed to the catch-up interest payment received in the third quarter of 2024.

Third quarter 2024 net interest income was $11.7 million, an increase of 16.6% from the third quarter of 2023. An increase in interest and dividend income of $3.5 million was primarily attributed to average yield increases of 74 basis points on loans including 39 basis points from the catch-up interest payment, 67 basis points on taxable investment securities, 227 basis points on fed funds sold and interest-earning deposits, and 65 basis points on all earning assets. The corresponding increase in loan interest income, taxable investment securities, and federal funds sold and interest-earning deposits was $2.0 million, $1.2 million, and $426,000, respectively. Increased interest and dividend income was partially offset by an increase in interest expense of $1.9 million. This increase in interest expense was predominantly the result of higher interest rates and balances associated with borrowing and higher average rates paid on interest-bearing deposits, compared to the third quarter of 2023.

Net interest margin was 3.34% in the third quarter of 2024 compared to 3.07% in the third quarter of 2023. The increase of 27 basis points was driven by improvements in earning asset yields and lower average borrowings, partially offset by higher funding costs, as well as 25 basis points attributed to the catch-up interest payment received in the third quarter of 2024.

Noninterest Income

Noninterest income totaled $1.7 million in the third quarter of 2024, an increase of $496,000 or 41.0% from the second quarter of 2024 and an increase of $514,000 or 43.1% from the third quarter of 2023.

Compared to the linked quarter, noninterest income growth included increases of $194,000 in earnings and gain on BOLI including the net death benefit of $175,000, $109,000 in debit card interchange fees, and $62,000 in service charges on deposit accounts, as well as a $33,000 decrease in loan servicing fees. Noninterest income growth from the linked quarter also reflected an increase of $204,000 in net realized losses on sales and redemptions of investment securities, as well as increases of $201,000 in net realized gains on sales of marketable equity securities and $50,000 in gains on sales of loans and foreclosed real estate.

Compared to the year-ago quarter, noninterest income growth for the third quarter of 2024 included increases of $278,000 in interchange fees, $196,000 in earnings and gain on BOLI including the net death benefit of $175,000 on BOLI, and $49,000 in service charges on deposit accounts, as well as a $20,000 decrease in loan servicing fees. Noninterest income growth from the year-ago quarter also reflected a $178,000 increase in net realized losses on sales and redemptions of investment securities, as well as increases of $101,000 in net realized gains on sales of marketable equity securities and $49,000 in gains on sales of loans and foreclosed real estate.

Prior to the October 1, 2024 sale of the Company’s insurance agency asset, it contributed $367,000 to noninterest income in the third quarter of 2024, compared to $260,000 and $310,000 in the linked and year-ago quarters, respectively.

Noninterest Expense

Noninterest expense totaled $10.3 million in the third quarter of 2024, increasing $2.4 million and $2.6 million from the linked and year-ago quarters, respectively. The increase was primarily due to $1.6 million in transaction-related expenses for the East Syracuse branch acquisition, in addition to third quarter 2024 operating costs of approximately $462,000 associated with operating Pathfinder Bank’s newest location.

Professional and other services expense was $1.8 million in the third quarter, increasing $1.1 million and $1.3 million from the linked and year-ago quarters, respectively. The increase was primarily attributed to branch acquisition-related expenses.

Salaries and benefits were $5.0 million in the third quarter of 2024, increasing $560,000 and $805,000 from the linked and year-ago quarters, respectively. The increase was primarily due to $141,000 transaction-related bonuses to employees, $115,000 reduced salary cost deferrals (“ASC 310-20”) associated with reduced lending volumes, and $80,000 of ongoing personnel-related costs associated with operating the branch acquired early in the third quarter of 2024. The remaining increase was primarily driven by higher salaries and benefits costs associated with merit increases and wage inflation.

Building and occupancy was $1.1 million in the third quarter of 2024, increasing $220,000 and $266,000 from the linked and year-ago quarters, respectively. These increases were due to ongoing facilities-related costs of approximately $322,000 associated with operating the branch acquired early in the third quarter of 2024, partially offset by seasonal reductions in building and occupancy expense categories when compared to the second quarter of 2024.

Prior to the October 1, 2024 sale of the Company’s insurance agency asset, it incurred $308,000 of noninterest expense in the third quarter of 2024, compared to $232,000 and $273,000 in the linked and year-ago quarters, respectively.

For the third quarter of 2024, annualized noninterest expense represented 2.75% of average assets, including 8 basis points from insurance agency expense and 43 basis points from acquisition-related expenses. The efficiency ratio was 75.28%, including 24 basis points and 1,186 basis points attributed to the insurance business and acquisition-related expenses, respectively. The efficiency ratio, which is not a financial metric under GAAP, is a measure that the Company believes is helpful to understanding its level of non-interest expense as a percentage of total revenue. For the linked and year-ago quarters, annualized noninterest expense represented 2.19% and 2.20% of average assets, respectively. The efficiency ratio was 74.08% and 67.93% in the linked and year-ago periods.

Statement of Financial Condition

As of September 30, 2024, the Company’s statement of financial condition reflects total assets of $1.48 billion, compared to $1.45 billion and $1.40 billion recorded on June 30, 2024 and September 30, 2023, respectively.

The increase in assets during the third quarter of 2024 was primarily due to higher total loan balances, including $29.9 million in primarily consumer, residential, and home equity loans acquired with the East Syracuse branch transaction in the third quarter of 2024.

Loans totaled $921.7 million on September 30, 2024, increasing 3.8% during the third quarter and 2.9% from one year prior. Consumer and residential loans totaled $388.7 million, increasing 7.6% during the third quarter and 4.8% from one year prior. Commercial loans totaled $534.5 million, increasing 1.4% during the third quarter and 1.7% from one year prior.

