As

filed with the Securities and Exchange Commission on December 29, 2023.

Registration

No. 333-_______

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Palisade

Bio, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

2834 |

|

52-2007292 |

(State

or Other Jurisdiction of

Incorporation or Organization) |

|

(Primary

Standard Industrial

Classification Code Number) |

|

(I.R.S.

Employer

Identification Number) |

Palisade

Bio, Inc.

7750

El Camino Real, Suite 2A

Carlsbad,

CA 92009

(858)

704-4900

(Address,

including zip code, and telephone number, including area code of registrant’s principal executive offices)

Paracorp

Incorporated

2140

S Dupont highway

Camden,

DE 19934

(302)

697-4590

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Raul Silvestre

Dennis Gluck

2629 Townsgate Road #215

Westlake Village, CA 91361

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

|

☐ |

|

Accelerated

filer |

|

☐ |

| |

|

|

|

| Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

| |

|

|

|

| |

|

|

|

Emerging growth company |

|

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED DECEMBER 29, 2023

PRELIMINARY

PROSPECTUS

[*]

shares of Common Stock

We are offering shares

of our common stock, par value $0.01 per share (the “common stock”) at a public offering price of $

per share.

The

underwriter has the option to purchase up to additional shares

of common stock solely to cover over-allotments, if any, at the price to the public, less the underwriting discounts and commissions, but such purchases cannot

exceed an aggregate of % of the number of shares of common stock sold in this offering. The over-allotment option is exercisable for

days from the date of this prospectus.

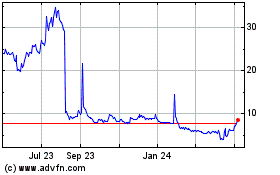

Our

common stock is listed on The Nasdaq Capital Market under the symbol “PALI”. On December 28, 2023, the last reported sale

price of our common stock was $0.6539 per share. The recent market price used throughout this prospectus may not be indicative

of the final offering price. The final public offering price will be determined through negotiation between us and the underwriter based

upon a number of factors, including our history and our prospects, the industry in which we operate, our past and present operating results

and the general condition of the securities markets at the time of this offering.

Investing

in our securities involves a high degree of risk. Before making an investment decision, please read the information under “Risk

Factors” beginning on page 6 of this prospectus and under similar headings in any amendment or supplement to this prospectus

or in any filing with the Securities and Exchange Commission that is incorporated by reference herein.

| | |

Per common share | | |

Total | |

| Public offering price | |

$ | | | |

$ | | |

| Underwriting discounts and commissions(1)(2) | |

$ | | | |

$ | | |

| Proceeds to us, before expenses | |

$ | | | |

$ | | |

| (1) |

We

have also agreed to reimburse the underwriter for certain expenses. See “Underwriting” for additional information. |

| (2) |

We

have granted a day option to the underwriter to purchase additional shares of common stock a (up to %

of the number of shares of common stock sold in this offering) solely to cover over-allotments, if any. |

The

underwriter expects to deliver the securities to purchasers in the offering on or about ,

2024

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED

IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

[NAME

OF UNDERWRITER]

The

date of this prospectus is , 2024.

TABLE

OF CONTENTS

We

incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without

charge by following the instructions under “Incorporation of Certain Information by Reference.” You should carefully read

this prospectus as well as additional information described under “Incorporation of Certain Information by Reference,” before

deciding to invest in our securities.

Neither

we nor the underwriter have authorized anyone to provide you with additional information or information different from that contained

or incorporated by reference in this prospectus or in any free writing prospectus that we have authorized for use in connection with

this offering. We take no responsibility for and can provide no assurance as to the reliability of, any other information that others

may give you. This prospectus does not constitute an offer to sell to any person, or a solicitation of an offer to purchase from any

person, the securities offered by this prospectus in any jurisdiction in which it is unlawful to make such offer or solicitation of an

offer.

The

underwriter is offering to sell, and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted.

The information contained in this prospectus and any free writing prospectus that we have authorized for use in connection with this

offering is accurate only as of the respective dates thereof, and the information in the documents incorporated by reference in this

prospectus is accurate only as of the date of those respective documents, regardless of the time of delivery of this prospectus or of

any sale of our securities. Our business, financial condition, results of operations, and prospects may have changed since such dates.

It is important for you to read and consider all information contained or incorporated by reference in this prospectus in making your

investment decision. You should read both this prospectus, as well as the documents incorporated by reference into this prospectus and

the additional information described under “Incorporation of Certain Information by Reference” in this prospectus before

investing in our securities.

Unless

otherwise indicated, information contained in or incorporated by reference into this prospectus concerning our business and the industry

and markets in which we operate, including with respect to our business prospects, our market position and opportunity, and the competitive

landscape, is based on information from our management’s estimates, as well as from industry publications, surveys, and studies

conducted by third parties. Our management’s estimates are derived from publicly available information, their knowledge of our

business and industry, and assumptions based on such information and knowledge, which they believe to be reasonable. In addition, while

we believe that information contained in the industry publications, surveys, and studies has been obtained from reliable sources,

we have not independently verified any of the data contained in these third-party sources, and the accuracy and completeness of the information

contained in these sources is not guaranteed.

Although

we are not aware of any misstatements regarding the market and industry data presented in this prospectus and the documents incorporated

herein by reference, these estimates involve risks and uncertainties and are subject to change based on various factors, including those

discussed under the heading “Risk Factors” in this prospectus and any related free writing prospectus, and under similar

headings in the other documents that are incorporated by reference into this prospectus, including in our Annual Report on Form 10-K

filed with the Securities and Exchange Commission (the “SEC”) on March 22, 2023 and our Quarterly Report on Form 10-Q

filed with the SEC on November 9, 2023. Accordingly, you should not place undue reliance on this information.

For

investors outside the United States: We and the underwriter have not done anything that would permit this offering or the possession

or distribution of this prospectus in any jurisdiction where action for those purposes is required, other than in the United States.

Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions

relating to, the offering of the shares of common stock and the distribution of this prospectus outside of the United States.

PROSPECTUS

SUMMARY

This

summary highlights certain information about us, this offering and selected information contained elsewhere in or incorporated by reference

into this prospectus. This summary is not complete and does not contain all of the information that you should consider before making

an investment decision. For a more complete understanding of our company, you should read and consider carefully the more detailed information

included or incorporated by reference in this prospectus and any applicable prospectus supplement, including the factors described under

the heading “Risk Factors” beginning on page 6 of this prospectus, and in our Annual Report on Form 10-K filed with the

SEC on March 22, 2023 and our Quarterly Report on Form 10-Q filed with the SEC on November 9, 2023, together with any free writing

prospectus we have authorized for use in connection with this offering and the financial statements and all other information incorporated

by reference in this prospectus. When used in this prospectus, except where the context otherwise requires, the terms the “Company,”

“we,” “us,” “our,” “Palisade,” or similar terms refer to Palisade Bio, Inc.

