UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of May 2024

Commission File Number: 001-40875

NUVEI CORPORATION

(Exact name of registrant as specified in its charter)

1100 René-Lévesque Boulevard

West, Suite 900

Montreal, Quebec H3B 4N4

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F ☐

Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Nuvei Corporation |

| |

|

|

| Date: May 14, 2024 |

By: |

/s/ Lindsay Matthews |

| |

|

Name: |

Lindsay Matthews |

| |

|

Title: |

General Counsel |

Exhibit 99.1

Nuvei Announces

Filing of Management Proxy Circular and Receipt of Interim Order in Relation to Go-Private Arrangement

| · | Shareholders stand to receive a significant and attractive cash premium, as the purchase price of US$34.00 per share represents

a 56% premium to the closing price of Subordinate Voting Shares on the last trading day before media reports regarding a potential transaction

involving Nuvei |

| · | Board recommends shareholders vote “FOR” the Arrangement |

| · | Shareholders are encouraged to review the proxy circular carefully and to submit

their proxies in advance of the June 14, 2024 at 10:00 a.m. (Eastern time) deadline |

| · | For more information go to www.NuveiPOA.com |

MONTREAL, May 14, 2024 -- Nuvei Corporation ("Nuvei"

or the "Company") (Nasdaq: NVEI) (TSX: NVEI), announced today that it has filed and is in the process of mailing a letter and

management proxy circular (the “Circular”) to shareholders in connection with its previously announced transaction to be taken

private by Advent International ("Advent").

The special meeting of shareholders (the “Meeting”) has

been called for shareholders of Nuvei to consider, and, if deemed advisable, to pass, with or without variation, a special resolution

(the “Arrangement Resolution”) approving a statutory plan of arrangement (the “Arrangement”) involving the Company

and Neon Maple Purchaser Inc. (the “Purchaser”), a newly-formed entity controlled by Advent, pursuant to the provisions of

the Canada Business Corporations Act. Pursuant to the Arrangement, the Purchaser will acquire all the issued and outstanding subordinate

voting shares (“Subordinate Voting Shares”) and multiple voting shares (“Multiple Voting Shares” and collectively

with the Subordinate Voting Shares, the “Shares”) of the Company that are not held by Philip Fayer, certain investment funds

managed by Novacap Management Inc. (collectively, "Novacap") and Caisse de dépôt et placement du Québec

(“CDPQ” and, collectively with Philip Fayer and Novacap and the entities they control directly or indirectly, the “Rollover

Shareholders”) [i]

for a price of US$34.00 cash per Share (the “Consideration”).

The Company also announced today that the Superior Court of Québec

(Commercial Division) (the "Court") has granted an interim order (the “Interim Order”) in connection with the Arrangement,

authorizing the calling and holding of the Meeting and other matters relating to the conduct of the Meeting.

Board Recommends Shareholders Vote FOR the Arrangement

The board of directors of the Company (the “Board”) has

unanimously concluded (with interested directors abstaining from voting) that the Arrangement is in the best interests of the Company

and its shareholders and recommends that shareholders vote FOR the Arrangement Resolution. This recommendation follows the unanimous recommendation

of a special committee of the Board which is comprised solely of independent directors and was formed in connection with the transaction

(the "Special Committee"), to the effect that the Arrangement and the entering into of the Arrangement Agreement is in the best

interests of the Company and the Arrangement is fair to Shareholders (other than the Rollover Shareholders). The Special Committee was

advised by independent legal counsel and retained TD Securities Inc. ("TD") as financial advisor and independent valuator.

Reasons to vote FOR the Arrangement include:

| · | Attractive Premium. The Consideration represents a significant and attractive premium of approximately 56% to the closing price

of the Subordinate Voting Shares on the Nasdaq on March 15, 2024, the last trading day prior to media reports regarding a potential transaction

involving the Company, and a premium of approximately 48% to the 90-day volume weighted average trading price[ii]

per Subordinate Voting Share as of such date. |

| · | Maximum Consideration. The Special Committee concluded, after extensive negotiations, that the Consideration, which represents

an increase of approximately 42% from the consideration initially proposed by Advent, was the highest price that could be obtained from

Advent and that further negotiation may have caused Advent to withdraw its proposal. |

| · | Consideration within the Valuation Range. The Consideration is within the range of the fair market value of the Shares as determined

by TD Securities in its formal valuation. |

| · | Form of Consideration. The cash consideration provides certainty of value and immediate liquidity. |

In the event that the Arrangement is not completed, the trading price

of the Subordinate Voting Shares could decline significantly to levels at or below those experienced before the dissemination of media

reports on March 16, 2024 regarding a potential transaction involving the Company.