With respect to liabilities, deposits totaled $1.20 billion on September 30, 2024, increasing 8.6% during the third quarter and 6.1% from one year prior. The increase in deposits during the third quarter of 2024 reflects $186.0 million assumed with the East Syracuse branch acquisition, offset by a reduction of $106.0 million in brokered deposits utilizing lower-cost liquidity provided by the transaction, as well as seasonal fluctuations in municipal deposits. The Company also utilized liquidity provided by the transaction to reduce short-term borrowings, which totaled $60.3 million on September 30, 2024 as compared to $127.6 million on June 30, 2024 and $56.7 million on September 30, 2023.

Shareholders equity totaled $120.3 million on September 30, 2024, down $3.1 million or 2.5% in the third quarter and $6.5 million or 5.7% from one year prior. The decrease reflects lower retained earnings attributed primarily to the elevated third quarter 2024 provision expense’s impact on net income in the period, which more than offset a significant reduction in accumulated other comprehensive loss (“AOCL”). AOCL improved to $6.7 million on September 30, 2024, declining $2.1 million or 23.6% during the third quarter and $6.6 million or 49.7% from one year prior, reflecting a favorable change in the interest rate environment.

Asset Quality

The Company’s asset quality metrics reflect the comprehensive loan portfolio review completed at the end of the third quarter of 2024.

Nonperforming loans were reduced by 34.0% in the third quarter of 2024 to $16.2 million or 1.75% of total loans on September 30, 2024. Nonperforming loans were $24.5 million or 2.76% of total loans on June 30, 2024 and $16.2 million or 1.80% of total loans on September 30, 2023.

Gross loan charge offs totaled $8.8 million in the third quarter of 2024, following completion of the portfolio review. Gross loan charge offs included $4.9 million for 13 nonperforming commercial loans, as well as $2.5 million for nonperforming positions primarily associated with secured solar purchased loan pools acquired in 2021.

Net charge offs (“NCOs”) after recoveries were $8.7 million or an annualized 1.29% of average loans in the third quarter of 2024, compared to $66,000 or 0.02% in the linked quarter and $3.8 million or 0.61% in the prior year period.

The $9.0 million provision for credit losses expense in the third quarter of 2024 primarily resulted from a replenishment of the allowance for credit losses (“ACL”) for commercial loan reserves and an adjustment to the lifetime loss estimate for solar purchased loan pool positions, which followed completion of the Company’s loan portfolio review. The Company believes it is sufficiently collateralized and reserved, with its ACL of $17.3 million on September 30, 2024 increasing by $382,000 from June 30, 2024 and $1.5 million from September 30, 2023. As a percentage of total loans, ACL represented 1.87% on September 30, 2024, 1.90% on June 30, 2024, and 1.76% on September 30, 2023.

Liquidity

The Company has diligently ensured a strong liquidity profile as of September 30, 2024 to meet its ongoing financial obligations. The Bank’s liquidity management, as evaluated by its cash reserves and operational cash flows from loan repayments and investment securities, remains robust and is effectively managed by the institution’s leadership.

The Bank’s analysis indicates that expected cash inflows from loans and investment securities are more than sufficient to meet all projected financial obligations. Total deposits increased to $1.20 billion on September 30, 2024 from $1.10 billion on June 30, 2024 and $1.13 billion on September 30, 2023. Core deposits increased to 77.45% of total deposits on September 30, 2024, from 67.98% on June 30, 2024 and 69.83% on September 30, 2023. This further underscores the success of the Bank’s strategic initiatives to enhance its core deposit franchise, including targeted marketing campaigns and customer engagement programs aimed at deepening banking relationships and enhancing deposit stability.

At the end of the current quarter, Pathfinder Bancorp had an available additional funding capacity of $105.2 million with the Federal Home Loan Bank of New York, which complements its liquidity reserves. Moreover, the Bank maintains additional unused credit lines totaling $27.3 million, which provide a buffer for additional funding needs. These facilities, including access to the Federal Reserve’s Discount Window, are part of a comprehensive liquidity strategy that ensures flexibility and readiness to respond to any funding requirements.

Cash Dividend Declared

On September 30, 2024, Pathfinder’s Board of Directors declared a cash dividend of $0.10 per share for holders of both voting common and non-voting common stock.

In addition, this dividend also extends to the notional shares of the Company’s warrants. Shareholders registered by October 18, 2024 will be eligible for the dividend, which is scheduled for disbursement on November 8, 2024.

This distribution aligns with Pathfinder Bancorp’s philosophy of consistent and reliable delivery of shareholder value.

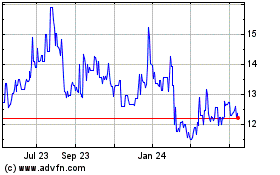

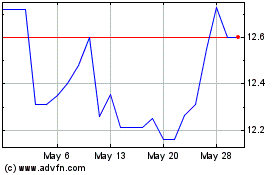

Evaluating the Company’s market performance, the closing stock price as of September 30, 2024 stood at $15.83 per share. This positions the dividend yield at an attractive 2.53%.

About Pathfinder Bancorp, Inc.

Pathfinder Bancorp, Inc. (NASDAQ: PBHC) is the commercial bank holding company for Pathfinder Bank, which serves Central New York customers throughout Oswego, Syracuse and their neighboring communities. Strategically located branches averaging approximately $100 million in deposits per location, as well as diversified consumer, mortgage and commercial loan portfolios, reflect the state-chartered Bank’s commitment to in-market relationships and local customer service. The Company also offers investment services to individuals and businesses. At September 30, 2024, the Oswego-headquartered Company had assets of $1.48 billion, loans of $921.7 million, and deposits of $1.20 billion. More information is available at pathfinderbank.com and ir.pathfinderbank.com.