Company

Overview

Palisade is a biopharmaceutical

company developing novel targeted therapeutics for serious chronic gastrointestinal diseases. The Company’s strategic focus is

the pre-clinical and clinical development of its lead product candidate, PALI-2108, which is at an early stage of development.

Our Lead Product Candidate

Our lead product candidate, PALI-2108,

is a precision orally administered, locally-restricted, colon-specific phosphodiesterase-4 (PDE4) inhibitor prodrug in early-stage development

for patients affected by moderate-to-severely active ulcerative colitis. We believe that PALI-2108 may be an effective treatment for

Crohn’s disease. PALI-2108 is currently undergoing investigational new drug approval in the United States (“IND”) and

clinical trial application in Canada (“CTA”) enabling studies including nonclinical safety and toxicology, chemistry, manufacturing

and controls and completing the validation of pharmacokinetic/pharmacodynamics assays. We believe we will be able to complete nonclinical

IND/CTA enabling activities by the end of the third quarter of 2024 and plan to submit our initial IND/CTA prior to the end of 2024.

Market

We

believe that if developed and approved for marketing, PALI-2108 could be an effective treatment for IBD. The Company’s initial

indications for PALI-2108 are:

| ● | Ulcerative

colitis. A condition involving inflammation and sores (ulcers) along the lining of the

large intestine (colon) and rectum; and |

| ● | Crohn’s

disease. A condition characterized by the inflammation of the lining of the digestive

tract, which often can involve the deeper layers of the digestive tract. Crohn’s disease

most commonly affects the small intestine. However, it can also affect the large intestine

and uncommonly, the upper gastrointestinal tract. |

Both

ulcerative colitis and Crohn’s disease are usually characterized by diarrhea, rectal bleeding, abdominal pain, fatigue and weight loss.

For some people, IBD is only a mild illness. For others, it’s a debilitating condition that can lead to life-threatening complications.

Based on statistics from the Centers for Disease Control and the United European Gastroenterology, it is estimated that globally, there

are approximately 3.6 million individuals suffering from IBD, resulting in a combined global market opportunity of $20 billion by 2031

(Source: Global Data).

Giiant

License Agreement

On

September 1, 2023, the Company entered into the Giiant License Agreement. Under the terms of the Giiant License Agreement, the Company

obtained the rights to develop, manufacture, and commercialize all compounds from Giiant, existing now and in the future, and any product

containing or delivering any licensed compound, in any formulation or dosage for all human and non-human therapeutic uses for any and

all indications worldwide, including those technologies that are the basis of PALI-2108. Pursuant to the terms of the Giiant License

Agreement, pre-clinical development PALI-2108 will be jointly undertaken by the Company and representatives of Giiant and the Company

will pay or reimburse a portion of the joint development costs. Upon the first approval of either an IND or CTA, the Company will assume

all development, manufacturing, regulatory and commercialization costs. Additionally, per the terms of the Giiant License Agreement,

the Company will pay (i) certain milestone payments (in cash or stock at the Company’s election) and (ii) royalty payments.

Implications

of Being a Smaller Reporting Company

We

are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage

of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements. We

will remain a smaller reporting company until the last day of any fiscal year for so long as either (1) the market value of our

shares of common stock held by non-affiliates does not equal or exceed $250.0 million as of the prior June 30th, or (2) our

annual revenues did not equal or exceed $100.0 million during such completed fiscal year and the market value of our shares of common

stock held by non-affiliates did not equal or exceed $700.0 million as of the prior June 30th. To the extent we take advantage of

any reduced disclosure obligations, it may make comparison of our financial statements with other public companies difficult or impossible.

Corporate

Information

We

were originally incorporated in 2001 in the State of Delaware under the name Neuralstem, Inc. In October 2019, we changed our name from

Neuralstem, Inc. to Seneca Biopharma, Inc., or Seneca. In April 2021, we effected a merger transaction with Leading Biosciences, Inc.,

or “LBS”, whereby LBS became a wholly owned subsidiary of Seneca. In April 2021, we changed our name from Seneca Biopharma,

Inc. to Palisade Bio, Inc. Our principal executive offices are located at 7750 El Camino Real, Suite 2A, Carlsbad, CA, 92009, our telephone

number is (858) 704-4900 and our website address is www.palisadebio.com. The information contained in or accessible through our website

does not constitute part of this prospectus supplement or the accompanying prospectus. As of December 28, 2023, we had nine full-time

employees.

Subsidiaries

We

primarily conduct our operations through LBS, our wholly owned subsidiary.

THE

OFFERING

| Securities

Offered |

|

Up

to shares of common stock. |

| |

|

| Use

of Proceeds |

|

We estimate that the net proceeds to us from this offering will be approximately $ million,

after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds

from this offering primarily for general corporate purposes, including research and development and working capital. See “Use of

Proceeds” for additional information |

| |

|

| Over-allotment

option |

|

The

underwriter has the option to purchase additional shares of common stock solely

to cover over-allotments, if any, at the price to the public less the underwriting discounts and commissions. The over-allotment

option may be used to purchase shares of common stock as determined by the underwriter, but such purchases cannot exceed an aggregate

of % of the number of shares of common stock sold in this offering. The over-allotment

option is exercisable for days from the date of this

prospectus. |

| |

|

| Common

stock outstanding before this offering |

|

shares.

|

| |

|

Common

stock to be outstanding immediately

after

this offering |

|

shares,

or shares if the underwriter exercises in full its option to purchase

additional shares of common stock. |

| |

|

|

| Risk

Factors |

|

This

investment involves a high degree of risk. See “Risk Factors” beginning on page 6 of this prospectus for a discussion

of factors you should consider carefully before buying our securities. |

| |

|

| Nasdaq

Symbol |

|

“PALI.” |

Unless otherwise indicated,

all information in this prospectus assumes no exercise of outstanding options or warrants, no conversion of the Series A 4.5% Convertible

Preferred Stock described.