Meeting Information and Circular

Shareholders should review the Circular, which describes, among other

things, the background to the Arrangement as well as the reasons for the determinations and recommendations of the Special Committee and

the Board. The Circular contains a detailed description of the Arrangement and includes additional information to assist in considering

how to vote at the Meeting. Shareholders are urged to read this information carefully and, if they require assistance, are urged to consult

their financial, legal, tax or other professional advisors.

To be effective, the Arrangement must be approved by the Arrangement

Resolution, the full text of which is outlined in Appendix A of the Circular, passed by: (i) at least 66 2/3% of the votes cast by the

holders of Multiple Voting Shares and Subordinate Voting Shares virtually present or represented by proxy at the Meeting, voting together

as a single class (with each Subordinate Voting Share being entitled to one vote and each Multiple Voting Share being entitled to ten

votes); (ii) not less than a simple majority of the votes cast by holders of Multiple Voting Shares virtually present or represented by

proxy at the Meeting; (iii) not less than a simple majority of the votes cast by holders of Subordinate Voting Shares virtually present

or represented by proxy at the Meeting; (iv) not less than a simple majority of the votes cast by holders of Subordinate Voting Shares

virtually present or represented by proxy at the Meeting (excluding the Subordinate Voting Shares held by the Rollover Shareholders and

the persons required to be excluded pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special

Transactions (“MI 61-101”)); and (v) not less than a simple majority of the votes cast by holders of Multiple Voting Shares

virtually present or represented by proxy at the Meeting (excluding the Multiple Voting Shares held by the Rollover Shareholders and the

persons required to be excluded pursuant to MI 61-101). In the Interim Order, the Court declared that the vote set out in clause (v) of

the preceding sentence is satisfied as there are no holders of Multiple Voting Shares who are eligible to cast a vote thereunder, as all

holders of Multiple Voting Shares are “interested parties” within the meaning of MI 61-101 and must be excluded from such

vote.

The Meeting is scheduled to be held on June 18, 2024 at 10:00 a.m. (Eastern

time), in a virtual format at the following link: https://web.lumiagm.com/432819058. The record date for determining shareholders entitled

to receive notice of and vote at the Meeting has been fixed as the close of business on May 9, 2024.

The Plan of Arrangement and a copy of the Arrangement Agreement are

available under Nuvei’s profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. Copies of the Circular and the Schedule

13E-3 required pursuant to the Rules under the U.S. Securities and Exchange Act of 1934, as amended, will also be available under Nuvei’s

profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

Vote Today FOR the Arrangement Resolution

Your vote is important regardless of the number of Shares you own.

If you are unable to be virtually present at the Meeting, we encourage you to submit your proxy or voting instruction form, so that your

Shares can be voted at the Meeting in accordance with your instructions. To be counted at the Meeting, votes must be received by Nuvei’s

transfer agent, TSX Trust Company, no later than 10:00 a.m. (Eastern time) on June 14, 2024, or, if the Meeting is adjourned or postponed,

at least 48 hours (excluding Saturdays and holidays) prior to the commencement of the reconvened Meeting.

Shareholder Questions and Assistance

The Company has retained Kingsdale Advisors to provide a broad array

of strategic advisory, governance, strategic communications, digital and investor campaign services.

If you have any questions or require more information with respect to

the procedures for voting, please contact Kingsdale Advisors, our strategic advisor by telephone at 1 (888) 327-0819 (toll-free in North

America) or at (416) 623-4173 (outside of North America), or by email at contactus@kingsdaleadvisors.com

About Nuvei

Nuvei (Nasdaq: NVEI) (TSX: NVEI) is the Canadian fintech company

accelerating the business of clients around the world. Nuvei's modular, flexible and scalable technology allows leading companies

to accept next-gen payments, offer all payout options and benefit from card issuing, banking, risk and fraud management services.

Connecting businesses to their customers in more than 200 markets, with local acquiring in 50 markets, 150 currencies and 700 alternative

payment methods, Nuvei provides the technology and insights for customers and partners to succeed locally and globally with

one integration.