Forward-Looking Statements

Certain statements contained herein are “forward looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are generally identified by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project” or similar expressions, or future or conditional verbs, such as “will,” “would,” “should,” “could,” or “may.” These forward-looking statements are based on current beliefs and expectations of the Company’s and the Bank’s management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company’s and the Bank’s control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from those set forth in the forward-looking statements as a result of numerous factors. Factors that could cause such differences to exist include, but are not limited to: risks related to the real estate and economic environment, particularly in the market areas in which the Company and the Bank operate; fiscal and monetary policies of the U.S. Government; inflation; changes in government regulations affecting financial institutions, including regulatory compliance costs and capital requirements; fluctuations in the adequacy of the allowance for credit losses; decreases in deposit levels necessitating increased borrowing to fund loans and investments; operational risks including, but not limited to, cybersecurity, fraud and natural disasters; the risk that the Company may not be successful in the implementation of its business strategy; changes in prevailing interest rates; credit risk management; asset-liability management; and other risks described in the Company’s filings with the Securities and Exchange Commission, which are available at the SEC’s website, www.sec.gov.

This release contains non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of a registrant’s historical or future financial performance, financial position, or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet, or statement of cash flows (or equivalent statements) of the registrant; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, the Company has provided reconciliations within the release of the non-GAAP financial measures to the most directly comparable GAAP financial.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PATHFINDER BANCORP, INC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selected Financial Information (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Amounts in thousands, except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