Unless

otherwise indicated, the number of shares of common stock to be outstanding immediately after this offering is based on 9,270,894

shares of common stock outstanding as of December 28, 2023, which includes 9,210,751 shares outstanding as of September 30,

2023, as adjusted for the following subsequent issuances: (i) an aggregate of 26,467 shares that were issued to employees pursuant to

the vesting of restricted stock units, and (ii) 33,676 shares that were issued on November 20, 2023 to various employees pursuant to

the Company’s 2021 Employee Stock Purchase Plan, as amended, but excludes:

| ● |

8,430

shares of common stock issuable upon exercise of outstanding stock options as of December 28, 2023 granted under the LBS 2013 Amended

and Restated Employee, Director, and Consultant Equity Incentive Plan, as amended and restated, or the 2013 Plan, with a weighted-average

exercise price of $1,054.60 per share; |

| |

|

| ● |

574,956

shares of common stock issuable upon exercise of outstanding stock options as of December 28, 2023, granted under the 2021 Equity

Incentive Plan, as amended, or the 2021 Plan, with a weighted-average exercise price of $4.21 per share, which includes a total of

78,160 shares of common stock issuable upon exercise of outstanding stock options each with an exercise price of $0.59 that were

conditionally granted to our Chief Executive Officer and Chief Medical Officer on November 21, 2023 subject to sufficient shares

available under the 2021 Plan; |

| |

|

| ● |

82,086

shares of common stock issuable upon exercise of outstanding stock options as of December 28, 2023 granted under the 2021 Inducement

Plan, with a weighted average exercise price of $4.90 per share; |

| |

|

| ● |

312,780

shares of common stock issuable upon vesting of restricted stock units outstanding as of December 28, 2023, granted under the 2021

Plan, which includes a total of 66,000 shares of common stock issuable upon vesting of restricted stock units that were conditionally

granted to our Chief Executive Officer and Chief Medical Officer on November 21, 2023 subject to sufficient shares available under

the 2021 Plan; |

| |

|

| ● |

50,144

shares of common stock issuable upon vesting of restricted stock units outstanding as of December 28, 2023, granted under the 2021

Inducement Plan; |

| |

|

| ● |

62,200

shares of common stock issuable upon vesting of restricted performance stock units outstanding as of December 28, 2023; all of which

were issued under the 2021 Plan which vest subject to certain milestones; |

| |

|

| ● |

5,397

shares of common stock reserved for future issuance under the 2021 Plan as of December 28, 2023, which excludes a total of 144,610

shares of common stock issuable upon exercise of outstanding stock options and outstanding restricted stock units that were conditionally

granted to our Chief Executive Officer and Chief Medical Officer on November 21, 2023 subject to sufficient shares being available

under the 2021 Plan, as well as any future automatic increases in the number of shares of common stock reserved for future issuance

under the 2021 Plan; |

| |

|

| ● |

110,871

shares of common stock reserved for future issuance under our 2021 Employee Stock Purchase Plan, or the ESPP, as of December 28,

2023, as well as any automatic increases in the number of shares of common stock reserved for future issuance under the ESPP; |

| |

|

| ● |

863,214

shares of common stock reserved for issuance under the 2021 Inducement Plan as of September 1, 2023; |

| |

|

| ● |

4,080,876

shares of common stock issuable upon exercise of outstanding warrants as of December 28, 2023 with a weighted-average exercise price

of $8.63 per share; and |

| |

|

| ● |

129

shares of common stock issuable upon conversion of the 200,000 outstanding shares of our Series A 4.5% Convertible Preferred Stock

as of December 28, 2023, as well as any future shares of common stock issuable upon conversion of additional shares of Series A 4.5%

Convertible Preferred Stock that may be issued as payment-in-kind dividends thereon in accordance with their terms. |

RISK

FACTORS SUMMARY

On

September 1, 2023, the Company announced that it had entered into a research collaboration and license agreement with Giiant Pharma Inc.

(“Giiant”) (the “Giiant License Agreement”) for the exclusive worldwide license to Giiant’s assets. As

a result, the Company changed its strategic focus. To the extent that the risk factors contained herein contradict any risk factors contained

in the Company’s recent periodic reports, the risk factors contained herein shall supersede. The risk factors contained in the

Company’s recent periodic reports remain applicable to the Company.

The

Company faces many risks and uncertainties, as more fully described in this Prospectus. Some of these risks and uncertainties are summarized

below. The summary below does not contain all of the information that may be important to you, and you should read this summary together

with the more detailed discussion of these risks and uncertainties contained in the Section entitled “Risk Factors.”

Risks

Related to This Offering and our Securities

| ● | You

will experience immediate and substantial dilution as a result of this offering and may experience

additional dilution in the future. |

| | | |

| ● | Management

will have broad discretion as to the use of the proceeds from this offering and may not use

the proceeds effectively |

| | | |

| ● | The

offering price will be set by the Company’s Board and does not necessarily indicate

the actual or market value of the Company’s common stock. |

| | | |

| ● | Future

sales of a significant number of our shares of common stock in the public markets, or the

perception that such sales could occur, could depress the market price of the Company’s

shares of common stock. |

| | | |

| ● | Terms

of subsequent financings may adversely impact the Company’s stockholders. |

| | | |

| ● | The

Company does not currently intend to pay dividends on our common stock, and any return to

investors is expected to come, if at all, only from potential increases in the price of the

Company’s common stock |

Risks

Related to the Company’s Development, Commercialization and Regulatory Approval of the Company’s Investigational Therapies

| ● | The

Company’s business depends on the successful pre-clinical and clinical development,

regulatory approval and commercialization of its recently licensed therapeutic compound,

PALI-2108. |

| | | |

| ● | There

are substantial risks inherent in drug development, and, as a result, the Company may not

be able to successfully develop PALI-2108 for commercial use. |

| | | |

| ● | The

Company depends on its license agreement with Giiant to permit the Company to use patents

and patent applications relating to PALI-2108. Termination of these rights or the failure

to comply with obligations under this agreement could materially harm the Company’s

business and prevent it from developing or commercializing its product candidates. |

| | | |

| ● | The

Company expects that its operations and development of PALI-2108 will require substantially

more capital than it currently has, and the Company cannot guarantee when or if it will be

able to secure such additional funding. |

| | | |

| ● | There

can be no assurance that the Company’s product candidates will obtain regulatory approval. |

| | | |

| ● | If

pre-clinical and clinical studies of PALI-2108 do not yield successful results, then the

Company will be unable to commercialize its product candidates. |

| | | |

| ● | Even

if the Company’s clinical studies are successful and achieve regulatory approval, the

approved product label may be more limited than the Company or analysts anticipate, which

could limit the commercial prospects of PALI-2108. |

| ● | The

Company may in the future conduct clinical trials for PALI-2108 outside the United States,

and the FDA and applicable foreign regulatory authorities may not accept data from such trials. |

| | | |

| ● | The

Company may rely on third-party CROs and other third parties to conduct and oversee its pre-clinical

studies and clinical trials. If these third parties do not meet the Company’s requirements

or otherwise conduct the studies or trials as required, the Company may not be able to satisfy

its contractual obligations or obtain regulatory approval for, or commercialize, its product

candidates. |

| | | |

| ● | The

Company has entered into a collaborative research agreement with Giiant related to pre-clinical

development, which will require the efforts of Giiant and its personnel, which are out of

the Company’s control. |

Risks

Related to the Company’s Business

| ● | The

Company has a very limited operating history and has never generated any revenues from product

sales. |

| | | |

| ● | The

Company’s business model assumes revenue from, among other activities, marketing or

out-licensing the products the Company develops. PALI-2108 is in the early stages of development

and because the Company has a short development history with PALI-2108, there is a limited

amount of information about the Company upon which you can evaluate its business and prospects. |

| | | |

| ● | The

Company has received a delisting notification from the Nasdaq Stock Market based on the Company’s