Forward-Looking Information

This press release contains "forward-looking information"

and "forward-looking statements" (collectively, "Forward-looking information") within the meaning of applicable securities

laws. This forward-looking information is identified by the use of terms and phrases such as "may", "would", "should",

"could", "expect", "intend", "estimate", "anticipate", "plan", "foresee",

"believe", or "continue", the negative of these terms and similar terminology, including references to assumptions,

although not all forward-looking information contains these terms and phrases. Particularly, statements regarding the proposed transaction,

including the proposed timing and various steps contemplated in respect of the transaction and statements regarding the plans, objectives,

and intentions of Mr. Philip Fayer, Novacap, CDPQ or Advent are forward-looking information.

In addition, any statements that refer to expectations, intentions,

projections or other characterizations of future events or circumstances contain forward-looking information. Statements containing forward-looking

information are not historical facts but instead represent management's expectations, estimates and projections regarding future events

or circumstances.

Forward-looking information is based on management's beliefs and assumptions

and on information currently available to management, and although the forward-looking information contained herein is based upon what

we believe are reasonable assumptions, investors are cautioned against placing undue reliance on this information since actual results

may vary from the forward-looking information.

Forward-looking information involves known and unknown risks and uncertainties,

many of which are beyond our control, that could cause actual results to differ materially from those that are disclosed in or implied

by such forward-looking information. These risks and uncertainties include, but are not limited to, the risk factors described in greater

detail under "Risk Factors" of the Company's annual information form filed on March 5, 2024. These risks and uncertainties

further include (but are not limited to) as concerns the

transaction, the failure of the parties to obtain the necessary shareholder,

regulatory and court approvals or to otherwise satisfy the conditions to the completion of the transaction, failure of the parties to

obtain such approvals or satisfy such conditions in a timely manner, significant transaction costs or unknown liabilities, failure to

realize the expected benefits of the transaction, and general economic conditions. Failure to obtain the necessary shareholder, regulatory

and court approvals, or the failure of the parties to otherwise satisfy the conditions to the completion of the transaction or to complete

the transaction, may result in the transaction not being completed on the proposed terms, or at all. In addition, if the transaction is

not completed, and the Company continues as a publicly-traded entity, there are risks that the announcement of the proposed transaction

and the dedication of substantial resources of the Company to the completion of the transaction could have an impact on its business and

strategic relationships (including with future and prospective employees, customers, suppliers and partners), operating results and activities

in general, and could have a material adverse effect on its current and future operations, financial condition and prospects. Furthermore,

in certain circumstances, the Company may be required to pay a termination fee pursuant to the terms of the Arrangement Agreement which

could have a material adverse effect on its financial position and results of operations and its ability to fund growth prospects and

current operations.

Consequently, all of the forward-looking information contained herein

is qualified by the foregoing cautionary statements, and there can be no guarantee that the results or developments that we anticipate

will be realized or, even if substantially realized, that they will have the expected consequences or effects on our business, financial

condition or results of operation. Unless otherwise noted or the context otherwise indicates, the forward-looking information contained

herein represents our expectations as of the date hereof or as of the date it is otherwise stated to be made, as applicable, and is subject

to change after such date. However, we disclaim any intention or obligation or undertaking to update or amend such forward-looking information

whether as a result of new information, future events or otherwise, except as may be required by applicable law.

For further information, please contact:

Investors

Kingsdale Advisors

contactus@kingsdaleadvisors.com

Chris Mammone, Head of Investor Relations

IR@nuvei.com

Media

Joel Shaffer

FGS Longview

Joel.shaffer@fgslongview.com

i

Philip Fayer, Novacap and CDPQ have agreed to sell all of their Shares (the "Rollover Shares") to the Purchaser for a combination

of cash and shares in the capital of the Purchaser, effectively rolling approximately 95%, 65% and 75%, respectively, of their Shares,

and are expected to receive in aggregate approximately US$563 million in cash for the Shares sold on closing (percentages and amount of

expected cash proceeds are based on current assumed cash position and are subject to change as a result of cash generated before closing).

Philip Fayer, Novacap and CDPQ are expected to hold or exercise control or direction over, directly or indirectly, approximately 24%,

18% and 12%, respectively, of the common equity in the resulting private company.

ii

Based on Canadian composite (Toronto Stock Exchange and all Canadian marketplaces) and U.S. composite (Nasdaq and all U.S. marketplaces).

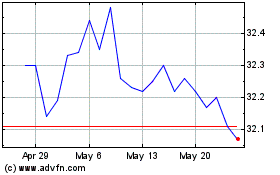

Nuvei (NASDAQ:NVEI)

Historical Stock Chart

From Apr 2024 to May 2024

Nuvei (NASDAQ:NVEI)

Historical Stock Chart

From May 2023 to May 2024