SELECTED BALANCE SHEET DATA: |

|

September 30, |

|

|

June 30, |

|

|

March 31, |

|

|

December 31, |

|

|

September 30, |

|

ASSETS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

|

$ |

18,923 |

|

|

$ |

12,022 |

|

|

$ |

13,565 |

|

|

$ |

12,338 |

|

|

$ |

12,822 |

|

Interest-earning deposits |

|

|

16,401 |

|

|

|

19,797 |

|

|

|

15,658 |

|

|

|

36,394 |

|

|

|

11,652 |

|

Total cash and cash equivalents |

|

|

35,324 |

|

|

|

31,819 |

|

|

|

29,223 |

|

|

|

48,732 |

|

|

|

24,474 |

|

Available-for-sale securities, at fair value |

|

|

271,977 |

|

|

|

274,977 |

|

|

|

279,012 |

|

|

|

258,716 |

|

|

|

206,848 |

|

Held-to-maturity securities, at amortized cost |

|

|

161,385 |

|

|

|

166,271 |

|

|

|

172,648 |

|

|

|

179,286 |

|

|

|

185,589 |

|

Marketable equity securities, at fair value |

|

|

3,872 |

|

|

|

3,793 |

|

|

|

3,342 |

|

|

|

3,206 |

|

|

|

3,013 |

|

Federal Home Loan Bank stock, at cost |

|

|

5,401 |

|

|

|

8,702 |

|

|

|

7,031 |

|

|

|

8,748 |

|

|

|

5,824 |

|

Loans |

|

|

921,660 |

|

|

|

888,263 |

|

|

|

891,531 |

|

|

|

897,207 |

|

|

|

896,123 |

|

Less: Allowance for credit losses |

|

|

17,274 |

|

|

|

16,892 |

|

|

|

16,655 |

|

|

|

15,975 |

|

|

|

15,767 |

|

Loans receivable, net |

|

|

904,386 |

|

|

|

871,371 |

|

|

|

874,876 |

|

|

|

881,232 |

|

|

|

880,356 |

|

Premises and equipment, net |

|

|

18,989 |

|

|

|

18,878 |

|

|

|

18,332 |

|

|

|

18,441 |

|

|

|

18,491 |

|

Assets held-for-sale |

|

|

- |

|

|

|

3,042 |

|

|

|

3,042 |

|

|

|

3,042 |

|

|

|

3,042 |

|

Operating lease right-of-use assets |

|

|

1,425 |

|

|

|

1,459 |

|

|

|

1,493 |

|

|

|

1,526 |

|

|

|

1,559 |

|

Finance lease right-of-use assets |

|

|

16,873 |

|

|

|

4,004 |

|

|

|

4,038 |

|

|

|

4,073 |

|

|

|

4,108 |

|

Accrued interest receivable |

|

|

6,806 |

|

|

|

7,076 |

|

|

|

7,170 |

|

|

|

7,286 |

|

|

|

6,594 |

|

Foreclosed real estate |

|

|

- |

|

|

|

60 |

|

|

|

82 |

|

|

|

151 |

|

|

|

189 |

|

Intangible assets, net |

|

|

6,217 |

|

|

|

76 |

|

|

|

80 |

|

|

|

85 |

|

|

|

88 |

|

Goodwill |

|

|

5,752 |

|

|

|

4,536 |

|

|

|

4,536 |

|

|

|

4,536 |

|

|

|

4,536 |

|

Bank owned life insurance |

|

|

24,560 |

|

|

|

24,967 |

|

|

|

24,799 |

|

|

|

24,641 |

|

|

|

24,479 |

|

Other assets |

|

|

20,159 |

|

|

|

25,180 |

|

|

|

23,968 |

|

|

|

22,097 |

|

|

|

31,459 |

|

Total assets |

|

$ |

1,483,126 |

|

|

$ |

1,446,211 |

|

|

$ |

1,453,672 |

|

|

$ |

1,465,798 |

|

|

$ |

1,400,649 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits |

|

$ |

986,103 |

|

|

$ |

932,132 |

|

|

$ |

969,692 |

|

|

$ |

949,898 |

|

|

$ |

953,143 |

|

Noninterest-bearing deposits |

|

|

210,110 |

|

|

|

169,145 |

|

|

|

176,421 |

|

|

|

170,169 |

|

|

|

174,710 |

|

Total deposits |

|

|

1,196,213 |

|

|

|

1,101,277 |

|

|

|

1,146,113 |

|

|

|

1,120,067 |

|

|

|

1,127,853 |

|

Short-term borrowings |

|

|

60,315 |

|

|

|

127,577 |

|

|

|

91,577 |

|

|

|

125,680 |

|

|

|

56,698 |

|

Long-term borrowings |

|

|

39,769 |

|

|

|

45,869 |

|

|

|

45,869 |

|

|

|

49,919 |

|

|

|

53,915 |

|

Subordinated debt |

|

|

30,057 |

|

|

|

30,008 |

|

|

|

29,961 |

|

|

|

29,914 |

|

|

|

29,867 |

|

Accrued interest payable |

|

|

236 |

|

|

|

2,092 |

|

|

|

1,963 |

|

|

|

2,245 |

|

|

|

1,731 |

|

Operating lease liabilities |

|

|

1,621 |

|

|

|

1,652 |

|

|

|

1,682 |

|

|

|

1,711 |

|

|

|

1,739 |

|

Finance lease liabilities |

|

|

16,829 |

|

|

|

4,359 |

|

|

|

4,370 |

|

|

|

4,381 |

|

|

|

4,391 |

|

Other liabilities |

|

|

16,986 |

|

|

|

9,203 |

|

|

|

9,505 |

|

|

|

11,625 |

|

|

|

10,013 |

|

Total liabilities |

|

|

1,362,026 |

|

|

|

1,322,037 |

|

|

|

1,331,040 |

|

|

|

1,345,542 |

|

|

|

1,286,207 |

|

Shareholders' equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Voting common stock shares issued and outstanding |

|

|

4,719,788 |

|

|

|

4,719,788 |

|

|

|

4,719,788 |

|

|

|

4,719,288 |

|

|

|

4,713,353 |

|

Voting common stock |

|

|

47 |

|

|

|

47 |

|

|

|

47 |

|

|

|

47 |

|

|

|

47 |

|

Non-Voting common stock |

|

|

14 |

|

|

|

14 |

|

|

|

14 |

|

|

|

14 |

|

|

|

14 |

|

Additional paid in capital |

|

|

53,231 |

|

|

|

53,182 |

|

|

|

53,151 |

|

|

|

53,114 |

|

|

|

52,963 |

|

Retained earnings |

|

|

73,670 |

|

|

|

78,936 |

|

|

|

77,558 |

|

|

|

76,060 |

|

|

|

74,282 |

|

Accumulated other comprehensive loss |

|

|

(6,716 |

) |

|

|

(8,786 |

) |

|

|

(8,862 |

) |

|

|

(9,605 |

) |

|

|

(13,356 |

) |

Unearned ESOP shares |

|

|

- |

|

|

|

(45 |

) |

|

|

(90 |

) |

|

|

(135 |

) |

|

|

(180 |

) |

Total Pathfinder Bancorp, Inc. shareholders' equity |

|

|

120,246 |

|

|

|

123,348 |

|

|

|

121,818 |

|

|

|

119,495 |

|

|

|

113,770 |

|

Noncontrolling interest |

|

|

854 |

|

|

|

826 |

|

|

|

814 |

|

|

|

761 |

|

|

|

672 |

|

Total equity |

|

|

121,100 |

|

|

|

124,174 |

|

|

|

122,632 |

|

|

|

120,256 |

|

|

|

114,442 |

|

Total liabilities and shareholders' equity |

|

$ |

1,483,126 |

|

|

$ |

1,446,211 |

|

|

$ |

1,453,672 |

|

|

$ |

1,465,798 |

|

|

$ |

1,400,649 |

|

The above information is preliminary and based on the Company's data available at the time of presentation.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

2024 |

|

|

2023 |

|

SELECTED INCOME STATEMENT DATA: |

|

2024 |

|

|

2023 |

|

|

Q3 |

|

|

Q2 |

|

|

Q1 |

|

|

Q4 |

|

|

Q3 |

|

Interest and dividend income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans, including fees |

|

$ |

39,182 |

|

|

$ |

34,919 |

|

|

$ |

14,425 |

|

|

$ |

12,489 |

|

|

$ |

12,268 |

|

|

$ |

12,429 |

|

|

$ |

12,470 |

|

Debt securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

|

17,007 |

|

|

|

12,408 |

|

|

|

5,664 |

|

|

|

5,736 |

|

|

|

5,607 |

|

|

|

5,092 |

|

|

|

4,488 |

|

Tax-exempt |

|

|

1,475 |

|

|

|

1,441 |

|

|

|

469 |

|

|

|

498 |

|

|

|

508 |

|

|

|

506 |

|

|

|

507 |

|

Dividends |

|

|

456 |

|

|

|

341 |

|

|

|

149 |

|

|

|

178 |

|

|

|

129 |

|

|

|

232 |

|

|

|

140 |

|

Federal funds sold and interest-earning deposits |

|

|

711 |

|

|

|

226 |

|

|

|

492 |

|

|

|

121 |

|

|

|

98 |

|

|

|

69 |

|

|

|

66 |

|

Total interest and dividend income |

|

|

58,831 |

|

|

|

49,335 |

|

|

|

21,199 |

|

|

|

19,022 |

|

|

|

18,610 |

|

|

|

18,328 |

|

|

|

17,671 |

|

Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest on deposits |

|

|

22,670 |

|

|

|

15,885 |

|

|

|

7,633 |

|

|

|

7,626 |

|

|

|

7,411 |

|

|

|

7,380 |

|

|

|

6,223 |

|

Interest on short-term borrowings |

|

|

3,476 |

|

|

|

1,624 |

|

|

|

1,136 |

|

|

|

1,226 |

|

|

|

1,114 |

|

|

|

1,064 |

|

|

|

674 |

|

Interest on long-term borrowings |

|

|

597 |

|

|

|

619 |

|

|

|

202 |

|

|

|

201 |

|

|

|

194 |

|

|

|

231 |

|

|

|

222 |

|

Interest on subordinated debt |

|

|

1,476 |

|

|

|

1,447 |

|

|

|

496 |

|

|

|

489 |

|

|

|

491 |

|

|

|

494 |

|

|

|

492 |

|

Total interest expense |

|

|

28,219 |

|

|

|

19,575 |

|

|

|

9,467 |

|

|

|

9,542 |

|

|

|

9,210 |

|

|

|

9,169 |

|

|

|

7,611 |

|

Net interest income |

|

|

30,612 |

|

|

|

29,760 |

|

|

|

11,732 |

|

|

|

9,480 |

|

|

|

9,400 |

|

|

|

9,159 |

|

|

|

10,060 |

|

Provision for (benefit from) credit losses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