Bid Price being under $1.00 for thirty (30) consecutive trading days. If the Company is not

able to regain compliance with the applicable continued listing requirements or standards

of The Nasdaq Capital Market, Nasdaq could delist its common stock. |

| | | |

| ● | The

Company’s success depends on the attraction and retention of senior management and

scientists with relevant expertise. |

| | | |

| ● | The

Company may choose to discontinue developing or commercializing any of its product candidates,

or may choose to not commercialize product candidates in approved indications, at any time

during development or after approval, which could adversely affect the Company and its operations. |

| | | |

| ● | The

Company’s inability to successfully in-license, acquire, develop and market additional

product candidates or approved products would impair its ability to grow its business. |

Risks

Related to the Company’s Dependence on Third Parties

| ● | The

Company expects to rely on collaborations with third parties for the successful development

and commercialization of its product candidates. |

| | | |

| ● | The

Company anticipates relying completely on third-party contractors to supply, manufacture

and distribute clinical drug supplies for its product candidates. |

Risks

Related to the Company’s Financial Operations

| ● | The

Company has expressed substantial doubt about its ability to continue as a going concern. |

| | | |

| ● | The

Company has a history of net losses, and it expects to continue to incur net losses and may

not achieve or maintain profitability. |

| | | |

| ● | Failure

to remediate a material weakness in internal controls over financial reporting could result

in material misstatements in the Company’s consolidated financial statements. |

Risks

Related to the Company’s Intellectual Property

| ● | The

Company may not be able to obtain, maintain or enforce global patent rights or other intellectual

property rights that cover its product candidates and technologies that are of sufficient

breadth to prevent third parties from competing against the Company. |

| | | |

| ● | If

the Company fails to comply with its obligations under its intellectual property license

agreements, it could lose license rights that are important to its business. |

Other

Risks Related to the Company’s Securities

| ● | The

Company will need to raise additional financing in the future to fund its operations, which

may not be available to it on favorable terms or at all. |

| | | |

| ● | The

stock price of the Company may be highly volatile. |

| | | |

| ● | If

the Company fails to maintain proper and effective internal controls, its ability to produce

accurate financial statements on a timely basis could be impaired. |

| | | |

| ● | The

Company’s Board of Directors has broad discretion to issue additional securities, which

might dilute the net tangible book value per share of its common stock for existing stockholders. |

RISK

FACTORS

Investing

in the Company’s common stock involves a high degree of risk. The Company has described below a number of uncertainties and risks

which, in addition to uncertainties and risks presented elsewhere in this Prospectus, may adversely affect its business, operating results

and financial condition. This Prospectus does not describe all of those risks. You should carefully consider the risk factors described

in this prospectus under the caption “Risks Related to This Offering and Our Securities” below. The uncertainties and risks

enumerated below as well as those presented elsewhere in this Prospectus should be considered carefully when evaluating the Company,

its business and the value of its securities. To the extent the term “product candidate” or “product candidates”

are used, it refers to the current and potential future products of the Company. To the extent the term “clinical trial”

or “clinical trials” are used, it refers to the extent applicable, to pre-clinical and clinical trials of the Company. On

September 1, 2023, the Company announced that it had entered into the Giiant License Agreement with Giiant for the exclusive worldwide

license to Giiant’s assets. As a result, the Company changed its strategic focus. To the extent that the risk factors contained

herein contradict any risk factors contained in the Company’s recent periodic reports, the risk factors contained herein shall

supersede. The risk factors contained in the Company’s recent periodic reports remain applicable to the Company.

Risks

Related to This Offering and Our Securities

You

will experience immediate and substantial dilution as a result of this offering and may experience additional dilution in the future.

You

will incur immediate and substantial dilution as a result of this offering. After giving effect to the sale by us of the common shares

offered in this offering and after deducting underwriting discounts and commissions and estimated offering expenses payable by us, investors

in this offering can expect an immediate dilution of approximately $ per share. In addition, our outstanding stock options, warrants

and shares of our Series A 4.5% Convertible Preferred Stock are convertible into or exercisable for shares of our common stock. To the extent that such securities are exercised or converted into

shares of our common stock, investors purchasing our securities in this offering may experience further dilution.

Moreover,

we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient

funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible

debt securities, the issuance of these securities could result in further dilution to our stockholders or result in downward pressure

on the price of our common stock. See the section titled “Dilution” for a more detailed discussion of the dilution you will

incur if you purchase common stock in this offering.

Management

will have broad discretion as to the use of the proceeds from this offering and may not use the proceeds effectively.

Our

management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways

that may not improve our results of operations or enhance the value of our common stock. Our failure to apply these funds effectively

could have a material adverse effect on our business and cause the price of our common stock to decline.

The

offering price will be set by the Company’s Board and does not necessarily indicate the actual or market value of the Company’s

common stock.

Our

Board (or a committee thereof) will approve the offering price and other terms of this offering after considering, among other things:

the number of shares authorized in our certificate of incorporation; the current market price of our common stock; trading prices of

our common stock over time; the volatility of our common stock; our current financial condition and the prospects for our future cash

flows; the availability of and likely cost of capital of other potential sources of capital; and market and economic conditions at the

time of the offering. The offering price is not intended to bear any relationship to the book value of our assets or our past operations,

cash flows, losses, financial condition, net worth or any other established criteria used to value securities. The offering price may

not be indicative of the fair value of the common stock.

Future

sales of a significant number of the Company’s shares of common stock in the public markets, or the perception that such sales

could occur, could depress the market price of the Company’s shares of common stock.

Sales

of a substantial number of our shares of common stock in the public markets, or the perception that such sales could occur, including

from the exercise of warrant or sales of common stock issuable thereunder, could depress the market price of our shares of common stock

and impair our ability to raise capital through the sale of additional equity securities. A substantial number of shares of common stock

are being offered by this prospectus. We cannot predict the number of these shares that might be sold nor the effect that future sales

of our shares of common stock, including shares issuable upon the exercise of warrants, would have on the market price of our shares

of common stock.

Terms

of subsequent financings may adversely impact the Company’s stockholders.

To

finance our future business plans and working capital needs, we will have to raise funds through the issuance of equity or debt securities

in addition to this offering. Depending on the type and the terms of any financing we pursue, stockholders’ rights and the value

of their investment in our common stock and warrants could be reduced. A financing could involve one or more types of securities including

common stock, convertible debt or warrants to acquire common stock. These securities could be issued at or below the then prevailing

market price for our common stock. In addition, if we issue secured debt securities, the holders of the debt would have a claim to our

assets that would be senior to the rights of stockholders until the debt is paid. Interest on these debt securities would increase costs

and negatively impact operating results. If the issuance of new securities results in diminished rights to holders of our common stock,

the market price of our common stock and the value of the warrants could be negatively impacted.