|

|

10,118 |

|

|

|

2,675 |

|

|

|

9,104 |

|

|

|

304 |

|

|

|

710 |

|

|

|

316 |

|

|

|

798 |

|

Held-to-maturity securities |

|

|

(90 |

) |

|

|

(24 |

) |

|

|

(31 |

) |

|

|

(74 |

) |

|

|

15 |

|

|

|

(74 |

) |

|

|

5 |

|

Unfunded commitments |

|

|

(43 |

) |

|

|

14 |

|

|

|

(104 |

) |

|

|

60 |

|

|

|

1 |

|

|

|

23 |

|

|

|

30 |

|

Total provision for credit losses |

|

|

9,985 |

|

|

|

2,665 |

|

|

|

8,969 |

|

|

|

290 |

|

|

|

726 |

|

|

|

265 |

|

|

|

833 |

|

Net interest income after provision for credit losses |

|

|

20,627 |

|

|

|

27,095 |

|

|

|

2,763 |

|

|

|

9,190 |

|

|

|

8,674 |

|

|

|

8,894 |

|

|

|

9,227 |

|

Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service charges on deposit accounts |

|

|

1,031 |

|

|

|

913 |

|

|

|

392 |

|

|

|

330 |

|

|

|

309 |

|

|

|

336 |

|

|

|

343 |

|

Earnings and gain on bank owned life insurance |

|

|

685 |

|

|

|

466 |

|

|

|

361 |

|

|

|

167 |

|

|

|

157 |

|

|

|

164 |

|

|

|

165 |

|

Loan servicing fees |

|

|

279 |

|

|

|

238 |

|

|

|

79 |

|

|

|

112 |

|

|

|

88 |

|

|

|

69 |

|

|

|

99 |

|

Net realized (losses) gains on sales and redemptions of investment securities |

|

|

(320 |

) |

|

|

60 |

|

|

|

(188 |

) |

|

|

16 |

|

|

|

(148 |

) |

|

|

2 |

|

|

|

(13 |

) |

Net realized gains (losses) on sales of marketable equity securities |

|

|

31 |

|

|

|

(208 |

) |

|

|

62 |

|

|

|

(139 |

) |

|

|

108 |

|

|

|

(47 |

) |

|

|

(39 |

) |

Gains on sales of loans and foreclosed real estate |

|

|

148 |

|

|

|

183 |

|

|

|

90 |

|

|

|

40 |

|

|

|

18 |

|

|

|

(2 |

) |

|

|

41 |

|

Loss on sale of premises and equipment |

|

|

(36 |

) |

|

|

- |

|

|

|

(36 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Debit card interchange fees |

|

|

610 |

|

|

|

455 |

|

|

|

300 |

|

|

|

191 |

|

|

|

119 |

|

|

|

161 |

|

|

|

22 |

|

Insurance agency revenue |

|

|

1,024 |

|

|

|

1,001 |

|

|

|

367 |

|

|

|

260 |

|

|

|

397 |

|

|

|

303 |

|

|

|

310 |

|

Other charges, commissions & fees |

|

|

1,203 |

|

|

|

764 |

|

|

|

280 |

|

|

|

234 |

|

|

|

689 |

|

|

|

332 |

|

|

|

265 |

|

Total noninterest income |

|

|

4,655 |

|

|

|

3,872 |

|

|

|

1,707 |

|

|

|

1,211 |

|

|

|

1,737 |

|

|

|

1,318 |

|

|

|

1,193 |

|

Noninterest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

13,687 |

|

|

|

12,243 |

|

|

|

4,959 |

|

|

|

4,399 |

|

|

|

4,329 |

|

|

|

3,677 |

|

|

|

4,154 |

|

Building and occupancy |

|

|

2,864 |

|

|

|

2,699 |

|

|

|

1,134 |

|

|

|

914 |

|

|

|

816 |

|

|

|

864 |

|

|

|

868 |

|

Data processing |

|

|

1,750 |

|

|

|

1,519 |

|

|

|

672 |

|

|

|

550 |

|

|

|

528 |

|

|

|

499 |

|

|

|

483 |

|

Professional and other services |

|

|

3,078 |

|

|

|

1,531 |

|

|

|

1,820 |

|

|

|

696 |

|

|

|

562 |

|

|

|

488 |

|

|

|

492 |

|

Advertising |

|

|

386 |

|

|

|

516 |

|

|

|

165 |

|

|

|

116 |

|

|

|

105 |

|

|

|

155 |

|

|

|

144 |

|

FDIC assessments |

|

|

685 |

|

|

|

663 |

|

|

|

228 |

|

|

|

228 |

|

|

|

229 |

|

|

|

222 |

|

|

|

222 |

|

Audits and exams |

|

|

416 |

|

|

|

476 |

|

|

|

123 |

|

|

|

123 |

|

|

|

170 |

|

|

|

259 |

|

|

|

159 |

|

Insurance agency expense |

|

|

825 |

|

|

|

817 |

|

|

|

308 |

|

|

|

232 |

|

|

|

285 |

|

|

|

216 |

|

|

|

273 |

|

Community service activities |

|

|

111 |

|

|

|

151 |

|

|

|

20 |

|

|

|

39 |

|

|

|

52 |

|

|

|

49 |

|

|

|

55 |

|

Foreclosed real estate expenses |

|

|

82 |

|

|

|

76 |

|

|

|

27 |

|

|

|

30 |

|

|

|

25 |

|

|

|

35 |

|

|

|

44 |

|

Other expenses |

|

|

1,989 |

|

|

|

1,660 |

|

|

|

803 |

|

|

|

581 |

|

|

|

605 |

|

|

|

580 |

|

|

|

759 |

|

Total noninterest expense |

|

|

25,873 |

|

|

|

22,351 |

|

|

|

10,259 |

|

|

|

7,908 |

|

|

|

7,706 |

|

|

|

7,044 |

|

|

|

7,653 |

|

(Loss) income before provision for income taxes |

|

|

(591 |

) |

|

|

8,616 |

|

|

|

(5,789 |

) |

|

|

2,493 |

|

|

|

2,705 |

|

|

|

3,168 |

|

|

|

2,767 |

|

(Benefit) provision for income taxes |

|

|

(160 |

) |

|

|

1,772 |

|

|

|

(1,173 |

) |

|

|

481 |

|

|

|

532 |

|

|

|

590 |

|

|

|

573 |

|

Net (loss) income attributable to noncontrolling interest and Pathfinder Bancorp, Inc. |

|

|

(431 |

) |

|

|

6,844 |

|

|

|

(4,616 |

) |

|

|

2,012 |

|

|

|

2,173 |

|

|

|

2,578 |

|

|

|

2,194 |

|

Net income attributable to noncontrolling interest |

|

|

93 |

|

|

|

87 |

|

|

|

28 |

|

|

|

12 |

|

|

|

53 |

|

|

|

42 |

|

|

|

18 |

|

Net (loss) income attributable to Pathfinder Bancorp Inc. |

|

$ |

(524 |

) |

|

$ |

6,757 |

|

|

$ |

(4,644 |

) |

|

$ |

2,000 |

|

|

$ |

2,120 |

|

|

$ |

2,536 |

|

|

$ |

2,176 |

|

Voting Earnings per common share - basic and diluted |

|

$ |

(0.09 |

) |

|

$ |

1.10 |

|

|

$ |

(0.75 |

) |

|

$ |

0.32 |

|

|

$ |

0.34 |

|

|

$ |

0.41 |

|

|

$ |

0.35 |

|

Series A Non-Voting Earnings per common share- basic and diluted |

|

$ |

(0.09 |

) |

|

$ |

1.10 |

|

|

$ |

(0.75 |

) |

|

$ |

0.32 |

|

|

$ |

0.34 |

|

|

$ |

0.41 |

|

|

$ |

0.35 |

|

Dividends per common share (Voting and Series A Non-Voting) |

|

$ |

0.30 |

|

|

$ |

0.27 |

|

|

$ |

0.10 |

|

|

$ |

0.10 |

|

|

$ |

0.10 |

|

|

$ |

0.09 |

|

|

$ |

0.09 |

|

The above information is preliminary and based on the Company's data available at the time of presentation.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

2024 |

|

|

2023 |

|

FINANCIAL HIGHLIGHTS: |

|

2024 |

|

|

2023 |

|

|

Q3 |

|

|

Q2 |

|

|

Q1 |

|

|

Q4 |

|

|

Q3 |

|

Selected Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets |

|

|

-0.05 |

% |

|

|

0.65 |

% |

|

|

-1.25 |

% |

|

|

0.56 |

% |

|

|

0.59 |

% |

|

|

0.72 |

% |

|

|

0.63 |

% |

Return on average common equity |

|

|

-0.57 |

% |

|

|

7.88 |

% |

|

|

-14.79 |

% |

|

|

6.49 |

% |

|

|

7.01 |

% |

|

|

8.72 |

% |

|

|

7.50 |

% |

Return on average equity |

|

|

-0.57 |

% |

|

|

7.88 |

% |

|

|

-14.79 |

% |

|

|

6.49 |

% |

|

|

7.01 |

% |

|

|

8.72 |

% |

|

|

7.50 |

% |

Return on average tangible common equity (1) |

|

|

-0.59 |

% |

|

|

8.23 |

% |

|

|

-15.28 |

% |

|

|

6.78 |

% |

|

|

7.32 |

% |

|

|

9.01 |

% |

|

|

7.75 |

% |

Net interest margin |

|

|

2.97 |

% |

|

|

3.02 |

% |

|

|

3.34 |

% |

|

|

2.78 |

% |

|

|

2.75 |

% |

|

|

2.74 |

% |

|

|

3.07 |

% |

Loans/deposits |

|

|

77.05 |

% |

|

|

79.45 |

% |

|

|

77.05 |

% |

|

|

80.66 |

% |

|

|

77.79 |

% |

|

|

80.10 |

% |

|

|

79.45 |

% |

Core deposits/deposits (2) |

|

|

77.45 |

% |

|

|

69.83 |

% |

|

|

77.45 |

% |

|

|

67.98 |

% |

|

|

69.17 |

% |

|

|

69.83 |

% |

|

|

69.83 |

% |

Annualized non-interest expense/average assets |

|

|

2.39 |

% |

|

|

2.16 |

% |

|

|

2.75 |

% |

|

|

2.19 |

% |

|

|

2.16 |

% |

|

|

2.01 |

% |

|

|

2.20 |

% |

Efficiency ratio (1) |

|

|

72.70 |

% |

|

|

66.58 |

% |

|

|

75.28 |

% |

|

|

74.08 |

% |

|

|

68.29 |

% |

|

|

67.25 |

% |

|

|

67.93 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Selected Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average yield on loans |