The

Company does not currently intend to pay dividends on the Company’s common stock, and any return to investors is expected to come,

if at all, only from potential increases in the price of the Company’s common stock.

At

the present time, we intend to use available funds to finance our operations. Accordingly, while payment of dividends rests within the

discretion of our Board, we have no intention of paying any such dividends in the foreseeable future. Any return to investors is expected

to come, if at all, only from potential increases in the price of our common stock.

Risks

Related to the Company’s Development, Commercialization and Regulatory Approval of the Company’s Investigational Therapies

The

Company’s business depends on the successful pre-clinical and clinical development, regulatory approval, and commercialization

of its recently licensed therapeutic compound, PALI-2108.

On

September 1, 2023, the Company announced that it had entered into a research collaboration and license agreement with Giiant, pursuant

to which the Company licensed all of Giiant’s current and future technologies, including PALI-2108. PALI-2108 is a pre-clinical

asset and the Company’s only asset being actively developed. The success of the Company depends on the development PALI-2108 which

is subject to a number of risks, including:

| ● | the

continued enforceability of the Company’s research collaboration and license

agreement with Giiant; |

| | | |

| ● | the

successful completion of pre-clinical and Individual New Drug Application (“IND”)

or Canadian Clinical Trial Application (“CTA”) enabling studies and research;

|

| | | |

| ● | the

submission and approval of an IND or CTA; |

| | | |

| ● | the

Company’s ability to develop clinical trial designs and protocols; |

| | | |

| ● | the

successful initiation and completion of its planned pre-clinical and clinical trials; |

| | | |

| ● | the

approval by the U.S. Food and Drug Administration (“FDA”) or other regulatory

authority to commence the marketing of the Company’s product candidates; |

| | | |

| ● | the

Company and its third-party contractors, if applicable, achieving and maintaining compliance

with their contractual obligations and with applicable regulatory requirements; |

| | | |

| ● | the

ability of the Company’s contract manufacturers to manufacture sufficient supply of

the Company’s product candidates to meet the required clinical trial and commercial

supplies; |

| | | |

| ● | the

ability of the Company’s contract manufacturers to remain in good standing with regulatory

agencies and to develop, validate and maintain commercially viable manufacturing facilities

and processes that are compliant with cGMP; |

| | | |

| ● | the

Company’s ability to obtain favorable labeling for its product candidates through regulators

that allows for successful commercialization; |

| ● | acceptance

by physicians, insurers and payors, and patients of the quality, benefits, safety and efficacy

of the Company’s product candidates, if approved, including relative to alternative

and competing treatments; |

| | | |

| ● | the

Company’s ability to price its product candidates to recover the Company’s development

costs and applicable milestone or royalty payments, and generate a satisfactory profit margin;

and |

| | | |

| ● | the

Company’s ability and its applicable collaboration and licensing partners’ ability

to establish and enforce intellectual property rights related to the product candidates and

technologies. |

If

the Company does not achieve one or more of these factors, many of which are beyond its control, in a timely manner or at all, the Company

could experience significant delays or an inability to obtain regulatory approvals or commercialize its proposed product candidate. Such

delays may result in increased costs and the failure to complete any required regulatory activity. Even if regulatory approvals are obtained,

the Company may never be able to successfully commercialize its product candidates. Accordingly, the Company cannot make assurances that

it will ever be able to generate sufficient revenue through the sale of any product candidates, if approved, to internally fund its business.

There

are substantial risks inherent in drug development, and, as a result, the Company may not be able to successfully develop PALI-2108 for

commercial use.

The

Company’s research and development efforts are focused on a therapeutic based on PDE4 inhibitors. The Company’s development

of PALI-2108 is in the early stages. However, such technology’s commercial feasibility and acceptance in the Company’s target

indication of inflammatory bowel disease (“IBD”) are unknown. Scientific research and development requires significant amounts

of capital and takes a long time to reach commercial viability, if it can be achieved at all. During the research and development process,

the Company may experience technological barriers that it may be unable to overcome. Further, certain underlying premises in the Company’s

development programs are not proven. Because of these and similar uncertainties, it is possible that the Company’s product candidates

will not reach commercialization. If the Company is unable to successfully develop and commercialize its product candidates, the Company

will be unable to generate revenue or build a sustainable or profitable business.

The

Company depends on its license agreement with Giiant to permit the Company to use patents and patent applications relating to PALI-2108.

Termination of these rights or the failure to comply with obligations under this agreement could materially harm the Company’s

business and prevent it from developing or commercializing its product candidates.

The

Company is a party to a license agreement with Giiant under which the Company is granted rights to patents and patent applications that

are important to its business. The Company relies on this license agreement in order to be able to use various proprietary technologies

that are material to its business, including certain patents and patent applications that cover PALI-2108. The Company’s rights

to use these patents and patent applications and employ the inventions claimed in these licensed patents are subject to the continuation

of and its compliance with the terms of its license agreement. If the Company fails to comply with any of its obligations under the license

agreement with Giiant, Giiant may have the right to terminate the license agreement, in which event the Company would not be able to

continue the development of PALI-2108. Additionally, disputes may arise under the license agreement regarding the intellectual property

that is subject to such license agreement. If disputes over intellectual property that the Company has licensed or in the future licenses,

prevent or impair its ability to maintain any of its license agreements on acceptable terms, the Company may be unable to successfully

develop and commercialize the affected product candidates and technologies.

Pre-clinical

and clinical drug development is very expensive, time-consuming and uncertain.

The

pre-clinical and clinical development of product candidates is very expensive, time-consuming, difficult to design and implement, and

the outcomes are inherently uncertain. Most product candidates that commence clinical trials are never approved by regulatory authorities

for commercialization and of those that are approved, many do not cover their costs of development. In addition, the Company, any partner

with which it may in the future collaborate, the FDA, or other regulatory authorities, including state and local agencies and counterpart

agencies in foreign countries, or institutional review boards (“IRB”) at the Company’s trial sites, may suspend, delay,

require modifications to or terminate the Company’s clinical trials, once begun, at any time.

The

Company expects that its operations and development of PALI-2108 will require substantially more capital than it currently has, and the

Company cannot guarantee when or if it will be able to secure such additional funding.

The

Company has historically funded its operations and prior development efforts through the sale of its securities. Based on the Company’s

existing cash resources and its current or future plan of operations, the Company may not have adequate capital to complete its anticipated

pre-clinical or clinical development or fund operations. Moreover, the Company cannot guarantee that its cash resources are sufficient

to provide for the Company’s working capital needs and complete any anticipated pre-clinical and clinical research and studies.