|

|

5.82 |

% |

|

|

5.17 |

% |

|

|

6.31 |

% |

|

|

5.64 |

% |

|

|

5.48 |

% |

|

|

5.55 |

% |

|

|

5.57 |

% |

Average cost of interest bearing deposits |

|

|

3.12 |

% |

|

|

2.23 |

% |

|

|

3.11 |

% |

|

|

3.21 |

% |

|

|

3.07 |

% |

|

|

3.10 |

% |

|

|

2.65 |

% |

Average cost of total deposits, including non-interest bearing |

|

|

2.64 |

% |

|

|

1.88 |

% |

|

|

2.59 |

% |

|

|

2.72 |

% |

|

|

2.61 |

% |

|

|

2.63 |

% |

|

|

2.24 |

% |

Deposits/branch (4) |

|

$ |

99,684 |

|

|

$ |

102,532 |

|

|

$ |

99,684 |

|

|

$ |

100,116 |

|

|

$ |

104,192 |

|

|

$ |

101,824 |

|

|

$ |

102,532 |

|

Pre-tax, pre-provision net income (1) |

|

$ |

9,714 |

|

|

$ |

11,221 |

|

|

$ |

3,368 |

|

|

$ |

2,767 |

|

|

$ |

3,579 |

|

|

$ |

3,431 |

|

|

$ |

3,613 |

|

Total revenue (1) |

|

$ |

35,587 |

|

|

$ |

33,572 |

|

|

$ |

13,627 |

|

|

$ |

10,675 |

|

|

$ |

11,285 |

|

|

$ |

10,475 |

|

|

$ |

11,266 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share and Per Share Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends per share |

|

$ |

0.30 |

|

|

$ |

0.27 |

|

|

$ |

0.10 |

|

|

$ |

0.10 |

|

|

$ |

0.10 |

|

|

$ |

0.09 |

|

|

$ |

0.09 |

|

Book value per common share |

|

$ |

19.71 |

|

|

$ |

18.67 |

|

|

$ |

19.71 |

|

|

$ |

20.22 |

|

|

$ |

19.97 |

|

|

$ |

19.59 |

|

|

$ |

18.67 |

|

Tangible book value per common share (1) |

|

$ |

17.75 |

|

|

$ |

17.91 |

|

|

$ |

17.75 |

|

|

$ |

19.46 |

|

|

$ |

19.21 |

|

|

$ |

18.83 |

|

|

$ |

17.91 |

|

Basic and diluted weighted average shares outstanding - Voting |

|

|

4,708 |

|

|

|

4,640 |

|

|

|

4,714 |

|

|

|

4,708 |

|

|

|

4,701 |

|

|

|

4,693 |

|

|

|

4,671 |

|

Basic and diluted earnings per share - Voting (3) |

|

$ |

(0.09 |

) |

|

$ |

1.10 |

|

|

$ |

(0.75 |

) |

|

$ |

0.32 |

|

|

$ |

0.34 |

|

|

$ |

0.41 |

|

|

$ |

0.35 |

|

Basic and diluted weighted average shares outstanding - Series A Non-Voting |

|

|

1,380 |

|

|

|

1,380 |

|

|

|

1,380 |

|

|

|

1,380 |

|

|

|

1,380 |

|

|

|

1,380 |

|

|

|

1,380 |

|

Basic and diluted earnings per share - Series A Non-Voting (3) |

|

$ |

(0.09 |

) |

|

$ |

1.10 |

|

|

$ |

(0.75 |

) |

|

$ |

0.32 |

|

|

$ |

0.34 |

|

|

$ |

0.41 |

|

|

$ |

0.35 |

|

Common shares outstanding at period end |

|

|

6,100 |

|

|

|

6,094 |

|

|

|

6,100 |

|

|

|

6,100 |

|

|

|

6,100 |

|

|

|

6,100 |

|

|

|

6,094 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pathfinder Bancorp, Inc. Capital Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company tangible common equity to tangible assets (1) |

|

|

7.36 |

% |

|

|

7.82 |

% |

|

|

7.36 |

% |

|

|

8.24 |

% |

|

|

8.09 |

% |

|

|

7.86 |

% |

|

|

7.82 |

% |

Company Total Core Capital (to Risk-Weighted Assets) |

|

|

15.55 |

% |

|

|

17.00 |

% |

|

|

15.55 |

% |

|

|

16.19 |

% |

|

|

16.23 |

% |

|

|

16.17 |

% |

|

|

17.00 |

% |

Company Tier 1 Capital (to Risk-Weighted Assets) |

|

|

11.84 |

% |

|

|

12.39 |

% |

|

|

11.84 |

% |

|

|

12.31 |

% |

|

|

12.33 |

% |

|

|

12.30 |

% |

|

|

12.39 |

% |

Company Tier 1 Common Equity (to Risk-Weighted Assets) |

|

|

11.33 |

% |

|

|

12.91 |

% |

|

|

11.33 |

% |

|

|

11.83 |

% |

|

|

11.85 |

% |

|

|

11.81 |

% |

|

|

12.91 |

% |

Company Tier 1 Capital (to Assets) |

|

|

8.29 |

% |

|

|

9.21 |

% |

|

|

8.29 |

% |

|

|

9.16 |

% |

|

|

9.16 |

% |

|

|

9.35 |

% |

|

|

9.21 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pathfinder Bank Capital Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank Total Core Capital (to Risk-Weighted Assets) |

|

|

14.52 |

% |

|

|

14.76 |

% |

|

|

14.52 |

% |

|

|

16.04 |

% |

|

|

15.65 |

% |

|

|

15.05 |

% |

|

|

14.76 |

% |

Bank Tier 1 Capital (to Risk-Weighted Assets) |

|

|

13.26 |

% |

|

|

13.51 |

% |

|

|

13.26 |

% |

|

|

14.79 |

% |

|

|

14.39 |

% |

|

|

13.80 |

% |

|

|

13.51 |

% |

Bank Tier 1 Common Equity (to Risk-Weighted Assets) |

|

|

13.26 |

% |

|

|

13.51 |

% |

|

|

13.26 |

% |

|

|

14.79 |

% |

|

|

14.39 |

% |

|

|

13.80 |

% |

|

|

13.51 |

% |

Bank Tier 1 Capital (to Assets) |

|

|

9.13 |

% |

|

|

10.11 |

% |

|

|

9.13 |

% |

|

|

10.30 |

% |

|

|

10.13 |

% |

|

|

10.11 |

% |

|

|

10.11 |

% |

(1) Non-GAAP financial metrics. See non-GAAP reconciliation included herein for the most directly comparable GAAP measures.

(2) Non-brokered deposits excluding certificates of deposit of $250,000 or more.

(3) Basic and diluted earnings per share are calculated based upon the two-class method. Weighted average shares outstanding do not include unallocated ESOP shares.

(4) Includes 11 full-service branches and one motor bank for September 30, 2024. Includes 10 full-service branches and one motor bank for all periods prior.

|

The above information is preliminary and based on the Company's data available at the time of presentation. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

2024 |

|

|

2023 |

|

ASSET QUALITY: |

|

2024 |

|

|

2023 |

|

|

Q3 |

|

|

Q2 |

|

|

Q1 |

|

|

Q4 |

|

|

Q3 |

|

Total loan charge-offs |

|

$ |

8,992 |

|

|

$ |

4,365 |

|

|

$ |

8,812 |

|

|

$ |

112 |

|

|

$ |

68 |

|

|

$ |

211 |

|

|

$ |

3,874 |

|

Total recoveries |

|

|

174 |

|

|

|

252 |

|

|

|

90 |

|

|

|

46 |

|

|

|

38 |

|

|

|

103 |

|

|

|

45 |

|

Net loan charge-offs |

|

|

8,818 |

|

|

|

4,113 |

|

|

|

8,722 |

|

|

|

66 |

|

|

|

30 |

|

|

|

108 |

|

|

|

3,829 |

|

Allowance for credit losses at period end |

|

|

17,274 |

|

|

|

15,767 |

|

|

|

17,274 |

|

|

|

16,892 |

|

|

|

16,655 |

|

|

|

15,975 |

|

|

|

15,767 |

|

Nonperforming loans at period end |

|

|

16,170 |

|

|

|

16,173 |

|

|

|

16,170 |

|

|

|

24,490 |

|

|

|

19,652 |

|

|

|

17,227 |

|

|

|

16,173 |

|

Nonperforming assets at period end |

|

$ |

16,170 |

|

|

$ |

16,362 |

|

|

$ |

16,170 |

|

|

$ |

24,550 |

|

|

$ |

19,734 |

|

|

$ |

17,378 |

|

|

$ |

16,362 |

|

Annualized net loan charge-offs to average loans |

|

|

1.29 |

% |

|

|

0.61 |

% |

|

|

1.29 |

% |

|

|

0.02 |

% |

|

|

0.01 |

% |

|

|

0.47 |

% |

|

|

0.61 |

% |

Allowance for credit losses to period end loans |

|

|

1.87 |

% |

|

|

1.76 |

% |

|

|

1.87 |

% |

|

|

1.90 |

% |

|

|

1.87 |

% |

|

|

1.78 |

% |

|

|

1.76 |

% |

Allowance for credit losses to nonperforming loans |

|

|

106.83 |

% |

|

|

97.49 |

% |

|

|

106.83 |

% |

|

|

68.98 |

% |

|

|

84.75 |

% |

|

|

92.73 |

% |

|

|

97.49 |

% |

Nonperforming loans to period end loans |

|

|

1.75 |

% |

|

|

1.80 |

% |

|

|

1.75 |

% |

|

|

2.76 |

% |

|

|

2.20 |

% |

|

|

1.92 |

% |

|

|

1.80 |

% |

Nonperforming assets to period end assets |

|

|

1.09 |

% |

|

|

1.17 |

% |

|

|

1.09 |

% |

|

|

1.70 |

% |

|

|

1.36 |

% |

|

|

1.19 |

% |

|

|

1.17 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

LOAN COMPOSITION: |

|

September 30, |

|

|

June 30, |

|

|

March 31, |

|

|

December 31, |

|

|

September 30, |

|

1-4 family first-lien residential mortgages |

|

$ |

255,235 |

|

|

$ |

250,106 |

|

|

$ |

252,026 |

|

|

$ |

257,604 |

|

|

$ |

252,956 |

|

Residential construction |

|

|

4,077 |

|

|

|

309 |

|

|

|

1,689 |

|

|

|

1,355 |

|

|

|

2,090 |

|

Commercial real estate |

|

|

378,805 |

|

|

|

370,361 |

|

|

|

363,467 |

|

|

|

358,707 |

|

|

|

362,822 |

|

Commercial lines of credit |

|

|

64,672 |

|

|

|

62,711 |

|

|

|

67,416 |

|

|

|

72,069 |

|

|

|

73,497 |

|

Other commercial and industrial |

|

|

88,247 |

|

|

|

90,813 |

|

|

|

91,178 |

|

|

|

89,803 |

|

|

|

85,506 |

|

Paycheck protection program loans |

|

|

125 |

|

|

|

136 |

|

|

|

147 |

|

|

|

158 |

|

|

|

169 |

|

Tax exempt commercial loans |

|

|

2,658 |

|

|

|

3,228 |

|

|

|

3,374 |

|

|

|

3,430 |

|

|

|

3,451 |

|

Home equity and junior liens |

|

|

52,709 |

|

|

|

35,821 |

|

|

|

35,723 |

|

|

|

34,858 |

|

|

|

34,666 |

|

Other consumer |

|

|

76,703 |

|

|

|

75,195 |

|

|

|

77,106 |

|

|

|

79,797 |

|

|

|

81,319 |

|

Subtotal loans |

|

|

923,231 |

|

|

|

888,680 |

|

|

|

892,126 |

|

|

|

897,781 |

|

|

|

896,476 |

|