As a result, the Company may need to secure additional financing. If the Company is not able to obtain financing in the future or on

acceptable terms, it may have to curtail its research and development efforts as well as its operations.

There

can be no assurance that the Company’s product candidates will obtain regulatory approval.

The

sale of human therapeutic products in the U.S. and foreign jurisdictions is subject to extensive and time-consuming regulatory approval

which requires, among other things:

| ● | pre-clinical

data required for the submission of an IND or CTA; |

| | | |

| ● | controlled

research and human clinical testing; |

| | | |

| ● | establishment

of the safety and efficacy of the product; |

| | | |

| ● | government

review and approval of a submission containing manufacturing, pre-clinical and clinical data;

and |

| | | |

| ● | adherence

to cGMP regulations during production and storage. |

The

proposed product candidate the Company currently has under development, PALI-2108, will require significant development, pre-clinical

and clinical testing and the investment of significant funds to gain regulatory approval before it can be commercialized. The results

of the Company’s research and human clinical testing of PALI-2108 may not meet regulatory requirements. If approved, PALI-2108

may also require the completion of post-market studies. There can be no assurance that PALI-2108 will be successfully developed and approved.

The process of completing pre-clinical and clinical testing and obtaining required approvals is expected to take a number of years and

require the use of substantial resources. Further, there can be no assurance that PALI-2108 will be shown to be safe and effective in

clinical trials or receive applicable regulatory approvals. If the Company fails to obtain regulatory approvals, it will not be able

to market PALI-2108 and its operations may be adversely affected.

If

pre-clinical and clinical studies of PALI-2108 do not yield successful results, then the Company will be unable to commercialize its

product candidates.

The

Company must demonstrate that PALI-2108 is safe and efficacious in humans through extensive pre-clinical and clinical testing. The Company’s

research and development programs are at an early stage of development. The Company may experience numerous unforeseen events during,

or as a result of, the testing process that could delay or prevent commercialization of any products, including the following:

| ● | the

results of pre-clinical studies may be inconclusive, or they may not be indicative of results

that will be obtained in human clinical trials; |

| | | |

| ● | safety

and efficacy results attained in early human clinical trials, if approved, may not be indicative

of results that are obtained in later clinical trials; |

| | | |

| ● | after

reviewing test results, the Company may abandon projects that it previously believed to be

promising; |

| | | |

| ● | the

Company or its regulators may suspend or terminate clinical trials because the participating

subjects or patients are being exposed to unacceptable health risks; and |

| | | |

| ● | PALI-2108

may not have the desired effects or may include undesirable side effects or other characteristics

that preclude regulatory approval or limit their commercial use if approved. |

It

may take the Company longer than it projects to complete pre-clinical studies and clinical trials, and the Company may not be able to

complete them at all.

Although

for planning purposes the Company projects the commencement, continuation and completion of its pre-clinical studies and clinical trials;

a number of factors, including scheduling conflicts with participating researchers and/or clinicians and research or clinical institutions,

and difficulties in identifying or enrolling patients who meet trial eligibility criteria, may cause significant delays. The Company

may not commence or complete pre-clinical studies or clinical trials involving PALI-2108 as projected or may not conduct them successfully.

Even

if the Company’s clinical studies are successful and achieve regulatory approval, the approved product label may be more limited

than the Company or analysts anticipate, which could limit the commercial prospects of PALI-2108.

At

the time therapeutic drugs are approved for marketing, they are given a “product label” from the FDA or other regulatory

body. In most countries this label sets forth the approved indication for marketing, and identifies potential safety concerns for prescribing

physicians and patients. While the Company intends to seek as broad a product label as possible for PALI-2108, the Company may receive

a narrower label than is expected by either the Company or third parties, such as stockholders and securities analysts. For example,

any approved products may only be indicated to treat refractory patients (i.e., those who have failed some other first-line therapy).

Similarly, it is possible that only a specific sub-set of patients safely responds to PALI-2108. As a result, even if successful in clinical

trials, PALI-2108 could be approved only for a subset of patients. Additionally, safety considerations may result in contraindications

that could further limit the scope of an approved product label. Any of these or other safety and efficacy considerations could limit

the commercial prospects, including market size, of PALI-2108.

Even

if PALI-2108 is approved for commercialization, future regulatory reviews or inspections may result in its suspension or withdrawal,

closure of a facility or enforcement of substantial fines.

If

regulatory approval to sell PALI-2108 is received, regulatory agencies will subject PALI-2108, as well as the manufacturing facilities,

to continual review and periodic inspection. If previously unknown problems with a product or manufacturing and laboratory facility are

discovered, or the Company fails to comply with applicable regulatory approval requirements, a regulatory agency may impose restrictions

on PALI-2108 or the Company. The agency may require the withdrawal of PALI-2108 from the market, closure of the facility or enforcement

of substantial fines.

The

Company may in the future conduct clinical trials for PALI-2108 outside the United States, and the FDA and applicable foreign regulatory

authorities may not accept data from such trials.

The

Company may in the future choose to conduct clinical trials outside of the U.S. Although the FDA or applicable foreign regulatory authority

may accept data from clinical trials conducted outside the U.S. or the applicable jurisdiction, acceptance of such study data by the

FDA or applicable foreign regulatory authority may be subject to certain conditions or exclusion. Where data from foreign clinical trials

are intended to serve as the basis for marketing approval in the United States, the FDA will not approve the application on the basis

of foreign data alone unless such data are applicable to the U.S. population and U.S. medical practice; the studies were performed by

clinical investigators of recognized competence; and the data are considered valid without the need for an on-site inspection by the

FDA or, if the FDA considers such an inspection to be necessary, the FDA is able to validate the data through an on-site inspection or

other appropriate means. Many foreign regulatory bodies have similar requirements. In addition, such foreign studies would be subject

to the applicable local laws of the foreign jurisdictions where the studies are conducted. There can be no assurance the FDA or applicable

foreign regulatory authority will accept data from trials conducted outside of the United States or the applicable home country. If the

FDA or applicable foreign regulatory authority does not accept such data, it would likely result in the need for additional trials, which

would be costly and time-consuming and delay aspects of the Company’s business plan.

The

Company may rely on third-party CROs and other third parties to conduct and oversee its pre-clinical studies and clinical trials. If

these third parties do not meet the Company’s requirements or otherwise conduct the studies or trials as required, the Company

may not be able to satisfy its contractual obligations or obtain regulatory approval for, or commercialize, its product candidates.

The

Company may rely on third-party CROs to conduct and oversee its anticipated pre-clinical studies and clinical trials and other aspects

of product development. The Company also expects to rely on various medical institutions, clinical investigators and contract laboratories

to conduct its trials in accordance with the Company’s clinical protocols and all applicable regulatory requirements, including

the FDA’s regulations and good clinical practice (“GCP”) requirements, which are an international standard meant to

protect the rights and health of patients and to define the roles of clinical trial sponsors, administrators and monitors, and state

regulations governing the handling, storage, security and recordkeeping for drug and biologic products. These CROs and other third parties

are expected to play a significant role in the conduct of these trials and the subsequent collection and analysis of data from the clinical

trials. The Company expects to rely heavily on these parties for the execution of its clinical trials and pre-clinical studies and will

control only certain aspects of their activities. The Company and its CROs and other third-party contractors will be required to comply

with GCP and good laboratory practice (“GLP”) requirements, which are regulations and guidelines enforced by the FDA and

comparable foreign regulatory authorities. Regulatory authorities enforce these GCP and GLP requirements through periodic inspections

of trial sponsors, principal investigators and trial sites. If the Company or any of these third parties fail to comply with applicable

GCP and GLP requirements, or reveal noncompliance from an audit or inspection, any clinical data generated in the Company’s clinical

trials may be deemed unreliable and the FDA or other regulatory authorities may require the Company to perform additional clinical trials

before approving the Company’s or the Company’s partners’ marketing applications. The Company cannot assure that upon

inspection by a given regulatory authority, such regulatory authority will determine whether or not any of the Company’s clinical

or pre-clinical trials comply with applicable GCP and GLP requirements. In addition, the Company’s clinical trials generally must

be conducted with compounds produced under cGMP regulations. The Company’s failure to comply with these regulations and policies

may require it to repeat clinical trials, which would be costly and delay the regulatory approval process. If any of the Company’s

CROs were to terminate their involvement with the Company, there is no assurance that the Company would be able to enter into arrangements

with alternative CROs or do so on commercially reasonable terms.

The

successful commercialization of PALI-2108, if approved, will depend in part on the extent to which government authorities and health

insurers establish adequate reimbursement levels and pricing policies.

Sales

of any approved drug candidate will depend in part on the availability of coverage and reimbursement from third-party payers such as

government insurance programs, including Medicare and Medicaid, private health insurers, health maintenance organizations and other health

care related organizations, who are increasingly challenging the price of medical products and services. Accordingly, coverage and reimbursement

may be uncertain. Adoption of any drug by the medical community may be limited if third-party payers will not offer coverage. Additionally,

significant uncertainty exists as to the reimbursement status of newly approved drugs. Cost control initiatives may decrease coverage

and payment levels for any drug and, in turn, the price that we will be able to charge and/or the volume of our sales. The Company is

unable to predict all changes to the coverage or reimbursement methodologies that will be applied by private or government payers. Any

denial of private or government payer coverage or inadequate reimbursement could harm the Company’s business or future revenues,

if any. If the Company partners with third parties with respect to any of its product candidates, the Company may be reliant on that

partner to obtain reimbursement from government and private payors for the drug, if approved, and any failure of that partner to establish

adequate reimbursement could have a negative impact on the Company’s revenues and profitability.

In

addition, both the federal and state governments in the United States and foreign governments continue to propose and pass new legislation,

regulations, and policies affecting coverage and reimbursement rates, which are designed to contain or reduce the cost of health care.

Further federal and state proposals and healthcare reforms are likely, which could limit the prices that can be charged for the product

candidates that the Company develops and may further limit the Company’s commercial opportunity. There may be future changes that

result in reductions in potential coverage and reimbursement levels for the Company’s product candidates, if approved and commercialized,

and the Company cannot predict the scope of any future changes or the impact that those changes would have on its operations.

If

future reimbursement for PALI-2108, subject to approval, are substantially less than projected, or rebate obligations associated with

them are substantially greater than expected, the Company’s future net revenue and profitability, if any, could be materially diminished.

The

Company faces potential product liability exposure, and if successful claims are brought against the Company, it may incur substantial

liability for a product candidate and may have to limit its commercialization.

The

use of the Company’s product candidates in clinical trials and the sale of any products for which the Company obtains marketing

approval exposes it to the risk of product liability claims. Product liability claims might be brought against the Company by clinical

trial participants, consumers, health-care providers, pharmaceutical companies, or others selling the Company’s products. If the

Company cannot successfully defend itself against these claims, it may incur substantial liabilities. Regardless of merit or eventual

outcomes of such claims, product liability claims may result in:

| ● | decreased

demand for the Company’s product candidates; |

| | | |

| ● | impairment

of the Company’s business reputation; |

| | | |

| ● | withdrawal

of clinical trial participants; |

| | | |

| ● | costs

of litigation; |

| | | |

| ● | substantial

monetary awards to patients or other claimants; and |

| | | |

| ● | loss

of revenues. |

The

Company’s insurance coverage may not be sufficient to reimburse it for all expenses or losses it may suffer. Moreover, insurance

coverage is becoming increasingly expensive and, in the future, the Company may not be able to maintain insurance coverage at a reasonable

cost or in sufficient amounts to protect it against losses.

Even

if a product candidate obtains regulatory approval, it may fail to achieve the broad degree of physician and patient adoption and use

necessary for commercial success.

The

commercial success of the Company’s product candidates, if approved, will depend significantly on attaining broad adoption and

use of the drug by physicians and patients. The degree and rate of physician and patient adoption of a product, if approved, will depend

on a number of factors, including but not limited to:

| ● | patient

demand for approved products that treat the indication for which they are approved; |

| | | |

| ● | the

effectiveness of a product compared to other available therapies or treatment regimens; |

| | | |

| ● | the

availability of coverage and adequate reimbursement from managed care plans and other healthcare

payors; |

| | | |

| ● | the

cost of treatment in relation to alternative treatments and willingness to pay on the part

of patients; |

| | | |

| ● | insurers’

willingness to see the applicable indication as a disease worth treating; |

| | | |

| ● | proper

administration by physicians or patients; |

| | | |

| ● | patient

satisfaction with the results, administration and overall treatment experience; |

| ● | limitations

or contraindications, warnings, precautions or approved indications for use different than

those sought by the Company that are contained in the final FDA-approved labeling, or other

authoritative regulatory body approved labeling, for the applicable product; |

| | | |

| ● | any

FDA requirement, or other authoritative regulatory body requirement, to undertake a risk

evaluation and mitigation strategy; |

| | | |

| ● | the

effectiveness of the Company’s sales, marketing, pricing, reimbursement and access,

government affairs, and distribution efforts; |

| | | |

| ● | adverse

publicity about a product or favorable publicity about competitive products; |

| | | |

| ● | new

government regulations and programs, including price controls and/or limits or prohibitions

on ways to commercialize drugs, such as increased scrutiny on direct-to-consumer advertising

of pharmaceuticals; and |

| | | |

| ● | potential

product liability claims or other product-related litigation. |

If

any of the Company’s product candidates are approved for use but fail to achieve the broad degree of physician and patient adoption

necessary for commercial success, the Company’s operating results and financial condition will be adversely affected, which may

delay, prevent or limit its ability to generate revenue and continue its business.

The

Company has entered into a collaborative research agreement with Giiant related to pre-clinical development, which will require the efforts

of Giiant and its personnel, which are out of the Company’s control.

The

license agreement with Giiant provides for certain joint research and development of PALI-2108 related to pre-clinical studies and development.

The Company’s business strategy relies on such collaboration to shorten the time required to file and IND and accelerate the knowledge

transfer of trade secrets and other know-how associated with the licensed technologies. Overall, the success of the development PALI-2108

will depend on the Company’s ability to manage such relationship, and to a certain extent, to the efforts of Giiant, which are

beyond the Company’s control.

Risks

Related to the Company’s Business

The

Company has a very limited operating history and has never generated any revenues from product sales.

The

Company is a biopharmaceutical company with a very limited operating history that may make it difficult to evaluate the success of its

business to date and to assess its future viability. The Company was initially formed in 2001 and its operations, to date, have been

limited to business planning, raising capital and other research and development activities related to its product candidates. The Company

has not yet demonstrated an ability to successfully complete any clinical trials and has never completed the development of any product

candidate, nor has it ever generated any revenue from product sales or otherwise. Consequently, the Company has no meaningful operations

upon which to evaluate its business, and predictions about its future success or viability may not be as accurate as they could be if

it had a longer operating history or a history of successfully developing and commercializing biopharmaceutical products.

The

Company’s business model assumes revenue from, among other activities, marketing or out-licensing the products the Company develops.

PALI-2108 is in the early stages of development and because the Company has a short development history with PALI-2108, there is a limited

amount of information about the Company upon which you can evaluate its business and prospects.

The

Company has no approved drugs and thus have not begun to market or generate revenues from the commercialization of any products. The

Company recently in-licensed PALI-2108 and accordingly, has only a limited history upon which one can evaluate its ability to develop

PALI-2108 as it is still at an early stage of development. Thus, the Company has limited experience and has not yet demonstrated an ability

to successfully overcome many of the risks and uncertainties frequently encountered by companies in new and rapidly evolving fields,

particularly in the biopharmaceutical area. For example, to execute the Company’s business plan, it will need to successfully:

| ● | Execute

product development activities using unproven technologies; |

| | | |

| ● | Build,

maintain, and protect a strong intellectual property portfolio; |

| | | |

| ● | Demonstrate

safety and efficacy of the Company’s drug candidates in multiple human clinical studies; |

| | | |

| ● | Receive

FDA approval and approval from similar foreign regulatory bodies; |

| | | |

| ● | Gain

market acceptance for the development and commercialization of any drugs the Company develops; |

| | | |

| ● | Ensure

the Company’s products are reimbursed by commercial and/or government payors at a rate

that permits commercial viability; |

| | | |

| ● | Develop

and maintain successful strategic relationships with suppliers, distributors, and commercial

licensing partners; |

| | | |

| ● | Manage

the Company’s spending and cash requirements as its expenses will increase in the near

term if the Company adds programs and additional pre-clinical and clinical trials; and |

| | | |

| ● | Effectively

market any products for which the Company obtains marketing approval. |

If

the company is unsuccessful in accomplishing these objectives, it may not be able to develop products, raise capital, expand its business

or continue its operations.

The

Company has received a delisting notification from the Nasdaq Stock Market based on the Company’s Bid Price being under $1.00 for

thirty (30) consecutive trading days. If the Company is not able to regain compliance with the applicable continued listing requirements

or standards of The Nasdaq Capital Market, Nasdaq could delist its common stock.

The

Company’s ability to publicly or privately sell equity securities and the liquidity of its common stock could be adversely affected

if is delisted from the Nasdaq Capital Market or if it is unable to transfer its listing to another stock market. In order to maintain

this listing, it must satisfy minimum financial and other continued listing requirements and standards, including a requirement to maintain

a minimum bid price of the Company’s common stock of $1.00 per share (“Minimum Bid Price Requirement”). On October

19, 2023, the Company received notice (the “Notice”) from the Nasdaq Stock Market LLC (“Nasdaq”) advising the

Company that for 30 consecutive trading days preceding the date of the Notice, the bid price of the Company’s common stock had

closed below the $1.00 per share minimum required for continued listing on the Nasdaq Capital Market pursuant to Nasdaq Listing Rule

5550(a)(2). Under Nasdaq Listing Rule 5810(c)(3)(A), the Company has until April 16, 2024 to regain compliance with the Minimum Bid Price

Requirement. If at any time during this period the closing bid price of the Company’s common stock is at least $1.00 for a minimum

of 10 consecutive business days, the Company will regain compliance with the Minimum Bid Price Requirement and its common stock will

continue to be eligible for listing on The Nasdaq Capital Market absent noncompliance with any other requirement for continued listing.

In the event that the Company does not regain compliance by April 16, 2024, the Company may be eligible for an additional 180 calendar

day grace period if the Company meets the continued listing requirement for market value of publicly held shares and all other initial

listing standards for the Nasdaq Capital Market with the exception of bid price, and the Company provides written notice to Nasdaq of

its intention to cure the deficiency during the second compliance period, by effecting a reverse stock split, if necessary.

If

the Company does not regain compliance within the allotted compliance period, including any extensions that may be granted by Nasdaq,

Nasdaq will provide notice that the Company’s common stock will be subject to delisting. The Company will then be entitled to appeal

the determination to a Nasdaq Listing Qualifications Panel and request a hearing. The Company cannot be sure that its share price will

comply with the requirements for continued listing of its shares on the Nasdaq Capital Market in the future or that it will comply with

the other continued listing requirements.

Notwithstanding,

the Company cannot assure you that, in the future, its securities will meet the continued listing requirements to be listed on Nasdaq.

If the Company’s common stock is delisted by Nasdaq, it could lead to a number of negative implications, including an adverse effect

on the price of its common stock, increased volatility in its common stock, reduced liquidity in its common stock, a limited availability

of market quotations for the Company’s common stock, the loss of federal preemption of state securities laws and greater difficulty

in obtaining financing. In addition, delisting of the Company’s common stock could deter broker-dealers from making a market in

or otherwise seeking or generating interest in its common stock, could result in a loss of current or future coverage by certain sell-side

analysts and might deter certain institutions and persons from investing in the Company’s securities at all. Delisting could also

cause a loss of confidence from the Company’s collaborators, vendors, suppliers and employees, which could harm its business and

future prospects.

If

the Company’s common stock is delisted by Nasdaq, its common stock may be eligible to trade on the OTC Bulletin Board, OTCQB or

another over-the-counter market. Any such alternative would likely result in it being more difficult for us to raise additional capital

through the public or private sale of equity securities and for investors to dispose of or obtain accurate quotations as to the market